Most Americans Admit to Emotional Spending as 38% Cope With Economic Uncertainty

Whether you’re revenge shopping after a breakup or soothing stress with a new pair of sneakers, retail therapy is common. And spending may feel great in the moment, but when the credit card bill shows up, many Americans rue their “swipe now, cry later” ways.

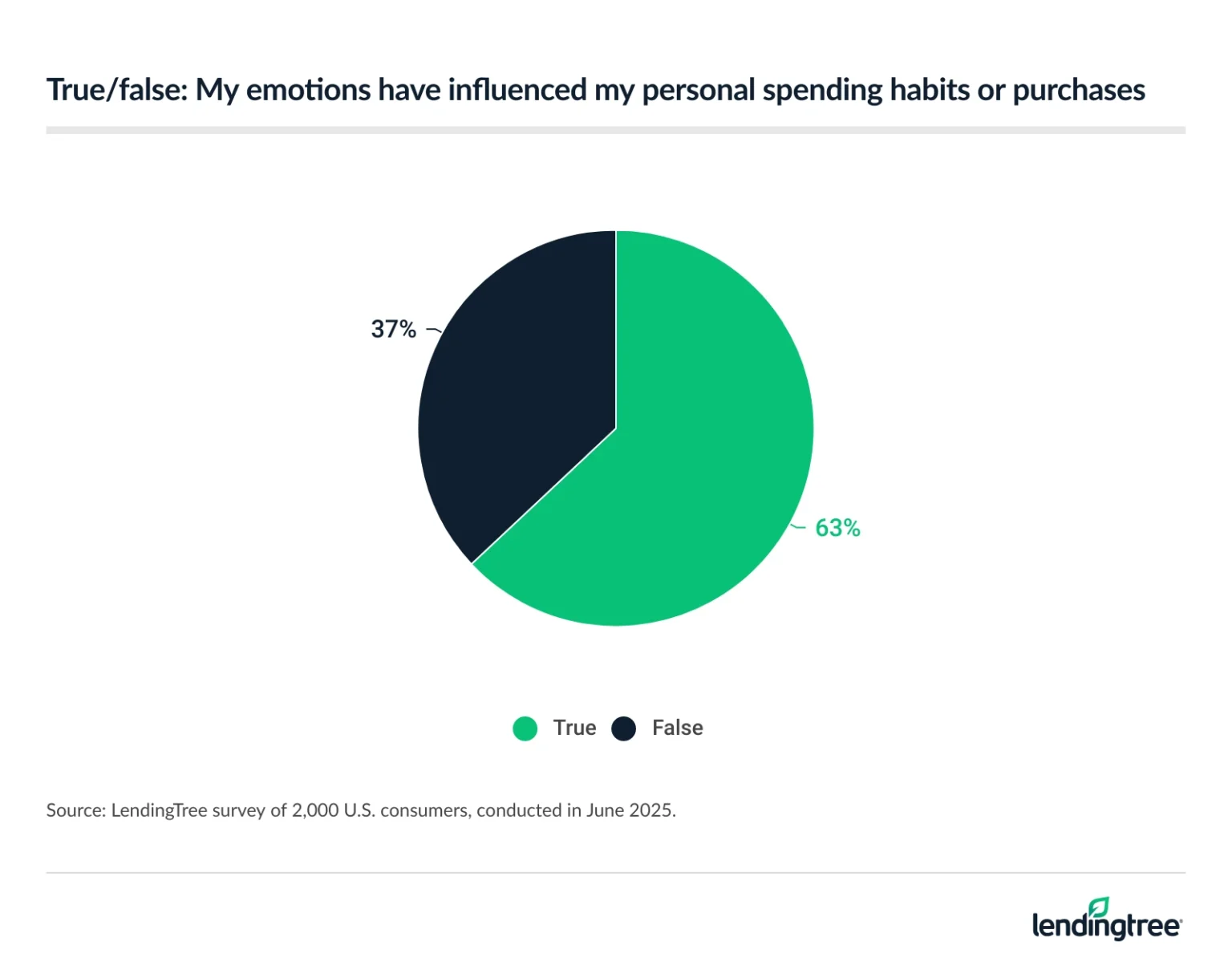

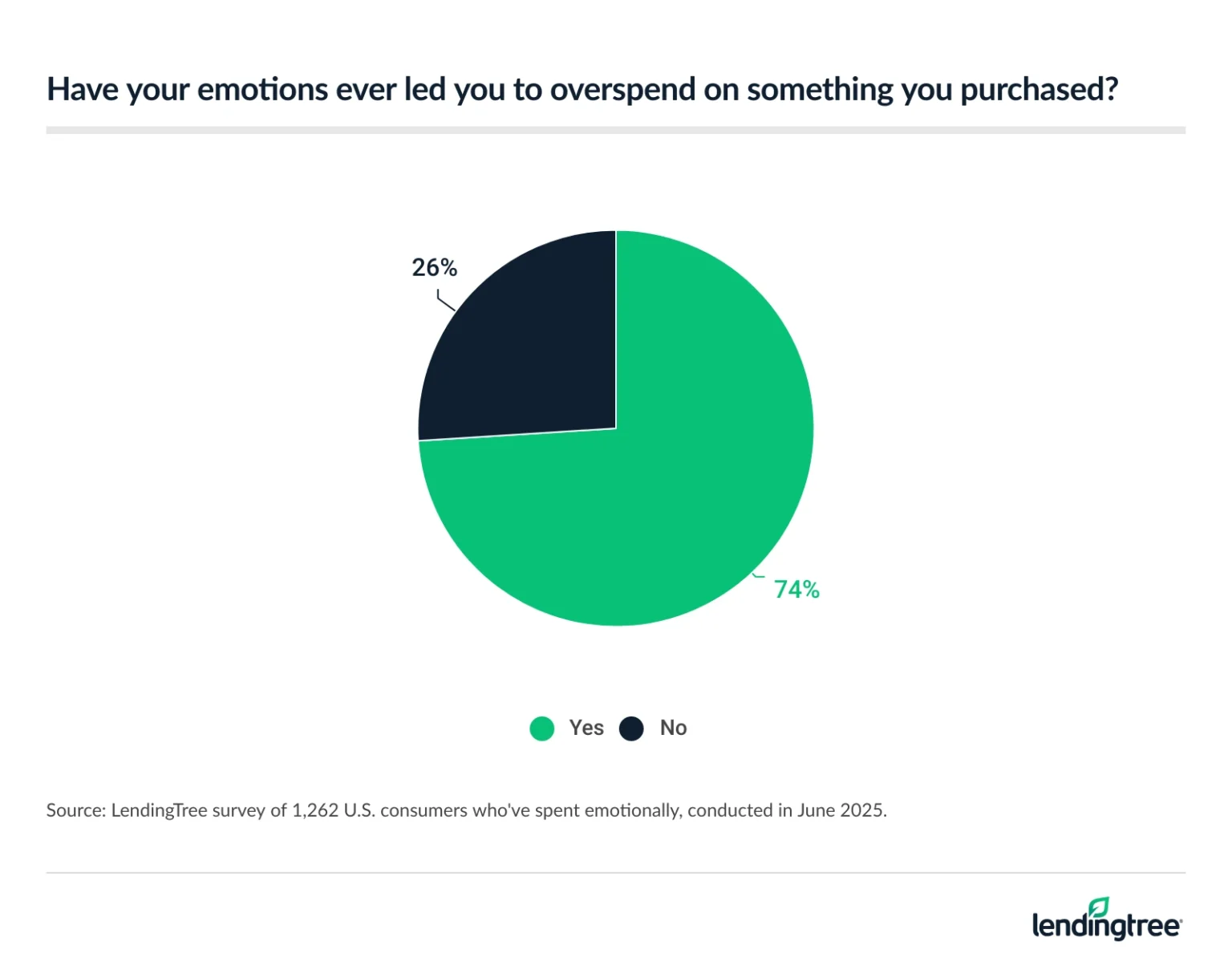

According to a LendingTree survey of 2,000 U.S. consumers, 63% of Americans say they’ve been emotionally influenced while shopping — but 74% of emotional shoppers say it has led them to overspend.

Here’s what else we found.

- When the going gets tough, the tough go shopping. More than 6 in 10 (63%) Americans admit their emotions influence their purchases, and 38% say the stress of current economic uncertainty has made them spend more. 46% believe emotional spending is normal.

- When the dopamine wears off, many are left with regret. Nearly 3 in 4 (74%) emotional shoppers say it’s led them to overspend, and 44% say it’s negatively impacted their financial well-being. That figure is especially high among millennials (50%) and Gen Zers (49%). More than 4 in 10 (43%) emotional spenders have gone into debt due to it, and 69% have regretted acting on their emotions in this way.

