Cheapest Car Insurance in Louisiana (2026)

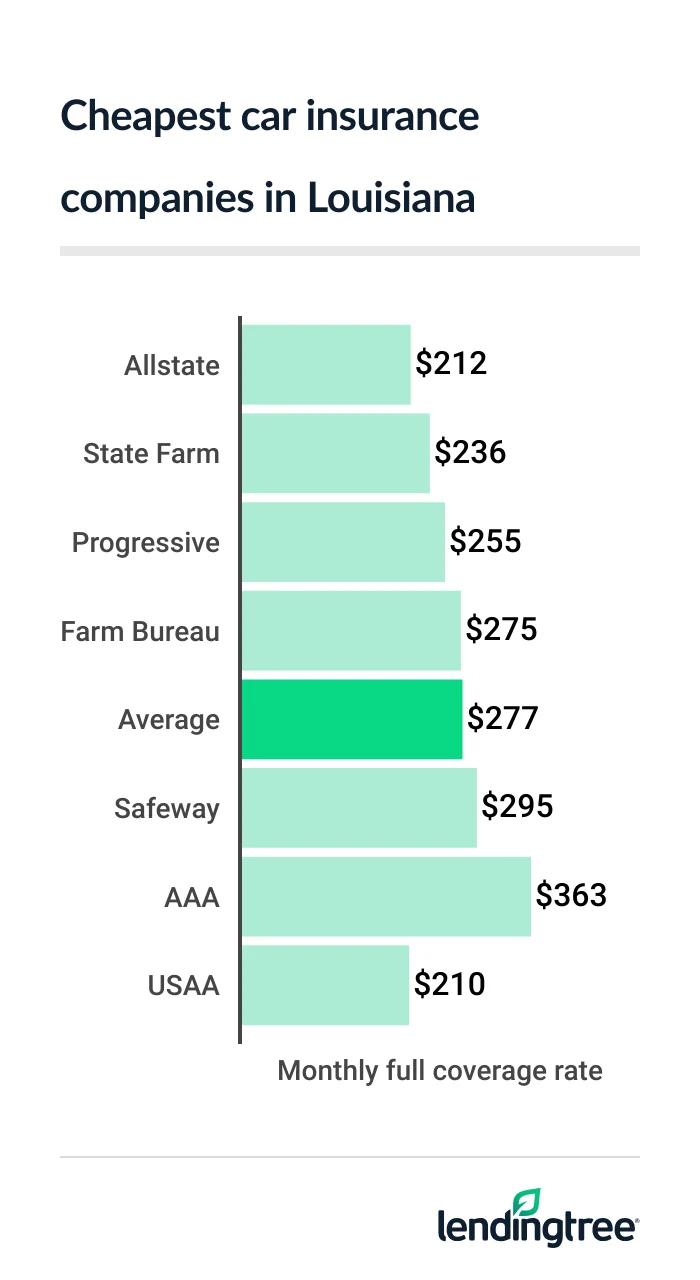

Allstate has the cheapest car insurance rates for most Louisiana drivers, at $212 a month for full coverage. This is $65 less than the state average of $277 a month.

Best cheap Louisiana car insurance

Louisiana’s cheapest full coverage car insurance: Allstate

Allstate has the cheapest full coverage car insurance for most Louisiana drivers, at $212 a month. This is 10% less than the next-cheapest rate of $236 a month from State Farm.

USAA is cheaper than both companies for full coverage

Full coverage costs an average of $277 a month in Louisiana. Your actual rate depends on factors like your driving record, location and credit.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Allstate | $212 | |

| State Farm | $236 | |

| Progressive | $255 | |

| Farm Bureau | $275 | |

| Safeway | $295 | |

| AAA | $363 | |

| Geico | $371 | |

| USAA* | $210 | |

Each company treats these factors differently and offers different car insurance discounts. This makes it good to compare car insurance quotes to find the cheapest rate.

