Best Maryland Homeowners Insurance

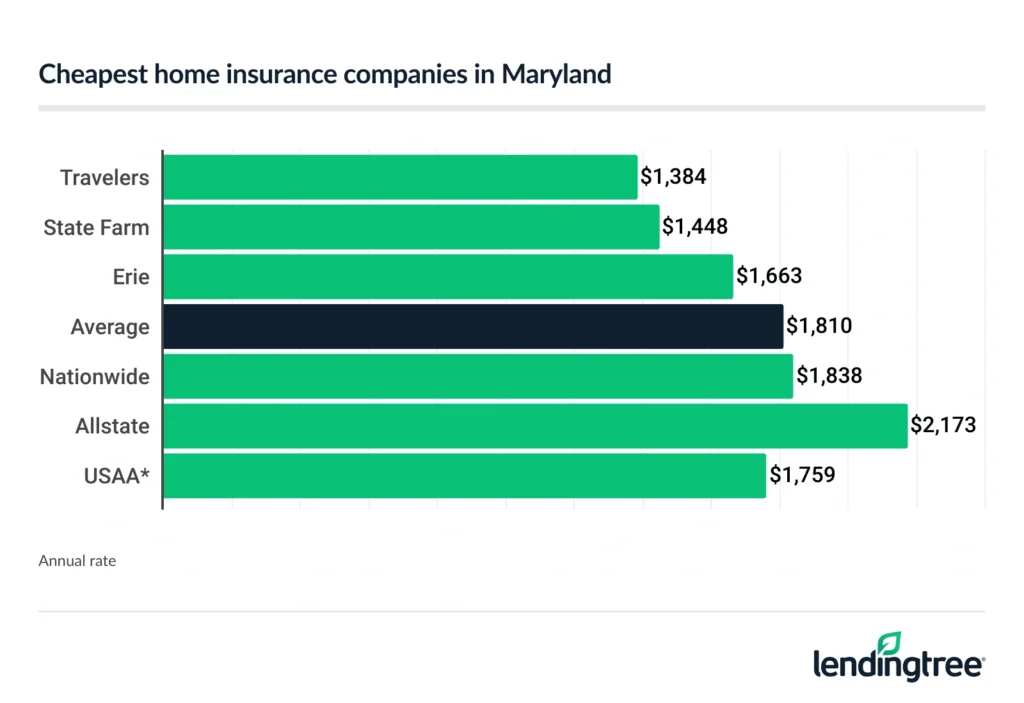

Travelers has the cheapest home insurance rate in Maryland, at an average of $1,384 a year. If you’re looking for an insurance company with great customer satisfaction and few complaints, then Erie Insurance is a great choice.

Best cheap home insurance companies in Maryland

Maryland’s cheapest home insurance companies

Travelers is the cheapest home insurance option in Maryland, offering an average rate of $1,384 a year. State Farm is the second-cheapest home insurance company in Maryland, at $1,448 a year.

For comparison, the average homeowners insurance rate in Maryland is $1,810 a year.

Cheapest home insurance companies in Maryland

| Company | Average annual rate | LendingTree score | |

|---|---|---|---|

| Travelers | $1,384 | |

| State Farm | $1,448 | |

| Erie | $1,663 | |

| Nationwide | $1,838 | |

| Allstate | $2,173 | |

| Chubb | $2,407 | Not rated |

| USAA* | $1,759 |

To get the cheapest home insurance for you, compare home insurance quotes from multiple companies while you shop.

Best homeowners insurance companies in Maryland

Erie is the best homeowners insurance company in Maryland, offering the best combo of cost and coverage.

Travelers has the state’s cheapest home insurance, with an average rate of $1,384 a year. Meanwhile, Allstate has the best selection of home insurance discounts. USAA has the best policy perks for military members, with Chubb best for coverage of luxury homes.

Maryland home insurance company comparison

| Company | Average annual rate | Overall satisfaction (higher is better) | Complaint index (lower is better) |

|---|---|---|---|

| Best overall: Erie | $1,663 | 888 (above average) | 0.50 (above average) |

| Cheapest rate and best for green homes: Travelers | $1,384 | 845 (below average) | 1.26 (below average) |

| Best discounts: Allstate | $2,173 | 868 (below average) | 1.81 (below average) |

| Best for military: USAA | $1,759 | 899 (above average) | 0.50 (above average) |

| Best for expensive homes: Chubb | $2,407 | 876 (above average) | 0.09 (above average) |

Best overall: Erie

Combining home insurance cost and coverage, Erie comes out on top in Maryland. Erie has an average rate of $1,663 a year, the third-cheapest rate in the state.

