58% of Consumers Have Their Bank Account Connected to Another Platform — Here Are the Pros and Cons

Technology can simplify things when it comes to money. You don’t always have to carry your credit card, you can invest from your phone and you can get an overview of your finances with minimal effort.

These are some of the ways connecting your bank account to other platforms can be helpful. And many are embracing the convenience it affords. In fact, 58% of consumers are linked to another platform or service, according to the latest survey of more than 1,000 Americans from LendingTree. But there can be downsides to this, too. Data breaches, for example, can quickly turn a convenience into anything but that.

To understand how people are using connected accounts, the survey also looked at the reliance on budgeting apps, reactions to data breaches and demographics on who’s using these features.

TABLE OF CONTENTS

- Key findings

- Nearly 6 in 10 consumers are linking their bank accounts to other platforms — here’s why

- 1 in 3 have been involved in a data breach associated with a connected bank account

- Financial mobile apps and the services that consumers crave the most

- Where is banking heading from here?

- Methodology

Key findings

- Consumers link their bank accounts to platforms or services for mobile payments, budget tracking, investing and more. Fifty-eight percent of consumers say their bank account is linked to another platform or service, such as Venmo or Apple Pay. And those with a connected bank account have it linked to three platforms on average.

- Proponents of connected bank accounts would prefer to cut their banks out of the process altogether. Fifty-seven percent of those with a linked bank account would consider conducting their banking through a connected service instead of a traditional bank account.