Cheapest Louisiana liability insurance: Allstate

At $61 a month, Allstate has Louisiana’s cheapest liability insurance. Progressive and State Farm have the next-cheapest liability-only insurance

Cheapest liability auto insurance

| Company | Monthly rate |

|---|---|

| Allstate | $61 |

| Progressive | $73 |

| State Farm | $76 |

| Farm Bureau | $101 |

| AAA | $104 |

| Geico | $119 |

| Safeway | $144 |

| USAA* | $77 |

State Farm has a better satisfaction rating from J.D. Power

Cheap car insurance for Louisiana teens: Allstate

Most Louisianans can get the cheapest car insurance for teens from Allstate. The company charges young drivers an average of $211 a month for liability insurance. This is 20% less than the next-cheapest rate of $264 a month from State Farm.

Allstate also has the cheapest full coverage for most teens, at $624 a month. This is only 2% less than State Farm’s rate.

Teen auto insurance rates

| Company | Liability-only | Full coverage |

|---|---|---|

| Allstate | $211 | $624 |

| State Farm | $264 | $636 |

| Geico | $314 | $894 |

| Farm Bureau | $358 | $911 |

| AAA | $360 | $1,062 |

| Safeway | $370 | $687 |

| Progressive | $410 | $1,371 |

| USAA* | $211 | $518 |

A lack of driving experience makes teens more likely to crash than older drivers. This is the main reason why they get charged so much for car insurance. Young drivers usually get cheaper rates on a parent’s policy than they do on their own.

Discounts also help make car insurance more affordable for young drivers and their families.

- Most companies, including Allstate and Geico, give teens a discount for getting good grades.

- State Farm and Geico are among the companies that give teens a discount for completing a driver training course.

It’s good to ask about these and other teen discounts when you get your car insurance quotes.

Best Louisiana car insurance rates after a speeding ticket: State Farm

Louisiana drivers with a speeding ticket get the cheapest car insurance quotes from State Farm. The company’s rates only go up to $249 a month after a ticket. This is 9% less than Allstate’s rate of $274 a month.

Insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $249 |

| Allstate | $274 |

| Farm Bureau | $275 |

| Safeway | $303 |

| Progressive | $328 |

| AAA | $506 |

| Geico | $523 |

| USAA* | $270 |

A speeding ticket raises insurance rates by an average of 23% in Louisiana to $341 a month. However, some companies increase their rates by smaller amounts. Shopping around helps you avoid overpaying for car insurance with a bad driving record.

Louisiana’s cheapest car insurance after an accident: State Farm

At $236 a month, State Farm has Louisiana’s cheapest car insurance after an at-fault accident. State Farm’s rate is 38% less than the average of $383 a month after an accident. Farm Bureau is the next-cheapest company, at $275 a month.

Insurance rates with an accident

| Company | Monthly rate |

|---|---|

| State Farm | $236 |

| Farm Bureau | $275 |

| Allstate | $318 |

| Safeway | $366 |

| Progressive | $407 |

| Geico | $572 |

| AAA | $582 |

| USAA* | $307 |

An accident raises the average price of car insurance in Louisiana by 38%. You can avoid a potential rate hike like this by adding accident forgiveness

Allstate and Progressive are among the companies that offer accident forgiveness. State Farm does not.

Best insurance for LA teens with bad driving records: Allstate/State Farm

Allstate and State Farm have Louisiana’s cheapest car insurance for teens with bad driving records. Allstate has the cheapest rates for teens with a speeding ticket, at $279 a month. This is only slightly less than State Farm’s rate of $289 a month.

State Farm has the cheapest quotes for teens with an at-fault accident, at $264 a month. This is 23% less than Allstate’s rate of $341 a month.

Insurance rates for bad teen drivers

| Company | Ticket | Accident |

|---|---|---|

| Allstate | $279 | $341 |

| State Farm | $289 | $264 |

| Farm Bureau | $358 | $358 |

| Safeway | $388 | $479 |

| Progressive | $421 | $456 |

| Geico | $512 | $465 |

| AAA | $565 | $675 |

| USAA* | $357 | $402 |

Cheapest LA car insurance after a DWI: Allstate

At $274 a month, Allstate has the cheapest car insurance for Louisiana drivers with a DWI (driving while intoxicated). This is barely cheaper than Farm Bureau’s rate of $275 a month. Progressive also has cheap DWI insurance at $290 a month.

