Best Renters Insurance in Georgia

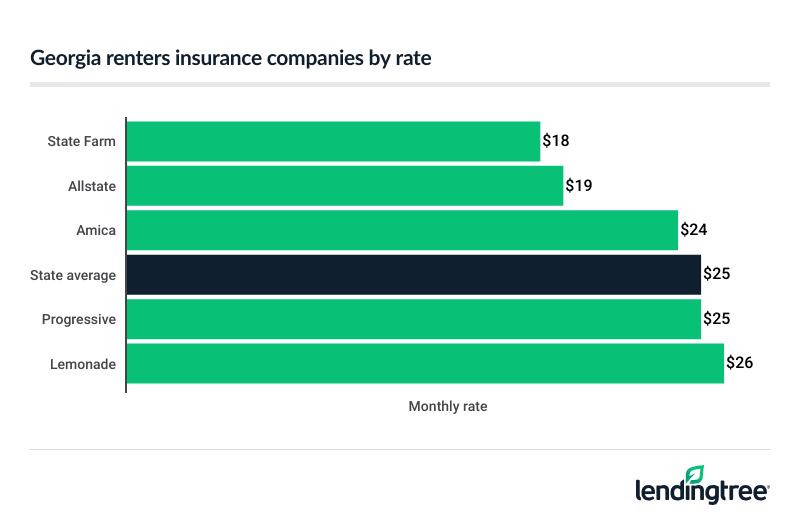

State Farm has the cheapest renters insurance in Georgia at an average rate of $18 a month – $7 per month cheaper than the state average.

Best cheap renters insurance in Georgia

Cheap renters insurance in Georgia

State Farm has the cheapest renters insurance in Georgia, with an average rate of $18 a month. This is about 28% cheaper than the state average rate of $25.

Allstate is right behind State Farm at $19 a month, followed by Amica at $24.

Cheapest renters insurance companies in Georgia

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $18 | |

| Allstate | $19 | |

| Amica | $24 | |

| Progressive | $25 | |

| Lemonade | $26 | |

Your renters insurance rate is based on more than where you live. Other factors that companies look at when calculating your renters insurance quote include the policy limit you choose, your deductible and your claim history.

Insurers don’t all treat these factors the same, though, which is why the quotes they send you are often different. To get your best rate, compare renters insurance quotes from several companies while you shop around.

Best renters insurance companies in Georgia

Best company: Amica

Amica is the best overall renters insurance company in Georgia, offering a strong combo of cheap rates, discounts and optional coverages. In fact, Amica has more add-ons and discounts than most of the other companies we surveyed in Georgia.

PROS

- Average rate lower than state average

- Several discounts

- Many add-on coverage options

CONS

- No 24/7 support

Cheapest company: State Farm

State Farm has the cheapest rate for renters insurance in Georgia, at $18 a month. It also scores well with customers.

PROS

- State’s lowest renters insurance rate

- Good customer satisfaction

- Most popular renters insurance company

CONS

- Not many discounts

- Few coverage options

Next-cheapest rates: Allstate

At $19 dollars a month, Allstate has the second-cheapest renters insurance rate in Georgia. It is also an excellent choice for senior renters. If you’re 55 years of age or older, you can save up to 25% on your renters insurance with Allstate.

PROS

- Cheap rates

- Good discounts

CONS

- Few add-on coverages

Best discounts: Progressive

Progressive offers the widest range of renters insurance discounts among companies operating in Georgia. Its discount offerings include savings for bundling your renters and car insurance, getting an advance quote, signing up for electronic documents and paying your annual premium in full.

PROS

- Many discounts

- Good online tools

- 24/7 phone support

CONS

- Sells policies through a third party

- Few optional coverages

Is renters insurance required in Georgia?

Renters insurance is not required by Georgia law, but landlords often require tenants to have it as part of the rental agreement. Landlords require renters insurance to avoid liability claims for damage tenants may cause.

Even if your landlord doesn’t require you to have renters insurance coverage, it’s often still a good idea to get it. Not only can renters insurance protect your belongings from fire and similar damage, but it usually includes loss of use coverage, as well. This covers additional living costs that can come up if you need to relocate while your rental home is repaired.

How much is renters insurance in Georgia?

Georgia residents pay an average of $25 a month, or about $300 a year, for renters insurance. This is 39% higher than the national average rate of $18 a month.

The actual price you pay depends on the discounts you get, the deductible you use and a few other factors. Compare quotes to get the best rate for your needs.

Methodology

LendingTree collected thousands of renters insurance quotes from the largest insurance companies in each state, based on data availability.

We used thousands of renters insurance quotes from across the U.S. for a 30-year-old single woman who has no recent renters insurance claims. Your rates may vary. Coverage limits include:

- Personal property coverage: $20,000

- Deductible: $500

- Personal liability: $100,000

- Guest medical protection: $1,000

- Loss of use: $9,000