Cheapest Car Insurance in Maryland (2026)

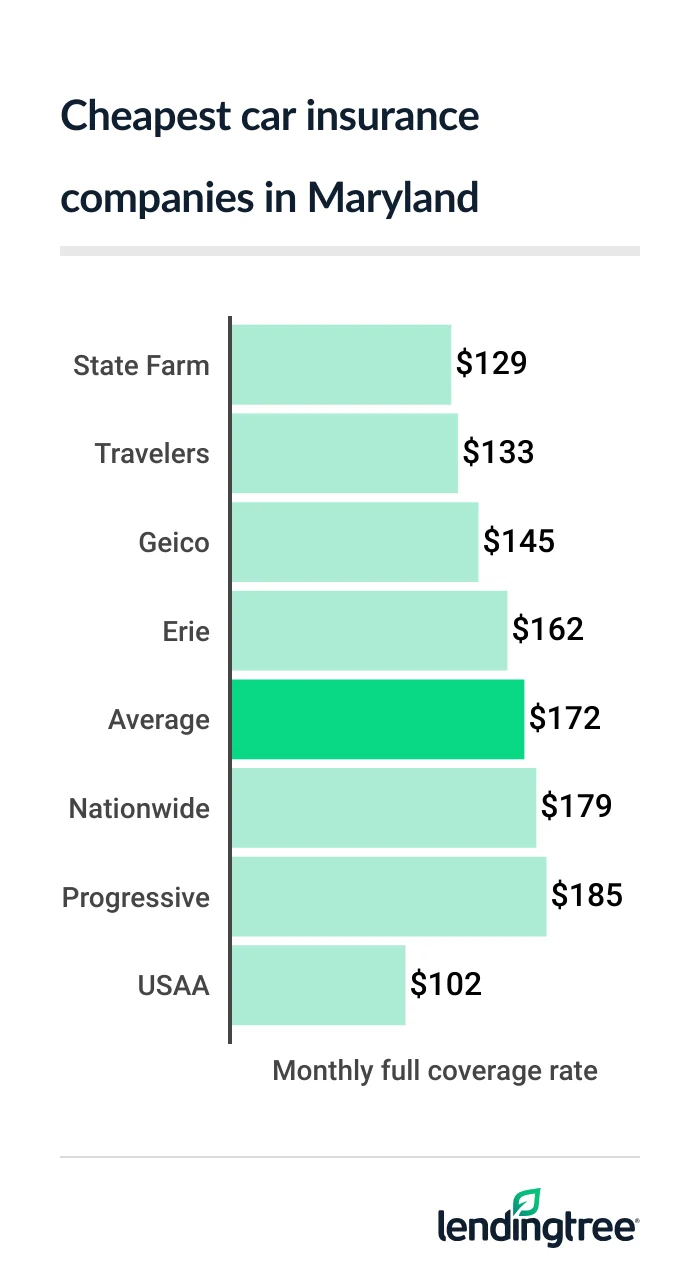

State Farm has the cheapest car insurance in Maryland for most drivers, at $129 for full coverage. This is $43 less than the state average of $172 per month.

Best cheap car insurance in Maryland

Cheapest full coverage car insurance in Maryland: State Farm

Most drivers in Maryland get the cheapest full coverage car insurance from State Farm, which offers an average rate of $129 per month.

Travelers is right behind at $133 per month for full coverage

Full coverage car insurance costs $172 per month, on average, in Maryland. State Farm’s average rate is 25% cheaper.

Full coverage auto insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $129 |  |

| Travelers | $133 |  |

| Geico | $145 | |

| Erie | $162 | |

| Nationwide | $179 | |

| Progressive | $185 | |

| Maryland Auto | Maryland Auto | $339 | Not rated |

| USAA* | $102 | |

Both State Farm and Travelers have several car insurance discounts that can help you save money.

State Farm has a few savings options that Travelers does not offer, such as discounts for anti-theft devices and vehicle safety features. Similarly, Travelers has offerings that State Farm lacks, such as discounts for owning a home and owning a vehicle that’s new, hybrid or electric.

Maryland’s best cheap liability insurance: State Farm

State Farm also has the cheapest liability car insurance for most Maryland drivers, with an average rate of $64 per month.