Car insurance rates with a DWI

| Company | Monthly rate |

|---|---|

| Allstate | $274 |

| Farm Bureau | $275 |

| Progressive | $290 |

| Safeway | $391 |

| State Farm | $531 |

| AAA | $538 |

| Geico | $715 |

| USAA* | $420 |

Best Louisiana bad-credit car insurance rates: Allstate

At $212 a month, Allstate has Louisiana’s best rates for bad-credit car insurance. Safeway is the next-cheapest company at $294 a month for drivers with bad credit. This is nearly 40% higher than Allstate’s rate.

Bad credit car insurance rates

| Company | Monthly rate |

|---|---|

| Allstate | $212 |

| Safeway | $295 |

| Progressive | $438 |

| Geico | $559 |

| Farm Bureau | $570 |

| AAA | $1,032 |

| State Farm | $1,139 |

| USAA* | $340 |

Insurance companies check your credit for things like your payment history and the amounts you borrow. Avoiding late payments and paying down debts can help you get cheaper car insurance.

Best car insurance in Louisiana

Allstate, State Farm and USAA are the best car insurance companies in Louisiana.

Allstate has Louisiana’s cheapest rates for most drivers. It also offers accident forgiveness, which you can’t get from State Farm. State Farm is a little more expensive for some drivers than Allstate, but it has a better satisfaction score.

Insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| AAA | 652 | A+ | |

| Allstate | 635 | A+ | |

| Farm Bureau | 645 | A | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| Safeway | Not rated | A | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

State Farm also offers a few more discounts than Allstate, including discounts for military personnel and drivers over 55 who take a defensive driving class. If you qualify, these could make State Farm your cheapest option.

USAA is the best choice if you meet its eligibility requirements. Its rates are among the state’s cheapest if you don’t have tickets or accidents. USAA also has a better satisfaction score than every other company.

Louisiana car insurance rates by city

New Orleans is Louisiana’s most expensive city for car insurance at $438 a month.

Car insurance tends to cost more in areas with higher accident rates, more crime or both. Higher medical and car repair costs can also drive up an area’s insurance costs.

Hornbeck has Louisiana’s cheapest car insurance, at $217 a month. This is barely cheaper than Sarepta’s rate of $218 a month. Drivers in Baton Rouge pay $334 a month for car insurance, or 21% more than the state average.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Abbeville | $258 | -7% |

