Cheapest Renters Insurance in Massachusetts

- Lemonade has the cheapest renters insurance rates in Massachusetts of $10 a month.

- Amica also has cheap rates and a good bundling discount.

- Allstate offers a great discount for Massachusetts retirees.

Best cheap renters insurance companies in MA

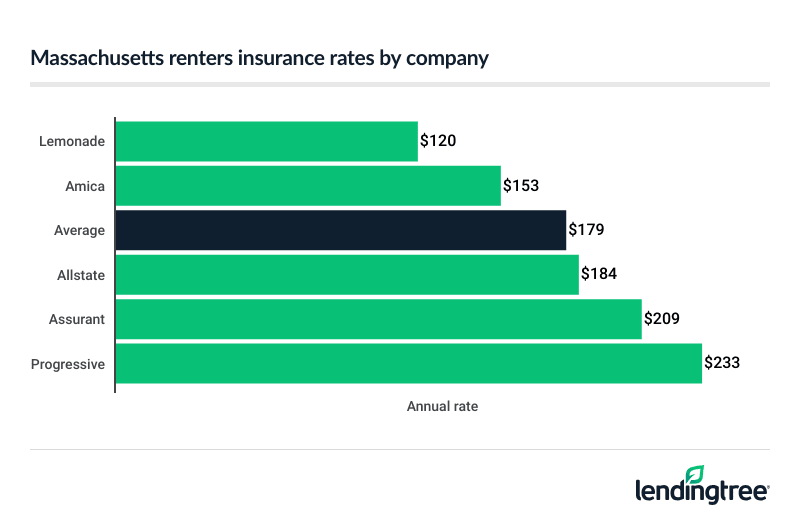

Cheapest renters insurance companies in Massachusetts

Lemonade has the cheapest renters insurance in Massachusetts. Its average rate is $120 a year. Amica is the second-cheapest company, at $153 a year.

Lemonade and Amica both offer bundling discounts. Bundling helps you save money if you buy an auto insurance policy as well as a renters policy from the same company. Amica’s bundling discount can save you up to 15% on your renters and auto insurance costs.

Allstate’s average renters insurance rate of $179 a year is close to the state average of $184. If you’re a retiree age 55 or more, it could be your cheapest option. This is because Allstate offers senior retirees a 25% discount on renters insurance.

Compare quotes between these three companies while you shop to see which one offers the cheapest price.

Cheapest renters insurance companies in Massachusetts

| Company | Monthly rate | Annual rate | LendingTree score | |

|---|---|---|---|---|

| Lemonade | $10 | $120 | |

| Amica | $13 | $153 | |

| Allstate | $15 | $184 | |

| Assurant | $17 | $209 | |

| Progressive | $19 | $233 |

Insurers look at many factors when creating your renters insurance quote. These include your:

- ZIP code

- Chosen coverage limits and deductible

- Insurance claim history

- Credit score (in many states)

Best renters insurance companies in Massachusetts

Lemonade is the best renters insurance company in Massachusetts for cheap rates. Amica has the best bundling discount, while State Farm has the best add-on coverages. Allstate is the best choice for retirees 55 years of age and older.

Best cheap rates in Massachusetts: Lemonade

Monthly rate: $10

Pros:

- Cheapest renters insurance rates in Massachusetts

- Replacement cost coverage is standard

- Fast online claim filing

- Good optional coverages

Cons:

- No 24/7 customer service

- You can only file claims online

Lemonade has the cheapest renters insurance rates in Massachusetts, at $10 a month. This is 33% cheaper than the state average of $15 a month. Lemonade also stands out for paying claims at replacement cost

Lemonade offers scheduled personal property coverage for an extra cost. Expensive items like jewelry are often covered at lower limits than other belongings. Scheduled personal property helps cover high-value items at their full value.

Best bundling discount: Amica

Monthly rate: $13

Pros:

- Cheap average rate

- Good bundling discount

- Strong customer satisfaction

- Several add-on coverages

Cons:

- No 24/7 customer service

- Few discounts overall

Amica has the best bundling discount for renters insurance in Massachusetts. If you buy both a renters and a car insurance policy with Amica, you can save up to 15% on both policies. It also has the state’s second-cheapest renters insurance rates, at $13 a month.

If you’re looking for a renters insurance quote from Amica, you can either get it online or call an agent.

Best renters insurance discount for 55+ retirees: Allstate

Monthly rate: $15

Pros:

- Good discount for retirees

- Several add-on coverage options

Cons:

- Few renters insurance discounts

Allstate has a 25% discount for Massachusetts retirees aged 55 or older. That’s good because the company’s average rate for renters insurance is $15 a month.

Allstate also has some good optional coverages that can help you customize your policy. These include add-ons for scheduled personal property, identity theft restoration and flood insurance.

What does renters insurance cover in Massachusetts?

Renters insurance covers your belongings, liability, medical payments and loss of use expenses.

Personal property

Personal property coverage replaces your stuff damaged by events like fire and windstorms. This includes clothing, electronics and furniture.

Liability

Covers injuries and property damage you cause to others.

Medical Payments

This coverage pays medical expenses for others hurt in your home, no matter who is at fault.

Loss of use (LOU)

LOU helps pay some of your extra living costs if you have to move out while repairs are made to your rental home. This can include meals, rent and extra commute costs.

Methodology

We used thousands of renters insurance quotes from across Massachusetts for a 30-year-old single woman who has no recent renters insurance claims. Your rates may vary. Coverage limits include:

- Personal property coverage: $20,000

- Deductible: $500

- Personal liability: $100,000

- Guest medical protection: $1,000

- Loss of use: $9,000