Cheapest Car Insurance in Baltimore, Maryland

Best cheap car insurance in Baltimore

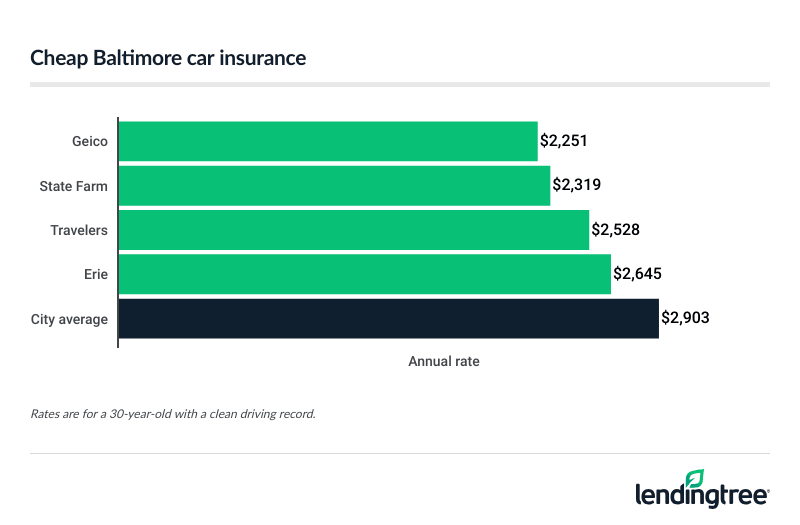

Cheapest full coverage car insurance in Baltimore: Geico

Geico has the cheapest full coverage car insurance in Baltimore at $2,251 a year, or $188 a month. USAA is cheaper, but it’s only available to the military community.

State Farm is slightly more expensive for full coverage

Full coverage auto insurance rates

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Geico | $2,251 |  |

| State Farm | $2,319 |  |

| Travelers | $2,528 |  |

| Erie | $2,645 |  |

| Progressive | $2,707 |  |

| Nationwide | $3,796 |  |

| Allstate | $5,503 |  |

| USAA* | $1,471 |  |

Your actual auto insurance rate depends on factors like your driving record, location and the type of car you drive. Each company treats these factors differently, and one may offer you a much lower rate than others do. This is why it’s good to compare car insurance quotes from a few different companies.

Baltimore’s cheapest liability car insurance quotes: Geico

At $100 a month, Geico has the cheapest liability insurance quotes for most Baltimore drivers. This is 12% less than the next-cheapest rate of $113 a month from State Farm.

Liability auto insurance

Liability auto insurance rates

| Company | Annual rate |

|---|---|

| Geico | $1,198 |

| State Farm | $1,354 |

| Travelers | $1,438 |

| Erie | $1,487 |

| Progressive | $1,565 |

| Nationwide | $2,088 |

| Allstate | $3,253 |

| USAA* | $651 |

Cheap car insurance for Baltimore teens: Erie

Most shoppers can find the cheapest car insurance for teens from Erie. The company charges young drivers $253 a month for liability insurance. This is 21% less than State Farm’s rate of $321 a month.

Erie charges teens $464 a month for full coverage.This is 19% less than State Farm’s rate of $572 a month.

Teen auto insurance rates

| Company | Annual liability | Annual full coverage |

|---|---|---|

| Erie | $3,030 | $5,562 |

| State Farm | $3,856 | $6,861 |

| Travelers | $4,149 | $7,136 |

| Geico | $4,206 | $8,577 |

| Progressive | $4,346 | $8,381 |

| Nationwide | $8,271 | $13,561 |

| Allstate | $13,788 | $23,514 |

| USAA* | $1,596 | $3,462 |

Teens’ lack of driving experience makes them more likely to be involved in an accident than older, more experienced drivers. This is one of the main reasons why teens pay so much for car insurance.

Teens usually get a cheaper rate when added to a parent’s auto policy than they do on their own.

- Erie also offers a youthful driver discount to teens who live with their parents.

