1 in 5 Loan, Line of Credit or Merchant Cash Advance Applicants Denied in 2024

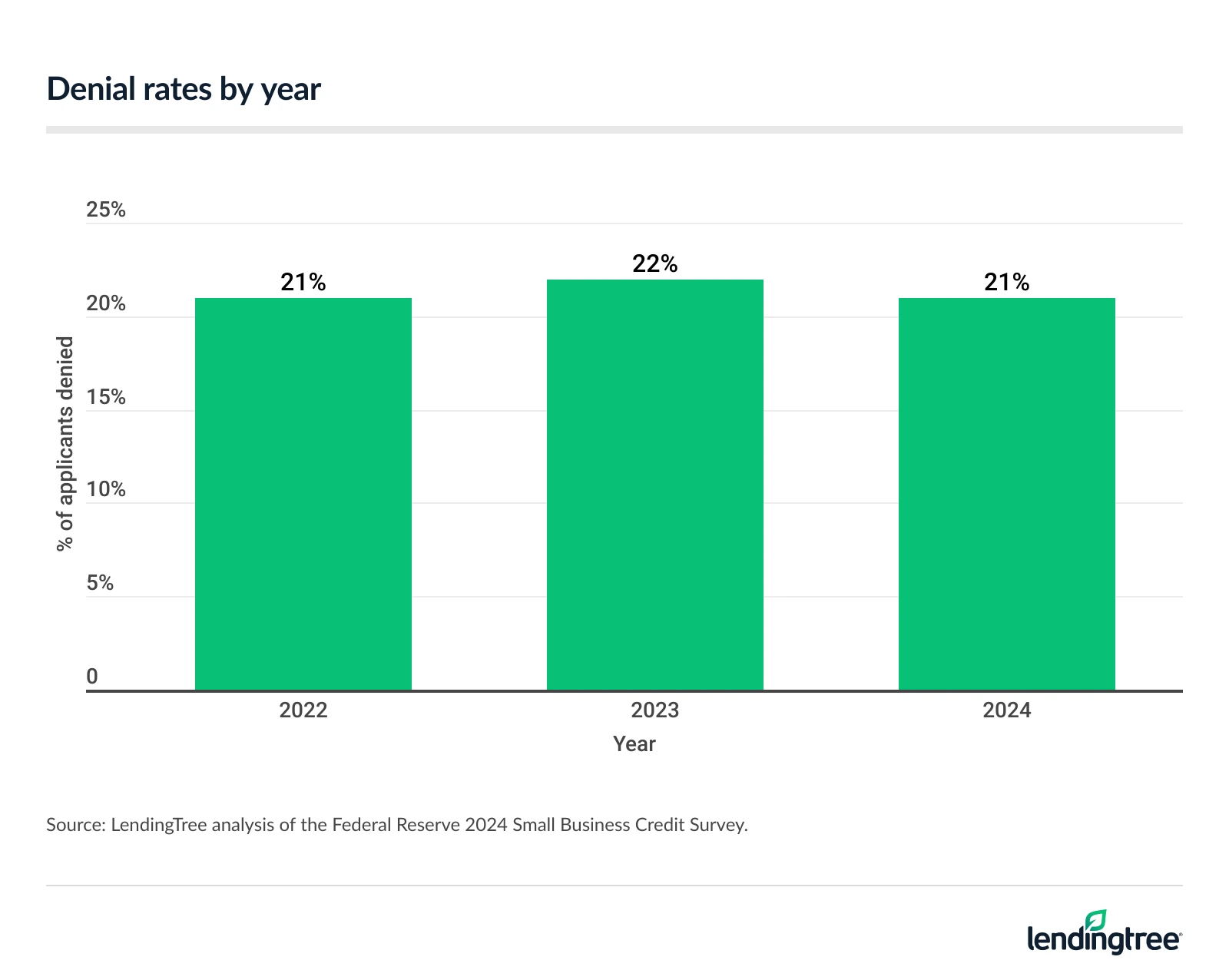

Having capital is one of the most important factors in running a small business, and taking out a loan is one way to get it. However, denial rates are high: According to a LendingTree analysis, a significant 21% of businesses that applied for a loan, line of credit (LOC) or merchant cash advance (MCA) in 2024 were denied.