| Abita Springs | $264 | -5% |

| Acme | $251 | -9% |

| Addis | $310 | 12% |

| Aimwell | $241 | -13% |

| Akers | $286 | 3% |

| Albany | $286 | 3% |

| Alexandria | $301 | 9% |

| Ama | $298 | 8% |

| Amelia | $254 | -9% |

| Amite City | $275 | -1% |

| Anacoco | $220 | -21% |

| Angie | $271 | -2% |

| Angola | $284 | 2% |

| Arabi | $426 | 54% |

| Arcadia | $220 | -20% |

| Archibald | $270 | -3% |

| Arnaudville | $281 | 1% |

| Ashland | $238 | -14% |

| Athens | $227 | -18% |

| Atlanta | $238 | -14% |

| Avery Island | $263 | -5% |

| Avondale | $377 | 36% |

| Baker | $321 | 16% |

| Baldwin | $248 | -11% |

| Ball | $285 | 3% |

| Banks Springs | $255 | -8% |

| Barataria | $336 | 21% |

| Barksdale AFB | $229 | -17% |

| Basile | $267 | -4% |

| Baskin | $238 | -14% |

| Bastrop | $247 | -11% |

| Batchelor | $303 | 9% |

| Baton Rouge | $334 | 21% |

| Bawcomville | $268 | -3% |

| Bayou Blue | $265 | -4% |

| Bayou Cane | $263 | -5% |

| Bayou Country Club | $248 | -10% |

| Bayou Gauche | $272 | -2% |

| Bayou Goula | $317 | 14% |

| Bayou L’Ourse | $268 | -3% |

| Bayou Vista | $251 | -9% |

| Belcher | $237 | -14% |

| Bell City | $269 | -3% |

| Belle Chasse | $354 | 28% |

| Belle Rose | $293 | 6% |

| Belmont | $226 | -18% |

| Bentley | $252 | -9% |

| Benton | $229 | -18% |

| Bernice | $231 | -17% |

| Berwick | $239 | -14% |

| Bethany | $240 | -14% |

| Bienville | $231 | -17% |

| Blanchard | $250 | -10% |

| Bogalusa | $275 | -1% |

| Bonita | $247 | -11% |

| Boothville | $309 | 12% |

| Bordelonville | $334 | 20% |

| Bossier City | $233 | -16% |

| Bourg | $264 | -5% |

| Boutte | $287 | 3% |

| Boyce | $289 | 4% |

| Braithwaite | $321 | 16% |

| Branch | $249 | -10% |

| Breaux Bridge | $288 | 4% |

| Bridge City | $379 | 37% |

| Brittany | $332 | 20% |

| Broussard | $276 | 0% |

| Brownfields | $344 | 24% |

| Brownsville | $266 | -4% |

| Brusly | $308 | 11% |

| Bunkie | $311 | 12% |

| Buras | $309 | 12% |

| Burnside | $326 | 17% |

| Bush | $262 | -5% |

| Cade | $280 | 1% |

| Calhoun | $269 | -3% |

| Calvin | $238 | -14% |

| Cameron | $271 | -2% |

| Campti | $246 | -11% |

| Cankton | $283 | 2% |

| Carencro | $289 | 4% |

| Carlyss | $262 | -5% |

| Carville | $312 | 12% |

| Castor | $229 | -17% |

| Catahoula | $281 | 1% |

| Cecilia | $287 | 3% |

| Center Point | $306 | 10% |

| Centerville | $270 | -3% |

| Central | $323 | 16% |

| Chackbay | $249 | -10% |

| Chalmette | $414 | 49% |

| Charenton | $249 | -10% |

| Chase | $231 | -17% |

| Chataignier | $283 | 2% |

| Chatham | $234 | -16% |

| Chauvin | $279 | 1% |

| Cheneyville | $278 | 0% |

| Choudrant | $228 | -18% |

| Church Point | $252 | -9% |

| Claiborne | $268 | -3% |

| Clarence | $244 | -12% |

| Clarks | $237 | -14% |

| Clayton | $238 | -14% |

| Clinton | $305 | 10% |

| Cloutierville | $254 | -8% |

| Colfax | $253 | -9% |

| Collinston | $246 | -11% |

| Columbia | $254 | -8% |

| Convent | $292 | 5% |

| Converse | $226 | -19% |

| Cotton Valley | $222 | -20% |

| Cottonport | $317 | 14% |

| Coushatta | $238 | -14% |

| Covington | $264 | -5% |

| Creole | $272 | -2% |

| Crowley | $247 | -11% |

| Crowville | $257 | -7% |

| Cullen | $223 | -19% |

| Cut Off | $258 | -7% |

| Darrow | $320 | 15% |

