64% of Americans Will Shop on Black Friday, Though Many Plan to Cut Back Due to Inflation

Nearly two-thirds of Americans expect to shop on Black Friday this year, with most opting to do so both online and in-store.

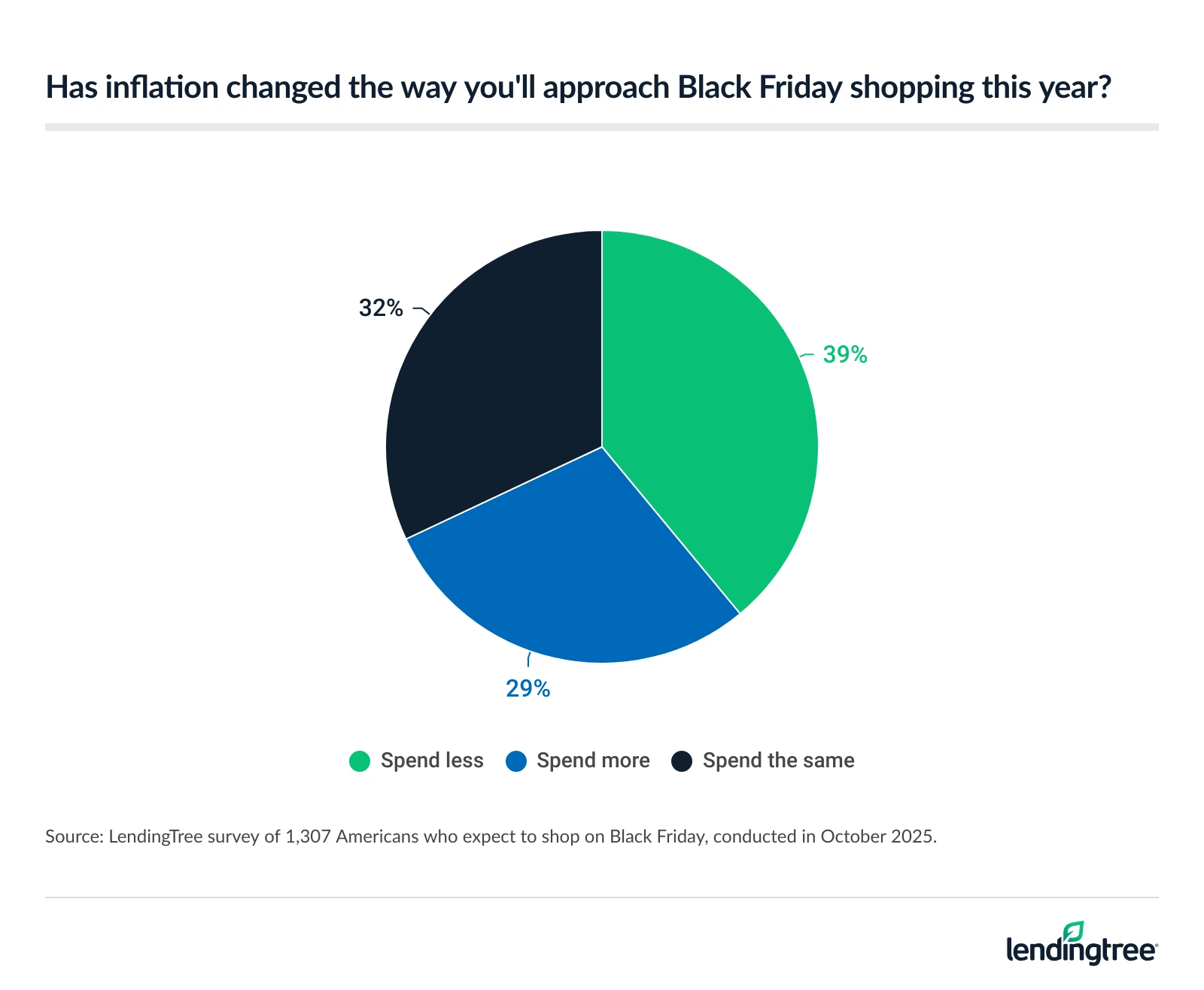

However, inflation looms large, with 39% of shoppers saying higher prices will lead them to spend less on Black Friday shopping this year.

