Most Gen Zers and Millennials Who Don’t Consider Themselves Wealthy Believe They Will Be Someday

If “Family Feud” asked 100 Americans which word or phrase best describes “wealthy,” their survey would say … there’s little consensus. Our latest LendingTree survey confirms the same.

We polled 2,000 people and found radically different ideas about their definitions of “wealthy” and achieving that status. Younger generations are the most optimistic, with 69% of Gen Zers and 54% of millennials who don’t consider themselves wealthy saying they think that they will be someday.

But is wealth all it’s built up to be? According to Ken Tumin, LendingTree senior industry analyst, wealth can provide the freedom of financial independence, but it doesn’t guarantee happiness.

“That can especially be the case if you’re always ‘keeping up with the Joneses,’” he says. “There will always be a more expensive house, car and vacation. Not only can this reduce your happiness, but it can drain your wealth.”

Key findings

- With more time to make their financial dreams come true, most Gen Zers and millennials believe they’ll be wealthy one day. 69% of Gen Zers and 54% of millennials who don’t consider themselves wealthy think it’ll happen in their lifetime. That compares with 41% of Americans, down 3 percentage points from last year. When asked why they think they’ll be wealthy one day, 76% attributed it to their mindset.

- For those who aren’t optimistic, the economy takes the brunt of the blame. Among the 59% of Americans who don’t consider themselves wealthy and don’t think they ever will be, 55% blame the current economy — and 38% preemptively blame the future economy. Though only 1 in 5 Americans consider themselves wealthy, just more than half feel they’re in a better position than their parents were at the same age.

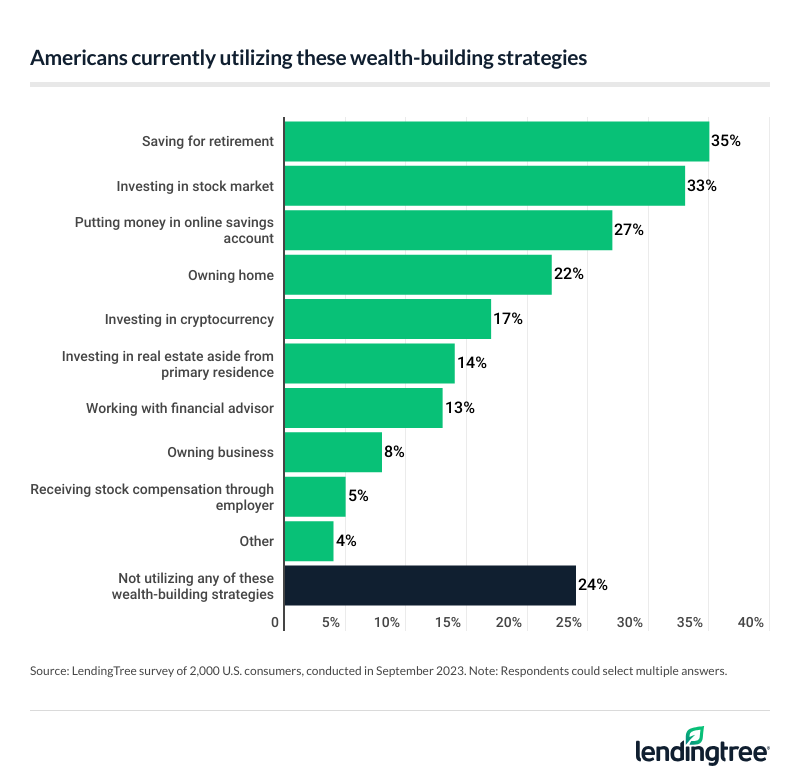

- Despite hard feelings among some, many Americans aren’t taking action to help themselves. 24% of Americans aren’t utilizing any wealth-building strategies. On the bright side, though, 35% are saving for retirement, 33% are investing in the stock market and 27% are putting money in an online savings account. When asked about the best ways to build wealth, the top choices were real estate (45%), the stock market (32%) and gold (25%).

