Holiday Blessed or Stressed? 56% of Gift-Givers Are Feeling the Pressure This Season, With Parents, Millennials and Women Topping the List

As the holidays approach, many Americans are feeling like their wallets are stretched thin. If costly Thanksgivings weren’t enough to stress consumers, more than half (56%) of those planning to give a holiday gift say they’re worried about it — with affordability as the No. 1 reason for stress.

We asked more than 2,000 U.S. consumers about their gift-giving stressors — here’s what we found.

- 81% of Americans plan to participate in holiday gift-giving this year, but the most wonderful time of the year doesn’t always come with cheer. 56% of gifters say they’re stressed about giving — especially parents with young children (66%), millennials (64%) and women (64%).

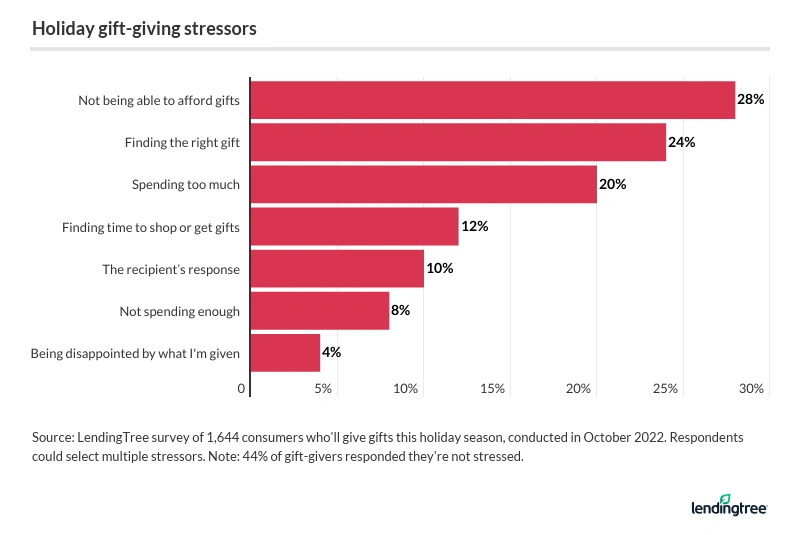

- The leading cause of holiday gift stress is not being able to afford presents (28%), while finding the right gift is a contributing factor (24%). Across demographics, women (37%) are most likely to cite an inability to afford gifts.

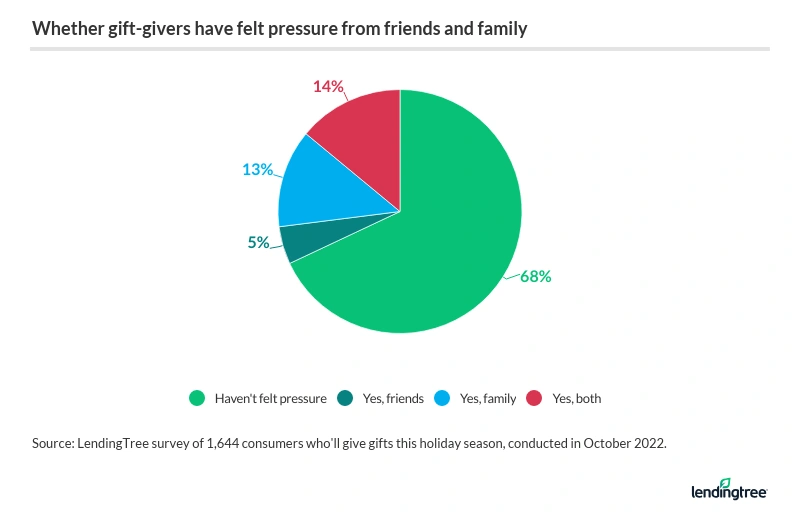

- While most givers say they haven’t felt gift pressure from outside sources (68%), nearly a third (32%) say they feel it from family and/or friends. To avoid the stress, 24% of gift-givers set budgets and 21% doled out gift cards.

- Givers might be trying too hard to find the right gift. 27% of gifters prefer to receive cash, 16% would rather get gift cards and 14% prefer experiences.

