Where to Get Cheap Car Insurance in El Paso

Best cheap car insurance companies in El Paso

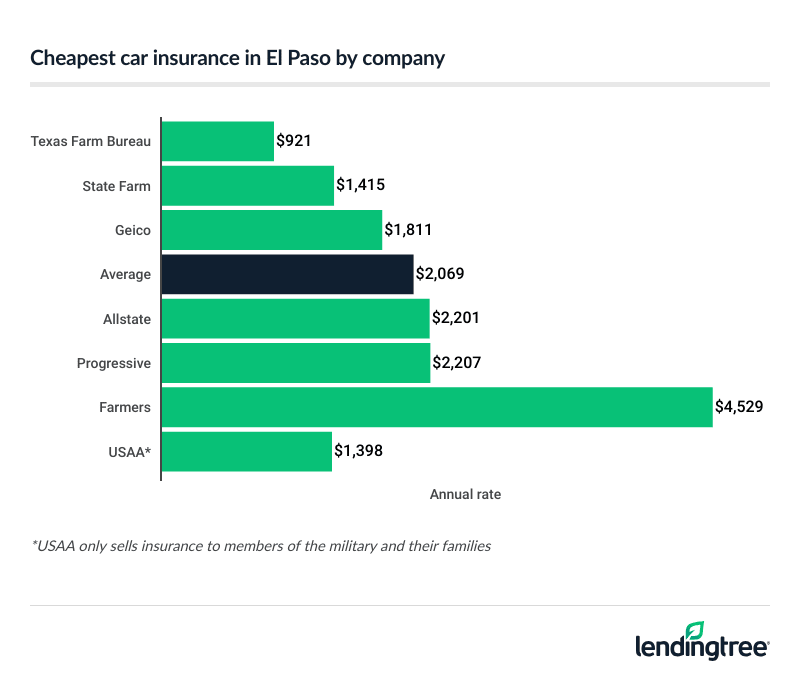

Cheapest full coverage car insurance in El Paso: Texas Farm Bureau

Texas Farm Bureau has the cheapest full coverage car insurance in El Paso, at an average rate of $921 a year, or $77 a month. State Farm is the next-cheapest company, at $1,415 a year. Both companies are cheaper than the city average rate of $2,069 a year.

State Farm’s average rate is a few hundred more than Texas Farm Bureau’s, but it offers many discounts that could make it cheaper. If you bundle auto and home insurance with State Farm, you can save up to $1,273. And if you insure two cars with State Farm, you may get its 20% multi-car discount.

Full coverage car insurance rates

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Texas Farm Bureau | $921 | |

| State Farm | $1,415 | |

| Geico | $1,811 | |

| Allstate | $2,201 | |

| Progressive | $2,207 | |

| Farmers | $4,529 | |

| USAA* | $1,398 | |

El Paso’s cheapest liability auto insurance: Texas Farm Bureau

Texas Farm Bureau has the cheapest liability auto insurance in El Paso, at $325 a year, or $27 a month. State Farm is the second-cheapest option, at $526 a year.

Progressive has the city’s third-cheapest rates of $601 a year. Compare quotes from all three companies to find which is the cheapest for you. Both State Farm and Progressive offer several discounts.

Also, State Farm and Progressive offer good coverage options. State Farm offers emergency roadside service

To compare, the average rate for minimum car insurance in El Paso is $764 a year.

Liability car insurance rates

| Company | Annual rate |

|---|---|

| Texas Farm Bureau | $325 |

| State Farm | $526 |

| Progressive | $601 |

| Geico | $750 |

| Allstate | $911 |

| Farmers | $1,763 |

| USAA* | $473 |

Cheap car insurance for young drivers in El Paso: Texas Farm Bureau

If you’re looking for the cheapest car insurance for teens in El Paso, get a quote from Texas Farm Bureau. Its average rate for liability-only car insurance is $612 a year, or $51 a month. Its full-coverage rate for teens is $1,480 a year.