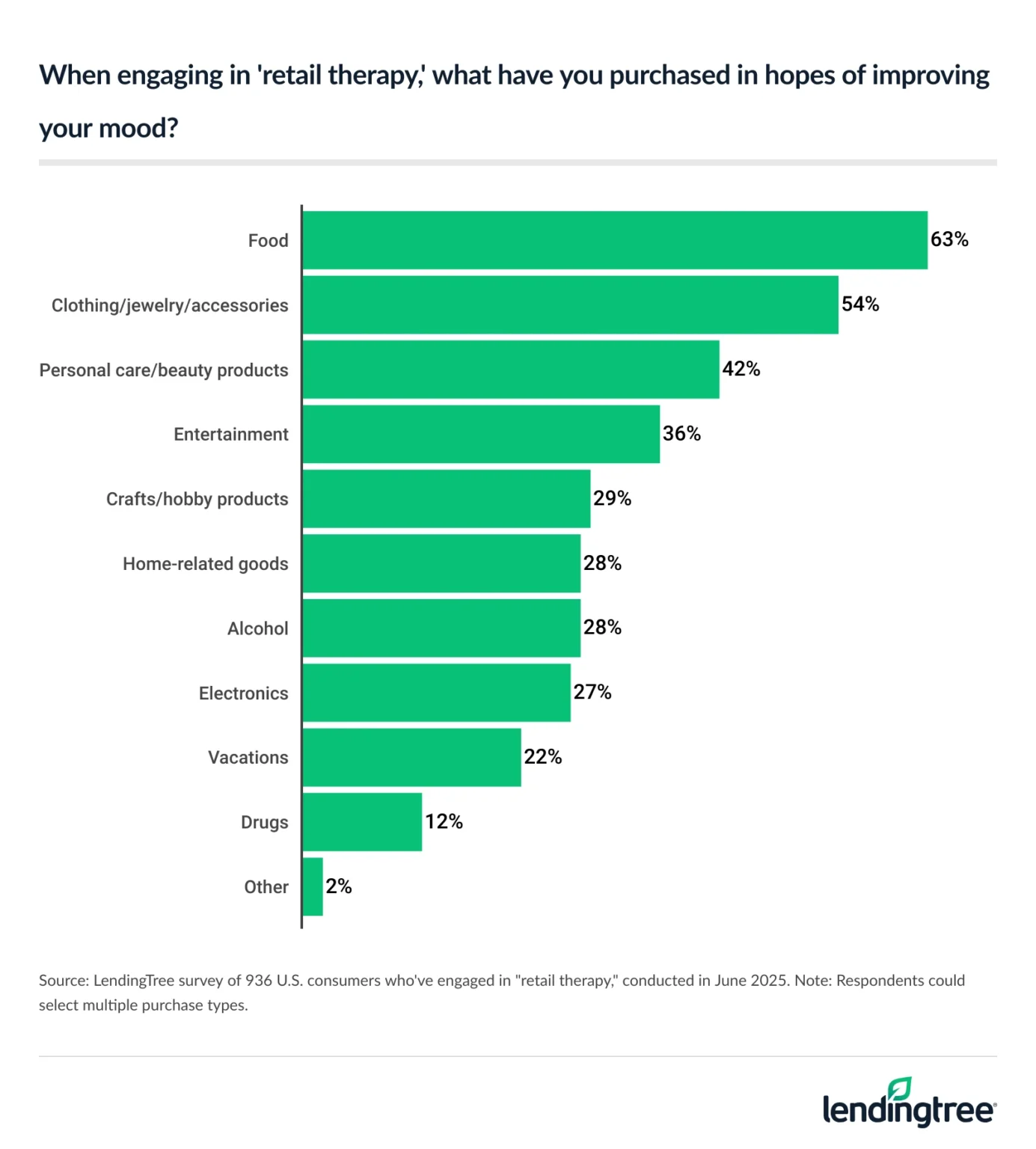

- Retail therapy is the prescription for happiness for many. Nearly half (47%) of consumers engage in retail therapy to improve their mood, with the most common purchases being food (63%), clothing and accessories (54%), and personal care or beauty products (42%). Overall, 54% of Americans consider retail therapy a form of self-care.