Erie also is one of the few companies in Maryland with an NAIC complaint index above the 1.0 average rating. This suggests it does a good job of resolving claim-related complaints.

PROS

- Below-average home insurance rates

- Guaranteed replacement cost coverage included in base policies

- Above-average complaint index rating

CONS

- Not many discounts

- Can’t file claim through app

- Few add-on coverage options

Cheapest rate and best for eco-friendly homes: Travelers

Travelers has the cheapest average home insurance rate in Maryland, at $1,384 a year.

It’s also an excellent choice if you have a green home, or are planning on going green. You can get a 5% discount if your house has Leadership in Energy and Environmental Design (LEED) certification.

PROS

- Cheap rates

- Good benefits for green homes

- 24/7 customer service

CONS

- Below-average customer satisfaction and complaint index

- Low bundling discount (15%) compared to other companies

- May have a banned dog list

Best discounts: Allstate

Allstate has an average home insurance rate of $2,173 in Maryland. While this is above the state average of $1,810 a year, Allstate does offer a wide variety of discounts to lower your premium. For example, if you bundle a car or life insurance policy with your Allstate home policy and save up to 25% on your insurance costs.

Other discounts you may qualify for include:

- Being claim-free

- Automatic payment signup

- Early policy signup

- Buying a new home

PROS

- Great discounts

- Identity theft restoration coverage

- Water backup coverage

- No banned dog list

CONS

- Below-average complaint index

- No extended replacement cost coverage

- Below average overall satisfaction

Best for military members: USAA

USAA has home insurance perks aimed at active-duty and veteran military members. This includes no deductible on personal property claims for personally-owned military equipment, such as uniforms.

PROS

- Excellent customer satisfaction rating

- Easy online quote process

- Personal property coverage at replacement cost

CONS

- Only available to active duty and retired military, as well as their families

- May get a different agent each time you contact USAA

Best for high-value homes: Chubb

Chubb specializes in covering luxury homes. It offers benefits like extended replacement cost coverage if a rebuild goes over your policy limit, as well as the ability to use your own contractor.

PROS

- Extended dwelling replacement cost coverage

- Good customer satisfaction and complaint index ratings

- You can use your own contractor

CONS

- High average rate in Maryland

- Need to call for a quote

- Few discounts in standard policy

Maryland home insurance rates by coverage amounts

Your policy’s dwelling coverage limit affects your premium. There’s a $437 difference in cost between a $350,000 and a $450,000 home insurance policy in Maryland. That breaks down to $36 more a month.

Average annual rate by dwelling coverage

| Dwelling coverage limit | Average annual rate |

|---|---|

| $350,000 | $1,598 |

| $400,000 | $1,810 |

| $450,000 | $2,035 |

Cost of homeowners insurance in Maryland

The average cost of homeowners insurance in Maryland is $1,810 a year. This is 35% lower than the national average cost of home insurance, which is $2,801.

Other factors that can affect your final home insurance quote include:

- The age of the home

- Your ZIP code

- The construction materials used

- Your claim history

Home insurance providers use different risk values when calculating your quote. For example, one company may think your home’s age is more of a risk than another company, and that could raise your rate.

To get the best combination of cost and coverage, compare several different home insurance companies online before buying a policy.

Maryland home insurance rates by city

Of the 15 most populated cities in Maryland, Frederick has the lowest average home insurance rate of $1,336 a year. Baltimore has the highest average rate of $2,224 a year.

Average cost of home insurance by city

| City | Average annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|

| Baltimore | $2,224 |

| Bel Air South | $1,708 |

| Bethesda | $1,430 |

| Columbia | $1,445 |

| Dundalk | $1,774 |

| Ellicott City | $1,501 |

| Frederick | $1,336 |

| Gaithersburg | $1,515 |

| Germantown | $1,501 |

| Glen Burnie | $1,720 |

| Rockville | $1,430 |

| Severn | $1,667 |

| Silver Spring | $1,454 |

| Towson | $1,743 |

| Waldorf | $1,884 |

Methodology

The rates shown in this article are based on nonbinding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in Maryland.

The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

*USAA is only available to active-duty and veteran military members and their families.