1 in 5 College Students Pay for Spring Break With Student Loans: Survey

Going on a trip with friends for spring break is a rite of passage for some college students, but one that can be pricey. As it turns out, some college students are spending — and borrowing — far more than they can afford in order to take part in this spring break tradition.

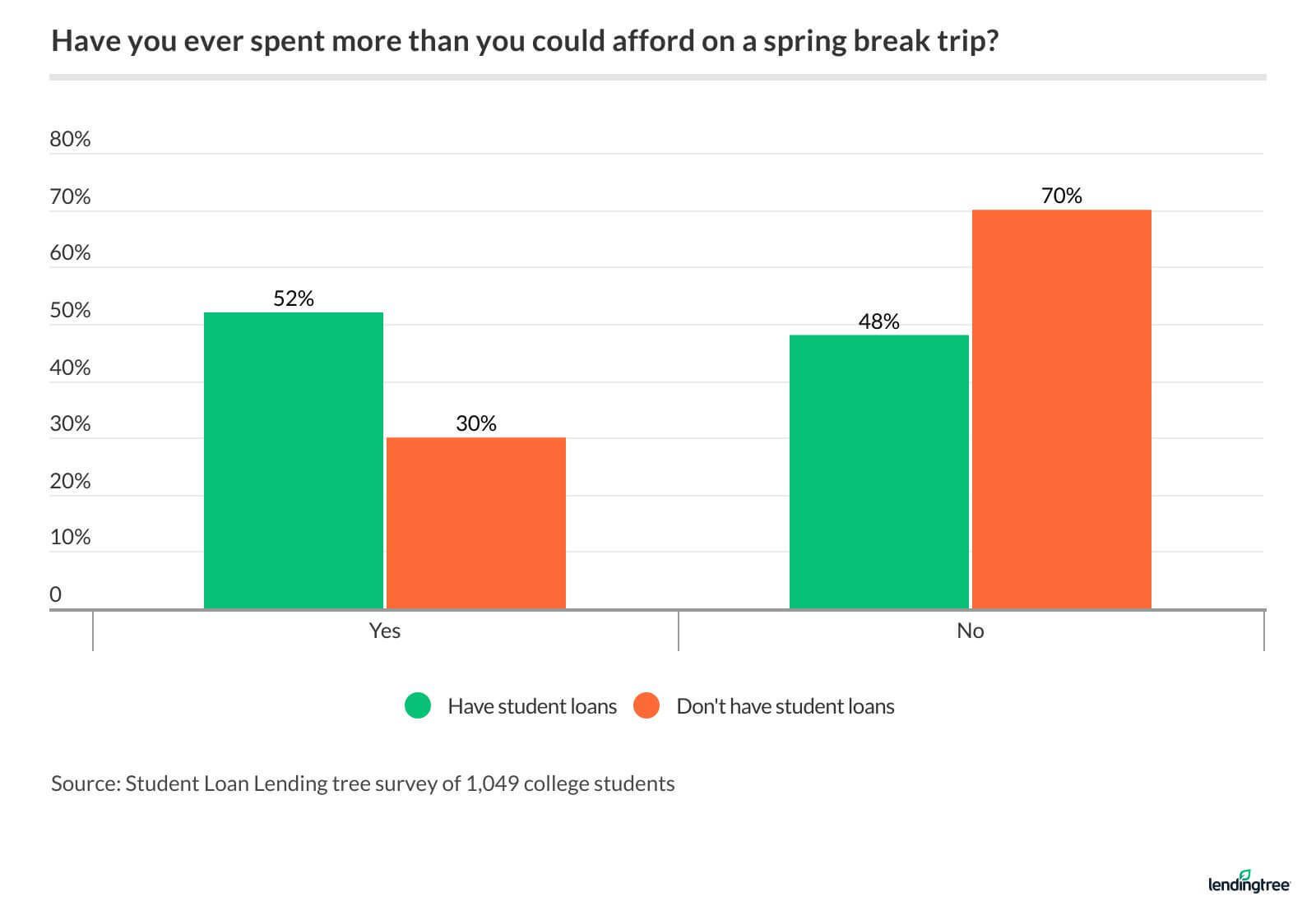

A LendingTree survey of over 1,000 undergraduate students found that nearly half admitted to spending more than they could afford on a spring break vacation. And more than 1 in 5 borrowers reported taking out extra student loans to finance their spring break activities.

