Cheapest Car Insurance in Arkansas (2026)

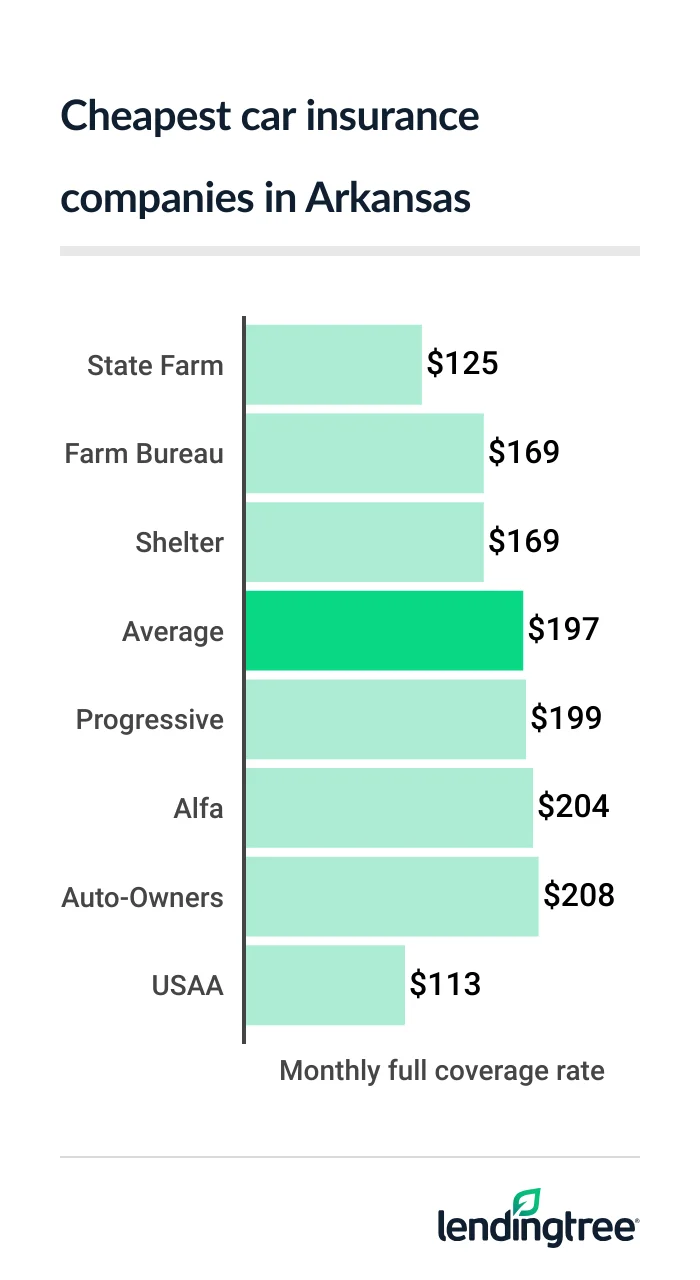

State Farm has the cheapest car insurance for most Arkansas drivers, at $125 per month for full coverage and $33 per month for liability-only coverage.

Best cheap car insurance in Arkansas

Cheapest full coverage car insurance in Arkansas: State Farm

Most Arkansas drivers get the cheapest full coverage car insurance from State Farm, which offers an average rate of $125 per month.

USAA is cheaper, at $113 per month. But only members of the military and their families can buy insurance from USAA.

After State Farm, Farm Bureau and Shelter are the next-cheapest companies for most drivers in Arkansas. Both have an average rate of $169 per month for full coverage insurance

Although Farm Bureau’s and Shelter’s average rates are 35% higher than State Farm’s, both companies have many discounts that might make them cheaper for you.

Full coverage rates by company

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $125 | |

| Farm Bureau | $169 | |

| Shelter | $169 | |

| Progressive | $199 | |

| Alfa | $204 | |

| Auto-Owners | $208 | |

| Geico | $226 | |

| Allstate | $272 | |

| Farmers | $290 | |

| USAA* | $113 | |

Look for discounts while shopping for car insurance, but also compare quotes from several companies. Different companies use different methods to come up with your rate. To get the best and cheapest policy, compare car insurance quotes before you buy or renew.

Arkansas’ cheapest liability insurance: State Farm

State Farm also has the cheapest liability car insurance for most drivers in Arkansas, at $33 per month.