Here’s a closer look at which loan types had the highest denial rates and the businesses most likely to be denied.

- 21% of businesses that applied for a loan, line of credit (LOC) or merchant cash advance (MCA) in 2024 were denied. That’s nearly unchanged from 22% in 2023. Overall, 37% of businesses applied in 2024. Among the states with available data, New York (29%) had the highest denial rate and Arizona (13%) had the lowest.

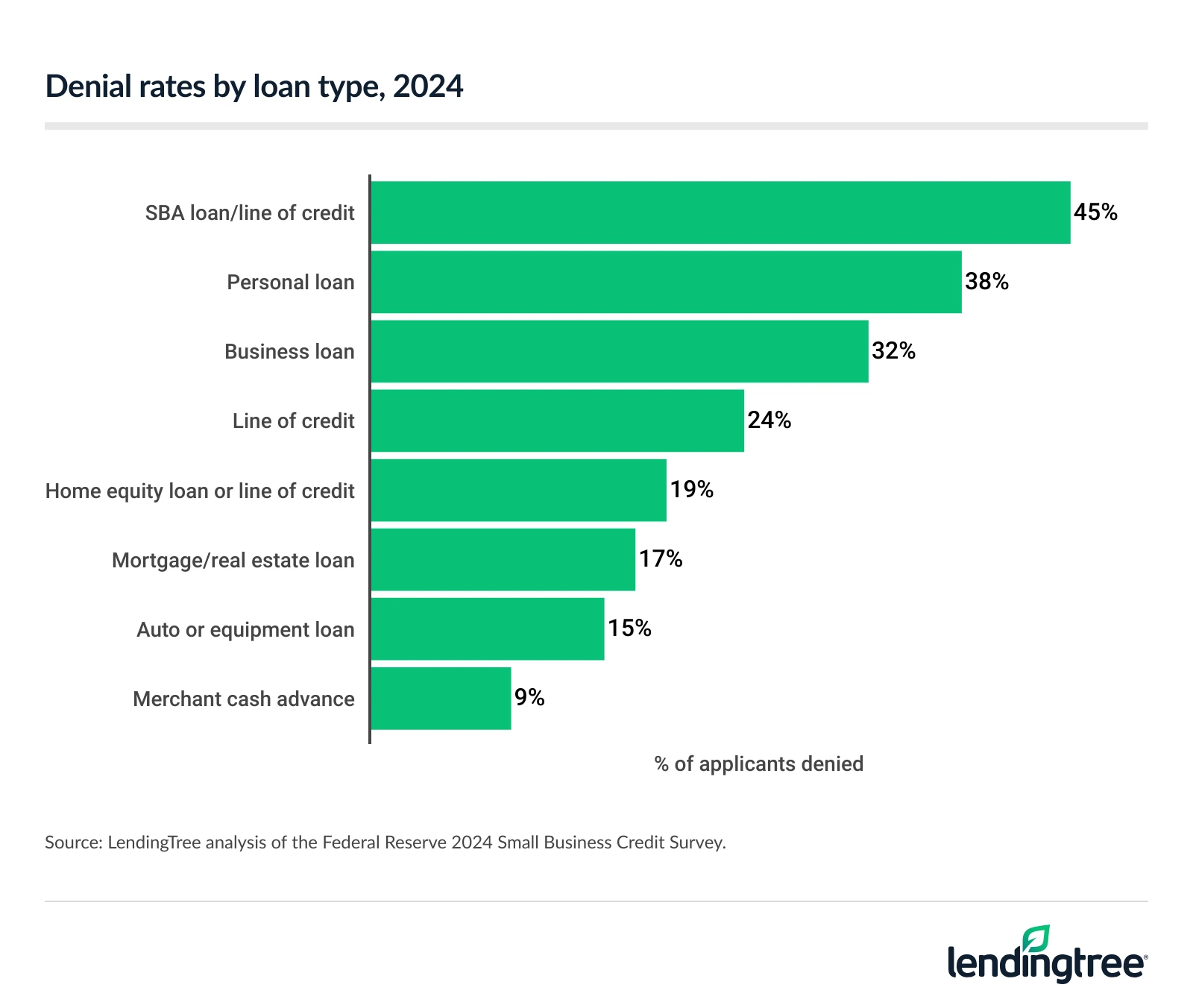

- Among loan types, Small Business Administration (SBA) loan or LOC applicants were denied nearly half the time. These applicants saw a 45% denial rate in 2024 — more than double the 21% rate across all types. Personal loans (38%) and business loans (32%) followed.

