Holiday Debt Hits $1,223 as Tariffs Push 45% of Americans to Cut Back on Gifts

Picture this: The holidays have come and gone. Something’s still lingering, but it isn’t snow — it’s debt.

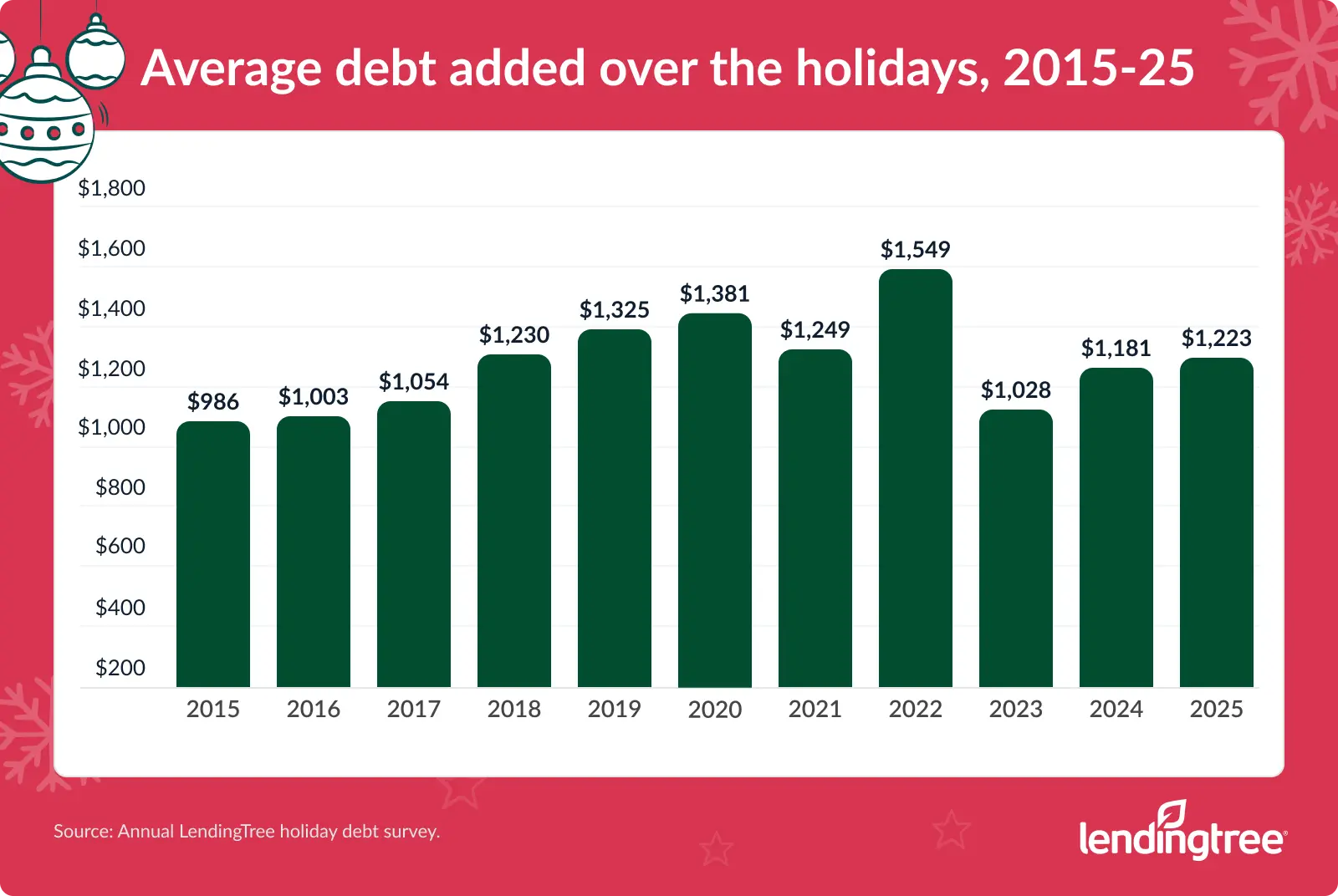

This year, over a third of consumers took on holiday debt, at an average of $1,223, according to a LendingTree survey of 2,000-plus U.S. consumers.