Alfa is next, with rates that average $45 per month. Auto-Owners, Farm Bureau and Progressive are close behind, all at just over $50 per month for liability insurance

Liability auto insurance rates by company

| Company | Monthly rate |

|---|---|

| State Farm | $33 |

| Alfa | $45 |

| Auto-Owners | $51 |

| Farm Bureau | $52 |

| Progressive | $52 |

| Shelter | $60 |

| Geico | $73 |

| Allstate | $95 |

| Farmers | $98 |

| USAA* | $28 |

State Farm may have cheaper liability insurance rates than Alfa for most Arkansas drivers, but Alfa has a better customer satisfaction score from J.D. Power

Best cheap car insurance for Arkansas teens: Alfa

For the cheapest teen car insurance rates in Arkansas, get quotes from Alfa and Farm Bureau.

Alfa has the state’s cheapest teen liability insurance rates of $80 per month. State Farm is next at $113 per month.

At $298 per month, Farm Bureau has the cheapest full coverage rates for Arkansas teens. Alfa is second at $312 per month.

Cheapest insurance rates for young drivers

| Company | Liability coverage | Full coverage |

|---|---|---|

| Alfa | $80 | $312 |

| State Farm | $113 | $343 |

| Farm Bureau | $125 | $298 |

| Shelter | $158 | $433 |

| Auto-Owners | $188 | $546 |

| Geico | $195 | $517 |

| Progressive | $263 | $871 |

| Farmers | $388 | $1,013 |

| Allstate | $395 | $1,064 |

| USAA* | $75 | $276 |

Young drivers pay much higher car insurance rates than older drivers, even if they have clean driving records. This is mostly because they get into more accidents.

Teen car insurance costs a lot less if the teen is added to a parent’s policy. You can also save money by getting certain discounts, like ones for good grades or taking a driver’s education course.

Cheap insurance after a speeding ticket in Arkansas: State Farm

At $132 per month, State Farm has the cheapest car insurance in Arkansas for drivers with a speeding ticket on their records.

Farm Bureau is the next-cheapest company for most of these drivers, with rates of about $181 per month.

Cheapest car insurance rates after a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $132 |

| Farm Bureau | $181 |

| Shelter | $201 |

| Auto-Owners | $208 |

| Progressive | $261 |

| Alfa | $290 |

| Geico | $291 |

| Allstate | $328 |

| Farmers | $395 |

| USAA* | $135 |

Both State Farm and Farm Bureau make their customers happy, based on their good J.D. Power scores. They also offer several car insurance discounts that could help you save money. State Farm has more discounts than Farm Bureau, however.

Some of State Farm’s discounts should be easy to get, too, including ones for air bags, anti-theft devices and certain safety features.

The average driver in Arkansas sees their car insurance rate go up by 23% after getting a speeding ticket. State Farm only raises its rates by 6% after a ticket, on average.

Cheapest Arkansas auto insurance after an accident: State Farm

State Farm has the cheapest car insurance after an accident in Arkansas. The company’s rates average $125 per month for these drivers.

Farm Bureau and Shelter are next, with rates that are around $220 per month.

Cheapest insurance rates with an accident

| Company | Monthly rate |

|---|---|

| State Farm | $125 |

| Farm Bureau | $214 |

| Shelter | $221 |

| Auto-Owners | $288 |

| Progressive | $290 |

| Alfa | $316 |

| Geico | $376 |

| Farmers | $399 |

| Allstate | $454 |

| USAA* | $159 |

Shelter’s many discounts may or may not make it your cheapest option if you qualify for a few of them. It might be worth a look either way, though, if customer service and satisfaction are important to you. Shelter scored much better than State Farm with customers in J.D. Power’s most recent study.

Also, Shelter’s standard policy comes with new car replacement coverage. This will replace your car with a brand-new one of the same year, make and model if it is totaled. Your totaled car must have been bought new, bought within the last year and been driven fewer than 15,000 miles.

You should expect your car insurance premium

Arkansas’ cheapest insurance for teens with bad driving records: Alfa

Arkansas teens with a ticket or accident on their driving records get the cheapest car insurance from Alfa, based on our data.

Alfa’s average car insurance rate for teen drivers with a speeding ticket is $101 per month. For teen drivers with an accident on their records, the company’s rates average $108 per month.

State Farm comes in second, at $123 per month after a ticket and $113 per month after an accident.

Teen car insurance rates with a bad driving record

| Company | Ticket | Accident |

|---|---|---|

| Alfa | $101 | $108 |

| Allstate | $516 | $621 |

| Auto-Owners | $188 | $301 |

| Farm Bureau | $139 | $168 |

| Farmers | $480 | $473 |

| Geico | $242 | $312 |

| Progressive | $276 | $291 |

| Shelter | $192 | $228 |

| State Farm | $123 | $113 |

| USAA* | $110 | $132 |

Best car insurance in Arkansas after a DWI: Farm Bureau

With rates of about $198 per month, Farm Bureau has Arkansas’ cheapest DUI insurance quotes.

