Cheapest Car Insurance in Charlotte, N.C.

Best cheap Charlotte car insurance

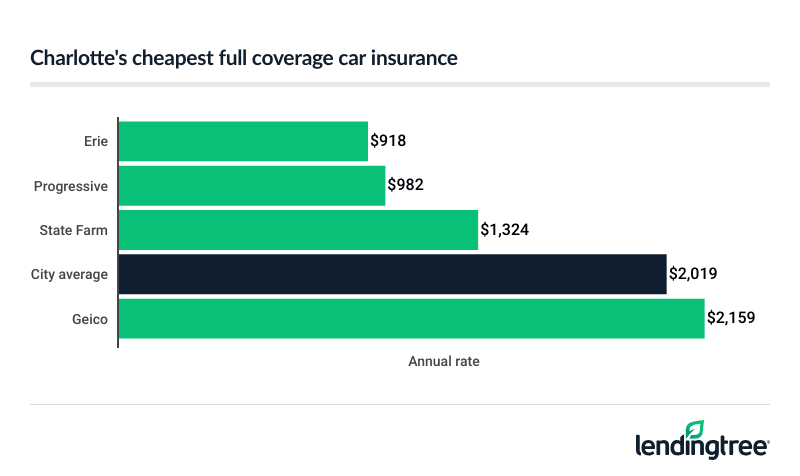

Cheapest full coverage car insurance in Charlotte: Erie

Erie has the cheapest full coverage car insurance quotes in Charlotte at $918 a year, or $77 a month. Progressive has the next-cheapest full coverage

Of the two companies, Erie has a better J.D. Power

Full coverage car insurance rates

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Erie | $918 | |

| Progressive | $982 | |

| State Farm | $1,324 | |

| Geico | $2,159 | |

| Nationwide | $2,255 | |

| Farm Bureau | $2,677 |  |

| Allstate | $3,814 | |

The actual price you pay for auto insurance depends on factors like your driving record, credit and vehicle.

Insurance companies’ rates in North Carolina tend to vary by customer. This makes it good to compare car insurance quotes from a few different companies.

Cheap liability car insurance in Charlotte: Erie

At $38 a month, Erie has Charlotte’s cheapest liability insurance quotes. This is 32% less than the next-cheapest liability rate, $57 a month from Progressive.

Liability covers injuries and damage you cause to other people and their property. North Carolina liability policies also include uninsured motorist

| Company | Annual rate |

|---|---|

| Erie | $461 |

| Progressive | $680 |

| State Farm | $851 |

| Nationwide | $927 |

| Geico | $1,156 |

| Farm Bureau | $1,470 |

| Allstate | $2,037 |

Best car insurance rates for Charlotte teens: Erie

Erie also has Charlotte’s cheapest car insurance for teens. It charges young drivers $84 a month for liability insurance and $163 a month for full coverage.

Progressive has Charlotte’s next-cheapest young driver rates. Its quotes average $123 a month for liability and $173 a month for full coverage. Progressive also gives teens a discount for good grades. Erie does not.

Car insurance rates for Charlotte teens

| Company | Annual liability | Annual full coverage |

|---|---|---|

| Erie | $1,009 | $1,961 |

| Progressive | $1,478 | $2,074 |

| State Farm | $1,758 | $2,733 |

| Geico | $1,873 | $3,994 |

| Nationwide | $2,077 | $4,545 |

| Farm Bureau | $3,546 | $6,335 |

| Allstate | $4,626 | $8,846 |

A lack of driving experience makes teens more likely to be involved in an accident than older drivers. This is the main reason why insurance companies charge them so much.

Teens usually get a better rate on a parent’s policy than they do on their own.

Cheap Charlotte car insurance after a ticket: Progressive

At $108 a month, Progressive has Charlotte’s cheapest auto insurance after a speeding ticket. Erie is only slightly more expensive at $113 a month.

In Charlotte, a speeding ticket raises the average price of full coverage by 39% to $234 a month. However, each company’s rates change by a different amount. Comparing quotes is a good way to find cheap car insurance with a bad driving record.

Auto insurance rates with a speeding ticket

| Company | Annual rate |

|---|---|

| Progressive | $1,294 |

| Erie | $1,354 |

| State Farm | $1,749 |

| Nationwide | $2,995 |

| Geico | $3,173 |

| Farm Bureau | $3,585 |

| Allstate | $5,473 |

Best Charlotte car insurance rates after an accident: Erie

Make sure to get quotes from Erie if you have an at-fault accident on your record. At $85 a month, the company has Charlotte’s cheapest full coverage after an accident.

Erie charges less than a third of the citywide average of $296 a month. It’s also 33% less than the next-cheapest rate of $127 a month from Progressive.

Insurance rates with an at-fault accident

| Company | Annual rate |

|---|---|

| Erie | $1,015 |

| Progressive | $1,524 |

| State Farm | $2,088 |

| Farm Bureau | $4,267 |

| Nationwide | $4,799 |

| Geico | $5,088 |

| Allstate | $6,124 |

Tickets and accidents tend to stay on your driving record for about three to five years in North Carolina. The exact length of time depends on your insurance company and the severity of the incident.

Best for Charlotte teens with a bad driving record: Erie

Charlotte teens with a bad driving record often get the cheapest car insurance quotes from Erie. The company’s liability rates for young drivers with a ticket average $106 a month. Teens with a recent at-fault accident pay an average of $92 a month.

Progressive has the next-best rates. Its young driver liability rates average $140 a month after a ticket and $153 a month after an accident.

