How to Get Preapproved for a Citi Credit Card

Your credit score takes a temporary hit each time you apply for a new credit card — whether the card issuer approves you for the card or not. Wouldn’t it be nice to know if you’re likely to be approved before you apply? That’s what credit card preapprovals offer.

Card issuers may review your credit history to give you a “prescreened,” “prequalified” or “preapproved” offer. No matter the terminology, these offers indicate that you’re likely to be approved for a credit card if you apply. That said, preapprovals aren’t a guarantee that your application will be approved. Still, preapprovals may be the best way to avoid the double whammy of a rejection and a credit score hit.

Here’s what you need to know about Citi’s pre-qualification online tool and other ways of getting a Citi card preapproval.

Ways to prequalify for a Citi credit card

How to get preapproved for a Citi credit card

Potential Citi cardholders have four primary ways to get some sort of preapproval or prequalification — from using an online tool to visiting a Citibank branch to seeing if you’re targeted for a special offer.

Use the Citi preapproval tool

The easiest way for potential Citi cardholders to find out if they are pre-qualified for a Citi card is to use the online Citi prescreening tool.

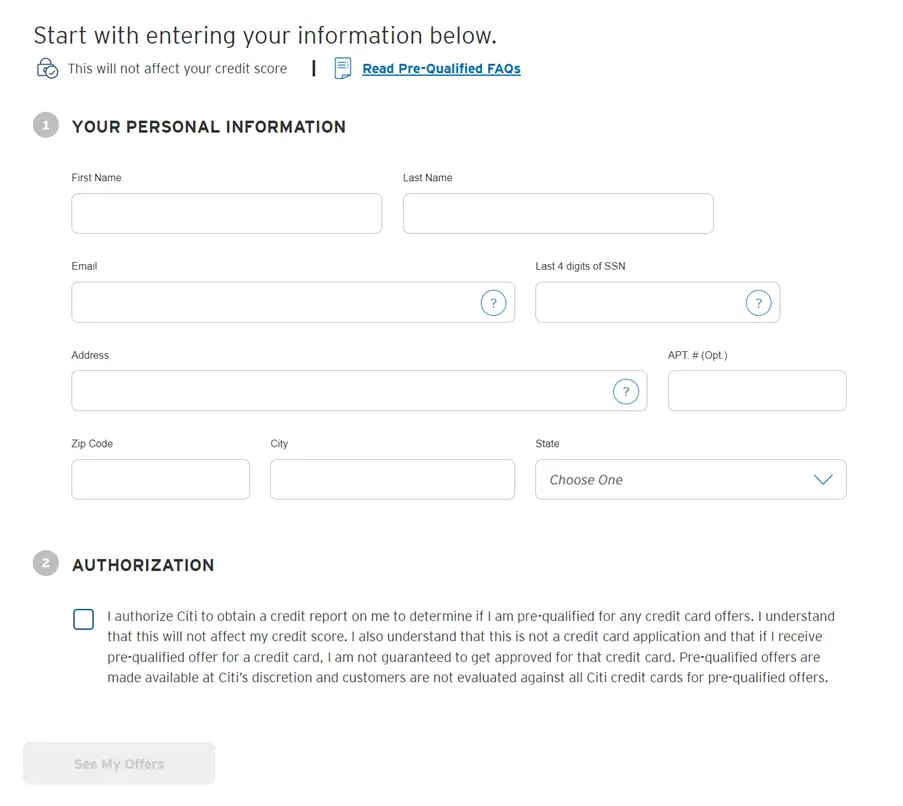

1. To get started, go to the following URL: https://online.citi.com/US/ag/cards/pre-screen.

2. Scroll down to the form to enter your:

- First name

- Last name

- Email address

- Last four digits of your Social Security number

- Full address

3. Then, read through the authorization, agree to the terms and click the “See My Offers” button to see if you are prequalified for a Citi credit card.

This Citi prequalification tool performs a “soft inquiry” on your credit report. This won’t negatively affect your credit. However, if you move forward with applying for a new card, your credit report will be hit with a “hard inquiry” that may cause your credit score to temporarily drop.

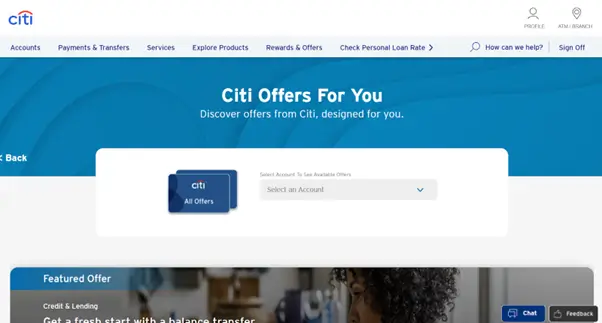

Check for offers in your Citi account

Another way you might get a Citi card preapproval offer is by logging into an existing Citi account. Citi often displays promotions when cardholders log into their accounts, although these offers can skew more toward banking products.