Progressive and Shelter have the next-cheapest quotes after a DUI (driving under the influence) conviction, or DWI

Car insurance rates after a DWI

| Company | Monthly rate |

|---|---|

| Farm Bureau | $198 |

| Progressive | $251 |

| Shelter | $256 |

| State Farm | $279 |

| Alfa | $295 |

| Allstate | $359 |

| Auto-Owners | $375 |

| Farmers | $385 |

| Geico | $405 |

| USAA* | $218 |

Progressive and Shelter have more discounts than Farm Bureau does. If you can get a couple of them, they may be cheaper companies for you. Also, you need to join the Arkansas Farm Bureau to get its insurance. Membership costs $40 a year and is open to non-farmers.

Arkansas drivers who are convicted of DWI should expect their car insurance rates to go up by around 53%. Farm Bureau customers only see their rates go up 17% after a DWI, on average.

Cheapest Arkansas car insurance rates for bad credit: Alfa

Alfa has the cheapest car insurance in Arkansas for most drivers with bad credit, at $204 per month.

Farm Bureau is next for bad-credit car insurance. Its rates average $298 per month.

Car insurance quotes with bad credit

| Company | Monthly rate |

|---|---|

| Alfa | $204 |

| Farm Bureau | $298 |

| Shelter | $327 |

| Progressive | $330 |

| Geico | $346 |

| Farmers | $436 |

| Allstate | $460 |

| Auto-Owners | $602 |

| State Farm | $619 |

| USAA* | $203 |

On average, Arkansas drivers with bad credit pay $382 per month for full coverage car insurance. That’s nearly double what drivers with good credit pay.

Best car insurance companies in Arkansas

State Farm is the best car insurance company in Arkansas overall. The company has the cheapest rates for most of the state’s drivers. It also offers many discounts, and customers rate it highly.

Arkansas car insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| Alfa | 685 | A | |

| Allstate | 635 | A+ | |

| Auto-Owners | 638 | A+ | |

| Farm Bureau | 645 | A | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| Shelter | 669 | A | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

Alfa and Farm Bureau are among Arkansas’ best car insurance companies. Alfa has the state’s cheapest rates for teen drivers, while Farm Bureau is the cheapest for drivers with a DWI. Both companies also have good J.D. Power scores — Alfa, especially.

Arkansas car insurance rates by city

The cheapest city in Arkansas for car insurance is Centerton, where rates average $172 per month. West Helena is the state’s most expensive city for car insurance. Rates there average $234 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Adona | $189 | -4% |