- State Farm doesn’t have a youthful driver discount. But it does give teens a discount for getting good grades in school.

Cheap Baltimore auto insurance with a ticket: State Farm

State Farm has the cheapest auto insurance for most Baltimore drivers with a speeding ticket at $208 a month. This is 14% less than the next-cheapest rate of $242 a month from Geico.

A speeding ticket raises the average cost of car insurance in Baltimore by 26%. However, some companies have smaller price increases. Shopping around can save you money on car insurance with a bad driving record.

Insurance rates with a speeding ticket

| Company | Annual rate |

|---|---|

| State Farm | $2,494 |

| Geico | $2,908 |

| Erie | $3,055 |

| Travelers | $3,309 |

| Progressive | $3,590 |

| Nationwide | $5,560 |

| Allstate | $6,698 |

| USAA* | $1,753 |

Best Baltimore auto insurance with an accident: State Farm

Most Baltimore drivers with an at-fault accident get the cheapest auto insurance rates from State Farm. The company charges drivers with a prior at-fault accident $235 a month, on average. This is 23% less than the second-cheapest rate of $307 a month from Travelers.

| Company | Annual rate |

|---|---|

| State Farm | $2,826 |

| Travelers | $3,688 |

| Erie | $3,871 |

| Geico | $3,918 |

| Progressive | $3,977 |

| Nationwide | $6,829 |

| Allstate | $10,204 |

| USAA* | $2,325 |

Travelers also offers accident forgiveness

Erie, Progressive and Nationwide also offer accident forgiveness. You usually need a few years of incident-free driving before you can add accident forgiveness to your policy.

Cheap Baltimore car insurance for bad teen drivers: Erie

Most Baltimore teens with a bad driving record get the cheapest car insurance quotes from Erie. The company’s liability rates for teens with a speeding ticket average $306 a month. It charges teens with an accident $343 a month.

State Farm is the next-cheapest company for young drivers with a prior incident. Its teen liability rates average $348 a month after a ticket and $399 a month after an accident.

Teen insurance rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Erie | $3,670 | $4,112 |

| State Farm | $4,179 | $4,790 |

| Progressive | $4,818 | $4,944 |

| Geico | $4,906 | $5,393 |

| Travelers | $5,405 | $6,170 |

| Nationwide | $8,993 | $9,102 |

| Allstate | $16,387 | $20,743 |

| USAA | $2,261 | $2,833 |

Baltimore’s cheapest DUI car insurance: Erie

Erie has Baltimore’s cheapest car insurance for drivers with a DUI (driving under the influence) conviction at $255 a month. Geico has the next-cheapest DUI insurance for most drivers at $268 a month. Along with being cheaper than Geico, Erie has a better satisfaction rating.

Best auto rates after a DUI

| Company | Annual rate |

|---|---|

| Erie | $3,055 |

| Geico | $3,220 |

| Travelers | $3,923 |

| Progressive | $4,061 |

| Allstate | $5,742 |

| Nationwide | $9,150 |

| State Farm | $11,830 |

| USAA* | $3,203 |

Best for Baltimore drivers with bad credit: Geico

Most Baltimore drivers with bad credit can get the cheapest car insurance quotes from Geico. The company’s bad credit car insurance rates average $268 a month. This is 20% less than the second-cheapest rate of $336 a month from Progressive.

Bad credit car insurance rates

| Company | Annual rate |

|---|---|

| Geico | $3,220 |

| Progressive | $4,033 |

| Travelers | $4,957 |

| Erie | $6,157 |

| Nationwide | $6,425 |

| Allstate | $7,758 |

| State Farm | $11,916 |

| USAA* | $2,617 |

Best car insurance companies in Baltimore

Geico is the best company for cheap car insurance quotes with a good driving record in Baltimore. State Farm, Travelers and USAA stand out for other reasons.

