Debt Consolidation Loans for Bad Credit Rates in February 2026

Bad credit? You have options. LendingTree users with bad credit get 5+ debt consolidation loan offers on average

Read more about how we made our picks for the best debt consolidation loans for bad credit.

Best debt consolidation for bad credit lenders with the lowest rates

Best for: Overall debt consolidation loans for bad credit – Upstart

- APR

- 6.50% – 35.99%

- May be approved with bad or no credit

- Get money as soon as one business day after you’re approved

- Sends money directly to your current creditors

- Only two repayment terms to choose from (36 or 60 months)

- Although you may be approved with bad credit, your rate will probably be high

- Can’t take out a loan with a second person

I shopped for personal loans with Upstart using my real personal information to better understand the application process. Here’s what I found:

- Application experience: Upstart’s application is straightforward and clear. It has more questions than the average loan application, but these questions are tied to its AI algorithm designed to improve users’ chances of approval.

- Unusual questions to prepare for: Amounts in checking, savings and investment accounts; car payment; miles on car

If you have bad (or no) credit, lending platform Upstart is worth exploring. Upstart uses an AI algorithm that looks at more than just credit score to approve or deny applications. It also considers factors like level of education and employment.

But if you have bad credit, you’ll likely be on the hook for a hefty origination fee and likely pay rates as high as 35.99%. You’ll also only have the option to choose between two repayment terms, whereas other lenders have multiple terms you can choose from.

Upstart has transparent eligibility requirements, including:

- Age: Be 18 or older

- Administrative: Have a U.S. address, personal banking account, email address and Social Security number

- Income: Have a valid source of income, including a job, job offer or another regular income source

- Credit-related factors: No bankruptcies within the last three years, reasonable number of recent inquiries on your credit report and no current delinquencies

- Credit score: None

Best for: Same-day debt consolidation loans – OneMain Financial

- APR

- 18.00% – 35.99%

California residents must borrow at least $3,000

- Get money in as soon as an hour, as long as you have a debit card

- Can use your car as collateral for better rates and odds of approval

- One of the lowest credit score requirements on the market

- Charges a one-time origination fee on every loan

- Not good if you need to consolidate more than $20,000 of debt

I shopped for personal loans with OneMain using my real information. Here’s what I found:

- Application experience: OneMain’s application is fast and easy to navigate, especially if you’ve prepared for additional questions about your income and employment (see below).

- Unusual questions to prepare for: Monthly take-home pay (most lenders ask for annual income), employer phone number, car payment

If you’re in a hurry to consolidate your debt, check your rates with OneMain Financial. You could get your money as soon as an hour after signing. Plus, OneMain has one of the lowest credit score requirements on the market — you could qualify with a credit score as low as 500.

That said, if you have a lot of debt, consider another lender on this list. OneMain only offers up to $20,000. You’ll also need to budget for a one-time origination fee that OneMain will take from your loan money before sending it to you.

OneMain Financial isn’t very transparent about its personal loan eligibility requirements, but it’s possible to qualify even with a credit score as low as 500. Before closing on a loan, you may need to provide:

- Government-issued identification (such as a driver’s license or passport)

- Proof of residence (such as a rental agreement or utility bill)

- Proof of income (such as pay stubs or tax returns)

OneMain loans are not available in Alaska, Arkansas, Connecticut, District of Columbia, Massachusetts, Rhode Island, Vermont or U.S. territories.

Best for: Fast approval decisions – Avant

- APR

- 9.95% – 35.99%

- May get your money as soon as the day after you’re approved

- Easily manage application and payments through mobile app

- Reports to all three credit bureaus

- Might not offer enough money if you have a large amount of debt to consolidate

- Potential for high origination fee

I shopped for personal loans with Avant using my real personal information to better understand the application process. Here’s what I found:

- Application experience: Avant’s application is straightforward and fast — easily one of the best application experiences I tested.

- Unusual questions to prepare for: None! Just make sure to have your Social Security number on hand.

If you need to consolidate your debt quickly, consider Avant. Avant can let you know if you’re approved within minutes and can fund your loan as soon as the next day.

You can only borrow up to $35,000 with Avant, so you’ll need to consider other lenders if you’re consolidating more debt. You’ll also need to budget for a potentially high origination fee that Avant will take out of your loan before sending it to you.

