Best Cheap Car Insurance in Kansas (2026)

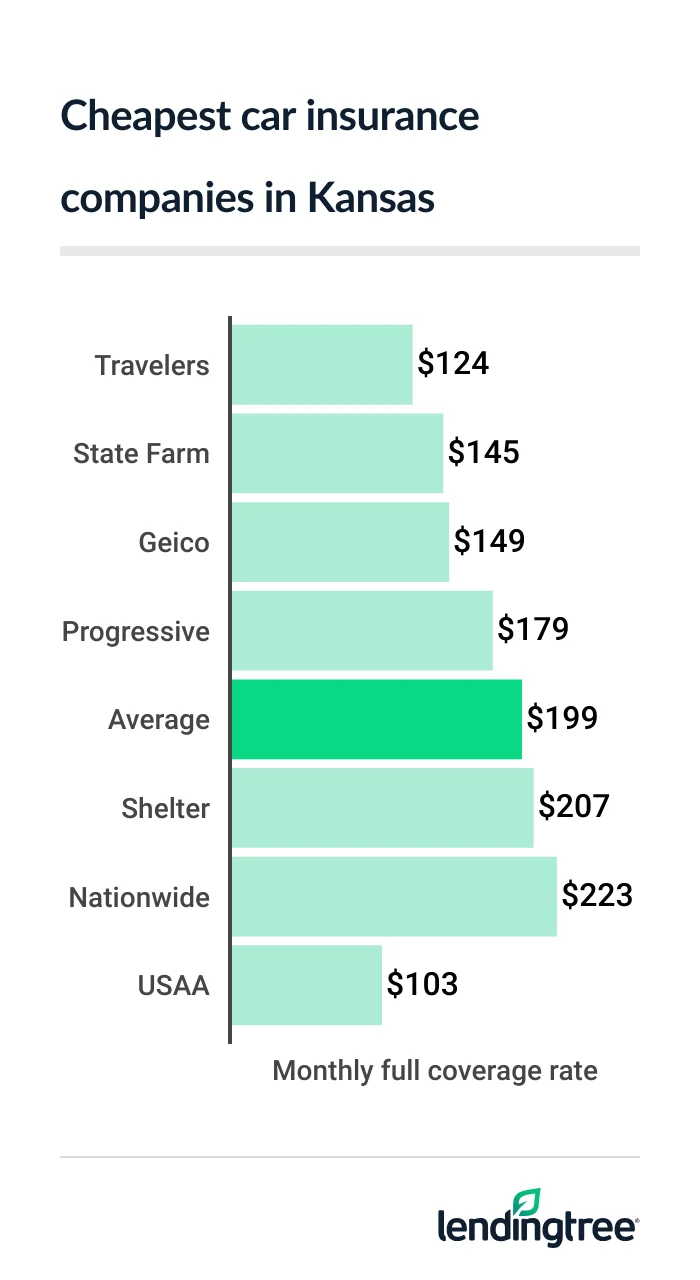

Travelers has the cheapest full coverage car insurance in Kansas at $124 a month. State Farm has the cheapest minimum coverage at $38 a month.

Best cheap car insurance in Kansas

Cheapest full coverage car insurance in Kansas: Travelers

Travelers has the cheapest full coverage car insurance for most Kansas drivers at $124 a month. USAA is cheaper, at $103 a month, but it’s only available to the military community.

State Farm and Geico are the next-cheapest companies for full coverage

Full coverage costs an average of $199 a month in Kansas. Your actual rate depends on factors like your driving record, location and credit.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $124 | |

| State Farm | $145 | |

| Geico | $149 | |

| Progressive | $179 | |

| Shelter | $207 | |

| Nationwide | $223 | |

| Allstate | $267 | |

| Farmers | $270 | |

| Farm Bureau | $319 | |

| USAA* | $103 | |

Each company treats these factors differently and offers different car insurance discounts. Comparing car insurance quotes helps you find the cheapest rate for your situation.

Kansas’ cheapest liability auto insurance: State Farm

At $38 a month, State Farm has Kansas’ cheapest liability insurance, or minimum coverage. Travelers is only slightly more expensive at $40 a month. Minimum coverage in Kansas includes liability

Cheap liability auto insurance

| Company | Monthly rate |

|---|---|

| State Farm | $38 |

| Travelers | $40 |

| Geico | $46 |

| Progressive | $65 |

| Farm Bureau | $68 |

| Shelter | $72 |

| Nationwide | $81 |

| Farmers | $99 |

| Allstate | $106 |

| USAA* | $26 |

Travelers has discounts that State Farm doesn’t for homeowners and hybrid or electric vehicles. These may make Travelers your cheapest option if you qualify. On the other hand, State Farm has a higher satisfaction rating, meaning better customer service, from J.D. Power

Kansas’ cheapest car insurance for teens: Travelers

Most Kansans can get the cheapest car insurance for teens from Travelers. The company charges young drivers $93 a month for minimum coverage. This is 28% less than the next-cheapest rate of $129 a month from State Farm.

