Nearly 4 in 10 With Credit Card Debt Have Lied About It — and High Earners Are Some of the Most Likely to Do So

Almost 4 in every 10 people with credit card debt have lied about it, and the highest-earning Americans are among the most likely to have done so.

LendingTree surveyed more than 900 people with credit card debt and found that many feel ashamed about it. Many have chosen to keep quiet about what they owe, while others take it a step further, lying to those closest to them about what they’re going through.

Here’s what we found.

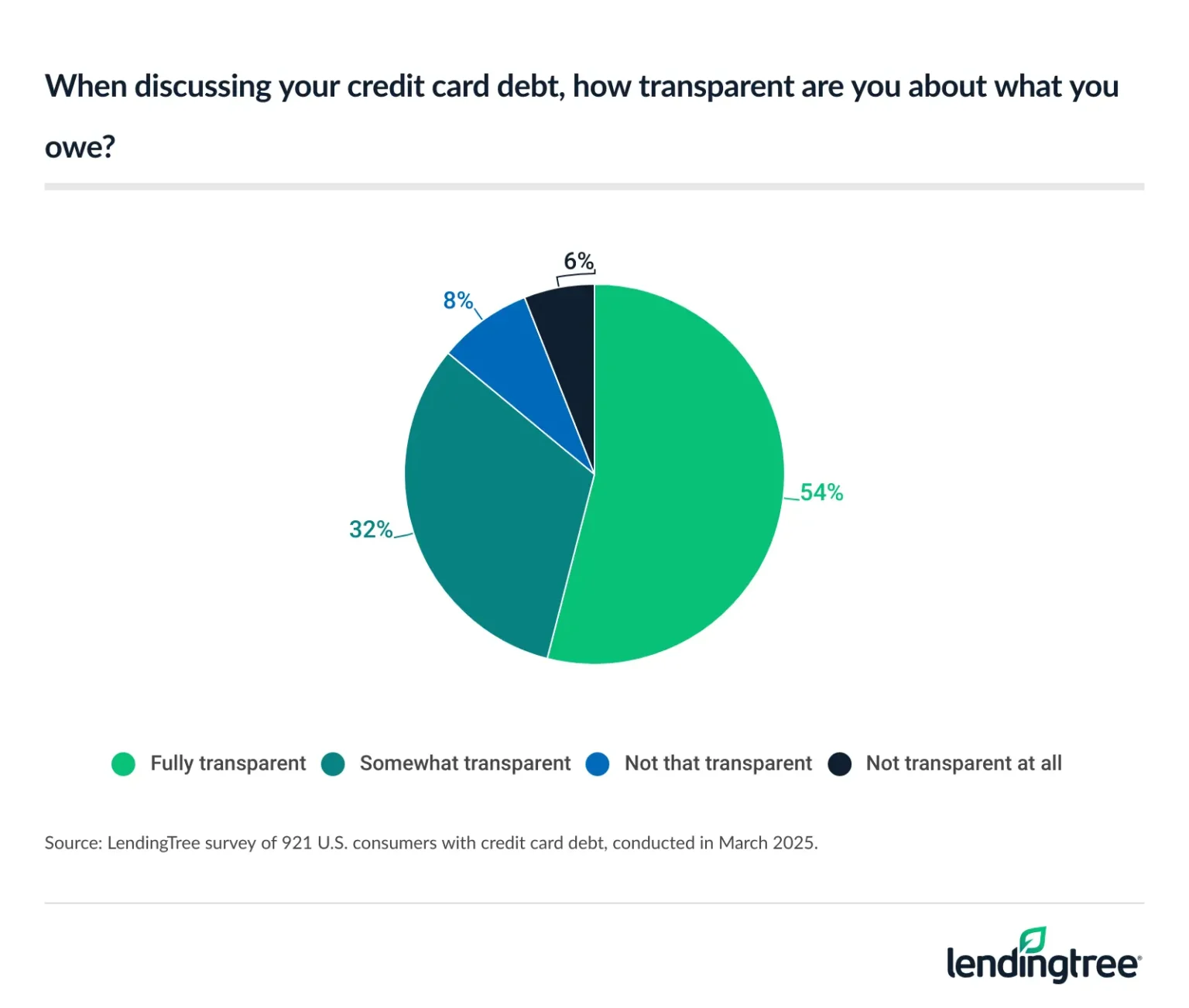

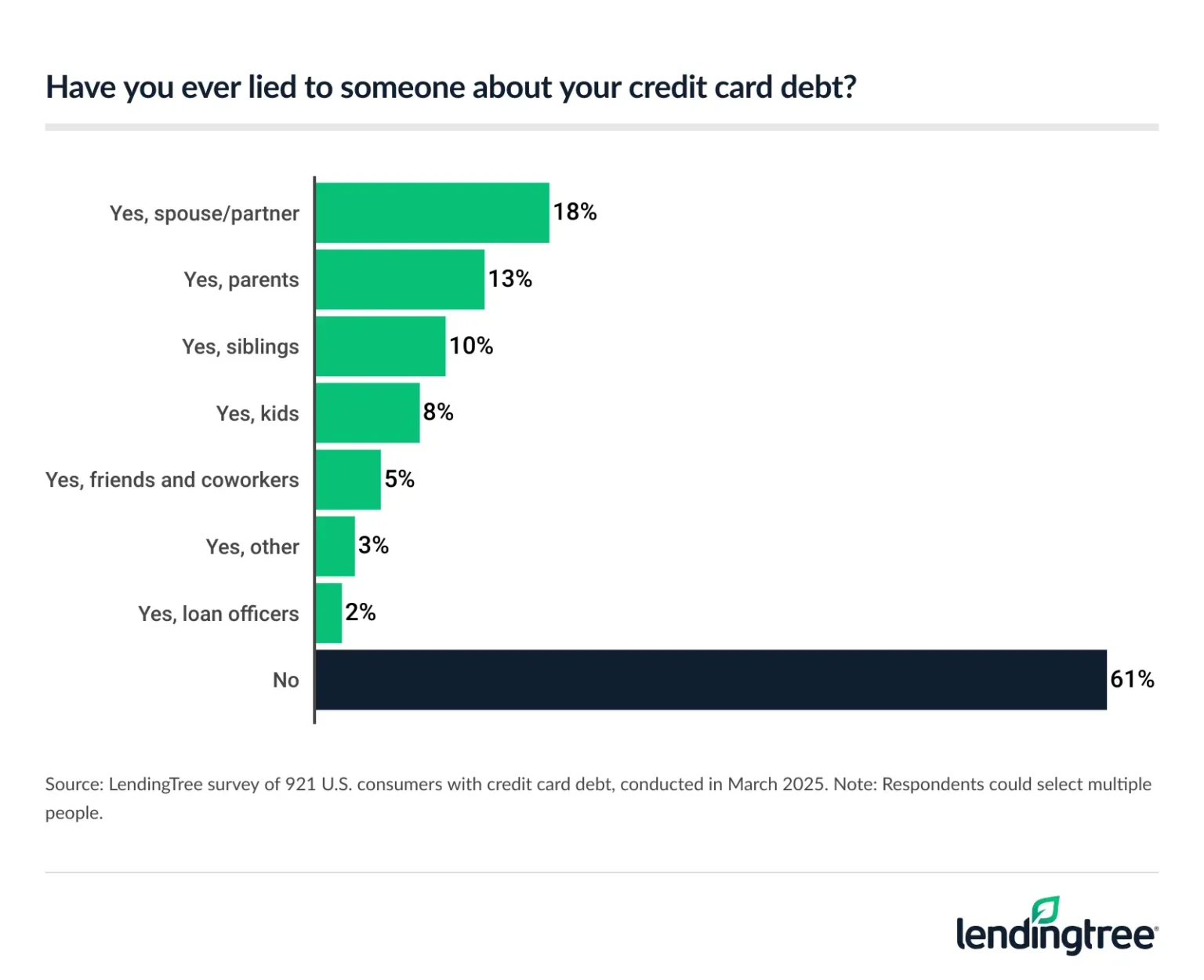

- Nearly 40% with credit card debt have lied about it. 39% of card debtors have done so, most commonly to their spouse or partner (18%), parents (13%) or siblings (10%). Just over half (54%) with credit card debt say they’re fully transparent about the amount they owe. That said, 49% of debtors downplay or hide the amount of credit card debt they have because they feel ashamed.

- Higher-income earners are among the most likely to have credit card debt and lie about it. While 46% of Americans are in credit card debt, 50% of those earning at least six figures annually have it, compared with 39% of those earning less than $30,000. Meanwhile, half of those earning $100,000 or more with card debt say they’ve lied about it, compared with 32% of those who earn less than $30,000.