| Delcambre | $251 | -9% |

| Delhi | $242 | -13% |

| Delta | $230 | -17% |

| Denham Springs | $308 | 11% |

| Dequincy | $251 | -9% |

| Deridder | $226 | -18% |

| Des Allemands | $272 | -2% |

| Destrehan | $295 | 7% |

| Deville | $282 | 2% |

| Dodson | $239 | -14% |

| Donaldsonville | $311 | 12% |

| Donner | $268 | -3% |

| Downsville | $244 | -12% |

| Doyline | $227 | -18% |

| Dry Creek | $231 | -17% |

| Dry Prong | $254 | -8% |

| Dubach | $224 | -19% |

| Dubberly | $220 | -21% |

| Dulac | $275 | -1% |

| Duplessis | $320 | 15% |

| Dupont | $331 | 20% |

| Duson | $288 | 4% |

| Eastwood | $230 | -17% |

| Echo | $310 | 12% |

| Eden Isle | $282 | 2% |

| Edgard | $311 | 12% |

| Effie | $316 | 14% |

| Egan | $245 | -12% |

| Elizabeth | $257 | -7% |

| Elm Grove | $234 | -16% |

| Elmer | $274 | -1% |

| Elmwood | $339 | 22% |

| Elton | $248 | -10% |

| Empire | $310 | 12% |

| Enterprise | $236 | -15% |

| Epps | $238 | -14% |

| Erath | $252 | -9% |

| Eros | $245 | -11% |

| Erwinville | $307 | 11% |

| Estelle | $388 | 40% |

| Estherwood | $245 | -12% |

| Ethel | $302 | 9% |

| Eunice | $264 | -5% |

| Evangeline | $244 | -12% |

| Evans | $228 | -18% |

| Evergreen | $313 | 13% |

| Fairbanks | $278 | 0% |

| Farmerville | $240 | -13% |

| Fenton | $248 | -11% |

| Ferriday | $240 | -13% |

| Fisher | $222 | -20% |

| Flatwoods | $273 | -2% |

| Flora | $267 | -4% |

| Florien | $221 | -20% |

| Fluker | $278 | 0% |

| Folsom | $271 | -2% |

| Fordoche | $292 | 5% |

| Forest | $259 | -7% |

| Forest Hill | $266 | -4% |

| Fort Jesup | $234 | -15% |

| Fort Johnson | $221 | -20% |

| Fort Necessity | $233 | -16% |

| Fort Polk | $220 | -21% |

| Fort Polk North | $219 | -21% |

| Fort Polk South | $221 | -20% |

| Franklin | $244 | -12% |

| Franklinton | $272 | -2% |

| French Settlement | $301 | 9% |

| Frierson | $224 | -19% |

| Galliano | $263 | -5% |

| Garden City | $270 | -3% |

| Gardere | $315 | 14% |

| Gardner | $287 | 4% |

| Garyville | $306 | 10% |

| Geismar | $321 | 16% |

| Georgetown | $240 | -13% |

| Gheens | $254 | -8% |

| Gibsland | $222 | -20% |

| Gibson | $272 | -2% |

| Gilbert | $235 | -15% |

| Gilliam | $236 | -15% |

| Glenmora | $266 | -4% |

| Gloster | $239 | -14% |

| Glynn | $300 | 8% |

| Golden Meadow | $269 | -3% |

| Goldonna | $250 | -10% |

| Gonzales | $314 | 13% |

| Gorum | $281 | 1% |

| Grambling | $226 | -19% |

| Gramercy | $292 | 6% |

| Grand Cane | $228 | -18% |

| Grand Chenier | $270 | -3% |

| Grand Coteau | $284 | 2% |

| Grand Isle | $312 | 13% |

| Grand Point | $288 | 4% |

| Grant | $257 | -7% |

| Gray | $269 | -3% |

| Grayson | $244 | -12% |

| Greensburg | $285 | 3% |

| Greenwell Springs | $327 | 18% |

| Greenwood | $244 | -12% |

| Gretna | $390 | 41% |

| Grosse Tete | $298 | 8% |

| Gueydan | $264 | -5% |

| Hackberry | $272 | -2% |

| Hahnville | $296 | 7% |

| Hall Summit | $237 | -15% |

| Hamburg | $316 | 14% |

| Hammond | $283 | 2% |

| Harahan | $339 | 22% |

| Harrisonburg | $243 | -12% |

| Harvey | $391 | 41% |

| Haughton | $230 | -17% |

| Hayes | $267 | -4% |

| Haynesville | $225 | -19% |

| Heflin | $222 | -20% |

| Hessmer | $321 | 16% |

| Hester | $287 | 4% |

| Hineston | $268 | -3% |

| Hodge | $221 | -20% |