Bad record car insurance for teens

| Company | Annual rate after a ticket | Annual rate after an accident |

|---|---|---|

| Erie | $1,274 | $1,105 |

| Progressive | $1,685 | $1,840 |

| State Farm | $2,077 | $2,279 |

| Geico | $2,077 | $3,375 |

| Nationwide | $2,380 | $3,301 |

| Farm Bureau | $4,106 | $4,527 |

| Allstate | $5,710 | $5,935 |

Cheapest DWI car insurance in Charlotte: Progressive

Progressive has the cheapest car insurance for Charlotte drivers with a DWI (driving while intoxicated) conviction. Its full coverage rates average $302 a month.

Erie has the next-cheapest DWI insurance at $326 a month. Erie and Progressive both charge less than half the city average of $667 a month for drivers with a DWI.

Auto insurance rates after a DWI

| Company | Annual rate |

|---|---|

| Progressive | $3,620 |

| Erie | $3,906 |

| Geico | $7,804 |

| Nationwide | $8,611 |

| Farm Bureau | $16,013 |

| Allstate | $16,045 |

Cheapest bad credit car insurance in Charlotte: Progressive

Charlotte drivers with bad credit can get the cheapest car insurance quotes from Progressive. The company’s bad-credit car insurance rates average $82 a month for full coverage. Erie is the next-cheapest company, at $112 a month.

Bad credit car insurance rates

| Company | Annual rate |

|---|---|

| Progressive | $982 |

| Erie | $1,343 |

| Nationwide | $2,940 |

| Geico | $3,149 |

| Farm Bureau | $3,613 |

| State Farm | $6,473 |

| Allstate | $8,225 |

Best-rated car insurance companies in Charlotte

Erie and Progressive stand out as the best car insurance companies in Charlotte. Both have low prices for most drivers and good customer service scores.

Erie has a higher satisfaction rating than most other Charlotte insurance companies. This means it generally has happier customers than its competitors do.

Progressive has a slightly better complaint rating

Progressive also has a better safe-driving app

Car insurance company ratings

| Company | Overall satisfaction* | Financial strength** | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ |  |

| Erie | 700 | A+ |  |

| Farm Bureau | 673 | A |  |

| Geico | 637 | A++ |  |

| Nationwide | 641 | A |  |

| Progressive | 622 | A+ |  |

| State Farm | 657 | A++ |  |

Charlotte car insurance rates by neighborhood

Tryon Hill’s 28206 ZIP code has Charlotte’s most expensive car insurance. Its drivers pay $2,347 a year, or $196 a month, for full coverage. This barely beats the $195 a month rate in Eastland’s 28212 ZIP.

Rockwell-Hemphill Heights’ 28269 ZIP has Charlotte’s cheapest car insurance at $151 a month. This is 10% less than the city average of $168 a month.

Insurance companies charge more in areas with higher accident and car theft rates. The price difference between Charlotte’s cheapest and most expensive ZIPs is $45 a month. This works out to $540 a year.

Car insurance rates by ZIP

| ZIP | Annual rate | ZIP vs. city average |

|---|---|---|

| 28105 | $1,922 | -5% |

| 28202 | $1,820 | -10% |

| 28203 | $1,820 | -10% |

| 28204 | $1,828 | -9% |

| 28205 | $2,334 | 16% |

| 28206 | $2,347 | 16% |

| 28207 | $1,829 | -9% |

| 28208 | $2,341 | 16% |

| 28209 | $1,839 | -9% |

| 28210 | $1,828 | -9% |

| 28211 | $1,835 | -9% |

| 28212 | $2,344 | 16% |

| 28213 | $2,281 | 13% |

| 28214 | $1,926 | -5% |

| 28215 | $2,281 | 13% |

| 28216 | $2,230 | 10% |

| 28217 | $2,311 | 14% |

| 28226 | $1,815 | -10% |

| 28227 | $1,956 | -3% |

| 28244 | $1,942 | -4% |

| 28246 | $1,942 | -4% |

| 28254 | $2,375 | 18% |

| 28262 | $2,283 | 13% |

| 28269 | $1,810 | -10% |

| 28270 | $1,833 | -9% |

| 28273 | $1,962 | -3% |

| 28274 | $1,942 | -4% |

| 28277 | $1,814 | -10% |

| 28278 | $1,952 | -3% |

| 28280 | $1,942 | -4% |

| 28281 | $1,942 | -4% |

| 28282 | $1,942 | -4% |

| 28284 | $1,942 | -4% |

| 28285 | $1,942 | -4% |

| 28287 | $1,954 | -3% |

Charlotte car insurance requirements

You need to meet North Carolina’s minimum car insurance requirements to drive legally in Charlotte. These include:

- Bodily injury liability: $30,000 per person, $60,000 per accident

- Property damage liability: $25,000

- Uninsured motorist bodily injury: $25,000 per person, $50,000 per accident

- Uninsured motorist property damage: $25,000

You usually also need collision and comprehensive for a car loan or lease. However, neither of these coverages is required by law.

You have to show proof of insurance to register your vehicle. North Carolina also has an automated insurance verification system.

The penalties for driving without insurance include fines, reinstatement fees and license plate revocation.

Methodology

LendingTree gets insurance rates from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of car insurance quotes for typical drivers in every Charlotte ZIP code. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX. Teen rates are for an 18-year-old male with no prior tickets or accidents.

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: minimum limits, where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible

—

For ratings, our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.