Is the Amex Fine Hotels + Resorts® Program Worth It in 2026?

Key takeaways

- The Amex Fine Hotels + Resorts® program offers valuable perks to eligible cardholders, like early check-ins, late checkouts, complimentary breakfast, room upgrades and travel credits at participating properties.

- To qualify, you must hold the American Express Platinum Card®, The Business Platinum Card® from American Express, the Centurion® Card from American Express or The American Express Corporate Platinum Card®.

- Booking through Amex Fine Hotels + Resorts won’t always get you a lower nightly rate, but taking advantage of the program’s exclusive benefits can make it worth it.

The American Express Fine Hotels + Resorts® program (FHR) lets you enjoy the beaches in Hawaii to the landscapes of Italy with premium benefits — and without hotel elite status. You’ll get cost-saving benefits at more than 1,800 top-rated properties worldwide, which can add significantly to the value of the American Express Platinum Card®, The Business Platinum Card® from American Express, the Centurion® Card from American Express or The American Express Corporate Platinum Card®.

The program is packed with perks, such as a complimentary breakfast, guaranteed late checkout and a $100 credit at select properties. It’s a great way to have a VIP travel experience without having to spend enough to hit elite status. Plus, your eligible card comes with its own luxury benefits that can help cover the high annual fees when paired with American Express Fine Hotels + Resorts® benefits.

What is Amex Fine Hotels + Resorts®?

Amex Fine Hotels + Resorts® is a travel booking program for select American Express cardholders that provides exclusive benefits at luxury resorts worldwide. You can book these properties through American Express Travel® and enjoy perks from a variety of hotel brands.

Depending on where and when you book a hotel in the program, you can earn additional savings through resort-specific special offers. This may include free night stays, food and beverage credits and discounted nightly rates.

Is Amex Fine Hotels + Resorts® worth it?

American Express Fine Hotels + Resorts® is worth it because you’ll get high-end benefits valued at around $550 per stay without holding elite status. This is a huge savings when stacked on top of rewards like 5X Membership Rewards® points on prepaid hotels booked through American Express Travel® with the American Express Platinum Card®. Properties in the Fine Hotels + Resorts® program range from large luxury hotels like the Fairmont Grand Del Mar in San Diego and independent hotels like The Lodge at Sea Island in St. Simons Island.

The downside is you have to book your stay through the American Express travel portal, where you won’t always get the best rate. If you’re a loyalty program member, you’ll also have to skip loyalty program points, and you may have to forgo your elite status benefits.