Travelers charges teens $260 a month for full coverage. This is 31% less than State Farm’s rate of $379 a month.

Teen auto insurance rates

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Travelers | $93 | $260 |

| State Farm | $129 | $379 |

| Geico | $168 | $525 |

| Farm Bureau | $177 | $657 |

| Shelter | $183 | $524 |

| Progressive | $234 | $745 |

| Farmers | $289 | $657 |

| Nationwide | $302 | $736 |

| Allstate | $322 | $796 |

| USAA* | $66 | $233 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This is why they often pay higher car insurance rates. Young drivers usually get cheaper rates on a parent’s policy than they do on their own.

Discounts can also help make car insurance more affordable for teens and their parents. Most companies give teens a discount for getting good grades. Some, including Travelers and Geico, give teens an additional discount for completing driver training.

It’s good to ask about these and other teen discounts when you get your quotes.

Cheap Kansas car insurance after a speeding ticket: State Farm

Most Kansas drivers with a speeding ticket can get the cheapest car insurance from State Farm. The company’s rates average $151 a month after a ticket. This is only barely cheaper than Travelers’ rate of $156 a month.

Insurance rates with a speeding ticket

| Company | Monthly rate |

|---|---|

| State Farm | $151 |

| Travelers | $156 |

| Geico | $193 |

| Progressive | $223 |

| Shelter | $239 |

| Allstate | $315 |

| Nationwide | $326 |

| Farmers | $346 |

| Farm Bureau | $398 |

| USAA* | $126 |

A speeding ticket raises car insurance rates by an average of 25% in Kansas. However, some companies have smaller increases. Shopping around is a good way to find cheap car insurance with a bad driving record.

Kansas’ cheapest auto insurance after an accident: State Farm

At $160 a month, State Farm has Kansas’ cheapest car insurance for most drivers with an at-fault accident. Travelers is only slightly more expensive at $167 a month. Both rates are about 45% less than the average of $292 a month after an accident.

Insurance rates after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $160 |

| Travelers | $167 |

| Progressive | $252 |

| Shelter | $261 |

| Geico | $288 |

| Nationwide | $393 |

| Farmers | $394 |

| Farm Bureau | $430 |

| Allstate | $431 |

| USAA* | $144 |

Travelers also gives you a discount for setting up electronic payments or paying up front. It also gives you a discount for getting a quote before your current policy with another company expires. Discounts like these can make Travelers your cheapest option after an accident.

Best for teens with bad driving records: Travelers

Most Kansas teens with bad driving records get the cheapest car insurance from Travelers. The company’s liability rates average $113 a month for young drivers with a speeding ticket. This is 19% less than the next-cheapest rate of $139 a month from State Farm.

At $131 a month, Travelers also has the cheapest liability insurance for teens with an accident. This is 14% less than State Farm’s rate of $153 a month.

Teens rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Travelers | $113 | $131 |

| State Farm | $139 | $153 |

| Geico | $196 | $220 |

| Shelter | $222 | $264 |

| Farm Bureau | $231 | $239 |

| Progressive | $246 | $263 |

| Nationwide | $329 | $333 |

| Farmers | $342 | $386 |

| Allstate | $410 | $618 |

| USAA* | $101 | $116 |

Cheap car insurance for Kansas drivers with a DUI: Travelers

At $176 a month, Travelers has Kansas’ cheapest car insurance after a DUI (driving under the influence). This is 52% less than the state average of $368 a month. Progressive also has cheap DUI insurance at $198 a month.

DUI insurance rates

| Company | Monthly rate |

|---|---|

| Travelers | $176 |

| Progressive | $198 |

| State Farm | $269 |

| Shelter | $300 |

| Allstate | $346 |

| Farmers | $357 |

| Nationwide | $535 |

| Geico | $540 |

| Farm Bureau | $751 |

| USAA* | $202 |

Best Kansas auto insurance for bad credit: Travelers

Travelers and Geico have Kansas’ cheapest bad-credit car insurance. Travelers charges drivers with bad credit an average of $203 a month for full coverage. Geico is slightly more expensive, at $214 a month.