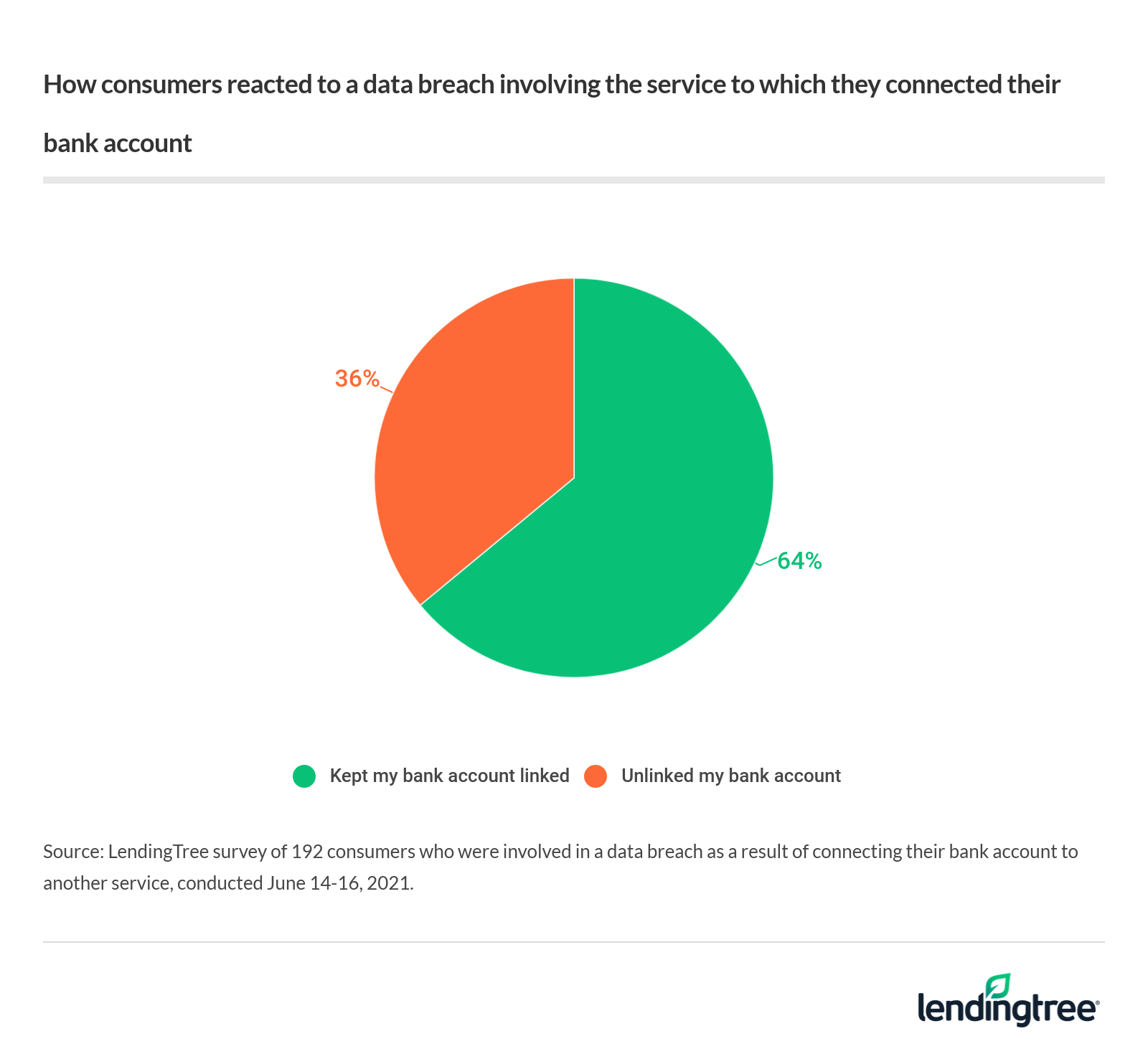

- Data breaches don’t always deter consumers from connecting their accounts to other platforms. Nearly a third (32%) of those with a linked bank account have been involved in a data breach due to the connection. Yet, most (64%) continued to keep their account connected despite the breach.

- Innovations in banking apps help consumers stay on top of their finances. Nearly 4 in 10 consumers (39%) rely on budgeting apps to keep track of their finances. And 84% could name at least one banking app feature they would use.

- As big tech companies enter the banking world, younger consumers are especially interested. Fifty-three percent of Gen Zers and 48% of millennials would be excited if their bank teamed with a company like Google or Apple, and 37% of those 40 and younger would rather bank with a fintech company than a traditional bank.

Nearly 6 in 10 consumers are linking their bank accounts to other platforms — here’s why

Most consumers embrace linking their bank accounts to other platforms, particularly millennials ages 25 to 40 (70%) and those who earn $100,000 or more (69%).

Among those who have at least one connected account, 79% have one to three connections. Interestingly, however, Gen Zers ages 18 to 24 are most likely to have three accounts connected (38%), though they are only the third-most likely generation to have a connected account at all. And people who earn $100,000 or more are significantly more likely to have four or more linked accounts than other income earners.