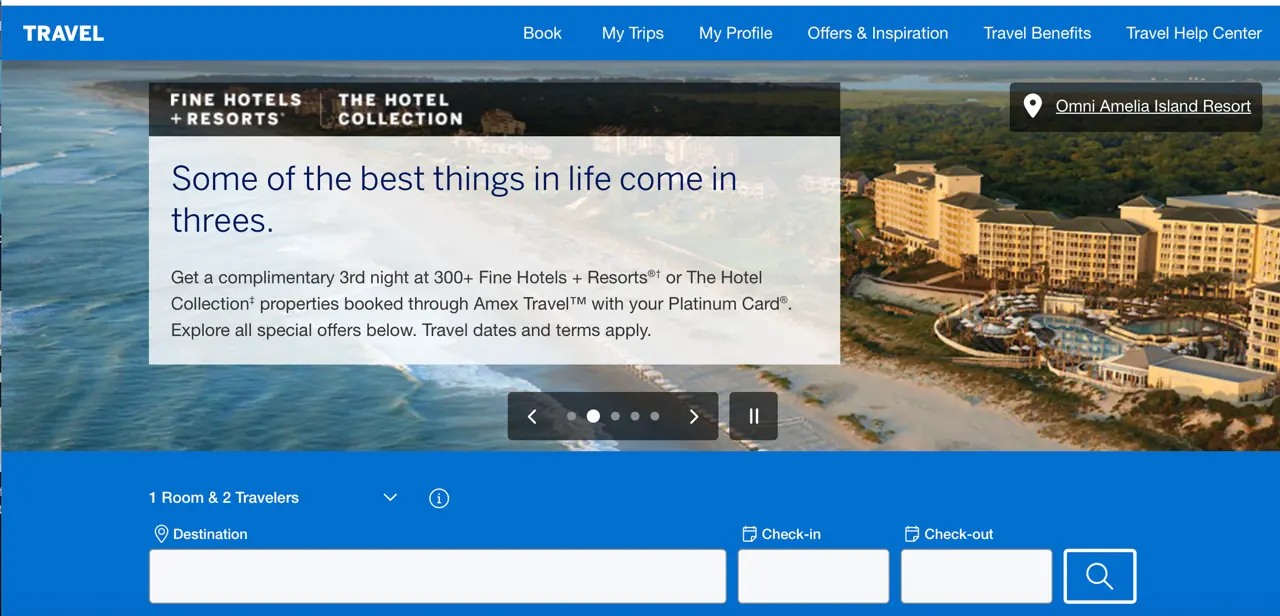

That said, many hotels offer additional perks — the third night free when you book a three-night stay — which can help bring down the total cost of your stay. Plus, you can combine other card benefits, like up to $300 back semi-annually (up to $600 total each year) on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel® if you have the American Express Platinum Card® or The Business Platinum Card® from American Express (minimum two-night stay required).

Which cards offer Amex Fine Hotels + Resorts® access?

American Express Fine Hotels + Resorts® is available if you have the American Express Platinum Card®, The Business Platinum Card® from American Express, The American Express Corporate Platinum Card® or the Centurion® Card from American Express.

Amex Fine Hotels + Resorts® benefits

The American Express Fine Hotels + Resorts® program has six main benefits that apply per room for up to three rooms per stay. According to American Express, these benefits are worth a total of around $550.

When you book an American Express Fine Hotels + Resorts® hotel through the American Express portal, you likely won’t be able to use hotel loyalty benefits or search for the lowest price, but the potential value of these program benefits will help make up for it.

$100 credit at select properties

The $100 credit is one of the most valuable benefits offered with Fine Hotels + Resorts®. The hotel chooses the form of credit that you will receive, and you’ll be able to see what type of credit you’ll get upon booking. A general property credit or food and beverage credit are common credits you’ll find, but credits can be unique to each property.

The credit may include:

- Food and beverage: Complimentary meal for two or a credit toward a dining experience

- Spa: Complimentary massage for two or credit toward a spa treatment

- Golf: Complimentary round of golf for two

- Private transfer: Complimentary private transfer to the airport

- Property credit: Choose how you want to use your credit at the property

Check in as early as noon when available

This is one of two benefits that’s not guaranteed at each stay. You’ll need to verify if the hotel has availability to give you an early check-in.

Room upgrade upon arrival, when available

Room upgrades depend on availability upon check-in. American Express also notes that certain room categories are not eligible for a room upgrade.

Daily complimentary breakfast during your trip for two people

While the $100 credit, when available, often applies to dining, adding on a complimentary daily breakfast can heavily reduce your food and beverage spending on your trip. Breakfast is valued at a minimum of $60 per room per day and varies by location.

Guaranteed 4 p.m. late checkout

With a guaranteed 4 p.m. checkout, you’ll get almost an entire extra day at the hotel of your choice without having to pay for an extra night. This can also be helpful if your flight is later in the day or you want to take advantage of additional amenities before you leave.

Complimentary Wi-Fi

Although many hotels now include complimentary Wi-Fi, some hotels charge a mandatory property fee that includes Wi-Fi. If this is the case, you’ll get a daily credit for the amount of Wi-Fi applied at checkout.

Amex Fine Hotels + Resorts® drawbacks

Although Amex Fine Hotels + Resorts® can offer incredible benefits and experiences, it’s not necessarily the best option for every trip.

Difficult to find the best rates

Unless a participating resort is running a special offer for discounted nights, it’s hard to come by savings on nightly rates through the program. However, the program’s credits can help you save.

May lose access to some hotel elite status perks

When you book through Fine Hotels + Resorts®, your hotel loyalty status may not get you extra perks; this can vary by program, so check your preferred hotel chain’s terms.

