Nearly 1 in 4 Businesses Are Moving More Online Amid Pandemic — And Here’s Where

Since the beginning of the coronavirus pandemic, nearly 1 in 4 businesses have increasingly used online platforms to offer goods and services, according to data from the U.S. Census Bureau’s Small Business Pulse Survey.

Many shoppers have changed their habits amid the crisis, offering unique opportunities for businesses that can leverage apps or websites to offer their products.

LendingTree researchers specifically looked at the 50 largest U.S. metros to pinpoint regional differences among businesses growing their online capabilities. But — according to our findings — the top three metros were in the West, Northeast and South, showing an increase across the U.S.

Key findings

- 34.1% of Denver businesses have increasingly turned to online platforms to offer goods and services amid the coronavirus pandemic, the highest among the 50 largest metros in the U.S. Buffalo, N.Y. (33.6%), and Louisville, Ky. (31.7%), are next.

- Riverside, Calif. (14.8%), Birmingham, Ala. (16.9%), and Cincinnati (18%) have the lowest rates of businesses increasing their usage of online platforms.

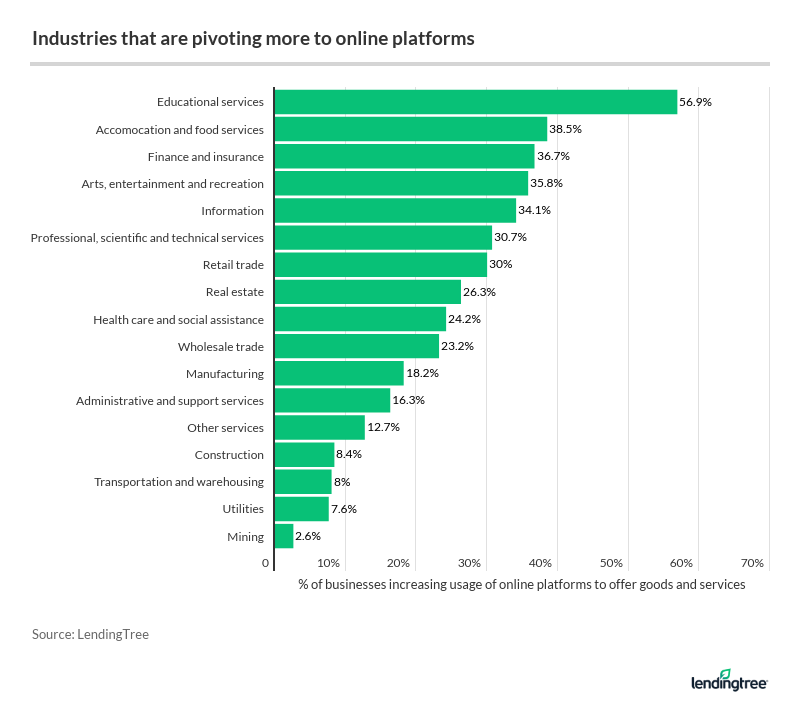

- Educational services (56.9%) and accommodation and food services (38.5%) businesses have been the most likely to utilize new online platforms. Mining, quarrying and oil and gas extraction (2.6%) businesses have been the least likely.

Businesses in Colorado, New York and Kentucky metros capitalizing the most on the shift to online

Growing COVID-19 restrictions make it significantly more difficult for businesses to operate and maintain customers. Here’s how the 50 largest U.S. metros stack up when it comes to moving more online amid the pandemic:

1. Denver: 34.1% of businesses moving more online

The plummeting temperatures in cold-weather cities like Denver could be pushing more businesses to utilize online platforms.

Available aid/assistance

The Small Business Emergency Relief Fund was launched in March to help struggling Denver businesses. Nearly 1,800 businesses have received stabilization grants totaling nearly $10.5 million — or an average of more than $5,800 — though initial funds were depleted in early December.