Travelers, Erie and Geico are next, each with rates of around $70 per month for liability or minimum coverage

Liability auto insurance rates

| Company | Monthly rate |

|---|---|

| State Farm | $64 |

| Travelers | $69 |

| Erie | $71 |

| Geico | $72 |

| Nationwide | $88 |

| Progressive | $131 |

| Maryland Auto | $140 |

| USAA* | $40 |

Geico has the highest average rate among the top cheapest companies, but it also has the most discounts. It’s possible to save money if your car has air bags, you have a clean driving record and you insure more than one vehicle. If you can get a few of them, Geico might be your cheapest option for Maryland car insurance.

Maryland Auto Insurance has the most expensive car insurance rates in the state for drivers who want minimum or full coverage. This is because the state runs Maryland Auto, and you can only buy a policy from it if your previous policy was canceled or you’ve been denied coverage by two or more companies.

Cheap car insurance for Maryland teens: Erie

At $149 per month, Erie has the cheapest car insurance rates for most teen drivers in Maryland. It also has the cheapest teen car insurance for those who want full coverage, at $349 per month.

State Farm and Travelers are the next-cheapest companies for most Maryland teens.

Monthly car insurance rates for teens

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Erie | $149 | $349 |

| State Farm | $187 | $381 |

| Travelers | $188 | $359 |

| Maryland Auto | $238 | $572 |

| Geico | $257 | $553 |

| Progressive | $284 | $473 |

| Nationwide | $315 | $567 |

| USAA* | $98 | $238 |

If you or a family member are or were in the military, make sure you compare car insurance quotes from USAA before you buy or renew a policy. It is by far the cheapest company for these drivers.

Most car insurance companies have discounts that can help make teen car insurance more affordable. Erie, State Farm and Travelers are good examples.

- Erie offers discounts for unmarried drivers under 21 who live with their parents, and unmarried young drivers whose parents used to insure them.

- Both State Farm and Travelers give discounts to students who earn good grades.

- All three companies also have discounts for students who go away to school and don’t take a car with them, or who complete an approved driver training course.

Maryland’s cheapest car insurance rates after a speeding ticket: State Farm

State Farm is the cheapest car insurance company in Maryland for most drivers with a speeding ticket on their records. Its average rate for these drivers is $137 per month.

Travelers has the second-cheapest rates for drivers with a ticket, at $176 per month. Geico and Erie come next, each with rates of just under $190 per month.

Car insurance rates after a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $137 |

| Travelers | $176 |

| Geico | $187 |

| Erie | $189 |

| Progressive | $234 |

| Nationwide | $257 |

| Maryland Auto | $339 |

| USAA* | $121 |

Erie has the best customer satisfaction score from J.D. Power

The average cost of car insurance for Maryland drivers after a speeding ticket is $205 per month.

You should expect your car insurance premium

Best cheap Maryland car insurance after an accident: State Farm

Maryland drivers with an at-fault accident on their records should compare quotes from State Farm, which offers rates of around $154 per month.

Travelers comes in second, with rates that average $196 per month.

Car insurance rates after an at-fault accident

| Company | Monthly rate |

|---|---|

| State Farm | $154 |

| Travelers | $196 |

| Geico | $252 |

| Erie | $258 |

| Progressive | $259 |

| Nationwide | $311 |

| Maryland Auto | $447 |

| USAA* | $160 |

The average driver in Maryland pays $254 per month for car insurance after an accident. That’s 48% more than what a driver with a clean record pays. State Farm only raises the rates of its customers by about 19% after an accident, based on our research.

Accident forgiveness

Cheapest auto insurance for Maryland teens with a ticket or accident: Erie

Erie has the cheapest auto insurance in Maryland for most teens with a ticket or accident on their driving records.

The company’s average rate for teens with a speeding ticket is $183 per month. For teens with an accident, its rates average $216 per month.

Monthly rates for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Erie | $183 | $216 |

| State Farm | $202 | $232 |

| Maryland Auto | $238 | $324 |

| Travelers | $246 | $289 |

| Geico | $300 | $329 |

| Progressive | $310 | $318 |

| Nationwide | $342 | $346 |

| USAA* | $138 | $173 |

State Farm has the second-cheapest rates for most Maryland teens with a ticket or accident. Maryland Auto and Travelers are next.

You can get more car insurance discounts from State Farm than you can from Erie, though both offer some good ways for young drivers to save money. Both also offer discounts for things like antilock brakes and paying for your policy in full each year.

Maryland’s cheapest DUI insurance: Erie

At $189 per month, Erie has the cheapest DUI insurance rates in Maryland. Travelers and Geico are next, with rates of just over $200 per month.

All of these companies come in well under the state average of $326 per month for Maryland drivers with a DUI (driving under the influence) conviction.