| Alexander | $201 | 2% |

| Alicia | $188 | -5% |

| Alix | $178 | -10% |

| Alleene | $204 | 4% |

| Alma | $186 | -6% |

| Almyra | $191 | -3% |

| Alpena | $183 | -7% |

| Alpine | $197 | 0% |

| Altheimer | $210 | 6% |

| Altus | $179 | -9% |

| Amagon | $193 | -2% |

| Amity | $203 | 3% |

| Antoine | $201 | 2% |

| Arkadelphia | $192 | -3% |

| Arkansas City | $218 | 10% |

| Armorel | $198 | 0% |

| Ash Flat | $202 | 2% |

| Ashdown | $198 | 0% |

| Atkins | $182 | -8% |

| Aubrey | $219 | 11% |

| Augusta | $194 | -2% |

| Austin | $193 | -2% |

| Avoca | $180 | -9% |

| Bald Knob | $194 | -2% |

| Banks | $211 | 7% |

| Barling | $177 | -10% |

| Barton | $230 | 17% |

| Bass | $188 | -5% |

| Bassett | $201 | 2% |

| Batesville | $194 | -2% |

| Bauxite | $202 | 2% |

| Bay | $185 | -6% |

| Bearden | $205 | 4% |

| Bee Branch | $195 | -1% |

| Beebe | $191 | -3% |

| Beech Grove | $189 | -4% |

| Beedeville | $192 | -3% |

| Beirne | $198 | 0% |

| Bella Vista | $175 | -11% |

| Belleville | $183 | -7% |

| Ben Lomond | $203 | 3% |

| Benton | $199 | 1% |

| Bentonville | $174 | -12% |

| Bergman | $180 | -9% |

| Berryville | $178 | -10% |

| Bethel Heights | $178 | -10% |

| Bexar | $202 | 2% |

| Big Flat | $184 | -7% |

| Bigelow | $196 | -1% |

| Biggers | $189 | -4% |

| Bismarck | $198 | 0% |

| Black Oak | $185 | -6% |

| Black Rock | $186 | -6% |

| Blevins | $205 | 4% |

| Bluff City | $206 | 5% |

| Bluffton | $187 | -5% |

| Blytheville | $195 | -1% |

| Board Camp | $194 | -1% |

| Boles | $184 | -7% |

| Bonnerdale | $197 | 0% |

| Bono | $190 | -4% |

| Booneville | $179 | -9% |

| Bradford | $194 | -2% |

| Bradley | $214 | 9% |

| Branch | $176 | -11% |

| Brickeys | $217 | 10% |

| Briggsville | $192 | -3% |

| Brinkley | $205 | 4% |

| Brockwell | $205 | 4% |

| Brookland | $190 | -4% |

| Bruno | $183 | -7% |

| Bryant | $201 | 2% |

| Buckner | $204 | 3% |

| Bull Shoals | $181 | -8% |

| Burdette | $203 | 3% |

| Cabot | $199 | 1% |

| Caddo Gap | $204 | 4% |

| Caldwell | $201 | 2% |

| Cale | $204 | 3% |

| Calico Rock | $207 | 5% |

| Calion | $211 | 7% |

| Camden | $202 | 3% |

| Cammack Village | $204 | 3% |

| Camp | $198 | 0% |

| Canehill | $181 | -8% |

| Caraway | $183 | -7% |

| Carlisle | $195 | -1% |

| Carthage | $212 | 8% |

| Casa | $185 | -6% |

| Cash | $191 | -3% |

| Casscoe | $194 | -1% |

| Caulksville | $176 | -11% |

| Cave City | $198 | 0% |

| Cave Springs | $175 | -11% |

| Cecil | $179 | -9% |

| Cedarville | $184 | -7% |

| Center Ridge | $185 | -6% |

| Centerton | $172 | -13% |

| Charleston | $178 | -10% |

| Charlotte | $198 | 0% |

| Cherokee Village | $205 | 4% |

| Cherry Valley | $197 | 0% |

| Chester | $185 | -6% |

| Chidester | $204 | 3% |

| Clarendon | $200 | 1% |

| Clarkedale | $205 | 4% |

| Clarkridge | $185 | -6% |

| Clarksville | $176 | -11% |

| Cleveland | $190 | -4% |

| Clinton | $198 | 0% |

| Coal Hill | $180 | -9% |

| College Station | $222 | 13% |

| Colt | $202 | 2% |

| Columbus | $206 | 5% |

| Combs | $185 | -6% |

| Compton | $184 | -7% |

| Concord | $200 | 1% |

| Conway | $186 | -6% |

| Cord | $199 | 1% |

| Corning | $191 | -3% |

| Cotter | $181 | -8% |

| Cotton Plant | $201 | 2% |

| Cove | $202 | 2% |

| Coy | $202 | 2% |

| Crawfordsville | $206 | 5% |

| Crocketts Bluff | $194 | -2% |

| Crossett | $223 | 13% |

| Crumrod | $227 | 15% |

| Curtis | $198 | 1% |

| Cushman | $197 | 0% |

| Damascus | $188 | -5% |

| Danville | $186 | -6% |

| Dardanelle | $183 | -7% |

| Datto | $194 | -2% |

| De Queen | $205 | 4% |

| De Valls Bluff | $198 | 1% |

| De Witt | $194 | -1% |

| DeWitt | $194 | -2% |

| Decatur | $177 | -10% |

