Nearly 2 in 3 Americans Have Used a Mobile Wallet, and 1 in 3 Spend More When They Do

Almost two-thirds of Americans have used a mobile wallet to make a purchase, and many say they spend more doing so than they would with a physical debit or credit card.

It’s never been easier to shop without a physical card, so LendingTree asked Americans about their behaviors, preferences and opinions related to mobile wallets. You know, those apps on our phones, such as Apple Pay, Samsung Pay or Google Pay, that let us make online or in-store purchases without a physical card.

But while mobile wallets are common, a large majority of Americans still prefer their plastic to their phone for in-store payments. Here’s what else we learned.

- Many consumers are tapping into mobile payments, and their spending shows. Nearly two-thirds of Americans (63%) have used a mobile wallet to make a purchase, including 84% of Gen Zers. However, 33% of mobile wallet users say it makes them spend more and 37% say they’ve tipped more.

- Most prefer their plastic, but younger generations are catching on. 74% of Americans use a physical debit or credit card most often when shopping in person. Just 13% prefer mobile wallets. However, younger generations are ahead of the curve, with 25% of Gen Zers using mobile wallets most often.

- Convenience and safety make mobile wallets more appealing. Among those who’ve used a mobile wallet, 43% like the faster checkout, 16% appreciate the increased security and 11% don’t like carrying cards. Additionally, 43% believe mobile wallets are more secure than physical cards.

- Don’t count out physical cards and wallets just yet. More than a third (37%) of mobile wallet users have stopped shopping somewhere that didn’t accept digital payments. However, 64% of mobile wallet users say they still expect to carry a physical wallet or card in five years.

Many consumers tapping into mobile payments — and their spending shows

Americans are embracing mobile wallets.

Our survey found that 63% of Americans have used a mobile wallet to make a purchase. There’s a substantial generational usage gap — 84% of Gen Zers ages 18 to 28 and 81% of millennials ages 29 to 44 have used them, versus 60% of Gen Xers ages 45 to 60 and just 30% of baby boomers ages 61 to 79 — but significant percentages of all demographics use them.

As you can see below, boomers are the outliers when it comes to mobile wallet usage.

