Women Are More Frugal Than Men, but They Feel Greater Financial Strain

A Pew Research Center analysis on the gender pay gap found that women earned an average of 82% of what men did in 2022.

That gap may contribute to some recent findings from a LendingTree survey of nearly 2,000 U.S. consumers about finances and spending habits. For instance, the survey finds that 37% of women aren’t able to save money (versus 22% of men), despite them being less likely to splurge, enjoy shopping for themselves or go into debt from nonessential spending.

“If your income is smaller, it likely means you have less financial margin for error, less money to put toward emergency funds and less financial freedom as a whole,” says Matt Schulz, LendingTree chief consumer finance analyst.

See what else the survey reveals about male and female approaches to finances.

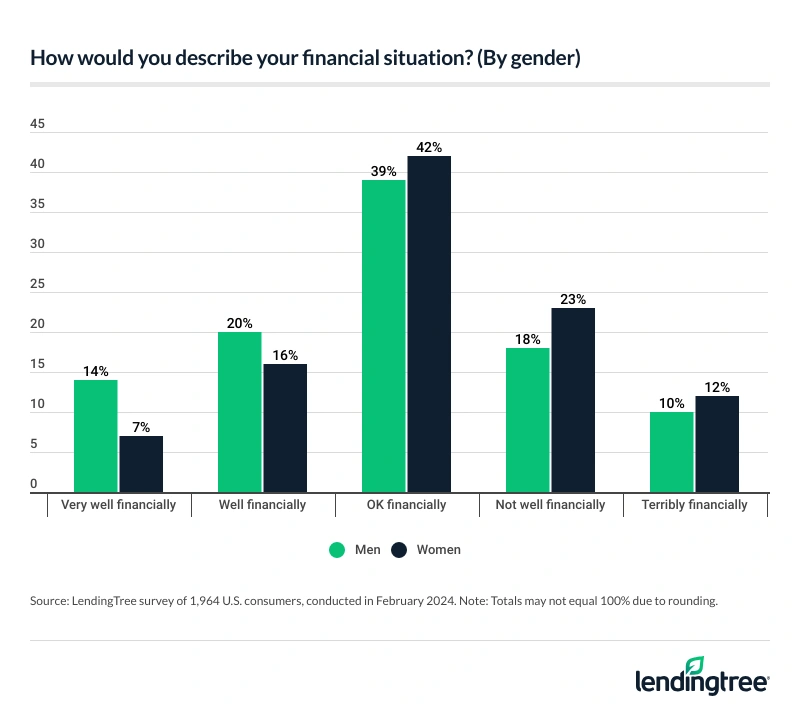

- Women are less likely than men to report they’re doing well financially but are more likely to curb spending. Just 23% of women say they’re doing well or very well financially — 11 percentage points behind men. Additionally, 37% of women aren’t able to save money, versus 22% of men. However, a higher rate of women than men are spending less compared to past years.

- Although men report greater financial stability, women are more cautious when shopping. Men are more likely than women to enjoy shopping for themselves (78% versus 70%). And a higher rate of men (51%) have fallen into debt due to nonessential spending, compared with 42% of women. Younger generations are more likely to enjoy personal shopping, led by 83% of millennial men and 82% of Gen Z men and women.

