Spending on Delivery Services Up 159% Since 2021 to $407 Monthly, on Average

In the age of technology, convenience is king — even if it comes at a cost. On-demand delivery service users spend an average of $407 a month on these conveniences, a significant increase from $157 when we last conducted this survey in 2021.

Keep reading to learn which services are most popular, how many consumers are overspending and how much users are tipping their delivery workers.

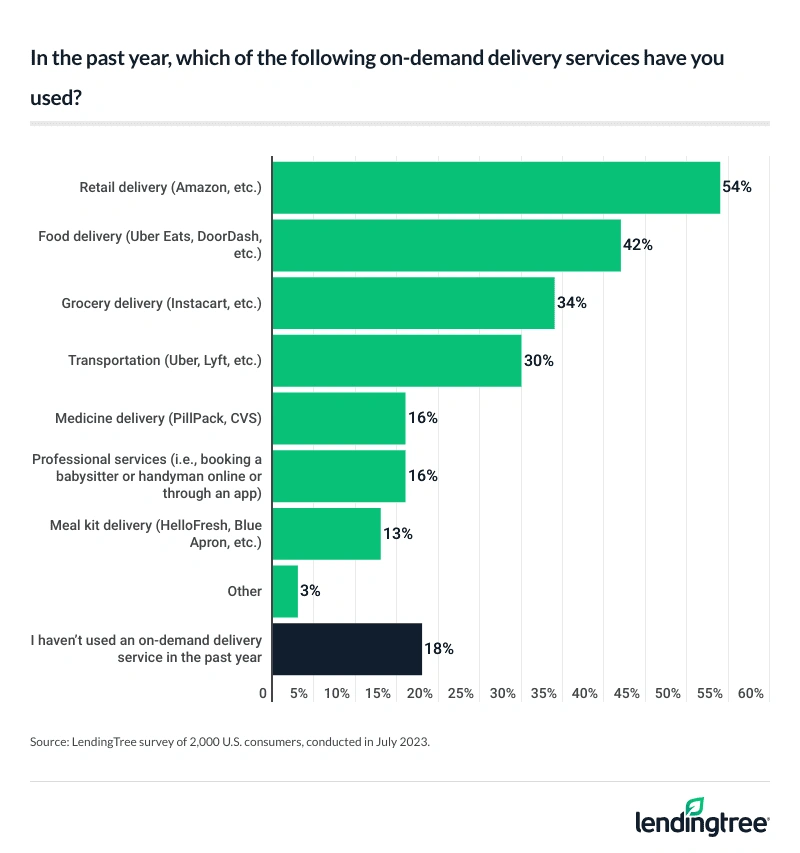

- On-demand delivery services have continued to grow in popularity in recent years — and many Americans are spending big from home. The 82% of Americans who have used one of these services in the past year are spending an average of $407 a month on them. This is up 159% from 2021, when the average spend for on-demand deliveries was $157 a month. The most popular services are retail (54%), food (42%) and grocery delivery (34%).

