62% of Gen Zers Feel Pressured to Keep Up With the Joneses, As Many Overspend Into Debt

More than 6 in 10 Gen Zers say they feel pressured to spend to keep up with others, according to a new LendingTree survey of nearly 2,000 consumers. That’s a far bigger number than any other age group, and those feelings are leading many of them into debt.

While our survey finds that Gen Zers are way more likely to feel the financial burden of keeping up with friends, family, co-workers, social media influencers and others, other generations aren’t immune. Overall, many Americans say they’ve overspent to impress someone, and most of those who have say they’ve gone into debt to do so.

Here’s more of what we found.

Key findings

- Younger generations feel the burden of keeping up with the Joneses. Almost a third (32%) of Americans say they feel financial pressure to keep up with someone, with many citing family or friends. The youngest generation feels significantly more pressure — 62% of Gen Zers say so, with 57% of Gen Zers noting it’s increased as they’ve aged.

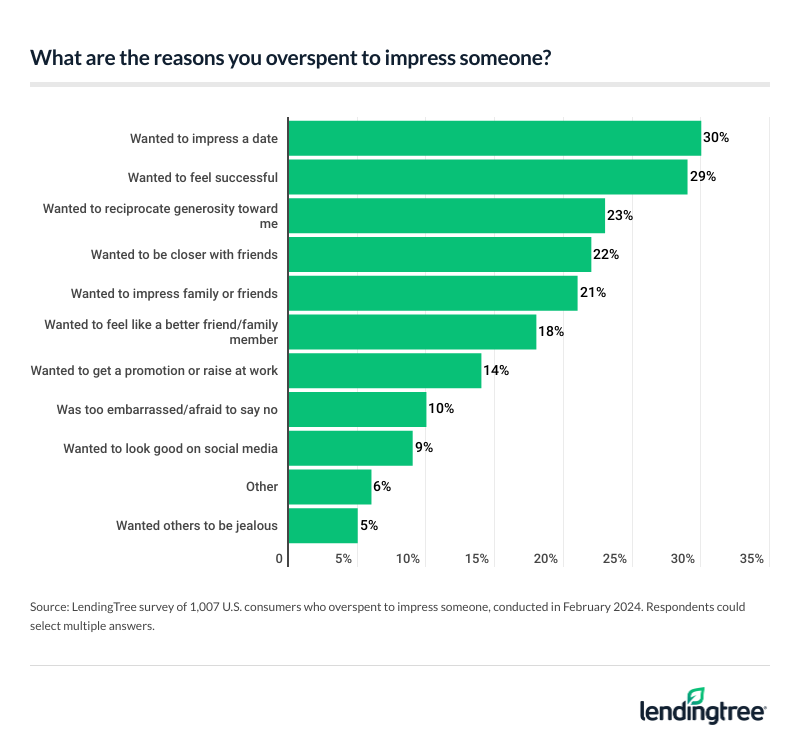

- This pressure is leading Americans to spend beyond their means. Over half (51%) admit they’ve overspent to impress someone else — common among younger generations and men. When asked why they felt inclined to shell out big bucks, 30% wanted to impress a date (including 40% of men), 29% wanted to feel successful and 23% wanted to reciprocate generosity.

