Cheap Car Insurance in Fort Worth

Texas Farm Bureau has the cheapest full coverage car insurance in Fort Worth for most drivers at $1,064 a year.

Best cheap car insurance in Fort Worth

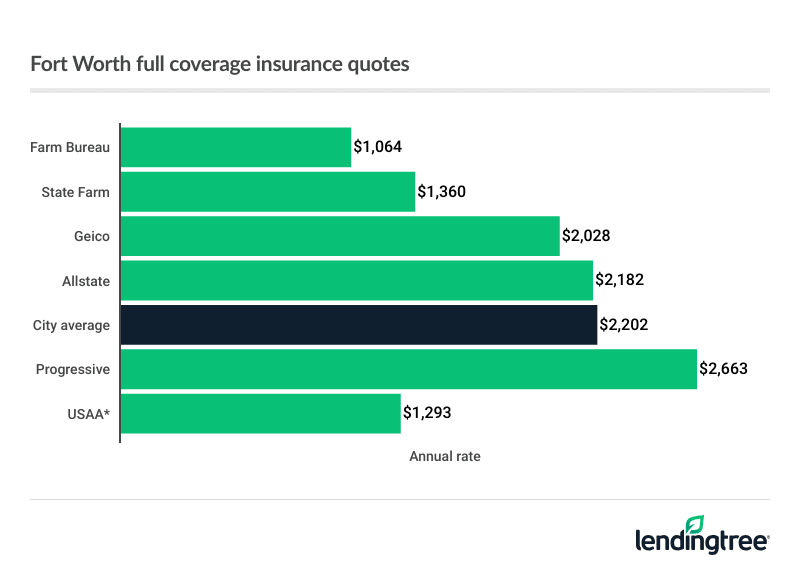

Cheapest full coverage car insurance in Fort Worth: Texas Farm Bureau

Texas Farm Bureau has the cheapest full coverage car insurance in Fort Worth at $1,064 a year, or $89 a month. USAA has the next-cheapest full coverage

Cheap Fort Worth full coverage auto insurance

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Texas Farm Bureau | $1,064 |  |

| State Farm | $1,360 |  |

| Geico | $2,028 |  |

| Allstate | $2,182 |  |

| Progressive | $2,663 |  |

| Farmers | $4,821 |  |

| USAA* | $1,293 |  |

Fort Worth drivers pay an average of $184 a month for full coverage. Your actual rate depends on factors like your driving record, credit and location. Each company views these factors differently. This makes it good to compare car insurance quotes from a few different companies.

Cheap Fort Worth liability car insurance: Texas Farm Bureau

At $35 a month, Farm Bureau has the cheapest liability insurance in Fort Worth. This is 50% less than the city average of $69 a month.

State Farm has the next-cheapest liability insurance

Liability auto insurance quotes

| Company | Annual rate |

|---|---|

| Texas Farm Bureau | $418 |

| State Farm | $572 |

| Progressive | $708 |

| Geico | $814 |

| Allstate | $895 |

| Farmers | $1,899 |

| USAA* | $493 |

Best cheap car insurance for Fort Worth teens: Farm Bureau

You can usually get cheap car insurance for teens from the Farm Bureau. The company’s liability quotes for young drivers average $68 a month. This is 70% less than the city average of $229 a month.

Young drivers pay an average of $148 a month for Farm Bureau’s full coverage. This is 74% less than the city average of $576 a month.

Annual teen auto insurance rates

| Company | Liability | Full coverage |

|---|---|---|

| Texas Farm Bureau | $811 | $1,780 |

| State Farm | $1,946 | $3,992 |

| Geico | $2,032 | $4,499 |

| Allstate | $2,968 | $6,481 |

| Progressive | $3,621 | $12,821 |

| Farmers | $6,514 | $15,746 |

| USAA* | $1,315 | $3,081 |

A lack of driving experience makes teens more likely to crash than older drivers. This is one of the main reasons why car insurance companies charge young drivers so much. Most young drivers get cheaper rates on a parent’s car insurance than they do on their own.

