Southwest® Rapid Rewards® Performance Business Credit Card Review: Best for Frequent Flyers

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

Key takeaway

Pros and cons

Pros

- Generous sign-up bonus

- Valuable rewards rate

- First checked bag free on eligible Southwest flights

- Annual anniversary bonus

- Global Entry/TSA PreCheck®/Nexus fee credit

- Elite status boost

- Earn points for Southwest Companion Pass®

- Save on seating fees

Cons

- High annual fee

- Underwhelming perks for the annual fee

- High spend threshold required to earn bonus

- Limited flight locations

- Points aren’t flexible

- Some benefits expire in 2026

Is the Southwest® Rapid Rewards® Performance Business Credit Card worth it?

First-year versus ongoing value

The Southwest® Rapid Rewards® Performance Business Credit Card is worth it for business owners who frequently travel with Southwest. If you just use the first checked bag free for you and three people on eligible Southwest flights (although you could use it for up to eight), you’ll save $280 on a round trip, which more than offsets the annual fee.

Plus, you’ll get a Global Entry/TSA PreCheck®/NEXUS fee credit, 9,000 anniversary points each year and more. It offers a generous sign-up bonus with points that can help you earn the Southwest Companion Pass® — and accelerated rewards earnings in popular business spending categories, such as direct hotel bookings, gas stations and restaurants.

On the downside, it’s light on unique perks compared to similarly priced airline cards like the Delta SkyMiles® Platinum Business American Express Card. And, you’re locked into using your rewards with Southwest. The Ink Business Preferred® Credit Card lets you transfer points to Southwest and many other travel partners for a lower $95 annual fee.

Changes in 2026

The card has a higher annual fee, plus new benefits, including complimentary checked bags and upgrades to extra legroom seats.

Also, a few perks are ending in 2026:

- Four upgraded boardings

- Up to 365 in-flight internet credits

- $500 fee credit for points transfers

Quick facts

Recommended credit: Credit scores ranges may vary. Your individual chance at approval may vary due to factors such as creditors using a particular variation at their discretion Excellent

Rewards Rate: 1X - 4X points

- Earn 4 points per $1 spent on Southwest® purchases.

- Earn 2 points per $1 spent on gas station and restaurant purchases.

- Earn 2 points per $1 spent on hotel accommodations booked directly with the hotel.

- Earn 2 points per $1 spent on local transit and commuting, including rideshare.

- Earn 1 point per $1 spent on all other purchases.

Welcome offer: 80,000 points

- Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening.

Rates

- Intro purchase APR: N/A

- Regular purchase APR: 19.49% - 27.99% Variable

- Intro balance transfer APR: N/A

- Regular balance transfer APR: 19.49% - 27.99% Variable

- Regular cash advance APR: 28.74% Variable

- Penalty APR: Up to 29.99%

Fees

- Annual fee: $299

- Balance transfer fee: Either $5 or 5% of the amount of each transfer, whichever is greater.

- Cash advance fee: Either $15 or 5% of the amount of each transaction, whichever is greater.

- Foreign exchange fee: $0

Other benefits

- 9,000 anniversary points on your cardmember anniversary

- First checked bag free for cardmembers and up to eight additional passengers on the same reservation on eligible Southwest flights

- Preferred or standard seat at booking for no additional charge for you and eight additional passengers on the same reservation when available on eligible Southwest flights

- Unlimited upgrades to an extra legroom seat within 48 hours before departure for you and eight additional passengers on the same reservation when available on eligible Southwest flights<

- Group 5 boarding for you and eight additional passengers on the same reservation on eligible Southwest flights<

- 2,500 tier qualifying points (TQPs) toward A-List status for every $5,000 spent in purchases annually

- 10,000 Companion Pass® qualifying points bonus every year

- 25% off in-flight purchases

- Up to $120 Global Entry/Nexus/TSA PreCheck® credit

Compare the Southwest® Rapid Rewards® Performance Business Credit Card to similar cards

| Credit Cards | Our Ratings | Annual Fee | Rewards Rate | Welcome Offer | |

|---|---|---|---|---|---|

Southwest® Rapid Rewards® Performance Business Credit Card*

|

$299 | 1X - 4X points

| 80,000 points

Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening.

| ||

Southwest® Rapid Rewards® Premier Business Credit Card*

|

$149 | 3X points

| 85,000 points

Earn 85,000 points after you spend $3,000 on purchases in the first 3 months your account is open.

| ||

Delta SkyMiles® Platinum Business American Express Card

|

$350 | 1.5X miles

| 100,000 miles

Limited Time Offer: Earn 100,000 Bonus Miles after spending $8,000 in purchases on your new Card in your first 6 months of Card Membership. Offer ends 4/1/26.

| ||

Ink Business Preferred® Credit Card*

|

$95 | 1X - 3X points

| 100,000 points

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

|

Southwest® Rapid Rewards® Performance Business Credit Card benefits

-

Generous sign-up bonus

The Southwest® Rapid Rewards® Performance Business Credit Card currently offers a very generous sign-up bonus: Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening.

