Home Insurance Fraud: 1 in 3 Policyholders Admit to Falsifying Claims

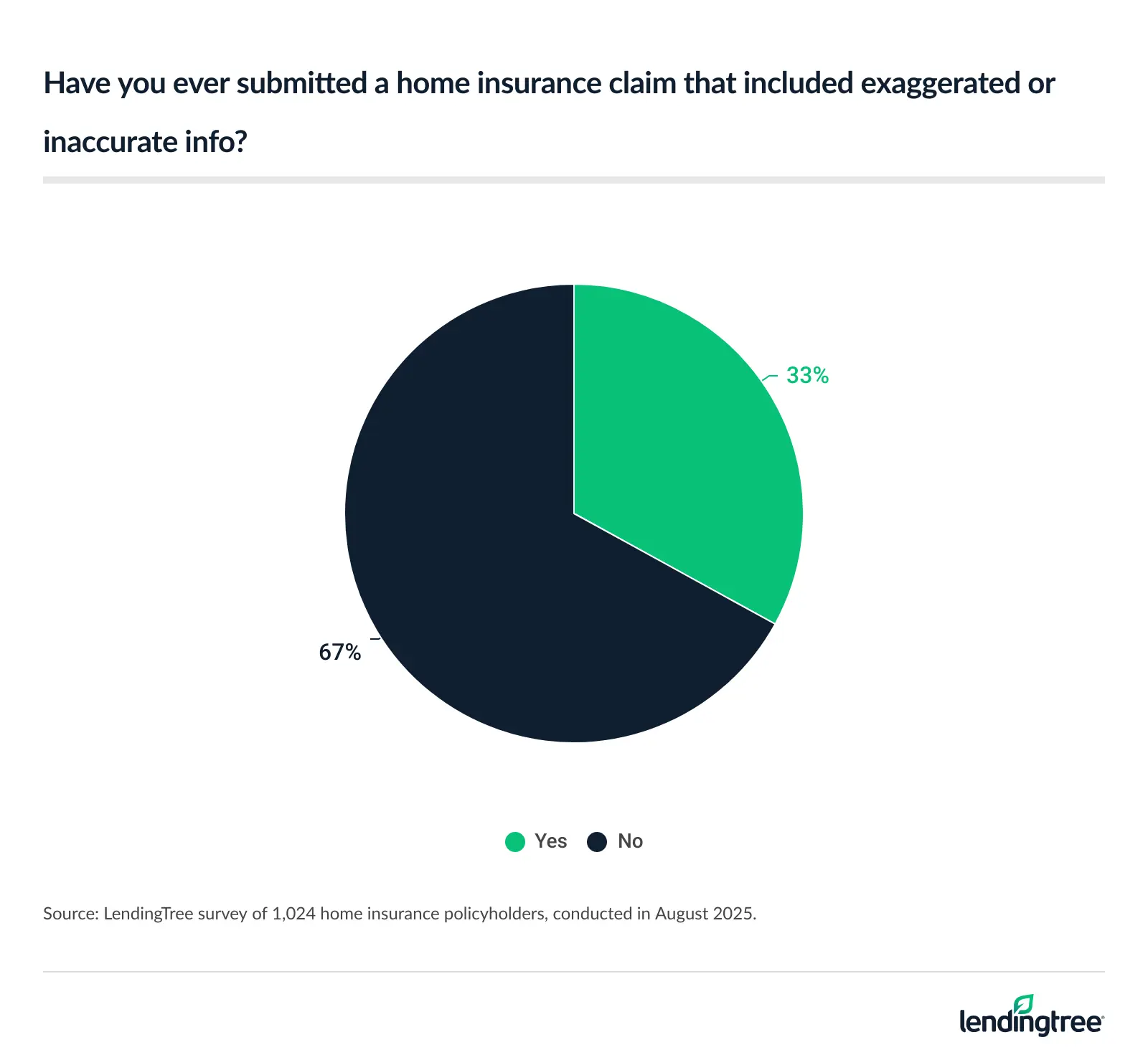

Many Americans quietly game the home insurance system. According to a survey of 2,000 U.S. consumers, 33% of policyholders have submitted claims with exaggerated or inaccurate info.

Here’s a closer look at when Americans think it’s OK to stretch the truth, what they believe is considered fraud and more.