Let’s break it down.

- Holiday spending shoved many Americans into the red this season. Over a third (37%) racked up holiday debt, averaging $1,223 — up from $1,181 last year and the highest since 2022. Parents with kids younger than 18 were hit even harder: Nearly half (48%) borrowed to cover the holidays, piling on an average of $1,324 in debt.

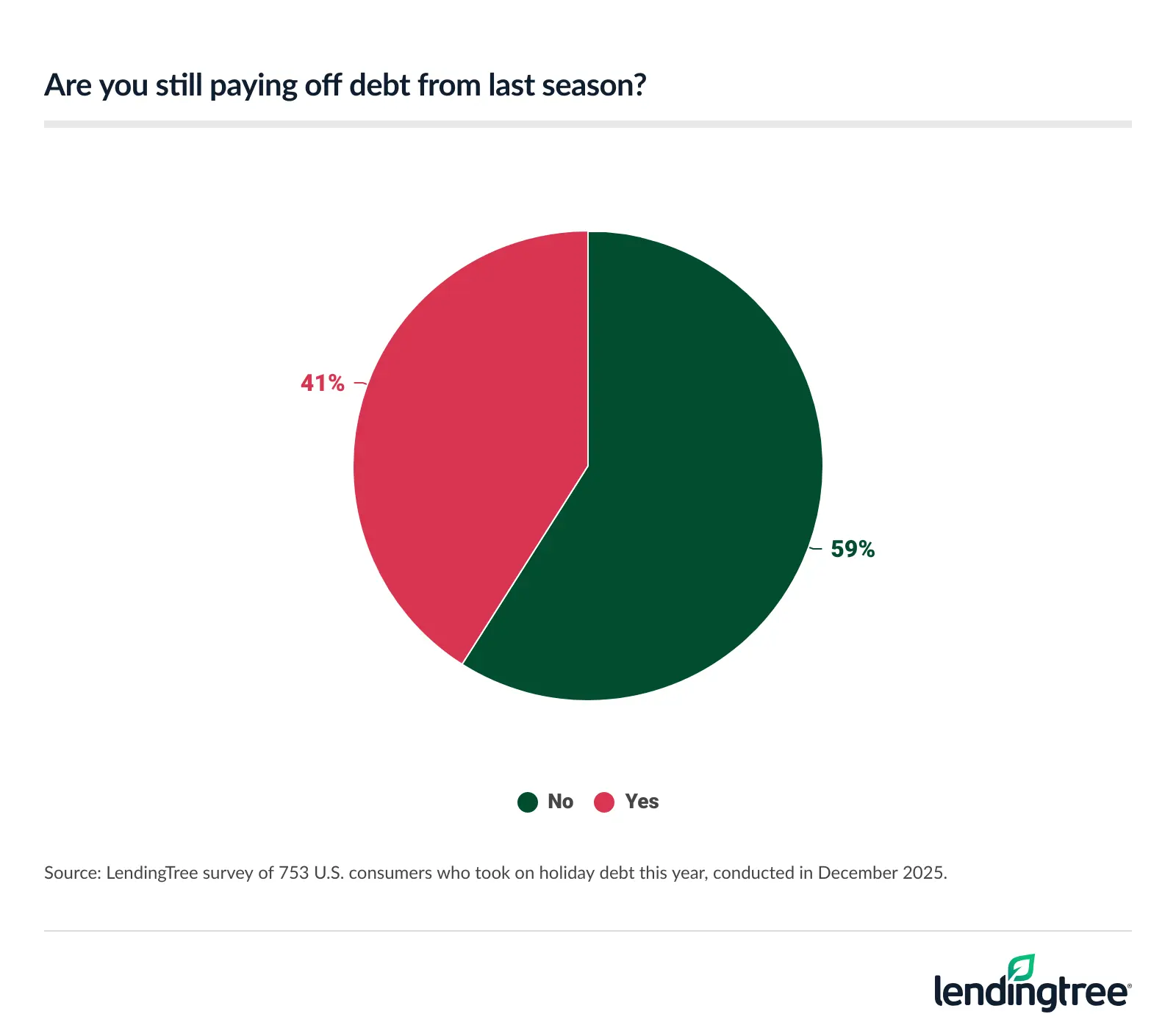

- Ghosts of holidays past still haunt some. Among those who took on debt this season, 41% are still digging out from last year’s bills. Overall, 59% with holiday debt this season admit they’re stressed about it and 47% regret spending as much as they did, common among parents of young kids (52%).