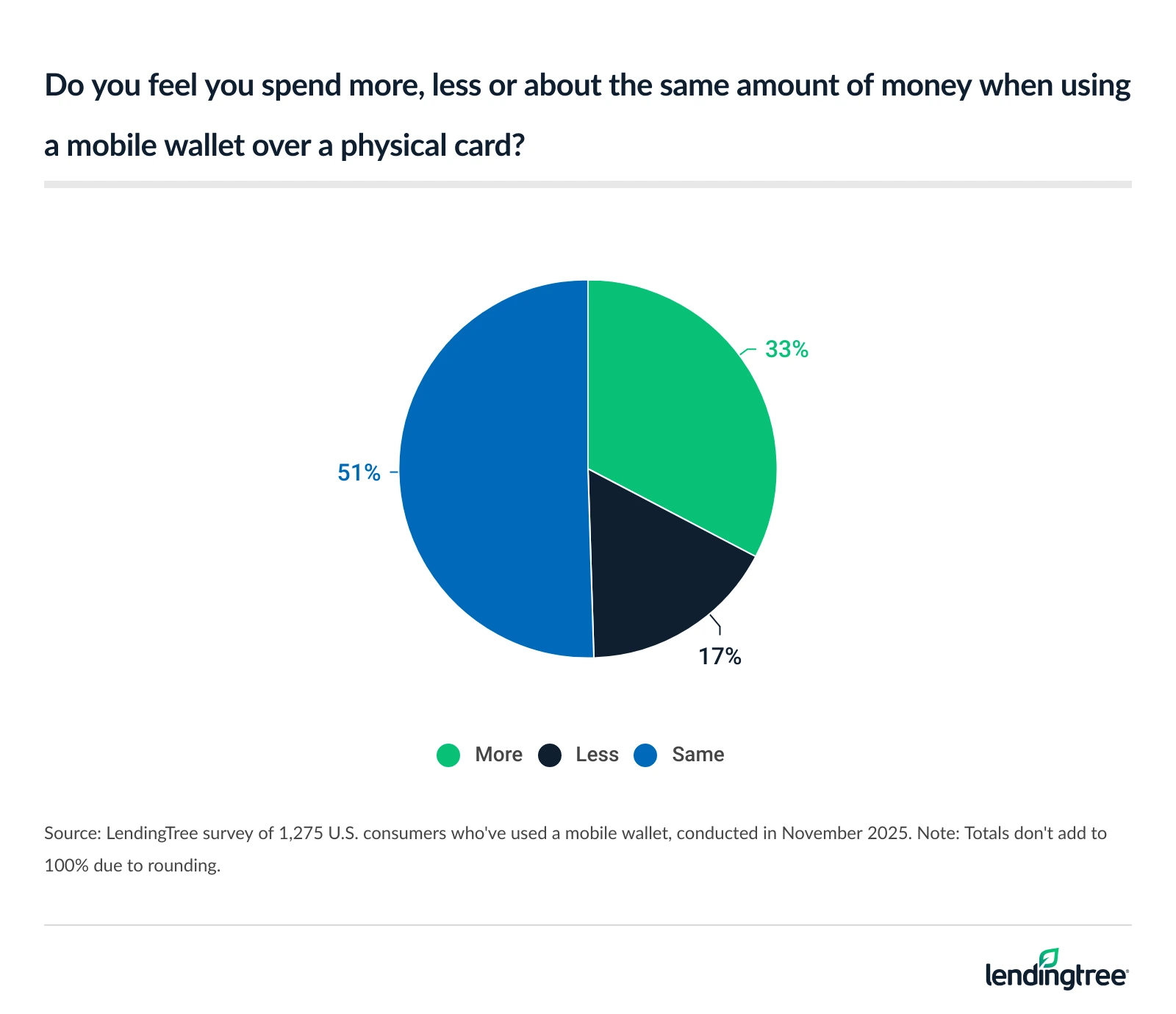

Unfortunately, many users report spending more when using mobile wallets than when using a physical credit or debit card. One-third (33%) of mobile wallet users say so, including 44% of parents with kids younger than 18 and 39% of millennials.

Just 17% say they spend less money with mobile wallets. Again, boomers are the outlier — they’re the only age group in which more people say they spend less with a mobile wallet than say they spend more (13% versus 9%; 78% say they spend the same).

Mobile wallets are even making people tip more. The survey showed that 37% of users say they’ve tipped more with a mobile wallet than