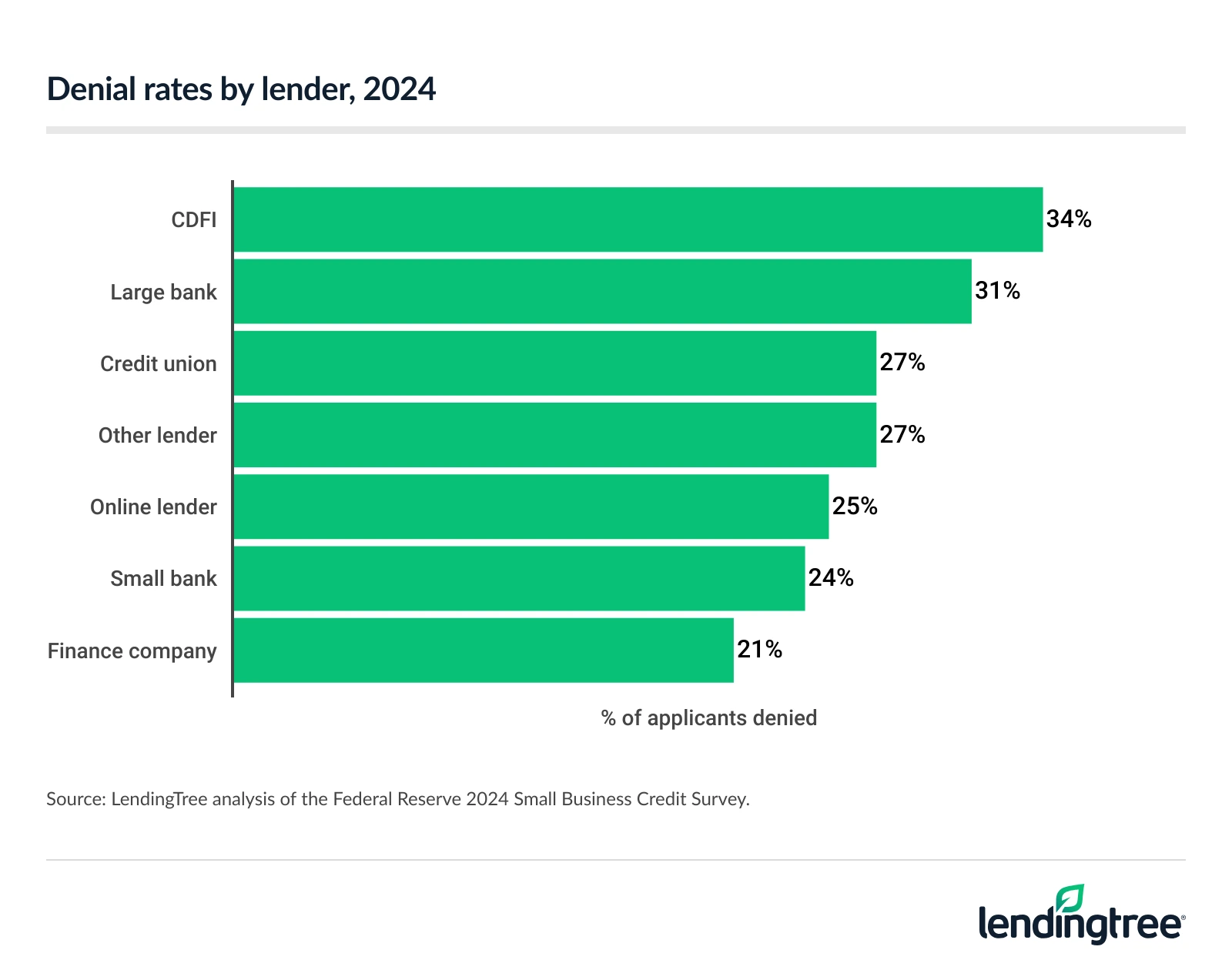

- Loan, LOC or MCA applicants were most commonly denied by community development financial institutions (CDFIs) and large banks. Their denial rates were 34% and 31%, respectively. Credit unions and other lenders were closest, both at 27%.

