Cheapest Car Insurance in Wisconsin (2026)

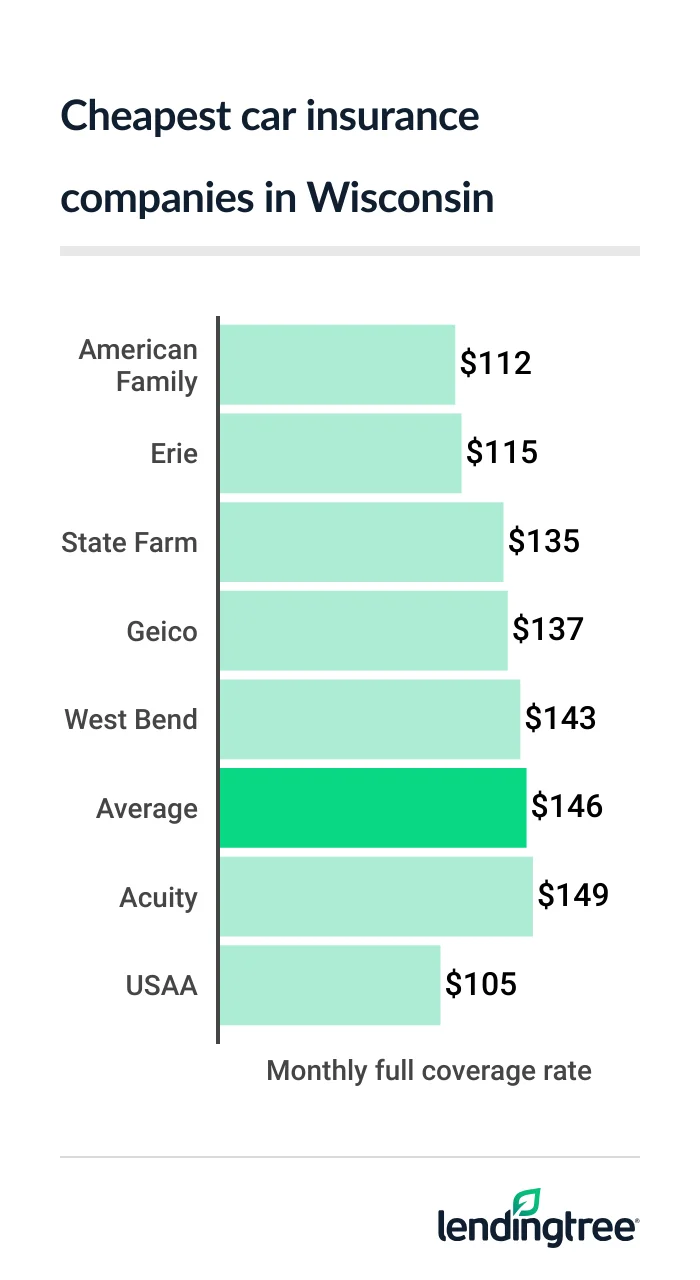

Erie and American Family are the best companies for cheap car insurance in Wisconsin. American Family has the state’s cheapest full coverage at $112 a month.

Best cheap car insurance in Wisconsin

Cheapest full coverage car insurance in Wisconsin: American Family

Most Wisconsin drivers get the cheapest full coverage car insurance from American Family, which offers an average rate of $112 per month. That’s $34 less than the state average of $146 per month for full coverage

Erie is nearly as cheap at $115 per month, while State Farm comes in third at $135 per month.

USAA is cheaper than all three companies, with an average rate of $105 per month. But only active or retired military and their families can buy a policy from USAA.

Both USAA and Erie have much better J.D. Power

Cheapest companies for full coverage

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| American Family | $112 | |

| Erie | $115 | |

| State Farm | $135 | |

| Geico | $137 | |

| West Bend | $143 | |

| Acuity | $149 | |

| Auto-Owners | $149 | |

| Allstate | $203 | |

| Progressive | $209 | |

| USAA* | $105 | |

Wisconsin’s cheapest liability car insurance: Erie

Erie has the cheapest liability insurance rates in Wisconsin, at $25 per month. This is $16 cheaper than the state average of $41 per month.

American Family and State Farm are the next-cheapest companies for liability

Cheapest companies for minimum coverage

| Company | Monthly rate |

|---|---|

| Erie | $25 |

| American Family | $30 |

| State Farm | $33 |

| Auto-Owners | $38 |

| Acuity | $42 |

| Geico | $43 |

| West Bend | $46 |

| Progressive | $49 |

| Allstate | $80 |

| USAA* | $27 |

You can get more car insurance discounts from American Family than you can from Erie or State Farm. That means American Family may be the cheapest option for you if you get a few of them.

American Family offers the most common car insurance discounts, such as for bundling auto and home policies, insuring more than one vehicle, and having a clean driving record.

Some other discounts you can get from AmFam are for enrolling in online billing, signing up for autopay and getting a quote at least seven days before your policy starts.

Cheap Wisconsin auto insurance for teen drivers: Erie and American Family

To get the cheapest teen car insurance in Wisconsin, make sure you get quotes from Erie and American Family while you shop for a policy.

Erie has the state’s lowest teen liability rates of $55 per month. American Family has the cheapest full coverage rates for most teen drivers, at $259 per month.