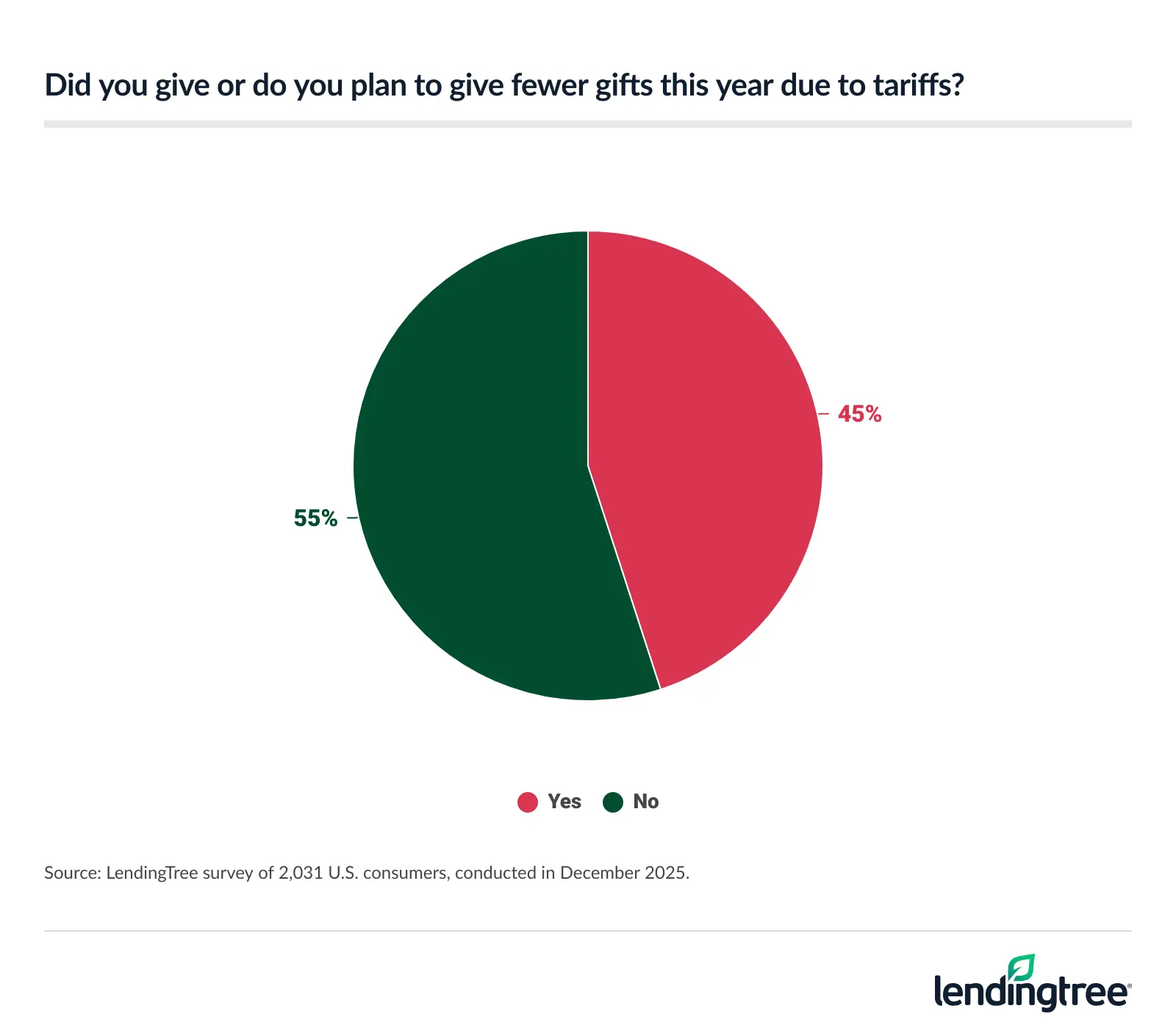

- Tariffs are stealing Christmas for many Americans. 45% plan to give fewer gifts this year due to tariffs. Additionally, 46% say gift prices have ruined the holidays for them, led by Gen Zers (57%). To cope, many are borrowing from tomorrow, as 45% giving gifts this year have used buy now, pay later (BNPL) financing for at least one purchase.