- Some are buying now and saving the bills for later. 52% of emotional spenders say that buy now, pay later (BNPL) loans have made them more likely to engage in emotional spending, led generationally by 62% of Gen Zers and 55% of millennials.

Current economic uncertainty has led to emotional shopping

Consumers enjoy retail therapy — even (or especially) when the economy is uncertain. All in all, 63% of Americans say emotions influence their purchases. The percentage is particularly high among six-figure earners (72%), those with children younger than 18 (70%) and Gen Zers ages 18 to 28 (69%).

Meanwhile, 38% of Americans say the stress of current economic uncertainty has made them spend more and 21% feel pressured to spend to keep up with others. Consumers don’t necessarily find that tendency concerning, though, as 46% believe emotional spending is normal.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — believes that impulsive spending is a perfectly normal response to being emotional.

“That doesn’t mean it’s something that should be encouraged, but it’s something that most of us have done at one point or another,” he says. “It can even be OK in moderation. However, when it happens too often to too large of a degree, it can be a real problem in a hurry.”

But not all Americans use shopping in this way — or even like it at all. While 33% love to shop, 50% say they like to shop but only do so when they have to.

Regret is common

Those who impulsively shop based on their mood may be left with regret. In fact, 74% of emotional shoppers say it’s led them to overspend.

That’s an impactful percentage, particularly as 44% say emotional shopping has negatively impacted their financial well-being — a figure that rises to at least half among those with children younger than 18 (52%) and millennials ages 29 to 44 (50%). Gen Zers are close behind at 49%.

“Most people live under a pretty tight budget, without a ton of wiggle room once their primary bills are paid,” Schulz says. “That’s especially true because of stubborn inflation and high interest rates. If you’re regularly overspending on anything, it can cause major issues.”

Beyond that, 43% of emotional spenders have gone into debt due to it — and a further 69% have regretted acting on their emotions in this way.

How do these trends contribute to the feeling of financial well-being across all Americans? Regardless of whether they emotionally shop, 58% of Americans feel at least somewhat satisfied about the state of their personal finances. Meanwhile, 27% of Americans say they consider themselves to be savers, 23% say they’re spenders and almost half (46%) say they consider themselves to be both savers and spenders equally.

Shopping improves mood

People who emotionally shop are typically looking to cheer themselves up. Across all Americans, 47% have engaged in retail therapy to improve their mood. In fact, nearly 3 in 5 (59%) Gen Zers have engaged in retail therapy to improve their mood.

When doing so, 63% say they buy food to improve their mood — the most common response. Clothing and accessories (54%) and personal care or beauty products (42%) follow.

Also of note: 54% of Americans consider retail therapy a form of self-care.

