Cheapest Car Insurance in Wyoming (2026)

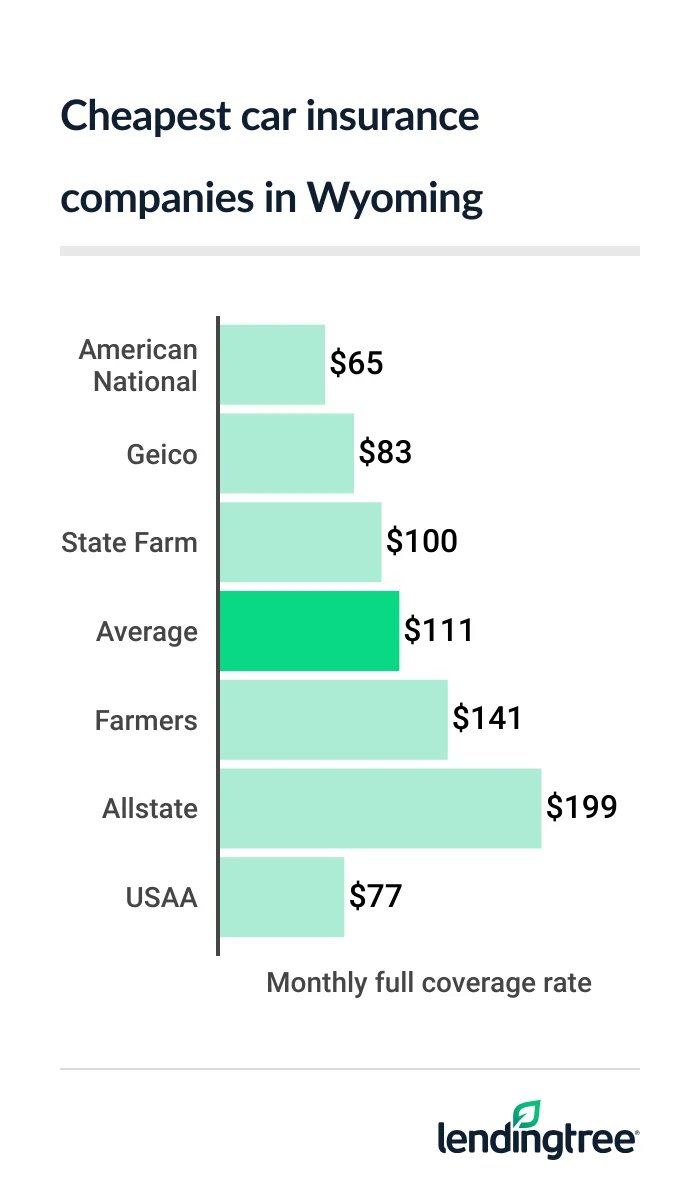

American National has Wyoming’s cheapest full coverage car insurance, at $65 a month. This is $46 less than the state average.

Best cheap Wyoming car insurance

Cheapest full coverage car insurance in Wyoming: American National

American National has Wyoming’s cheapest full coverage car insurance, at $65 a month. Geico is the next-cheapest company for most drivers, at $83 a month. USAA is cheaper than Geico for full coverage

Full coverage costs an average of $111 a month in Wyoming. The actual rate you get depends on factors like your driving record, location and credit.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| American National | $65 | |

| Geico | $83 | |

| State Farm | $100 | |

| Farmers | $141 | |

| Allstate | $199 | |

| USAA* | $77 | |

Each company treats these factors differently and has different car insurance discounts. This makes it good to compare car insurance quotes from a few companies to find the cheapest rate.

Cheap Wyoming liability insurance: American National

At $13 a month, American National has Wyoming’s cheapest liability insurance, or minimum coverage. Geico is only slightly more expensive for liability insurance

Cheapest liability car insurance

| Company | Monthly rate |

|---|---|

| American National | $13 |

| Geico | $15 |

| State Farm | $20 |

| Farmers | $39 |

| Allstate | $58 |

| USAA* | $17 |

Geico has more discounts than American National, which could make it your cheapest option. These include discounts for:

- Serving in the military

- Working for the federal government

- Belonging to a participating professional or alumni group

- Owning your home

- Getting an online quote

It’s good to ask each company you contact for quotes about the discounts you can get. This helps make sure none are overlooked.

Cheap WY car insurance for young drivers: American National

American National has Wyoming’s cheapest car insurance for teens. Its young driver rates average $36 a month for liability insurance and $154 a month for full coverage. Geico is the next-cheapest company, at $36 a month for liability and $223 a month for full coverage.