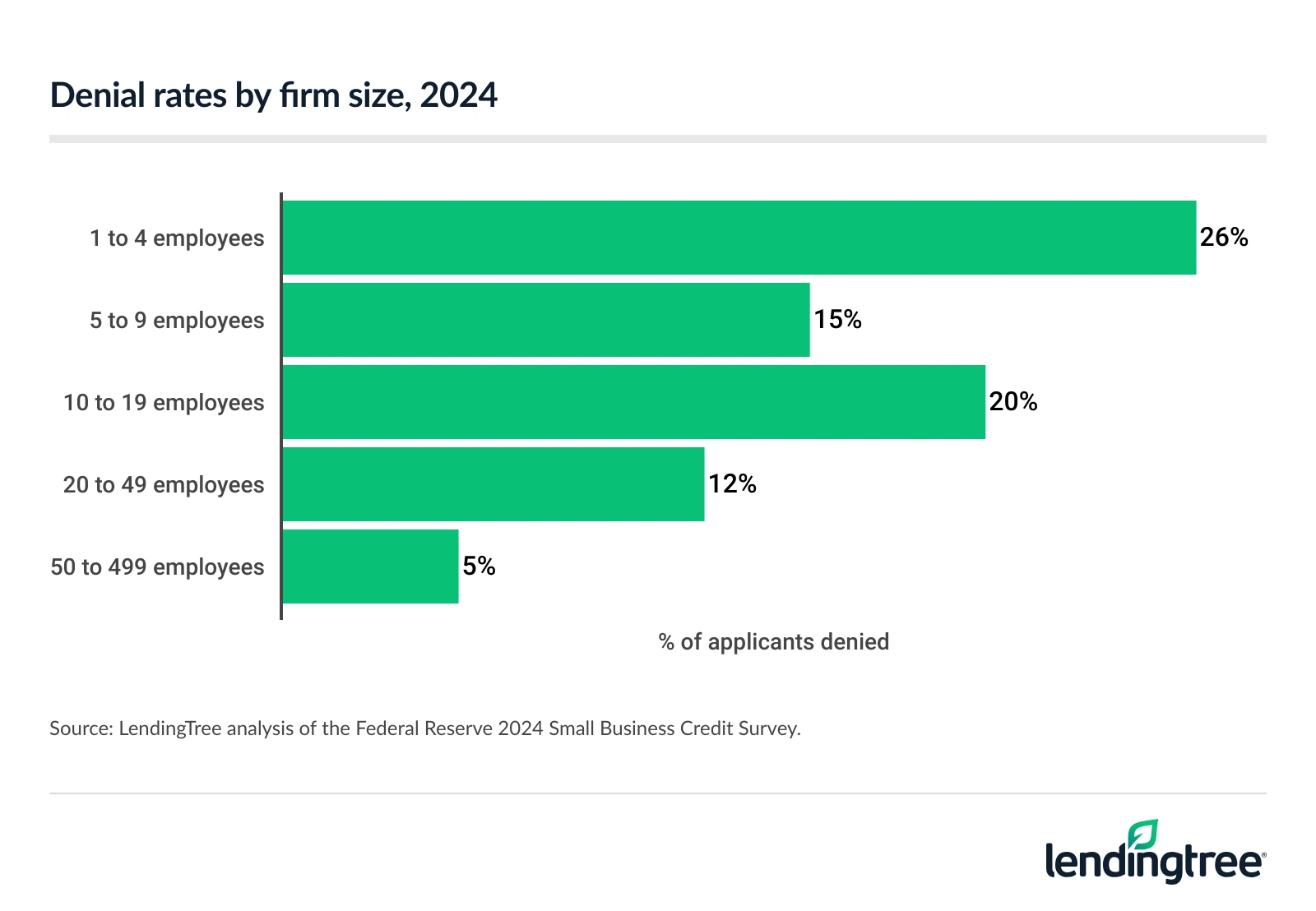

- The smallest firms were five times more likely to be denied for a loan, LOC or MCA than the largest ones. The 2024 denial rate for businesses with one to four employees was 26%, compared with 5% among large firms with 50 to 499 employees. By race, 39% of Black-owned businesses were denied in 2024 — by far the highest.

- Looking more recently, financials were the main reason cited for business loan denials in Q1 2025. 68.4% of businesses said this was the reason, with the next closest being credit history (21.5%) and collateral (5.7%).

This study mostly analyzes three funding options for businesses. They are:

- Business loan: A lump sum of money that’s borrowed from a lender and repaid over a set term with interest. They’re often used for large, one-time expenses, such as equipment purchases or business expansions. Interest rates may be fixed or variable. The application process for these loans can be lengthy, as they often require collateral.

- Line of credit (LOC): You borrow as needed up to a set limit and repay with interest. It provides flexibility for ongoing cash flow needs or unpredictable expenses, and you only pay interest on the amount you use. Interest rates are often variable and may be higher than traditional loan rates. The application process is generally simpler than for a loan, though it often requires collateral.

- Merchant cash advance (MCA): Unlike a loan, an MCA is an advance on future revenue, often repaid via a percentage of daily or weekly sales or fixed withdrawals. It’s used for short-term capital needs or quick business growth. There aren’t traditional interest charges — instead, repayment is based on a factor rate, making it more expensive than a loan or line of credit. The application process is often simple, approvals can be fast and collateral is generally not required.

Loan, line of credit and merchant cash advance denial rates high