| Holden | $287 | 3% |

| Homer | $227 | -18% |

| Hornbeck | $217 | -22% |

| Hosston | $238 | -14% |

| Houma | $265 | -4% |

| Husser | $277 | 0% |

| Ida | $237 | -15% |

| Independence | $274 | -1% |

| Innis | $298 | 7% |

| Inniswold | $313 | 13% |

| Iota | $245 | -12% |

| Iowa | $257 | -7% |

| Jackson | $317 | 14% |

| Jamestown | $225 | -19% |

| Jarreau | $299 | 8% |

| Jeanerette | $256 | -8% |

| Jefferson | $342 | 23% |

| Jena | $232 | -16% |

| Jennings | $249 | -10% |

| Jigger | $257 | -7% |

| Jones | $242 | -13% |

| Jonesboro | $221 | -20% |

| Jonesville | $245 | -12% |

| Joyce | $264 | -5% |

| Kaplan | $248 | -10% |

| Keatchie | $232 | -16% |

| Keithville | $239 | -14% |

| Kelly | $237 | -14% |

| Kenner | $346 | 25% |

| Kentwood | $275 | -1% |

| Kilbourne | $234 | -16% |

| Killian | $288 | 4% |

| Kinder | $254 | -8% |

| Kraemer | $249 | -10% |

| Krotz Springs | $281 | 1% |

| Kurthwood | $222 | -20% |

| La Place | $320 | 15% |

| Labadieville | $266 | -4% |

| Lacassine | $263 | -5% |

| Lacombe | $272 | -2% |

| Lafayette | $290 | 5% |

| Lafitte | $340 | 23% |

| Lafourche Crossing | $251 | -10% |

| Lake Arthur | $249 | -10% |

| Lake Charles | $287 | 4% |

| Lake Providence | $239 | -14% |

| Lakeland | $295 | 6% |

| Lakeshore | $278 | 0% |

| Lakeview | $254 | -9% |

| Laplace | $319 | 15% |

| Larose | $260 | -6% |

| Lawtell | $283 | 2% |

| Lebeau | $284 | 2% |

| Leblanc | $258 | -7% |

| Lecompte | $289 | 4% |

| Leesville | $220 | -21% |

| Lena | $274 | -1% |

| Leonville | $281 | 1% |

| Lettsworth | $309 | 12% |

| Libuse | $292 | 5% |

| Lillie | $231 | -17% |

| Lisbon | $230 | -17% |

| Livingston | $291 | 5% |

| Livonia | $292 | 5% |

| Lockport | $257 | -7% |

| Lockport Heights | $258 | -7% |

| Logansport | $230 | -17% |

| Longleaf | $282 | 2% |

| Longstreet | $226 | -19% |

| Longville | $234 | -16% |

| Loranger | $275 | -1% |

| Loreauville | $257 | -7% |

| Lottie | $295 | 6% |

| Luling | $287 | 4% |

| Lutcher | $286 | 3% |

| Lydia | $263 | -5% |

| Madisonville | $262 | -6% |

| Mamou | $278 | 0% |

| Mandeville | $263 | -5% |

| Mangham | $248 | -11% |

| Mansfield | $221 | -20% |

| Mansura | $330 | 19% |

| Many | $221 | -20% |

| Maringouin | $300 | 8% |

| Marion | $240 | -13% |

| Marksville | $326 | 18% |

| Marrero | $391 | 41% |

| Marthaville | $240 | -13% |

| Martin | $238 | -14% |

| Mathews | $258 | -7% |

| Maurepas | $293 | 6% |

| Maurice | $258 | -7% |

| Melrose | $244 | -12% |

| Melville | $288 | 4% |

| Mer Rouge | $244 | -12% |

| Meraux | $408 | 47% |

| Mermentau | $243 | -12% |

| Merrydale | $365 | 32% |

| Merryville | $233 | -16% |

| Metairie | $341 | 23% |

| Midway | $230 | -17% |

| Milton | $287 | 3% |

| Minden | $222 | -20% |

| Minorca | $240 | -13% |

| Mittie | $261 | -6% |

| Monroe | $279 | 1% |

| Montegut | $266 | -4% |

| Monterey | $249 | -10% |

| Montgomery | $246 | -11% |

| Monticello | $339 | 22% |

| Montz | $333 | 20% |

| Mooringsport | $240 | -14% |

| Mora | $283 | 2% |

| Moreauville | $330 | 19% |

| Morgan City | $256 | -8% |

| Morganza | $292 | 5% |

| Morrow | $284 | 2% |

| Morse | $248 | -11% |

| Moss Bluff | $272 | -2% |

| Mount Airy | $310 | 12% |

| Mount Hermon | $274 | -1% |