Best teen auto insurance rates

| Company | Liability | Full coverage |

|---|---|---|

| American National | $36 | $154 |

| Geico | $50 | $223 |

| State Farm | $64 | $318 |

| Farmers | $107 | $409 |

| Allstate | $163 | $685 |

| USAA* | $48 | $205 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This, in turn, leads to high auto insurance rates for young drivers. Most teens get cheaper rates on a parent’s car insurance than they do on their own.

Usage-based insurance can also help make car insurance more affordable for young drivers. These programs usually make you download a smartphone app that monitors your driving. You get discounts based on how safely you drive.

UBI is available to drivers of any age, but teens may benefit the most. Along with discounts, the apps provide feedback you can use to improve your driving.

Geico and State Farm have UBI programs. American National does not.

Best Wyoming car insurance after a speeding ticket: American National

Most Wyoming drivers with a speeding ticket can get cheap auto insurance from American National, at $94 a month. State Farm charges $109 a month. State Farm also offers online quotes, which makes it easy to compare its rates to other companies.

Cheap car insurance after a ticket

| Company | Monthly rate |

|---|---|

| American National | $94 |

| State Farm | $109 |

| Farmers | $149 |

| Geico | $160 |

| Allstate | $225 |

| USAA* | $87 |

A speeding ticket raises the average cost of car insurance by 23% in Wyoming to $137 a month. However, some companies raise their rates by lower amounts. Shopping around helps you find cheap insurance with a bad driving record.

Cheap WY car insurance after an accident: American National

American National has the cheapest car insurance for most Wyoming drivers with an at-fault accident. These rates average $108 a month. State Farm and Geico are the next-cheapest companies at about $120 a month each.

Best auto insurance rates after an accident

| Company | Monthly rate |

|---|---|

| American National | $108 |

| State Farm | $117 |

| Geico | $122 |

| Farmers | $163 |

| Allstate | $269 |

| USAA* | $95 |

Auto insurance rates go up by an average of 31% in Wyoming after an at-fault accident. An accident usually affects your rate for three to five years.

It’s especially good to shop around if you’re paying extra for an accident from more than three years ago. You may get cheaper car insurance from a company with a shorter look-back period.

Cheapest WY car insurance for bad teen drivers: American National

Wyoming teens with a prior driving incident get the cheapest car insurance quotes from American National. The company’s liability rates average $42 a month for teens with a speeding ticket. This is 33% less than the next-cheapest rate of $62 a month from Geico.

American National’s rates for teens with an accident average $50 a month. This is only slightly less than Geico’s rate of $55 a month.

Cheap teen rates after a driving incident

| Company | Ticket | Accident |

|---|---|---|

| American National | $42 | $50 |

| Geico | $62 | $55 |

| State Farm | $72 | $79 |

| Farmers | $113 | $124 |

| Allstate | $187 | $189 |

| USAA* | $50 | $57 |

Cheap Wyoming car insurance after a DUI: American National

At $122 a month, American National has Wyoming’s cheapest car insurance after a DUI (driving under the influence). State Farm has the next-cheapest DUI insurance, at $190 a month. Drivers with a DUI pay an average of $194 a month for full coverage. Shopping around can help you find a cheaper rate.

Best DUI insurance rates

| Company | Monthly rate |

|---|---|

| American National | $122 |

| State Farm | $190 |

| Geico | $205 |

| Allstate | $242 |

| Farmers | $262 |

| USAA* | $139 |

Best bad-credit car insurance in Wyoming: American National

Wyoming drivers with bad credit can get the cheapest auto insurance from American National. The company’s rates for drivers with bad credit average $93 a month. Geico has the next-cheapest bad-credit car insurance, at $115 a month. American National also offers gap insurance

Cheap car insurance for bad credit

| Company | Monthly rate |

|---|---|

| American National | $93 |

| Geico | $115 |

| State Farm | $167 |

| Farmers | $170 |

| Allstate | $300 |

| USAA* | $224 |

Insurance companies check your credit for things like missed payments and borrowing amounts. They believe these factors show how likely you are to have an accident or other claim. You can often get cheaper insurance by avoiding late payments and paying down debts.

Wyoming’s best car insurance companies

American National’s low rates and coverage options make it the best car insurance company for most Wyoming drivers. It charges 41% less than the state average for full coverage and has the cheapest rates for teens.

The company’s full coverage policies protect your vehicle’s custom parts and equipment. Many other companies only cover your car’s factory-installed items. American also offers gap insurance, which you can’t get from State Farm or Geico.

Insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| American National | Not rated | A | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

USAA is the best choice if you meet its membership requirements

USAA also has a better satisfaction rating from J.D. Power

Wyoming car insurance rates by city

Sheridan and seven other cities or towns tie for Wyoming’s cheapest car insurance, at $107 a month. The others are:

- Big Horn

- Ranchester

- Wyarno

- Dayton

- Parkman

- Banner

- Story

Drivers in all eight of these locations pay 4% less than the state average of $111 a month.

Insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Afton | $111 | -1% |

| Aladdin | $113 | 2% |

| Albin | $110 | -1% |

| Alcova | $111 | 0% |

| Alpine | $111 | -1% |

| Alta | $118 | 6% |

| Alva | $113 | 2% |

| Antelope Valley-Crestview | $113 | 2% |

| Arapahoe | $110 | -1% |

| Arminto | $111 | 0% |

| Arvada | $110 | -1% |

| Auburn | $111 | -1% |

| Baggs | $108 | -3% |

| Bairoil | $112 | 1% |

| Banner | $107 | -4% |

| Bar Nunn | $112 | 1% |

| Basin | $110 | -1% |

| Bedford | $111 | -1% |

| Beulah | $113 | 2% |

| Big Horn | $107 | -4% |

| Big Piney | $110 | -1% |

| Bondurant | $110 | -1% |

| Bosler | $110 | -1% |

| Boulder | $110 | -1% |

| Buffalo | $111 | 0% |

| Buford | $110 | -1% |

| Burlington | $110 | -1% |

| Burns | $110 | -1% |

| Byron | $110 | -1% |

| Carpenter | $110 | -1% |

| Casper | $112 | 0% |

| Centennial | $110 | -1% |

| Cheyenne | $109 | -2% |

| Chugwater | $110 | -1% |

| Clearmont | $109 | -2% |

| Cody | $110 | -1% |

| Cokeville | $111 | -1% |

| Cora | $110 | -1% |

| Cowley | $110 | -1% |

| Crowheart | $110 | -1% |

| Daniel | $110 | -1% |

| Dayton | $107 | -4% |

| Deaver | $110 | -1% |

| Devils Tower | $113 | 2% |

| Diamondville | $111 | -1% |

| Dixon | $108 | -3% |

| Douglas | $109 | -2% |

| Dubois | $110 | -1% |

| Edgerton | $112 | 1% |

| Elk Mountain | $108 | -3% |

| Emblem | $110 | -1% |

| Encampment | $108 | -3% |

| Ethete | $111 | 0% |

| Etna | $111 | -1% |

| Evanston | $109 | -2% |

| Evansville | $112 | 1% |

| Fairview | $111 | -1% |

| Farson | $112 | 1% |

| Fe Warren AFB | $110 | -1% |

| Fort Bridger | $109 | -2% |

| Fort Laramie | $111 | 0% |

| Fort Washakie | $111 | 0% |

| Four Corners | $113 | 2% |

| Fox Farm-College | $109 | -2% |

| Frannie | $110 | -1% |

| Freedom | $111 | -1% |

| Frontier | $111 | -1% |

| Garrett | $110 | -1% |

| Gillette | $114 | 2% |

| Glendo | $112 | 1% |

| Glenrock | $110 | -1% |

| Granger | $112 | 1% |

| Granite Canon | $110 | -1% |

| Green River | $112 | 1% |

| Greybull | $110 | -1% |

| Grover | $111 | -1% |

| Guernsey | $110 | -1% |

| Hanna | $108 | -3% |

| Hartville | $110 | -1% |

| Hawk Springs | $110 | -1% |

| Hiland | $112 | 1% |

| Hillsdale | $110 | -1% |

| Hoback | $118 | 6% |

| Horse Creek | $110 | -1% |

| Hudson | $111 | 0% |

| Hulett | $113 | 2% |

| Huntley | $110 | -1% |

| Hyattville | $110 | -1% |

| Jackson | $118 | 6% |

| Jay Em | $111 | 0% |

| Jeffrey City | $111 | 0% |

| Jelm | $110 | -1% |

| Kaycee | $112 | 1% |

| Kelly | $117 | 6% |

| Kemmerer | $111 | -1% |

| Kinnear | $110 | -1% |

| Kirby | $110 | -1% |

| La Barge | $111 | -1% |

| Lagrange | $111 | -1% |

| Lance Creek | $113 | 2% |

| Lander | $111 | 0% |

| Laramie | $110 | -1% |

| Leiter | $108 | -2% |

| Linch | $111 | 0% |

| Lingle | $111 | 0% |

| Little America | $112 | 1% |

| Lonetree | $109 | -2% |

| Lost Springs | $112 | 1% |

| Lovell | $110 | -1% |

| Lucerne | $110 | -1% |

| Lusk | $111 | 0% |

| Lyman | $109 | -2% |

| Lysite | $111 | 0% |

| Manderson | $110 | -1% |