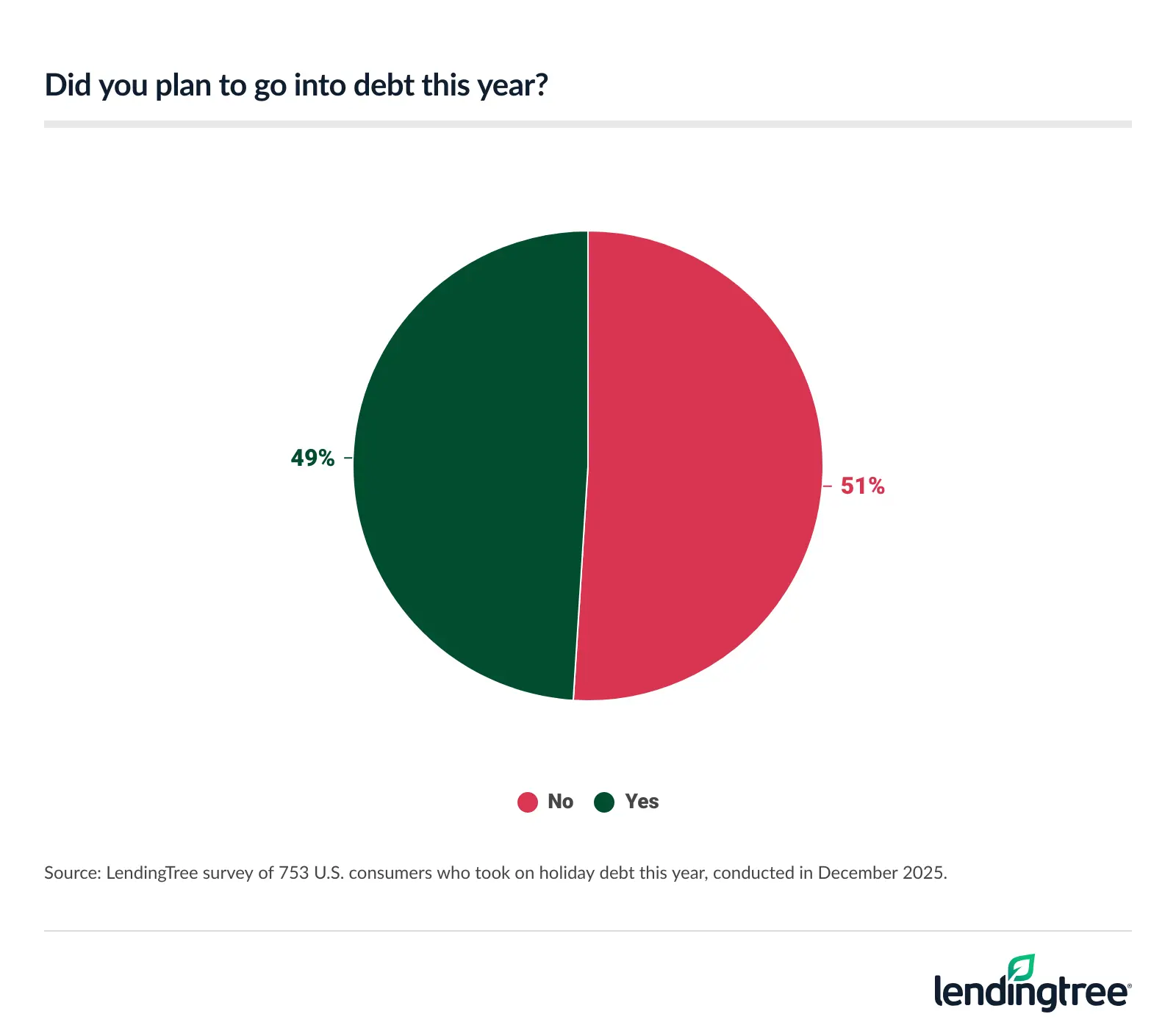

- For many, holiday debt isn’t a shock. Among holiday debtors, 49% planned to go into the red. Most of the debt is sitting on credit cards (62%), BNPL loans (35%) or store credit cards (32%). When asked how long it’ll take for them to pay it off, 63% said three months or longer, and 40% are paying interest rates of 20.00% or more.

Santa is coming, but the bills won’t leave

Christmas cheer isn’t free. During this year’s holiday season, a whopping 37% racked up holiday debt. On average, those with holiday debt racked up $1,223. That’s up from $1,181 last year and the highest since 2022.

Here are the average debts in the 11 years LendingTree has conducted this survey:

Parents with kids younger than 18 are significantly more likely to take on holiday debt, with 48% borrowing, at an average of $1,324.

Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” says that’s in line with what he expected.

“No one should be surprised that parents with young kids are more likely to take on holiday debt,” he says. “The pressure to spend big on the holidays comes from all sides and can be hard to ignore.”

Six-figure earners (47%) are also among the most likely to borrow for the holidays, taking on an average of $1,505 — the highest by demographic. By age group, millennials ages 29 to 44 and Gen Zers ages 18 to 28 are the most likely to borrow, both at 44%. They accumulated a similar $1,294 and $1,295, respectively, in debt.

What does that spending look like? In total, 76% of Americans plan to give gifts this year. Of this group, 50% completed their shopping by the time this survey was fielded Dec. 10 to 15.

Nearly half (46%) of gift-givers say their most expensive present cost $250 or more. Gift-givers are most likely to say the most expensive presents are for spouses or significant others (34%) or children (33%).