Car insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Travelers | $203 |

| Geico | $214 |

| Progressive | $298 |

| Nationwide | $312 |

| Shelter | $382 |

| Farmers | $408 |

| Allstate | $438 |

| Farm Bureau | $584 |

| State Farm | $800 |

| USAA* | $186 |

Insurance companies check your credit for things like your payment history and the amounts you borrow. These are different from the factors that lenders focus on. Avoiding late payments and paying down debts can help you get cheaper car insurance.

Best car insurance in Kansas

Travelers, State Farm and USAA have the best car insurance in Kansas for different reasons.

Insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Farm Bureau | 645 | A | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| Shelter | 669 | A | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

Along with low rates, Travelers has more coverage options than most companies. It offers gap insurance

- Gap insurance can come in handy if you finance your car with a low down payment.

- Accident forgiveness keeps your rate low after your first at-fault accident.

- New car replacement protects you if your car is totaled while it’s relatively new.

State Farm stands out for its low rates and good customer service. Its high satisfaction score means customers like State Farm’s rates, coverage options and customer service. The company offers in-person service from agents in most Kansas communities. It also caters to DIY shoppers with online quotes and a user-friendly smartphone app.

USAA is the best choice for drivers who meet its eligibility requirements. It has cheap rates for most qualifying members. It also has a better satisfaction score than every other car insurance company.

Kansas auto insurance rates by city

Almena has the most expensive auto insurance among Kansas’ cities and towns. Its drivers pay an average of $233 a month for full coverage. This is 17% higher than the state average. Drivers in nearby Norton have the next-highest rates, at $231 a month.

On the flip side, Gardner has Kansas’ cheapest car insurance, at $173 a month. This is 13% less than the state average. Salina and Eudora tie for the next-cheapest, each at $174 a month.

Drivers in Wichita pay $209 a month, or 5% more than the state average. At $218 a month, Kansas City drivers pay 10% more than the state average.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Abbyville | $195 | -2% |