they would have with a physical card. Nearly half of parents of young kids (49%) say so, as do 45% of Gen Zers and 42% of men.

Most prefer their plastic, but younger generations catching on

While most Americans have used mobile wallets, our survey shows that a good, old-fashioned physical credit card remains people’s tool of choice for in-store payments.

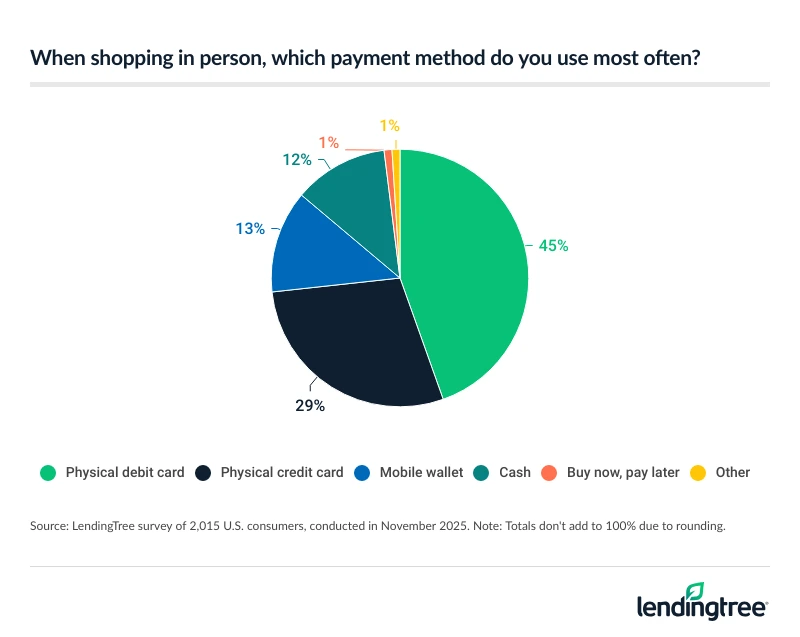

About 3 in 4 Americans (74%) say they use a physical debit or credit card most often when shopping in person, while only 13% prefer to use a mobile wallet. However, more people prefer mobile wallets over cash, which is the favorite payment method for 12% of Americans.