Car insurance rates with a DUI

| Company | Monthly rate |

|---|---|

| Erie | $189 |

| Travelers | $204 |

| Geico | $207 |

| Progressive | $251 |

| Nationwide | $415 |

| Maryland Auto | $502 |

| State Farm | $617 |

| USAA* | $221 |

If you’re convicted of a DUI in Maryland, expect your car insurance costs to nearly double. Erie customers may see much lower increases, though. Our research shows Erie only raises the rates of its policyholders by around 17% after a DUI.

Cheap car insurance for MD drivers with bad credit: Geico

Geico is the cheapest auto insurance company in Maryland for drivers with bad credit. Its rates average $207 per month. That’s 35% less than the state average of $320 per month.

Second place goes to Travelers, which offers rates of about $247 per month. Progressive comes in third at $265.

Car insurance rates for drivers with bad credit

| Company | Monthly rate |

|---|---|

| Geico | $207 |

| Travelers | $247 |

| Progressive | $265 |

| Nationwide | $297 |

| Maryland Auto | $339 |

| Erie | $371 |

| State Farm | $655 |

| USAA* | $178 |

Maryland drivers with poor credit pay 86% more for car insurance than drivers with good credit.

To improve your credit, focus on paying down debts and avoiding late payments. Once your credit score goes up, shop for car insurance again. You’ll likely get much better quotes.

Best car insurance in Maryland

State Farm and Erie are the best car insurance companies in Maryland for different reasons.

Maryland auto insurance company ratings

| Company | LendingTree | J.D. Power | AM Best |

|---|---|---|---|

| Erie | 703 | A | |

| Geico | 645 | A++ | |

| Maryland Auto | Not rated | Not rated | Not rated |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

State Farm has the best car insurance in Maryland for typical drivers with clean records. It has affordable rates, many discounts and good customer service ratings. It lacks coverage options, however.

Erie is the state’s best car insurance company if you are a teen driver or if you have one in your household. It’s great for drivers with a DUI, too. Erie also stands out for including coverage in its standard policies that most insurers charge extra for, like accident forgiveness and pet injury coverage.

Maryland car insurance rates by city

Easton is Maryland’s cheapest city for car insurance, with rates that average $141 per month. The state’s most expensive city for car insurance is Gwynn Oak, where rates average $256 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Abell | $162 | -6% |