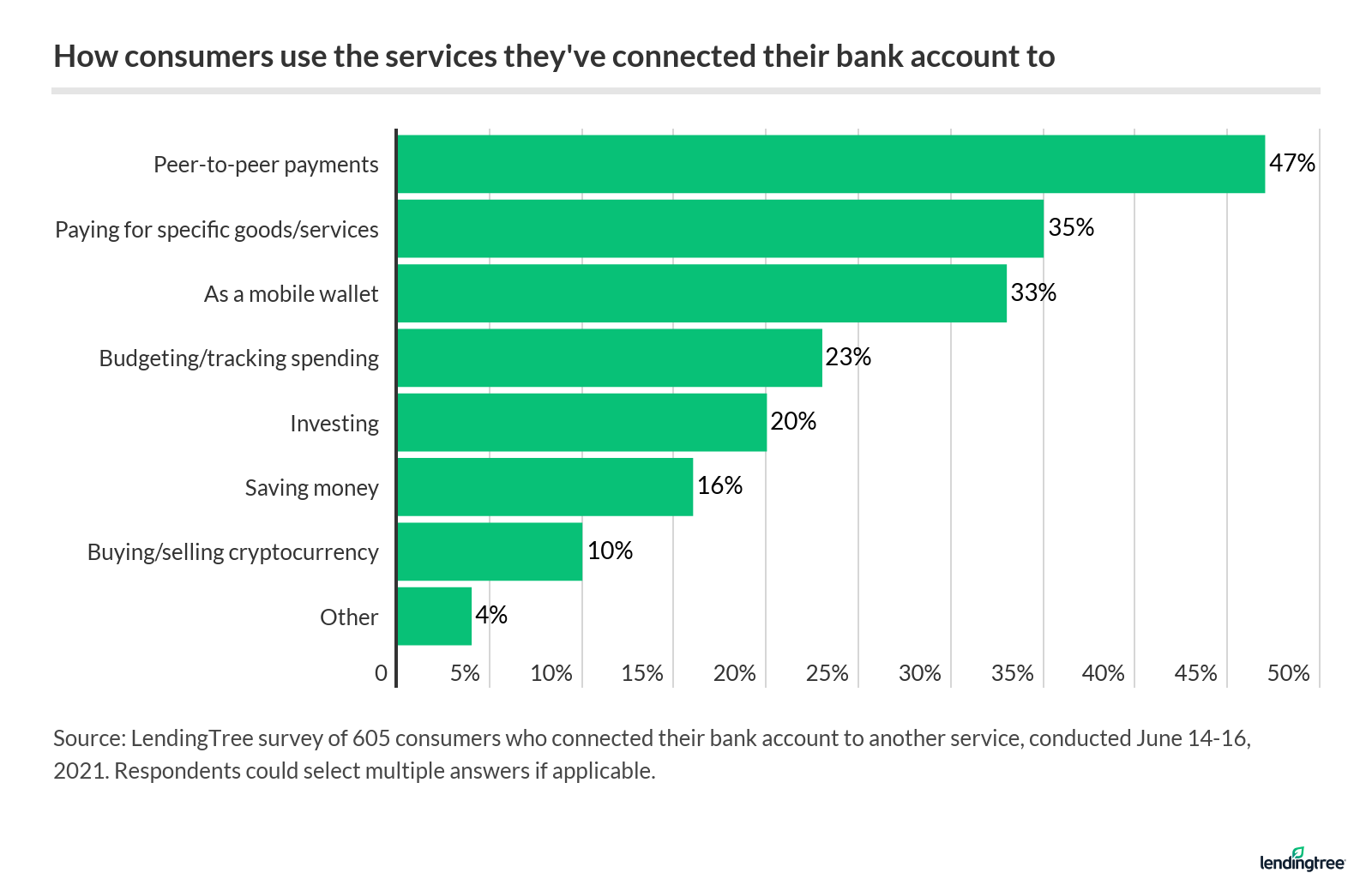

The survey also asked how people who have at least one connected account use those services:

Connecting your bank account to online personal finance tools can have advantages, says Ismat Mangla, LendingTree senior director of content.

“Many money management apps like Mint.com are simply ‘read-only’ and can be invaluable when it comes to tracking your money and having a big picture of your finances,” she says.

Would you conduct your banking through a connected app if you could?

Fifty-seven percent of respondents say they’d consider using a connected app, like Venmo or Apple Pay, as their primary bank. This attitude seems more prevalent among younger generations: 75% of Gen Zers say yes, compared with just 20% of baby boomers ages 56 to 75. Men (69%) are also more likely to say yes than women (41%).

Given the general convenience of these kinds of payment apps, it makes sense. Once set up, you don’t have to know banking information (like routing and account numbers) to transfer funds to other people. They’re often free to use. And you might even find a reminder feature built into these apps. These allow you to keep track of payment requests more easily, like getting reimbursed for an Airbnb booking.

1 in 3 have been involved in a data breach associated with a connected bank account

About a third of those who have a connected account have subsequently been involved in a data breach. Millennials and men (40% each) are more likely to have been involved in a data breach than their generational and gender counterparts. But those who earn $100,000 or more (46%) are the most likely across all the demographics examined.