In 2024, about 1 in 5 businesses (21%) that applied for a loan, line of credit (LOC) or merchant cash advance (MCA) in 2024 were denied. That’s similar to the 22% denied in 2023.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says that could be because there’s still an incredible amount of uncertainty in the economy right now.

“Inflation, tariffs, high interest rates and a slow job market are making things tough on small businesses and the customers they’re trying to attract,” he says. “Amid this uncertainty, banks pull back — as they tend to do in risky, unpredictable times. Standards for lending to consumers and businesses have generally been tight for some time, and that’s unlikely to change soon.”

Inflation, tariffs, high interest rates and a slow job market are making things tough on small businesses and the customers they’re trying to attract.

Overall, 37% of businesses applied for a loan in 2024.

Among the states with available data, New York had the highest denial rate at 29%, with Georgia and Texas tying for second at 28%. Conversely, Arizona (13%) and Minnesota (16%) had the lowest rates. (Note: Just 19 states had a sample size over 100.)

Denial rates by state

| Rank | State | % of applicants denied |

|---|---|---|

| 1 | New York | 29% |

| 2 | Georgia | 28% |

| 2 | Texas | 28% |

| 4 | Florida | 27% |

| 4 | Maryland | 27% |

| 6 | New Jersey | 25% |

| 7 | Michigan | 23% |

| 7 | Ohio | 23% |

| 9 | California | 21% |

| 9 | North Carolina | 21% |

| 9 | Virginia | 21% |

| 12 | Pennsylvania | 19% |

| 13 | Alabama | 18% |

| 13 | Illinois | 18% |

| 13 | Louisiana | 18% |

| 16 | Hawaii | 17% |

| 16 | Massachusetts | 17% |

| 18 | Minnesota | 16% |

| 19 | Arizona | 13% |

Interest rates fall slightly

Among those approved, they’ll likely get better interest rates than those in the near past (though still significantly higher than in past years).

The median fixed rate for new small business loans has slightly decreased in recent quarters. In Q1 2025, the median fixed rate was 7.4%, down from a peak of 8.0% the previous year.