Cheapest teen car insurance rates

| Company | Liability only | Full coverage |

|---|---|---|

| Erie | $55 | $268 |

| American Family | $82 | $259 |

| Geico | $102 | $332 |

| West Bend | $105 | $266 |

| State Farm | $110 | $363 |

| Auto-Owners | $135 | $348 |

| Progressive | $216 | $833 |

| Allstate | $241 | $531 |

| Acuity | $303 | $888 |

| USAA* | $64 | $233 |

Discounts are one of the best and easiest ways to save money on car insurance for teen drivers. Most car insurance companies offer discounts for:

- Getting good grades

- Completing a driver’s education or training program

- Going away to college and leaving your car at home

Another way for teen drivers to save money on car insurance is to get added to a parent’s policy. The parent’s rate will go up, but the total price will still be cheaper than if you get your own coverage.

Cheapest auto insurance in Wisconsin after a speeding ticket: Erie

Erie is Wisconsin’s cheapest car insurance company for drivers with a speeding ticket on their records. Its average rate for these drivers is $127 per month.

American Family, State Farm and Auto-Owners are next, each with rates of less than $150 per month.

Cheapest rates after a ticket

| Company | Monthly rate |

|---|---|

| Erie | $127 |

| American Family | $134 |

| State Farm | $144 |

| Auto-Owners | $149 |

| West Bend | $161 |

| Geico | $182 |

| Acuity | $205 |

| Allstate | $229 |

| Progressive | $334 |

| USAA* | $123 |

The average cost of car insurance after a speeding ticket in Wisconsin is $179 per month. That’s $33 per month more than what drivers with a clean record pay for the same coverage.

Best cheap Wisconsin car insurance after an accident: West Bend

At $150 per month, West Bend is Wisconsin’s cheapest company for car insurance after an accident.

State Farm’s average rate is only $2 more, though, at $152 per month. Erie and Auto-Owners are next, each with average rates that are less than $170 per month.

Cheapest rates after an accident

| Company | Monthly rate |

|---|---|

| West Bend | $150 |

| State Farm | $152 |

| Erie | $161 |

| Auto-Owners | $166 |

| American Family | $191 |

| Geico | $246 |

| Acuity | $251 |

| Allstate | $317 |

| Progressive | $352 |

| USAA* | $145 |

Although West Bend has the state’s lowest rate for drivers after an accident, you should also get a quote from State Farm if you want the best and cheapest insurance. State Farm scores well with customers based on its good J.D. Power rating, and it also has many more discounts than West Bend.

Most drivers in Wisconsin pay $213 per month for car insurance after an at-fault accident. This is almost $70 per month more than what the state’s drivers with clean records pay.

Wisconsin’s cheapest auto insurance for teens with bad driving records: Erie

Teen drivers with a speeding ticket or accident on their records in Wisconsin usually get the cheapest car insurance from Erie.

Erie’s average rate for Wisconsin teens with a speeding ticket is $64 per month. For teens with an accident, the company’s rates average $73 per month.

Cheapest rates for teens after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Erie | $64 | $73 |

| American Family | $114 | $154 |

| West Bend | $119 | $110 |

| State Farm | $123 | $135 |

| Geico | $129 | $178 |

| Auto-Owners | $135 | $166 |

| Progressive | $253 | $263 |

| Allstate | $282 | $312 |

| Acuity | $303 | $323 |

| USAA* | $90 | $113 |

American Family has the second-cheapest car insurance rates for most young drivers with a ticket, at $114 per month. West Bend comes in second for young drivers after an accident, at $110 per month.

Cheap car insurance in Wisconsin after a DUI: West Bend

West Bend has the cheapest DUI insurance quotes for Wisconsin drivers, at $156 per month. That’s about $70 less than the state average of $227 per month for drivers with a DUI (driving under the influence) conviction.

Cheapest quotes after a DUI

| Company | Monthly rate |

|---|---|

| West Bend | $156 |

| Erie | $195 |

| American Family | $205 |

| Geico | $225 |

| State Farm | $232 |

| Auto-Owners | $238 |

| Allstate | $250 |

| Progressive | $283 |

| Acuity | $294 |

| USAA* | $192 |

Car insurance with West Bend, Erie, American Family and Geico is cheaper than the state average. AmFam and Geico both offer many discounts that could help bring down your car insurance costs after a DUI.

With Geico, you may get a discount for having certain vehicle safety features, being a homeowner, going paperless or signing up for autopay.

You should expect your car insurance premium

Cheapest car insurance with bad credit in Wisconsin: State Farm

With an average quote of $139 per month, State Farm has the cheapest car insurance for drivers with bad credit in Wisconsin.

American Family, Geico and West Bend are the next-cheapest companies for drivers with poor credit. All three have average rates that are around $200 per month.

Cheapest quotes for drivers with poor credit

| Company | Monthly rate |

|---|---|

| State Farm | $139 |

| American Family | $200 |

| Geico | $207 |

| West Bend | $208 |

| Acuity | $223 |

| Erie | $264 |

| Allstate | $315 |

| Progressive | $347 |

| Auto-Owners | $544 |

| USAA* | $208 |

The state average rate for car insurance with poor credit is $266 per month. This is $120 per month more than what Wisconsin drivers with good credit pay for the same policies.

Best car insurance in Wisconsin

Erie and American Family are the best car insurance companies in Wisconsin.

Wisconsin car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| Acuity | Not rated | A+ | |

| Allstate | 635 | A+ | |

| American Family | 640 | A | |

| Auto-Owners | 638 | A+ | |

| Erie | 703 | A | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ | |

| West Bend | Not rated | A |

Erie’s rates are cheapest for most driver and coverage types. And when their rates aren’t the lowest, they’re close to it. Beyond rates, Erie has a great J.D Power score. Among other things, this means customers trust the company to handle any problems that may come up.

