2nd COVID-19 Wave Has New Orleans, San Antonio and Birmingham Small Business Owners Most Worried About Futures

Countless Americans hope daily for a return to normalcy, even though what we consider normal may not return any time soon — or at all. It’s especially true for small business owners. In fact, 4 in 5 New Orleans small business owners think it’ll take at least four months for business to return to normal, if at all. This is up from just more than 3 in 5 amid the first COVID-19 wave.

LendingTree researchers used U.S. Census Bureau Small Business Pulse Survey data from the 50 largest metros to see where business owners’ outlooks have changed the most since the pandemic’s first wave. We specifically looked at small businesses that think it’ll take at least four months to recover, as well as those that don’t think they’ll return to normal or have already closed.

We also looked at national sentiment, including operational challenges, financial stress and expected recovery. Here’s what we learned.

Key findings

- New Orleans, San Antonio and Birmingham, Ala., business owners saw the biggest shifts in expectations since the first COVID-19 wave. Between the end of April and the beginning of December, the percentage of businesses saying it would take at least 4 months to recover — if ever — increased in these metros by at least 16 percentage points.

- Charlotte, N.C., business owners, meanwhile, have the highest hopes for the future of their businesses. In April, 73.6% of small businesses thought it would take at least 4 months to recover, but that figure plummeted to 60.5% by early December.

- Small business owners’ expectations for the future are generally worse amid the second wave than they were during the first. In 34 metros, expectations worsened between the waves. In 10, expectations improved, while 6 saw no change.

Gloomy expectations rise most in New Orleans, San Antonio and Birmingham, Ala., amid 2nd wave

Across the 50 metros, an average of 70.9% of small businesses believe it’ll take at least four months to recover — if at all. And, in general, small business owners had a gloomier outlook for the future during the second wave than during the first. This was the case in 34 metros, where expectations worsened between waves. (In another six, expectations remained the same.)

New Orleans, San Antonio and Birmingham, Ala., small business owners experienced the largest shift in expectations between the first and second COVID-19 waves. Between the end of April and the beginning of December, the perception that it would take at least four months to recover increased in those metros by at least 16 percentage points.

As COVID-19 cases continue to rise around these cities, small businesses could face tighter restrictions on their operations, said Melissa Wylie, LendingTree senior small business writer.

“These could include lower in-person capacity limits or shorter operating hours,” Wylie said. “For small businesses already struggling, further restrictions could present a breaking point.”

In fact, New Orleans reinstituted Modified Phase One on Jan. 8, which sets a 25% capacity at many businesses, including:

- Beauty salons

- Casinos

- Gyms

- Movie theaters

- Restaurants

- Retail stores

- Shopping malls

New Orleans relies heavily on tourism, so additional restrictions — including indoor seating being prohibited at bars and breweries and indoor live entertainment being banned at these establishments — can contribute to the gloominess from small business owners. This is especially true during Mardi Gras season, though Orleans parish parades have already been canceled for 2021.

Wylie noted that she isn’t surprised so many business owners aren’t feeling hopeful for the future. “Conditions continue to change, and entrepreneurs continue to adapt, but operating in a constant state of uncertainty is surely exhausting,” she said.

If small business owners choose to stay open, Wylie believes they’ll need to remain as flexible as possible and come up with new revenue streams.

“Continue to save as much money as possible,” she said. “Don’t be afraid to try something new and to abandon any strategy, service or product that is not serving the business.”

Charlotte, N.C., businesses most optimistic since 1st wave

While many cities aren’t optimistic about the future of small businesses in their area, expectations did improve in 10 of the 50 largest U.S. metros:

While it’s difficult to pin down why some metros are more optimistic than others, government support certainly doesn’t hurt.

Business owners in Charlotte, N.C., were able to seek local financial resources in 2020, including the MeckCounty Cares Small Business Relief Grant and the Access to Capital Small Business Recovery grants program.

“Many cities across the U.S. offered similar resources to struggling entrepreneurs, and it’s important for small business owners to see what funding may still be available in their area,” Wylie said.

Sacramento, Calif., and Phoenix were the next most optimistic cities. Like business owners in Charlotte, entrepreneurs in Sacramento and Phoenix had access to local funding opportunities, including California’s Small Business COVID-19 Relief Grant Program and the city of Phoenix’s Small Business Resiliency Grants Program.

Where businesses stand nationally, from operational challenges and financial stress to expected recovery

The Census Bureau Small Business Pulse Survey tracks four indexes, each of which focus on different topics. These findings can begin to give an idea of where small businesses stand:

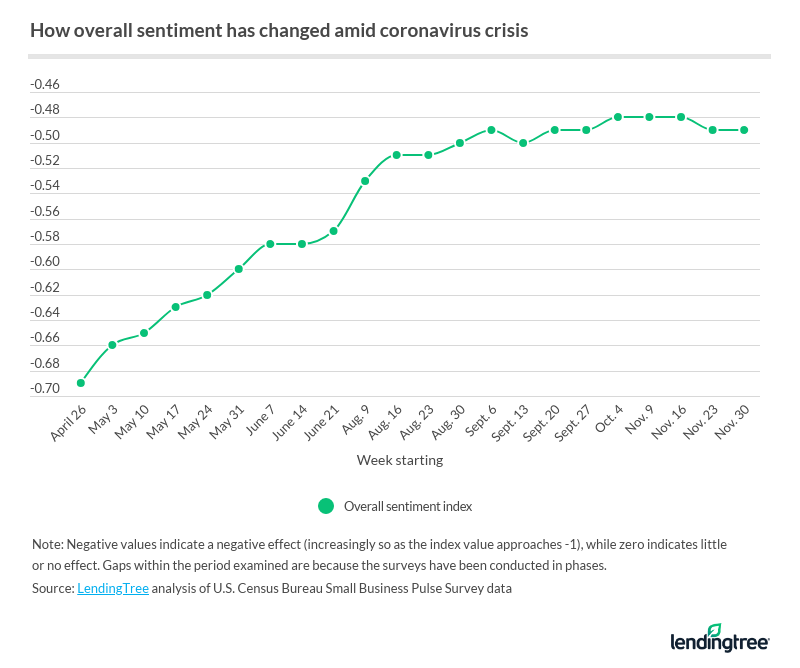

- The overall sentiment index, which measures how the pandemic has affected small businesses, fell in late November for the first time since mid-September — and for only the second time since the Census Bureau started tracking crisis data in late April. That being said, the index is much closer to being neutral than at the start of the pandemic.

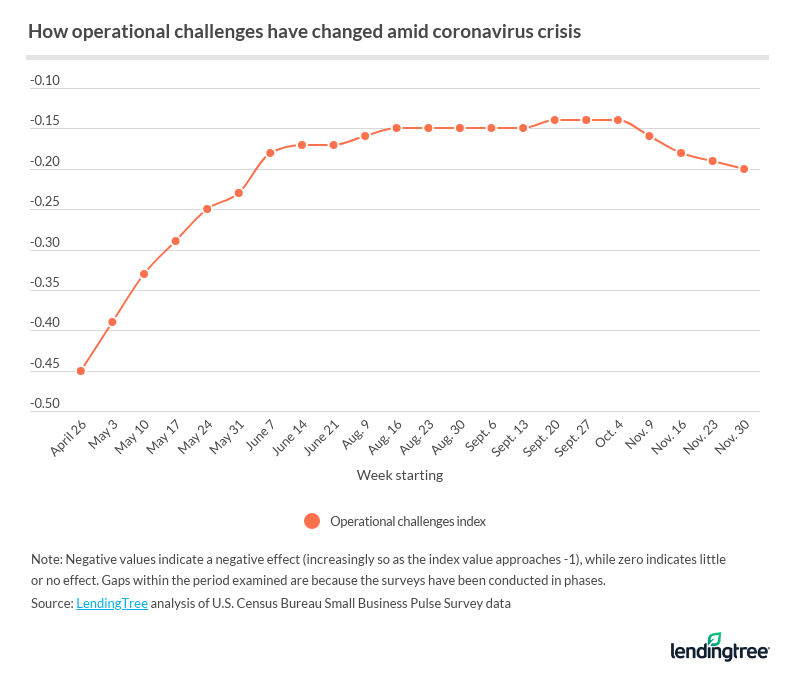

- The operational challenges index assesses the overall effect of the pandemic on business operations. This index steadily improved from late April to early November, but it has worsened weekly since then.

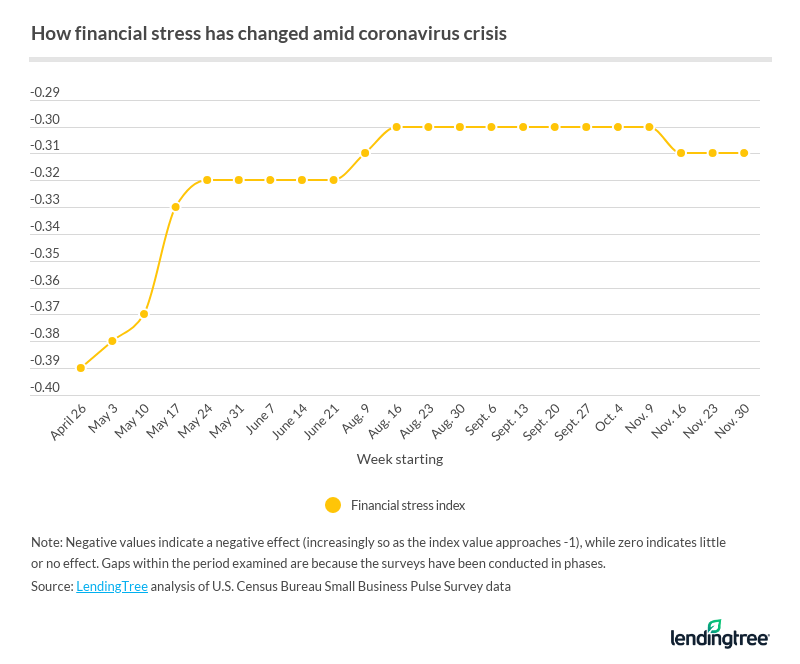

- The financial stress index assesses the financial difficulties experienced by businesses. It has held flat since mid-November, when it dropped for the first time since the start of the pandemic.