| Aberdeen | $181 | 5% |

| Aberdeen Proving Ground | $186 | 8% |

| Abingdon | $181 | 6% |

| Accident | $156 | -9% |

| Accokeek | $207 | 20% |

| Adamstown | $155 | -10% |

| Adelphi | $217 | 26% |

| Algonquin | $148 | -14% |

| Allen | $152 | -11% |

| Andrews AFB | $198 | 15% |

| Annapolis | $171 | 0% |

| Annapolis Junction | $179 | 4% |

| Annapolis Neck | $172 | 0% |

| Aquasco | $195 | 13% |

| Arbutus | $232 | 35% |

| Arden on the Severn | $169 | -1% |

| Arnold | $167 | -2% |

| Ashton | $172 | 0% |

| Aspen Hill | $184 | 7% |

| Avenue | $161 | -6% |

| Baden | $202 | 18% |

| Baldwin | $178 | 4% |

| Ballenger Creek | $154 | -11% |

| Baltimore | $252 | 47% |

| Barclay | $148 | -14% |

| Barnesville | $168 | -2% |

| Barstow | $163 | -5% |

| Barton | $152 | -11% |

| Beallsville | $170 | -1% |

| Bel Air | $170 | -1% |

| Bel Air North | $169 | -1% |

| Bel Air South | $170 | -1% |

| Bel Alton | $175 | 2% |

| Belcamp | $181 | 6% |

| Beltsville | $207 | 20% |

| Benedict | $183 | 6% |

| Benson | $176 | 3% |

| Bensville | $191 | 11% |

| Berlin | $142 | -17% |

| Berwyn Heights | $201 | 17% |

| Bethesda | $154 | -10% |

| Bethlehem | $145 | -16% |

| Betterton | $149 | -13% |

| Big Pool | $151 | -12% |

| Bishopville | $142 | -17% |

| Bittinger | $154 | -10% |

| Bivalve | $152 | -12% |

| Bladensburg | $226 | 32% |

| Bloomington | $154 | -10% |

| Boonsboro | $151 | -12% |

| Boring | $187 | 9% |

| Bowie | $193 | 12% |

| Bowleys Quarters | $211 | 23% |

| Bowmans Addition | $147 | -14% |

| Boyds | $171 | 0% |

| Bozman | $146 | -15% |

| Braddock Heights | $154 | -10% |

| Brandywine | $210 | 22% |

| Brentwood | $221 | 29% |

| Brinklow | $173 | 1% |

| Brookeville | $167 | -3% |

| Brooklandville | $201 | 17% |

| Brooklyn | $227 | 32% |

| Brooklyn Park | $219 | 27% |

| Brookmont | $155 | -9% |

| Broomes Island | $163 | -5% |

| Brownsville | $156 | -9% |

| Brunswick | $156 | -9% |

| Bryans Road | $188 | 10% |

| Bryantown | $180 | 5% |

| Buckeystown | $154 | -10% |

| Burkittsville | $154 | -10% |

| Burtonsville | $190 | 10% |

| Bushwood | $162 | -6% |

| Butler | $196 | 14% |

| Cabin John | $158 | -8% |

| California | $158 | -8% |

| Callaway | $159 | -7% |

| Calverton | $199 | 16% |

| Cambridge | $148 | -14% |

| Camp Springs | $222 | 29% |

| Capitol Heights | $235 | 37% |

| Carney | $211 | 23% |

| Cascade | $150 | -13% |

| Catonsville | $225 | 31% |

| Cavetown | $151 | -12% |

| Cecilton | $160 | -7% |

| Cedarville | $208 | 21% |

| Centreville | $146 | -15% |

| Chance | $150 | -13% |

| Chaptico | $163 | -5% |

| Charlestown | $176 | 3% |

| Charlotte Hall | $174 | 2% |

| Chase | $203 | 18% |

| Cheltenham | $206 | 20% |

| Chesapeake Beach | $166 | -3% |

| Chesapeake City | $167 | -3% |

| Chesapeake Ranch Estates | $162 | -6% |

| Chester | $145 | -16% |

| Chestertown | $147 | -15% |

| Cheverly | $233 | 36% |

| Chevy Chase | $156 | -9% |

| Chevy Chase Section Five | $157 | -9% |

| Chevy Chase Section Three | $157 | -9% |

| Chevy Chase View | $161 | -6% |

| Chevy Chase Village | $156 | -9% |

| Chewsville | $153 | -11% |

| Childs | $180 | 5% |

| Chillum | $216 | 26% |

| Church Creek | $150 | -13% |

| Church Hill | $147 | -14% |

| Churchton | $174 | 1% |

| Churchville | $174 | 2% |

| Claiborne | $146 | -15% |

| Clarksburg | $173 | 1% |

| Clarksville | $175 | 2% |

| Clear Spring | $151 | -12% |

| Clements | $161 | -6% |

| Clinton | $205 | 19% |

| Cobb Island | $178 | 4% |

| Cockeysville | $208 | 21% |

| Colesville | $196 | 14% |

| College Park | $205 | 19% |

| Colmar Manor | $222 | 29% |

| Colora | $173 | 1% |

| Coltons Point | $160 | -7% |

| Columbia | $181 | 5% |

| Compton | $158 | -8% |