The survey also looked at whether a data breach resulted in disconnecting from compromised apps. Most (about two-thirds) say they didn’t unlink their account:

Seventy-four percent of those who earn $75,000 to $99,999 say they kept their account linked, post data-breach — the most of any demographic. That was followed by those earning $100,000 or more and baby boomers (69% each).

Assuming you still use — and find value in — a connected app, it’s best to take swift action after a data breach:

- Confirm if your personal details were leaked and, if so, find out what was compromised

- Change your password (and make sure it isn’t a repeat from another account)

- Sign up for two-factor authentication where you can to boost your protection

- Notify your financial institution of the breach

- Get your credit score or credit report (or both) so you’ll know if there have been any recent changes

If your Social Security number is compromised, you may also want to consider a credit freeze to prevent others from opening new accounts in your name. If you aren’t using the connected app, deleting your account is also a good idea. Companies may also offer assistance in dealing with the fallout of a data breach, like identity theft. If your personal details are leaked, it’s worth considering.

On this note, the survey also found that 68% of consumers say concerns about data privacy keep them from connecting their bank account to potentially helpful apps or services. And those earning between $75,000 and $99,999 (78%) and Gen Zers (74%) are warier of this than others.

Financial mobile apps and the services that consumers crave the most

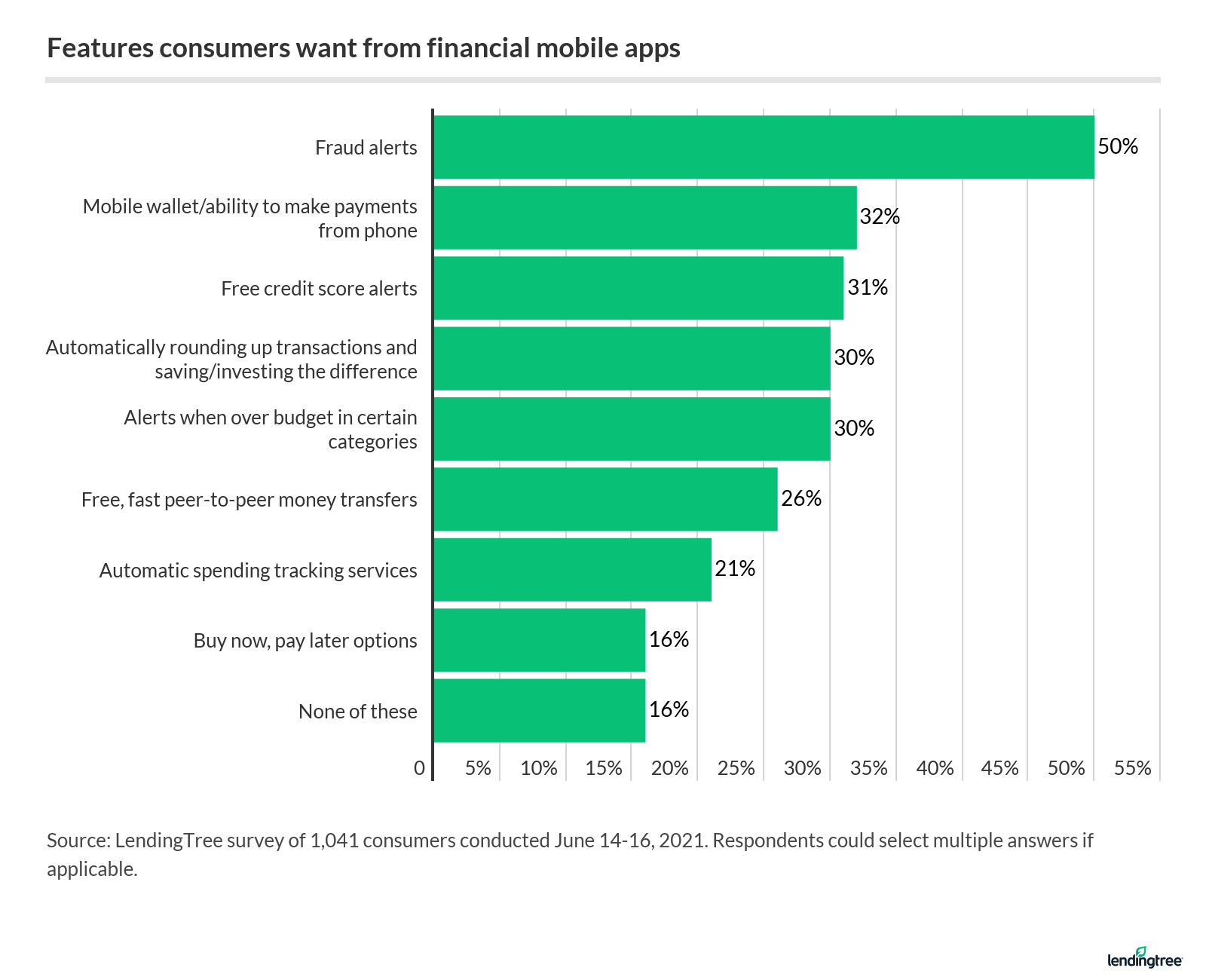

By a wide margin, fraud alerts are the most desirable feature among financial apps:

Interestingly, while half of respondents are interested in fraud alerts, only a quarter of Gen Zers are.

“For example, seeing a big drop in your credit score for no apparent reason can be a sign that you’ve recently been a victim of identity theft. Apps like LendingTree Spring can help you spot those changes quickly so you can do something about them.”

Thirty-nine percent of respondents agree that budgeting apps are critical to help them stay on top of their finances. And some demographics took to this idea in greater numbers:

- 51% of those earning $100,000 or more

- 50% of Gen Zers

- 48% of millennials

- 48% of men

“There’s no one-size-fits-all answer for how best to manage your budget,” Schulz says. “Whether you prefer pencil and paper, Excel spreadsheets or the latest budgeting apps, they can all be super-effective. It’s all about knowing yourself and how you like to do things. That said, many of these budgeting apps offer tools to help streamline your processes and can make things much easier on you.”

And while older Americans tend to be less interested in these kinds of tools (just 21% of baby boomers say budgeting apps are critical to their financial management), Schulz says they would be well-served to embrace this technology.

“I understand some of the concerns that folks may have, but the truth is that this technology really can make managing your money easier — and that’s a pretty big deal,” he says.

Where is banking heading from here?