To get a loan with Avant, you’ll need to meet the following minimum requirements:

- Residency: Not available to residents of Hawaii, Iowa, Maine, Massachusetts, New York, Vermont, Washington and West Virginia.

- Administrative: Must have a bank account. May need to submit bank statements, pay stubs or tax documents to prove your income. Avant may also call your employer to verify your employment.

- Credit score: 580+

Best for: Getting lower rates with a secured loan – Best Egg

- APR

- 5.99% – 29.99%

- Lower rates and better odds of approval using your home’s fixtures as collateral

- No risk to your home if you can’t make payments

- No additional paperwork or appraisal necessary

- Hard to sell home before you pay off your loan

- Charges one-time origination fee on every loan

I shopped for personal loans with Best Eggusing my real information. Here’s what I found:

- Application experience: Best Egg asks more questions than the average lender, but its application is clear and easy to complete. Once you have offers, you can quickly click through to a loan agreement that outlines next steps and how much you’ll pay.

- Unusual questions to prepare for: Annual income for other people in your household, other types of accounts held (e.g., savings, retirement and investments), car payment, number of cash advances taken in past six months

If you’re a homeowner and looking for the lowest debt consolidation rates for your credit score, consider applying with Best Egg. Best Egg offers a homeowner discount that allows you to use your home’s fixtures (like cabinets) as collateral in exchange for lower rates and better approval odds.

Keep in mind that as long as you’re paying off your secured loan, it will be hard to sell or refinance your home since Best Egg will have a lien on your home’s fixtures.

Best Egg uses your home’s permanent fixtures as collateral, but no appraisal is needed. Instead, Best Egg will review your credit history and home equity to see if you qualify.

You must also meet the requirements below to qualify for a Best Egg loan:

- Age: Be of legal age to accept a loan in your state (usually 18)

- Citizenship: Be a U.S. citizen or permanent resident living in the U.S.

- Administrative: Have a personal checking account, email address and physical address

- Residency: Not live in the District of Columbia, Iowa, Vermont, West Virginia or U.S. territories

- Credit score: 580+

Best for: Stretching out your payments – Upgrade

- APR

- 7.74% – 35.99%

- Offers repayment terms as long as 84 months

- May get money within a day of accepting loan offer

- Use your car as collateral to improve your approval chances

- Get better odds of approval by adding a second person with good credit to your loan

- Keeps 1.85% – 9.99% out of every loan as an origination fee

I shopped for personal loans with Upgrade using my real information. Here’s what I found:

- Application experience: Upgrade’s application is very quick with few questions, and it’s easy to apply with a co-borrower — you can add their information on the first page.

- Unusual step to prepare for: Must create an account to see your rates

Lending platform Upgrade offers the longest repayment terms on our list. Longer terms mean you’ll likely pay more in interest over the life of the loan in exchange for cheaper monthly payments.

Plus, Upgrade offers joint loans. If you’re looking to consolidate debt that you and someone else have accrued together, it’s worth your time to check your rates with Upgrade. You can also put your car up as collateral with a secured loan to access lower rates.

If your score is low, you’ll likely pay a steep origination fee. Upgrade also charges $10 for missed or late payments.

To qualify for a loan through Upgrade, you must meet the requirements below:

- Age: Be at least 18 years old (19 in some states)

- Citizenship: Be a U.S. citizen, permanent resident or live in the U.S. with a valid visa