Young drivers can also often get discounts for:

- Getting good grades

- Completing an accredited driver training program

- Going off to college without a car

Best Fort Worth car insurance with a ticket: Farm Bureau

At $89 a month, Farm Bureau has the cheapest full coverage for drivers with a speeding ticket. State Farm is the next-cheapest company at $113 a month.

Auto insurance rates for speeders

| Company | Annual rate |

|---|---|

| Texas Farm Bureau | $1,064 |

| State Farm | $1,360 |

| Allstate | $2,182 |

| Geico | $2,435 |

| Progressive | $3,538 |

| Farmers | $6,618 |

| USAA* | $1,459 |

A speeding ticket raises the average price of Fort Worth car insurance by 21% to $184 a month. However, some companies increase their rates by lower amounts. This makes it important to shop around if you have a bad driving record.

Cheap Fort Worth car insurance after an accident: State Farm

Drivers with an at-fault accident can get the cheapest car insurance from State Farm. Its full coverage quotes after an accident average $133 a month. Farm Bureau is only slightly more expensive at $141 a month.

Insurance rates after an accident

| Company | Annual rate |

|---|---|

| State Farm | $1,599 |

| Texas Farm Bureau | $1,697 |

| Allstate | $2,338 |

| Geico | $3,289 |

| Progressive | $4,197 |

| Farmers | $13,193 |

| USAA* | $1,957 |

An at-fault accident can increase your car insurance rate by 83% to $337 a month. Some companies offer accident forgiveness

Cheap Fort Worth car insurance for bad teen drivers: Farm Bureau

Teens with bad driving records can get the cheapest car insurance quotes from Farm Bureau. The company has the cheapest liability for young drivers with a ticket at $68 a month. The company’s rates for teens with an at-fault accident average $97 a month.

State Farm is the next-cheapest company. It charges young drivers an average of $162 a month after a ticket and $183 a month after an accident.

Annual teen rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Texas Farm Bureau | $811 | $1,164 |

| State Farm | $1,946 | $2,196 |

| Geico | $2,274 | $3,003 |

| Allstate | $2,968 | $3,012 |

| Progressive | $3,683 | $3,753 |

| Farmers | $7,771 | $13,196 |

| USAA* | $1,807 | $2,285 |

Fort Worth’s cheapest car insurance for a DUI: State Farm

State Farm has the cheapest DUI insurance in Fort Worth at $121 a month for full coverage. This is 29% less than the next-cheapest rate of $170 a month from Farm Bureau.

A DUI raises the average price of car insurance in Fort Worth by 40% to $257 a month.

DUI car insurance rates

| Company | Annual rate |

|---|---|

| State Farm | $1,448 |

| Texas Farm Bureau | $2,041 |

| Allstate | $2,806 |

| Progressive | $3,110 |

| Geico | $3,671 |

| Farmers | $6,078 |

| USAA* | $2,469 |

Best Fort Worth car insurance for bad credit: Allstate

Allstate has Fort Worth’s cheapest bad-credit car insurance at $182 a month for full coverage. This is 9% less than the second-cheapest rate of $201 a month from Farm Bureau.

Bad credit car insurance rates

| Company | Annual rate |

|---|---|

| Allstate | $2,182 |

| Texas Farm Bureau | $2,409 |

| Progressive | $4,608 |

| Geico | $5,321 |

| Farmers | $7,980 |

| State Farm | $8,757 |

| USAA* | $2,004 |

Bad-credit car insurance costs an average of $396 a month in Fort Worth. This is more than double the rate for drivers with good credit.

Your payment history and borrowing levels are key credit factors that affect your insurance rate. Avoiding late payments and paying down debt can help you get lower rates.