| Conowingo | $175 | 2% |

| Cooksville | $173 | 1% |

| Coral Hills | $236 | 38% |

| Cordova | $145 | -15% |

| Corriganville | $150 | -13% |

| Cottage City | $223 | 30% |

| Crapo | $151 | -12% |

| Cresaptown | $150 | -13% |

| Crisfield | $149 | -13% |

| Crocheron | $150 | -13% |

| Crofton | $171 | 0% |

| Croom | $206 | 20% |

| Crownsville | $169 | -1% |

| Crumpton | $147 | -14% |

| Cumberland | $147 | -14% |

| Curtis Bay | $196 | 14% |

| Damascus | $168 | -2% |

| Dameron | $161 | -6% |

| Dames Quarter | $151 | -12% |

| Darlington | $173 | 0% |

| Darnestown | $170 | -1% |

| Davidsonville | $172 | 0% |

| Dayton | $172 | 0% |

| Deal Island | $150 | -13% |

| Deale | $173 | 1% |

| Deer Park | $157 | -9% |

| Delmar | $149 | -13% |

| Denton | $147 | -14% |

| Derwood | $173 | 1% |

| Dickerson | $163 | -5% |

| District Heights | $231 | 35% |

| Dowell | $162 | -5% |

| Drayden | $159 | -7% |

| Drum Point | $162 | -6% |

| Dundalk | $218 | 27% |

| Dunkirk | $165 | -4% |

| Earleville | $157 | -9% |

| East New Market | $150 | -13% |

| East Riverdale | $222 | 29% |

| Easton | $141 | -18% |

| Eckhart Mines | $147 | -14% |

| Eden | $149 | -13% |

| Edgemere | $205 | 19% |

| Edgewater | $170 | -1% |

| Edgewood | $193 | 12% |

| Edmonston | $223 | 30% |

| Eldersburg | $168 | -2% |

| Elk Mills | $180 | 5% |

| Elkridge | $185 | 8% |

| Elkton | $175 | 2% |

| Ellerslie | $153 | -11% |

| Ellicott City | $182 | 6% |

| Emmitsburg | $153 | -11% |

| Essex | $217 | 26% |

| Ewell | $151 | -12% |

| Fairland | $189 | 10% |

| Fairmount Heights | $235 | 37% |

| Fairplay | $150 | -12% |

| Fairwood | $193 | 12% |

| Fallston | $175 | 2% |

| Faulkner | $179 | 4% |

| Federalsburg | $147 | -14% |

| Ferndale | $196 | 14% |

| Finksburg | $172 | 0% |

| Fishing Creek | $150 | -13% |

| Flintstone | $152 | -12% |

| Forest Heights | $226 | 31% |

| Forest Hill | $169 | -1% |

| Forestville | $228 | 33% |

| Fork | $182 | 6% |

| Fort Howard | $193 | 12% |

| Fort Meade | $185 | 8% |

| Fort Washington | $210 | 22% |

| Fountainhead-Orchard Hills | $150 | -12% |

| Four Corners | $185 | 8% |

| Frederick | $155 | -10% |

| Freeland | $172 | 0% |

| Friendly | $214 | 24% |

| Friendship | $175 | 2% |

| Friendship Heights Village | $155 | -10% |

| Friendsville | $156 | -9% |

| Frostburg | $147 | -14% |

| Fruitland | $151 | -12% |

| Fulton | $173 | 1% |

| Funkstown | $153 | -11% |

| Gaithersburg | $175 | 2% |

| Galena | $148 | -14% |

| Galesville | $175 | 2% |

| Gambrills | $177 | 3% |

| Gapland | $151 | -12% |

| Garrett Park | $162 | -5% |

| Garrison | $235 | 37% |

| Georgetown | $157 | -8% |

| Germantown | $175 | 2% |

| Gibson Island | $174 | 1% |

| Girdletree | $146 | -15% |

| Glassmanor | $226 | 32% |

| Glen Arm | $193 | 13% |

| Glen Burnie | $197 | 15% |

| Glen Echo | $159 | -7% |

| Glenarden | $215 | 25% |

| Glenelg | $173 | 1% |

| Glenn Dale | $204 | 19% |

| Glenwood | $167 | -3% |

| Glyndon | $205 | 19% |

| Goldsboro | $143 | -17% |

| Grahamtown | $147 | -14% |

| Grantsville | $155 | -10% |

| Grasonville | $143 | -17% |

| Great Mills | $157 | -9% |

| Greenbelt | $201 | 17% |

| Greensboro | $145 | -16% |

| Gunpowder | $191 | 11% |

| Gwynn Oak | $256 | 49% |

| Hagerstown | $153 | -11% |

| Halethorpe | $225 | 31% |

| Halfway | $150 | -12% |

| Hampstead | $166 | -3% |

| Hampton | $206 | 20% |

| Hancock | $151 | -12% |

| Hanover | $188 | 9% |

| Harmans | $188 | 9% |

| Harwood | $175 | 2% |

| Havre De Grace | $178 | 4% |

| Hebron | $150 | -13% |

| Helen | $159 | -7% |

| Henderson | $145 | -15% |

| Herald Harbor | $169 | -1% |

| Highland | $172 | 0% |

| Hillandale | $211 | 23% |

| Hillcrest Heights | $230 | 34% |