- Administrative: Have a valid bank account and email address

- Credit score: 580+

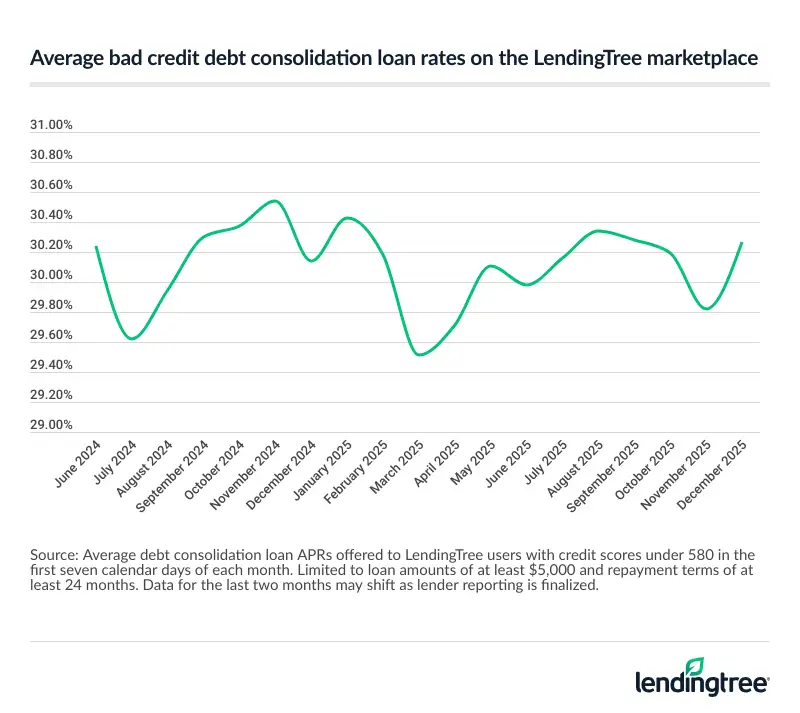

Bad credit debt consolidation loan rates averaging at 30.27%

Concerned about the high rate?

We have tips below to increase your approval odds and improve your credit score to lower your rate.

Debt consolidation loans for bad credit rate trends over time

Rates for borrowers with a credit score below 580 have remained under 31.00% for over a year. The average debt consolidation loan offer for bad credit on the LendingTree marketplace was 30.27% APR in December 2025.

What to know about debt consolidation loans for bad credit

It can be hard to know if a debt consolidation loan is right for you — or even if you’ll qualify for a loan that saves you money.

Debt consolidation loans help people like you combine multiple debts into one. The goal is to lower your monthly payments and the total amount of interest you pay.

If you have bad credit (FICO Score below 580), you might be wondering if you’ll even qualify. It’s possible, but you’ll need to compare the rates you’re currently paying with the ones in your offer to make sure consolidating is worth it.

Use the LendingTree debt consolidation calculator to see how much you could save with lower rates. When you get an offer, use our calculator again to see if you’ll save on the total cost of your loan.

See how much you can save on your debt consolidation loan for bad credit with LendingTree

Why do millions of Americans trust LendingTree?

25+ years in business. 110+ million Americans served. $260+ billion in funded loans.

Security

Instead of sharing information with multiple lenders, fill out one simple, secure form in five minutes or less.

Savings

We’ll match you with up to five lenders from our network of 300+ lenders who will call to compete for your business.

Support

We provide ongoing support with free credit monitoring, budgeting insights and personalized recommendations to help you save.