| Abilene | $191 | -4% |

| Admire | $186 | -7% |

| Agenda | $201 | 1% |

| Agra | $220 | 11% |

| Albert | $206 | 4% |

| Alden | $201 | 1% |

| Alexander | $209 | 5% |

| Allen | $187 | -6% |

| Alma | $184 | -8% |

| Almena | $233 | 17% |

| Alta Vista | $185 | -7% |

| Altamont | $195 | -2% |

| Alton | $205 | 3% |

| Altoona | $196 | -1% |

| Americus | $185 | -7% |

| Andale | $190 | -4% |

| Andover | $195 | -2% |

| Anthony | $204 | 3% |

| Arcadia | $190 | -4% |

| Argonia | $199 | 0% |

| Arkansas City | $189 | -5% |

| Arlington | $196 | -1% |

| Arma | $186 | -6% |

| Arnold | $218 | 10% |

| Ashland | $226 | 14% |

| Assaria | $184 | -7% |

| Atchison | $185 | -7% |

| Athol | $214 | 8% |

| Atlanta | $193 | -3% |

| Attica | $206 | 4% |

| Atwood | $223 | 12% |

| Auburn | $178 | -11% |

| Augusta | $194 | -2% |

| Aurora | $201 | 1% |

| Axtell | $186 | -6% |

| Baileyville | $183 | -8% |

| Baldwin City | $177 | -11% |

| Barnard | $197 | -1% |

| Barnes | $199 | 0% |

| Bartlett | $193 | -3% |

| Basehor | $186 | -6% |

| Baxter Springs | $195 | -2% |

| Bazine | $215 | 8% |

| Beattie | $188 | -6% |

| Beaumont | $196 | -1% |

| Beeler | $214 | 8% |

| Bel Aire | $206 | 4% |

| Belle Plaine | $192 | -4% |

| Belleville | $202 | 2% |

| Beloit | $201 | 1% |

| Belpre | $206 | 4% |

| Belvue | $180 | -9% |

| Bendena | $187 | -6% |

| Benedict | $196 | -1% |

| Bennington | $187 | -6% |

| Bentley | $189 | -5% |

| Benton | $193 | -3% |

| Bern | $183 | -8% |

| Berryton | $179 | -10% |

| Beverly | $193 | -3% |

| Bird City | $222 | 12% |

| Bison | $210 | 5% |

| Blue Mound | $196 | -1% |

| Blue Rapids | $190 | -4% |

| Bluff City | $202 | 2% |

| Bogue | $221 | 11% |

| Bonner Springs | $187 | -6% |

| Bremen | $189 | -5% |

| Brewster | $216 | 9% |

| Bronson | $200 | 1% |

| Brookville | $188 | -5% |

| Brownell | $215 | 8% |

| Bucklin | $229 | 15% |

| Bucyrus | $182 | -9% |

| Buffalo | $197 | -1% |

| Buhler | $189 | -5% |

| Bunker Hill | $210 | 6% |

| Burden | $193 | -3% |

| Burdett | $206 | 4% |

| Burdick | $185 | -7% |

| Burlingame | $189 | -5% |

| Burlington | $193 | -3% |

| Burns | $194 | -2% |

| Burr Oak | $207 | 4% |

| Burrton | $182 | -8% |

| Bushton | $209 | 5% |

| Byers | $205 | 3% |

| Caldwell | $195 | -2% |

| Cambridge | $194 | -2% |

| Caney | $196 | -1% |

| Canton | $185 | -7% |

| Carbondale | $187 | -6% |

| Cassoday | $194 | -2% |

| Catharine | $204 | 3% |

| Cawker City | $205 | 3% |

| Cedar | $215 | 8% |

| Cedar Point | $191 | -4% |

| Cedar Vale | $195 | -2% |

| Centerville | $192 | -3% |

| Centralia | $184 | -7% |

| Chanute | $195 | -2% |

| Chapman | $189 | -5% |

| Chase | $204 | 3% |

| Chautauqua | $193 | -3% |

| Cheney | $192 | -3% |

| Cherokee | $187 | -6% |

| Cherryvale | $199 | 0% |

| Chetopa | $196 | -1% |

| Chicopee | $185 | -7% |

| Cimarron | $226 | 14% |

| Circleville | $183 | -8% |

| Claflin | $207 | 4% |

| Clay Center | $192 | -3% |

| Clayton | $222 | 12% |

| Clearview City | $189 | -5% |

| Clearwater | $196 | -1% |

| Clifton | $199 | 0% |

| Clyde | $202 | 2% |

| Coats | $206 | 4% |

| Coffeyville | $199 | 0% |

| Colby | $211 | 6% |

| Coldwater | $221 | 11% |

| Collyer | $224 | 13% |

| Colony | $193 | -3% |

| Columbus | $196 | -1% |

| Colwich | $191 | -4% |

| Concordia | $202 | 2% |

| Conway Springs | $194 | -2% |

| Coolidge | $223 | 12% |

| Copeland | $222 | 12% |

| Corning | $184 | -7% |

| Cottonwood Falls | $191 | -4% |

| Council Grove | $187 | -6% |

| Courtland | $203 | 2% |

| Crestline | $201 | 1% |

| Cuba | $202 | 2% |

| Cummings | $187 | -6% |