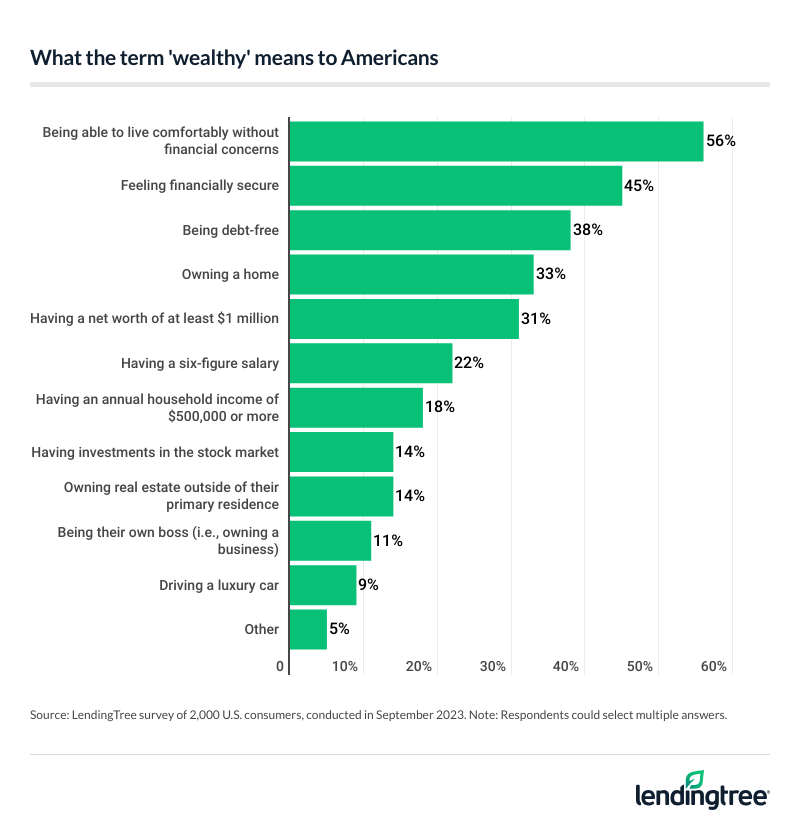

- Wealth can be subjective, and many Americans have different interpretations. When asked what “wealthy” meant to them, 56% cited living comfortably without concern about finances, 45% said feeling financially secure and 38% cited living debt-free. Meanwhile, 38% say they think it’s possible to be wealthy and still have nonmortgage debt, while 31% say you can’t be in debt and be wealthy. In addition, 30% of Americans believe you need a net worth of at least $1 million to consider yourself wealthy.

Are Americans rolling in wealth?

It depends on who you ask. Just 20% of Americans consider themselves wealthy, though men (26%) are nearly twice as likely to think so than women (14%).

Somewhat surprisingly, younger generations are more likely to consider themselves wealthy than older generations — 24% of millennials (ages 27 to 42) and 23% of Gen Zers (ages 18 to 26) consider themselves wealthy, versus just 17% of baby boomers (ages 59 to 77) and 15% of Gen Xers (ages 43 to 58).

Not so surprisingly, the more money someone makes, the more likely they are to consider themselves wealthy. Of those who make $100,000 or more a year, 43% believe they’re wealthy — just 12% of those who make less than $35,000 or between $35,000 and $49,999 do.

But will they ever be wealthy? An optimistic 41% of those who don’t consider themselves wealthy say yes, though that’s down 3 percentage points from last year. Men and women are fairly evenly split, with 43% of men and 40% of women saying they believe they’ll be wealthy.

With years to earn, 69% of Gen Zers and 54% of millennials who don’t consider themselves wealthy expect they will be in their lifetime. That’s significantly higher than the 31% of Gen Xers and 21% of baby boomers who believe the same.

Should wealth be the goal? Probably not, according to Tumin.

“Wealth is relative,” he says. “Instead of being concerned about wealth, people should focus on life goals, such as financial independence.”

But for those forging ahead with their sights on becoming wealthy, how do they think they’ll achieve that status? It’s mind over matter for most, with 76% of respondents who believe they’ll be wealthy someday thinking their mindset will make it happen.

That’s followed by:

- Their personal employment prospects (25%)

- The future economy (22%)

- Their educational background (21%)

Flipping to those who are more pessimistic (or realistic?) about their chances of achieving wealth, 55% say the current economy makes them believe they won’t be wealthy in their lifetime. This is especially true among millennials (62%).

Other top reasons people believe they won’t ever be wealthy:

- Current assets (41%)

- Future economy (38%)

- Personal employment prospects (32%)

Only 12% believe their family background will keep them from being wealthy, while 14% say the same about their educational background.

But are people at least doing better than their parents did financially? Respondents are split overall, with 51% of all Americans saying they believe they’re in a better financial position than their parents were at their age. Gen Xers were least likely to think so (43%), followed by millennials (52%), baby boomers (54%) and Gen Zers (57%).

To do better today, Tumin says wealth-building needs to start as early as possible.

“Gen Zers and millennials have to be committed to long-term investing starting early in their careers,” he says. “Responsibility for retirement savings falls heavily on the individual in today’s world, and that can be difficult with many jobs today that don’t offer retirement savings benefits. Those who wait too long before they get serious about investing will find it almost impossible to reach the necessary wealth to secure retirement.”

What Americans think about wealth-building strategies — and whether they’re utilizing them

Most Americans think the road to riches lies in real estate (45%). That’s followed by:

- The stock market (32%)

- Gold (25%)

- Savings bonds (21%)

- Cash (21%)

- Tax-advantaged retirement account (16%)

They’re not always putting their money where their mouths are, however. Only 14% of respondents say they invest in real estate outside their private residences. But over one-third say they’re saving for retirement (35%), and 33% say they’re currently investing in the stock market. Men are more likely to invest in the stock market for wealth-building — 40%, versus 26% of women.

Undeterred by the headlines surrounding cryptocurrency, 14% of Americans say they believe it’s a good wealth-building strategy, and 17% are currently investing in crypto to build wealth. Men are significantly more likely than women to invest in cryptocurrency for wealth-building — 25% versus 10%, respectively.