American Express Fine Hotels + Resorts® destinations

Fine Hotels + Resorts® includes over 1,800 properties worldwide. Here are a few examples of qualifying hotels’ popular destinations.

| Hotel | Special offer | Dates |

|---|---|---|

| Grand Wailea, A Waldorf Astoria Resort | 25% off the nightly room rate on select rooms (excluding taxes and fees) | Book by March. 31, 2026 for travel by Dec. 31, 2026 |

| Park Hyatt Chicago | 15% off the nightly room rate on select rooms (excluding taxes and fees) | Book by March 31, 2026 for travel by April 30, 2026 |

| Mandarin Oriental Paris | Complimentary fourth night | Book by April 28, 2026 for travel by May 2, 2026 |

| Conrad Tulum Riviera Maya | Complimentary third night | Book by Jan. 31, 2026 for travel by Oct. 1, 2026 |

| Corinthia London | Complimentary third night | Book by March 31, 2026 for travel by April 20, 2026 |

| The Okura Tokyo | Complimentary third night | Book by March 10, 2026 for travel between Jan. 4 and March 13, 2026 |

How to book an American Express Fine Hotels + Resorts® stay

- Visit the Fine Hotels + Resorts® home page and start browsing destinations.

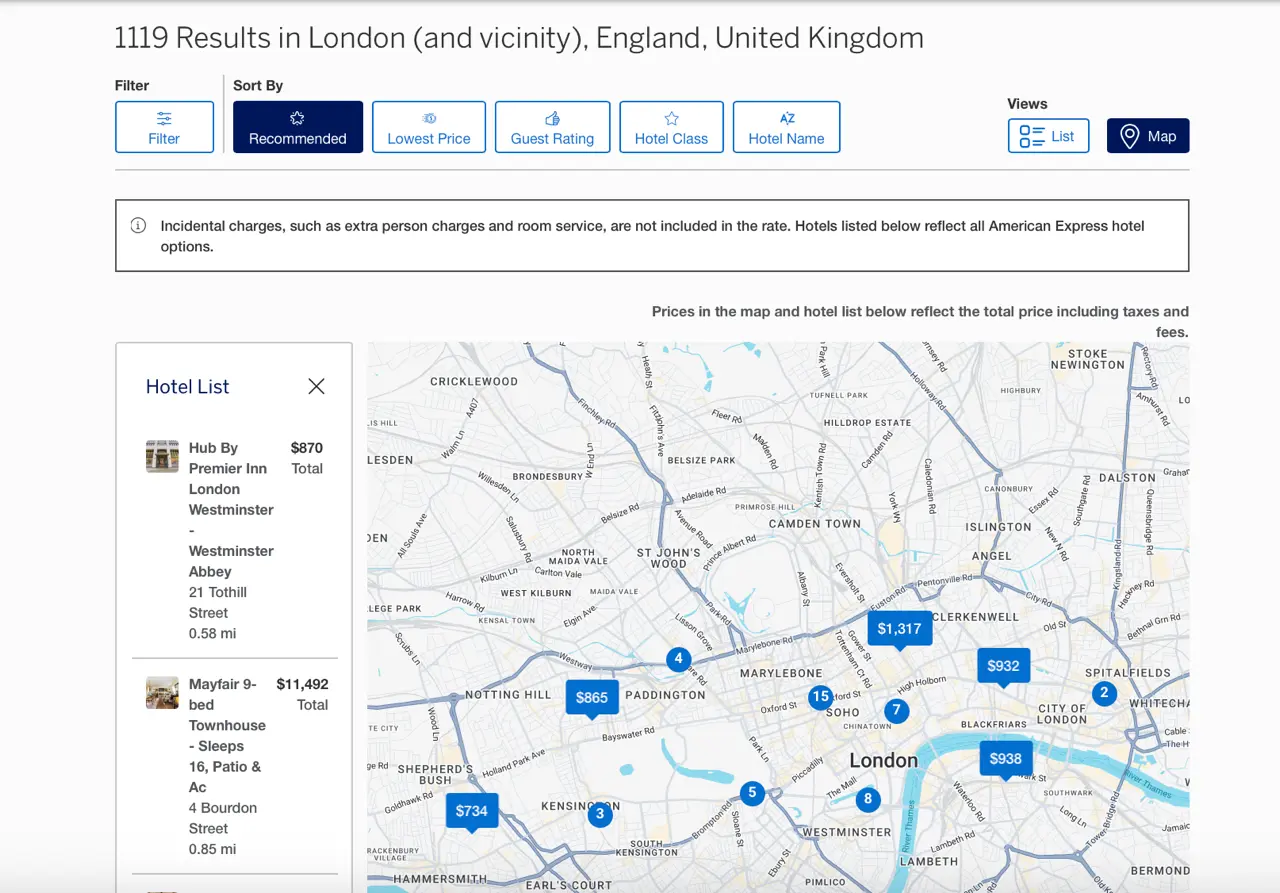

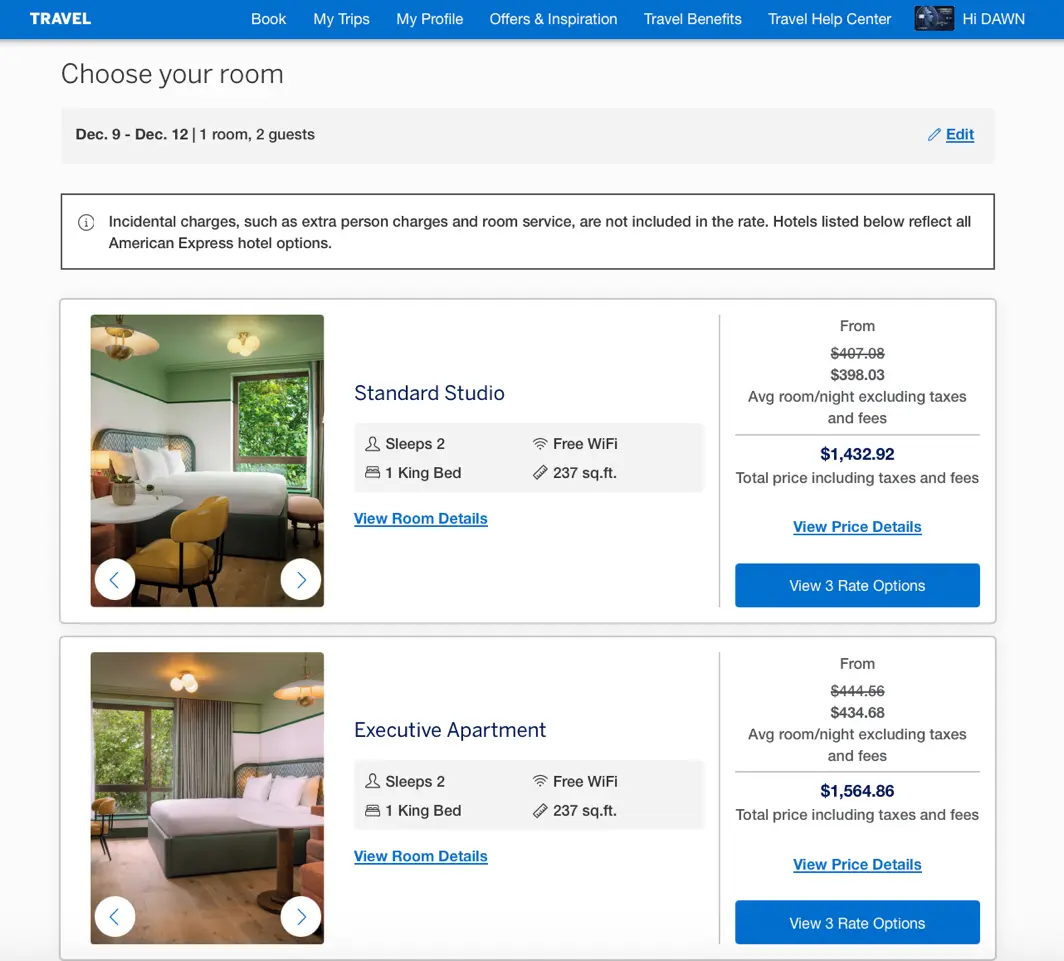

- Once you input your destination and dates, you can browse and compare all hotels available. You can also see TripAdvisor reviews to help you make your decision.