State Farm is the next-cheapest, at $1,792 a year for liability car insurance and $3,931 a year for full coverage. These rates are more than double Texas Farm Bureau’s, so discounts will only help so much.

Also, Texas Farm Bureau is number one in Texas for customer satisfaction, based on J.D. Power’s 2024 U.S. Auto Insurance Study. State Farm came in third. This combo of cost and customer satisfaction makes Texas Farm Bureau a solid choice.

Car insurance for teen drivers

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Texas Farm Bureau | $612 | $1,480 |

| State Farm | $1,792 | $3,931 |

| Geico | $1,841 | $3,978 |

| Allstate | $3,017 | $6,553 |

| Progressive | $3,021 | $10,738 |

| Farmers | $5,986 | $14,451 |

| USAA* | $1,266 | $3,232 |

Teens pay the highest car insurance rates of any age group, mostly because they get into a lot of accidents. Your rates should go down as you age, especially if you keep a clean driving record.

El Paso’s cheapest auto insurance after a speeding ticket: Texas Farm Bureau

El Paso drivers with a speeding ticket find the cheapest car insurance rates with Texas Farm Bureau, at $921 a year, or $77 a month. State Farm is 54% more at $1,415 a year, but the right combo of discounts could make it the cheaper choice for you.

To compare, the average driver in El Paso pays $2,486 a year for full-coverage car insurance after a ticket.

Car insurance rates after a ticket

| Company | Annual rate |

|---|---|

| Texas Farm Bureau | $921 |

| State Farm | $1,415 |

| Geico | $2,173 |

| Allstate | $2,201 |

| Progressive | $2,935 |

| Farmers | $6,181 |

| USAA* | $1,579 |

Cheapest car insurance after an accident in El Paso: Texas Farm Bureau

El Paso drivers needing the cheapest car insurance after an accident may find it with Texas Farm Bureau. Its average rate with an accident is $1,420 a year, or $118 a month. State Farm is the next-cheapest choice at $1,634 a year.

If Texas Farm Bureau isn’t available to you, State Farm should be the cheapest choice. The average cost of car insurance in El Paso after an accident is $3,814 a year. The majority of the biggest car insurance companies in El Paso come in under this average rate.

Car insurance rates after an accident

| Company | Annual rate |

|---|---|

| Texas Farm Bureau | $1,420 |

| State Farm | $1,634 |

| Allstate | $2,347 |

| Geico | $2,911 |

| Progressive | $3,493 |

| Farmers | $12,795 |

| USAA* | $2,097 |

Cheap car insurance for El Paso teens with bad driving records: Texas Farm Bureau

Texas Farm Bureau has the cheapest car insurance rates for teens with a bad driving history. Its average rate for these drivers is $612 a year after a ticket and $879 a year after an accident. State Farm is the second-cheapest option, at $1,792 a year after a ticket and $2,022 after an accident.

Cheapest rates for teens with bad driving records

| Company | Ticket | Accident |

|---|---|---|

| Texas Farm Bureau | $612 | $879 |

| State Farm | $1,792 | $2,022 |

| Geico | $2,052 | $2,711 |

| Allstate | $3,017 | $3,057 |

| Progressive | $3,071 | $3,137 |

| Farmers | $7,145 | $12,125 |

| USAA* | $1,740 | $2,206 |

Cheapest El Paso auto insurance with a DWI: State Farm

State Farm has the cheapest car insurance rates after a DWI for El Paso drivers, at $1,487 a year, or $124 a month. Texas Farm Bureau comes in second at $1,708.

Not only does State Farm have the lowest average rates for drivers with DWIs, but it offers more discounts than other companies, too.

El Paso drivers with a DWI pay $2,873 a year for car insurance, on average, which is 68% more than what State Farm charges.