Key findings

- Home insurance policyholders stretch the truth when making claims. A third admit to submitting a claim with exaggerated or inaccurate info. Additionally, 41% say they’d be tempted to exaggerate a claim if faced with a major home repair. And 37% say they’ve been encouraged to falsify or exaggerate a claim, including 59% of Gen Z policyholders.

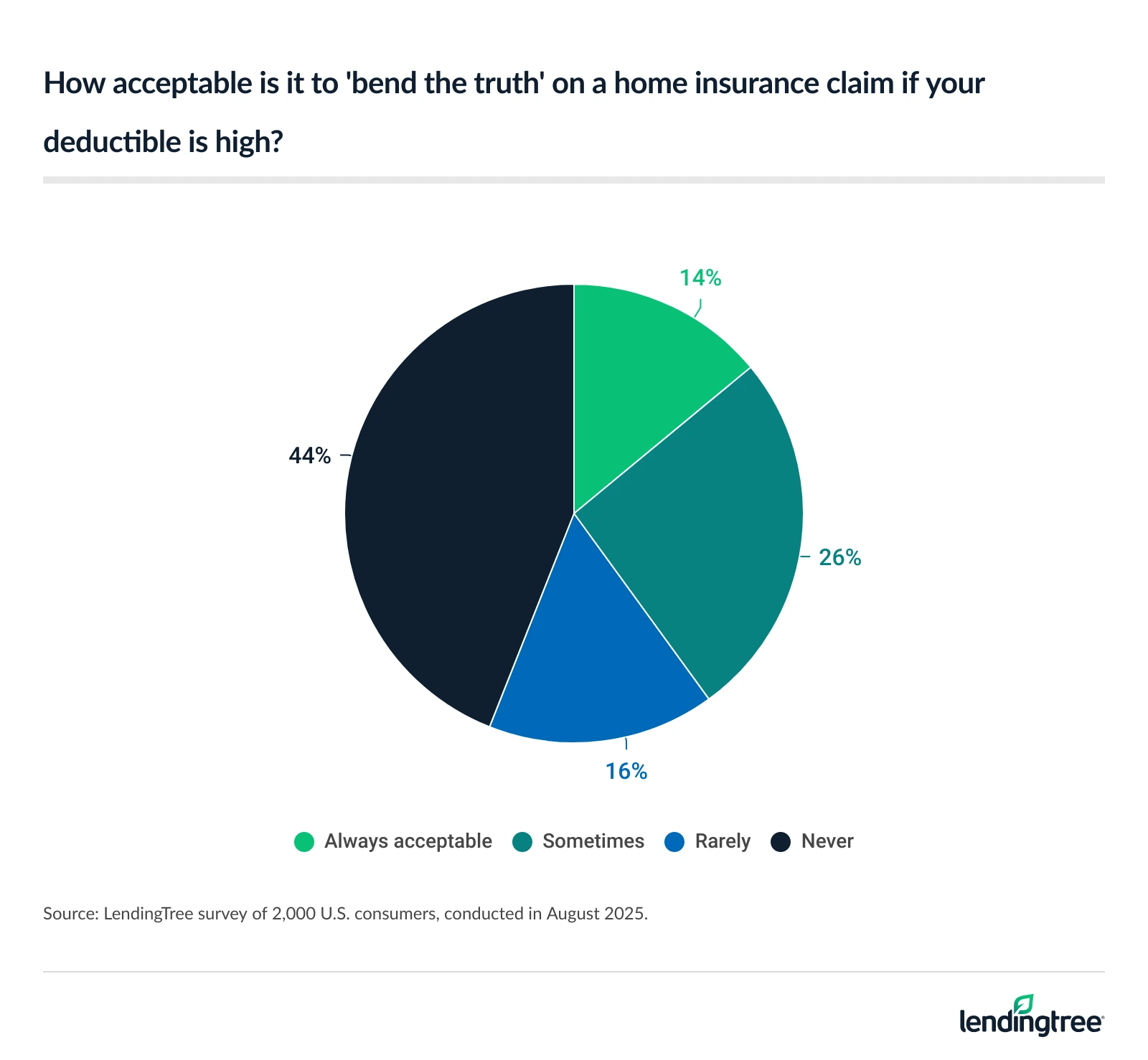

- Some Americans believe home insurance fraud is acceptable in certain situations. When asked when it’s acceptable to bend the truth on home insurance claims, 42% say at least some of the time if the insurer is being difficult or you’ve lost more than your policy covers. Meanwhile, 41% say it’s acceptable at least some of the time after a natural disaster or when a deductible is high.