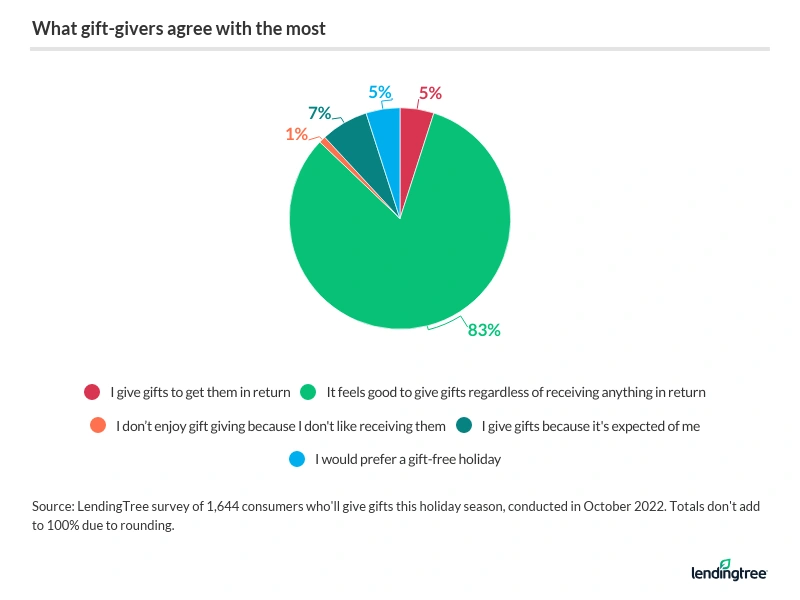

- Although it might be stressful to get there, 83% of givers say it makes them feel good to gift something regardless of what they get in return. When they receive one, 72% cite that their favorite gifts are thoughtful ones.

Majority of Americans plan to give a holiday gift, but most are stressed about it

This year, 81% of Americans plan to give a gift for the holidays. It may be worth reaching out to your well-off aunt or uncle this year, as six-figure earners (89%) are the most likely to give a holiday gift. Parents with children younger than 18 are also high on the list at 84%.

On the other hand, inflation may be cutting into low-earning consumers’ holiday budgets. Those earning less than $35,000 are the least likely to give a holiday gift: Just 71% of this demographic is participating in gift-giving this year — 18 percentage points lower than six-figure earners. Those without children are also less inclined to give a gift, at 78%.

It’s not all holiday cheer, though: More than half (56%) of those planning to give a gift say they’re stressed about it. That’s particularly true for parents with young children (66%), millennials (ages 26 to 41) (64%) and women (64%) — more on that below.

Lack of affordability is the leading cause of gift-giving stress

Cash is tight this year, and fulfilling your gift-giving responsibilities may be a little more difficult. In fact, for those giving a gift this year, their top concern is not being able to afford presents (28%).

According to LendingTree chief consumer finance analyst Matt Schulz, inflation is to blame for those struggling to afford a gift.

“The truth is that your holiday spending dollar won’t go nearly as far this year as it did last year,” Schulz says. “That means that if you haven’t increased your holiday spending budget — and unfortunately, many Americans simply can’t — you’re going to have to make some sacrifices. One of those sacrifices might just be giving fewer gifts this season.”

Across demographics, women (37%) are most likely to cite an inability to afford gifts, though parents with young children (35%) aren’t far behind.

Givers are also worried about finding the right gift (24%), particularly Gen Zers (ages 18 to 25) (35%), six-figure earners (29%) and women (28%). One in 5 givers (20%) are stressed about spending too much on gifts, with parents with young children (27%) and millennials (27%) the most likely to say so. Following that, 12% of givers say they’re stressed about finding the time to shop for a gift, leading with Gen Zers (20%).

Most gift-givers don’t feel pressure from others, but some feel it from family

You’re not alone if you’ve ever felt the pressure to give a gift: Most givers say they haven’t felt gift pressure from outside sources this year (68%), but nearly a third (32%) say they feel it from family and/or friends.

This comes as the majority of givers say they expect to spend the most money on gifts for their families, particularly for children (47%). While 19% say they expect to spend the most on a significant other — the second-highest response — 12% plan to spend the most on their parents or guardians.

Gen Z givers, the group most likely to say they’ve felt the pressure this year (45%), are also the most likely to spend the most on their parents or guardians (29%). They’re also the third most likely group to shell out for their siblings (13%, versus 7% across all gift-givers).