Get Small Business Loans Tailored to You

The city is also allowing more business applications to be submitted online, which can make it easier for new businesses to start — and utilize online platforms.

Meanwhile, the Temporary Outdoor Expansion Program allows certain city businesses — from restaurants and bars to coffee shops and breweries — to use expanded areas through October 2021. However, this could be more difficult as the weather turns.

Coronavirus restrictions

In November, Denver moved to Colorado’s Level Red, prohibiting public and private gatherings of people in separate households, with limited exceptions. The city could exit Level Red in mid-January, according to the Denver Post.

Interestingly, the largest segment of businesses in the Denver metro area don’t use online platforms at all (37.9%), though this is below the average of 45.7% across the 50 metros.

2. Buffalo, N.Y.: 33.6% of businesses moving more online

In October, New York state launched Empire State Digital to help small businesses enhance their online presence, setting up partnerships with companies like Clearbanc, Etsy, Shopify and Square.

Available aid/assistance

The city of Buffalo offers a Business Assistance page that provides information about where to get financial support, from disaster relief business loans to grants for personal protective equipment (PPE) reimbursement.

The Keep Buffalo Niagara Working initiative organizes guidelines from the Centers for Disease Control and Prevention (CDC) and requirements from the state to assist businesses owners looking to reopen.

In early December, the city held Buy Black Buffalo Week, which aimed to give a boost to Black-owned businesses increasing their online presence.

Coronavirus restrictions

Buffalo transitioned to New York’s Orange Warning Zone just before Thanksgiving, which limits certain businesses to a 25% capacity. Businesses that didn’t expand their online capabilities amid the first COVID-19 wave could now be reconsidering after the second one.

A significant 43.6% of businesses within the Buffalo metro don’t use online platforms at all — the highest among our top three.

3. Louisville, Ky.: 31.7% of businesses moving more online

Growing COVID-19 restrictions have led to concepts like Farm+House Louisville, a virtual farmers market that allows customers to shop for produce, meat, ready-to-eat-meals and dairy products — among other things — via an app.

Available aid/assistance

Louisville Forward has disbursed just over $27 million in relief grants to more than 800 businesses in the area. Businesses sought grants ranging from $845 to $50,000, according to Louisville Business First.

Meanwhile, the Small Business COVID-19 Relief Grant program specifically allowed funds to be used for technology to adapt platforms for online sales, though applications are no longer being accepted.

Coronavirus restrictions

Jefferson County, where Louisville is located, moved back into Kentucky’s red zone in mid-October. Recommendations included:

- Reducing in-person shopping

- Avoiding in-person dining at restaurants and bars

- Prioritizing businesses that enforce mask mandates and other guidelines

The percentage of Louisville businesses increasingly using online platforms to offer goods and services was similar to the rates for businesses that don’t use online platforms (35.4%) or reported no changes (32.9%).

Businesses in California, Alabama and Ohio metros capitalizing the least on the shift to online

Among the cities whose online shift is moving more slowly, there’s a common theme: Between 40.7% and 60.9% of businesses in those places don’t have online platforms at all, meaning it’s almost impossible to have a high percentage of businesses shifting more online. In addition, funding opportunities aren’t as widespread in these metros as they are in those at the top of the list.

50. Riverside, Calif.: 14.8% of businesses moving more online

Nearly 61% of Riverside businesses don’t use online platforms — the highest percentage among the 50 metros.

What’s happening in California — and Riverside County, in particular — make it harder to explain, though:

- The governor of California announced a Regional Stay at Home Order in early December.

- Riverside County is averaging 135 cases per 100,000 residents as of Jan. 7, according to the New York Times — the fourth-highest count among California counties. And the state has the third highest per-100,000 rate in the U.S., behind Arizona and Rhode Island.

These factors would seem to contribute to a push to moving more Riverside businesses online, but that hasn’t happened.