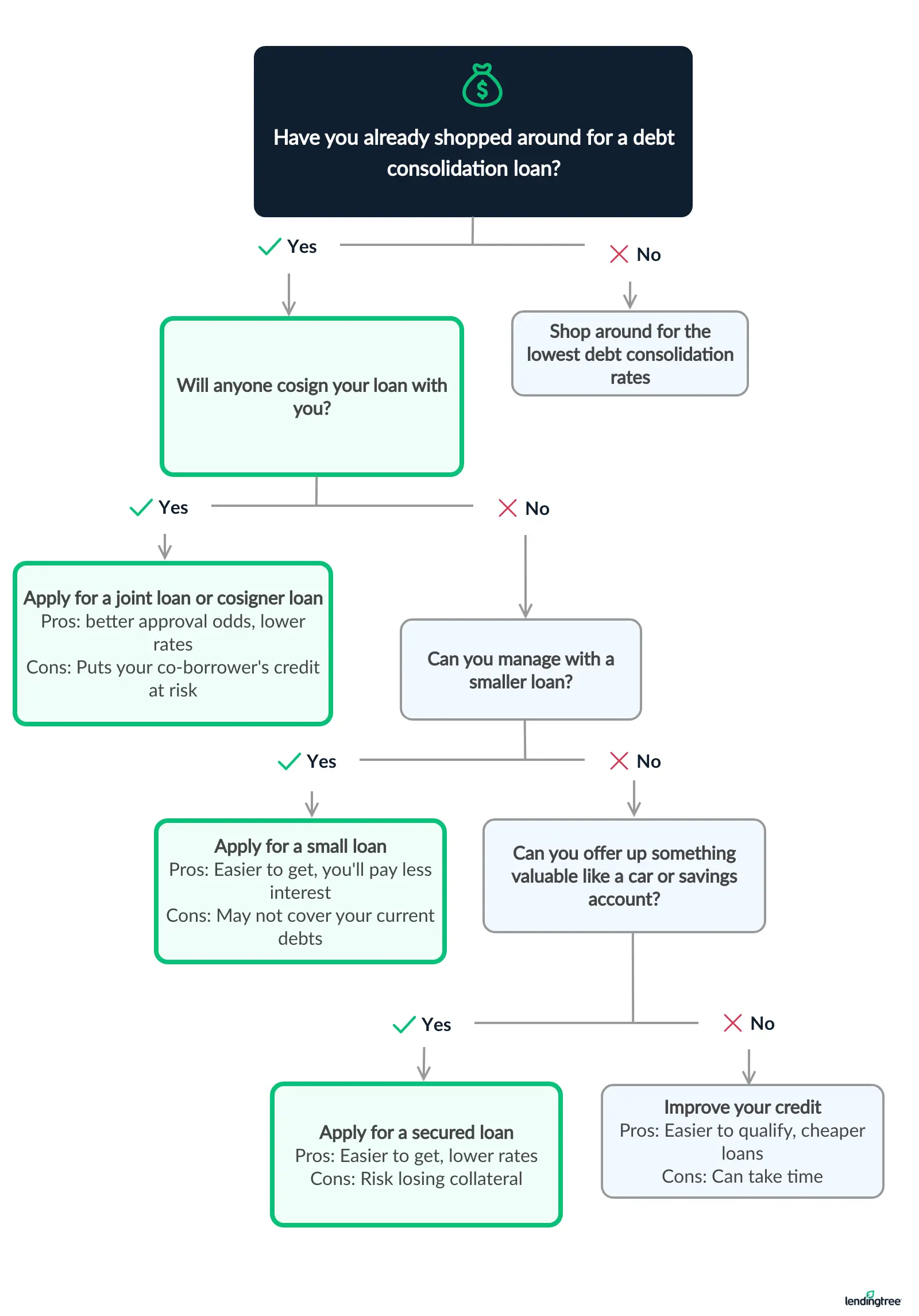

How to improve your odds of qualifying for a debt consolidation loan

Why use LendingTree?

$2.8B in funding

In 2024 alone, LendingTree helped find over $2.8 billion in funding for people seeking personal loans.

$1,659 in savings

LendingTree users save $1,659 on average just by shopping and comparing rates.

308,000 loans

In 2024, LendingTree helped find funding for over 308,000 personal loans.

What to do if you don’t qualify for a loan

Don’t qualify? You still have options. Consider the strategies below to help you manage your debt.

Debt management strategies

You can pay off your debt on your own with the right plan. Create a budget, limit your expenses and use extra money to pay off the debt. Consider different debt payoff techniques, and choose the one that works for you.

Improve your credit score

The best way to improve your chances of getting a new loan is to boost your credit score. Improving your score may take time, but using your credit responsibly can help bring your score back up. Start by making on-time payments and disputing possible errors.

Get your own credit report card for free with LendingTree Spring. We’ll show you how you’re doing on each of the factors that affect your credit, like payment history and credit utilization. Plus, we’ll give you personalized recommendations on how to improve your score.

Bankruptcy

Bankruptcy is a legal process that clears your debt under certain conditions, giving you a clean slate. The cons? You may have to give up some of your assets, and your credit will take a major hit. Bankruptcy can also affect your ability to borrow money in the future.

Debt settlement

Debt settlement services will likely hurt your credit score by encouraging you to miss payments and avoid contacting creditors while the company negotiates with them. There are risks to using these services, and you should consult a credit counselor before signing up.

Expert insights on debt consolidation loans for bad credit in 2026

Prioritize offers lower than your current rates and ideally below 36% APR, a common max for personal loans. Prequalify to get an idea of offers you could receive without touching your credit.

Should you get a debt consolidation loan if you have bad credit? If you can honestly answer “yes” to the following three questions, it’s likely a good financial move.

- Will you save money? If you have serious credit problems, you’ll likely have trouble qualifying for a good rate. Use our debt consolidation loan calculator to compare the interest rates on your current debts with your debt consolidation loan offers. (You can check your rates by prequalifying for a debt consolidation loan — it won’t affect your credit.)

- Do you have a plan to pay off the debt? Consolidation alone usually isn’t enough to help you become debt-free. But if you’re willing to follow a plan to get out of debt, a consolidation loan can be the first step in the right direction.