Key findings

- College students expect to spend an average of about $620 for spring break, and 45% of respondents say they’ve spent more than they could afford on a spring break trip. (Read more)

- Nearly 1 in 4 students think they’ll take on credit card debt to pay for spring break. (Read more)

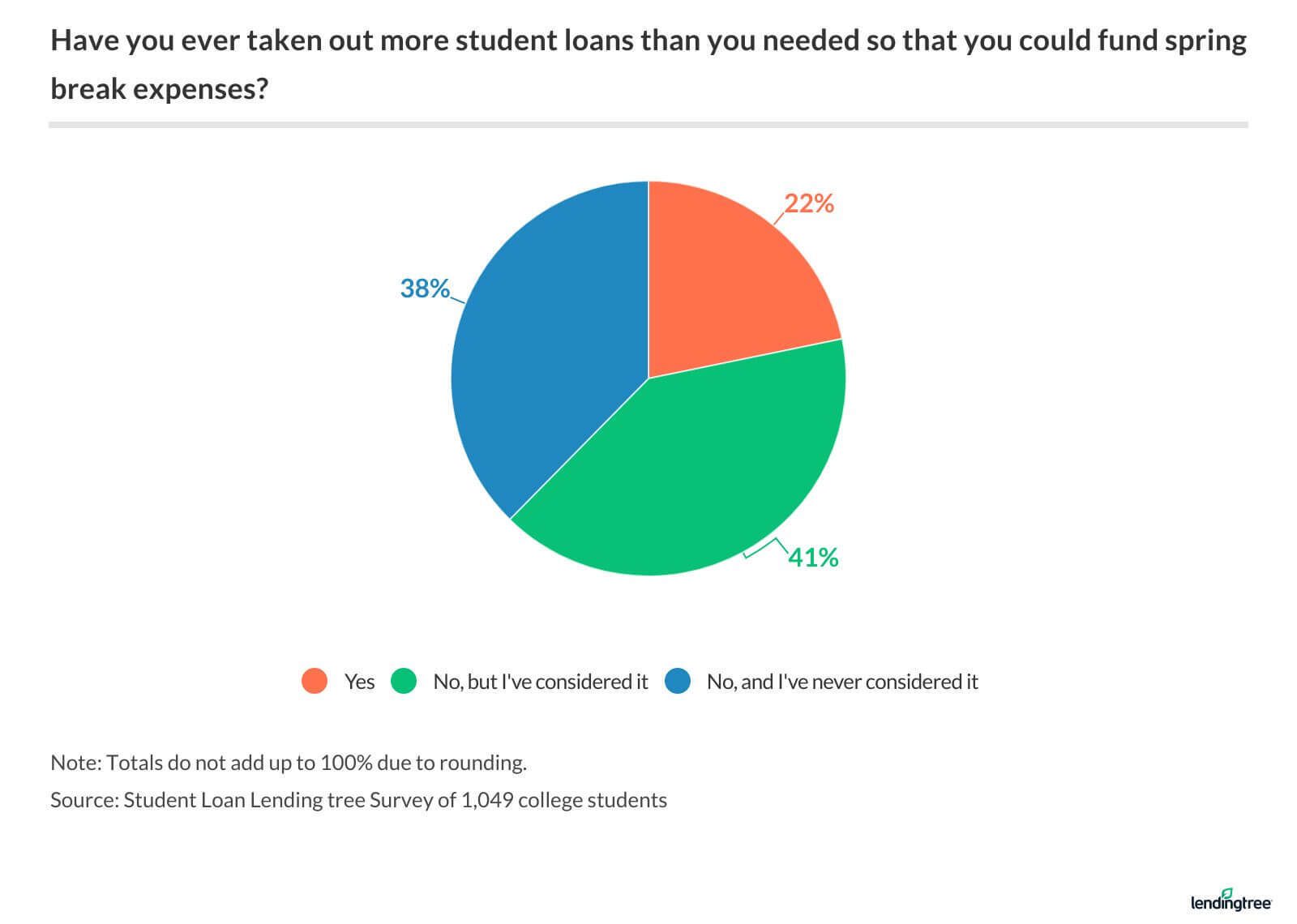

- 22% of student loan borrowers have taken out additional student loans to pay for their trip. (Read more)