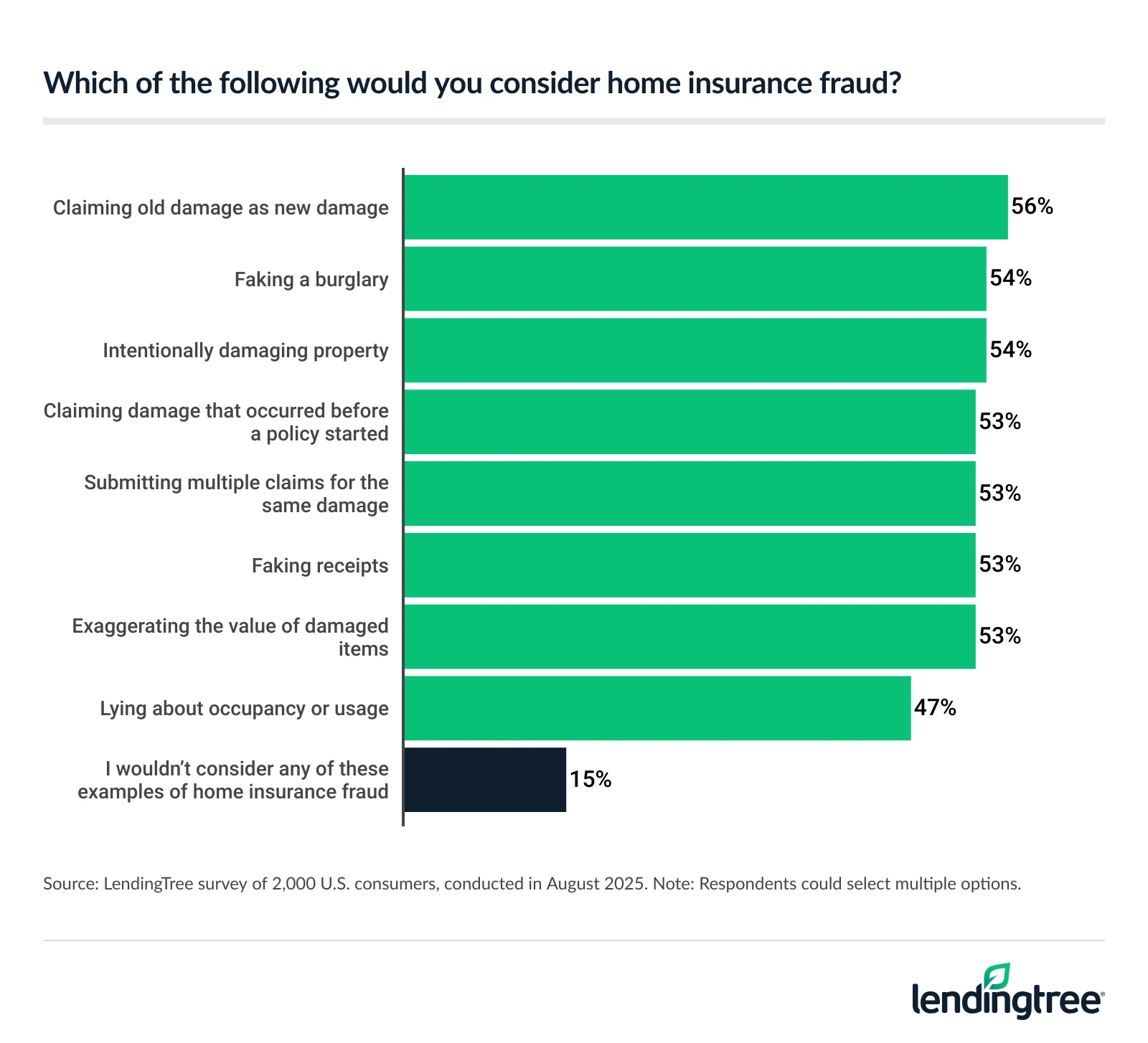

- Ignorance is bliss for those who are unclear about home insurance fraud. 47% of Americans don’t consider exaggerating the value of damaged items, claiming damage that occurred before a policy started, intentionally damaging property or faking receipts to be fraud. Additionally, 46% don’t consider faking a burglary as fraudulent behavior.