| Deer | $189 | -4% |

| Delaplaine | $188 | -5% |

| Delaware | $183 | -8% |

| Delight | $207 | 5% |

| Dell | $196 | -1% |

| Dennard | $199 | 1% |

| Dermott | $215 | 9% |

| Des Arc | $203 | 3% |

| Desha | $197 | 0% |

| Diamond City | $185 | -6% |

| Diaz | $188 | -5% |

| Dierks | $204 | 3% |

| Doddridge | $211 | 7% |

| Dolph | $205 | 4% |

| Donaldson | $194 | -2% |

| Dover | $182 | -8% |

| Drasco | $200 | 1% |

| Driver | $206 | 4% |

| Dumas | $216 | 9% |

| Dyess | $197 | 0% |

| Earle | $204 | 3% |

| East Camden | $202 | 2% |

| East End | $208 | 5% |

| Edgemont | $192 | -3% |

| Edmondson | $206 | 4% |

| El Dorado | $210 | 6% |

| El Paso | $190 | -4% |

| Elaine | $229 | 16% |

| Elizabeth | $193 | -2% |

| Elkins | $188 | -5% |

| Elm Springs | $177 | -10% |

| Emerson | $208 | 5% |

| Emmet | $202 | 2% |

| England | $205 | 4% |

| Enola | $190 | -4% |

| Ethel | $198 | 0% |

| Etowah | $199 | 1% |

| Eudora | $214 | 8% |

| Eureka Springs | $180 | -9% |

| Evansville | $177 | -10% |

| Evening Shade | $198 | 1% |

| Everton | $180 | -9% |

| Fairfield Bay | $190 | -4% |

| Farmington | $180 | -9% |

| Fayetteville | $180 | -9% |

| Fifty Six | $201 | 2% |

| Fisher | $199 | 1% |

| Flippin | $181 | -9% |

| Floral | $199 | 1% |

| Fordyce | $207 | 5% |

| Foreman | $204 | 3% |

| Forrest City | $205 | 4% |

| Fort Smith | $179 | -9% |

| Fouke | $211 | 7% |

| Fountain Hill | $221 | 12% |

| Fox | $199 | 1% |

| Franklin | $200 | 2% |

| Fredonia (Biscoe) | $203 | 3% |

| Frenchmans Bayou | $202 | 2% |

| Friendship | $194 | -2% |

| Fulton | $207 | 5% |

| Gamaliel | $184 | -7% |

| Garfield | $182 | -8% |

| Garland City | $209 | 6% |

| Garner | $193 | -2% |

| Gassville | $180 | -9% |

| Gateway | $178 | -10% |

| Genoa | $208 | 6% |

| Gentry | $174 | -12% |

| Gepp | $198 | 0% |

| Gibson | $200 | 1% |

| Gilbert | $187 | -5% |

| Gillett | $194 | -2% |

| Gillham | $198 | 0% |

| Gilmore | $205 | 4% |

| Glencoe | $200 | 1% |

| Glenwood | $213 | 8% |

| Goodwin | $212 | 7% |

| Goshen | $179 | -10% |

| Gosnell | $195 | -1% |

| Gould | $216 | 10% |

| Grady | $221 | 12% |

| Grannis | $200 | 1% |

| Grapevine | $197 | 0% |

| Gravelly | $187 | -5% |

| Gravette | $178 | -10% |

| Green Forest | $183 | -7% |

| Greenbrier | $192 | -3% |

| Greenland | $182 | -8% |

| Greenway | $186 | -6% |

| Greenwood | $177 | -10% |

| Greers Ferry | $194 | -2% |

| Gregory | $190 | -4% |

| Griffithville | $193 | -2% |

| Grubbs | $190 | -4% |

| Guion | $200 | 1% |

| Gurdon | $195 | -1% |

| Guy | $187 | -5% |

| Hackett | $179 | -9% |

| Hagarville | $179 | -9% |

| Hamburg | $223 | 13% |

| Hampton | $206 | 5% |

| Hardy | $203 | 3% |

| Harrell | $204 | 3% |

| Harriet | $192 | -3% |

| Harrisburg | $196 | -1% |

| Harrison | $179 | -10% |

| Hartford | $178 | -10% |

| Hartman | $177 | -10% |

| Harvey | $187 | -5% |

| Haskell | $198 | 0% |

| Hasty | $186 | -6% |

| Hatfield | $196 | -1% |

| Hattieville | $184 | -7% |

| Havana | $182 | -8% |

| Haynes | $220 | 11% |

| Hazen | $198 | 0% |

| Heber Springs | $190 | -4% |

| Hector | $185 | -6% |

| Helena-West Helena | $231 | 17% |

| Henderson | $185 | -6% |

| Hensley | $202 | 3% |

| Hermitage | $217 | 10% |

| Heth | $205 | 4% |

| Hickory Plains | $198 | 0% |

| Hickory Ridge | $194 | -2% |

| Higden | $193 | -2% |

| Higginson | $191 | -3% |

| Highfill | $174 | -12% |

| Highland | $203 | 3% |

| Hindsville | $188 | -5% |

| Hiwasse | $177 | -11% |

| Holiday Island | $180 | -9% |

| Holly Grove | $208 | 6% |

| Hope | $202 | 3% |

| Horatio | $205 | 4% |

| Horseshoe Bend | $201 | 2% |

| Hot Springs | $201 | 2% |

