62% of Cardholders Have Paid Extra to Use a Credit Card, but Over Half Say That Should Be Illegal

Nearly 2 in 3 cardholders have been charged an extra fee by a merchant to use a credit card, according to a LendingTree survey. However, most cardholders don’t think such fees should be legal.

These surcharges are a retailer’s attempt to recoup the fees it pays for the ability to accept credit card payments. Known as swipe fees or interchange fees, the fees paid by merchants typically equal 1.5% to 3.5% of the transaction price — a big deal for merchants’ bottom lines, especially considering how small many companies’ profit margins are. Surcharges to cover those fees have generally been legal in most states for more than a decade, but it’s clear that cardholders aren’t happy about that.

Here’s more of what we found in our survey.

Surcharges are OK on credit card purchases, but not debit cards

While merchants are generally able to legally add surcharges on credit card transactions, they can’t do the same on debit card transactions.

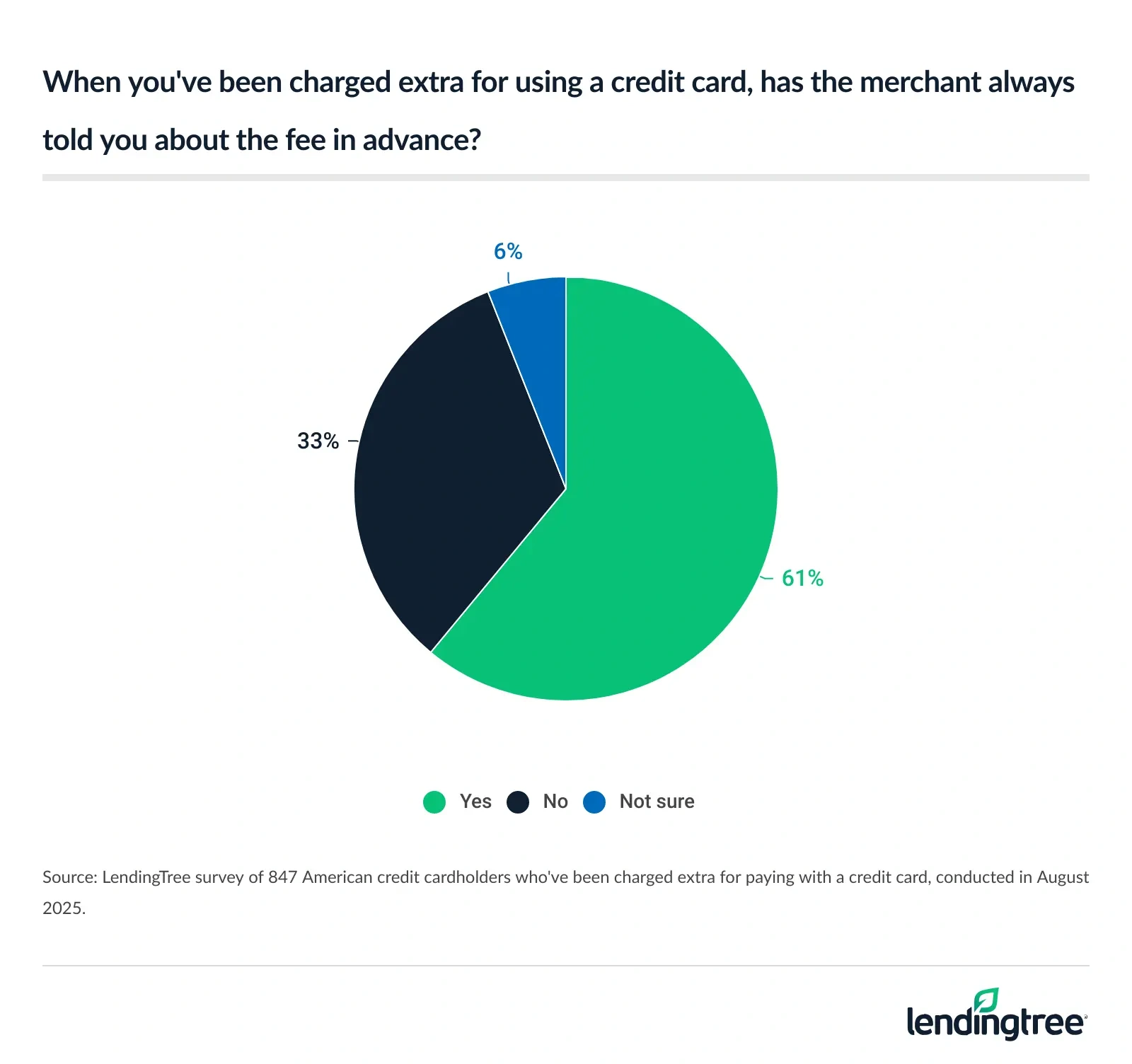

- Credit cards make spending easy, but some cardholders get hit with surprise fees. Over 6 in 10 cardholders (62%) have been hit with extra charges for using a credit card, and one-third of them say they weren’t always warned about the fee before paying.