| Cunningham | $199 | 0% |

| Damar | $218 | 10% |

| Danville | $202 | 2% |

| De Soto | $179 | -10% |

| Dearing | $200 | 1% |

| Deerfield | $223 | 12% |

| Delia | $184 | -7% |

| Delphos | $202 | 2% |

| Denison | $184 | -8% |

| Dennis | $194 | -2% |

| Denton | $185 | -7% |

| Derby | $191 | -4% |

| Dexter | $193 | -3% |

| Dighton | $220 | 11% |

| Dodge City | $226 | 14% |

| Dorrance | $207 | 4% |

| Douglass | $195 | -2% |

| Downs | $209 | 5% |

| Dresden | $224 | 13% |

| Durham | $190 | -4% |

| Dwight | $182 | -8% |

| Eastborough | $210 | 6% |

| Easton | $190 | -4% |

| Edgerton | $176 | -11% |

| Edna | $195 | -2% |

| Edson | $219 | 10% |

| Edwardsville | $204 | 3% |

| Effingham | $187 | -6% |

| El Dorado | $196 | -1% |

| Elbing | $187 | -6% |

| Elk City | $196 | -1% |

| Elk Falls | $194 | -2% |

| Elkhart | $227 | 14% |

| Ellinwood | $207 | 4% |

| Ellis | $199 | 0% |

| Ellsworth | $208 | 5% |

| Elmdale | $188 | -5% |

| Elsmore | $198 | 0% |

| Elwood | $184 | -7% |

| Emmett | $180 | -9% |

| Emporia | $185 | -7% |

| Englewood | $224 | 13% |

| Ensign | $226 | 14% |

| Enterprise | $189 | -5% |

| Erie | $198 | 0% |

| Esbon | $203 | 2% |

| Eskridge | $189 | -5% |

| Eudora | $174 | -12% |

| Eureka | $196 | -1% |

| Everest | $184 | -7% |

| Fairview | $182 | -8% |

| Fairway | $187 | -6% |

| Fall River | $199 | 0% |

| Falun | $188 | -5% |

| Farlington | $191 | -4% |

| Florence | $189 | -5% |

| Fontana | $186 | -6% |

| Ford | $228 | 15% |

| Formoso | $205 | 3% |

| Fort Dodge | $227 | 14% |

| Fort Leavenworth | $189 | -5% |

| Fort Riley | $176 | -11% |

| Fort Scott | $193 | -3% |

| Fostoria | $190 | -4% |

| Fowler | $224 | 13% |

| Frankfort | $189 | -5% |

| Franklin | $187 | -6% |

| Fredonia | $196 | -1% |

| Freeport | $205 | 3% |

| Frontenac | $186 | -6% |

| Fulton | $198 | 0% |

| Galena | $194 | -3% |

| Galesburg | $196 | -2% |

| Galva | $184 | -7% |

| Garden City | $222 | 12% |

| Garden Plain | $193 | -3% |

| Gardner | $173 | -13% |

| Garfield | $207 | 4% |

| Garland | $195 | -2% |

| Garnett | $196 | -1% |

| Gas | $194 | -2% |

| Gaylord | $215 | 8% |

| Gem | $216 | 9% |

| Geneseo | $203 | 2% |

| Geuda Springs | $190 | -4% |

| Girard | $187 | -6% |

| Glade | $216 | 9% |

| Glasco | $201 | 1% |

| Glen Elder | $206 | 4% |

| Goddard | $192 | -3% |

| Goessel | $184 | -8% |

| Goff | $183 | -8% |

| Goodland | $216 | 9% |

| Gorham | $206 | 4% |

| Gove | $217 | 9% |

| Grainfield | $218 | 10% |

| Grandview Plaza | $177 | -11% |

| Grantville | $187 | -6% |

| Great Bend | $207 | 4% |

| Greeley | $195 | -2% |

| Green | $194 | -2% |

| Greenleaf | $200 | 1% |

| Greensburg | $210 | 6% |

| Greenwich | $199 | 0% |

| Grenola | $196 | -1% |

| Gridley | $195 | -2% |

| Grinnell | $216 | 9% |

| Gypsum | $186 | -6% |

| Haddam | $201 | 1% |

| Halstead | $179 | -10% |

| Hamilton | $196 | -1% |

| Hanover | $200 | 1% |

| Hanston | $228 | 15% |

| Hardtner | $218 | 10% |

| Harper | $204 | 3% |

| Hartford | $193 | -3% |

| Harveyville | $181 | -9% |

| Havana | $197 | -1% |

| Haven | $192 | -3% |

| Havensville | $182 | -9% |

| Haviland | $207 | 4% |

| Hays | $192 | -3% |

| Haysville | $206 | 4% |

| Hazelton | $219 | 10% |

| Healy | $217 | 9% |

| Hepler | $191 | -4% |

| Herington | $189 | -5% |

| Herndon | $219 | 10% |

| Hesston | $177 | -11% |

| Hiawatha | $184 | -7% |

| Highland | $186 | -6% |

| Hill City | $227 | 15% |

| Hillsboro | $186 | -6% |

| Hillsdale | $193 | -3% |

| Hoisington | $206 | 4% |

| Holcomb | $223 | 12% |

| Hollenberg | $198 | 0% |