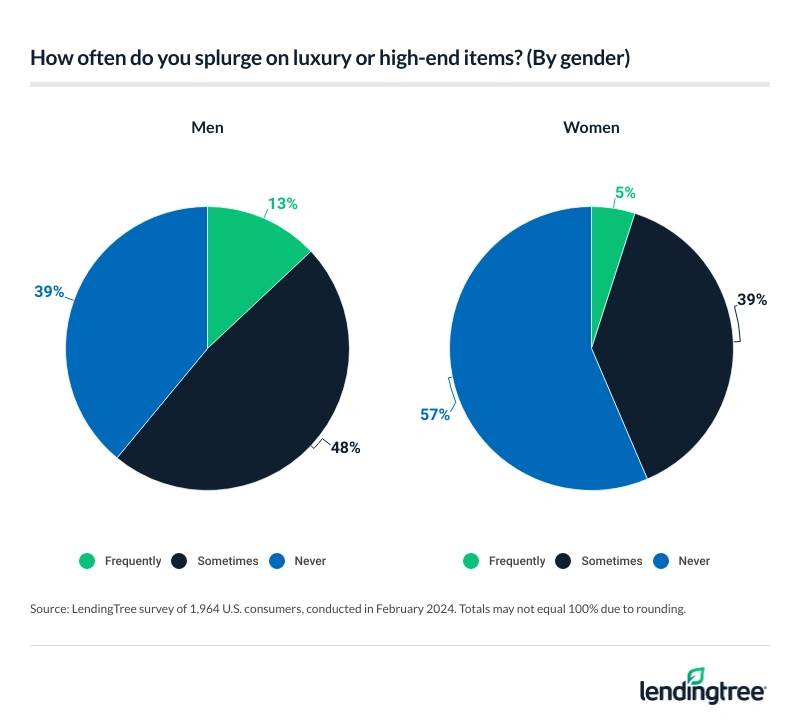

- Most Americans like to occasionally treat themselves. While over half (52%) of consumers say they splurge on luxury or high-end items, men are more likely than women to do so (61% versus 43%). Across generations, 74% of Gen Z men and 71% of millennial men admit to splurging on expensive items, compared with 51% of Gen X men and 30% of baby boomer men. Men are also more likely to report feeling pressured by fashion trends.

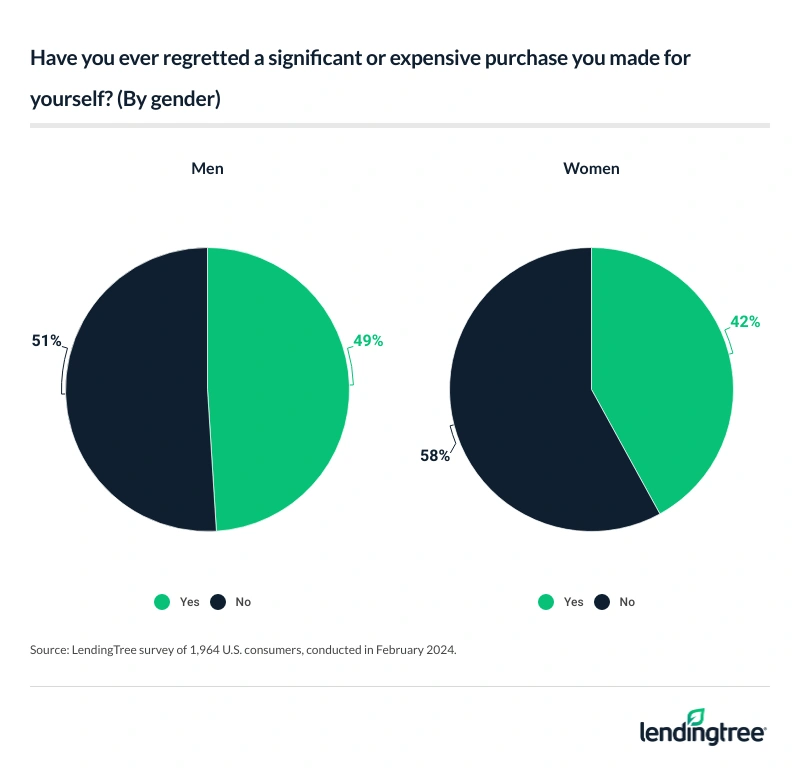

- Splurging can, unfortunately, come with buyer’s remorse. Nearly half (49%) of men and 42% of women have regretted making a significant or expensive purchase. Women are more likely to experience buyer’s remorse surrounding expensive clothing, while men tend to regret overspending on tech or gadgets. As to why they regret their big purchase? The majority, 57%, say it cost too much.

Fewer women are doing well financially than men, but they’re curbing spending

Fewer than 1 in 4 (23%) women report they’re doing well or very well financially, while more than 1 in 3 men (34%) say the same.

Conversely, 12% of women say they’re doing terribly financially, versus 10% of men. There’s an even starker contrast among millennials ages 28 to 43, with millennial women (19%) nearly twice as likely to report doing terribly as millennial men (10%).

One reason for the disparity could be that more women say they’re unable to save money regularly (37% of women, versus 22% of men). This contrast is especially noticeable in the millennial cohort, with 43% of millennial women saying they aren’t able to save money, versus 19% of millennial men.

Not having a financial cushion could make people feel less financially secure, and the pay gap and other factors could play a role in why women are struggling more, Schulz says. “There’s also the pink tax and the fact that they’re more likely to head single-parent households and bear the bulk of parenting responsibilities in two-parent households. They face a lot of financial headwinds that men don’t necessarily have to.”

As hard as it may be, saving is one of the biggest keys to financial stability and breaking the cycle of debt, Schulz says. “For example, if you pay off your credit card debt and have no emergency savings, chances are that the next unexpected expense is going to go right back on the credit card, putting you in debt once again.” That said, it can be easier said than done for many consumers, he adds.