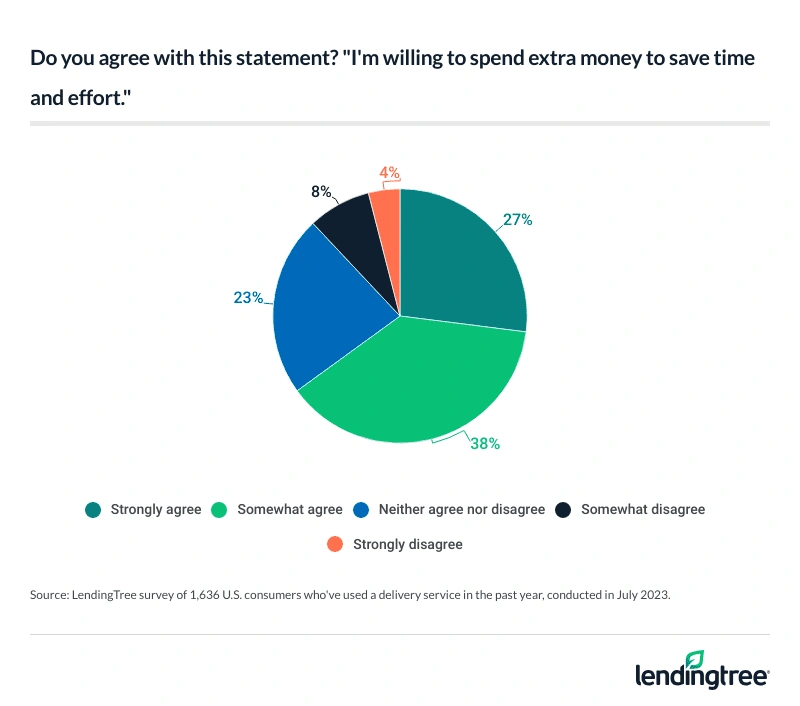

- Most Americans are willing to pay up to save time, but some are tempted to overspend on convenience. Almost two-thirds (65%) of users agree they’re willing to spend extra money to save time; however, 44% admit to spending more than they can afford on these services, with 27% doing so this past year. When asked what aspect of on-demand delivery services customers appreciate most, 43% say they value not having to leave their homes.

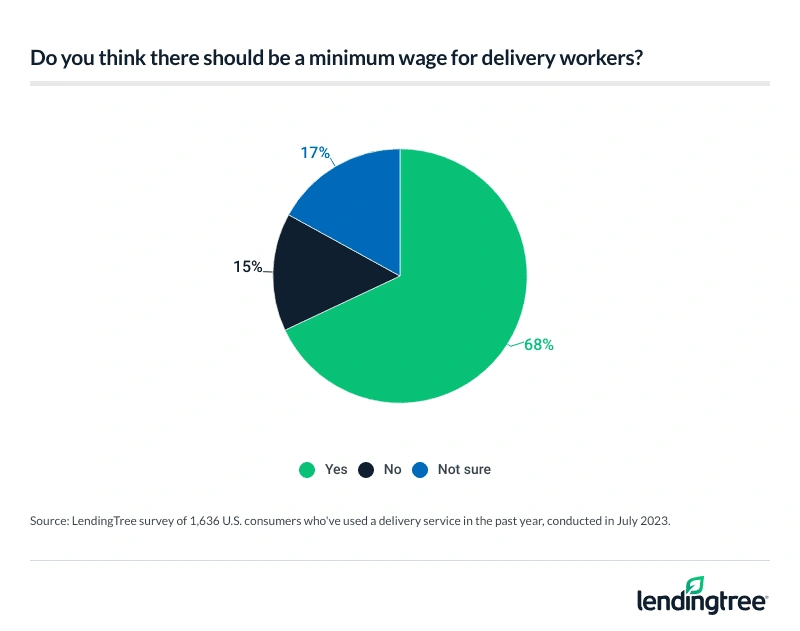

- Those who utilize these services believe delivery workers should be paid fairly and most are happy to pitch in — at least a little. Over two-thirds (68%) of those who use these services believe there should be a minimum wage for delivery workers, and 79% say they tip for convenience services when it’s an option. However, tip amounts vary: 65% of them say they tip 15% or less, while 8% tip more than 20%.

