Young But Naive? Age Influences Financial Optimism and Payment Methods — See How Your Generation Spends

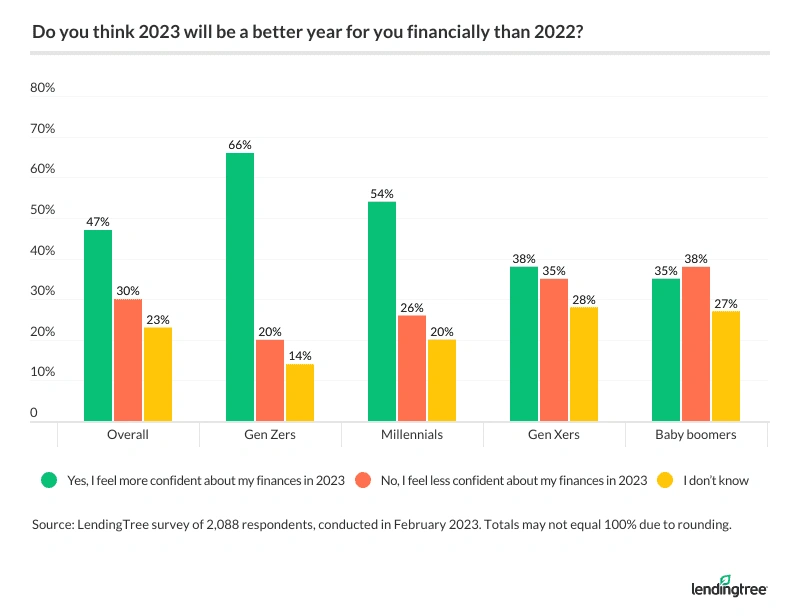

Young consumers are optimistic that 2023 will be their year — financially, at least. Despite the rocky economy, more than half of millennials and Gen Zers say they think they’ll have a better financial year than in 2022, making them the most financially optimistic generations.

That’s not the only generational difference: Beyond financial optimism, consumers have different preferred payment methods and financial stressors depending on their age. To see how your generation spends, keep reading our most recent survey of nearly 2,100 U.S. consumers.

- Young and (possibly) naive: Age is a driving factor for financial optimism in 2023. 66% of Gen Zers say they feel 2023 will be a better year for them financially than 2022, followed by millennials at 54%. Meanwhile, 38% of baby boomers and 35% of Gen Xers aren’t feeling as confident about 2023.

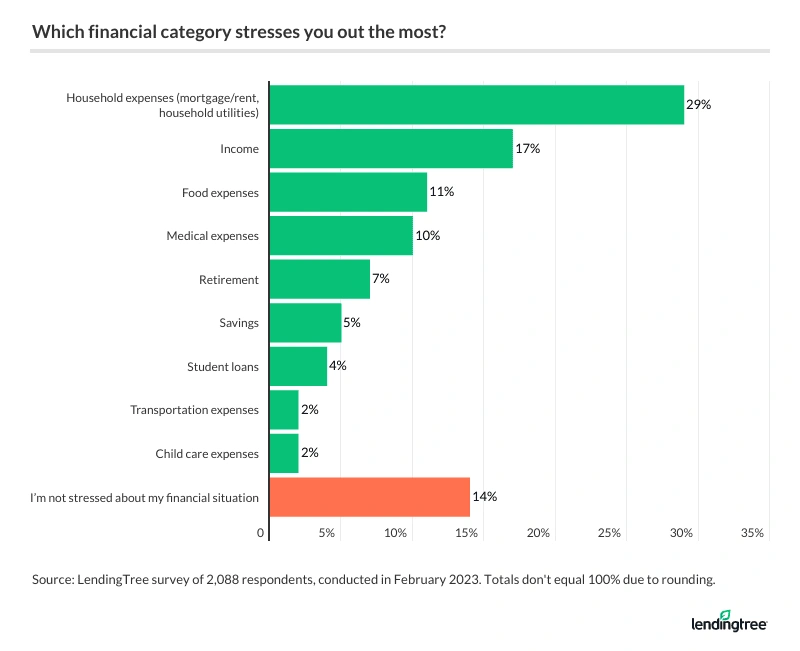

- Regardless of age, household expenses are fueling stress. 29% of Americans say household expenses — including mortgage or rent and utilities — cause the most financial headaches. Income is the second-leading cause of financial stress for Gen Zers and millennials in particular (both at 21%).