Baltimore’s best car insurance

| Company | J.D. Power** | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ |  |

| Erie | 700 | A+ |  |

| Geico | 637 | A++ |  |

| Nationwide | 641 | A |  |

| Progressive | 622 | A+ |  |

| State Farm | 657 | A++ |  |

| Travelers | 616 | A++ |  |

| USAA* | 739 | A++ |  |

Best for cheap rates: Geico

Geico has several car insurance discounts that make its quotes for good drivers more affordable. These include discounts for federal workers and members of more than 500 professional and academic organizations. Military service can also get you a discount from Geico.

Best for bundling: State Farm

State Farm’s car insurance quotes are nearly as low as Geico’s, and it has a better satisfaction score. State Farm also has cheap home insurance rates in Maryland. State Farm’s discount for bundling car insurance with a home or renters policy makes it more even affordable.

Best coverage options: Travelers

Along with accident forgiveness, Travelers also offers gap insurance

Best for military families: USAA

Low rates and great customer service ratings makes USAA a no-brainer if you meet its military eligibility requirements. It has a higher satisfaction rating than every other car insurance company. This means its customers generally like its price, coverage options and customer service.

Baltimore car insurance rates by neighborhood

At $214 a month, drivers in Hawkins Bay’s 21226 ZIP code have the Baltimore area’s cheapest car insurance. Car insurance in unincorporated Nottingham’s 21236 ZIP is only slightly more expensive at $215 a month.

Forest Park’s 21216 ZIP has Baltimore’s most expensive car insurance at $326 a month. This is 35% higher than the area average of $242 a month. Drivers in Berea’s 21213 ZIP have the next-highest rate at $316 a month.

Car insurance rates by ZIP code

| ZIP code | Annual rate | Difference from city average |

|---|---|---|

| 21201 | $3,095 | 7% |

| 21202 | $3,209 | 11% |

| 21205 | $3,419 | 18% |

| 21206 | $3,262 | 12% |

| 21207 | $3,243 | 12% |

| 21208 | $2,891 | 0% |

| 21209 | $2,830 | -2% |

| 21210 | $2,719 | -6% |

| 21211 | $2,809 | -3% |

| 21212 | $2,731 | -6% |

| 21213 | $3,798 | 31% |

| 21214 | $3,191 | 10% |

| 21215 | $3,636 | 25% |

| 21216 | $3,910 | 35% |

| 21217 | $3,643 | 26% |

| 21218 | $3,297 | 14% |

| 21222 | $2,650 | -9% |

| 21223 | $3,742 | 29% |

| 21224 | $2,874 | -1% |

| 21225 | $2,823 | -3% |

| 21226 | $2,569 | -11% |

| 21227 | $2,872 | -1% |

| 21229 | $3,117 | 7% |

| 21230 | $2,734 | -6% |

| 21231 | $2,942 | 1% |

| 21233 | $2,858 | -2% |

| 21234 | $2,601 | -10% |

| 21236 | $2,574 | -11% |

| 21237 | $2,805 | -3% |

| 21239 | $3,114 | 7% |

| 21240 | $2,365 | -19% |

| 21250 | $2,588 | -11% |

| 21251 | $3,268 | 13% |

| 21287 | $2,879 | -1% |

Baltimore car insurance laws

You need car insurance to drive legally in Baltimore and elsewhere in Maryland. The state verifies your insurance when you register your vehicle. The penalties for driving without insurance include fines and suspension of your vehicle’s registration.

Minimum car insurance coverage requirements in Baltimore

The minimum amounts of car insurance you need to drive legally in Baltimore include:

- Bodily injury liability: $30,000 per person, $60,000 per accident

- Property damage liability: $15,000

- Uninsured motorist: $30,000 per person, $60,000 per accident

Baltimore insurance companies are also required to offer at least $2,500 in personal injury protection (PIP). Full PIP is highly recommended. However, you can get a cheaper rate if you opt for limited PIP. You have to sign a waiver to do so.

Collision

Methodology

LendingTree gets insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of car insurance quotes for a typical driver in every Baltimore-area ZIP code. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX. Teen rates are for an 18-year-old male.

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $2,500

- Collision: $500 deductible

- Comprehensive: $500 deductible

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.