- Nearly half of cardholders don’t know that card companies make money from swipe fees. These fees, also called interchange fees, are what merchants pay to be able to accept credit cards. When merchants tack on a credit card surcharge, they’re typically doing so to cover these fees. However, 46% of cardholders don’t realize that card companies make money off these fees.

- Many question whether credit card surcharges should be legal. Over half of cardholders (56%) say it should be illegal for retailers to charge extra for using a credit card. That includes 70% of baby boomers and 64% of women.

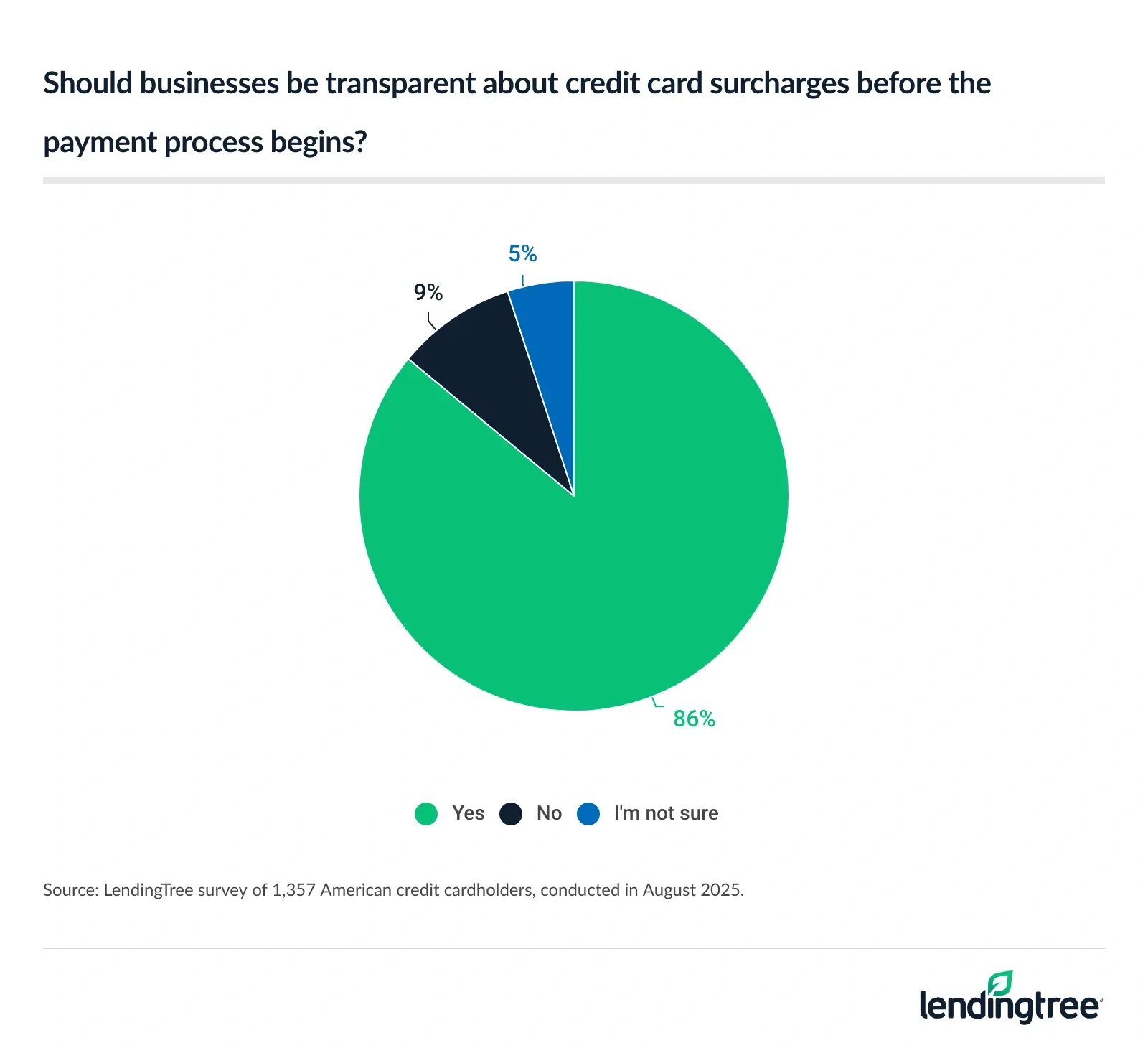

- Transparency is key when it comes to credit card surcharges, but most cardholders would prefer a cash discount instead. The majority of cardholders (86%) say businesses should disclose credit card surcharges up front. However, 84% would rather have merchants offer a discount for paying in cash instead of adding a surcharge.