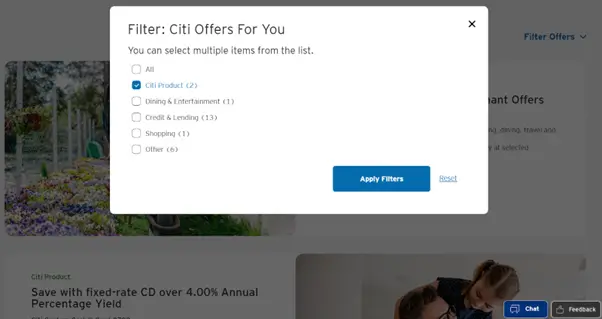

- To see a full list of offers, browse to the Citi Offers For You page. Many of the offers listed here will be related to your existing cards — from Citi Merchant Offers to balance transfer offers.

- Click the “Filter offers” toggle under the “Featured Offer” box. Select “Citi product” from the list to narrow the page results to credit card offers. If you are preapproved for a credit card, it should appear on the page.

Reply to an offer from Citi

Another way that you may be preapproved for a Citi credit card is through a letter or email from Citi. If you’re hoping to get a special offer on a new Citi card — or a spending bonus on a current card — you should keep a close eye on these letters and emails. You’ll need an invitation code and your last name to apply online for any offer.

Keep in mind that you won’t get prequalified offers through this or other methods if you’ve opted out of getting prescreened offers through OptOutPrescreen.com

Visit your local Citi branch

Finally, you might get a special Citi credit card preapproval by visiting a Citibank branch. Branch bankers occasionally can offer elevated offers or have alternative ways to submit your information to see targeted offers.

Citi credit cards that you may be preapproved for

Let’s cut to the chase: There isn’t a public list of Citi prequalified credit cards. Even if we were able to get our hands on some secret list of which Citi credit cards are currently available through preapproval, the results would still vary based on your credit score and credit history.

Instead, here’s a list of Citi credit cards you could possibly be preapproved for:

| Credit Cards | Our Ratings | Annual Fee | Rewards Rate | Welcome Offer | |

|---|---|---|---|---|---|

Citi Strata Premier® Card

|

$95 | 1X - 10X points

| 60,000 points

Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com.

| ||

Citi Double Cash® Card

|

$0 | 2% - 5% cash back

| $200 cash back

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

| ||

Citi Custom Cash® Card*

|

$0 | 1% - 5% cash back

| $200 cash back

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

| ||

Citi Rewards+® Card*

|

$0 | 1X - 5X points

| 20,000 points

Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com

|

Prequalified vs. preapproved: What’s the difference?

Each credit card issuer has its preferred term, but the idea is essentially the same. With both prequalifications and preapprovals, a card issuer has reviewed basic info from your credit profile to extend a special offer to apply for a card.

Citi generally uses the term “prequalification” or “prequalified” to indicate that it’s making you a personalized offer based on your credit profile. However, you may also see the term “prescreen” on Citi’s website.

What factors go into Citi credit card preapproval?

We can’t be sure what specific factors Citi uses for preapproval. Citi merely states that its preapprovals are “based on your credit profile.”

However, we can make some educated guesses based on the information Citi would have access to when making its decision. Citi performs a soft inquiry of your credit, meaning it could review your credit payment history, any collection activity, the number of recent hard credit inquiries and your number of credit accounts to make its decision on whether or not to preapprove you.

How to boost your preapproval odds for a Citi credit card

The best way to boost your Citi card preapproval odds is to focus on boosting your credit score. Try the following:

- See if you can be added as an authorized user of someone with an established credit history.

- Pay down existing credit card balances to lower your credit utilization.

- Ensure your credit reports aren’t locked or frozen.

- Review your credit report and request correction of any inaccuracies.

- Make at least minimum payments on all outstanding credit cards and loans.

- Wait until at least three months after your last hard credit inquiry to apply.

Frequently asked questions

It depends on the Citi card that you are applying for. Some Citi cards are designed for consumers who need to build their credit, making these easy credit cards to get. Other Citi credit cards have more stringent credit requirements. The higher your credit score, the more likely Citi will approve you for a credit card.

Citi credit cards can be opened online, over the phone, in a Citibank branch or by responding to a Citi mailer. The best terms and offers may vary between these options, so it’s worth checking your options before applying.

Citi doesn’t publish exact credit score requirements for each card. Instead, they offer a variety of cards targeted for different credit histories. For instance, the Citi® Secured Mastercard® is designed for consumers with little or no credit history. Meanwhile, the Citi Strata Premier® Card generally requires a good / excellent credit score.

Citi advertises the ability to “get a response in under a minute” on credit card applications, making Citi one of the top issuers for getting instant approval on credit cards. On select credit cards, you may even be able to get an instant credit card number.

The Citi® Secured Mastercard® is designed for consumers with little or no credit history, making it one of the easiest cards to qualify for. Just note that cardholders need to make a security deposit to qualify to use the card.

The information related to the Citi Custom Cash® Card, Citi Rewards+® Card and Citi® Secured Mastercard® has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.