- Can you avoid new debt? Paying off your current debts with a consolidation loan and racking up more debt will land you in financial hot water. Make sure you’re committed to avoiding new debt, or consolidation could make your current finances even worse.

Having bad credit can make you an easy target for predatory lenders that offer payday loans or car title loans. These types of loans don’t typically require a credit check, but they come with high APRs and short repayment terms that can trap you in a cycle of debt.

Pros and cons of a debt consolidation loan for bad credit

Pros

- Save money with lower interest rates than you’re currently paying

- Can reduce the size — and number — of monthly payments

- Could improve your credit score if you can keep up with your new payments

Cons

- Hard to get low rates with bad credit

- May not qualify for a large enough loan to pay off all debts

- New hard inquiry can hurt your credit

Alternatives to consolidating debt with bad credit

Credit counseling or debt management plan

If you’ve fallen into debt, you could contact a nonprofit credit counseling agency that helps people negotiate with creditors and creates a debt management plan. Debt management plans can simplify your monthly debt payment, much like a consolidation loan does.

Credit counselors often are an affordable option relative to financing your debt, but make sure you find a credit counselor who meets your specific needs. They can also help you create a budget and teach money management skills.

Home equity loan

Sometimes you can get lower rates when you use your home as collateral. With a home equity loan or home equity line of credit (HELOC), you can use your home to finance your new loan — but watch out, because nonpayment can eventually lead to foreclosure.

Other secured loan

Using collateral like cars, bank accounts and other valuable items can help you qualify for lower rates. Secured loans will likely have better terms — but again, they come with the risk that the lender will take your asset if you stop making payments.

401(k) loan

Some companies let you borrow from your 401(k). The interest you pay goes back into your 401(k), but you can only borrow up to half of the vested amount or $50,000 (if the vested amount is higher). You might also have to pay the balance in full if you leave your job.

When banks compete, you win

You’d shop around for flights. Why not your loan? LendingTree makes it easy. Fill out one form and get lenders from the country’s largest network to compete for your business.

Tell us what you need

Take two minutes to tell us who you are and how much money you need. It’s free, simple and secure.

Shop your offers

LendingTree users who get at least one offer receive 20 offers on average. Compare your offers side by side to get the best deal.

Get your money

Pick a lender and sign your loan paperwork. You could see money in your account in as soon as 24 hours.

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

How we chose the best debt consolidation loans for bad credit

LendingTree’s team of expert writers and editors reviewed more than 40 lenders and lending platforms — and shopped directly with 15 of them — to find the best debt consolidation loans for bad credit. To make our list, lenders must offer debt consolidation loans, advertise a minimum credit score of 580 or lower and cap their annual percentage rates (APRs) at 36% or lower.

From there, we assessed each lender or marketplace across four categories: eligibility and access; cost to borrow; loan terms and options; repayment support and tools.

According to our systematic rating and review process, the best personal loans for bad credit come from Upstart, Best Egg, Upgrade, Avant and OneMain Financial.

LendingTree reviews and fact-checks our top lender picks on a monthly basis.

Our categories

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Why trust LendingTree’s methodology?

Our writers and editors dig through the facts, contact lenders directly and even go through the application process ourselves if it helps better explain what you can expect. As a Certified Financial Education Instructor℠, I’m committed to breaking down complex financial details so people can make confident, informed decisions with their money.

Jessica’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.

Frequently asked questions

If you’re able to keep up with your loan payments, debt consolidation loans may actually improve your credit score. As you pay off your debt, you’ll show creditors that you can make payments on time. Over time, this can boost your credit score.

Different lenders have different credit score requirements. Some will require that you have a good credit score, while others will accept fair credit. The lower your credit score, the higher your APR will likely be.

LendingTree understands that you’re more than just your credit score. That’s why we partner with lenders that work with bad credit, excellent credit and scores in between. The best way to see if you qualify is by checking rates (it won’t hurt your credit score).

Yes, it is possible to get a debt consolidation loan with bad credit with LendingTree. However, you’ll likely pay high rates, and you may need to take out a secured loan or apply with a co-borrower. If you’re stuck with high rates, you can always refinance your personal loan down the road.

If you want to apply for a debt consolidation loan but have a lot of debt, getting approved may be difficult, but not impossible. For starters, check your credit score to see where you stand and work on cutting down on your debt. You can do this by using methods like the debt snowball method or the debt avalanche method.