The city does offer the Microenterprise Business Grant Program, which provides a one-time grant of up to $7,500. So while there is additional, localized support in place, a one-time grant may not be enough for many businesses to use the funds to move more online.

49. Birmingham, Ala.: 16.9% of businesses moving more online

In Birmingham, 51.5% of businesses aren’t using online platforms. But, similar to Riverside, it’s hard to explain.

Alabama has the 10th highest per-100,000 rate in the U.S. as of Jan. 7, and Jefferson County, where Birmingham is located, is seeing an even higher rate than the state overall.

Available aid/assistance

The Birmingham Business Resource Center highlights aid that mostly focuses on federal loan relief, such as:

- Paycheck Protection Program (PPP) loans

- Economic Injury Disaster Loans (EIDLs)

The pressure of handling loan forgiveness properly when it comes to PPP, as well as the continued question marks around lockdowns, could make it more difficult for businesses to invest beyond maintaining the status quo, or at least coming close.

Business Loan Interest Rates: The Basic Guide

48. Cincinnati: 18% of businesses moving more online

Though the percentage of businesses in Cincinnati that don’t use online platforms at all (40.7%) is lower than the national average, less than 1 in 5 are moving more online amid the crisis.

Notably, different from the other two metros at the bottom, Ohio’s per-100,000 rate — as of Jan. 7 — virtually mirrors that of Hamilton County, where Cincinnati is located.

Available aid/assistance

The Cincinnati USA Regional Chamber provides technical business resources for those interested in making the leap to an online-friendly model. However, rather than offering financial assistance, it’s focused on connecting businesses with private services that can help. So, in this case, business owners are essentially given the keys, but not the gas money they need to get going.

Educational services pivot the most to online, while mining and quarrying pivot the least

Educational services and accommodation and food services were the sectors most likely to take advantage of online platforms, while mining and quarrying were the least. (Of course, mining and quarrying are not quite online businesses, so it makes sense for this sector to fall at the bottom of the list.)

The educational sector is highly compatible with online platforms, from elementary and secondary schools to colleges, as well as educational support services. Many colleges, for instance, made the switch to online learning as the pandemic hit, offering video lectures and virtual office hours.

But not all industries are as lucky.

“Every industry is impacted differently, but so much of that is based on where you’re located,” said Hunter Stunzi, LendingTree senior vice president of small business and investments.

A significant part of this comes down to whether your business is deemed essential and how your state is handling the pandemic. “Anything that was heavily in the business-to-consumers space and relying on foot traffic, they’re not in a comfortable position,” he added.

4 ways that businesses can increase their online presence

Creating an online presence is important for the vast majority of small businesses. Here’s how to start creating yours.

- Create a customer-friendly website. Establishing an online presence is essential, but that presence needs to appease visitors. Websites, for example, need to clarify common or important questions, detail return policies (if applicable) and provide contact information. Customers should be able to read product reviews, too.

- Make it easy to buy products. E-commerce — arguably the main reason why an online presence is important — allows customers to buy products without leaving their homes, translating to more sales. Platform options can include PayPal and Square, but make sure to scrutinize any fee schedules.

- Leverage existing selling platforms. Small businesses can leverage the power of larger platforms, including Amazon, eBay, Etsy and Shopify. This way, business owners can set up an online store and reach these platforms’ existing customers. Depending on the niche, advertising on these sites could help businesses stand out from the crowd.

- Make sure the website is mobile-friendly. We may still be stuck at home, but our phones work just fine when it comes to buying products. Websites should work on both desktop and mobile — as well as on tablets — to reach the most customers.

16 Best Online Business Ideas for Entrepreneurs

Methodology

LendingTree researchers analyzed data from the Census Bureau’s Small Business Pulse Survey to estimate the percentage of businesses in the 50 largest U.S. metros that reported an increase in their usage of online platforms. The survey was fielded from Nov. 23 to Nov. 29, 2020, asking respondents about any changes since March 13, 2020.

Compare business loan offers