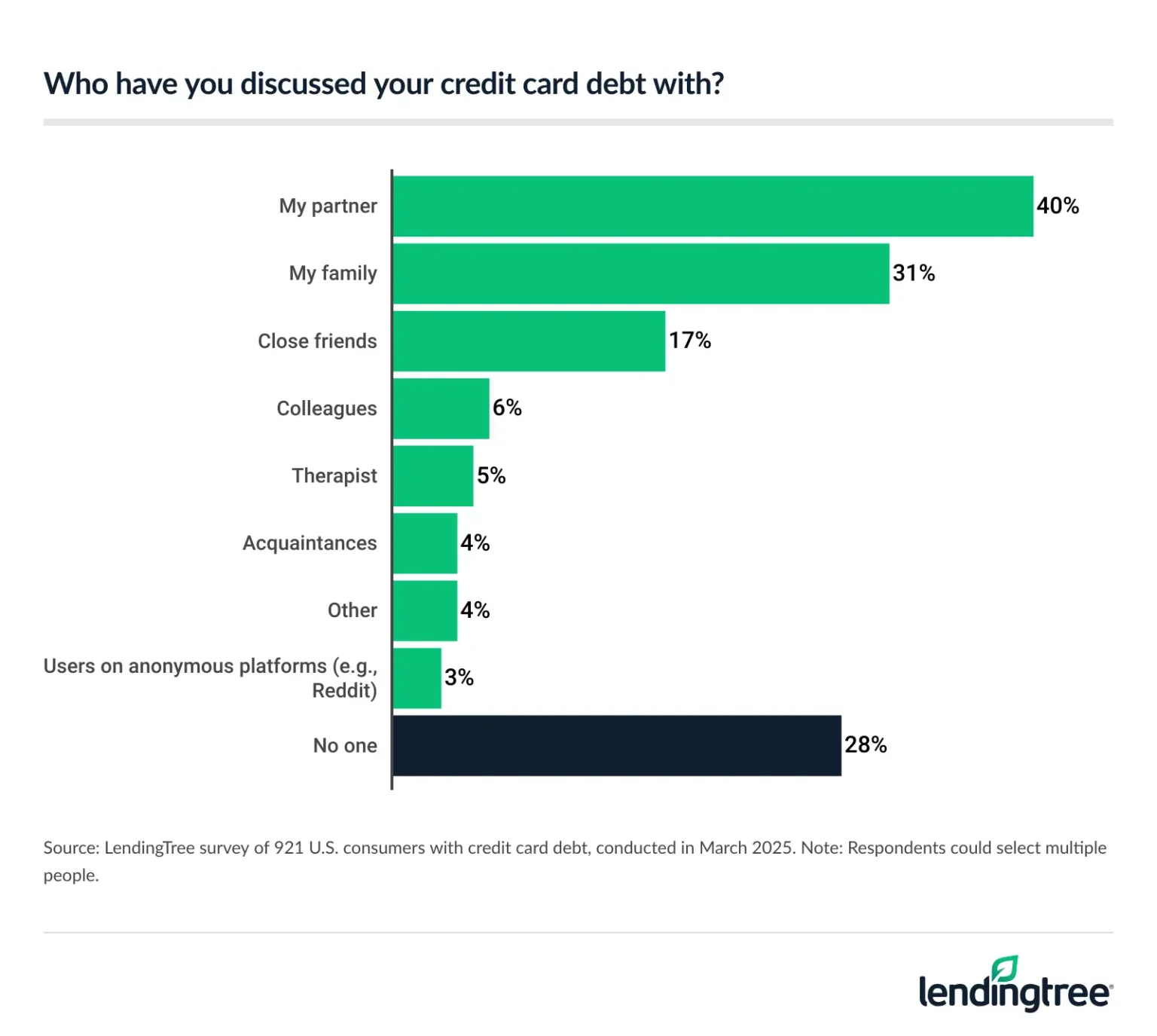

- Many prefer to keep their debt close to their chest. 28% with credit card debt say they haven’t discussed it with anyone. Women are far more likely than men to say so (35% versus 21%), and baby boomers are more than twice as likely as Gen Zers or millennials to say so. Among those who have told others about their debt, the most likely confidantes are partners (40%), family (31%) and close friends (17%).

- Most feel in control of their card debt, though some have taken extreme measures to deal with it. 74% with card debt say they have control of it, and high-income earners are most likely to agree. 81% of higher earners with credit card debt say so, versus 61% of lower earners. Also, 51% of those with card debt have had it for less than a year.