| Hillsboro | $146 | -15% |

| Hollywood | $155 | -9% |

| Hughesville | $179 | 5% |

| Hunt Valley | $209 | 22% |

| Huntingtown | $164 | -5% |

| Hurlock | $149 | -13% |

| Hyattsville | $227 | 32% |

| Hydes | $183 | 7% |

| Ijamsville | $156 | -9% |

| Ilchester | $184 | 7% |

| Indian Head | $191 | 11% |

| Ingleside | $147 | -14% |

| Ironsides | $189 | 10% |

| Issue | $180 | 5% |

| Jarrettsville | $174 | 2% |

| Jefferson | $154 | -10% |

| Jessup | $183 | 6% |

| Joppa | $181 | 5% |

| Keedysville | $152 | -12% |

| Kemp Mill | $183 | 7% |

| Kennedyville | $147 | -14% |

| Kensington | $165 | -4% |

| Kettering | $205 | 20% |

| Keymar | $157 | -9% |

| Kingsville | $187 | 9% |

| Kitzmiller | $155 | -10% |

| Knoxville | $156 | -9% |

| Konterra | $188 | 10% |

| La Plata | $177 | 3% |

| La Vale | $146 | -15% |

| Ladiesburg | $155 | -10% |

| Lake Arbor | $205 | 20% |

| Lake Shore | $172 | 0% |

| Landover | $233 | 36% |

| Landover Hills | $225 | 31% |

| Langley Park | $212 | 23% |

| Lanham | $211 | 23% |

| Lanham Seabrook | $211 | 23% |

| Lansdowne | $220 | 28% |

| Largo | $206 | 20% |

| Laurel | $185 | 8% |

| Laytonsville | $172 | 0% |

| Leitersburg | $149 | -13% |

| Leonardtown | $157 | -8% |

| Lexington Park | $159 | -8% |

| Libertytown | $153 | -11% |

| Lineboro | $171 | 0% |

| Linganore | $154 | -10% |

| Linkwood | $149 | -13% |

| Linthicum | $196 | 14% |

| Linthicum Heights | $192 | 12% |

| Lisbon | $165 | -4% |

| Little Orleans | $152 | -11% |

| Lochearn | $243 | 42% |

| Lonaconing | $150 | -13% |

| Long Green | $198 | 15% |

| Lothian | $177 | 3% |

| Loveville | $161 | -6% |

| Luke | $153 | -11% |

| Lusby | $162 | -6% |

| Lutherville | $197 | 14% |

| Lutherville Timonium | $197 | 15% |

| Maddox | $163 | -5% |

| Madison | $150 | -12% |

| Manchester | $166 | -3% |

| Manokin | $147 | -14% |

| Marbury | $190 | 11% |

| Mardela Springs | $147 | -14% |

| Marion Station | $149 | -13% |

| Marlow Heights | $229 | 33% |

| Marriottsville | $186 | 9% |

| Marydel | $145 | -16% |

| Maryland City | $175 | 2% |

| Maryland Line | $187 | 9% |

| Massey | $150 | -13% |

| Maugansville | $149 | -13% |

| Mayo | $171 | -1% |

| Mc Henry | $155 | -10% |

| McDaniel | $145 | -15% |

| Mechanicsville | $167 | -3% |

| Middle River | $216 | 26% |

| Middletown | $154 | -10% |

| Midland | $153 | -11% |

| Midlothian | $153 | -11% |

| Milford Mill | $244 | 42% |

| Millersville | $174 | 2% |

| Millington | $147 | -14% |

| Mitchellville | $203 | 18% |

| Monkton | $180 | 5% |

| Monrovia | $156 | -9% |

| Montgomery Village | $183 | 7% |

| Morganza | $162 | -6% |

| Morningside | $228 | 33% |

| Mount Aetna | $150 | -13% |

| Mount Airy | $155 | -10% |

| Mount Lena | $151 | -12% |

| Mount Rainier | $222 | 29% |

| Mount Savage | $148 | -14% |

| Mount Vernon | $152 | -12% |

| Mount Victoria | $183 | 6% |

| Mountain Lake Park | $156 | -9% |

| Myersville | $153 | -11% |

| Nanjemoy | $187 | 9% |

| Nanticoke | $150 | -13% |

| National Harbor | $219 | 27% |

| Naval Academy | $169 | -2% |

| Neavitt | $146 | -15% |

| New Carrollton | $224 | 30% |

| New Market | $155 | -10% |

| New Midway | $155 | -10% |

| New Windsor | $164 | -4% |

| Newark | $144 | -16% |

| Newburg | $179 | 4% |

| Newcomb | $144 | -16% |

| North Beach | $168 | -2% |

| North Bethesda | $157 | -9% |

| North East | $171 | -1% |

| North Kensington | $170 | -1% |

| North Potomac | $163 | -5% |

| Nottingham | $210 | 22% |

| Oakland | $156 | -9% |

| Ocean City | $141 | -18% |

| Ocean Pines | $142 | -17% |

| Odenton | $181 | 6% |

| Oldtown | $150 | -13% |

| Olney | $168 | -2% |

| Overlea | $241 | 40% |

| Owings | $166 | -3% |

