8 in 10 Who Asked to Lower Their Credit Card’s APR In Past Year Were Successful

More than 8 in 10 credit cardholders who asked for a lower interest rate in the past year were successful, according to a new report from LendingTree.

However, too few people take the time to make that call – and women are the most likely to leave that money on the table.

LendingTree asked more than 1,000 credit cardholders whether they requested any of the following from their card issuers in the past year: a waived or reduced annual fee, an increased credit limit, a waived late fee and a reduced APR or interest rate.

Our 2018 report showed that people have had success asking for these breaks in the past. In the 2019 report, we focused on people’s success rate in the past year and what we saw was that people are still getting what they ask for.

With every one of these requests, significantly more than half of those who ask – and sometimes more than 3 in 4 who ask – got a positive response. Yet, most Americans still don’t ask, and oftentimes it is because they simply don’t know they can initiate these types of requests.

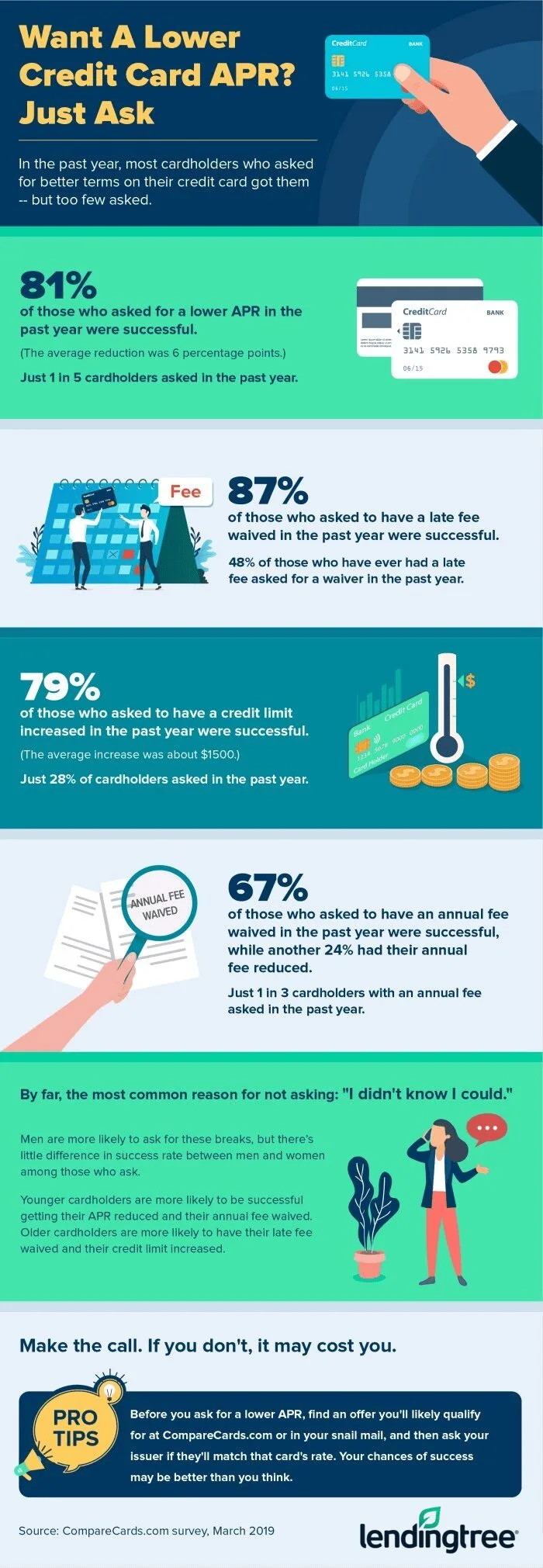

- 81% of those who requested a reduced APR in the past year were successful, but just 1 in 5 cardholders asked. The average APR reduction was about 6 percentage points.

- 87% of those who asked to have a late fee waived in the past year were successful. Yet, almost half (48%) of those who have ever incurred a late fee asked for a waiver in the past year.

- 79% of those who asked to have a credit limit increased in the past year were successful. But only 28% of cardholders had asked. The average increase was about $1,500.

- 67% of those who asked to have an annual fee waived in the past year were successful, while another 24% had their annual fee reduced. Just one in three cardholders with an annual fee made that request in the past year.

- By far the most common reason given for not asking: “I didn’t know that I could.” “I didn’t think I’d be successful” was also a common answer.

- Men are more likely to ask for these breaks, but there’s little difference in the success rate between men and women among those who ask.

- Younger folks are more likely to be successful getting an APR reduced and annual fee waived, while older folks are most likely to have a late fee waived and credit limit increased.

The bottom line: Make that call!

You have far more power with your credit card company than you realize. You just have to be willing to wield it, and far too few people do. That’s a shame because their reluctance to act ends up costing them money.

- A late fee can cost nearly $40.

- An annual fee can cost hundreds of dollars.

- A high APR can result in you paying hundreds more in extra interest.

- A low credit limit can hurt your credit utilization rate, keeping your credit score low and costing you several thousand dollars over the years in the form of higher rates and fees on credit cards, mortgages and auto loans.

If you’re living paycheck to paycheck or on a budget, you’re doing yourself a disservice by not at least picking up the phone and making one of these requests. That’s especially true when it comes to lowering your interest rate. If you carry a balance, reducing your interest even a few points will significantly reduce how much interest you pay over time and how long it takes to pay it off. It’s just simple math.

For example, if you have a balance of $5,000 on a card with a 24% APR and pay $250 per month, it’ll take 26 months to pay it off and you’ll pay about $1,450 in interest. Lower that APR to 18% — a 6-point reduction, equal to the average drop shown in our survey – and you’ll save more than $450 in interest and two months in payoff time. Still think it’s not worth making a call?

For some of these requests, you’ll likely won’t have to do much more than call and ask. That’s often true with late fees, which many issuers waive for first-time offenders without a second thought. Other requests might require some negotiation.

If you’re negotiating APRs, come to the call with ammunition in the form of other offers that you’ve seen at LendingTree or perhaps in your snail mail. That can help frame your negotiation. (“I’ve had your card for many years, but it has a 24% APR and I’ve just been offered a card with an 20% APR. Would you be willing to match it?”) If you’ve been a good customer, there’s a good chance the bank will work with you.

Like my dad always says, it never hurts to ask. The worst thing that can happen is they say no.

However, you might get a yes, and if that happens, some amazing things can happen. It’s true whether you’re a middle school kid building up the courage to ask their crush on a date, a hard-working employee asking your boss for a raise or a struggling cardholder asking for a lower interest rate on their credit card. Be brave. Make the call. There’s a good chance you’ll be glad you did.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,284 Americans, with the sample base proportioned to represent the general population. The survey was fielded March 5-8, 2019, and the margin for error for all respondents is +/- 2.7%.