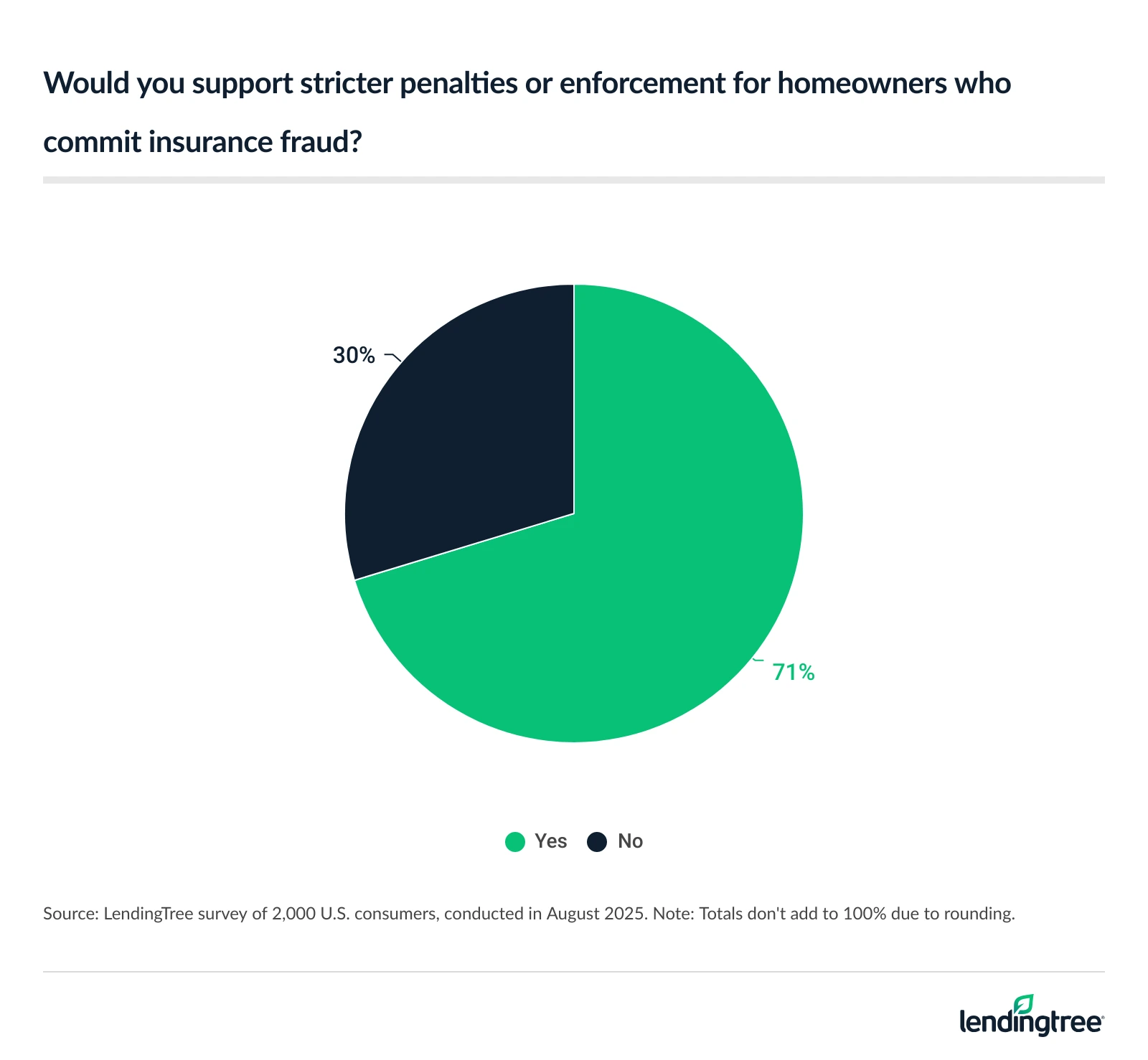

- A majority of Americans support more stringent penalties for fraud. 71% would support stricter penalties for homeowners who commit fraud. In fact, 78% believe home insurance fraud leads to higher premiums for everyone and 63% would report someone for committing home insurance fraud.

Home insurance policyholders exaggerate claims

Across all home insurance policyholders, 33% admit to submitting a claim with exaggerated or inaccurate info. That figure is highest among those with children younger than 18 (53%), Gen Zers ages 18 to 28 (53%) and millennials ages 29 to 44 (51%).