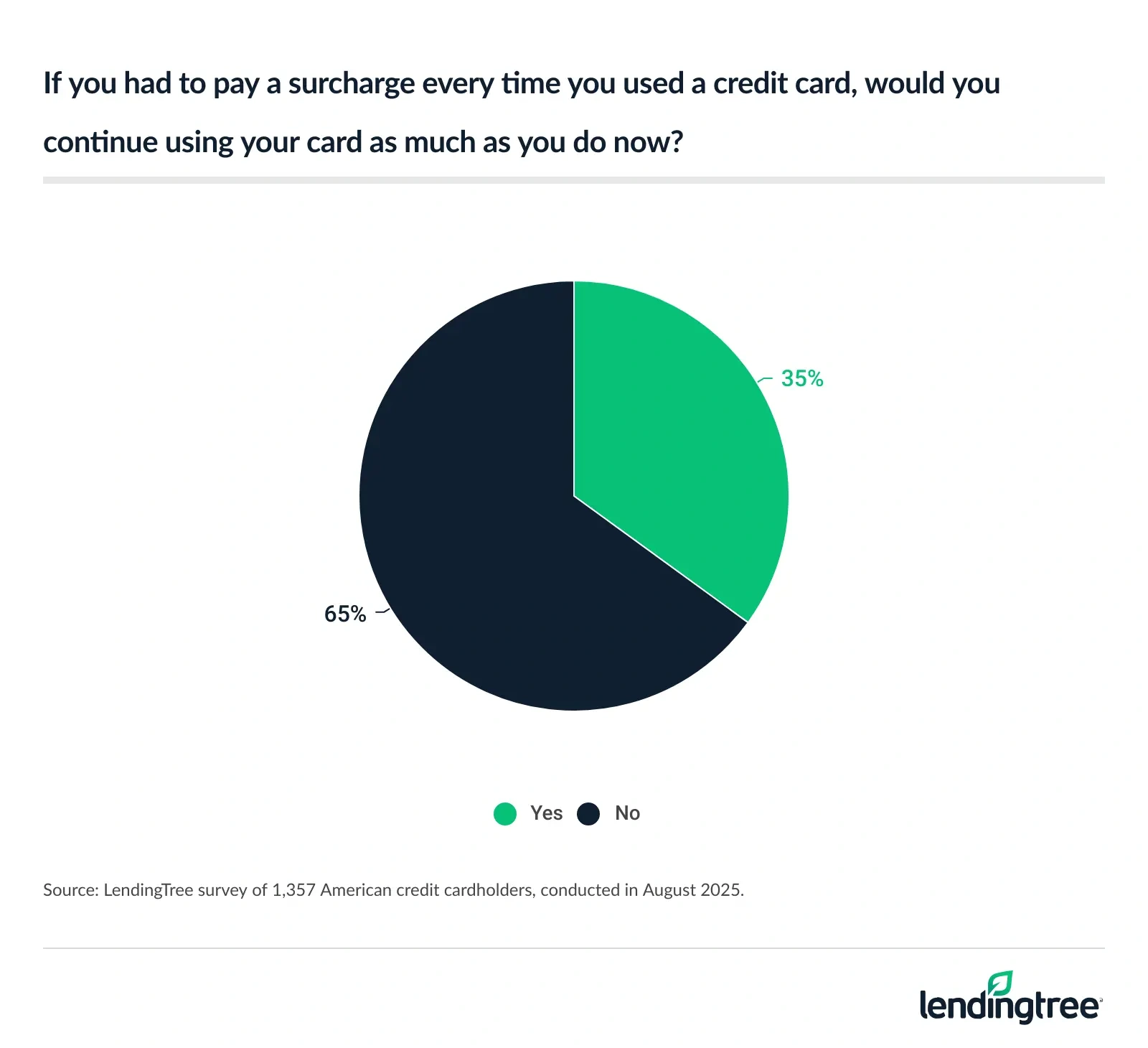

- Younger cardholders avoid fees by paying with cash. If merchants charged an extra fee every time customers used a credit card, 65% of cardholders say they wouldn’t use the card as much as they currently do. When asked how they pay when a business has a credit surcharge, 30% switch to cash — with Gen Zers at 35%.