- Americans are gearing up for Black Friday deals, but inflation will hold some back. 64% of Americans plan to shop on Black Friday this year, with 32% expecting to spend at least $500. More than half (54%) of Black Friday shoppers will shop both online and in person, while another 32% plan to only shop online. Nearly 7 in 10 shoppers (68%) say inflation will impact their plans, with 39% expecting to spend less. Nearly half (47%) of Gen Zers will spend less on Black Friday due to inflation.

- Many have taken on Black Friday debt. 38% who have made Black Friday purchases in the past have gone into debt as a result. 83% of this group did so last year — including 15% who are still paying it off.

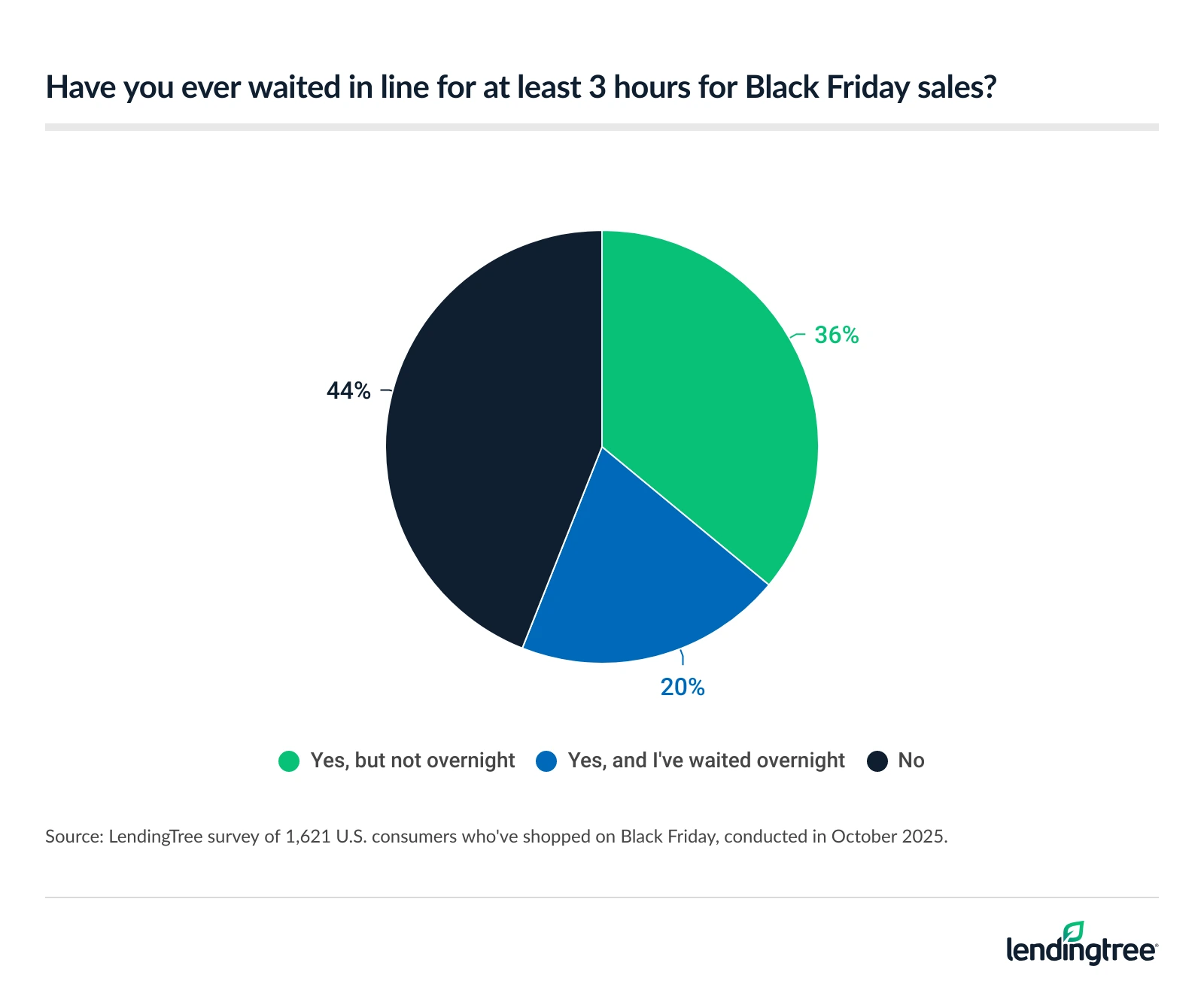

- More than half of past Black Friday shoppers have spent three hours or more in line for sales. 56% of them have done that, including 20% who’ve waited overnight. (29% of parents with young kids have waited overnight.) Conversely, the top reasons Americans have avoided stores on Black Friday are crowds (53%), long lines (46%) and traffic or parking hassles (39%).