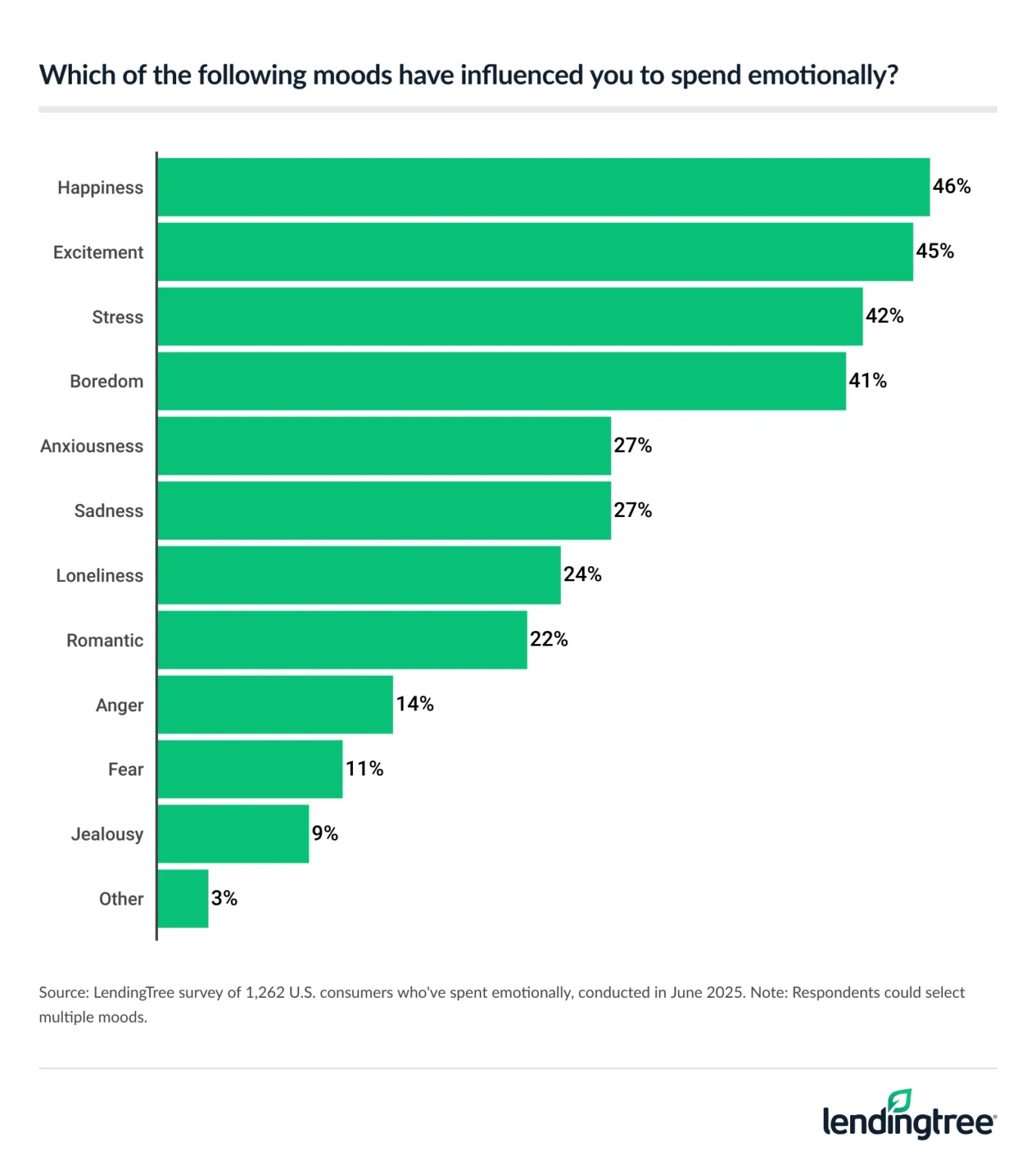

Separately, 81% of emotional spenders say their mood sometimes or often influences their purchases. When it comes to which moods have influenced a purchase, positive feelings — perhaps surprisingly — top the list. Across all emotional shoppers, 46% say happiness has influenced a purchase, while 45% say excitement.

52% of emotional spenders are influenced by BNPL

While emotional spending may be impulsive, many shoppers push off the bill. In fact, a whopping 52% of emotional spenders say buy now, pay later (BNPL) loans have made them more likely to engage in emotional spending.

By age group, Gen Zers (62%) and millennials (55%) are the most likely to say these loans make emotional spending more likely for them. Those with children younger than 18 (60%) are the most likely to feel encouraged by BNPL across all other demographics.

Schulz finds these figures concerning. “BNPL is definitely something that emotional spenders can get themselves in trouble with because these loans are so easy to get,” he says. “They’re far more accessible than even store credit cards, so the possibility of overspending is very real.”

Breaking up with retail therapy: Top expert tips

It can be difficult to break retail therapy habits, particularly if you’re an impulsive spender. If emotional spending is affecting your financial health significantly, there are a few things to keep in mind:

- Try the 24-hour rule. “When you’re emotional, it can be easy to let yourself get swept up in those emotions,” Schulz says. “It can absolutely be easier said than done, but taking a moment to breathe and to assess things can change everything. Before you buy something impulsively, you should wait 24 hours instead. Then, if a day later you still want the item, go for it. However, often after all that time passes, the item doesn’t look quite as appealing anymore. The 24-hour rule can help turn that purchase into a dodged bullet rather than a regret.”

- Opt for a credit card rather than BNPL. “We’ve all bought things in the heat of the moment and eventually wished we hadn’t,” he says. “BNPL has become notorious for being difficult when it comes to returns, with returners sometimes required to pay off the entire BNPL loan before the return can be processed. That’s typically not an issue with a credit card.”

- Unsubscribe from temptation. If you’re prone to emotional spending, your inbox and social feeds might be working against you. Unsubscribe from promotional emails, mute shopping apps and unfollow brands that trigger impulse buys. Out of sight, out of cart.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from June 2 to 3, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79