Among the demographics, only two prefer a mobile wallet over either a physical credit card or a physical debit card — none prefer a mobile wallet over both. Among Gen Z users, 25% say they use a mobile device most often when shopping in person, while just 19% say a credit card is their top choice. (The most popular option, a physical debit card, is preferred by 40% of Gen Zers.) Meanwhile, 12% of people earning less than $30,000 prefer a mobile wallet, while just 10% say physical credit cards are the payment tool they’d opt for when shopping in person. (Again, physical debit cards are the runaway top choice, with 52% preferring them.)

Convenience, safety make mobile wallets more appealing

Why do so many people prefer mobile wallets? The need for speed.

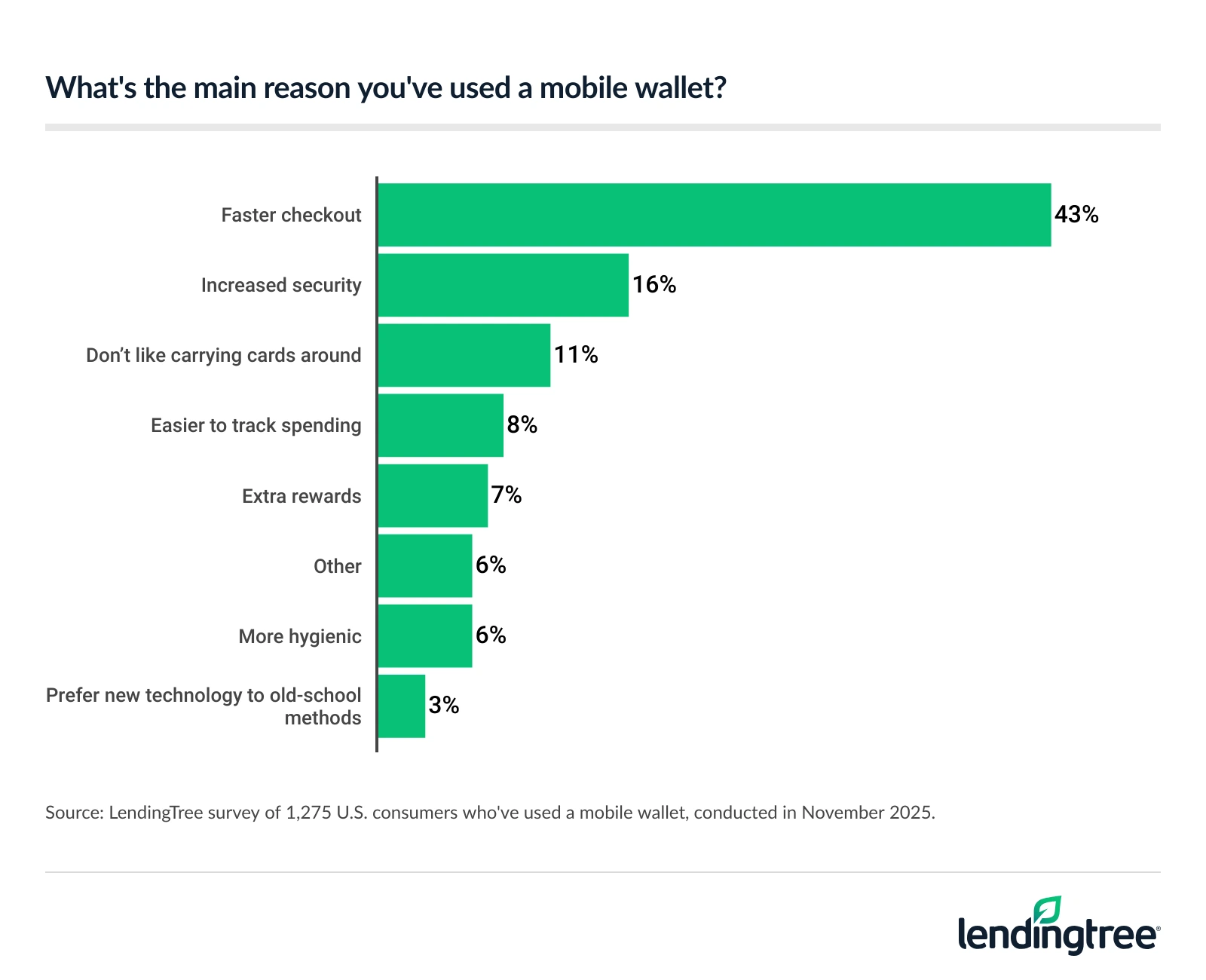

When we asked those who’ve used a mobile wallet to tell us the main reason they chose a wallet over a physical card, 43% said they could check out more quickly. That was the top answer among every age group, income level, parental status and gender. The next most popular answers: increased security (16%) and not liking carrying cards around (11%). Women are more likely to say they don’t want to carry the cards around (14% versus 8%), while men are more likely than women to cite security as a prime reason (20% versus 13%).

Still, most mobile wallet users don’t see them as significantly more secure than physical cards. The survey found that 43% believe they’re more secure, but 50% say they’re similarly secure to physical cards. Just 8% say they’re less secure.

There’s a noticeable gender gap: 50% of men say mobile wallets are more secure, while just 34% of women do.

Don’t count out physical cards, wallets just yet

Perhaps no single data point in our survey drives home the popularity of mobile wallets more than this one: 37% of mobile wallet users say they’ve stopped shopping somewhere because they didn’t accept digital payments. The younger you are and the more money you make, the more likely you are to say so.