That’s the highest sign-up bonus among co-branded Southwest credit cards. If you have a business trip coming up and you’ll use the card’s other benefits, the Southwest® Rapid Rewards® Performance Business Credit Card could be valuable. Note that these points count toward earning the Southwest Companion Pass® (more on that below).

→ See the biggest credit card sign-up bonuses.

-

High rewards rate on Southwest purchases

Along with the sign-up bonus, the Southwest® Rapid Rewards® Performance Business Credit Card offers the highest rewards rate on Southwest purchases of the two Southwest business cards. You’ll earn 4 points per $1 spent on Southwest® purchases. Earn 2 points per $1 spent on gas station and restaurant purchases. Earn 2 points per $1 spent on hotel accommodations booked directly with the hotel. Earn 2 points per $1 spent on local transit and commuting, including rideshare. Earn 1 point per $1 spent on all other purchases.

The rewards rate is valuable, but not much different from other Southwest credit cards. So unless you’re flying very frequently, the higher rewards rate may not be worth the annual fee for you and your business.

Tip: If you’re aiming to earn points for Southwest flights, you should consider non-branded cards like the Ink Business Preferred® Credit Card and Sapphire Reserve for Business℠ (see rates & fees). These cards earn flexible Chase Ultimate Rewards® points, which can be transferred to Southwest.→ Learn more about transferring Chase Ultimate Rewards® points.

-

First checked bag free

The Southwest® Rapid Rewards® Performance Business Credit Card offers a first checked bag free on eligible Southwest flights for you and up to eight additional passengers on the same reservation. A checked bag normally costs $35, so if you regularly fly with several companions, these savings can add up quickly.

-

Large anniversary bonus

Cardholders receive 9,000 bonus points each year on their cardmember anniversary. In comparison, the Southwest® Rapid Rewards® Premier Business Credit Card, only offers 6,000 bonus anniversary points.

This bonus is worth around $126* in airfare by our estimates, so it can cover a large part of the annual fee each year.

*Based on LendingTree’s value methodology -

Global Entry/TSA PreCheck®/NEXUS credit

You’ll receive a statement credit of up to $120 every four years for either Global Entry, Nexus or TSA PreCheck®. This is a great perk that can cover up much of the card’s $299 annual fee if you’re already paying for this benefit.

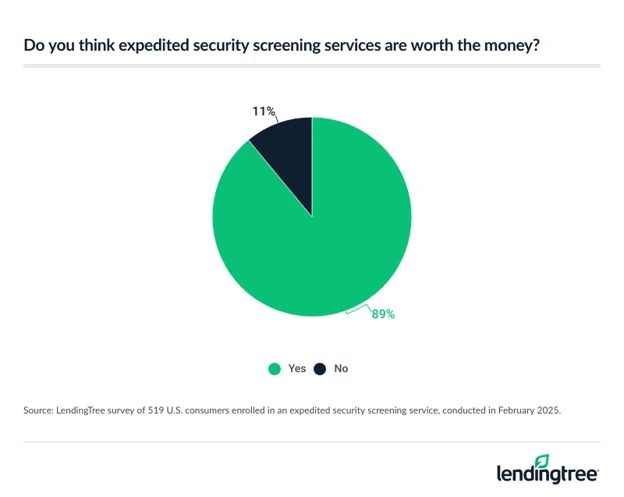

LendingTree survey: Is Global Entry/TSA PreCheck® worth it?

9 in 10 enrollees (89%) say expedited screening is worth the money, according to a recent LendingTree survey.

-

Elite status boost

You can earn 2,500 tier qualifying points (TQPs) toward A-List status for every $5,000 spent — with no limit on the amount of TQPs you can earn. This is a step above the Southwest® Rapid Rewards® Premier Business Credit Card, which only earns 2,000 TQPs per $5,000 spent.