Best Fort Worth car insurance companies

Farm Bureau’s cheap rates and excellent ratings make it the best car insurance company for Fort Worth drivers. It has a better customer satisfaction rating from J.D. Power

However, Farm Bureau mostly offers basic car insurance coverages like liability and collision. It doesn’t offer gap insurance

You can’t get rideshare driver coverage

USAA is the only company with a higher J.D Power rating than Farm Bureau. This is among the reasons why USAA is a great choice for current and former service members and their families.

Fort Worth car insurance company ratings

| Company | J.D. Power** | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ |  |

| Farmers | 619 | A |  |

| Geico | 637 | A++ |  |

| Progressive | 622 | A+ |  |

| State Farm | 657 | A++ |  |

| Texas Farm Bureau | 686 | A- |  |

| USAA* | 739 | A++ |  |

Fort Worth auto insurance rates by neighborhood

At $166 a month, Keller’s 76262 ZIP code has the cheapest car insurance among Fort Worth neighborhoods and suburbs. The price in Burleson’s 76028 ZIP code is only slightly higher at $167 a month.

Texas Christian University’s 76130 ZIP has Fort Worth’s most expensive car insurance at $237 a month. This is 27% higher than rates in Stop Six’s 76105, the area’s second-most expensive area.

Car insurance tends to cost more in areas with high crash or car theft rates. The rate difference between Fort Worth’s cheapest and most expensive ZIP codes is $71 a month.

Insurance rates by Fort Worth ZIP code

| ZIP code | Annual rate | Difference from city average |

|---|---|---|

| 76008 | $2,055 | -7% |

| 76028 | $2,007 | -9% |

| 76036 | $2,095 | -5% |

| 76040 | $2,084 | -5% |

| 76052 | $2,043 | -7% |

| 76053 | $2,098 | -5% |

| 76102 | $2,179 | -1% |

| 76103 | $2,162 | -2% |

| 76104 | $2,185 | -1% |

| 76105 | $2,238 | 2% |

| 76106 | $2,221 | 1% |

| 76107 | $2,101 | -5% |

| 76108 | $2,042 | -7% |

| 76109 | $2,086 | -5% |

| 76110 | $2,117 | -4% |

| 76111 | $2,156 | -2% |

| 76112 | $2,107 | -4% |

| 76114 | $2,162 | -2% |

| 76115 | $2,114 | -4% |

| 76116 | $2,057 | -7% |

| 76118 | $2,100 | -5% |

| 76119 | $2,201 | 0% |

| 76120 | $2,162 | -2% |

| 76123 | $2,124 | -4% |

| 76126 | $2,045 | -7% |

| 76127 | $2,118 | -4% |

| 76129 | $2,102 | -5% |

| 76131 | $2,111 | -4% |

| 76132 | $2,029 | -8% |

| 76133 | $2,116 | -4% |

| 76134 | $2,118 | -4% |

| 76135 | $2,095 | -5% |

| 76137 | $2,118 | -4% |

| 76140 | $2,079 | -6% |

| 76148 | $2,077 | -6% |

| 76155 | $2,121 | -4% |

| 76164 | $2,184 | -1% |

| 76177 | $2,039 | -7% |

| 76179 | $2,138 | -3% |

| 76244 | $2,066 | -6% |

| 76247 | $2,024 | -8% |

| 76262 | $1,992 | -10% |

Fort Worth car insurance requirements

You have to meet Texas’ 30/60/25 liability requirements to drive legally in Fort Worth. The minimum coverages and limits include:

- Bodily injury liability: $30,000 per person, $60,000 per accident

- Property damage liability: $25,000

Insurance companies are required to offer personal injury protection

Methodology

LendingTree gets insurance rates from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX. Our sample teen is an 18-year-old male with no tickets or accidents.

Minimum liability policies provide liability coverage with Texas’ required limits. Full coverage policies include:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

—

For LendingTree scores, our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

Overall satisfaction ratings are from the J.D. Power 2024 U.S. Auto Insurance Study.

*USAA is only available to current and former members of the U.S. military and their families.