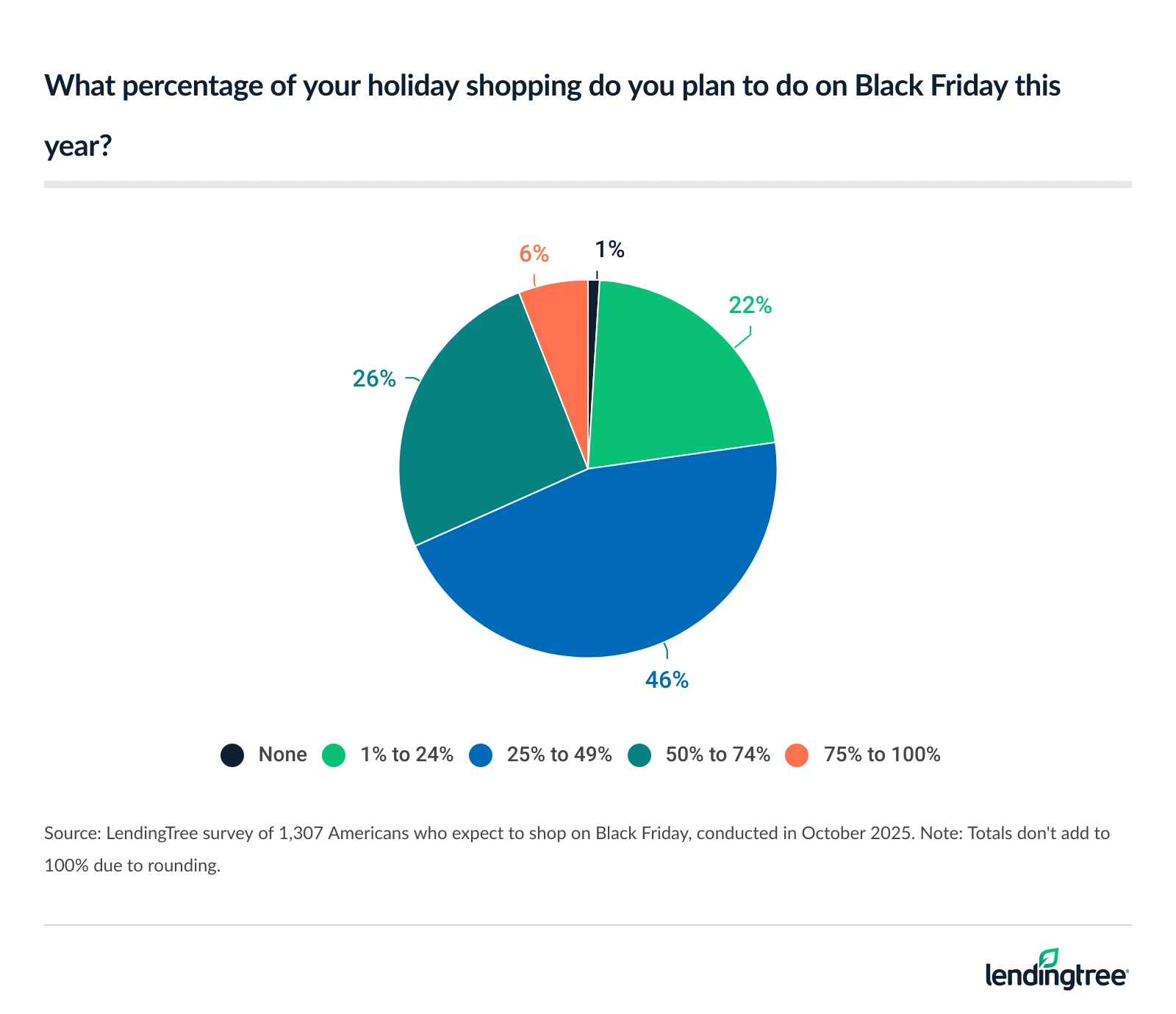

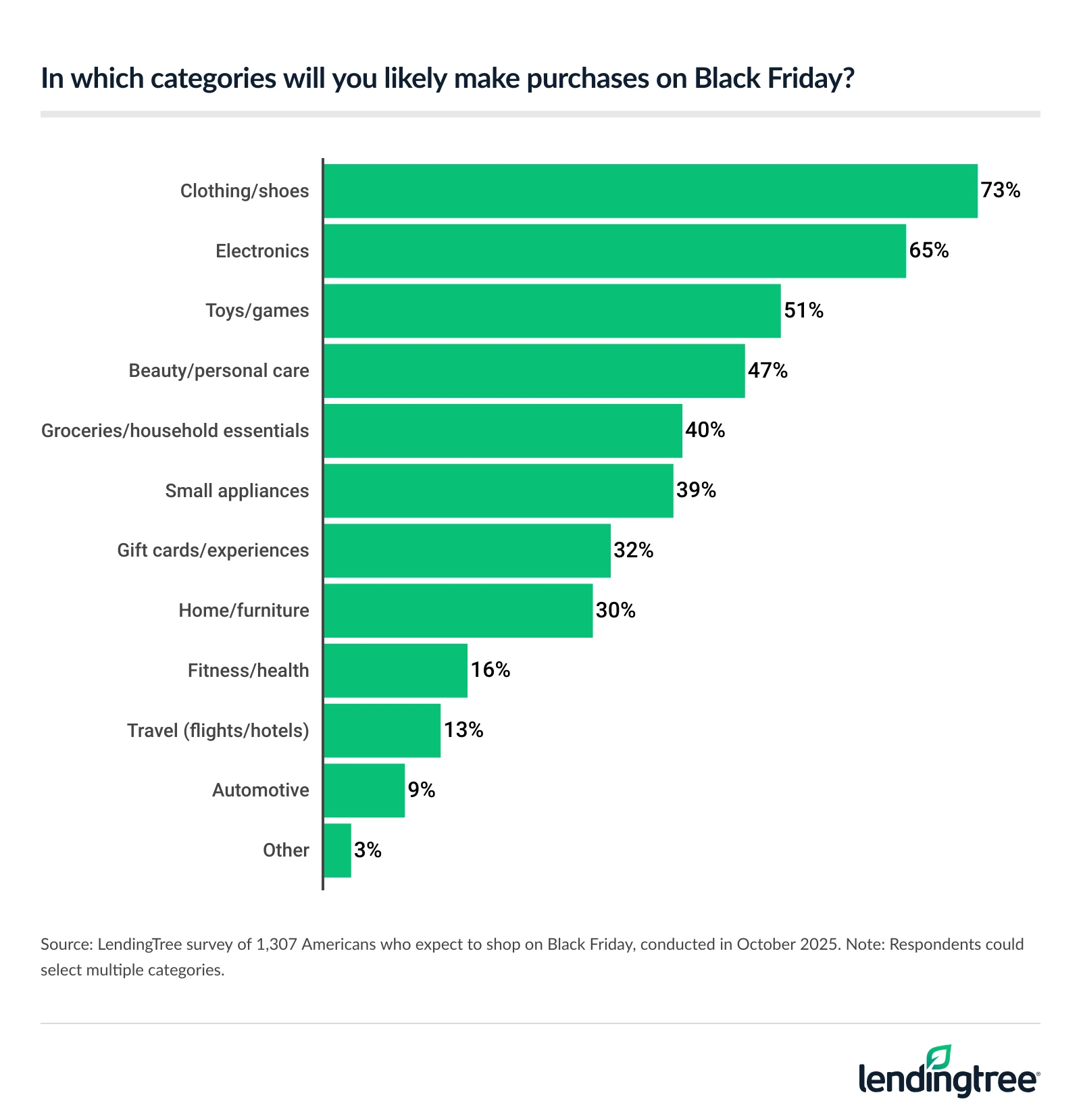

- Many will do at least half of their holiday shopping on Black Friday. 32% of Black Friday shoppers say they’ll purchase at least half of their holiday gifts then. Topping the shopping lists are clothes (73%), electronics (65%), and toys and games (51%).

Americans gearing up for Black Friday, but inflation will hold some back

Almost 2 in 3 Americans (64%) say they plan to shop on Black Friday this year. Parents of young kids (84%), millennials ages 29 to 44 (79%) and men (71%) are among the most likely to do so. Among Black Friday shoppers, more than half (54%) say they’ll shop online and in person that day. Another 32% plan to only shop online, while just 14% of shoppers will only do it in person.