| Holton | $182 | -8% |

| Holyrood | $209 | 5% |

| Home | $186 | -6% |

| Hope | $189 | -5% |

| Horton | $185 | -7% |

| Howard | $195 | -2% |

| Hoxie | $217 | 9% |

| Hoyt | $183 | -8% |

| Hudson | $206 | 4% |

| Hugoton | $222 | 12% |

| Humboldt | $196 | -1% |

| Hunter | $203 | 2% |

| Hutchinson | $190 | -4% |

| Independence | $198 | 0% |

| Ingalls | $223 | 12% |

| Inman | $181 | -9% |

| Iola | $194 | -2% |

| Isabel | $209 | 5% |

| Iuka | $206 | 4% |

| Jamestown | $203 | 2% |

| Jennings | $223 | 12% |

| Jetmore | $230 | 16% |

| Jewell | $207 | 4% |

| Johnson City | $226 | 14% |

| Junction City | $177 | -11% |

| Kanopolis | $208 | 5% |

| Kanorado | $219 | 10% |

| Kansas City | $218 | 10% |

| Kechi | $202 | 2% |

| Kendall | $224 | 13% |

| Kensington | $214 | 8% |

| Kincaid | $199 | 0% |

| Kingman | $200 | 1% |

| Kinsley | $209 | 5% |

| Kiowa | $219 | 10% |

| Kirwin | $219 | 10% |

| Kismet | $224 | 13% |

| La Crosse | $209 | 5% |

| La Harpe | $196 | -1% |

| Lacygne | $194 | -3% |

| Lake City | $217 | 9% |

| Lake Quivira | $185 | -7% |

| Lakin | $222 | 12% |

| Lamont | $195 | -2% |

| Lancaster | $185 | -7% |

| Lane | $192 | -3% |

| Lansing | $186 | -6% |

| Larned | $210 | 6% |

| Latham | $198 | 0% |

| Lawrence | $175 | -12% |

| LeRoy | $195 | -2% |

| Leavenworth | $190 | -4% |

| Leawood | $182 | -8% |

| Lebanon | $216 | 9% |

| Lebo | $192 | -3% |

| Lecompton | $176 | -12% |

| Lehigh | $184 | -7% |

| Lenexa | $181 | -9% |

| Lenora | $225 | 13% |

| Leon | $196 | -1% |

| Leonardville | $184 | -7% |

| Leoti | $216 | 9% |

| Levant | $214 | 8% |

| Lewis | $210 | 6% |

| Liberal | $220 | 11% |

| Liberty | $199 | 0% |

| Liebenthal | $207 | 4% |

| Lincoln | $198 | 0% |

| Lincoln Center | $198 | 0% |

| Lincolnville | $188 | -5% |

| Lindsborg | $183 | -8% |

| Linn | $201 | 1% |

| Linwood | $190 | -4% |

| Little River | $206 | 3% |

| Logan | $223 | 12% |

| Long Island | $222 | 12% |

| Longford | $194 | -3% |

| Longton | $194 | -2% |

| Lorraine | $207 | 4% |

| Lost Springs | $186 | -6% |

| Louisburg | $183 | -8% |

| Lucas | $210 | 6% |

| Ludell | $220 | 11% |

| Luray | $207 | 4% |

| Lyndon | $191 | -4% |

| Lyons | $201 | 1% |

| Macksville | $209 | 5% |

| Madison | $195 | -2% |

| Mahaska | $200 | 1% |

| Maize | $198 | 0% |

| Manhattan | $175 | -12% |

| Mankato | $206 | 4% |

| Manter | $217 | 9% |

| Maple City | $199 | 0% |

| Maple Hill | $186 | -7% |

| Mapleton | $197 | -1% |

| Marienthal | $218 | 10% |

| Marion | $186 | -7% |

| Marquette | $190 | -5% |

| Marysville | $188 | -5% |

| Matfield Green | $192 | -4% |

| Mayetta | $183 | -8% |

| Mayfield | $198 | 0% |

| McCracken | $209 | 5% |

| McCune | $190 | -5% |

| McDonald | $219 | 10% |

| McFarland | $183 | -8% |

| McLouth | $188 | -5% |

| McConnell AFB | $205 | 3% |

| McPherson | $183 | -8% |

| Meade | $224 | 13% |

| Medicine Lodge | $227 | 14% |

| Melvern | $193 | -3% |

| Meriden | $183 | -8% |

| Merriam | $185 | -7% |

| Milan | $199 | 0% |

| Milford | $178 | -11% |

| Milton | $196 | -1% |

| Miltonvale | $199 | 0% |

| Minneapolis | $196 | -1% |

| Minneola | $226 | 14% |

| Mission | $187 | -6% |

| Mission Hills | $186 | -6% |

| Moline | $197 | -1% |

| Montezuma | $224 | 13% |

| Monument | $215 | 8% |

| Moran | $197 | -1% |

| Morganville | $195 | -2% |

| Morland | $220 | 11% |

| Morrill | $182 | -9% |

| Morrowville | $201 | 1% |

| Moscow | $223 | 12% |

| Mound City | $198 | 0% |

| Mound Valley | $195 | -2% |

| Moundridge | $184 | -7% |

| Mount Hope | $196 | -1% |

| Mulberry | $189 | -5% |