Credit cards make swiping easy, but some cardholders get hit with surprise fees

Women are much more likely than men to say they weren’t informed of the charge in advance (38% versus 29%). Baby boomers and Gen Xers are more likely than their younger counterparts to say so. Meanwhile, those making $100,000 or more a year are the least likely income bracket to say they were charged the fee without warning.

Nearly half of cardholders don’t know that card companies make money from swipe fees

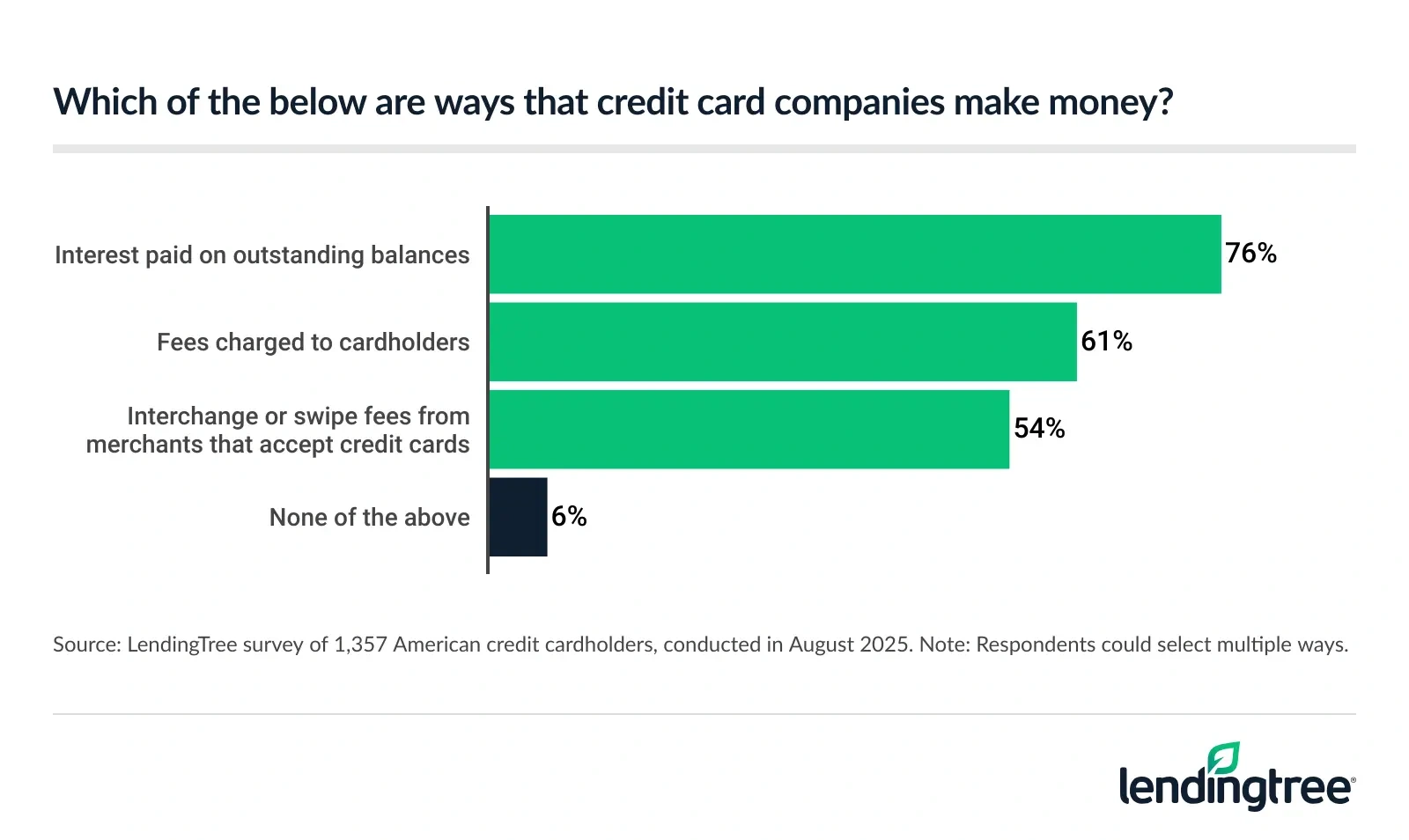

Credit card companies primarily make money in three ways:

- Interest paid on outstanding balances

- Fees charged to cardholders, including annual fees, late fees, foreign transaction fees, cash advance fees and more

- Swipe (or interchange) fees paid by merchants that accept credit cards

When asked if any of the above methods were among the ways credit card companies make money, most respondents showed a basic understanding. For example, more than 3 in 4 cardholders (76%) said these companies make money off interest and 61% said they make money off fees charged to cardholders. However, just 54% of cardholders knew that card companies make money off swipe fees paid by merchants.

