Nearly 7 in 10 Rewards Credit Cardholders Sitting on Unused Cash Back, Points or Miles

The potential to earn travel, cash back and more are a few of the benefits that rewards credit cards may feature. With such valuable perks, it’s no wonder that 87% of credit cardholders have at least one that allows them to earn rewards, according to the latest LendingTree survey of nearly 1,300 credit cardholders.

Yet not everyone is taking advantage of the rewards they accumulate. In fact, the majority of rewards credit cardholders (almost 70%) have unused cash back rewards, points or miles.

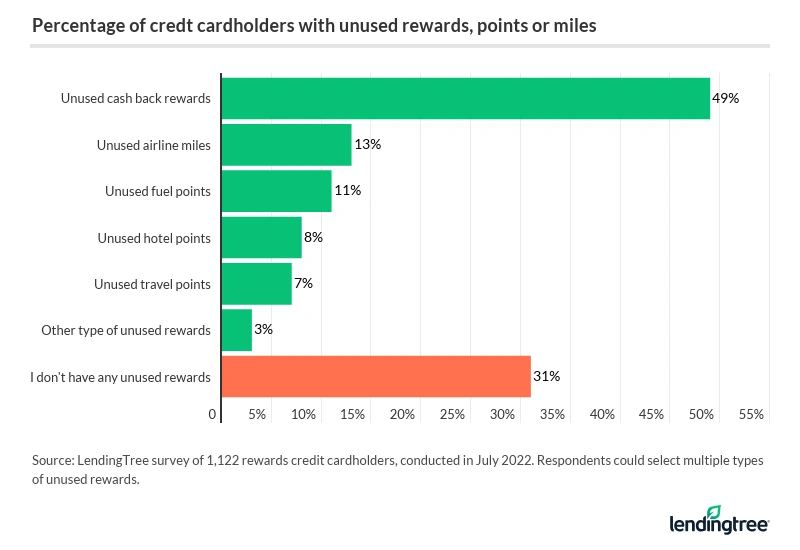

- Nearly 70% of rewards credit cardholders are sitting on unused cash back, points or miles. Of that group, the majority (49%) have unused cash back rewards, while 13% have unused airline miles and 11% unused fuel points. Of those with unused cash back rewards, nearly a third (31%) have stockpiled $100 or more.

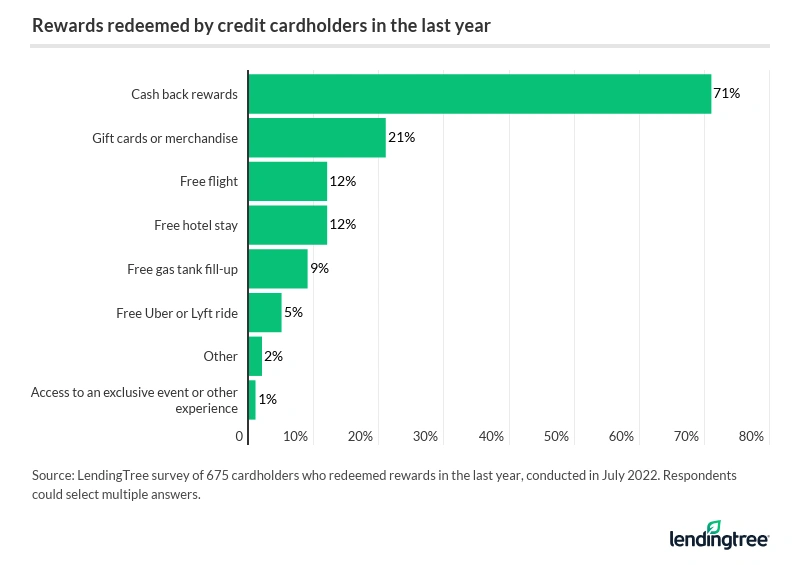

- 40% of rewards credit cardholders haven’t cashed in on any rewards in the past year. As for those who have redeemed rewards in the past year, most (71%) redeemed cash back, while 21% cashed in points for merchandise or gift cards, 12% earned a free flight and another 12% a free hotel stay.