American Family’s rates are also among the cheapest in nearly every category. Its full coverage rates are the state’s most affordable. AmFam’s J.D. Power score isn’t as good as Erie’s, but it’s still better than average. The company also offers many discounts and coverage options.

Wisconsin insurance rates by city

The cheapest city for car insurance in Wisconsin is Kimberly, where rates average $115 per month.

Drivers in Brill pay the state’s highest car insurance rates of $192 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Abbotsford | $149 | 2% |

| Abrams | $145 | 0% |

| Adams | $158 | 8% |

| Adell | $134 | -8% |

| Afton | $130 | -10% |

| Albany | $142 | -2% |

| Algoma | $132 | -9% |

| Allenton | $133 | -9% |

| Allouez | $118 | -19% |

| Alma | $167 | 14% |

| Alma Center | $160 | 10% |

| Almena | $166 | 14% |

| Almond | $148 | 2% |

| Altoona | $133 | -9% |

| Amberg | $168 | 15% |

| Amery | $170 | 17% |

| Amherst | $146 | 0% |

| Amherst Junction | $151 | 4% |

| Aniwa | $152 | 4% |

| Antigo | $152 | 5% |

| Appleton | $117 | -19% |

| Arcadia | $156 | 7% |

| Arena | $150 | 3% |

| Argonne | $161 | 10% |

| Argyle | $150 | 3% |

| Arkansaw | $168 | 15% |

| Arkdale | $159 | 9% |

| Arlington | $133 | -8% |

| Armstrong Creek | $163 | 12% |

| Arpin | $145 | 0% |

| Ashland | $158 | 8% |

| Ashwaubenon | $115 | -21% |

| Athelstane | $169 | 16% |

| Athens | $150 | 3% |

| Auburndale | $140 | -4% |

| Augusta | $162 | 12% |

| Avalon | $126 | -13% |

| Avoca | $153 | 5% |

| Babcock | $155 | 6% |

| Bagley | $148 | 2% |

| Baileys Harbor | $125 | -14% |

| Baldwin | $149 | 3% |

| Balsam Lake | $174 | 19% |

| Bancroft | $144 | -1% |

| Bangor | $145 | 0% |

| Baraboo | $141 | -4% |

| Barneveld | $151 | 4% |

| Barron | $166 | 14% |

| Barronett | $170 | 17% |

| Bassett | $134 | -8% |

| Bay City | $156 | 7% |

| Bayfield | $162 | 11% |

| Bayside | $153 | 5% |

| Bear Creek | $149 | 2% |

| Beaver Dam | $129 | -12% |

| Beldenville | $156 | 7% |

| Belgium | $127 | -13% |

| Belleville | $135 | -8% |

| Bellevue | $117 | -20% |

| Belmont | $143 | -2% |

| Beloit | $126 | -13% |

| Benet Lake | $136 | -7% |

| Benoit | $162 | 11% |

| Benton | $143 | -2% |

| Berlin | $144 | -1% |

| Big Bend | $129 | -12% |

| Birchwood | $173 | 19% |

| Birnamwood | $162 | 11% |

| Biron | $139 | -4% |

| Black Creek | $133 | -9% |

| Black Earth | $131 | -10% |

| Black River Falls | $155 | 7% |

| Blair | $165 | 13% |

| Blanchardville | $156 | 7% |

| Blenker | $148 | 2% |

| Bloomer | $158 | 9% |

| Bloomington | $146 | 0% |

| Blue Mounds | $136 | -7% |

| Blue River | $154 | 5% |

| Bohners Lake | $131 | -10% |

| Bonduel | $143 | -2% |

| Boscobel | $156 | 7% |

| Boulder Junction | $156 | 7% |

| Bowler | $158 | 9% |

| Boyceville | $165 | 13% |

| Boyd | $163 | 12% |

| Brandon | $128 | -12% |

| Brantwood | $161 | 11% |

| Brice Prairie | $129 | -12% |

| Briggsville | $158 | 8% |

| Brill | $192 | 32% |

| Brillion | $125 | -14% |

| Bristol | $138 | -5% |

| Brodhead | $137 | -6% |

| Brokaw | $140 | -4% |

| Brookfield | $133 | -9% |

| Brooklyn | $133 | -9% |

| Brown Deer | $185 | 27% |

| Browns Lake | $131 | -10% |

| Brownsville | $130 | -11% |

| Browntown | $141 | -3% |

| Bruce | $173 | 19% |

| Brule | $167 | 15% |

| Brussels | $132 | -9% |

| Bryant | $155 | 6% |

| Burlington | $131 | -10% |

| Burnett | $129 | -12% |

| Butler | $143 | -2% |

| Butte Des Morts | $128 | -12% |

| Butternut | $162 | 11% |

| Cable | $171 | 18% |

| Cadott | $158 | 9% |

| Caledonia | $137 | -6% |

| Cambria | $144 | -1% |

| Cambridge | $126 | -13% |

| Cameron | $163 | 12% |

| Camp Douglas | $156 | 7% |

| Camp Lake | $135 | -7% |

| Campbellsport | $136 | -7% |

| Caroline | $161 | 11% |

| Cascade | $134 | -8% |

| Casco | $135 | -7% |

| Cashton | $154 | 6% |

| Cassville | $146 | 0% |

| Cataract | $149 | 2% |

| Catawba | $165 | 13% |

| Cazenovia | $158 | 8% |

| Cecil | $146 | 1% |

| Cedar Grove | $125 | -14% |

| Cedarburg | $130 | -11% |

| Centuria | $171 | 17% |

| Chain O’ Lakes | $146 | 0% |

| Chaseburg | $155 | 7% |

| Chenequa | $131 | -10% |

| Chetek | $167 | 15% |

| Chili | $146 | 0% |

| Chilton | $125 | -14% |

| Chippewa Falls | $135 | -7% |

| Clam Lake | $172 | 18% |

| Clayton | $174 | 20% |

| Clear Lake | $172 | 18% |

| Cleveland | $124 | -15% |

| Clinton | $129 | -12% |

| Clintonville | $152 | 4% |

| Clyman | $131 | -10% |

| Cobb | $145 | 0% |

| Cochrane | $160 | 10% |

| Colby | $149 | 2% |

| Coleman | $160 | 10% |

| Colfax | $161 | 10% |

| Colgate | $130 | -11% |

| Collins | $128 | -12% |

| Coloma | $156 | 7% |

| Columbus | $132 | -10% |

| Combined Locks | $115 | -21% |

| Como | $130 | -11% |

| Comstock | $170 | 16% |

| Conover | $158 | 9% |

| Conrath | $174 | 19% |

| Coon Valley | $150 | 3% |

| Cornell | $169 | 16% |

| Cornucopia | $162 | 11% |

| Cottage Grove | $126 | -14% |

| Couderay | $173 | 19% |

| Crandon | $158 | 8% |

| Crivitz | $165 | 13% |

| Cross Plains | $127 | -13% |

| Cuba City | $140 | -4% |

| Cudahy | $139 | -4% |

| Cumberland | $169 | 16% |

| Curtiss | $154 | 6% |

| Cushing | $173 | 19% |

| Custer | $147 | 1% |

| Dallas | $171 | 17% |

| Dalton | $153 | 5% |

| Danbury | $176 | 21% |

| Dane | $127 | -13% |

| Darien | $128 | -12% |

| Darlington | $149 | 3% |

| De Pere | $116 | -20% |

| De Soto | $158 | 8% |

| DeForest | $126 | -14% |

| Deer Park | $163 | 12% |

| Deerbrook | $156 | 7% |

| Deerfield | $126 | -13% |

| Delafield | $130 | -11% |

| Delavan | $128 | -12% |

| Delavan Lake | $128 | -12% |

| Dellwood | $156 | 7% |

| Delwood | $158 | 8% |

| Denmark | $127 | -13% |

| Dickeyville | $145 | -1% |

| Dodge | $155 | 7% |

| Dodgeville | $145 | 0% |

| Dorchester | $152 | 4% |

| Dousman | $134 | -8% |

| Downing | $166 | 14% |

| Downsville | $154 | 6% |

| Doylestown | $136 | -7% |

| Dresser | $172 | 18% |

| Drummond | $173 | 19% |

| Dunbar | $164 | 13% |

| Durand | $167 | 14% |

| Eagle | $131 | -10% |

| Eagle Lake | $133 | -9% |

| Eagle River | $158 | 9% |

| East Ellsworth | $163 | 12% |

| East Troy | $132 | -9% |

| Eastman | $157 | 8% |

| Eau Claire | $134 | -8% |

| Eau Galle | $162 | 11% |

| Eden | $132 | -10% |

| Edgar | $146 | 0% |

| Edgerton | $129 | -12% |

| Edmund | $143 | -2% |

| Egg Harbor | $125 | -15% |

| Eland | $163 | 12% |

| Elcho | $159 | 9% |

| Eldorado | $129 | -11% |

| Eleva | $156 | 7% |

| Elk Mound | $149 | 2% |

| Elkhart Lake | $127 | -13% |

| Elkhorn | $130 | -11% |

| Ellison Bay | $127 | -13% |

| Ellsworth | $154 | 6% |

| Elm Grove | $133 | -9% |

| Elmwood | $162 | 11% |

| Elmwood Park | $143 | -2% |

| Elroy | $156 | 7% |

| Elton | $158 | 9% |

| Embarrass | $150 | 3% |

| Endeavor | $158 | 9% |

| Ephraim | $127 | -13% |

| Ettrick | $160 | 10% |

| Evansville | $134 | -8% |

| Exeland | $178 | 22% |

| Fairchild | $165 | 13% |

| Fairwater | $130 | -11% |

| Fall Creek | $152 | 5% |

| Fall River | $134 | -8% |

| Fence | $167 | 14% |

| Fennimore | $149 | 3% |

| Ferryville | $162 | 11% |

| Fifield | $157 | 8% |

| Fish Creek | $125 | -14% |

| Fitchburg | $129 | -12% |

| Florence | $165 | 14% |

| Fond du Lac | $123 | -15% |

| Fontana | $131 | -10% |

| Fontana-on-Geneva Lake | $132 | -10% |

| Footville | $130 | -11% |

| Forest Junction | $124 | -15% |

| Forestville | $131 | -10% |

| Fort Atkinson | $125 | -14% |

| Fountain City | $157 | 8% |

| Fox Lake | $128 | -12% |

| Fox Point | $153 | 5% |

| Foxboro | $161 | 10% |

| Francis Creek | $129 | -11% |

| Franklin | $133 | -9% |

| Franksville | $133 | -9% |

| Frederic | $178 | 23% |

| Fredonia | $130 | -11% |

| Fremont | $144 | -1% |

| French Island | $132 | -9% |

| Friendship | $157 | 8% |

| Friesland | $143 | -2% |

| Galesville | $150 | 3% |

| Galloway | $184 | 26% |

| Gays Mills | $164 | 13% |

| Genesee Depot | $130 | -11% |

| Genoa | $155 | 7% |

| Genoa City | $131 | -10% |

| Germantown | $130 | -11% |

| Gile | $161 | 11% |

| Gillett | $152 | 4% |

| Gilman | $168 | 16% |

| Gilmanton | $161 | 11% |

| Gleason | $156 | 7% |

| Glen Flora | $178 | 22% |

| Glen Haven | $148 | 1% |

| Glenbeulah | $130 | -11% |

| Glendale | $182 | 25% |

| Glenwood City | $160 | 10% |

| Glidden | $161 | 11% |

| Goodman | $162 | 11% |

| Gordon | $172 | 18% |

| Gotham | $154 | 6% |

| Grafton | $127 | -13% |

| Grand Marsh | $160 | 10% |

| Grand View | $172 | 18% |

| Granton | $151 | 4% |

| Grantsburg | $175 | 20% |

| Gratiot | $147 | 1% |

| Green Bay | $116 | -20% |

| Green Lake | $145 | 0% |

| Green Valley | $155 | 6% |

| Greendale | $133 | -9% |

| Greenfield | $150 | 3% |

| Greenleaf | $126 | -14% |

| Greenville | $122 | -16% |

| Greenwood | $156 | 7% |

| Gresham | $152 | 5% |

| Hager City | $149 | 2% |

| Hales Corners | $131 | -10% |

| Hammond | $148 | 2% |

| Hancock | $157 | 7% |

| Hannibal | $184 | 26% |

| Hanover | $131 | -10% |

| Harshaw | $156 | 7% |

| Hartford | $132 | -9% |

| Hartland | $131 | -10% |

| Hatley | $155 | 7% |

| Haugen | $166 | 14% |

| Hawkins | $169 | 16% |

| Hayward | $175 | 20% |

| Hazel Green | $142 | -3% |

| Hazelhurst | $153 | 5% |

| Heafford Junction | $185 | 27% |

| Helenville | $130 | -11% |

| Herbster | $170 | 16% |

| Hertel | $181 | 24% |

| Hewitt | $140 | -4% |

| High Bridge | $164 | 13% |

| Highland | $149 | 2% |

| Hilbert | $125 | -14% |

| Hillpoint | $154 | 5% |

| Hillsboro | $161 | 11% |

| Hingham | $124 | -15% |

| Hixton | $163 | 12% |

| Hobart | $118 | -19% |

| Holcombe | $173 | 19% |

| Hollandale | $154 | 5% |

| Holmen | $134 | -8% |

| Horicon | $131 | -10% |

| Hortonville | $127 | -13% |

| Houlton | $148 | 2% |

| Howard | $117 | -20% |

| Howards Grove | $121 | -17% |

| Hubertus | $132 | -10% |

| Hudson | $145 | 0% |

| Humbird | $160 | 10% |

| Hurley | $160 | 10% |

| Hustisford | $133 | -9% |

| Hustler | $160 | 10% |

| Independence | $165 | 13% |

| Iola | $161 | 10% |

| Irma | $155 | 7% |

| Iron Belt | $161 | 10% |

| Iron Ridge | $132 | -9% |

| Iron River | $172 | 18% |

| Ixonia | $128 | -12% |

| Jackson | $130 | -11% |

| Janesville | $127 | -13% |

| Jefferson | $123 | -15% |

| Jim Falls | $153 | 5% |

| Johnson Creek | $123 | -16% |

| Juda | $137 | -6% |

| Jump River | $187 | 28% |

| Junction City | $145 | 0% |

| Juneau | $131 | -10% |

| Kansasville | $133 | -8% |

| Kaukauna | $117 | -20% |

| Kellnersville | $132 | -10% |

| Kendall | $154 | 5% |

| Kennan | $164 | 12% |

| Kenosha | $141 | -3% |

| Keshena | $149 | 3% |

| Kewaskum | $134 | -8% |

| Kewaunee | $132 | -9% |

| Kiel | $128 | -12% |

| Kieler | $143 | -2% |

| Kimberly | $115 | -21% |

| King | $147 | 1% |

| Knapp | $162 | 11% |

| Knowlton | $142 | -3% |

| Kohler | $121 | -17% |

| Krakow | $144 | -1% |

| Kronenwetter | $141 | -3% |

| La Crosse | $134 | -8% |

| La Farge | $162 | 11% |

| La Pointe | $158 | 8% |

| La Valle | $154 | 5% |

| Lac du Flambeau | $153 | 5% |

| Ladysmith | $168 | 15% |

| Lake Arrowhead | $151 | 4% |

| Lake Delton | $145 | -1% |

| Lake Geneva | $130 | -11% |

| Lake Hallie | $135 | -8% |

| Lake Koshkonong | $126 | -14% |

| Lake Lorraine | $129 | -11% |

| Lake Mills | $125 | -14% |

| Lake Nebagamon | $167 | 15% |

| Lake Ripley | $125 | -14% |

| Lake Tomahawk | $154 | 6% |

| Lake Wazeecha | $140 | -4% |

| Lake Wisconsin | $135 | -8% |

| Lake Wissota | $136 | -7% |

| Lakewood | $157 | 8% |

| Lancaster | $143 | -2% |

| Land O Lakes | $161 | 11% |

| Lannon | $129 | -12% |

| Laona | $162 | 12% |

| Larsen | $126 | -13% |

| Lauderdale Lakes | $131 | -10% |

| Legend Lake | $150 | 3% |

| Lena | $154 | 6% |

| Leopolis | $151 | 4% |

| Lime Ridge | $152 | 5% |

| Linden | $145 | 0% |

| Little Chute | $116 | -20% |

| Little Round Lake | $173 | 19% |

| Little Suamico | $141 | -3% |

| Livingston | $146 | 0% |

| Lodi | $134 | -8% |

| Loganville | $151 | 4% |

| Lomira | $131 | -10% |

| Lone Rock | $155 | 7% |

| Long Lake | $160 | 10% |

| Lowell | $131 | -10% |

| Loyal | $154 | 5% |

| Lublin | $164 | 13% |

| Luck | $176 | 21% |

| Luxemburg | $132 | -9% |

| Lyndon Station | $154 | 6% |

| Madison | $131 | -10% |

| Maiden Rock | $161 | 10% |

| Malone | $126 | -13% |

| Manawa | $154 | 6% |

| Manitowish Waters | $156 | 7% |

| Manitowoc | $125 | -14% |

| Maple | $168 | 15% |

| Maple Bluff | $132 | -10% |

| Maplewood | $162 | 11% |

| Marathon | $140 | -4% |

| Marathon City | $140 | -4% |

| Marengo | $162 | 11% |

| Maribel | $130 | -10% |

| Marinette | $149 | 2% |

| Marion | $160 | 10% |

| Markesan | $145 | 0% |

| Marshall | $128 | -12% |

| Marshfield | $143 | -2% |

| Mason | $171 | 17% |

| Mather | $161 | 11% |

| Mattoon | $154 | 5% |

| Mauston | $152 | 4% |

| Mayville | $131 | -10% |

| Mazomanie | $133 | -9% |

| Mc Naughton | $154 | 6% |

| McFarland | $126 | -13% |

| Medford | $158 | 9% |

| Mellen | $161 | 10% |

| Melrose | $164 | 12% |

| Menasha | $117 | -20% |

| Menomonee Falls | $130 | -10% |

| Menomonie | $155 | 7% |

| Mequon | $136 | -6% |

| Mercer | $161 | 10% |

| Merrill | $147 | 1% |

| Merrillan | $163 | 12% |

| Merrimac | $143 | -2% |

| Merton | $131 | -10% |

| Middleton | $127 | -13% |

| Mikana | $168 | 15% |

| Milladore | $146 | 0% |

| Millston | $155 | 7% |

| Milltown | $172 | 18% |

| Milton | $128 | -12% |

| Milwaukee | $181 | 24% |

| Mindoro | $150 | 3% |

| Mineral Point | $147 | 1% |

| Minocqua | $150 | 3% |

| Minong | $177 | 22% |

| Mishicot | $127 | -13% |

| Mondovi | $163 | 12% |

| Monona | $129 | -12% |

| Monroe | $139 | -5% |

| Montello | $160 | 10% |

| Montfort | $146 | 0% |

| Monticello | $144 | -1% |

| Montreal | $160 | 10% |

| Morrisonville | $129 | -12% |

| Mosinee | $141 | -3% |

| Mount Calvary | $129 | -12% |

| Mount Hope | $150 | 3% |

| Mount Horeb | $133 | -9% |

| Mount Pleasant | $139 | -4% |

| Mount Sterling | $155 | 7% |

| Mountain | $158 | 9% |

| Mukwonago | $131 | -10% |

| Muscoda | $154 | 6% |

| Muskego | $125 | -14% |

| Nashotah | $130 | -10% |

| Necedah | $156 | 7% |

| Neenah | $116 | -20% |

| Neillsville | $155 | 6% |

| Nekoosa | $147 | 1% |

| Nelson | $172 | 18% |

| Nelsonville | $152 | 4% |

| Neopit | $154 | 6% |

| Neosho | $134 | -8% |

| Neshkoro | $160 | 10% |

| New Auburn | $167 | 15% |

| New Berlin | $127 | -13% |

| New Franken | $126 | -14% |

| New Glarus | $146 | 0% |

| New Holstein | $127 | -13% |

| New Lisbon | $154 | 5% |

| New London | $142 | -2% |

| New Munster | $133 | -9% |

| New Post | $176 | 21% |

| New Richmond | $152 | 4% |

| Newburg | $130 | -11% |

| Newton | $128 | -12% |

| Niagara | $163 | 12% |

| Nichols | $133 | -9% |

| North Fond du Lac | $123 | -15% |

| North Freedom | $142 | -2% |

| North Hudson | $145 | 0% |

| North Lake | $131 | -10% |

| North Prairie | $133 | -9% |

| Norwalk | $152 | 4% |

| Oak Creek | $135 | -8% |

| Oakfield | $127 | -13% |

| Oconomowoc | $130 | -10% |

| Oconomowoc Lake | $130 | -10% |

| Oconto | $149 | 2% |

| Oconto Falls | $149 | 2% |

| Odanah | $157 | 8% |

| Ogdensburg | $157 | 8% |

| Ogema | $166 | 14% |

| Ojibwa | $174 | 20% |

| Okauchee | $132 | -10% |

| Okauchee Lake | $131 | -10% |

| Omro | $128 | -12% |

| Onalaska | $129 | -12% |

| Oneida | $125 | -14% |

| Ontario | $157 | 8% |

| Oostburg | $121 | -17% |

| Oregon | $128 | -12% |

| Orfordville | $130 | -11% |

| Osceola | $169 | 16% |

| Oshkosh | $120 | -18% |

| Osseo | $161 | 10% |

| Owen | $156 | 7% |

| Oxford | $163 | 12% |

| Paddock Lake | $136 | -7% |

| Palmyra | $132 | -9% |

| Pardeeville | $141 | -3% |

| Park Falls | $158 | 8% |

| Park Ridge | $136 | -6% |

| Pearson | $158 | 9% |

| Pelican Lake | $159 | 9% |

| Pell Lake | $131 | -10% |

| Pembine | $167 | 15% |

| Pepin | $171 | 18% |

| Peshtigo | $153 | 5% |

| Pewaukee | $128 | -12% |

| Phelps | $162 | 11% |

| Phillips | $159 | 9% |

| Phlox | $153 | 5% |

| Pickerel | $159 | 9% |

| Pickett | $124 | -15% |

| Pigeon Falls | $159 | 9% |

| Pine River | $154 | 6% |

| Pittsville | $148 | 2% |

| Plain | $155 | 6% |

| Plainfield | $151 | 4% |

| Platteville | $141 | -3% |

| Pleasant Prairie | $142 | -3% |

| Plover | $138 | -6% |

| Plum City | $162 | 11% |

| Plymouth | $125 | -14% |

| Poplar | $163 | 12% |

| Port Edwards | $143 | -2% |

| Port Washington | $125 | -14% |

| Port Wing | $172 | 18% |

| Portage | $138 | -5% |

| Porterfield | $156 | 7% |

| Post Lake | $159 | 9% |

| Potosi | $144 | -1% |

| Potter | $128 | -12% |

| Potter Lake | $131 | -10% |

| Pound | $161 | 11% |

| Powers Lake | $132 | -10% |

| Poy Sippi | $157 | 8% |

| Poynette | $136 | -7% |

| Prairie Du Chien | $144 | -1% |

| Prairie Farm | $176 | 21% |

| Prairie du Sac | $142 | -3% |

| Prentice | $162 | 11% |

| Prescott | $144 | -1% |

| Presque Isle | $161 | 11% |

| Princeton | $151 | 3% |

| Pulaski | $131 | -10% |

| Racine | $143 | -2% |

| Radisson | $177 | 22% |

| Randolph | $132 | -9% |

| Random Lake | $130 | -11% |

| Readfield | $146 | 1% |

| Readstown | $164 | 13% |

| Redgranite | $156 | 7% |

| Reedsburg | $145 | 0% |

| Reedsville | $129 | -11% |

| Reeseville | $131 | -10% |

| Rewey | $145 | 0% |

| Rhinelander | $152 | 4% |

| Rib Lake | $160 | 10% |

| Rib Mountain | $132 | -10% |

| Rice Lake | $164 | 12% |

| Richfield | $130 | -11% |

| Richland Center | $157 | 8% |

| Ridgeland | $168 | 15% |

| Ridgeway | $150 | 3% |

| Ringle | $144 | -1% |

| Rio | $137 | -6% |

| Ripon | $131 | -10% |

| River Falls | $146 | 0% |

| River Hills | $153 | 5% |

| Roberts | $145 | -1% |

| Rochester | $130 | -11% |

| Rock Springs | $146 | 0% |

| Rockland | $148 | 1% |

| Rosendale | $128 | -12% |

| Rosholt | $154 | 6% |

| Rothschild | $131 | -10% |

| Rubicon | $134 | -8% |

| Rudolph | $141 | -3% |

| Salem | $136 | -7% |

| Sandy Hook | $142 | -3% |

| Sarona | $176 | 21% |

| Sauk City | $136 | -7% |

| Saukville | $127 | -13% |

| Saxon | $164 | 13% |

| Sayner | $159 | 9% |

| Scandinavia | $154 | 5% |

| Schofield | $131 | -10% |

| Sextonville | $150 | 3% |

| Seymour | $130 | -11% |

| Sharon | $128 | -12% |

| Shawano | $143 | -2% |

| Sheboygan | $121 | -17% |

| Sheboygan Falls | $119 | -18% |

| Sheldon | $179 | 23% |

| Shell Lake | $178 | 23% |

| Sherwood | $122 | -16% |

| Shiocton | $140 | -4% |

| Shorewood | $159 | 9% |

| Shorewood Hills | $130 | -11% |

| Shullsburg | $145 | -1% |

| Silver Lake | $135 | -8% |

| Sinsinawa | $144 | -1% |

| Siren | $178 | 22% |

| Sister Bay | $125 | -14% |

| Slinger | $129 | -12% |

| Sobieski | $141 | -3% |

| Soldiers Grove | $163 | 12% |

| Solon Springs | $166 | 14% |

| Somerset | $152 | 5% |

| South Milwaukee | $134 | -8% |

| South Range | $157 | 8% |

| South Wayne | $146 | 0% |

| Sparta | $147 | 1% |

| Spencer | $145 | -1% |

| Spooner | $179 | 23% |

| Spring Green | $150 | 3% |

| Spring Valley | $157 | 8% |

| Springbrook | $177 | 22% |

| St. Cloud | $130 | -11% |

| St. Croix Falls | $172 | 18% |

| St. Francis | $150 | 3% |

| St. Germain | $157 | 8% |

| St. Nazianz | $129 | -12% |

| St. Peter | $123 | -15% |

| Stanley | $165 | 13% |

| Star Lake | $165 | 13% |

| Star Prairie | $169 | 16% |

| Stetsonville | $155 | 6% |

| Steuben | $158 | 8% |

| Stevens Point | $137 | -6% |

| Stitzer | $146 | 1% |

| Stockholm | $168 | 15% |

| Stoddard | $150 | 3% |

| Stone Lake | $176 | 21% |

| Stoughton | $125 | -14% |

| Stratford | $146 | 0% |

| Strum | $162 | 11% |

| Sturgeon Bay | $125 | -14% |

| Sturtevant | $136 | -6% |

| Suamico | $118 | -19% |

| Sullivan | $130 | -11% |

| Summit Lake | $158 | 8% |

| Sun Prairie | $126 | -13% |

| Superior | $145 | 0% |

| Suring | $156 | 7% |

| Sussex | $129 | -11% |

| Tainter Lake | $161 | 10% |

| Taylor | $165 | 13% |

| Theresa | $132 | -10% |

| Thiensville | $137 | -6% |

| Thorp | $159 | 9% |

| Three Lakes | $157 | 8% |

| Tichigan | $131 | -10% |

| Tigerton | $166 | 14% |

| Tilleda | $152 | 4% |

| Tisch Mills | $164 | 13% |

| Tomah | $146 | 0% |

| Tomahawk | $154 | 6% |

| Tony | $171 | 17% |

| Townsend | $154 | 6% |

| Trego | $179 | 23% |

| Trempealeau | $151 | 4% |

| Trevor | $135 | -7% |

| Tripoli | $158 | 9% |

| Tunnel City | $149 | 2% |

| Turtle Lake | $172 | 18% |

| Twin Lakes | $133 | -9% |

| Two Rivers | $127 | -13% |

| Union Center | $155 | 6% |

| Union Grove | $134 | -8% |

| Unity | $149 | 2% |

| Upson | $162 | 12% |

| Valders | $127 | -12% |

| Van Dyne | $125 | -14% |

| Verona | $126 | -13% |

| Vesper | $151 | 3% |

| Viola | $162 | 11% |

| Viroqua | $159 | 9% |

| Wabeno | $162 | 12% |

| Waldo | $128 | -12% |

| Wales | $128 | -12% |

| Walworth | $128 | -12% |

| Warrens | $153 | 5% |

| Washburn | $160 | 10% |

| Washington Island | $126 | -14% |

| Waterford | $130 | -10% |

| Waterloo | $128 | -12% |

| Watertown | $129 | -12% |

| Waukau | $129 | -11% |

| Waukesha | $127 | -13% |

| Waunakee | $124 | -15% |

| Waupaca | $145 | 0% |

| Waupun | $128 | -12% |

| Wausau | $134 | -8% |

| Wausaukee | $169 | 16% |

| Wautoma | $156 | 7% |

| Wauwatosa | $171 | 17% |

| Wauzeka | $156 | 7% |

| Webster | $179 | 23% |

| West Allis | $153 | 5% |

| West Baraboo | $140 | -4% |

| West Bend | $131 | -10% |

| West Milwaukee | $162 | 11% |

| West Salem | $133 | -9% |

| Westboro | $162 | 11% |

| Westby | $156 | 7% |

| Westfield | $159 | 9% |

| Weston | $131 | -10% |

| Weyauwega | $148 | 2% |

| Weyerhaeuser | $171 | 18% |

| Wheeler | $168 | 15% |

| White Lake | $158 | 8% |

| Whitefish Bay | $157 | 8% |

| Whitehall | $160 | 10% |

| Whitelaw | $130 | -11% |

| Whitewater | $128 | -12% |

| Whiting | $136 | -6% |

| Wild Rose | $155 | 7% |

| Willard | $160 | 10% |

| Williams Bay | $128 | -12% |

| Wilmot | $134 | -8% |

| Wilson | $156 | 7% |

| Wilton | $153 | 5% |

| Wind Lake | $130 | -11% |

| Wind Point | $140 | -4% |

| Windsor | $126 | -13% |

| Winnebago | $122 | -16% |

| Winneconne | $129 | -12% |

| Winter | $175 | 20% |

| Wisconsin Dells | $146 | 0% |

| Wisconsin Rapids | $142 | -2% |

| Withee | $158 | 8% |

| Wittenberg | $165 | 13% |

| Wonewoc | $158 | 8% |

| Woodford | $147 | 1% |

| Woodland | $133 | -9% |

| Woodman | $152 | 4% |

| Woodruff | $150 | 3% |

| Woodville | $152 | 4% |

| Woodworth | $138 | -5% |

| Wrightstown | $123 | -16% |

| Wyocena | $141 | -3% |

| Zachow | $146 | 0% |

| Zenda | $130 | -10% |

The average cost of car insurance in Wisconsin’s largest cities:

- Appleton, $117 per month

- Eau Claire, $134 per month

- Green Bay, $116 per month

- Madison, $131 per month

- Milwaukee, $181 per month

- Racine, $143 per month

Minimum coverage for car insurance in Wisconsin

You need to meet Wisconsin’s car insurance requirements to drive legally in the state. These requirements include:

- $25,000 of bodily injury liability coverage per person

- $50,000 of bodily injury liability coverage per accident

- $10,000 of property damage coverage

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

State law doesn’t require full coverage, which usually includes collision

Frequently asked questions

Wisconsin car insurance costs $146 a month, on average, if you buy a full coverage policy. If you only buy liability coverage, the state average cost is $41 a month.

The cheapest car insurance in Wisconsin comes from Erie. It has the lowest average rate for liability coverage, at $25 per month. American Family has the state’s lowest full coverage rate of $112 per month.

Wisconsin is an at-fault state for car insurance. This means if you cause an accident, you have to pay medical and repair bills related to it.

How we selected the cheapest car insurance companies in Wisconsin

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Wisconsin

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.