About 40% of those with card debt have lied about it

Credit card debt can be scary. The deeper you get into it, the more overwhelming it can feel. Given that, it’s understandable that many Americans aren’t comfortable telling others about what they’re going through. In fact, 49% of Americans with credit card debt say they downplay or hide the amount of card debt they have because they’re ashamed.

Only slightly more than half of those with card debt (54%) say they’re fully transparent when discussing their debts with others.

The older you are, the more likely you are to say you’re fully transparent when discussing these matters. That said, just 59% of baby boomers ages 61 to 79 say that, meaning there are an awful lot of Americans of any age who aren’t exactly an open book when it comes to their debt.

Many Americans even lie about their situation. About 4 in 10 (39%) card debtors have done so, often telling tales to the most important people in their lives. Nearly 1 in 5 (18%) say they’ve lied to their spouse or partner, while 13% have lied to their parents, 10% to their siblings and 8% to their kids.

Higher-income earners are among the most likely to have credit card debt and lie about it

Our survey found that 46% of Americans have credit card debt. The percentage is even higher for those earning $100,000 or more per year, reaching 50%, versus just 39% of those making less than $30,000.

That may surprise some, as credit card debt is often seen primarily as a problem for lower-income Americans. However, millions of high-earning Americans struggle with credit card debt every day for various reasons.

High earners are also among the most likely to lie about having credit card debt. Half of card debtors earning $100,000 or more say they’ve lied about it, compared with 32% of those making less than $30,000. The more money you make, the more likely you are to lie about your card debt.

Many prefer to keep their debt a secret

Many with card debt see silence as their best option. Nearly 3 in 10 card debtors (28%) say they’ve never discussed their debt with anyone. Those who have told others about their debt are most likely to have confided in their partner (40%), a family member (31%) and close friends (17%).

Women are significantly more likely than men to suffer their card debt in silence (35% versus 21%), while baby boomers are more than twice as likely as Gen Zers ages 18 to 28 or millennials ages 29 to 44 to do so.

Higher-income Americans with card debt are more likely than their lower-earning counterparts to have discussed that debt with someone — 85% of those earning $100,000 or more have done so, versus 57% of those earning less than $30,000. However, given that those high earners are also the most likely to have lied about card debt, it isn’t clear those conversations are doing any good.

Most feel in control of their card debt, though some have taken extreme measures to deal with it

Credit card debt can get out of hand in a hurry, especially with interest rates as high as they are today. However, our survey showed that most card debtors (74%) feel in control of that debt.

Perhaps unsurprisingly, high-income earners are among the most likely to say they feel they have the debt under control, with 81% of those earning $100,000 or more saying so. Men are more likely than women to say so (81% versus 67%). Gen Zers are the most likely age group to say they have their card debt under control at 83%, versus 79% of boomers, 72% of millennials and 67% of Gen Xers ages 45 to 60.

Also, slightly more than half (51%) of current credit card debtors say they’ve had that debt for less than a year. Boomers are the most likely age group to have had debt longer than a year, with 66% saying so, versus 25% of Gen Zers.

Don’t be afraid to seek help

I’ve been there. I’ll never forget the conversation in which I told my girlfriend (now wife) I had about $10,000 in credit card debt. I was petrified because I knew she might hear the news and run screaming. Good luck with that!

Thankfully, she didn’t. Instead, she helped keep me disciplined and on track to pay down that debt. It took me five years or so — a monthly payment on a brand-new car slowed the process a bit — and I felt like I had lifted a giant boulder off my chest once it was done. Others have surely felt something similar because big debts often take a physical, emotional and financial toll, with 42% saying they feel like their credit card debt negatively impacts their health.

Of course, there’s no guarantee a conversation like that would go as well for you as mine did, but there’s likely far more to gain from having the chat go well than there is to lose from having the conversation go south. That’s true for conversations with partners, friends and loved ones, but it’s also true when you talk to lenders and other big businesses.

In my book, “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” there’s a section in which I talk about how to ask a lender to skip a payment during a difficult financial time. Most lenders have so-called hardship programs they can implement to help people through a short-term rough patch. This may include deferring a payment, waiving a fee, temporarily lowering an interest rate and other breaks that can be useful to someone struggling mightily. However, you won’t get that help if you don’t ask for it.

That’s also true when it comes to family and friends. Most who love you will want to help you with what you’re facing. They’re probably not going to write you a check — borrowing from family or friends can be a major issue — but having them as a cheering section can make a huge difference.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers from March 4 to 6, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79