It’s not for a lack of trying, however, with 6 in 10 women saying they’re spending less now than in past years. Despite that, just 22% of women say they’re satisfied with their progress toward their financial goals (versus the 31% of men who say the same).

Women are more cautious when spending

One sign that women are more frugal than men is their comfort level when shopping for themselves. While 78% of men enjoy making purchases such as clothes, accessories or products for themselves, a lower percentage of women — 70% — say the same.

Generationally, though, it’s millennials and baby boomers ages 60 to 78 driving that trend. Among Gen Zers ages 18 to 27 and Gen Xers ages 44 to 59, an equal percentage (82% and 73%, respectively) of men and women say they enjoy shopping for themselves.

Another aspect of cautious spending is consumers’ willingness to overextend themselves. Men are more likely than women to say they’ve gotten into credit card debt because of nonessential spending — 51% versus 42%.

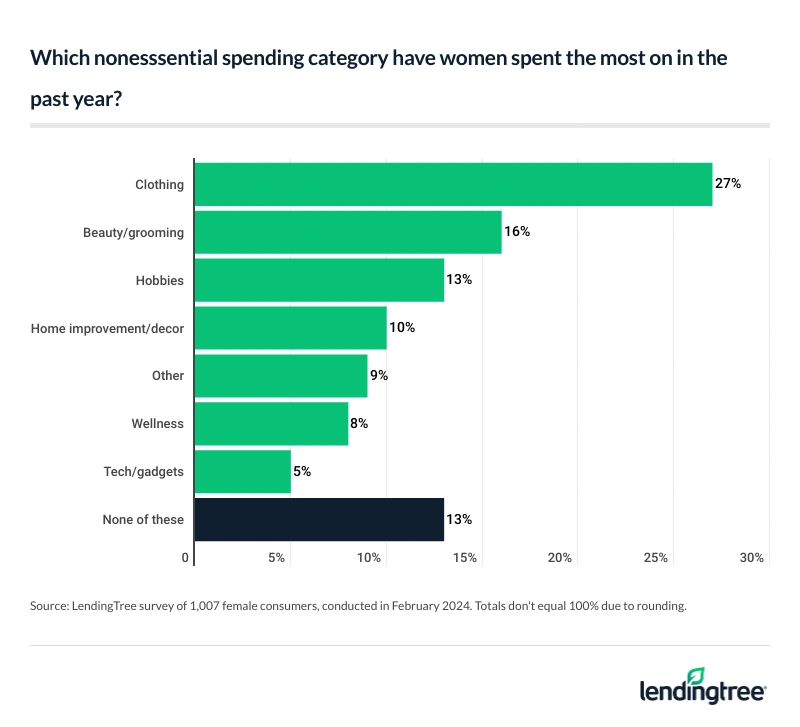

As for the most popular nonessential spending categories of men and women, clothing tops the list for both. For men, hobbies and tech gadgets round out the top three. For women, spending on beauty and grooming is second, followed by hobbies.

As for how people pay for their various purchases, both men and women choose debit cards most often, followed by credit cards and cash.

“If you’re not comfortable with credit cards or don’t want the temptation of all that extra credit, it’s perfectly fine to use a debit card,” Schulz says. “That said, credit cards are safer than debit cards because if a bad guy gets your debit card, he can take real money out of a real checking account.”

In addition, he says credit cards can be a great way to build your credit. “Paying with debit cards or cash can’t do that for you,” Schulz adds.

Another aspect the survey examines is how people prefer to shop. Women show a higher preference for online shopping over in-person shopping (37% versus 30%), while it’s a toss-up between in-store and online for men, with each response garnering 34%. The remaining respondents in both groups say they spend money evenly the two ways.

Most Americans like to occasionally treat themselves

While the survey finds that most consumers (52%) enjoy a good splurge every now and then, men do so more than women — 61% versus 43%. The younger the cohort, the larger the tendency to splurge:

- Gen Zers: 69%

- Millennials: 64%

- Gen Xers: 45%

- Baby boomers: 32%

Splurging on high-end luxury items can sometimes be OK, depending on your financial situation,” Schulz says. “Everyone has their thing they spend money on, and doing so in moderation is often no big deal.” However, frequent splurges can be a surefire way to wreck a budget and make your financial situation worse, he warns.

Wanting to keep up with the latest trends seems to correlate to extra spending, as men say they feel that pressure more so than women (23% versus 12%). The same is true for younger generations versus their older counterparts.