Median interest rates on new small business term loans (fixed vs. variable)

| Quarter | Median fixed rate | Median variable rate |

|---|---|---|

| Q1 2025 | 7.4% | 7.9% |

| Q4 2024 | 7.4% | 7.8% |

| Q3 2024 | 7.8% | 8.4% |

| Q2 2024 | 8.0% | 8.7% |

| Q1 2024 | 8.0% | 8.7% |

| Q4 2023 | 8.0% | 8.8% |

| Q3 2023 | 7.7% | 8.8% |

| Q2 2023 | 7.5% | 8.7% |

| Q1 2023 | 7.1% | 8.0% |

| Q4 2022 | 6.5% | 7.6% |

| Q3 2022 | 5.6% | 6.4% |

| Q2 2022 | 4.8% | 5.3% |

| Q1 2022 | 4.3% | 4.5% |

| Q4 2021 | 4.1% | 4.2% |

| Q3 2021 | 4.2% | 4.5% |

| Q2 2021 | 2.7% | 4.3% |

| Q1 2021 | 1.3% | 4.2% |

| Q4 2020 | 4.2% | 4.3% |

| Q3 2020 | 3.7% | 4.5% |

| Q2 2020 | 1.2% | 4.4% |

| Q1 2020 | 5.0% | 4.8% |

| Q4 2019 | 5.1% | 5.6% |

| Q3 2019 | 5.4% | 5.7% |

| Q2 2019 | 5.7% | 6.0% |

| Q1 2019 | 5.8% | 6.0% |

| Q4 2018 | 5.8% | 6.0% |

| Q3 2018 | 5.6% | 5.9% |

| Q2 2018 | 5.5% | 5.7% |

| Q1 2018 | 5.3% | 5.5% |

| Q4 2017 | 5.1% | 5.4% |

Variable rates also fell, decreasing from 8.7% in Q1 2024 to 7.9% in Q1 2025. But that’s slightly up from 7.8% in Q4 2024.

Denial rates jump to 45% depending on loan type

By loan type, those applying for an SBA loan or LOC were the most likely to be denied. In fact, these applicants saw a 45% denial rate in 2024 — more than double the 21% rate across all types.

Schulz believes some denials could be the result of the applicant not knowing the SBA’s lending standards in terms of what makes a small business.

“There are limitations in terms of annual revenue and employees,” he says. “If you’re too big, you just might not be able to get the loan. Additionally, for the SBA 7(a) loan, the most popular type of SBA loan, your odds of approval are likely to improve if you’ve been in business for at least two to three years. Lastly, your personal credit score could be an issue. Typically, borrowers with personal FICO Scores of 680 or higher tend to have the best odds of getting approved.”

Personal loans (often taken out by startups or new business owners who may have good credit but don’t qualify for business loans yet) followed at 38%, with business loans (32%) rounding out the top three.

Conversely, MCA applicants had the lowest denial rate at just 9%, with auto or equipment loans (15%) and mortgage/real estate loans (17%) following.

Denial rates vary by institution type

Like loan type, denial rates also vary by institution type. Loan, LOC or MCA applicants were denied most commonly by community development financial institutions (CDFIs) — specialized institutions dedicated to providing financing options to underserved communities that traditional financial institutions may not reach — at 34%. Large banks (31%) followed.

Credit unions and other lenders tied for third, both at 27%.

Meanwhile, denial rates were lowest for finance companies — businesses that specialize in loans but don’t take cash deposits like banks — at 21%, followed by small banks (24%) and online lenders (25%).

While those denial rates may make you consider your financing options more carefully, Schulz says it makes the most sense to keep your options open.

“Credit unions, smaller banks and other lenders can be great alternatives to consider, especially if you already have a relationship with one,” he says. “However, it’s important to understand that credit unions and other alternative lenders may have less lending capacity than the big banks and may not be able to approve loans as large as what might be available from a big megabank. Also, credit unions may have stricter membership requirements, meaning that you simply may not be able to get a loan from them because you don’t meet their criteria to join.”

Small firms most likely to be denied

Looking at business demographics, small firms were five times more likely to be denied than the largest ones. Among businesses with one to four employees, the 2024 denial rate was 26%. Comparatively, that rate was just 5% among large firms with 50 to 499 employees.