| Hot Springs National Park | $201 | 2% |

| Hot Springs Village | $195 | -1% |

| Houston | $187 | -5% |

| Hoxie | $186 | -6% |

| Hughes | $212 | 7% |

| Humnoke | $199 | 1% |

| Humphrey | $198 | 0% |

| Hunter | $200 | 1% |

| Huntington | $180 | -9% |

| Huntsville | $189 | -4% |

| Huttig | $217 | 10% |

| Ida | $195 | -1% |

| Imboden | $188 | -5% |

| Ivan | $208 | 5% |

| Jacksonport | $189 | -4% |

| Jacksonville | $198 | 0% |

| Jasper | $186 | -6% |

| Jefferson | $206 | 4% |

| Jersey | $210 | 7% |

| Jerusalem | $186 | -6% |

| Jessieville | $199 | 1% |

| Johnson | $177 | -10% |

| Joiner | $202 | 2% |

| Jones Mill | $208 | 6% |

| Jonesboro | $192 | -3% |

| Judsonia | $194 | -2% |

| Junction City | $210 | 6% |

| Keiser | $198 | 1% |

| Kensett | $192 | -3% |

| Keo | $201 | 2% |

| Kibler | $184 | -7% |

| Kingsland | $215 | 9% |

| Kingston | $185 | -6% |

| Kirby | $210 | 6% |

| Knobel | $189 | -4% |

| Knoxville | $179 | -9% |

| La Grange | $218 | 10% |

| Lafe | $187 | -5% |

| Lake City | $184 | -7% |

| Lake Hamilton | $202 | 3% |

| Lake Village | $215 | 9% |

| Lakeview | $180 | -9% |

| Lamar | $181 | -8% |

| Lambrook | $223 | 13% |

| Landmark | $221 | 12% |

| Langley | $207 | 5% |

| Lavaca | $176 | -11% |

| Lawson | $210 | 6% |

| Leachville | $192 | -3% |

| Lead Hill | $184 | -7% |

| Leola | $199 | 1% |

| Lepanto | $192 | -3% |

| Leslie | $199 | 1% |

| Letona | $192 | -3% |

| Lewisville | $207 | 5% |

| Lexa | $230 | 16% |

| Lincoln | $180 | -9% |

| Little Flock | $178 | -10% |

| Little Rock | $213 | 8% |

| Little Rock Air Force Base | $200 | 1% |

| Lockesburg | $203 | 3% |

| Locust Grove | $198 | 0% |

| London | $180 | -9% |

| Lonoke | $197 | 0% |

| Lonsdale | $203 | 3% |

| Louann | $207 | 5% |

| Lowell | $176 | -11% |

| Luxora | $200 | 1% |

| Lynn | $194 | -2% |

| Mabelvale | $209 | 6% |

| Madison | $204 | 4% |

| Magazine | $176 | -11% |

| Magnolia | $205 | 4% |

| Malvern | $196 | -1% |

| Mammoth Spring | $204 | 3% |

| Manila | $194 | -2% |

| Mansfield | $185 | -6% |

| Marble Falls | $183 | -7% |

| Marcella | $200 | 1% |

| Marianna | $220 | 11% |

| Marion | $210 | 6% |

| Marked Tree | $194 | -2% |

| Marmaduke | $190 | -4% |

| Marshall | $195 | -1% |

| Marvell | $230 | 16% |

| Maumelle | $202 | 2% |

| Mayflower | $194 | -2% |

| Maynard | $190 | -4% |

| Maysville | $176 | -11% |

| Mc Caskill | $204 | 4% |

| Mc Crory | $200 | 1% |

| Mc Dougal | $191 | -3% |

| Mc Gehee | $218 | 11% |

| Mc Neil | $203 | 3% |

| Mc Rae | $192 | -3% |

| McAlmont | $207 | 5% |

| McCrory | $200 | 1% |

| McGehee | $218 | 10% |

| Melbourne | $203 | 3% |

| Mellwood | $227 | 15% |

| Mena | $193 | -2% |

| Menifee | $186 | -6% |

| Midland | $182 | -8% |

| Midway | $182 | -8% |

| Mineral Springs | $200 | 1% |

| Minturn | $187 | -5% |

| Monette | $180 | -9% |

| Monticello | $216 | 10% |

| Montrose | $217 | 10% |

| Moro | $221 | 12% |

| Morrilton | $181 | -8% |

| Morrow | $176 | -11% |

| Moscow | $220 | 11% |

| Mount Holly | $208 | 6% |

| Mount Ida | $204 | 3% |

| Mount Judea | $188 | -5% |

| Mount Pleasant | $202 | 2% |

| Mount Vernon | $191 | -3% |

| Mountain Home | $181 | -8% |

| Mountain Pine | $199 | 1% |

| Mountain View | $200 | 1% |

| Mountainburg | $186 | -6% |

| Mulberry | $183 | -7% |

| Murfreesboro | $206 | 4% |

| Nashville | $202 | 2% |

| Natural Dam | $188 | -5% |

| New Blaine | $183 | -7% |

| New Edinburg | $213 | 8% |

| Newark | $198 | 0% |

| Newhope | $206 | 5% |

| Newport | $188 | -5% |

| Norfork | $185 | -6% |

| Norman | $203 | 3% |

| Norphlet | $209 | 6% |

| North Crossett | $223 | 13% |

| North Little Rock | $204 | 3% |