| Napoleonville | $277 | 0% |

| Natalbany | $278 | 0% |

| Natchez | $244 | -12% |

| Natchitoches | $242 | -13% |

| Negreet | $253 | -9% |

| New Iberia | $266 | -4% |

| New Llano | $219 | -21% |

| New Orleans | $438 | 58% |

| New Roads | $296 | 7% |

| New Sarpy | $293 | 6% |

| Newellton | $239 | -14% |

| Noble | $222 | -20% |

| Norco | $301 | 9% |

| North Hodge | $223 | -20% |

| North Vacherie | $278 | 0% |

| Norwood | $292 | 5% |

| Oak Grove | $236 | -15% |

| Oak Hills Place | $321 | 16% |

| Oak Ridge | $246 | -11% |

| Oakdale | $267 | -4% |

| Oberlin | $255 | -8% |

| Oil City | $234 | -15% |

| Old Jefferson | $314 | 13% |

| Olla | $233 | -16% |

| Opelousas | $283 | 2% |

| Oscar | $299 | 8% |

| Ossun | $290 | 4% |

| Otis | $285 | 3% |

| Paincourtville | $282 | 2% |

| Palmetto | $285 | 3% |

| Paradis | $277 | 0% |

| Patterson | $234 | -15% |

| Paulina | $287 | 4% |

| Pearl River | $272 | -2% |

| Pelican | $225 | -19% |

| Perry | $259 | -6% |

| Pierre Part | $276 | -1% |

| Pilottown | $308 | 11% |

| Pine Grove | $289 | 4% |

| Pine Prairie | $283 | 2% |

| Pineville | $293 | 6% |

| Pioneer | $239 | -14% |

| Pitkin | $234 | -16% |

| Plain Dealing | $220 | -21% |

| Plaquemine | $316 | 14% |

| Plattenville | $289 | 4% |

| Plaucheville | $318 | 15% |

| Pleasant Hill | $230 | -17% |

| Point Place | $241 | -13% |

| Pointe à la Hache | $317 | 14% |

| Pollock | $250 | -10% |

| Ponchatoula | $281 | 1% |

| Port Allen | $314 | 13% |

| Port Barre | $284 | 2% |

| Port Sulphur | $312 | 13% |

| Powhatan | $268 | -3% |

| Poydras | $391 | 41% |

| Prairieville | $314 | 13% |

| Presquille | $263 | -5% |

| Pride | $313 | 13% |

| Prien | $281 | 1% |

| Princeton | $226 | -19% |

| Provencal | $238 | -14% |

| Quitman | $225 | -19% |

| Raceland | $261 | -6% |

| Ragley | $249 | -10% |

| Rayne | $250 | -10% |

| Rayville | $248 | -11% |

| Red Chute | $229 | -17% |

| Reddell | $280 | 1% |

| Reeves | $259 | -6% |

| Reserve | $313 | 13% |

| Rhinehart | $259 | -7% |

| Richmond | $227 | -18% |

| Richwood | $295 | 7% |

| Ringgold | $225 | -19% |

| River Ridge | $347 | 25% |

| Roanoke | $247 | -11% |

| Robeline | $241 | -13% |

| Robert | $289 | 4% |

| Rodessa | $238 | -14% |

| Rosedale | $299 | 8% |

| Roseland | $272 | -2% |

| Rosepine | $226 | -18% |

| Rougon | $302 | 9% |

| Ruby | $306 | 10% |

| Ruston | $220 | -21% |

| Saline | $237 | -15% |

| Sarepta | $218 | -21% |

| Schriever | $261 | -6% |

| Scott | $287 | 4% |

| Shenandoah | $311 | 12% |

| Shongaloo | $221 | -20% |

| Shreveport | $253 | -9% |

| Sibley | $222 | -20% |

| Sicily Island | $242 | -13% |

| Sieper | $284 | 2% |

| Sikes | $240 | -13% |

| Simmesport | $325 | 17% |

| Simpson | $223 | -19% |

| Simsboro | $219 | -21% |

| Singer | $230 | -17% |

| Slagle | $249 | -10% |

| Slaughter | $304 | 10% |

| Slidell | $280 | 1% |

| Sondheimer | $233 | -16% |

| Sorrel | $252 | -9% |

| Sorrento | $319 | 15% |

| South Vacherie | $275 | -1% |

| Spearsville | $233 | -16% |

| Spokane | $238 | -14% |

| Springfield | $288 | 4% |

| Springhill | $223 | -19% |

| St. Amant | $315 | 14% |

| St. Benedict | $291 | 5% |

| St. Bernard | $394 | 42% |

| St. Francisville | $292 | 5% |

| St. Gabriel | $317 | 14% |