Additionally, if faced with a major home repair, 41% say they’d be tempted to exaggerate a claim to help offset deductibles or losses. Meanwhile, some policyholders (37%) say they’ve been encouraged to falsify or exaggerate a claim, particularly Gen Zers (59%), those with children younger than 18 (57%) and millennials (56%).

Also worth noting, 34% of policyholders admit they’d allow a contractor to handle their home insurance claim and inflate their repair estimate, while 16% say they’d consider it.

Some believe fraud is sometimes acceptable

Across all Americans, 42% say bending the truth is acceptable at least some of the time if the insurer is being difficult or you’ve lost more than your policy covers. And 41% say it’s acceptable at least some of the time after a natural disaster or when your deductible is high.

Following, 40% say it’s acceptable at least some of the time to “get back” what you paid in premiums.

A growing distrust and resentment toward insurance providers may be to blame. In recent years, many insurers have raised rates or not renewed policies. In fact, the average cost of a standard home insurance policy is a significant $2,801 a year. Additionally, 51% of Americans say insurance companies are only sometimes or never fair in how they handle claims — which may leave many consumers feeling justified in taking advantage of the system.

Home insurance expert and licensed insurance agent Rob Bhatt says that’s not uncommon.

“Insurance companies aren’t perfect,” he says. “They mishandle claims from time to time, and some companies mishandle claims at higher rates than others. This leads to trust issues. Some homeowners don’t trust their home insurance company. If you don’t trust the other party in a business relationship to act responsibly, you may be tempted to act irresponsibly via an exaggerated claim.”

That said, 68% haven’t heard of people in their community gaming the system with homeowners insurance. However, 87% of Americans believe that home insurance fraud is at least somewhat common.

Some Americans think exaggeration isn’t fraud

Many Americans may not be aware of what constitutes insurance fraud. Despite being considered fraudulent, 47% of Americans don’t consider exaggerating the value of damaged items, claiming damage that occurred before a policy started, intentionally damaging property or faking receipts to be fraud.

Meanwhile, 46% don’t consider faking a burglary as fraud.

Interestingly, 94% of home insurance policyholders are at least somewhat confident in their understanding of their policy coverage — suggesting ignorance may be bliss when it comes to misunderstandings about fraud.

Americans believe there should be stricter penalties for fraud

Despite many supporting or misunderstanding fraud, a whopping 71% of Americans would support stricter penalties for homeowners who commit fraud.

That comes as 78% of Americans believe home insurance fraud leads to higher premiums for everyone and 63% would report someone for committing home insurance fraud.

Meanwhile, a significant 74% say small exaggerations in home insurance claims are harmful.

Bhatt says insurance fraud affects the cost of insurance for honest homeowners in a few ways. “When fraudsters succeed, they increase the amounts that insurance companies have to pay out in claims,” he says. “This is a cost increase that insurance companies pass along to customers in the form of higher rates.”

There’s also the cost of investigating fraud. “Fraudulent claims often require more staff time and resources to investigate than legitimate claims,” Bhatt says. “These additional insurance company expenses contribute to rate increases for honest customers. Additionally, the existence of insurance fraud necessitates that insurance companies invest in personnel and technology to help them detect and prevent such fraud. The growing cost of fraud prevention measures is another cost that gets passed along to homeowners.”

Navigating claims responsibly: Expert tips

If you’re looking to ensure you get fair compensation for a home insurance claim while staying within the bounds of your policy, we offer the following advice:

- Create and maintain a home inventory. “This is an itemized list of your possessions, with photos and relevant details about each item or set,” he says. “It’s pretty easy to put one together in an hour or two with a spreadsheet and your phone camera. It’s good to include as many details as possible about your items, including prices, purchase dates and locations, and brand and model names.”

- Keep all receipts and records. Paper trails are your best defense in the event of a claim. Hang on to receipts for big-ticket items, warranty information and any records of repairs or upgrades. When you can prove value and condition with documentation, your claim is more likely to be resolved quickly and fairly.

- Report damage promptly. Don’t delay in notifying your insurer after a loss. Policies often require claims to be filed within a certain time frame, and waiting too long can jeopardize your payout. Even if you’re still gathering details, letting your insurer know right away starts the process and demonstrates good faith.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from Aug. 13 to 16, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79