When asked what gifts they plan to buy, clothing (65%) topped the list, ahead of electronics or gadgets (49%) and gift cards (45%). Gift-givers also planned to buy:

- Toys or games (41%)

- Jewelry (38%)

- Food or drink (31%)

- Beauty or personal care (28%)

- Books or educational materials (25%)

- Home goods (17%)

- Household appliances (14%)

- Travel-related gifts (13%)

- Experiences (11%)

- Other (6%)

Prior debt haunts some

It’s not just this year’s debt that consumers worry about. Among those who took on debt this season, 41% are still paying last year’s bills, too. That figure is especially high among six-figure earners (50%), those with children younger than 18 (50%) and millennials (49%).

Schulz says that’s alarming.

“Carrying a month or two of holiday debt is no big deal,” he says. “Extend that out to six months to a year or longer and it becomes significant because of how high interest rates are on credit cards today. The average APR on a credit card accruing interest is nearly 23.00% today, and the average APR for a new credit card is nearly 24.00%. Both of those numbers are down a bit from the record highs of recent years, but they’re still sky-high. You’ll pay a high price for carrying a balance this holiday shopping season.”

Of those with holiday debt this year, 59% say they’re stressed about it and 47% regret spending as much as they did. Regret is especially common among those earning less than $30,000 (55%), parents of young kids (52%), millennials (51%) and Gen Zers (51%).

Tariffs played the Grinch for many

This Christmas, tariffs are an uninvited guest that has influenced many Americans’ spending habits. When this survey was fielded, 45% of Americans planned to give fewer gifts this year due to tariffs.