Splurging can come with buyer’s remorse

Nearly half (49%) of men and 42% of women have felt regret after splurging on something expensive.

For women, 30% of buyer’s remorse involves clothing, while men regret overspending on tech or gadgets the most (27%). As to why they regret their big purchase? The majority, 57%, say it cost too much, followed by 23% who say they didn’t like the item as much as they thought they would.

5 tips to manage credit card spending

Keeping credit card spending in check can be challenging, as digital shopping and constant advertisements and promotions on social media make it too easy to click and buy.

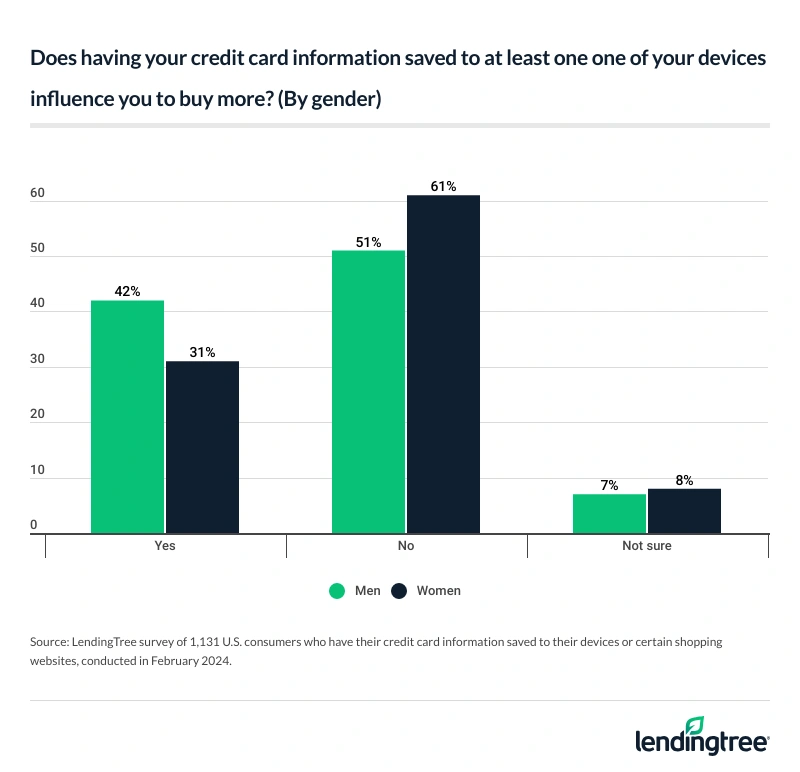

In fact, nearly half (49%) of female respondents say they have their credit card information saved on a device or website, and 31% of them say it has influenced them to spend more.

Even if your card information isn’t saved, a surprising number of consumers have their details memorized for their most-used card, including 24% of women and 36% of men. Across women, the percentage is highest among Gen Zers (40%).

Sales and discounts also influence when and how much people shop. Among women, 47% say they plan their spending around sales and discounts, versus 44% of men. While this can be a smart strategy for saving money, it might backfire if people feel pressured to buy things they don’t need when prices drop.

To help curb credit card spending, here are some tips to help you think through your purchase strategically.

- Don’t set up your credit cards for one-click shopping. “Retailers already make it super easy to buy,” Schulz says. “Don’t make it even easier by enabling one-click shopping.”

- Sleep on it. If you’re adding items to an online shopping cart, let them stay there 24 hours before you buy to avoid impulse shopping. “If an item can’t pass the 24-hour test, meaning you don’t want it after you let it sit for 24 hours, you shouldn’t buy it,” he says.

- Have a payback plan before you buy. “If you already know how you’re going to pay for something when you buy it, it becomes a far more manageable expense,” Schulz says. Even if paying for something means going into a bit of debt, you can make it work with minimal extra costs if you have a payoff plan.

- Try to stretch your budget with cash back or other credit card rewards. Rewards are an awesome way to extend your budget, he says. “That 1% or 2% cash back may not seem like much, but it can add up when you earn it consistently over the course of a year or more.”

- Have an accountability partner and/or a cheering section. Managing your finances is far easier when you don’t have to do it alone. Friends and family who know about your financial goals are more likely to help ensure you don’t end up in situations where you might overspend or wreck your budget — and they can help you celebrate your financial wins. “That stuff makes a real difference,” Schulz says.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,964 U.S. consumers ages 18 to 78 from Feb. 13 to 19, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78