A-List status comes with perks, including:

- Priority boarding*

- Preferred or standard seat at booking when available and an extra legroom seat within 48 hours of departure when available to help you save on seating fees*

- 25% earning bonus on every qualifying flight

- First checked bag free, second checked bag $35

- Same-day standby (taxes and fees may apply)/li>

- Priority and express lanes at Southwest check-in counters and airport security checkpoints

*For flights on or before Jan. 26, 2026 -

Earn the Southwest Companion Pass®

The points earned from your Southwest® Rapid Rewards® Performance Business Credit Card count toward the coveted Southwest Companion Pass®, which allows a designated person to fly with you for free (except taxes and fees) each time you purchase or redeem points for a Southwest flight for a full calendar year, plus the remainder of the year in which you earned it. To qualify for the Companion Pass®, you must earn 135,000 points or take 100 one-way flights in a calendar year.

With the Southwest® Rapid Rewards® Performance Business Credit Card, you’ll earn 10,000 Companion Pass® qualifying points bonus every year. Your sign-up bonus also contributes to the points requirement for the Companion Pass®. Plus, if you combine your points with a sign-up bonus from a Southwest consumer card, you can earn all the points you need in a year.

-

Save on seating fees

The Southwest® Rapid Rewards® Performance Business Credit Card lets you pick your seat on eligible Southwest flights — and possibly even score an extra legroom seat — for no fee. You’ll get a complimentary Preferred or standard seat for you and eight additional passengers at the time of booking. And you’re eligible for unlimited upgrades to an extra legroom seat within 48 hours before departure for you and eight additional passengers on the same reservation when available.

The seat upgrades are a new feature for the card, so it’s not clear yet how often the upgrades are available. However, it’s a unique benefit, so this may be a good fit for you if you value having extra legroom. -

Additional Southwest Airlines benefits

The Southwest® Rapid Rewards® Performance Business Credit Card comes with several other Southwest Airlines perks to help you save, including:

- 25% off in-flight purchases

- 9,000 anniversary points on your cardmember anniversary

- Group 5 boarding for you and eight additional passengers on the same reservation

Southwest® Rapid Rewards® Performance Business Credit Card drawbacks

-

Annual fee

At $299, the Southwest® Rapid Rewards® Performance Business Credit Card’s annual fee is on the high side — especially when compared with the annual fees of the other consumer Southwest Rapid Rewards cards. If you use the perks like the Global Entry/TSA PreCheck®/Nexus fee credit, you can more than make up for the annual fee in the first year.

The fee is a bit lower compared to similar cards like the Delta SkyMiles® Platinum Business American Express Card (see rates & fees). But the card also lacks all the extra perks and credits that most mid-tier airline cards offer to justify their high fees.

-

Limited flight locations

Because Southwest Airlines flies to a limited number of destinations, it may not be the most convenient airline for your travel needs. But keep in mind that Southwest adds new flight destinations from time to time. To see where Southwest Airlines flies, visit their route search tool here.

-

Rewards aren't very flexible

The most valuable way to use your Southwest points is on Southwest flights. Unlike general business travel cards, the Southwest® Rapid Rewards® Performance Business Credit Card doesn’t have a wide variety of hotel and airline transfer partners. Outside of Southwest flights, you can redeem points for some merchandise, international flights operated by other airlines, hotel stays, gift cards and rental cars, but the value is poor.

→ Learn more about Southwest Rapid Rewards

Southwest® Rapid Rewards® Performance Business Credit Card vs. Southwest® Rapid Rewards® Premier Business Credit Card

Southwest’s business card portfolio also includes the Southwest® Rapid Rewards® Premier Business Credit Card. Both cards offer bonus points on Southwest Airlines purchases. However, the Southwest® Rapid Rewards® Premier Business Credit Card has a lower annual fee ($149), anniversary bonus (6,000 miles) and initial sign-up bonus.

If you don’t need the extra TQPs or complimentary seat upgrades, it’s likely a better fit than the Southwest® Rapid Rewards® Performance Business Credit Card. You’ll get mostly the same perks, including a first checked bag free and 10,000 Companion Pass® qualifying points.