| Owings Mills | $233 | 36% |

| Oxford | $143 | -16% |

| Oxon Hill | $221 | 29% |

| Paramount-Long Meadow | $150 | -13% |

| Park Hall | $160 | -7% |

| Parkton | $174 | 1% |

| Parkville | $218 | 27% |

| Parole | $171 | 0% |

| Parsonsburg | $148 | -14% |

| Pasadena | $184 | 7% |

| Patuxent River | $157 | -9% |

| Peppermill Village | $234 | 36% |

| Perry Hall | $205 | 19% |

| Perry Point | $176 | 2% |

| Perryman | $183 | 6% |

| Perryville | $174 | 1% |

| Phoenix | $194 | 13% |

| Pikesville | $250 | 46% |

| Piney Point | $160 | -7% |

| Pinto | $152 | -11% |

| Pittsville | $148 | -14% |

| Pleasant Hills | $179 | 4% |

| Pocomoke City | $146 | -15% |

| Point of Rocks | $157 | -8% |

| Pomfret | $182 | 6% |

| Poolesville | $170 | -1% |

| Port Deposit | $179 | 4% |

| Port Republic | $162 | -6% |

| Port Tobacco | $182 | 6% |

| Potomac | $161 | -6% |

| Potomac Heights | $191 | 11% |

| Potomac Park | $147 | -14% |

| Powellville | $147 | -14% |

| Preston | $144 | -16% |

| Price | $146 | -15% |

| Prince Frederick | $164 | -5% |

| Princess Anne | $151 | -12% |

| Pylesville | $176 | 3% |

| Quantico | $151 | -12% |

| Queen Anne | $146 | -15% |

| Queenstown | $143 | -16% |

| Randallstown | $245 | 43% |

| Rawlings | $148 | -14% |

| Redland | $178 | 4% |

| Rehobeth | $147 | -14% |

| Reisterstown | $227 | 32% |

| Rhodesdale | $149 | -13% |

| Riderwood | $204 | 19% |

| Ridge | $160 | -7% |

| Ridgely | $144 | -16% |

| Rising Sun | $173 | 1% |

| Riva | $172 | 0% |

| Riverdale | $224 | 30% |

| Riverdale Park | $223 | 30% |

| Riviera Beach | $175 | 2% |

| Robinwood | $150 | -12% |

| Rock Hall | $145 | -15% |

| Rock Point | $180 | 5% |

| Rockville | $167 | -3% |

| Rocky Ridge | $153 | -11% |

| Rohrersville | $151 | -12% |

| Rosedale | $242 | 41% |

| Rossville | $214 | 25% |

| Royal Oak | $146 | -15% |

| Sabillasville | $153 | -11% |

| Salisbury | $155 | -10% |

| Sandy Spring | $173 | 1% |

| Savage | $185 | 8% |

| Scaggsville | $178 | 4% |

| Scotland | $161 | -6% |

| Seabrook | $210 | 22% |

| Seat Pleasant | $234 | 36% |

| Secretary | $150 | -13% |

| Severn | $192 | 12% |

| Severna Park | $176 | 2% |

| Shady Side | $174 | 1% |

| Sharpsburg | $151 | -12% |

| Sharptown | $150 | -13% |

| Sherwood | $146 | -15% |

| Sherwood Forest | $173 | 1% |

| Showell | $145 | -15% |

| Silver Hill | $231 | 35% |

| Silver Spring | $188 | 9% |

| Simpsonville | $181 | 6% |

| Smithsburg | $151 | -12% |

| Snow Hill | $145 | -15% |

| Solomons | $163 | -5% |

| Somerset | $154 | -10% |

| South Kensington | $164 | -4% |

| South Laurel | $195 | 13% |

| Sparks Glencoe | $191 | 11% |

| Sparrows Point | $209 | 21% |

| Spencerville | $185 | 8% |

| Spring Gap | $152 | -12% |

| Spring Ridge | $154 | -10% |

| Springdale | $209 | 22% |

| St. Inigoes | $160 | -7% |

| St. James | $151 | -12% |

| St. Leonard | $161 | -6% |

| St. Marys | $159 | -7% |

| St. Marys City | $159 | -7% |

| St. Michaels | $144 | -16% |

| Stevenson | $199 | 16% |

| Stevensville | $145 | -16% |

| Still Pond | $147 | -14% |

| Stockton | $146 | -15% |

| Street | $176 | 3% |

| Sudlersville | $147 | -14% |

| Suitland | $230 | 34% |

| Sunderland | $165 | -4% |

| Swanton | $155 | -9% |

| Sykesville | $167 | -3% |

| Takoma Park | $198 | 15% |

| Tall Timbers | $160 | -7% |

| Taneytown | $158 | -8% |

| Taylors Island | $149 | -13% |

| Temple Hills | $225 | 31% |

| Templeville | $144 | -16% |

| Thurmont | $152 | -11% |

| Tilghman | $149 | -13% |

| Tilghmanton | $151 | -12% |

| Timonium | $199 | 16% |

| Toddville | $150 | -12% |

| Towson | $216 | 26% |

| Tracys Landing | $170 | -1% |

| Trappe | $143 | -17% |

| Travilah | $164 | -5% |

| Trego-Rohrersville Station | $151 | -12% |