| O Kean | $185 | -6% |

| Oak Grove | $183 | -7% |

| Oak Grove Heights | $187 | -5% |

| Oakland | $185 | -6% |

| Oark | $183 | -7% |

| Oden | $200 | 1% |

| Ogden | $200 | 1% |

| Oil Trough | $196 | -1% |

| Okolona | $197 | 0% |

| Ola | $189 | -4% |

| Omaha | $183 | -7% |

| Oneida | $232 | 17% |

| Onia | $200 | 1% |

| Osceola | $199 | 1% |

| Oxford | $207 | 5% |

| Ozan | $206 | 4% |

| Ozark | $181 | -8% |

| Ozone | $180 | -9% |

| Palestine | $208 | 5% |

| Pangburn | $190 | -4% |

| Paragould | $187 | -5% |

| Paris | $176 | -11% |

| Parkdale | $218 | 11% |

| Parkin | $195 | -1% |

| Parks | $190 | -4% |

| Paron | $201 | 2% |

| Parthenon | $186 | -6% |

| Patterson | $200 | 1% |

| Pea Ridge | $178 | -10% |

| Peach Orchard | $190 | -4% |

| Pearcy | $199 | 1% |

| Peel | $186 | -6% |

| Pelsor | $187 | -5% |

| Pencil Bluff | $198 | 1% |

| Perry | $190 | -4% |

| Perryville | $194 | -2% |

| Pettigrew | $186 | -6% |

| Pickens | $217 | 10% |

| Piggott | $184 | -7% |

| Pindall | $186 | -6% |

| Pine Bluff | $215 | 9% |

| Pineville | $207 | 5% |

| Piney | $202 | 2% |

| Plainview | $192 | -3% |

| Pleasant Grove | $201 | 2% |

| Pleasant Plains | $200 | 1% |

| Plumerville | $183 | -7% |

| Pocahontas | $186 | -6% |

| Pollard | $188 | -5% |

| Ponca | $188 | -5% |

| Poplar Grove | $232 | 17% |

| Portia | $186 | -6% |

| Portland | $223 | 13% |

| Pottsville | $182 | -8% |

| Poughkeepsie | $204 | 3% |

| Powhatan | $188 | -5% |

| Poyen | $199 | 1% |

| Prairie Creek | $180 | -9% |

| Prairie Grove | $181 | -8% |

| Prattsville | $201 | 2% |

| Prescott | $199 | 1% |

| Prim | $197 | 0% |

| Proctor | $207 | 5% |

| Pyatt | $183 | -7% |

| Quitman | $194 | -2% |

| Ratcliff | $177 | -11% |

| Ravenden | $193 | -2% |

| Ravenden Springs | $187 | -5% |

| Rector | $187 | -5% |

| Redfield | $204 | 3% |

| Reydell | $211 | 7% |

| Reyno | $190 | -4% |

| Rison | $219 | 11% |

| Rivervale | $197 | 0% |

| Rockwell | $202 | 2% |

| Roe | $201 | 2% |

| Rogers | $176 | -11% |

| Rohwer | $219 | 11% |

| Roland | $206 | 4% |

| Romance | $194 | -2% |

| Rose Bud | $188 | -5% |

| Rosie | $197 | 0% |

| Rosston | $203 | 3% |

| Rover | $193 | -2% |

| Royal | $200 | 1% |

| Rudy | $186 | -6% |

| Russell | $195 | -1% |

| Russellville | $181 | -8% |

| Saffell | $196 | -1% |

| Sage | $200 | 1% |

| Salem | $201 | 2% |

| Saratoga | $201 | 2% |

| Scotland | $198 | 0% |

| Scott | $204 | 3% |

| Scranton | $179 | -9% |

| Searcy | $190 | -3% |

| Sedgwick | $190 | -4% |

| Shannon Hills | $209 | 6% |

| Sheridan | $200 | 1% |

| Sherrill | $207 | 5% |

| Sherwood | $200 | 1% |

| Shirley | $192 | -3% |

| Sidney | $205 | 4% |

| Siloam Springs | $172 | -13% |

| Sims | $205 | 4% |

| Smackover | $209 | 6% |

| Smithville | $195 | -1% |

| Snow Lake | $217 | 10% |

| Solgohachia | $183 | -7% |

| Sparkman | $204 | 4% |

| Springdale | $178 | -10% |

| Springfield | $187 | -5% |

| St. Charles | $198 | 0% |

| St. Francis | $187 | -5% |

| St. Joe | $186 | -6% |

| St. Paul | $193 | -2% |

| Stamps | $204 | 3% |

| Star City | $220 | 12% |

| State University | $197 | 0% |

| Stephens | $208 | 5% |

| Story | $208 | 5% |

| Strawberry | $194 | -2% |

| Strong | $213 | 8% |

| Sturkie | $198 | 0% |

| Stuttgart | $193 | -2% |

| Subiaco | $177 | -10% |

| Success | $194 | -2% |

| Sulphur Rock | $197 | 0% |

| Sulphur Springs | $176 | -11% |

| Summers | $178 | -10% |

| Summit | $182 | -8% |

| Sweet Home | $210 | 6% |

| Swifton | $191 | -3% |

| Taylor | $209 | 6% |

| Texarkana | $210 | 6% |

| Thida | $201 | 2% |

| Thornton | $204 | 3% |

| Tichnor | $198 | 0% |

| Tillar | $218 | 10% |