Consumers are right to hold back. A LendingTree study on tariffs found that if current tariffs had been in place during the 2024 winter holidays, consumers and retailers would have faced an extra $40.6 billion burden from gift purchases. That breaks down to $132 per shopper.

More broadly speaking, 46% say gift prices have ruined the holidays for them. That figure is especially high among Gen Zers (57%), those earning less than $30,000 (53%) and those with children younger than 18 (52%).

To cope with high prices, 45% giving gifts this year have used buy now, pay later (BNPL) financing for at least one purchase, with 20% doing so for multiple purchases.

If times are tough, it’s OK to give your friends and family a heads up that gifts may be a little light this year. You don’t have to open up your books or give them an economics lesson, but sharing a bit about what you’re going through can make a difference.

Even if inflation isn’t growing as fast as it has in recent years, Schulz says the price of most everything is still high — and there’s no question that it’s taking a toll on shoppers.

“It’s forcing some to rely on credit cards more to make ends meet, but it’s pushing some others to look for lower-cost alternatives or to cut back shopping altogether,” he says. “For example, more people are opting for BNPL loans instead of store cards, in search of an interest-free way to extend their holiday shopping budget. While BNPL can be a good choice, if used wisely, it’s crucial that people understand what they’re getting into before they apply.”

Debt is the least surprising gift of all

Although debt may be high and many may still be paying off last year’s holiday debt, most expected to put themselves in debt this year. Among those with holiday debt, 49% had planned to go into the red. Parents with children younger than 18 (56%), six-figure earners (55%) and millennials (55%) were the most likely to expect their debt.

When it comes to the most common types of debt, 62% put their purchases on credit cards. That’s followed by BNPL loans (35%) and store credit cards (32%). Regardless of whether they took on debt, 43% of consumers applied for a store credit card this holiday season.

When asked how long it’ll take for them to pay off their holiday debt, 37% said two months or less, leaving 63% to take three months or longer. Alarmingly, 40% are paying interest rates of 20.00% or more, while 34% are paying rates between 10.00% and 19.99% and 17% are paying less than 10.00%.

Schulz says that’s a big deal because it can have a profound effect on your finances for the next several months, depending on how big that debt is. But not all debt is bad debt.

“The right credit card, used the right way, can be an asset during the holidays,” he says. “Rewards can help extend your holiday budget. The card’s consumer protections can make things easier if an item doesn’t arrive or you need to return it. It can make travel more affordable and comfortable with free or reduced-cost flights and hotel nights, lower gas prices and even lounge access. However, there’s real risk, too. It’s no secret that people also spend more with credit cards than they do with cash, and that’s a big deal, especially if you’re on a tight budget.”

Keeping spirits high and balances low: Top expert tips

If you’re struggling with too much debt after the holiday season, Schulz says there are a few things you can do to help pay it off. He recommends the following:

- A 0% balance transfer credit card is one of the most powerful weapons you can have in the fight against credit card debt. “You’ll need good credit to get one, and there are fees and fine print that you need to know about, but the savings can be an absolute lifesaver,” he says. “If you don’t have good enough credit to get one, a debt consolidation loan can help you pay less interest.”

- Don’t be afraid to ask for help. “Lenders have hardship programs that can help you through a short-term rough patch,” he says. “That could include deferred payments, lower interest rates, waived fees and other temporary help. However, you won’t get them if you don’t ask. And the sooner you ask, the better. You may be more likely to get the benefit of the doubt when you’re still current on your payments than if you’ve already paid late a time or two. An accredited nonprofit credit counselor can be useful as well.”

- Communicate. “Your loved ones probably don’t want you to take on debt,” he says. “If times are tough, it’s OK to give your friends and family a heads up that gifts may be a little light this year. You don’t have to open up your books or give them an economics lesson, but sharing a bit about what you’re going through can make a difference. Honestly, there’s a good chance they might be going through something similar or know others who are. Plus, if someone does get put off by what you tell them, it probably says more about them than about you.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,032 U.S. consumers ages 18 to 79 from Dec. 10 to 15, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennials: 29 to 44

- Generation X: 45 to 60

- Baby boomers: 61 to 79