| Mullinville | $210 | 6% |

| Mulvane | $198 | 0% |

| Munden | $202 | 2% |

| Murdock | $205 | 3% |

| Muscotah | $186 | -6% |

| Narka | $198 | 0% |

| Nashville | $204 | 3% |

| Natoma | $207 | 4% |

| Neal | $194 | -2% |

| Nekoma | $210 | 6% |

| Neodesha | $195 | -2% |

| Neosho Falls | $192 | -3% |

| Neosho Rapids | $188 | -5% |

| Ness City | $217 | 9% |

| Netawaka | $181 | -9% |

| New Cambria | $183 | -8% |

| New Century | $175 | -12% |

| Newton | $183 | -8% |

| Nickerson | $193 | -3% |

| Niotaze | $193 | -3% |

| Norcatur | $223 | 12% |

| North Newton | $180 | -10% |

| Norton | $231 | 16% |

| Nortonville | $188 | -5% |

| Norway | $207 | 4% |

| Norwich | $207 | 4% |

| Oaklawn-Sunview | $212 | 7% |

| Oakley | $211 | 6% |

| Oberlin | $221 | 11% |

| Offerle | $203 | 2% |

| Ogallah | $223 | 12% |

| Ogden | $178 | -10% |

| Oketo | $186 | -6% |

| Olathe | $177 | -11% |

| Olmitz | $202 | 2% |

| Olpe | $187 | -6% |

| Olsburg | $183 | -8% |

| Onaga | $185 | -7% |

| Oneida | $183 | -8% |

| Opolis | $185 | -7% |

| Osage City | $191 | -4% |

| Osawatomie | $186 | -6% |

| Osborne | $207 | 4% |

| Oskaloosa | $189 | -5% |

| Oswego | $193 | -3% |

| Otis | $211 | 6% |

| Ottawa | $191 | -4% |

| Overbrook | $186 | -7% |

| Overland Park | $182 | -8% |

| Oxford | $195 | -2% |

| Ozawkie | $189 | -5% |

| Palco | $219 | 10% |

| Palmer | $197 | -1% |

| Paola | $184 | -7% |

| Paradise | $208 | 5% |

| Park | $215 | 8% |

| Park City | $205 | 3% |

| Parker | $194 | -2% |

| Parkerfield | $189 | -5% |

| Parsons | $193 | -3% |

| Partridge | $195 | -2% |

| Pawnee Rock | $206 | 4% |

| Paxico | $183 | -8% |

| Peabody | $186 | -7% |

| Peck | $198 | 0% |

| Penokee | $223 | 12% |

| Perry | $183 | -8% |

| Peru | $192 | -3% |

| Pfeifer | $198 | 0% |

| Phillipsburg | $221 | 11% |

| Piedmont | $202 | 2% |

| Pierceville | $224 | 13% |

| Piqua | $196 | -1% |

| Pittsburg | $185 | -7% |

| Plains | $222 | 12% |

| Plainville | $217 | 9% |

| Pleasanton | $195 | -2% |

| Plevna | $197 | -1% |

| Pomona | $193 | -3% |

| Portis | $203 | 2% |

| Potwin | $198 | 0% |

| Powhattan | $183 | -8% |

| Prairie View | $218 | 10% |

| Prairie Village | $185 | -7% |

| Pratt | $208 | 5% |

| Prescott | $197 | -1% |

| Pretty Prairie | $196 | -1% |

| Princeton | $192 | -3% |

| Protection | $229 | 15% |

| Quenemo | $193 | -3% |

| Quinter | $218 | 10% |

| Ramona | $191 | -4% |

| Randall | $203 | 2% |

| Randolph | $184 | -7% |

| Ransom | $218 | 10% |

| Rantoul | $192 | -4% |

| Raymond | $204 | 3% |

| Reading | $184 | -7% |

| Redfield | $195 | -2% |

| Republic | $201 | 1% |

| Rexford | $214 | 8% |

| Richfield | $226 | 14% |

| Richmond | $194 | -2% |

| Riley | $182 | -8% |

| Riverton | $193 | -3% |

| Robinson | $184 | -8% |

| Rock | $197 | -1% |

| Roeland Park | $190 | -4% |

| Rolla | $228 | 15% |

| Rosalia | $199 | 0% |

| Rose Hill | $199 | 0% |

| Rossville | $177 | -11% |

| Roxbury | $194 | -2% |

| Rozel | $211 | 6% |

| Rush Center | $210 | 6% |

| Russell | $202 | 2% |

| Sabetha | $182 | -8% |

| Salina | $174 | -12% |

| Satanta | $221 | 11% |

| Savonburg | $197 | -1% |

| Sawyer | $212 | 7% |

| Scammon | $193 | -3% |

| Scandia | $202 | 2% |

| Schoenchen | $192 | -3% |

| Scott City | $217 | 9% |

| Scranton | $189 | -5% |

| Sedan | $195 | -2% |

| Sedgwick | $188 | -5% |

| Selden | $219 | 10% |

| Seneca | $183 | -8% |

| Severy | $201 | 1% |

| Sharon | $224 | 13% |

| Sharon Springs | $220 | 11% |

| Shawnee | $183 | -8% |

| Silver Lake | $178 | -10% |

| Simpson | $201 | 1% |

| Smith Center | $214 | 8% |