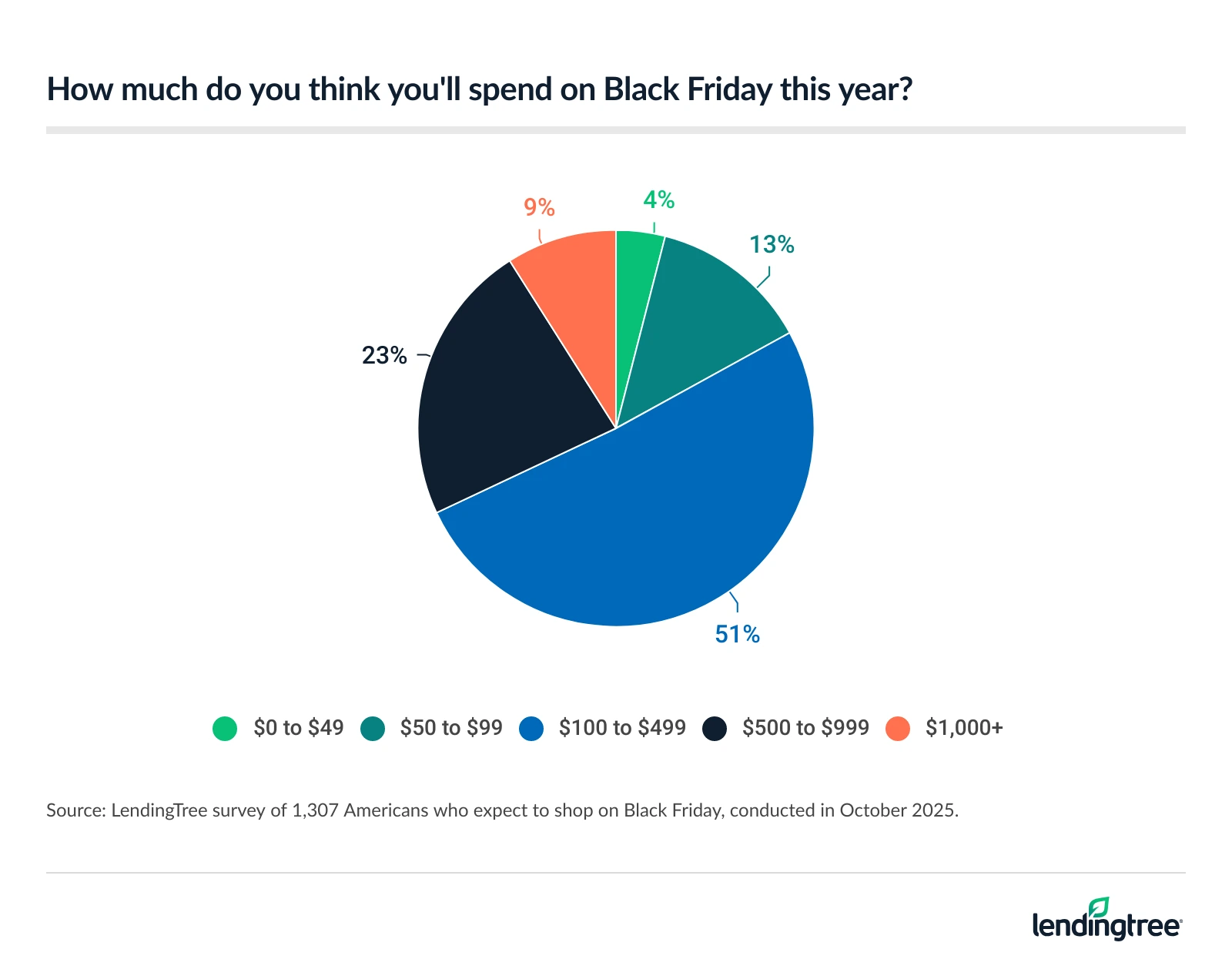

Those who will spend on Black Friday often spend big, with 32% expecting to spend at least $500. Just 17% of Black Friday shoppers will spend less than $100.

Still, almost 7 in 10 Black Friday shoppers (68%) say inflation will impact their spending plans, including 39% who expect to spend less and 29% who expect to pay more.

Tariffs threaten to push $28.6 billion in extra holiday expenses onto consumers

Men are twice as likely as women (38% versus 18%) to say they’ll spend more because of inflation, while women are far more likely than men to say they’ll spend less (48% versus 31%). Meanwhile, nearly half (47%) of Gen Zers ages 18 to 28 will spend less on Black Friday due to inflation — the highest of any age group — while 36% of millennials say they’ll spend more because of inflation. That’s also the highest of any age group.

That divide might seem strange at first, but people’s reaction to inflation may simply reflect their own financial margin for error. Consider this:

- For some, these extra prices may be inconvenient or annoying, but they won’t be enough to stop them from doing their regular holiday shopping. Those people may be more likely to spend more than they did last year due to inflation.

- For others, however, rising prices may prove to be a bridge too far, forcing people to cut back on spending, even on something as important as holiday gifts. Those people may be likely to spend less than last year because of inflation.

Many have taken on Black Friday debt

With big spending often comes debt. Black Friday is certainly no exception, as our survey revealed that 38% of people who’ve made Black Friday purchases in the past have gone into debt as a result. Parents of young kids (50%), men (46%) and millennials (45%) are among the most likely to have done so.

Among those who have taken on Black Friday debt in the past, 83% did so last year, including 15% who are still paying it off.

Most people (78%) who will shop on Black Friday this year say they’ll make a budget for their shopping spending, and 56% of budget-makers say they’ll stick closely to it. However, a closer look at the data provides some reason to doubt that. For example, our survey shows that 46% of people who’ve shopped on Black Friday in the past say at least a quarter of their purchases are impulse buys. About 1 in 6 past Black Friday shoppers (16%) say that more than half of their purchases on that day are impulse buys. That sort of spontaneity can make it more challenging — though certainly not impossible — to stick tightly to a budget.

More than half of Black Friday shoppers have spent 3 hours or more in line for sales

Massive crowds and long lines are as synonymous with Black Friday as big deals, and our survey is further proof. Among those who’ve shopped Black Friday in the past, 56% say they’ve waited at least three hours in line to do so. That includes 20% who’ve waited overnight.