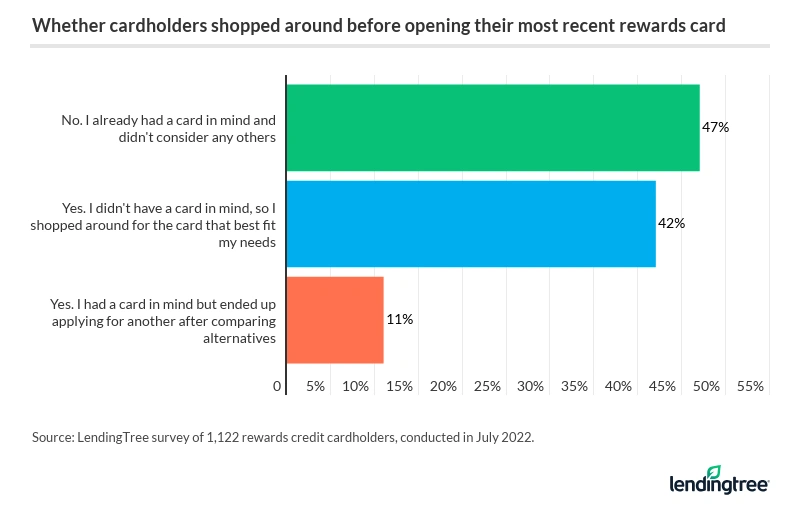

- Shopping around for a credit card helped consumers find their best rewards option. 53% of rewards cardholders say they compared multiple credit cards before applying. Those who shopped around for a card are less likely to have unused credit card rewards than those who didn’t compare multiple cards (66% versus 73%).

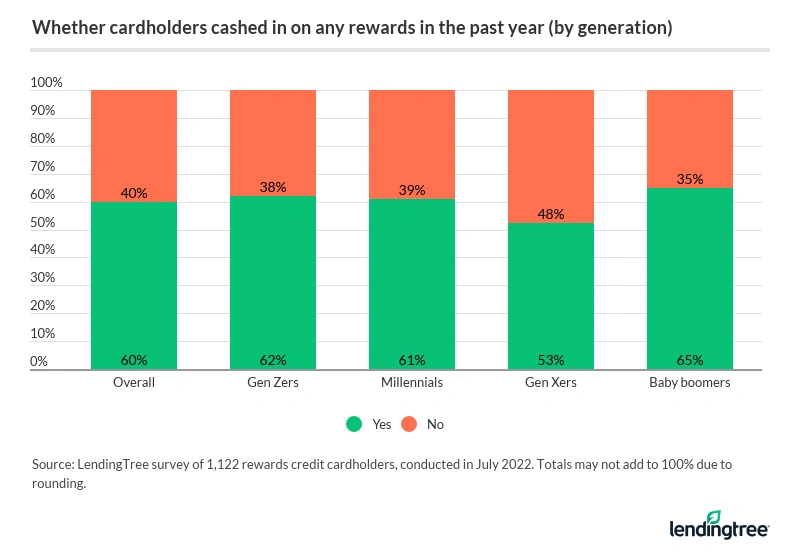

- Gen Zers redeem credit card rewards more frequently than other generations, but baby boomers are most likely to do so annually. 17% of Gen Zers cash in on rewards every month (or more often), compared with 11% of millennials and 9% of Gen Xers and baby boomers. However, baby boomers were most likely to redeem credit card rewards in the past year (65%, versus 62% of Gen Zers). Gen Xers were least likely at 53%.