| Soldier | $181 | -9% |

| Solomon | $188 | -5% |

| South Haven | $196 | -1% |

| South Hutchinson | $192 | -3% |

| Spearville | $228 | 15% |

| Spivey | $204 | 2% |

| Spring Hill | $179 | -10% |

| St. Francis | $222 | 12% |

| St. George | $176 | -11% |

| St. John | $210 | 6% |

| St. Marys | $180 | -10% |

| St. Paul | $195 | -2% |

| Stafford | $208 | 5% |

| Stark | $197 | -1% |

| Sterling | $200 | 0% |

| Stilwell | $178 | -11% |

| Stockton | $220 | 11% |

| Strong City | $190 | -4% |

| Sublette | $221 | 11% |

| Summerfield | $186 | -6% |

| Sun City | $224 | 13% |

| Sylvan Grove | $200 | 1% |

| Sylvia | $201 | 1% |

| Syracuse | $225 | 13% |

| Talmage | $194 | -2% |

| Tampa | $191 | -4% |

| Tecumseh | $181 | -9% |

| Tescott | $185 | -7% |

| Thayer | $195 | -2% |

| Tipton | $205 | 3% |

| Tonganoxie | $188 | -5% |

| Topeka | $183 | -8% |

| Toronto | $196 | -1% |

| Towanda | $199 | 0% |

| Treece | $195 | -2% |

| Tribune | $218 | 10% |

| Troy | $188 | -5% |

| Turon | $200 | 1% |

| Tyro | $197 | -1% |

| Udall | $195 | -2% |

| Ulysses | $222 | 12% |

| Uniontown | $198 | -1% |

| Utica | $217 | 9% |

| Valley Center | $201 | 1% |

| Valley Falls | $189 | -5% |

| Vassar | $190 | -4% |

| Vermillion | $185 | -7% |

| Victoria | $196 | -1% |

| Viola | $199 | 0% |

| Virgil | $196 | -2% |

| Wakarusa | $179 | -10% |

| Wakeeney | $224 | 13% |

| Wakefield | $189 | -5% |

| Waldo | $208 | 5% |

| Waldron | $210 | 6% |

| Walker | $196 | -1% |

| Wallace | $217 | 9% |

| Walnut | $191 | -4% |

| Walton | $184 | -7% |

| Wamego | $178 | -11% |

| Washington | $200 | 1% |

| Waterville | $192 | -3% |

| Wathena | $185 | -7% |

| Waverly | $196 | -1% |

| Webber | $204 | 3% |

| Weir | $191 | -4% |

| Welda | $195 | -2% |

| Wellington | $196 | -1% |

| Wellsville | $187 | -6% |

| Weskan | $218 | 10% |

| West Mineral | $193 | -3% |

| Westmoreland | $182 | -8% |

| Westphalia | $193 | -3% |

| Westwood | $190 | -4% |

| Westwood Hills | $191 | -4% |

| Wetmore | $184 | -7% |

| White City | $182 | -8% |

| White Cloud | $185 | -7% |

| Whitewater | $193 | -3% |

| Whiting | $181 | -9% |

| Wichita | $209 | 5% |

| Williamsburg | $193 | -3% |

| Wilmore | $228 | 15% |

| Wilsey | $183 | -8% |

| Wilson | $209 | 5% |

| Winchester | $190 | -5% |

| Windom | $188 | -5% |

| Winfield | $198 | -1% |

| Winona | $214 | 8% |

| Woodbine | $188 | -5% |

| Woodston | $218 | 10% |

| Wright | $228 | 15% |

| Yates Center | $196 | -1% |

| Zenda | $205 | 3% |

Kansas car insurance requirements

You need car insurance to drive legally in Kansas. The state’s minimum car insurance requirements include:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000

-

Uninsured motorist

: $25,000 per person, $50,000 per accidentUninsured motorist covers you and your passengers for injuries caused by a driver with no insurance. It’s required in about 20 states and optional everywhere else.

-

Personal injury protection

(PIP) : $4,500PIP covers injuries to you and your passengers, whether you or another driver causes the accident. It also covers lost wages and certain other expenses.

Bodily injury liability helps cover the medical bills of anyone you injure in a car accident. Property damage liability covers damage you cause to property like fences, toll booths and light posts.

You typically need to add collision

How we selected the cheapest car insurance companies in Kansas

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $4,500 per person

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Kansas

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.