| Tuscarora | $156 | -9% |

| Tyaskin | $151 | -12% |

| Tylerton | $151 | -12% |

| Union Bridge | $157 | -9% |

| Unionville | $152 | -12% |

| University Park | $223 | 30% |

| Upper Fairmount | $147 | -14% |

| Upper Falls | $184 | 7% |

| Upper Hill | $147 | -14% |

| Upper Marlboro | $207 | 21% |

| Upperco | $180 | 5% |

| Urbana | $155 | -10% |

| Valley Lee | $159 | -8% |

| Vienna | $150 | -13% |

| Waldorf | $193 | 12% |

| Walker Mill | $231 | 35% |

| Walkersville | $155 | -10% |

| Warwick | $158 | -8% |

| Washington Grove | $181 | 5% |

| Welcome | $180 | 5% |

| Wenona | $150 | -13% |

| West Friendship | $169 | -2% |

| West Laurel | $186 | 9% |

| West Ocean City | $142 | -17% |

| West River | $176 | 2% |

| Westernport | $153 | -11% |

| Westminster | $168 | -2% |

| Westover | $148 | -14% |

| Westphalia | $230 | 34% |

| Whaleyville | $145 | -16% |

| Wheaton | $175 | 2% |

| White Hall | $174 | 1% |

| White Marsh | $201 | 17% |

| White Oak | $185 | 8% |

| White Plains | $190 | 11% |

| Whiteford | $178 | 4% |

| Willards | $147 | -15% |

| Williamsport | $149 | -13% |

| Wilson-Conococheague | $150 | -12% |

| Windsor Mill | $251 | 46% |

| Wingate | $151 | -12% |

| Wittman | $147 | -15% |

| Woodbine | $167 | -3% |

| Woodlawn | $245 | 43% |

| Woodmore | $204 | 19% |

| Woodsboro | $160 | -7% |

| Woodstock | $185 | 8% |

| Woolford | $149 | -13% |

| Worton | $148 | -14% |

| Wye Mills | $144 | -16% |

The average cost of car insurance in Baltimore is $252 per month. That’s 47% higher than the state average.

In Columbia, car insurance rates average $181 per month, or only 5% more than the state average.

Minimum coverage for car insurance in Maryland

You need these coverages and limits to meet Maryland’s minimum car insurance requirements:

- Bodily injury liability: $30,000 per person, $60,000 per accident

- Property damage liability: $15,000

- Uninsured motorist bodily injury: $30,000 per person, $60,000 per accident

- Uninsured motorist property damage: $15,000

- Personal injury protection (PIP): $2,500

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property.

PIP covers injuries to you and your passengers, no matter who caused the accident. Even if you have health insurance, PIP can spare you from some out-of-pocket costs.

You can scale back or remove PIP to lower your car insurance rate. If you need help deciding whether to keep it, ask for rates with and without PIP in the quotes you get.

Frequently asked questions

Car insurance in Maryland costs $172 per month, on average, if you buy full coverage. If you only buy minimum coverage, the state average cost is $84 per month.

The cheapest car insurance in Maryland comes from State Farm if you don’t have military ties. For minimum coverage, State Farm’s average rate is $64 per month. For full coverage, its average rate is $129 per month.

USAA’s average rates are cheaper, but you must be current or former military, or be related to someone who is, to qualify.

No, Maryland has traditional at-fault accident laws. If you cause an accident, you are financially responsible for other people’s injuries and property damage. The liability coverage in your car insurance covers these expenses, up to your policy’s limits.

The penalties for driving without insurance in Maryland include a fine and suspension of your vehicle’s registration.

How we selected the cheapest car insurance companies in Maryland

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured / underinsured motorist property damage: $15,000

- Personal injury protection: $2,500

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Maryland

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.