- Food, plane tickets and entertainment top the list of biggest spring break expenses. (Read more)

- 80% of students said it seemed like everyone else was doing something fun for spring break, but they couldn’t afford it. Those with student loans were more likely to feel this way than their debt-free peers. (Read more)

Nearly half of college students have overspent on spring break

Nearly 1 in 3 college students are planning to vacation with friends this spring break. Among those traveling, 43% will go to a beach in the U.S., while just over 1 in 10 will head to a beach abroad.

On average, college students expect to spend around $620 on spring break, with senior-year students planning to spend the most, at almost $760.

But this price tag isn’t necessarily within students’ budget, as 45% of survey respondents (including 54% of senior-year students) said they had spent more than they could afford on a spring break trip at least once during their college career.

Spring break sparks fear of missing out

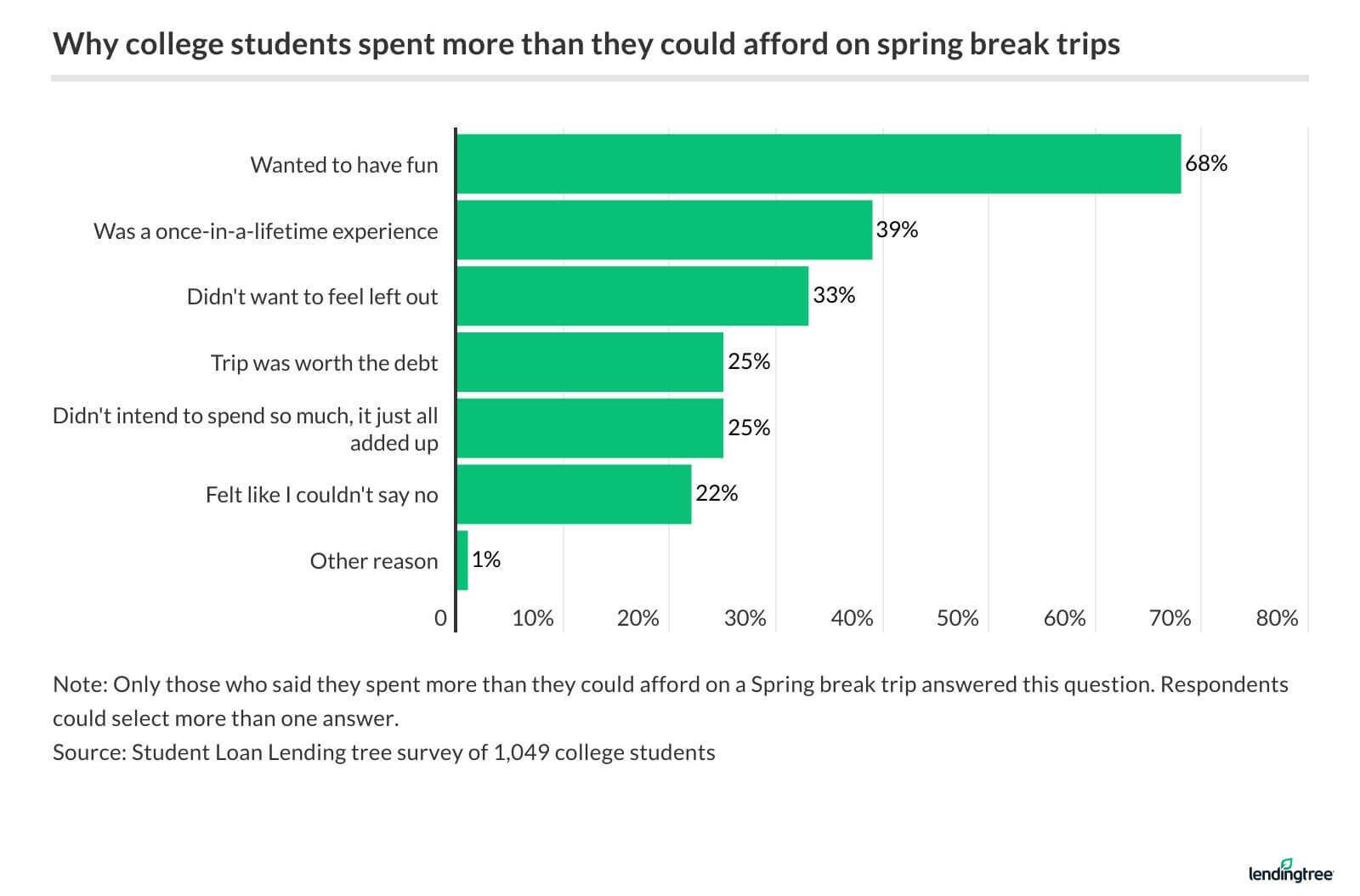

Despite the high price tag, most students value spring break as a time to unwind. Among those who spent more than they could afford, 68% said their reason was simply to have fun.

Meanwhile, 33% said they overspent on their spring break because they “didn’t want to feel left out,” and 39% said the trip seemed like a once-in-a-lifetime experience.

One in four students said they hadn’t expected to spend as much as they did, but 25% also said their trip was worth the debt.

But this trip can go hand in hand with credit card debt

Given that spring break expenses are unaffordable for many students, some expect to go into credit card debt to pay for it. In fact, nearly 1 in 4 college students surveyed expected that they would take on credit card debt for spring break expenses.

Student loan borrowers were especially likely to anticipate credit card debt, with 29% saying they thought they would incur debt, as opposed to 15% of their student loan-free peers.

Some student borrowers take out extra loans for spring break

Along with credit cards, student loan borrowers have also relied on student loan money to pay for spring break costs. In fact, 22% of borrowers said they’d taken out more loans than they needed to fund their trips.

Men were more likely to do so, with 34% planning to spend loan money on spring break, versus 21% of women. Another 41% of students of either gender said that although they hadn’t used student loan money on spring break, they had considered doing so.

The biggest spring break expenses are food and plane tickets

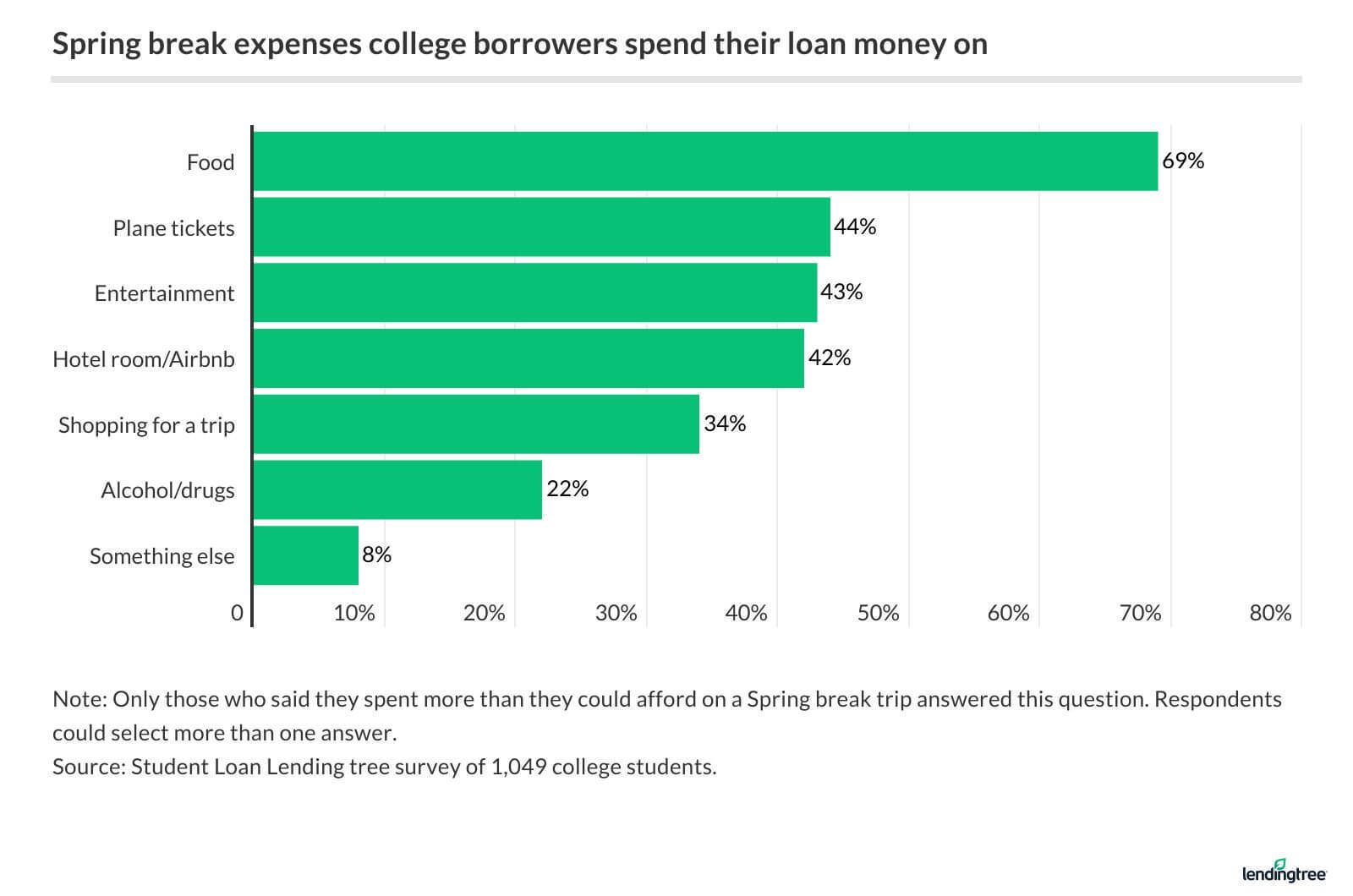

On average, these borrowers said they had previously shelled out about $1,200 of their student loan money on spring break.

Among those who planned to use student loan money on their upcoming break, 69% said they would use at least some of it to buy food, 44% said they would buy plane tickets, and 43% cited entertainment.

Hotel rooms or Airbnbs, shopping and alcohol or drugs were also big spending categories, with 42%, 34% and 22% using their loan money to cover those expenses, respectively.

Many students turn down spring break due to the cost

While some students are using credit cards or student loans to pay for spring break travel, the majority are skipping spring break due to the expense.

Among all respondents, about 80% either “completely” or “somewhat” agreed with the statement “it seems like everyone else at college is doing something fun for spring break, but I can’t afford it.” Student loan borrowers were especially likely to feel this way (84% vs. 74% for non-borrowers).

Among all students, 51% said they’d been invited to do something for spring break but turned down the invitation due to financial constraints. Here too, student loan borrowers had to turn down plans more often than their debt-free peers, with 57% reporting that this had happened versus 39% of non-borrowers.

A word of caution about taking on debt for spring break

Spring break can offer a reprieve from hectic studies. It is an opportunity to let loose and decompress. But you might regret the expense in years to come if you take on debt to pay for it.

Because of compounding interest, you’ll end up paying more on your student loans than you originally borrowed (especially with unsubsidized loans). So that $620 to $760 spring break trip could potentially cost you more money after you graduate.

The same goes for credit card debt, which usually carries higher interest rates than student loans. So even though the price tag might not seem so bad today, it could balloon in the months and years to come.

If you’re determined to go on spring break, the following steps to save money:

- Use flight and hotel comparison sites to find your best deals, and if possible, keep your dates flexible.

- Shop for groceries at your destination instead of eating out for every meal, since restaurant expenses can add up fast.

- Consider sharing a room with one or more friends to split costs.

- Create a spending plan before you leave so you know exactly how much room you have in your budget for food, shopping and other expenses.

- Work a side hustle or part-time job to save up for your trip.

- Avoid using student loans or credit cards to cover your expenses, since doing so could increase the eventual price of the vacation significantly.

You might also consider an alternative spring break experience, such as volunteering through an organization that provides scholarships to cover your expenses.

LendingTree contracted with Qualtrics to conduct an online survey of 1,049 undergraduate college students. The survey was fielded Feb. 10-18, 2020.