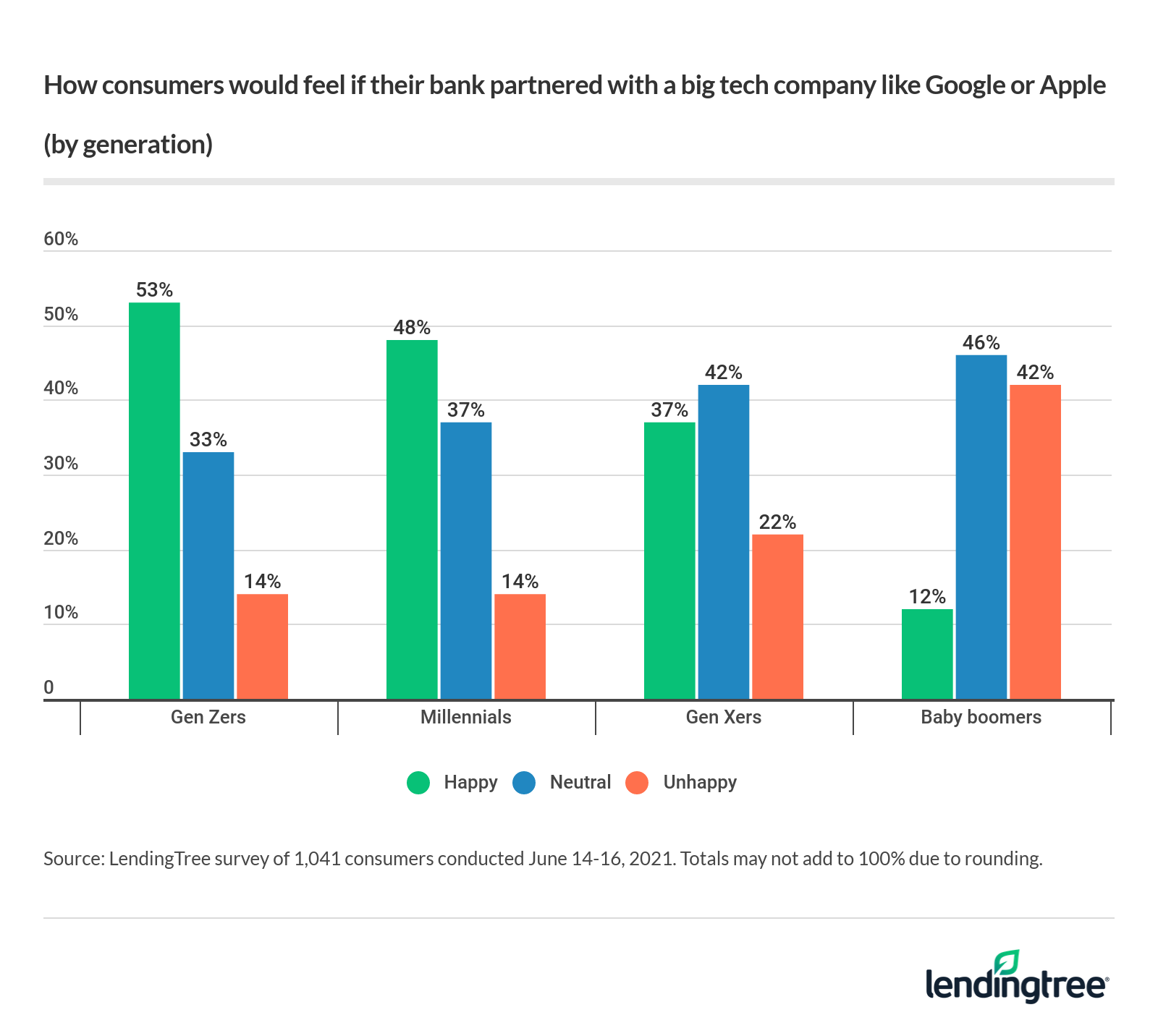

For many, the coronavirus pandemic brought the problems of brick-and-mortar banking to the surface, emphasizing the importance of virtual options like those afforded by connected apps. So it makes sense that more than a third (36%) of consumers say they would be excited if their bank teamed with a big tech company like Google or Apple.

Like previous trends here, men (47%) are more likely to be happy about this than women (25%). And 51% of those making $100,000+ would be happy, versus 26% of those making less than $35,000. Finally, younger generations are more open to this kind of move than others:

The survey also looked at traditional versus fintech banking attitudes, finding that 27% would prefer the latter option, but the majority preferred sticking to a traditional bank.

Following the established trends, younger folks, as well as men and high earners, are generally more likely to be interested in fintech banking than their counterparts. For example, 39% of millennials and 36% of Gen Zers express interest, versus 8% of baby boomers.

The options afforded by connected bank accounts often come with trade-offs: The potential for security risks via data breaches versus the convenience of paying back your friend instantly, and getting a better feel for your budget. And as we move toward an increasingly more connected world and more people embrace these kinds of technologies, it seems that it’s a trend that’s here to stay.

Methodology

LendingTree commissioned Qualtrics to field an online survey of 1,041 Americans, conducted June 14-16, 2021. The survey was administered using a non-probability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby boomer: 56 to 75

While the survey also included consumers from the silent generation (defined as those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.