| St. James | $292 | 5% |

| St. Joseph | $241 | -13% |

| St. Landry | $288 | 4% |

| St. Martinville | $283 | 2% |

| St. Maurice | $262 | -5% |

| St. Rose | $301 | 9% |

| Stanley | $229 | -17% |

| Starks | $257 | -7% |

| Start | $246 | -11% |

| Sterlington | $275 | -1% |

| Stonewall | $234 | -16% |

| Sugartown | $231 | -17% |

| Sulphur | $262 | -5% |

| Summerfield | $225 | -19% |

| Sun | $268 | -4% |

| Sunset | $285 | 3% |

| Sunshine | $314 | 13% |

| Supreme | $273 | -2% |

| Swartz | $274 | -1% |

| Talisheek | $265 | -4% |

| Tallulah | $228 | -18% |

| Tangipahoa | $275 | -1% |

| Taylor | $251 | -9% |

| Terrytown | $395 | 43% |

| Theriot | $268 | -3% |

| Thibodaux | $251 | -9% |

| Tickfaw | $276 | 0% |

| Timberlane | $395 | 42% |

| Tioga | $307 | 11% |

| Transylvania | $235 | -15% |

| Triumph | $310 | 12% |

| Trout | $230 | -17% |

| Tullos | $230 | -17% |

| Tunica | $297 | 7% |

| Turkey Creek | $282 | 2% |

| Uncle Sam | $316 | 14% |

| Union | $292 | 5% |

| Urania | $228 | -18% |

| Vacherie | $275 | -1% |

| Varnado | $293 | 6% |

| Venice | $309 | 11% |

| Ventress | $296 | 7% |

| Vidalia | $239 | -14% |

| Village St. George | $318 | 15% |

| Ville Platte | $282 | 2% |

| Vinton | $259 | -7% |

| Violet | $412 | 49% |

| Vivian | $236 | -15% |

| Waggaman | $375 | 35% |

| Wakefield | $292 | 5% |

| Walker | $301 | 8% |

| Washington | $283 | 2% |

| Waterproof | $237 | -14% |

| Watson | $321 | 16% |

| Welcome | $292 | 5% |

| Welsh | $246 | -11% |

| West Monroe | $268 | -3% |

| Westlake | $270 | -3% |

| Westminster | $307 | 11% |

| Westwego | $377 | 36% |

| Weyanoke | $293 | 6% |

| White Castle | $315 | 13% |

| Wildsville | $237 | -15% |

| Wilson | $304 | 10% |

| Winnfield | $238 | -14% |

| Winnsboro | $233 | -16% |

| Wisner | $236 | -15% |

| Woodmere | $395 | 42% |

| Woodworth | $293 | 6% |

| Youngsville | $289 | 4% |

| Zachary | $324 | 17% |

| Zwolle | $221 | -20% |

Minimum coverage for car insurance in Louisiana

You need car insurance to drive legally in Louisiana. The minimum insurance coverage required by law includes:

- Bodily injury liability: $15,000 per person, $30,000 per accident

- Property damage liability: $25,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

Collision

Uninsured motorist

Uninsured motorist coverage tends to be cheap. It can protect you from large medical bills if you’re injured by a driver without insurance.

Frequently asked questions

Yes. Car insurance is required by law in Louisiana. You have to have basic amounts of liability coverage to drive legally.

Liability car insurance costs an average of $94 a month in Louisiana. Full coverage costs $277 a month, on average. Your rates are likely to vary based on factors like your driving record, location and credit.

Allstate, State Farm and USAA have the cheapest car insurance in Louisiana. Allstate is cheapest for most drivers without a ticket or accident. State Farm is cheaper after a ticket or accident. USAA is often cheaper than both companies, but it’s only available to the military community.

How we selected the cheapest car insurance companies in Louisiana

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Louisiana

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.