And it’s not just Gen Zers who are stressed, either. Parents with young children are also among the most likely to feel pressure from family and/or friends (39%). This group is also the most likely to spend the most on children (76%).

Still, gift-givers are finding ways to reduce stress. In particular, 24% say they’re setting budgets — a method Schulz highly recommends.

“A budget helps reduce your gift-giving stress by allowing you more control,” he says. “It can help you know exactly how much you can afford to spend on gifts this holiday, and if you end up still going a little overboard with gift shopping, it can show you places where you can trim your expenses to make up for it. That’s a big deal. It’s far, far better than flying blind and hoping for the best.”

Meanwhile, 21% of gifters are reducing stress by giving gift cards this year, with baby boomers (ages 57 to 76) (27%) the most likely group to do so. Following that, 17% are making wish lists — that method is most common among women and Gen Zers, at 19% for both.

Gift-givers are also reducing stress by:

- Discussing gift expectations (12%)

- Participating in a Secret Santa or another secret gift exchange (7%)

- Going shopping together (6%)

- Playing White Elephant, a game in which players contribute gifts to a pool anonymously (5%)

- Another method (4%)

Gifters prefer getting cash, gift cards and experiences

Looking at what givers like receiving might shed some light on what the best gifts may be. Responses indicate that they might be trying a little too hard to find the right gift, as 27% of gifters prefer to receive cash. Other popular answers don’t involve personalized material gifts: 16% would rather have gift cards, while 14% prefer experiences.

Additional common responses include:

- Technology (11%)

- Clothes (9%)

- Handmade gifts (7%)

Either way, though, the majority of gift-givers say they weren’t disappointed in the most recent gift they received (43%). And while 33% say they were disappointed, they say it’s the thought that counts. Finally, 14% say they were hopeful for a more thoughtful gift.

When it comes to who these givers expect gifts from, 31% expect their significant others to spend the most on gifts for them this holiday season — particularly married respondents (45%) and six-figure earners (41%). Meanwhile, 24% expect their children to shell out the most for them, a figure that’s highest among parents with adult children (42%) and baby boomers (40%).

Finally, 21% of givers expect their parents or guardians to spend the most on them this holiday season. The youngest generation is the most likely to expect their parents or parental figures to spend the most on them, with 44% of Gen Zers saying they expect the most from their parents.

The top reason for giving gifts? It makes gifters feel good

Although many may feel stressed about giving this year, 83% of givers say it makes them feel good to give — regardless of what they get in return.

Meanwhile, 7% give gifts because it’s expected of them. The next popular responses? Gifters are equally likely to say they prefer a gift-free holiday and give a gift to receive one in return, at 5% for both. Gen Zers are the most likely group to give gifts in order to get them, at 11%.

When they do receive one, 72% say their favorite gifts are thoughtful ones. That’s far higher than the 9% of givers who say their favorite gifts are useful ones, the second most common response.

3 ways credit cards can help relieve gift-giving stress

If you’re among the consumers stressed about gift-giving this year, Schulz says that credit cards can help ease your financial burden — so long as you use them right. Particularly, he recommends:

- Open a new credit card. “If you’ve saved cash for your holiday shopping this season, a new credit card can help that cash go any further,” he says. “Instead of paying cash for the gifts, get a new credit card with a sign-up bonus, put the purchases on that card and then use your savings to pay the balance off in full when the bill comes due. That way, you’ll be able to take advantage of the sign-up bonus without paying any interest.”

- If you’re struggling with debt, consider opening a 0% balance transfer credit card. “A 0% balance transfer card can save you real money and significantly reduce the amount of time it takes to pay off the balance because it lets you not accrue interest on that balance for up to 21 months,” Schulz says. “That can potentially free up some money in the short term for your holiday shopping budget.”

- Take advantage of cash back rewards or points for buying gift cards. “If you have a credit card that gives you extra cash back or points for shopping at certain types of stores, you could leverage those extra rewards for savings on gift cards,” he says. “For example, if you have a card that gives you 5% back on grocery store purchases, you could go to your favorite grocery store’s gift card rack, buy gift cards from other businesses and save 5% in the process. That’s a good way to take advantage of certain cards’ rotating rewards categories.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,033 U.S. consumers ages 18 to 76 on Oct. 18, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76