Just 43% of Gen Z cardholders and 49% of millennial cardholders said they knew card companies make money off swipe fees, compared with 52% of Gen X cardholders and 69% of boomer cardholders. Fewer than half of parents of young kids said the same, along with fewer than half of cardholders making less than $50,000 a year.

That lack of knowledge creates a real problem for merchants. If people don’t know that merchants pay swipe fees every time someone buys with a credit card in their store, people aren’t going to understand why merchants want them to pay extra when they use a credit card. If people don’t understand that, they’re not going to be happy about paying that extra charge.

Many question whether credit card surcharges should be legal

More than half of cardholders (56%) say surcharges for paying with a credit card should be illegal.

Women are much more likely than men to say so (64% versus 49%). Baby boomers are more likely than any other age group to say they should be illegal, and people earning less than $100,000 a year are more likely than higher-earning Americans to say the same.

Just 36% of respondents say these surcharges should be legal, while 8% say they don’t know. Parents of young kids (54% say they should be legal), millennials (51%) and those earning $100,000 or more a year (51%) are among the few groups supporting the ability to levy these surcharges.

Transparency is key when it comes to credit card surcharges

Our survey leaves no doubt that most cardholders aren’t big fans of credit card surcharges. However, it’s also clear that cardholders feel that if they’re going to be hit with these charges, merchants should at least be upfront about it.

The vast majority of cardholders (86%) say businesses should be transparent about the credit card surcharges before a payment is made.

However, a similar percentage (84%) would rather have merchants offer a discount for paying in cash instead of adding a surcharge. Baby boomers are the most likely to agree with this, at 93%.

Younger cardholders avoid fees by paying with cash

Americans love spending on credit cards, and financial institutions and retailers have done an amazing job over the years of making it easier to do so.

However, our survey shows that cardholders’ love of plastic clearly has its limits. For example, if they had to pay a surcharge every time they used a credit card, 65% of cardholders say they wouldn’t use the card as much as they do currently.

Because of how this question was worded, it’s possible that some people who answered “no” might use the card more if surcharges were added. Given the disdain for these surcharges in other parts of the survey, it seems unlikely that many would, but it’s possible. So we can’t say definitively that all 65% would use the card less if surcharges were imposed.

Still, when asked how they pay when a business requires a surcharge, nearly 6 in 10 (59%) say they still pay with a card. However, 30% switch to pay with cash and 8% choose not to buy at all.

Women are more likely than men to switch to cash, at 32% versus 28%. Gen Zers at 35% and boomers at 33% are the most likely age groups to do so.

Among the least likely groups to switch to cash? High-income earners. Just 24% of those making $100,000 or more say they pay cash to avoid a credit card surcharge, while at least 28% of lower-income brackets say the same.

You still have power when it comes to surcharges

Don’t forget: While businesses in most states are well within their rights to add a surcharge when you buy with a credit card, you still have options.

- You can walk away. Most things we buy are available from many retailers. If one of them charges a surcharge, consider leaving that place and seeking another that doesn’t.

- You can ask to have the fee waived or reduced. There’s no guarantee that this will work, but it can’t hurt to ask, especially if you’re a longtime regular customer. That business isn’t going to want to lose your business over a small fee.

- You can opt to use cash or debit. Surcharges are only permissible with credit card transactions, not with debit card transactions. If you prefer to pay with plastic but hate surcharges, paying by debit is the move. And while some merchants have gone entirely cashless, most businesses are more than happy to take good, ol’ American dollar bills — and you won’t have to pay extra to use them.

- You can view these surcharges as a way to support your favorite business. The truth is that credit card processing fees are a significant burden on merchants. By willingly paying these surcharges — whether you like them or not — you’re helping the business’s bottom line and making life just a little bit easier on them.

However, customers should never stand for shady or improper treatment from a business. If a merchant charges a fee but doesn’t disclose it properly or the amount of the fee seems to exceed what’s reasonable, make your displeasure known. Tell the merchant. Let the credit card network know what happened. You could even consider informing your state’s attorney general or consumer protection department.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 Aug. 4-7, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79