That’s understandable, Schulz says, but your firm size isn’t the whole story.

“If a business only has a handful of employees, it could be a sign to lenders that they’re just getting started,” he says. “Of course, plenty of small businesses are extremely successful, but to some lenders, a company’s small size can spur questions about stability and growth potential, making it seem like a potentially risky borrower. Putting up additional collateral can help if you’re willing to take on the risk. Improving your credit score can also make a difference.”

Additionally, Black-owned businesses were significantly more likely to be denied than any other race, at 39%. Hispanic-owned businesses (29%) followed, while the denial rate was just 18% among white-owned businesses.

Looking at revenue, firms with annual revenues of $50,001 to $100,000 saw a 35% denial rate in 2024 — the highest among this group. Meanwhile, those earning more than $10 million had the lowest rate at 4%.

Denial rates by business demographics

| Race/ethnicity of owner(s) | % of applicants denied |

| Black or African American | 39% |

| Hispanic | 29% |

| Asian | 24% |

| White | 18% |

| Gender of owner(s) | % of applicants denied |

| Men-owned | 21% |

| Women-owned | 18% |

| Industry | % of applicants denied |

| Retail | 25% |

| Leisure and hospitality | 24% |

| Manufacturing | 22% |

| Business support and consumer services | 19% |

| Health care and education | 19% |

| Nonmanufacturing goods production and associated services | 19% |

| Professional services and real estate | 19% |

| Age of firm | % of applicants denied |

| 3-5 years | 29% |

| 6-10 years | 24% |

| 11-15 years | 23% |

| 16-20 years | 20% |

| 0-2 years | 18% |

| 21+ years | 14% |

| Revenue | % of applicants denied |

| $50,001-$100,000 | 35% |

| $100,001-$250,000 | 32% |

| $25,001-$50,000 | 28% |

| $500,001-$1 million | 22% |

| $250,001-$500,000 | 21% |

| $0-$25,000 | 20% |

| $1 million-$5 million | 15% |

| $5 million-$10 million | 9% |

| More than $10 million | 4% |

By industry, denial rates were highest in retail (25%), leisure and hospitality (24%), and manufacturing (22%).

Also worth noting, startups (businesses in operation for up to two years at the time of application) had an 18% denial rate — the second-lowest after firms in operation for 21 or more years (14%). Businesses operating for three to five years faced the highest denial rate, at 29%.

Looking at Q1 2025, financials were the main reason cited for business loan denials, with 68.4% of businesses citing this reason. Credit history (21.5%) and collateral (5.7%) followed. (Note: This Q1 2025 data is specific to business loan denials, not the combined look at business loans, LOCs and MCAs.)

Finding funding as a small business: Top expert tips

Finding funding in this economic climate may be difficult, but it’s not impossible. Schulz offers the following advice:

- Make sure you understand what you’re applying for. “As great as it might sound to get a loan, not doing your homework and understanding what is required and who is eligible is setting yourself up for failure,” he says.

- Strengthen your credit profile. “That includes both your personal credit and your business credit score,” he says. “It’s certainly easier said than done, but it’s hard to overstate the importance of good credit when applying for business loans or personal loans.”

- Have a clear business plan. Lenders want to see where their money is going. Showing a well-thought-out plan with realistic financial projections can make all the difference in getting approved.

Methodology

LendingTree researchers analyzed the Federal Reserve 2024 Small Business Credit Survey (SBCS).

Denial rates reflect the percentage of applicants that, in a survey question about the best outcome on their loan, line of credit (LOC) or merchant cash advance (MCA) application(s), reported receiving “none” of the financing requested.

Results are based on responses from employer firms that applied for these products in the prior 12 months (approximately September-November 2023 through September-November 2024).

Interest rate data comes from the Federal Reserve Bank of Kansas City’s Small Business Lending Survey (SBLS), using median rates for new fixed-rate and variable-rate term loans. The most common reasons for loan denials are also from this survey, as of Q1 2025. The Q1 2025 data looks solely at business loans, not combined business loans, LOCs and MCAs.

Compare business loan offers