| Tilly | $188 | -5% |

| Timbo | $200 | 2% |

| Tollette | $199 | 1% |

| Tontitown | $177 | -10% |

| Traskwood | $196 | -1% |

| Trumann | $192 | -3% |

| Tucker | $206 | 5% |

| Tuckerman | $188 | -5% |

| Tumbling Shoals | $192 | -3% |

| Tupelo | $193 | -2% |

| Turner | $223 | 13% |

| Turrell | $204 | 4% |

| Twin Groves | $189 | -4% |

| Tyronza | $202 | 2% |

| Ulm | $197 | 0% |

| Umpire | $201 | 2% |

| Uniontown | $187 | -5% |

| Valley Springs | $183 | -7% |

| Van Buren | $184 | -7% |

| Vandervoort | $199 | 1% |

| Vanndale | $196 | -1% |

| Vendor | $188 | -5% |

| Vilonia | $196 | -1% |

| Viola | $202 | 2% |

| Violet Hill | $200 | 1% |

| Wabash | $229 | 16% |

| Wabbaseka | $204 | 3% |

| Walcott | $188 | -5% |

| Waldenburg | $198 | 0% |

| Waldo | $206 | 5% |

| Waldron | $181 | -8% |

| Walnut Ridge | $183 | -7% |

| Ward | $195 | -1% |

| Warm Springs | $188 | -5% |

| Warren | $213 | 8% |

| Washington | $205 | 4% |

| Watson | $216 | 10% |

| Weiner | $194 | -2% |

| Wesley | $192 | -3% |

| West Crossett | $223 | 13% |

| West Fork | $182 | -8% |

| West Helena | $234 | 18% |

| West Memphis | $209 | 6% |

| West Point | $192 | -3% |

| West Ridge | $202 | 2% |

| Western Grove | $184 | -7% |

| Wheatley | $204 | 4% |

| Whelen Springs | $197 | 0% |

| White Hall | $210 | 6% |

| Wickes | $201 | 2% |

| Wideman | $204 | 3% |

| Widener | $205 | 4% |

| Wilburn | $193 | -2% |

| Williford | $201 | 2% |

| Willisville | $204 | 3% |

| Wilmar | $216 | 10% |

| Wilmot | $220 | 11% |

| Wilson | $201 | 2% |

| Wilton | $198 | 0% |

| Winchester | $215 | 9% |

| Winslow | $181 | -8% |

| Winthrop | $200 | 2% |

| Wiseman | $200 | 1% |

| Witter | $195 | -1% |

| Witts Springs | $191 | -3% |

| Woodson | $205 | 4% |

| Wooster | $190 | -4% |

| Wright | $208 | 5% |

| Wrightsville | $213 | 8% |

| Wynne | $193 | -2% |

| Yellville | $183 | -7% |

| Yorktown | $223 | 13% |

Drivers in Arkansas’ biggest cities pay average rates that are between those extremes.

- Little Rock, $213

- Fayetteville, $180

- Fort Smith, $179

- Springdale, $178

- Jonesboro, $192

Minimum coverage for car insurance in Arkansas

Arkansas requires all drivers to have 25/50/25 liability car insurance. This means you need at these these types and amounts of coverage:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000

Bodily injury liability helps cover the medical bills of anyone you injure in a car accident. Property damage liability covers damage you cause to property like fences, toll booths and light posts.

If you have a car loan, your lender will probably make you add collision

Frequently asked questions

Full coverage car insurance costs $197 per month in Arkansas, on average. The state average cost of liability car insurance is $59 per month.

State Farm has the cheapest car insurance in Arkansas for most drivers. This includes drivers with clean records and drivers with a ticket or accident on their records.

Liability-only car insurance from State Farm costs $33 per month with State Farm if you have a clean record. The company’s average rate for full coverage car insurance is $125 per month.

USAA’s rates are even cheaper, but it’s only for the military and their families.

Yes, car insurance is required by law in Arkansas. If you’re convicted of driving without insurance in Arkansas, you could be fined and your vehicle’s registration may be suspended.

You must have your insurance ID card with you and show it to law enforcement when asked.

How we selected the cheapest car insurance companies in Arkansas

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Arkansas

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.