How to Get Free Car Insurance Quotes (2026)

A car insurance quote is more than the estimated cost of a policy you’re thinking of buying. It’s also a free tool you can use to get cheap car insurance.

A car insurance quote is more than the estimated cost of a policy you’re thinking of buying. It’s also a free tool you can use to get cheap car insurance. Comparing car insurance quotes from multiple insurance companies could save you $42 a month, or about $500 a year.

Best cheap auto insurance quotes

How do I get a car insurance quote?

Getting car insurance quotes online is easy and takes just a few steps.

1. Start by gathering personal info

Insurance companies may ask you for the following:

- Your name, address and date of birth

- Your driver’s license number

- Make, model and mileage of your car

- Your driving and car insurance history

- The names and dates of birth of anyone else the policy will cover

- The policy coverage options and limits you want

- Any car loan financing info you have

2. Visit an insurance company’s website

If you’re getting a quote directly from an insurance provider, you can usually get a quote from their website. The site will have you enter the info it needs to calculate your quote. If you have questions at any time, call the insurer and talk with an agent.

3. Figure out how much coverage you want

Your state will most likely require you to buy at least liability-only insurance, which is basic car insurance. You may also need comprehensive and collision coverage if you have a loan or a lease. Even if you aren’t required to buy comprehensive

4. Submit the quote

Your quote should be emailed to you after you finish this process. Keep it on hand to compare with other car insurance quotes you request.

For quicker car insurance quotes, use auto insurance comparison sites. These sites ask you to share your info once, then get you quotes from multiple insurers.

You can also get car insurance quotes over the phone or in person. Call an insurance company’s 800 number or walk into one of its offices to talk with an agent. This will take longer than getting a quote online, but you’ll get all the help you need.

Where can I get cheap car insurance quotes?

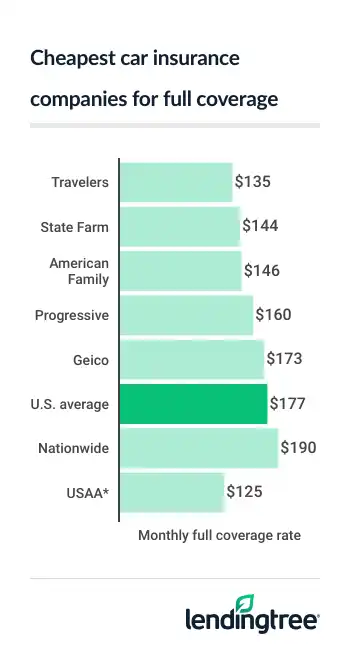

Most drivers get the cheapest full coverage car insurance quotes from Travelers, which charges an average of $135 a month.

Travelers’ rate is 24% lower than the national average for full coverage

Cheapest car insurance companies for full coverage

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $135 | |

| State Farm | $144 | |

| American Family | $146 | |

| Progressive | $160 | |

| Geico | $173 | |

| Nationwide | $190 | |

| Allstate | $248 | |

| Farmers | $258 | |

| USAA* | $125 | |

USAA has the cheapest full coverage quotes overall, averaging $125 a month. However, USAA only sells insurance to military members and their families.

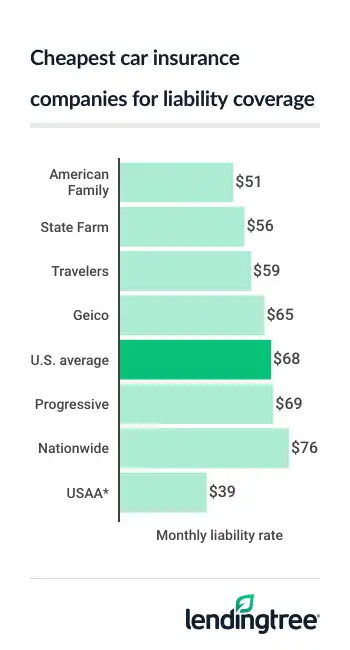

American Family has cheapest liability insurance quotes at an average of $51 a month. This is 25% cheaper than the national average of $68 a month for liability

State Farm ($56 a month), Travelers ($59 a month) and Geico ($65 a month) also have cheap liability rates.