- By clicking “Select” next to the hotel of your choice, you’ll be able to browse room types. Before you can select your room, you’ll be prompted to log in to your American Express account.

- When you’re ready, you must book your stay using an eligible American Express card in order to receive FHR benefits. But you can ultimately pay for your stay using any American Express card that’s in your name. Also know that FHR benefits can be applied to up to three rooms per stay booked using your eligible card.

When to use American Express Fine Hotels + Resorts®

Elite-like benefits at boutique or non-chain hotels

Boutique or non-chain hotels don’t typically offer the option to get elite status or additional benefits. You may not usually choose a boutique hotel for this reason, but the American Express Fine Hotels + Resorts® program is a good solution for this. For example, the Surfrider Malibu is a boutique hotel that offers Fine Hotels + Resorts® benefits.

Elite benefits at large hotel brands without the status

Without the Fine Hotels + Resorts® program, you’ll need to reach elite status with a specific hotel brand to get the same benefits. For example, you would need to stay 50+ nights and reach Platinum Elite status with Marriott Bonvoy® to get a 4 p.m. late checkout benefit.

If you’re loyal to a hotel brand, elite status may give you more hotel-specific benefits. But if you don’t stay at a specific hotel chain enough to hit elite status each year, the Fine Hotels + Resorts® program is a good choice. In some instances, you can even use your elite status and Fine Hotels + Resorts® together, though many hotels require you to book through their channels to use your elite status.

Extra savings on short stays

The $100 credit is one of the most valuable benefits you can get with the Fine Hotels + Resorts® program. You’ll get a $100 credit at participating properties no matter how long you stay, so you can maximize this credit on shorter trips. For example, if you’re looking for a relaxing weekend getaway to the Baccarat Hotel New York, FHR will cover a $250 food and beverage credit as a limited time offer (on eligible room categories when you book by Dec. 31, 2025 and travel by Jan. 2, 2026). This is a huge savings for a one- or two-night stay. Plus, if you find a hotel offering a third or fourth night free, you can extend your short trip at no additional cost.

The American Express Platinum Card® also offers up to $600 in statement credits (up to $300 back semi-annually) for eligible prepaid hotels through American Express Travel®. This is another big way to reduce the cost of a shorter stay once a year.

The Hotel Collection vs. Fine Hotels + Resorts®

Similar to Fine Hotels + Resorts®, The Hotel Collection offers exclusive hotel perks to eligible American Express cardholders. The main difference is that The Hotel Collection is available with the American Express® Gold Card and the American Express® Business Gold Card — in addition to the American Express Platinum Card® and The Business Platinum Card® from American Express.

Additionally, with The Hotel Collection, cardholders must book a minimum of a two-night stay to receive the benefits. The program also offers fewer benefits than Fine Hotels + Resorts®:

| The Hotel Collection benefits | Fine Hotels + Resorts benefits |

|---|---|

|

|

The Fine Hotels + Resorts® program also has more hotels to choose from. The Hotel Collection has more than 1,300 hotels globally, while Fine Hotels + Resorts® offers more than 1,800.

Frequently asked questions

Yes, but it may not be the best use of your points. Membership Rewards® points redeemed for Amex Fine Hotels + Resorts® stays will be worth 1 cent — and you can likely get more value by transferring them to travel partners. So when booking stays in the program, it’s often best to pay with cash.

You can narrow down your search for the right property with American Express’s hotel search tool.

The Fine Hotels + Resorts® (FHR) program can offer more value, since it includes over 500 more properties than The Hotel Collection and slightly better benefits — but only the highest level American Express cards can access FHR. The Hotel Collection is more widely available, though, since American Express® Gold Card members can access it as well. The key difference is that The Hotel Collection is missing a couple of the FHR benefits, like free breakfast and 4 p.m. checkout.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

- American Express Platinum Card®

- The Business Platinum Card® from American Express

- American Express® Gold Card

- American Express® Business Gold Card

The information related to the Centurion® Card from American Express and The American Express Corporate Platinum Card® has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.