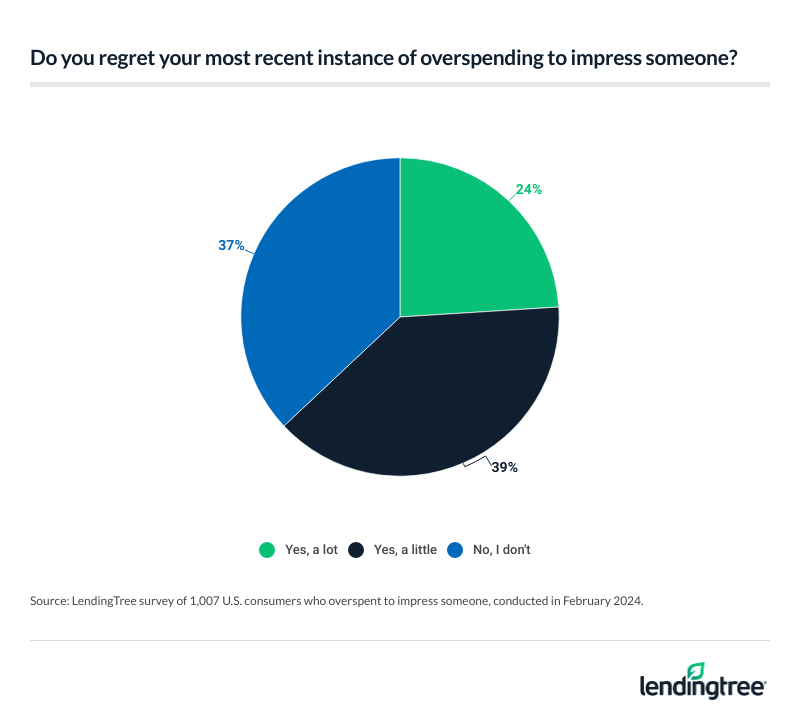

- Unfortunately, many are left with debt, regret and broken relationships. Among those who’ve overspent to impress someone, 56% have been in debt due to this need to show off. Almost a quarter are no longer in contact with the person they were trying to impress, and 63% regret their most recent instance of overspending.

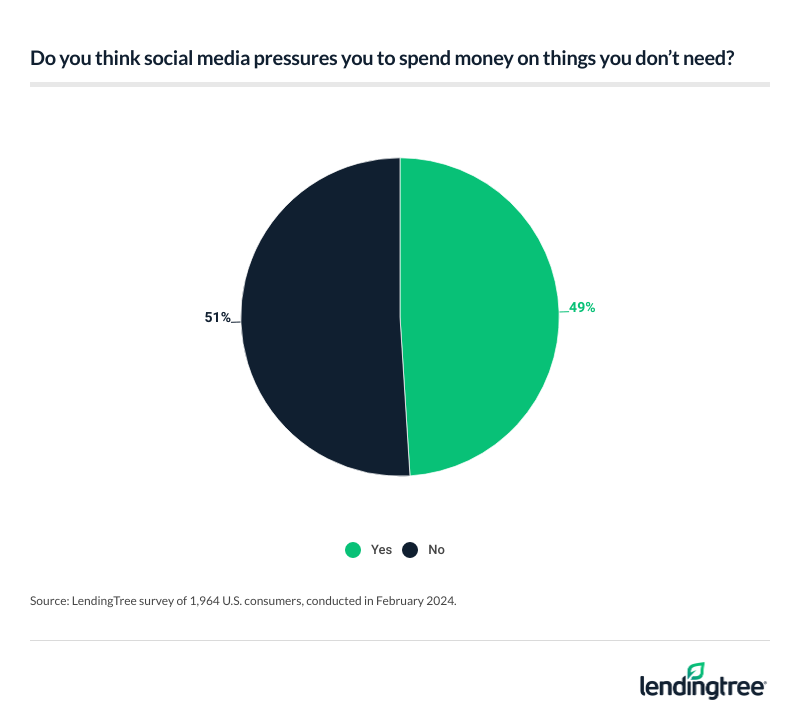

- Social media has influenced many to overspend, but de-influencing is here to save their wallets. Close to half (49%) of Americans agree social media pressures them to spend on things they don’t need, led by 65% of Gen Zers. However, 39% of Americans know about de-influencing — a trend discouraging consumers from buying things they don’t need. Among those aware of de-influencing, 36% feel positive about it.

Younger generations feel burden of keeping up with the Joneses

Americans are spenders — it’s what they do. Consumer spending drives our economy, and that won’t change anytime soon.

However, that spending is driven far too often by fear. For example, we fear we’re not doing enough, that we’re falling behind our neighbors, relatives, co-workers or even those we’re only in touch with via social media. It’s a phenomenon called “keeping up with the Joneses,” and it causes many Americans to feel pressure to spend more and more and more. That spending then leads to overspending, which leads to debt, which can lead to real trouble.

Our survey finds that younger generations are far more likely than their older counterparts to say they feel that pressure. More than 6 in 10 Gen Zers ages 18 to 27 (62%) and 44% of millennials ages 28 to 43 say so, versus just 25% of Gen Xers ages 44 to 59 and 8% of baby boomers ages 60 to 78. That adds up to about 1 in 3 (32%) American adults saying they’ve felt pressured to spend to keep up with the Joneses.

A deeper dive into the numbers shows men are far more likely than women to say they feel that pressure (41% to 25%), the highest-earning Americans are more likely to say so than the lowest (38% of those making $100,000 or more versus 29% of those making less than $30,000) and parents with young kids are more likely to feel it than those with grown children or with no children (45% versus 15% and 35%, respectively).

Interestingly, younger and older generations are split on whether the pressure they feel has ramped up as they’ve gotten older. More than half (57%) of Gen Zers say they feel the pressure more acutely with age, as do 46% of millennials. On the other hand, just 26% of Gen Xers and 10% of baby boomers say the same.

Most Gen Zers and millennials who don’t consider themselves wealthy believe they will be someday

This pressure is leading Americans to spend beyond their means

With great pressure, unfortunately, often comes great spending. That’s clear from our survey, which shows that more than half (51%) of Americans say they’ve gone overboard in spending to impress someone.