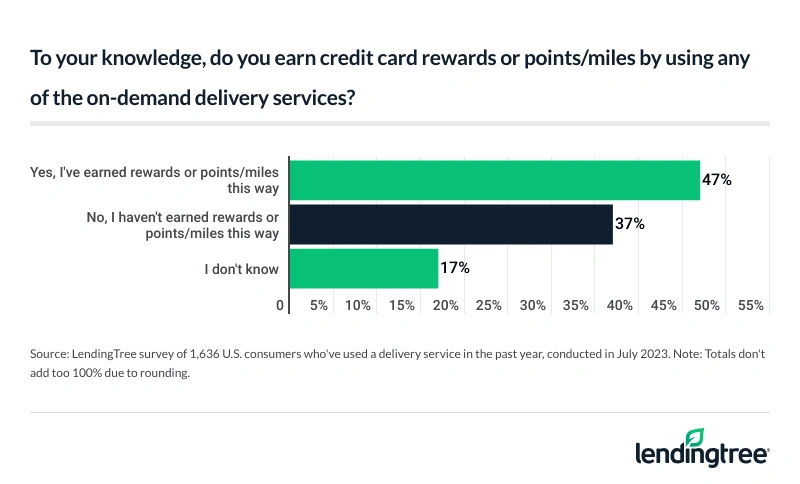

- Savvy credit cardholders are racking up reward points by choosing delivery. 47% say they earn credit card rewards through these delivery services, and 54% say they would apply for a new card if it offered discounts and/or rewards on their favorite on-demand delivery services. Millennials are leading the pack, with 60% saying they earn rewards and 70% saying they would apply for a new card with delivery rewards.

Delivery service users spend an average of $407 a month

On-demand delivery services have seemingly become a staple for many, particularly as 82% of Americans have used one of these services in the past year. That’s up from 77% in 2021.

Not only are more Americans utilizing delivery services, but they’re also spending more. This year, users are spending an average of $407 a month on delivery — up from $157 a month in 2021. That’s a 159% increase.

While LendingTree chief consumer finance analyst Matt Schulz says he’s surprised by the magnitude of the change, he isn’t surprised with the direction of it.

“The COVID-19 pandemic was a massive turning point when it came to delivery in this country,” he says. “We embraced delivery services like never before. We began using them more, in part, because we didn’t have a choice, but millions of Americans found that they really valued the services in the end.“They’ve kept using them as the pandemic has receded and other COVID-era trends have fallen by the wayside. They’ve even been willing to pay extra for these services as inflation has run roughshod over the country. That certainly seems to hint that these services are here to stay.”

Younger generations are more likely to spend big. Millennials (ages 27 to 42) spend $575 a month, on average, on these services — the most of any generation. That’s followed by:

- Gen Zers (ages 18 to 26): $535

- Gen Xers (ages 43 to 58): $282

- Baby boomers (ages 59 to 77): $153

Men ($478 a month) are more likely to shell out on delivery than women ($337). In addition, those with children younger than 18 ($569 a month) spend significantly more than those without children ($325) and those with adult children ($248).

When it comes to what type of delivery consumers use, 54% say they’ve ordered retail delivery in the past year — making it the most popular option. That’s followed by food (42%) and grocery delivery (34%).

By demographic, millennials (56%), six-figure earners (56%) and those with children younger than 18 (53%) are the most likely to have used a food delivery service in the past year.

Meanwhile, six-figure earners (66%), baby boomers (59%) and those earning between $50,000 and $74,999 (59%) are the most likely to have used a retail delivery service.

Users stretch their budgets for the sake of convenience

There’s a reason why on-demand services are so popular: They save time. Among those who use delivery services, 65% agree they’re willing to spend extra money to save time.

Unsurprisingly, six-figure earners are the most likely to agree at 85%. By generation, that figure’s highest among millennials at 76% — that compares with:

- 62% of Gen Xers

- 55% of baby boomers

- 55% of Gen Zers

Parents of young children are also more willing to spend more if it means saving time. While three-fourths (75%) of parents with children younger than 18 say they’re willing to spend more money, just 58% of those without children and 57% of those with adult children say similarly.

Meanwhile, men (72%) are much more likely to spend more for time than women (58%).

While Schulz believes sending extra money to save time can make a lot of sense, he also notes that it’s certainly possible to overdo it.

“It’s never been easier to buy something and have it on your doorstep in a hurry,” he says. “That’s amazing, but that convenience also can easily lead to overspending. You’re probably less likely to go on a spending spree if you have to pay cash in a brick-and-mortar store and transport the product back to your home than if you can buy it with two clicks on your phone and have someone bring it to you. Overspending is dangerous. A little here and there may not be a big deal, but too much too often can be catastrophic.”

Still, many users have overdone it. In fact, 44% admit to spending more than they can afford on these services. That’s particularly true among adults with children younger than 18 (58%), millennials (57%) and Gen Zers (56%). Of this group, 27% admit doing so this past year.