Nearly 3 in 4 parents of young kids (73%) say they’ve waited in long lines at Black Friday sales, while men are more likely than women (64% versus 47%) to have done it. The younger you are, the more likely you are to have done so.

However, clearly not all Americans see the fun in braving hordes of shoppers and spending hours in line in search of great deals. We asked people if they’ve ever avoided shopping in-store on Black Friday, and 90% of Americans said yes. The most commonly given reason? Crowds. More than half (53%) of Americans cite that. Long lines (46%) and traffic or parking hassles (39%) weren’t far behind.

Many will do at least half of their holiday shopping on Black Friday

While there’s no question that many shoppers love Black Friday because of the excitement and energy of the crowds, the day is ultimately about one thing: holiday shopping.

About 1 in 3 (32%) Black Friday shoppers say they’ll purchase at least half of their holiday gifts on that day, while just 1% won’t do any holiday shopping on that day. Men are slightly more likely than women (33% versus 30%) to do most of their holiday shopping on Black Friday, while millennials (35%) are the most likely age group to do so.

The most commonly sought items on Black Friday likely won’t surprise anyone who has set foot in a store during the holidays: clothes (73%), electronics (65%), and toys and games (51%).

A closer examination of the data reveals that clothing is the most likely purchase for most demographics. Men are a notable exception, with electronics narrowly edging out clothing (73% versus 71%) at the top of their list.

How to stay out of the red on Black Friday

Black Friday is about spending. Most retailers offer deals to get you to buy on that day, and it can be easy to get swept up in the excitement of bargain shopping. However, as our survey makes clear, that excitement can lead to debt.

Here are some important things to be mindful of this Black Friday:

- A deal isn’t always a deal: While retailers often advertise eye-catching discounts on Black Friday, sometimes those deals aren’t all they’re cracked up to be. CamelCamelCamel.com is a price-tracking site that can help you see if that big Black Friday discount is a special deal or nothing special. The site won’t have price histories for every item, but its listings are extensive enough to make it worth your time to check.

- Shopping around can be the best deal: There can be substantial price differences from one retailer to another. If you don’t take the time to look around, you could pay too much.

- More things are negotiable than you’d think: Retailers are generally highly motivated to move merchandise during the holiday season, so they might be more willing to bargain than they would be at other times of the year. Of course, you shouldn’t expect to haggle over the cost of a blouse or an Xbox at places like Walmart or Target. However, furniture, appliances and other big-ticket-item prices might be up for discussion. That can be especially true at locally owned retailers, but it can also be true at bigger retailers when it comes to floor-model appliances, for example. Ultimately, it can’t hurt to ask.

- Store credit cards can help, but only if you don’t carry a balance: These cards come with big-time perks and discounts that can save you real money during the holidays. Unfortunately, however, they often come with interest rates of 30% or higher, meaning that if you carry a balance, any rewards or discounts you receive will likely be outweighed by interest. Proceed with caution.

- Special financing usually comes with a big catch: Retailers love to tout their “special financing” deals in which you get, for example, six months to pay off a purchase interest-free. What they don’t always make clear is that if you don’t pay that purchase off in full during that interest-free period — even if you’ve paid $995 out of $1,000 — you may get hit with a bill for all the interest you would have accrued going back to the original purchase date. That can be an unpleasant surprise.

- Making a list makes a difference: It sounds simple, but it’s true. Creating a list can help you avoid impulse buys that can damage your budget. We saw in our survey how common these spontaneous purchases are on Black Friday, and, of course, making a list won’t eliminate them, but it can help. The simple act of making a list can change the vibe of a shopping trip. With that list in hand, you’re no longer wandering in search of inspiration. Instead, you’re on a mission to find what you’re looking for. That matters.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,050 U.S. consumers ages 18 to 79 from Oct. 9 to 13, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennials: 29 to 44

- Generation X: 45 to 60

- Baby boomers: 61 to 79