Men (59%, versus 44% of women) are far more likely to say they’ve done so. Also, the younger you are, the more likely you are to say you’ve done so (72% of Gen Zers, versus just 30% of boomers).

The most commonly splurged-upon items are:

- Clothing, shoes and accessories (19% say they’ve overspent on these to impress someone)

- Gifts (14%)

- Fancy dinners (11%)

The most common reasons among overspenders for these splurges? Impressing a date (30%) and wanting to feel successful (29%), but those are far from the only popular reasons.

For men, by far the most common reason for overspending is trying to impress a date. Forty percent of men who overspend say this is the reason, versus just 16% of women. The second most common among men is wanting to feel successful (34%, versus 24% of women).

For women, the top reasons are quite different. Twenty-seven percent of female overspenders say they’ve done so to reciprocate the generosity shown to them, while 25% say they wanted to feel like a better friend or family member.

69% of Americans admit to emotional spending, pushing 39% of them into debt

Many overspenders are left with debt, regret, broken relationships

Not surprisingly, all that overspending often leads to debt. More than half of overspenders (56%) say they’ve been in debt due to their splurges. Adding insult to injury, about 1 in 4 (23%) overspenders say they’re not in contact with the person they spent all that money on.

Given that, it shouldn’t surprise anyone that overspenders’ remorse is real. Regardless of the reason for going overboard, lots of those who did — 63% — say they wish they hadn’t.

Men are more likely than women (68% versus 57%) to express regret, as are younger Americans (77% of Gen Zers, versus 41% of boomers). There was little difference when broken down by income (61% of those making $100,000 or more say so, versus 64% of those making under $30,000).

Social media has influenced many to overspend, but de-influencing is here to save their wallets

When it comes to overspending, there’s no question social media has played a major role. Virtually every social platform is overrun with influencers trying to get you to buy something they’re hawking. Our survey shows that, to a big degree, it’s working.

Nearly half (49%) of Americans say social media pressures them to buy things they don’t need. Almost two-thirds (65%) of Gen Zers agree, while just 34% of boomers do. Men are slightly more likely than women to agree (51% versus 47%).

Change might be in the air, though. A recent social media trend called de-influencing — in which people try to dissuade people from buying what they don’t need — has generated a great deal of attention. Our survey finds that 39% of Americans are aware of it.

However, de-influencing is getting decidedly mixed reviews. Our survey shows that 36% of those familiar with the concept view it positively, while 33% see it negatively. (Another 31% are neutral.)

Splurging can be OK — in moderation

Some people will always feel the need to spend to keep up with the Joneses. Splurging to impress others is practically a tale as old as time, and it isn’t going to stop anytime soon. (If you have any doubts, look at how many people saw de-influencing as negative.)

Still, like so many things in personal finance and life, spending to keep up with the Joneses can be harmless when done planfully and in moderation. Done wisely, it can even give a positive return — for example, adding that extra bedroom or bathroom to your house to keep up with your neighbors can increase the value of your home by more than what it costs to implement.

That’s typically not how this pressure-driven spending works, though. It’s usually more about hastily buying that new sports car, that crazy-expensive purse or throwing that absurdly overdone birthday party for your 3-year-old. Those types of moves wreck budgets, cause big family fights and generally make your financial world messier than it needs to be.

How do you avoid these splurges? Honestly, there’s no guaranteed, foolproof method, but here are some things that might help:

- Step away from social media. If you spend less time looking at your friends’ and family’s social feeds, you’ll likely be less tempted to let them influence your spending.

- Use the 24-hour rule. If you’re thinking of buying something, take a deep breath and wait 24 hours before you do it. Often, these big splurge purchases will look and feel very different to you after a good night’s sleep and without the adrenaline of the spontaneous purchase coursing through your veins.

- Create a budget. If you’re intimately familiar with how much money is coming in and going out of your household each month, it can change your perspective on your financial situation. Suddenly, you understand just what that new Tesla would do to your household’s financial picture. That understanding may be enough to help you resist the urge to splurge.

- Channel that energy in another direction. Learning to recognize when the urge to overspend has hit is one of the keys to handling the problem. It may require some help to get you there, but you can learn to take that cue and redirect those feelings. Instead of instantly going to buy something online, go for a walk, read a book or listen to your favorite music. It doesn’t matter what positive activity you redirect the energy toward; what matters most is that you break the habit of spending.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,964 U.S. consumers ages 18 to 78 from Feb. 13 to 19, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Get debt consolidation loan offers from up to 5 lenders in minutes