| Manville | $111 | 0% |

| McKinnon | $112 | 1% |

| Medicine Bow | $108 | -3% |

| Meeteetse | $111 | 0% |

| Meriden | $110 | -1% |

| Midwest | $112 | 1% |

| Mills | $111 | 0% |

| Moorcroft | $113 | 2% |

| Moose | $118 | 6% |

| Moose Wilson Road | $118 | 6% |

| Moran | $117 | 6% |

| Mountain View | $108 | -3% |

| Natrona | $111 | 0% |

| Newcastle | $113 | 2% |

| Nordic | $111 | -1% |

| North Rock Springs | $112 | 1% |

| Opal | $111 | -1% |

| Osage | $113 | 2% |

| Otto | $110 | -1% |

| Parkman | $107 | -4% |

| Pavillion | $110 | -1% |

| Pine Bluffs | $110 | -1% |

| Pinedale | $110 | -1% |

| Point of Rocks | $112 | 1% |

| Powder River | $111 | 0% |

| Powell | $110 | -1% |

| Ralston | $110 | -1% |

| Ranchester | $107 | -4% |

| Ranchettes | $109 | -2% |

| Rawlins | $108 | -3% |

| Recluse | $115 | 3% |

| Reliance | $112 | 1% |

| Riverton | $110 | -1% |

| Robertson | $110 | -1% |

| Rock River | $110 | -1% |

| Rock Springs | $112 | 1% |

| Rozet | $115 | 3% |

| Saddlestring | $111 | 0% |

| Saratoga | $108 | -3% |

| Savery | $108 | -3% |

| Shawnee | $110 | -1% |

| Shell | $110 | -1% |

| Sheridan | $107 | -4% |

| Shirley Basin | $108 | -3% |

| Shoshoni | $110 | -1% |

| Sinclair | $108 | -3% |

| Slater | $111 | 0% |

| Smoot | $111 | -1% |

| South Greeley | $109 | -2% |

| South Park | $118 | 6% |

| St. Stephens | $110 | -1% |

| Story | $107 | -4% |

| Sundance | $113 | 2% |

| Superior | $113 | 2% |

| Ten Sleep | $111 | 0% |

| Teton Village | $118 | 6% |

| Thayne | $111 | -1% |

| Thermopolis | $110 | -1% |

| Tie Siding | $110 | -1% |

| Torrington | $111 | 0% |

| Upton | $113 | 2% |

| Van Tassell | $111 | 0% |

| Veteran | $110 | -1% |

| Vista West | $111 | 0% |

| Walcott | $108 | -3% |

| Wamsutter | $112 | 1% |

| Wapiti | $110 | -1% |

| Warren AFB | $109 | -2% |

| Weston | $115 | 3% |

| Wheatland | $111 | 0% |

| Wilson | $118 | 6% |

| Wolf | $108 | -2% |

| Worland | $111 | 0% |

| Wright | $113 | 2% |

| Wyarno | $107 | -4% |

| Yellowstone National Park | $110 | -1% |

| Yoder | $110 | -1% |

Jackson is one of eight areas with Wyoming’s most expensive car insurance, at $118 a month. It ties with:

- Hoback

- Moose Wilson Road

- South Park

- Teton Village

- Wilson

- Alta

- Moose

Drivers in Cheyenne pay $109 a month for car insurance, or 2% less than the state average. Casper drivers pay $112 a month, or just $1 more than the state average.

Minimum car insurance requirements in Wyoming

Car insurance is required by law in Wyoming. The state’s minimum car insurance requirements include:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $20,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

Collision

SR-22 insurance in Wyoming

You may need SR-22 car insurance to reinstate your driving privileges after certain violations. These range from driving without insurance to DUI.

An SR-22 is a certificate that shows you have car insurance. Your insurance company sends it to the state when you purchase your policy. Most companies offer SR-22 insurance. They usually add a small filing fee to your rate.

The actual price you pay for SR-22 insurance depends largely on your driving record. SR-22 insurance costs about $200 a month after a major violation like DUI. Rates are closer to $140 a month after a lesser offense like driving without insurance.

Getting quotes from multiple companies is a good way to find the cheapest SR-22 insurance.

How we selected the cheapest car insurance companies in Wyoming

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Wyoming

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.