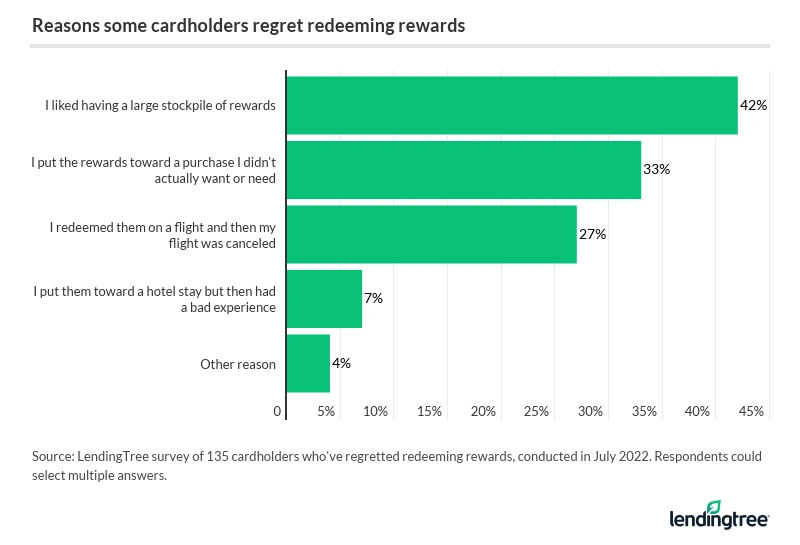

- Rewards regrets and mistakes aren’t widespread, but they do exist. 15% of rewards cardholders say some of their rewards, points or miles expired before they could use them. Separately, 14% have regretted redeeming their rewards, mainly because they liked having a large stockpile or put the rewards toward a purchase they didn’t want or need.

Cardholders have untapped rewards available — why aren’t they redeeming them?

Most rewards cardholders (69%) are sitting on unused cash back, points or miles. However, LendingTree chief consumer finance analyst Matt Schulz isn’t surprised by that percentage.

“Many people who collect rewards are doing so with a goal in mind, such as a dream vacation with their family,” he says. “As they earn, those rewards points and miles sit unused.”

Nearly half (49%) of rewards cardholders haven’t redeemed all the cash back available to them. Of that group, nearly a third (31%) have stockpiled $100 or more, including 11% who have $200 or more.

Below, you’ll find more insight into unused credit card rewards, and the types of rewards cardholders seem to stockpile the most.

People who earn less are less likely to have unused rewards than those who earn more. More than 6 in 10 (63%) who make less than $35,000 a year have unused rewards, versus 74% of cardholders who make $100,000 or more.

The primary difference between these two groups is airline miles. Almost a quarter (23%) of six-figure earners have airline miles saved. By comparison, just 4% of those making less than $35,000 have airline miles stashed away.

The top three reasons why rewards credit cardholders are sitting on unused rewards are:

- 63% enjoy saving rewards until they reach a certain amount

- 22% don’t have enough rewards, points or miles to pay for travel yet (e.g., flight, hotel stay)

- 11% have rewards for travel but don’t have any upcoming trips

Stockpiling rewards for a future goal isn’t a bad idea. But rewards points and miles tend to lose value over time, so Schulz cautions cardholders to be careful about waiting too long before redeeming their rewards.

40% haven’t redeemed any credit card rewards in the past year, but baby boomers lead the charge generationally

In the past year, 40% of rewards cardholders haven’t cashed in on any rewards. But among the majority of cardholders who redeemed rewards, high-income earners took the lead:

- 70% of six-figure earners have redeemed rewards in the past year

- 47% of those earning less than $35,000 made reward redemptions in the past year

“Airlines, hotel chains and credit card issuers have long catered to wealthier Americans because those folks are most likely to be able to afford to travel more,” Schulz says.

Higher income levels make higher credit card limits more likely as well, providing a higher ceiling when it comes to the amount of rewards, points and miles a cardholder can earn.

People in different age groups also redeemed credit card rewards at a different rate. Baby boomers (ages 57 to 76) were most likely to redeem credit card rewards in the past year. Gen Xers (ages 42 to 56), by comparison, were the least likely to cash in their points, miles or cash back.

“For baby boomers, I think a lot of it is about simply having more time to travel,” Schulz says. “Many are retired and on a fixed income but have plenty of time to go places. Rewards allow them to travel more without wrecking their budget.”

Here’s how the different generations have redeemed credit card rewards in the past year.

Of the 60% of cardholders who redeemed rewards in the past year, the most popular redemption choice (71%) was cash back. On the other end of the spectrum, just 1% of rewards cardholders redeemed rewards for experiences, like exclusive events or VIP access.

Here’s how rewards credit cardholders chose to redeem their rewards in the past 12 months.

Next, we examined how often cardholders redeem their credit card rewards:

- At least once a month (11%)

- Every other month (11%)

- Every 3 months (19%)

- Every 6 months (18%)

- Once a year (20%)

- Less than once a year (22%)

As mentioned, a higher rate of baby boomers cash in on rewards in a typical year than other generations. And yet, Gen Zers (ages 18 to 25) redeem rewards more frequently: About 1 in 5 — 17% — Gen Zers cash in on rewards every month or more often, compared with 11% of millennials (ages 26 to 41) and 9% of Gen Xers and baby boomers.