Are Americans on the right road to wealth? Not so much.

“One part of the basic wealth-building strategy is long-term, regular investing in a broad-market, low-cost stock market mutual fund or ETF,” Tumin says. “Many Americans don’t understand this, don’t trust it or don’t take the time and patience to execute it.”

More than half of Americans say wealth means ability to live comfortably without concern about finances

“Wealthy” is a subjective term, but most (56%) say it’s about living comfortably without worrying about finances, while 45% say it means feeling financially secure. Just under a third (31%) say wealth means a net worth of at least $1 million, and 22% say it means a six-figure salary.

For those making six figures, $100,000 is no longer a marker of success and achievement, with 84% of six-figure earners saying you need to earn at least $250,000 to be wealthy.

Tumin says if he had to choose one word to define “wealth,” it would be independence.

“Being financially independent, in that one doesn’t have to work to live a comfortable life, is a reasonable definition of being wealthy,” he says.

When it comes to debt and wealth, Americans are split. Debt is a dealbreaker for 31% of respondents who say you can’t be in debt and be considered wealthy. Others are more willing to accept debt as part of the wealth mix, with another 31% saying it’s possible to be wealthy and have debt as long as it’s mortgage debt. Further, 38% say that you can have nonmortgage debt and still be wealthy.

As for wealth by the numbers, 32% of Americans believe you need to make at least $100,000 a year to consider yourself wealthy — however, only 16% of Americans who make that much say it’s enough to be wealthy. Meanwhile, 31% of those who make $100,000 or more a year say you need to make at least $500,000 annually to be wealthy.

If they earned $1 million a year, would they be rich? It would take at least that for 19% of our respondents to consider themselves wealthy. Only 13% of Gen Zers think it takes $1 million, compared with 19% of millennials, 20% of baby boomers and 21% of Gen Xers. Most Gen Zers (37%) believe you need to make at least $100,000 a year to be wealthy, which is also the baseline for 33% of baby boomers, 32% of Gen Xers and 30% of millennials. The sweet spot for 28% of respondents is $250,000-plus a year, while 22% say it’s $500,000 or more.

When it comes to net worth, 19% of Americans say they’d need at least $5 million to consider themselves wealthy, while 30% say they’d need $1 million or more. For 29%, a net worth of $250,000 or more would make them feel wealthy, while it would take at least $500,000 for the remaining 22% of respondents.

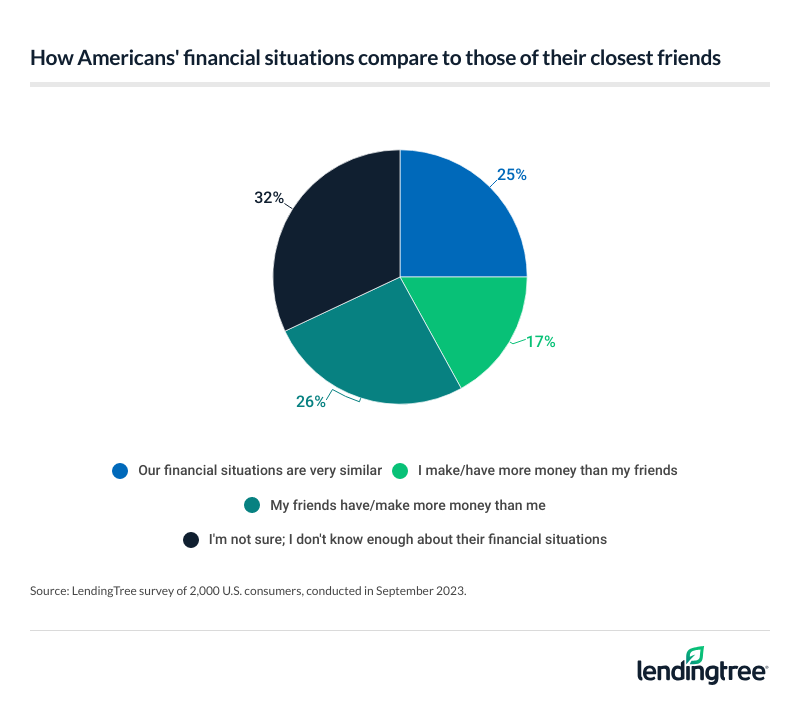

Should you compare yourself to others financially?

It’s said that comparison is the thief of joy, but how does that translate to wealth? Nearly a third of respondents (32%) say they don’t know enough about their closest friends’ financial situation to make comparisons. The rest, however, do, with 26% saying their friends have more/make more money than they do and 17% saying they have/make more than their friends. One-quarter say their financial situations are similar.

“Comparing yourself to others can be dangerous to your wealth and happiness,” Tumin says.

However, it’s not all bad.

“One pro with comparing yourself to others is that it can spur you into action to start creating a financial plan and to start executing it to reach your long-term financial goals,” he says.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 77 from Sept. 5-11, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Get debt consolidation loan offers from up to 5 lenders in minutes