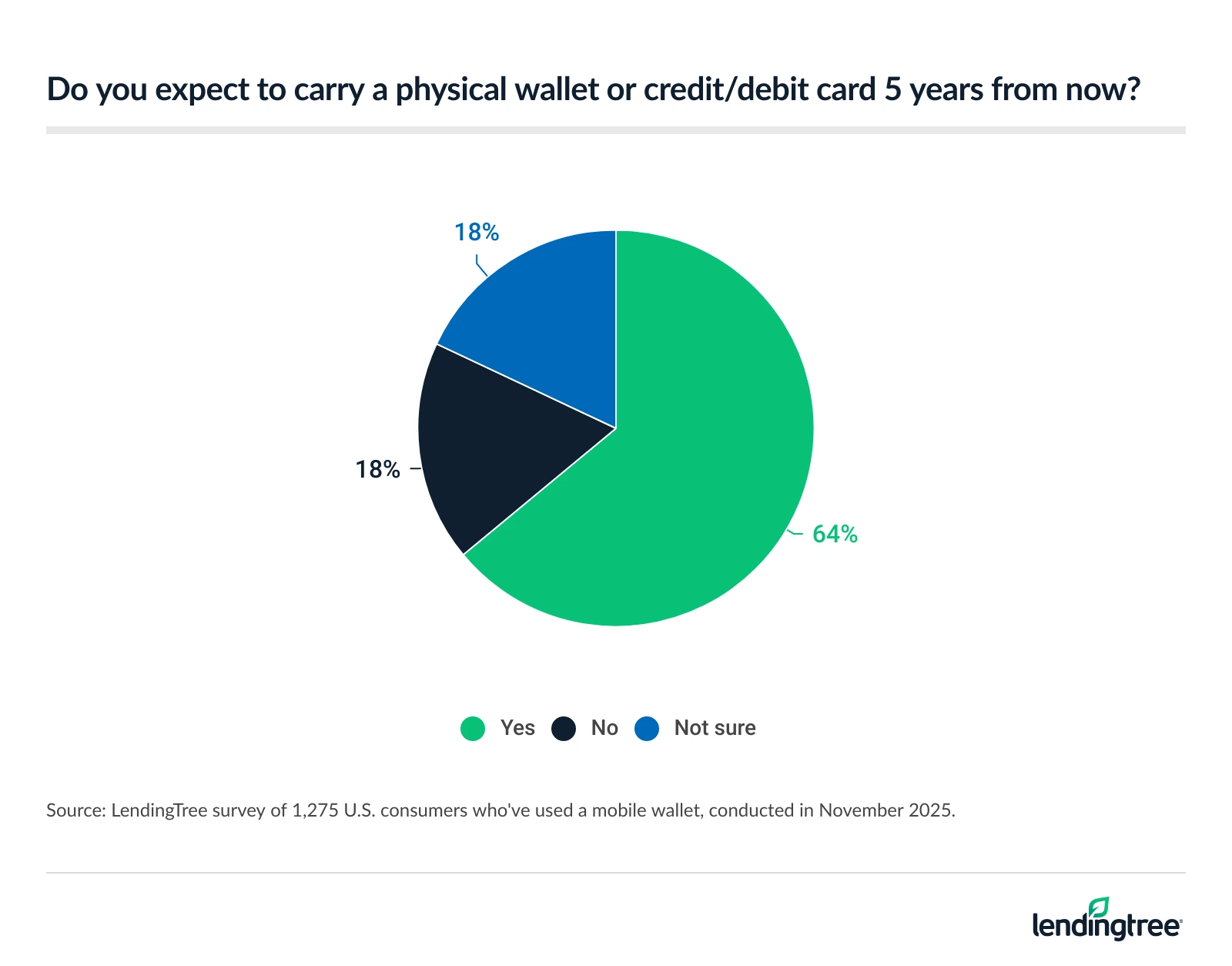

Does the popularity of mobile wallets mean that physical wallets will be a thing of the past soon, though? Most mobile wallet users say no.

Nearly 2 in 3 mobile wallet users (64%) say they expect to carry a physical wallet or card in five years, while just 18% don’t. Another 18% aren’t sure. Perhaps unsurprisingly, Gen Zers are the most pessimistic about the future of physical cards and wallets, with 25% saying they don’t expect to carry them five years from now.

Don’t let your mobile wallet lead you into debt

Financial institutions, retailers and tech companies have done a masterful job of making it as easy and frictionless as possible to spend as much as you want, whenever and wherever.

Remember this, though: Just because you can spend more easily doesn’t mean you should. Here are a few simple tips to help you avoid overspending with your mobile wallet.

- Put away the phone. Nooooooo!! I know, I know. I struggle with it, too, but it’s possible to set your phone aside for a while. If you’re mindlessly scrolling and shopping, lift your head up and safely toss the phone onto a chair or pillow across the room. If you’re with someone you trust, have them keep your phone while you’re shopping. You rob the phone of much of its power over you by having it a bit out of your reach.

- Limit the number of cards you keep in your wallet. Among mobile wallet users, more than 4 in 10 have at least three cards stored in the mobile wallet they use most. That can be good because it gives you plenty of options, but it can also be bad for the same reason. If you’re concerned about overspending, consider only storing your debit card in your mobile wallet. It’s no secret that people tend to overspend when they use credit cards, so leaving those out of your wallet — physical or mobile — can help.

- Try the 24-hour rule. When you’re about to buy something unplanned, stop and breathe. If you’re shopping online, leave the item in your cart for 24 hours. Once that time is over, if you still want to buy it, that’s your choice. However, you may find that in the absence of the adrenaline rush, that deal doesn’t look as appealing. You can do the same thing in a physical store by walking away and leaving the item on the shelves. You can always come back and get it later if it passes the 24-hour test.

- Make a list. It may sound simple, but it can help. The simple act of making a list before you shop changes the vibe of the trip. You’re no longer browsing in search of inspiration. Instead, you’re on a mission to get these specific things you’re looking for. That tighter focus can make you less susceptible to impulse spending.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,015 U.S. consumers ages 18 to 79 from Nov. 5 to 10, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79