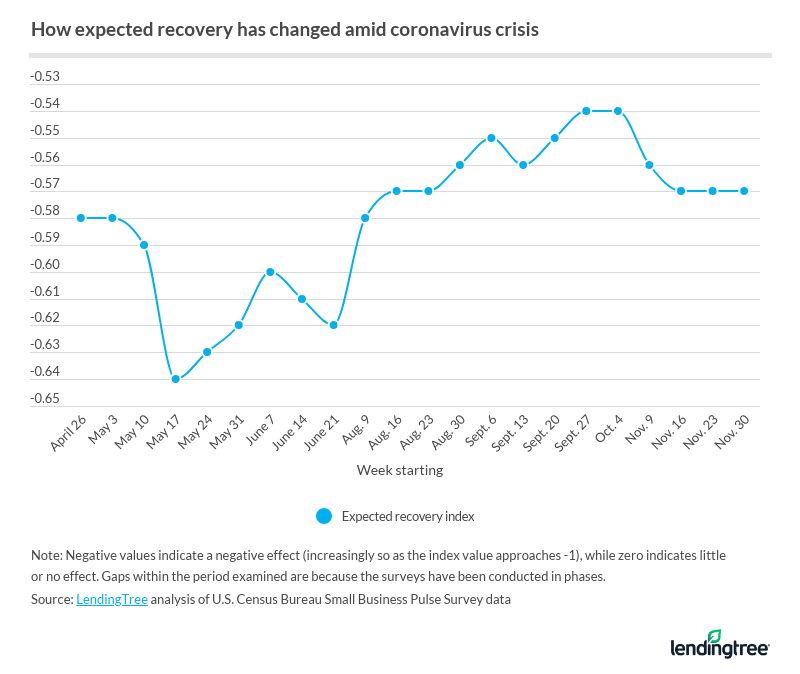

- The expected recovery index is down marginally since late September and is just slightly better than at the start of the recovery. This index summarizes the length of the expected recovery of businesses.

Overall sentiment index

The drop in the percentage of businesses that said the pandemic has had a large negative effect has impacted the general increase in sentiment. At the beginning of tracking, 51.4% of businesses said the effect of the pandemic was largely negative. Even with cases picking back up, just 30.3% of small businesses now say the effect has been largely negative.

Operational challenges index

Since the beginning of November, more businesses are reporting a drop in revenues, which could be pushing the operational challenges index in the opposite direction. During the week of Nov. 9, 33.4% of small businesses reported a drop in revenue in the past week. Similarly, during the week of Nov. 30, 38.7% of small businesses reported a revenue drop in the past week.

Financial stress index

One change that explains the small increase in financial stress recently is the amount of cash on hand for businesses. From the week of Sept. 13, 54.6% of small businesses reported at least having one month of cash on hand. That number has been trending down recently, with the data showing only 51.3% of businesses with at least one month of cash on hand.

Expected recovery index

More than 6 in 10 (61.2%) businesses nationwide reported they believe it’ll be at least four months until their business will recover to the level it was at a year ago, up from 58.6% in late September and early October. The percentage of businesses that have reported permanently closing is up to 1.9% from 1.6% in late September and early October.

4 changes small businesses can still make to adapt to pandemic

- See if government funding makes sense for your business. Federal relief for small businesses is available once again in the form of Paycheck Protection Program (PPP) loans and Economic Injury Disaster Loans (EIDLs), both issued through the U.S. Small Business Administration. PPP loans are forgivable, while the EIDL program includes a forgivable grant. Both of these programs can provide major financial assistance for small businesses, but there are strict eligibility requirements and stipulations around how you can spend the money. Make sure you understand whether a PPP loan or an EIDL would be a good fit for your business.

- Take out a short-term business loan. This is only the case if you can pay it back, though. A short-term business loan from an online lender can help you cover an immediate funding need, from payroll to inventory and more. “However, you would need to repay your loan, plus interest, on a relatively quick schedule,” Wylie said. “Only consider taking on debt if your business is generating enough steady revenue to make repayments.”

- Look for new revenue opportunities. Depending on your business model, you may be able to offer virtual or contactless offerings in place of — or in addition to — your typical services. “Think creatively about how to reach your customers,” Wylie said. “Consider looking to similar businesses in your community for ideas or inspiration.”

- Save, save, save. As the pandemic wears on, small business will likely face changing circumstances. Wylie recommends cutting costs as much as possible and creating a financial cushion for your business that you could access in an emergency. She suggested setting up a strategy for handling a sudden drop in revenue or similar surprises.

Methodology

We compared U.S. Census Bureau Small Business Pulse Survey data collected between April 26 and May 2 — the first wave — to data collected between Nov. 30 and Dec. 6 — the second wave. We calculated the percentage of businesses in each period that said it would take at least four months to return to normal operations. For the first period, we included businesses that said they’d never recover. For the second period, we included businesses that had permanently closed, in addition to those that said they’d never recover.

Compare business loan offers