The benefits of on-demand delivery may make it hard to say no. Among delivery users, 43% say they most value not having to leave their home — making it the most popular answer. Meanwhile, 34% value saving time and 15% value saving money.

Majority believe delivery workers should be paid a minimum wage

Several popular on-demand delivery services built themselves around the idea of a gig economy, meaning their delivery workers are classified as contractors rather than employees. These workers lose many protections employees typically have with an employer — particularly, they’re not required to be paid minimum wage.

Consumers don’t necessarily agree with this decision, though — 68% of those who use these services believe there should be a minimum wage for delivery workers. That’s particularly true among six-figure earners (78%), adults with children younger than 18 (76%) and those earning between $75,000 and $99,999 (74%). Meanwhile, Gen Zers (55%) are the least likely to agree.

While tips may not make up for poor wages, they may certainly help — and most do tip. An overwhelming 79% say they tip for these convenience services when it’s an option, a figure that’s highest among six-figure earners (88%), parents with children younger than 18 (86%) and millennials (83%).

Tip amounts vary, though: The majority who tip for convenience say they tip 15% or lower (65%), while 8% tip more than 20%. As far as the most generous tippers, six-figure earners (16%) and millennials (12%) are the most likely to tip over 20%.

66% of users have had to complain about missing or inaccurate orders

While the majority of consumers tip, dissatisfaction may play a role in amounts. Mistakes are common, too: 66% of consumers have had to complain to a delivery service about a missing or inaccurate order. To break that down even further, 38% have received an inaccurate order, 28% say their entire order went missing and 22% say that an item from their order was missing.

Gen Zers are the most likely to experience delivery mistakes (75%), followed by millennials (71%).

Delivery services may benefit credit cardholders

While consumers shell out big bucks for delivery services, they’re not entirely losing out. In fact, 47% say they earn credit card rewards points or miles by using these services. Six-figure earners lead here at 70%. Adults with children younger than 18 and millennials follow, at 60% for both.

In addition, men (56%) are more likely to earn rewards than women (38%).

Even more than that, 54% say they would apply for a new card if it offered discounts and/or rewards on their favorite on-demand delivery services — and 45% have applied for a new credit card specifically for this reason.

Six-figure earners (72%), adults with children younger than 18 (71%) and millennials (70%) are again the most likely groups to consider opening a new card. They’re also the most likely to have done so already.

Beyond credit cards, 42% of users have joined memberships (like Uber One and Amazon Prime) to save on purchases because they use them so much. Millennials lead at 60%, followed by adults with children younger than 18 (59%) and six-figure earners (59%).

Expert tips on limiting delivery spending

While the convenience of delivery can seem worth its weight in gold, it often impacts our spending more than we think. And while Schulz says it’s understandable to overspend occasionally, doing so can quickly become a problem. To rein in your delivery spending, Schulz offers the following advice:

- Make lists. “Impulse buying wrecks budgets, plain and simple,” he says. “That’s true whether you’re shopping in person or online. One of the best ways to rein in those spontaneous buys is to make lists before shopping. Having a simple shopping list changes the vibe of the trip. You’re not browsing anymore in search of inspiration. You’re on a mission, looking for specific items you need. Of course, the list won’t stop your impulse buying altogether, but they are a very good low-effort first step.”

- Run the numbers. “While spending money to save time can be a wise move, it’s likely that many of us use these delivery services without taking the time to look at how much more they’re costing us,” he says. “If we crunched the numbers on what we spent on delivery, it might be a real eye-opener. It might even make you rethink how often you use delivery. That won’t be the case for everyone, but it’s still worth doing the exercise.”

- Consider a new credit card. “The right card for you is the one that gives you the most rewards for the things you buy the most,” he says. “If you spend more than the average person on delivery services, it could absolutely be worth looking into cards that reward those services. For most people, however, a simple cash back card that gives you 2% back on everything you buy no matter where you buy it is probably your best choice.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 77 from July 7-12, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77