Shopping around helped cardholders find their best rewards card option

Shopping around for the best deal could work in your favor when looking for any financing — loans, mortgages and, yes, rewards credit cards, too. Overall, 53% of cardholders say they compared multiple rewards credit cards before applying, including 11% who initially sought a specific card but changed their minds after looking into alternatives.

According to Schulz, there’s a staggering number of credit card options to choose from — and if you don’t do at least a little comparison shopping, you’ll do yourself a disservice.

“If you don’t shop around, you could end up with a higher interest rate, more fees, smaller credit limit or less lucrative rewards,” he says. “Those are the last things you need, especially with inflation running rampant.”

Here’s how shopping around for a credit card impacted cardholders’ final choice in terms of which account to open.

Here’s another interesting fact: Those who shopped around for a card are less likely to have unused credit card rewards than those who didn’t compare multiple cards (66% versus 73%).

As for the cardholders with higher redemption rates, Schulz speculates that comparison shopping may have helped them find a card that better fit their lifestyle.

“It could also simply be that those who were more engaged in the card-shopping process were also more engaged in collecting and redeeming those cards’ rewards,” he says. “Often, the more interested you are in something, the more likely you are to be willing to put in a little bit of extra work for it.”

Expired rewards and other redemption regrets

Most people don’t experience regret after redeeming the credit card rewards, points or miles they earn. Nonetheless, regret isn’t unheard of, either.

Of course, if you sit on some credit card rewards long enough, they might expire — and 15% of rewards cardholders say this unpleasant experience has happened to them. An additional 18% aren’t sure if they had credit card rewards expire, so that figure could be even higher.

The best way to prevent this problem from happening, says Schulz, is to be sure to use your credit card rewards.

“Obviously, you shouldn’t just redeem perfectly good reward points and miles for something that doesn’t give you good value,” he says. “However, it’s important to remember that rewards points and miles tend to be depreciating assets. They’re only going to get less valuable over time.”

It’s worth pointing out that 14% have regretted redeeming their rewards, with Gen Zers (23%) and millennials (22%) most likely to have regretted redeeming rewards. By comparison, 96% of baby boomers say they’ve never regretted redeeming rewards.

Among those who wished they had redeemed their rewards differently after the fact, here are the most common reasons why those rewards cardholders felt that way.

Maximize your credit card rewards in 5 steps

Below are five tips to maximize your credit card rewards:

- Never go into debt to earn extra rewards: “No matter how lucrative the rewards, overspending to get them doesn’t make sense,” Schulz says. “The math just doesn’t work in your favor.” When you charge more than you can afford to pay off in a given month, the interest you pay will likely offset the value of any rewards you earn — perhaps by a lot.

- Choose rewards credit cards that mesh with your spending habits. “The best credit card for you is the one that fits your lifestyle,” Schulz says. When you ask yourself what you’ll buy with the card and what sort of rewards you want in return, your answers can help guide you to the right credit card choice for you. If you can stack those rewards with loyalty programs, you might qualify for even more benefits.

- Capitalize on bonus opportunities. “Sign-up bonuses can be really helpful for folks on a tight budget,” Schulz says. “Just make sure that you’re comfortable with how much you have to spend to get the bonus.” Remember, going into credit card debt to chase a sign-up bonus probably won’t work in your favor.

- Take advantage of special offers. Some credit cards, for example, offer incentives to use one brand over another (e.g., Uber instead of Lyft). When you use a particular brand, you might earn more rewards or be able to take advantage of credits. Gen Zers in particular are most likely to maximize their credit card issuer’s partnerships with other brands — if given the opportunity to earn incentives by using a preferred brand, 22% of Gen Zers “always” opt to do so.

- Track your rewards to avoid losing them. “It’s easy to lose track of what rewards you have, especially if you have multiple credit cards or are in multiple loyalty programs,” Schulz says. To avoid this issue, consider using a spreadsheet, an app or just an old-school pen and paper. Whatever tracking method you choose, keeping a record of your credit card rewards could help you avoid the mistake of forgetting about them.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,293 U.S. credit cardholders ages 18 to 76 from July 8-15, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76