Cheapest car insurance companies for liability coverage

| Company | Monthly rate |

|---|---|

| American Family | $51 |

| State Farm | $56 |

| Travelers | $59 |

| Geico | $65 |

| Progressive | $69 |

| Nationwide | $76 |

| Farmers | $101 |

| Allstate | $104 |

| USAA* | $39 |

How do I compare car insurance quotes?

Comparing car insurance quotes helps you get the cheapest rate for the coverage you want and need. To compare car insurance quotes and get your best deal:

- Understand your coverage needs. Liability only covers injuries and damages you cause others. For your own injuries and vehicle damage, you need full coverage that includes comprehensive and collision insurance. Your state may require you to have uninsured motorist coverage. Uninsured motorist covers you and your passengers for injuries caused by a driver with no insurance. It can also cover damage to your car.

- Get quotes from several car insurance companies. This makes it easy to see which company offers the cheapest rate for the types and amounts of car insurance coverage you need.

- Look at the quotes you receive side by side. Make sure they all provide the same coverage options and amounts. If they don’t, correct any that are different.

- Consider the premiums of each quote. Keep in mind that some quotes may show a monthly rate, while others will show an annual rate.

- Do all of the quotes include one or more discounts? If not, they could make a big difference.

If all else is the same, the quote with the lowest premium is probably the best one for you.

What factors influence my car insurance quotes?

Companies consider many factors when coming up with your car insurance quote, such as your:

- Driving record

- Insurance claim history

- Car make and model

- ZIP code

- Age

- Gender

- Marital status

- Credit score

Driving history

You’ll likely get a cheaper quote with a clean driving record than you will if you’ve had a recent violation or accident, for example.

Insurance rates by driving record

| Driving record | Monthly rate |

|---|---|

| Clean record | $177 |

| Speeding ticket | $219 |

| At-fault accident | $263 |

| DUI | $329 |

Age

If you’re a teen who has just started driving, you’ll get a higher quote than you would if you’ve been driving for several years. For example, a 16-year-old pays nearly three times as much for car insurance as a 25-year-old.

Rates tend to level off for most drivers by age 35. However, your rates are likely to tick up in your retirement years. A 75-year-old pays an average of 19% more for car insurance than a 65-year-old.

Insurance rates by age

| Driver age | Monthly rate |

|---|---|

| 16 | $915 |

| 17 | $789 |

| 18 | $684 |

| 19 | $580 |

| 20 | $521 |

| 21 | $437 |

| 25 | $314 |

| 30 | $281 |

| 35 | $273 |

| 45 | $266 |

| 55 | $250 |

| 65 | $239 |

| 75 | $284 |

Credit history

Depending on the state you live in, car insurance companies can use credit scores when calculating your car insurance rate. If you have a poor credit score, your rate may be higher than someone with a good score.

Insurance rates by credit score

| Credit rating | Monthly rate |

|---|---|

| Good credit | $177 |

| Poor credit | $345 |

How do I get cheap car insurance quotes?

Besides comparing quotes, you can do the following to get cheaper quotes:

Take advantage of discounts: Car insurance discounts can help lower your rate significantly. Companies may offer these common car insurance discounts and more:

- Multi-policy or bundling discount

- Multi-car discount

- Good driver discount

- Good student discount

- Automatic payment discount

- Pay in full discount

Increase your deductible: Raising your car insurance deductible will lower your car insurance rate. However, we don’t recommend increasing your deductible if you can’t pay the deductible amount if you need to file a claim.

Reduce coverage for a cheap car: If you have a cheap used car, full coverage car insurance may not be worth the cost. Comprehensive and collision coverage pay for damage done to your car. If your car isn’t worth much and you can afford to buy another car if it’s undrivable, it may not be worth paying extra for a full-coverage policy

Frequently asked questions

Yes, car insurance quotes are free, nonbinding estimates of the rate an insurance company can give you. Your actual rate can change until you lock in your policy.

No. When car insurance companies check your credit, they use “soft pulls.” These inquiries do not affect your credit score.

Car insurance quotes are usually valid for up to 30 days. The actual length of time varies by insurance company.

How we evaluate car insurance companies

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we rated car insurance companies

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.