Cheapest car insurance with a DWI

| Company | Annual rate |

|---|---|

| State Farm | $1,487 |

| Texas Farm Bureau | $1,708 |

| Progressive | $2,583 |

| Allstate | $2,779 |

| Geico | $3,246 |

| Farmers | $5,661 |

| USAA* | $2,650 |

After teens, drivers with a DWI are the highest-risk group for car insurance companies. How long a DWI stays on your record depends on the state where you live. In El Paso, a DWI stays on your driving record permanently. A DWI will usually affect your car insurance for three to five years, but the amount of time can vary.

Cheapest car insurance in El Paso with bad credit: Texas Farm Bureau

El Paso drivers get the cheapest car insurance for bad credit from Texas Farm Bureau. It charges these drivers an average rate of $2,083 a year, or $174 a month. Allstate is close behind at $2,201 a year.

Although Allstate’s average rate is slightly more than Texas Farm Bureau’s, Allstate offers more car insurance discounts that could save you money. This is why it’s important to compare quotes from several companies before you buy to see which is the best for you.

Cheap car insurance with bad credit

| Company | Annual rate |

|---|---|

| Texas Farm Bureau | $2,083 |

| Allstate | $2,201 |

| Progressive | $3,825 |

| Geico | $4,760 |

| Farmers | $7,506 |

| State Farm | $9,736 |

| USAA | $2,193 |

Best car insurance companies in El Paso

Texas Farm Bureau is El Paso’s best car insurance company because of its low average rate. It also has great customer service and financial strength ratings.

State Farm scores better for financial strength from AM Best, but its customer satisfaction rating from J.D. Power is worse. Both companies are still above the J.D. Power

El Paso’s best-rated car insurance companies

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Farmers | 619 | A | |

| Geico | 637 | A++ | |

| Progressive | 622 | A+ |  |

| State Farm | 657 | A++ | |

| Texas Farm Bureau | 686 | A- |  |

| USAA* | 739 | A++ |  |

Car insurance rates in El Paso by neighborhood

El Paso’s 79912 ZIP code has the city’s cheapest rates for auto insurance at $1,937 a year, or $161 a month. This is 4% cheaper than the city average of $2,069.

The 79910 ZIP code has El Paso’s highest average rate of $2,292 a year, which is 14% more than the city average.

El Paso car insurance rates by ZIP code

| ZIP code | Annual rate | % from average |

|---|---|---|

| 79901 | $1,968 | -2% |

| 79902 | $1,975 | -2% |

| 79903 | $1,983 | -1% |

| 79904 | $1,975 | -2% |

| 79905 | $1,994 | -1% |

| 79906 | $1,987 | -1% |

| 79907 | $2,025 | 1% |

| 79908 | $1,997 | -1% |

| 79910 | $2,292 | 14% |

| 79911 | $1,964 | -2% |

| 79912 | $1,937 | -4% |

| 79915 | $1,971 | -2% |

| 79922 | $2,000 | 0% |

| 79924 | $2,017 | 0% |

| 79925 | $1,991 | -1% |

| 79927 | $2,029 | 1% |

| 79928 | $2,019 | 0% |

| 79930 | $2,013 | 0% |

| 79932 | $1,960 | -2% |

| 79934 | $1,982 | -1% |

| 79935 | $2,014 | 0% |

| 79936 | $2,030 | 1% |

| 79938 | $2,089 | 4% |

| 79968 | $2,024 | 1% |

Car insurance companies look at many factors other than where you live when coming up with your quote, including:

- The make and model of your car

- Your driving and claims history

- Coverage limits and deductible

El Paso’s minimum car insurance requirements

Drivers in El Paso are required by law to have a minimum of 30/60/25 liability car insurance. This means:

-

$30,000 of bodily injury liability

coverage for one personBodily injury liability helps cover the medical bills of anyone you injure in a car accident.

- $60,000 of bodily injury liability coverage for two or more people

-

$25,000 of property damage liability

coverageProperty damage liability covers damage you cause to property like fences, toll booths and light posts.

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: minimum limits, where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighed these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military, as well as certain family members.