How to Save Money on Car Insurance

There are many ways you can lower your car insurance costs. Comparing quotes from multiple companies is one good option. Discounts are another great way to save on auto insurance.

Between these and other methods, like raising your deductible and dropping coverage you don’t need, you should be able to make your annual premium a lot cheaper.

Compare car insurance quotes

Taking the time to do a car insurance comparison of several companies is one of the best and easiest ways to save money on car insurance.

Auto insurance companies look at many factors when calculating your quote. They weigh the risks tied to these factors differently, though, which is why you may get different quotes from each one. Comparing quotes from a few companies lets you see who will offer you the best combo of cost and coverage.

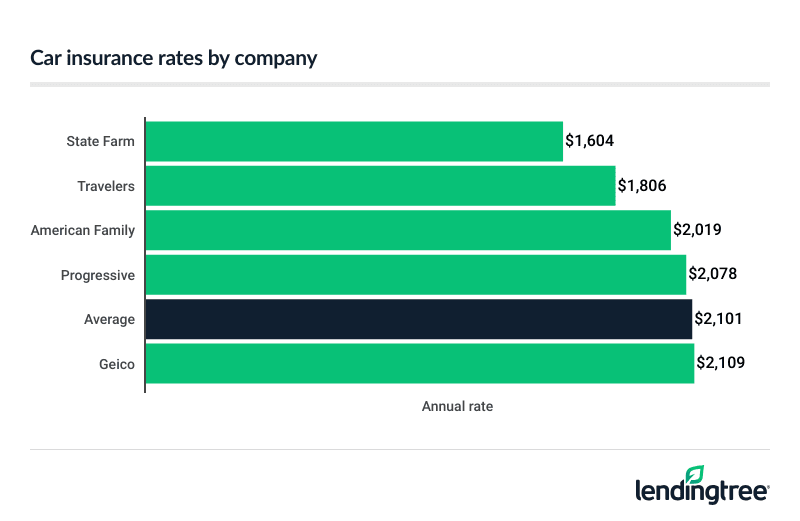

The average cost of car insurance is $2,101 a year for full coverage. Use these sample rates to help you decide where to get car insurance quotes.

Take advantage of discounts

Companies offer car insurance discounts to stay competitive. Not all companies have the same discounts, though. American Family and Nationwide may give you a discount for low mileage, for example, while most other top companies do not.

Also, Allstate offers a bundling discount that can save you up to 25% when you get both auto and home insurance from it. American Family has a similar discount but only promises savings of up to 23%. With Farmers, you can save 10% or more by bundling.

Car insurance discounts by company

| Discount | Progressive | Travelers | State Farm | American Family | Nationwide | Allstate | Farmers |

|---|---|---|---|---|---|---|---|

| Multi-policy/bundle | |||||||

| Multi-car | |||||||

| Safe/good driver | |||||||

| Good student | |||||||

| Teen driver | |||||||

| Paperless | |||||||

| Pay in full | |||||||

| Automatic payment | |||||||

| Driver education | |||||||

| Low mileage |

As important as discounts can be, you should still compare quotes from each company after you figure in discounts. One company offering more discounts than another company doesn’t mean it will be the cheapest for you.

Raise your deductible

If you raise your car insurance deductible

If your deductible is $500 and you file an $8,000 claim, for example, you will need to pay the $500 before your car insurance covers the rest.

Drop coverage you don’t need

Dropping car insurance coverage you no longer need should save you some money as well.

This is especially true if your car is old and only worth only a few thousand dollars. At a point, the cost of a full coverage car insurance policy could be more than the actual cash value of your vehicle. Dropping collision

Before you drop coverage, discuss it with your car insurance agent to make sure you aren’t overlooking any potential issues.

Get usage-based car insurance

If you’re a safe driver, usage-based car insurance (UBI) could be a great way to lower your costs. UBI tracks how often you drive through a telematic device or smartphone app, then adjusts your rate based on your risk level.

If you don’t drive frequently, consider pay-per-mile car insurance. Using technology similar to UBI, pay-per-mile car insurance tracks how often you drive and bases your rate on that. The less you drive, the less you’ll pay for your car insurance.

Some companies that offer usage-based car insurance:

- Allstate

- Liberty Mutual

- Metromile

Improve your credit score

Maintaining a healthy credit history can go a long way toward helping you save on auto insurance. Insurers see a link between your credit score and the chances of you filing a claim, and they may charge you a higher rate to offset any risk. Keeping your credit score high should keep your insurance costs low.

Some states don’t let car insurance companies consider credit while setting rates. Others limit its use.

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX. Teen rates are for an 18-year-old male.

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: minimum limits, where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible