Chase Offers Program Guide 2026: How to Get Extra Rewards

Key takeaways

- Chase Offers is a program that lets you earn additional cash back on a variety of products and services when you use your eligible Chase card to make the purchase.

- These offers are targeted to consumers based on their normal spending habits, so they can vary from person to person.

- To earn the cash back, you must activate the offer online or via the Chase mobile app prior to making the purchase.

If you have an eligible Chase credit card, you can get even more bang for your buck through Chase Offers. Like Amex Offers and Capital One Offers, the program lets you earn cash back on eligible purchases through a variety of limited-time promotions.

What’s more, the incentives you earn through Chase Offers are given on top of the rewards you’re already earning from your Chase card. They can also be “stacked” with other shopping promotions, including eligible purchases made through the Chase Ultimate Rewards® portal.

→ Read more about the best credit cards from Chase.

How do Chase Offers work?

To redeem Chase Offers, simply add them to your Chase account — either online or through the mobile app — and make a qualifying purchase using your eligible Chase card. You’ll earn cash back in the form of a statement credit, which will automatically be added to your account within 14 business days.

Which credit cards are eligible for Chase Offers?

Chase Offers are available through all credit cards from Chase, including cash back credit cards, travel credit cards and co-branded credit cards.

| Credit Cards | Our Ratings | Welcome Offer | Rewards Rate | Annual Fee | |

|---|---|---|---|---|---|

Chase Freedom Unlimited®

|

$200 cash back

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

| 1.5% - 5% cash back

| $0 | ||

Chase Freedom Flex®*

|

$200 cash bonus

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| 1% - 5% cash back

| $0 | ||

Chase Freedom Rise® Credit Card*

|

$25 statement credit

Earn a $25 statement credit when you sign up for automatic payments within the first three months of opening your account and remain enrolled for at least 90 days.

| 1.5% cash back

| $0 | ||

Chase Sapphire Preferred® Card

|

75,000 points

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

| 1X - 5X points

| $95 | ||

Ink Business Preferred® Credit Card*

|

100,000 points

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

| 1X - 3X points

| $95 | ||

Chase Sapphire Reserve®*

|

125,000 points

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

| 1X - 8X points

| $795 |

How to check for Chase Offers online

- Log in to your Chase credit card account at Chase.com.

- Find the Chase Offers by scrolling down and finding the “Chase Offers” tab on the right side of your screen. Click on the arrow next to the number of offers to see the available offers.

- To add an offer, click the “+” icon in the lower right-hand corner of the offer. The plus sign will change to a green circle with a check mark once the offer has been added successfully. You’ll also need to follow the fine print in the offer for the promotion to apply — each individual offer has its own deadlines, spending requirements, reward caps and other restrictions or conditions.

- When you’re ready to use an offer, make your purchase using your Chase credit card. If you have more than one Chase credit card, offers may vary between accounts, so be careful to use the appropriate card for the offer.

- Finally, wait for your cash back to be added to your account as a statement credit.

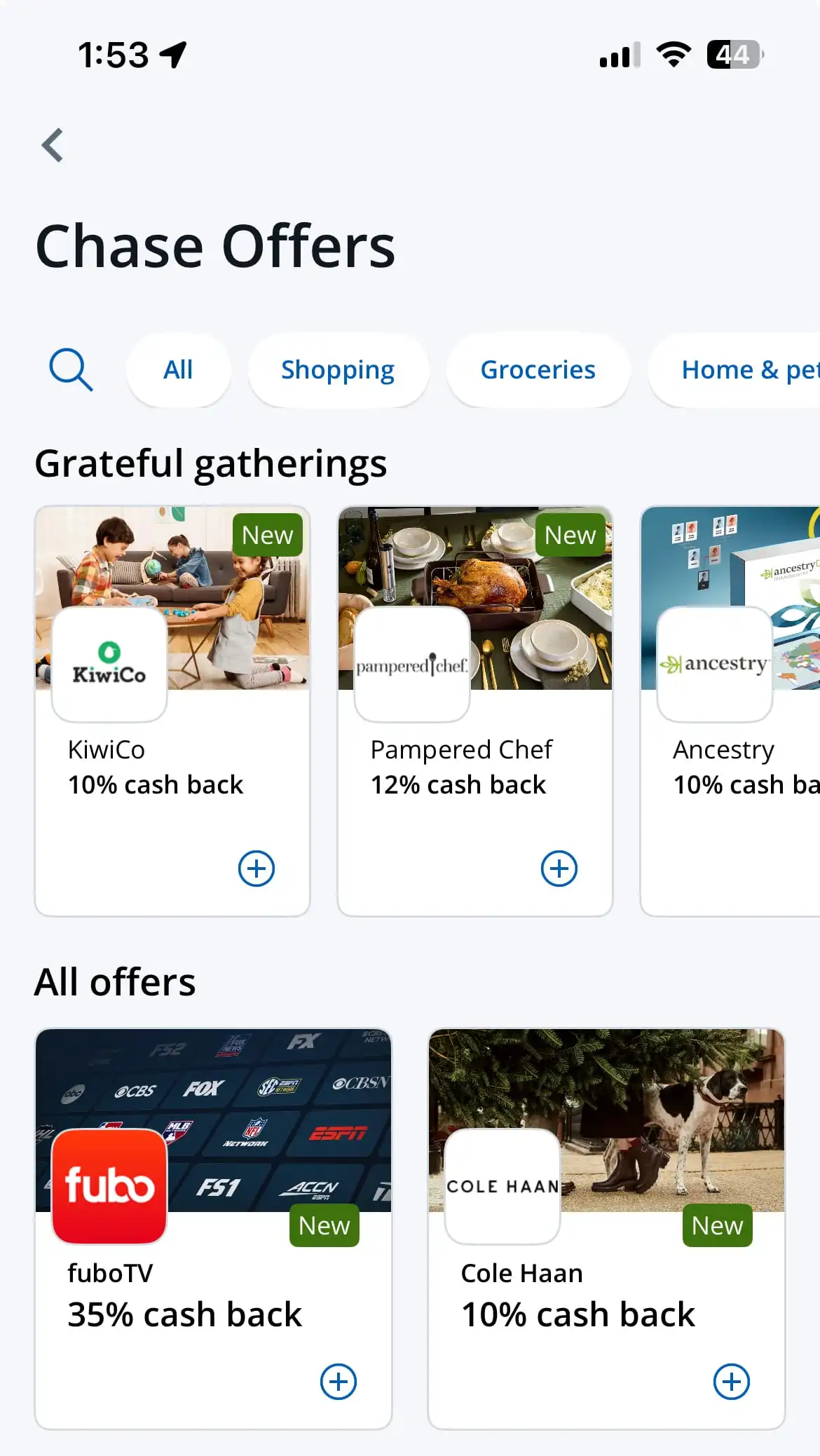

How to check for Chase Offers in the Chase mobile app

- Log in to your Chase credit card account through the app.

- Find the Chase Offers by scrolling to the bottom of the screen. Then click on the arrow next to the number of available offers to see all current offers.

- To add an offer, click the “+” icon in the lower right-hand corner of the offer. You will see a checkmark in a green circle, and the phrase “Added to card.” You’ll also need to follow the fine print in the offer for the promotion to apply — each individual offer has its own deadlines, spending requirements, reward caps and other restrictions or conditions.

- When you’re ready to use an offer, make your purchase with your Chase credit card. If you have more than one Chase credit card, offers may vary between accounts, so be careful to use the appropriate card for the offer.

- Finally, wait for your cash back to be added to your account as a statement credit.

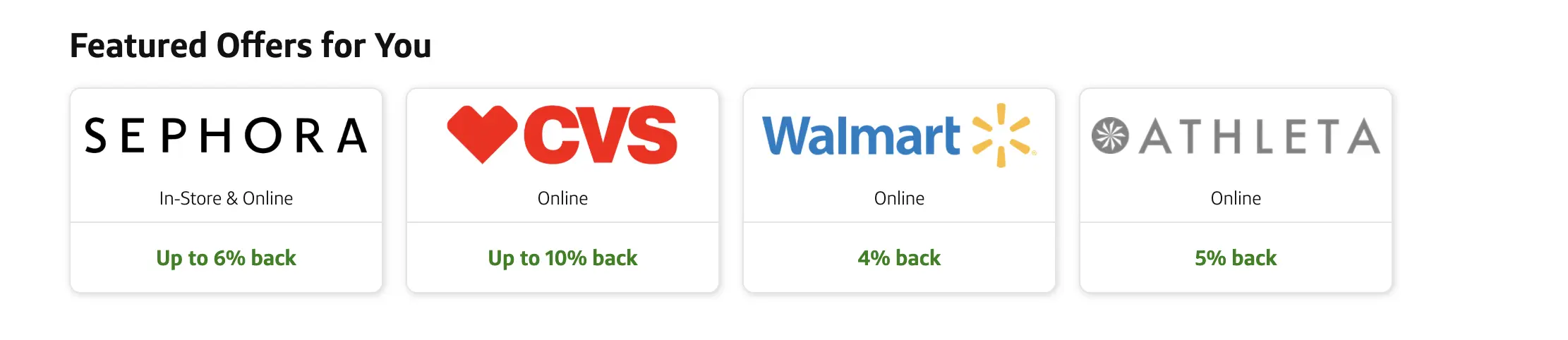

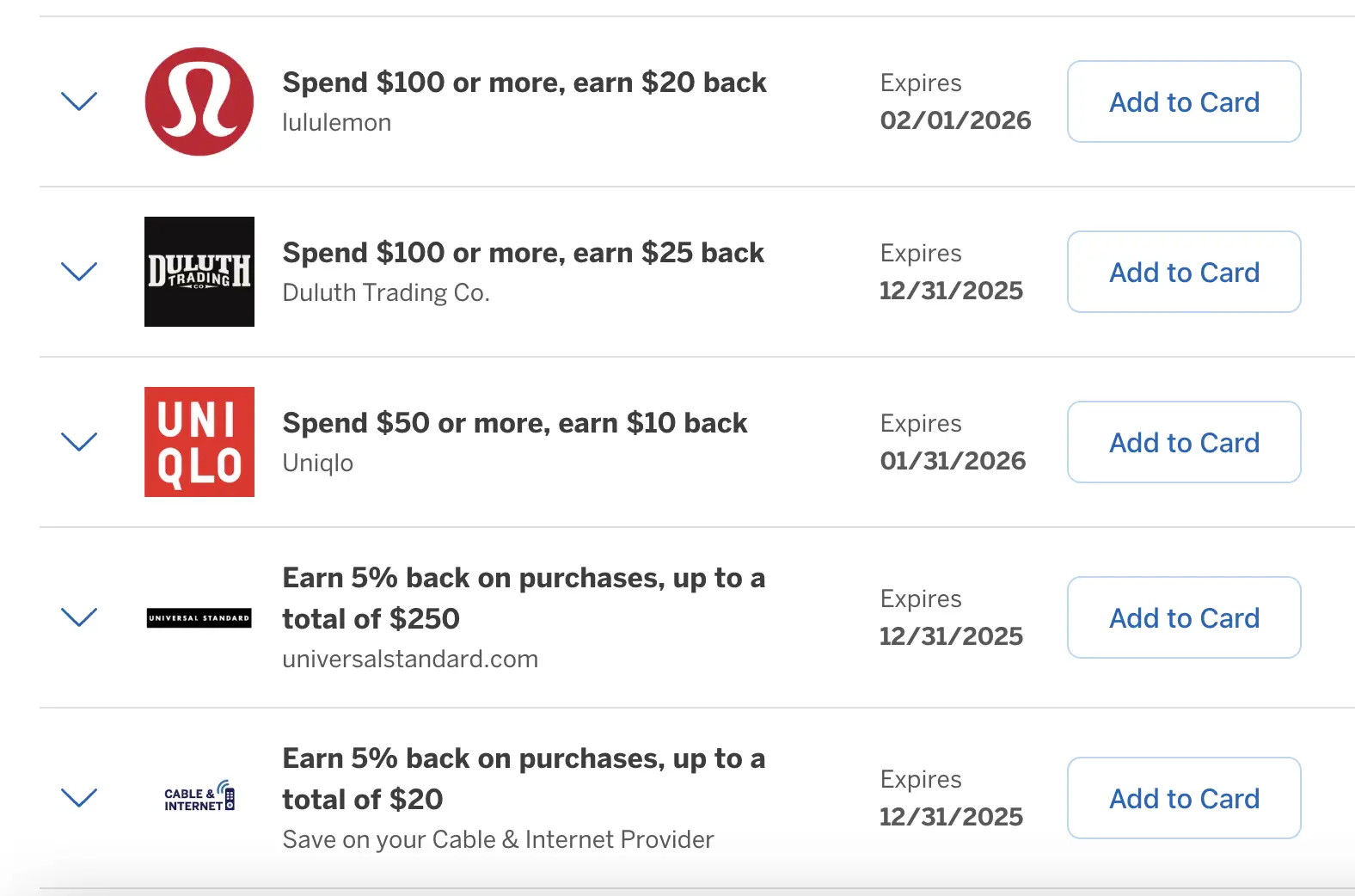

Recent Chase Offers in 2026

Chase Offers change on a regular basis and may include a mix of brick-and-mortar and online retailers and services. Here are some offers that were available at the time of publishing:

- YouTube TV: $20 cash back

- Magazines.com: 25% cash back

- SeatGeek: 5% cash back

- Total Wireless: 25% cash back

- FanDuel Sports Network: 50% cash back

- Wild Alaskan Company: $30 cash back

- Blue Apron: 15% cash back

- Nuts.com: 10% cash back

- Potbelly: 5% cash back

- Lindt: 10% cash back

- The Boll & Branch Shop: $100 cash back

- Tommy Hilfiger: 15% cash back

- Cole Haan: 10% cash back

- Zales: $50 cash back

- Solgaard: 20% cash back

- Chase TravelSM: $100 back

- Turo: $30 cash back

- Lyft: 10% cash back

- Cruise America: $50 cash back

- Westin® Hotels & Resorts: 10% cash back

- Trust & Will: $50 cash back

- Ancestry: 10% cash back

- Dropbox: 30% cash back

How to maximize Chase Offers

Getting the most out of Chase Offers isn’t difficult. But you do have to remember that they exist and manually add the offers to your account. To maximize your earning potential throughout the year, try the following:

- Add every Chase Offer to your card you might use.

Adding these offers to your card is easy and entirely risk-free, so you should add any and all you think you can use. If you don’t use a Chase Offer before the deal expires, there aren’t any consequences that come into play. The offer simply disappears from your account, and that’s that. - Gain additional cash back by shopping through an online cash back portal.

Some cardholders report success when using Chase Offers with the Chase Shopping portal. Others note that you can use them with Rakuten, a cash back shopping portal, to increase your savings. - Check your offers regularly.

Since Chase Offers are updated regularly, you’ll want to check frequently to see which offers are available. We suggest checking your account for new offers at least once a week to make sure you don’t miss out. - Note the offers’ expiration dates and other fine print.

Remember that each offer has stipulations that apply, including a cash back maximum and an expiration date. Make sure you know the terms for the offers you plan to use, so you don’t make additional purchases you don’t need or try to use an offer after its expiration date. - Don’t buy things you don’t need.

While some offers may be tempting, you don’t save money when you buy something that you don’t need. Use Chase Offers to help you stay within your budget on items you usually buy or need to buy.

Chase Offers vs. Amex Offers vs. Capital One Offers

| Chase Offers | Amex Offers | Capital One Offers | |

|---|---|---|---|

| How do you use the offer? | Add offer to account | Add offer to account | Use online link |

| How soon do rewards post? | Within 14 business days | Up to 90 days after the offer period ends | 45 days |

| How are rewards given? | Statement credit | Statement credit or Membership Rewards points | Statement credit or credit card rewards |

Amex Offers (offered with eligible American Express credit cards) and Capital One Offers (offered with eligible Capital One credit cards) are similar programs to Chase Offers in some ways.

All three are available for almost all cardholders (from their respective issuer) in the U.S. Both Chase Offers and Amex Offers require cardholders to manually add the offers to their account for the promotion to apply.

The biggest difference between Amex Offers and Chase Offers is that offers from American Express tend to be more lucrative, although they may require you to spend more to earn the rewards. Some offers earn cash back, which is awarded as a statement credit, while others earn Membership Rewards® points.

Capital One Offers is essentially an online shopping portal where you can earn statement credits from your purchases. This means that, unlike Amex Offers and Chase Offers, you won’t have to add the offer to your card. But you will need to make sure you follow the correct link (from the Capital One Offers section of your credit card account) to make the purchase. You can see offers from Capital One on the Capital One mobile app or through your online account.

Here are some examples of Amex and Capital One offers available at the time of publishing:

Amex

- Sunglass Hut: $30 back if you spend $150 or more

- HBO Max annual subscription: $25 back if you spend $99 or more

- Levi’s: $35 back if you spend $175 or more

- Revolve: Earn +5 miles per dollar spent, up to 5,000 miles

- Fubo TV: Earn $30 when you spend $70 or more up to three times

Capital One

- Columbia: 20% back online

- CVS: Up to 6% back online

- Disney+: Up to $37 back online

- Verizon: Up to $150 back

- Booking.com: Up to 2% back online

Frequently asked questions

No. You must add a Chase Offer before making a purchase.

Chase Offers generally take up to 14 days to post to your account as a statement credit. If you have met the criteria for the offer but haven’t received the statement credit by 30 days after the transaction posted, contact Chase by calling the number on the back of your credit card, or submitting an account inquiry at Chase.com or on the mobile app.

Chase states that Chase Offers change regularly, and cardholders report seeing new offers as frequently as every day or every week.

Chase Offers are only available to eligible cardholders with a U.S. address listed as their primary residence or place of business. New accounts and those used infrequently may not receive Chase Offers until they are using the card regularly.

The information related to the Chase Freedom Flex®, Chase Freedom Rise® Credit Card, Ink Business Preferred® Credit Card and Chase Sapphire Reserve® has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.