| Southwest® Rapid Rewards® Performance Business Credit Card | Southwest® Rapid Rewards® Premier Business Credit Card | |

|---|---|---|

| Annual fee | $299 | $149 |

| Rewards rate | 1X - 4X points

Earn 4 points per $1 spent on Southwest® purchases. Earn 2 points per $1 spent on gas station and restaurant purchases. Earn 2 points per $1 spent on hotel accommodations booked directly with the hotel. Earn 2 points per $1 spent on local transit and commuting, including rideshare. Earn 1 point per $1 spent on all other purchases. | 3X points Receive 6,000 anniversary points each year. Enjoy benefits including 3X points on Southwest Airlines® purchases, First checked bag free, 10,000 Companion Pass® qualifying points boost each year, and more. |

| Sign-up bonus | 80,000 points Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. | 85,000 points Earn 85,000 points after you spend $3,000 on purchases in the first 3 months your account is open. |

| Anniversary points | 9,000 | 6,000 |

| Upgrade to extra legroom seat | 48 hours before departure | N/A |

| Complimentary seat assignment | At booking | Up to 48 hours before departure |

| Tier qualifying points | 2,500 for every $5,000 spent | 2,000 for every $5,000 spent |

| Other benefits |

|

|

Alternate airline cards

Southwest® Rapid Rewards® Performance Business Credit Card vs. Delta SkyMiles® Platinum Business American Express Card

The Delta SkyMiles® Platinum Business American Express Card is a $350 annual fee card that packs a ton of value for business owners who fly with Delta frequently (see rates & fees).

It comes with a generous welcome offer and rewards rate on Delta flights. Plus, it comes with several perks and credits, including:

- An annual companion certificate for one select flight for just the taxes and fees (baggage charges and other restrictions apply)

- Up to $200 Delta Stays statement credit after using your Delta SkyMiles® Platinum Business American Express Card to book prepaid hotels or vacation rentals through Delta Stays

- Up to $120 Resy credit for eligible purchases*

- Up to $120 rideshare credit via $10 back each month on select U.S. rideshare purchases*

- Up to $120 Global Entry/TSA PreCheck® credit every four years

If you’re looking for more credits and benefits, the Delta SkyMiles® Platinum Business American Express Card is likely a better fit for you. Despite its slightly higher annual fee, it’s easy to make up for it with its practical credits.

Southwest® Rapid Rewards® Performance Business Credit Card vs. Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card is a business travel credit card that isn’t tied to any specific hotel or airline brand. You can transfer your points to any of Chase’s transfer partners — including Southwest — and often boost the value of your points.

One of the best features of this card is its sign-up bonus: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That’s $900* cash back or $1,125* toward travel when redeemed through Chase Travel℠.

That alone could more than make up for the $95 annual fee, depending on how you redeem it. You won’t get airline perks like free checked bags. But you will get more flexible and valuable points that you can use for Southwest flights.

Is the Southwest® Rapid Rewards® Performance Business Credit Card right for you?

If you’re a Southwest loyalist who wants the best seating on Southwest Airlines and wants to earn TQPs at the highest rate possible, the Southwest® Rapid Rewards® Performance Business Credit Card is the best choice. If your business can meet the required minimum spending to earn the sign-up bonus, you’ll also earn a large number of points that can help you earn the Southwest Companion Pass®.

However, if you’re less concerned about seat assignments, the Southwest® Rapid Rewards® Premier Business Credit Card offers many of the same benefits, including free checked bags and Group 5 boarding, for a lower annual fee. And, if you’re just looking to earn points for Southwest flights, you should consider the Ink Business Preferred® Credit Card, which lets you transfer points to Southwest and offers more flexibility.

How we rate travel credit cards

We take a comprehensive, data-driven approach to identify the best travel cards. We use an objective rating and ranking system that evaluates over 200 credit cards from more than 50 issuers. All recommendations are made by LendingTree’s editorial team, completely independent of affiliate partnerships or compensation. Every card is selected based on its merit and ability to help people achieve their financial goals. We use the following criteria to make our picks:

- Average value over two years (80% of rating)

We calculate the value of rewards and perks for the average cardholder using U.S. Bureau of Labor Statistics data and an annual spend of $20,000, minus the annual fee. This value includes the card’s sign-up bonus, annual bonus (including free night certificates) and travel perks like lounge access and travel credits. We look at the average rewards earned over two years to balance out a card’s ongoing value with its first-year value. - Flexibility of rewards (15% of rating)

We consider how easy the rewards are to use, looking at factors like expiration dates, minimum thresholds to redeem, blackout dates and the availability of flexible redemption options like travel statement credits and cash back. - Other features (5% of rating)

We also compare a card’s benefits, such as purchase protections, travel protections and elite status benefits against benefits from other cards.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

The information related to the Southwest® Rapid Rewards® Performance Business Credit Card, Southwest® Rapid Rewards® Premier Business Credit Card, Ink Business Preferred® Credit Card and Sapphire Reserve for Business℠ has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.