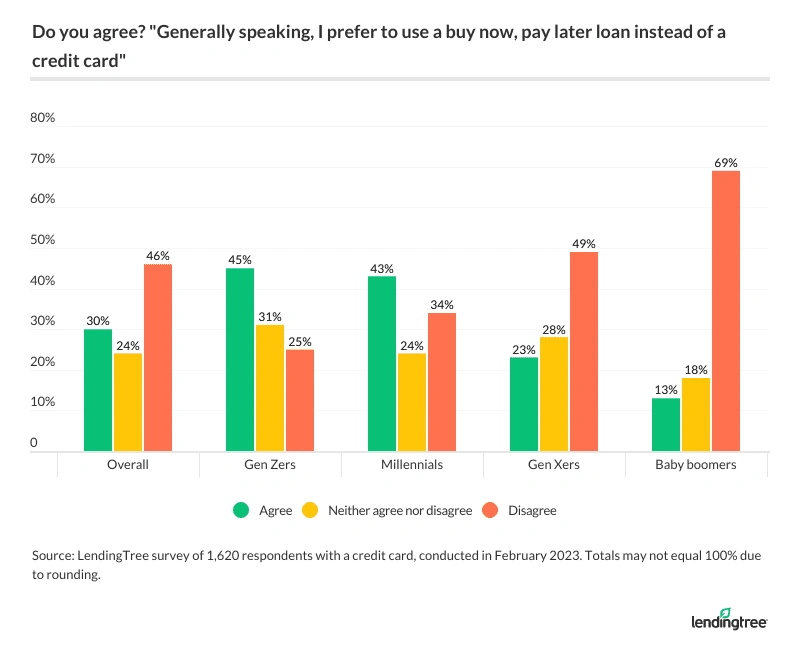

- With newer payment methods like buy now, pay later, younger generations are quicker to convert. 45% of Gen Zers with a credit card say they generally prefer using a BNPL loan over a credit card. 66% of millennials with a credit card generally prefer to use debit over credit, while 34% of Gen Xers overall say they have a credit card but prefer other payment methods (like cash or debit) for everyday purchases.

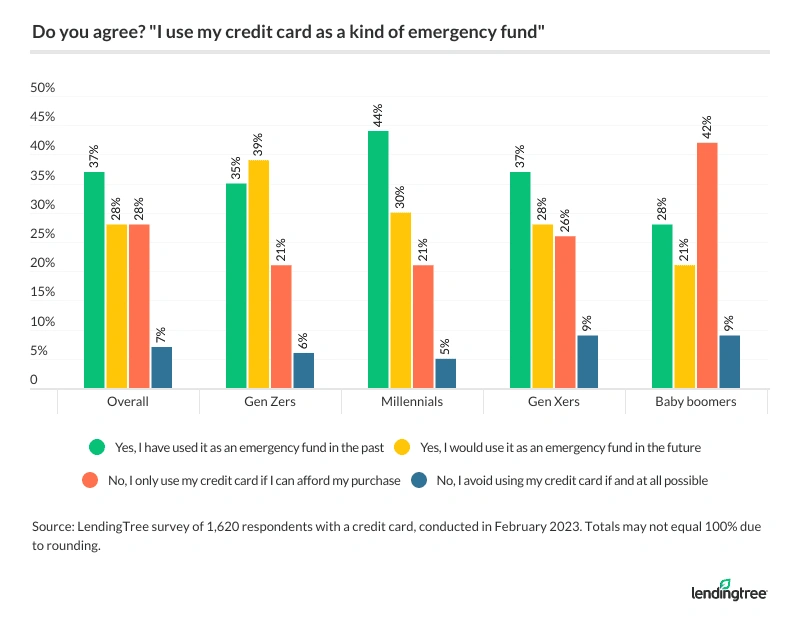

- Preference aside, going into debt is most Americans’ backup plan. 74% of millennials say they have or would use their credit cards as an emergency fund, followed by 73% of Gen Zers, 65% of Gen Xers and 49% of baby boomers.

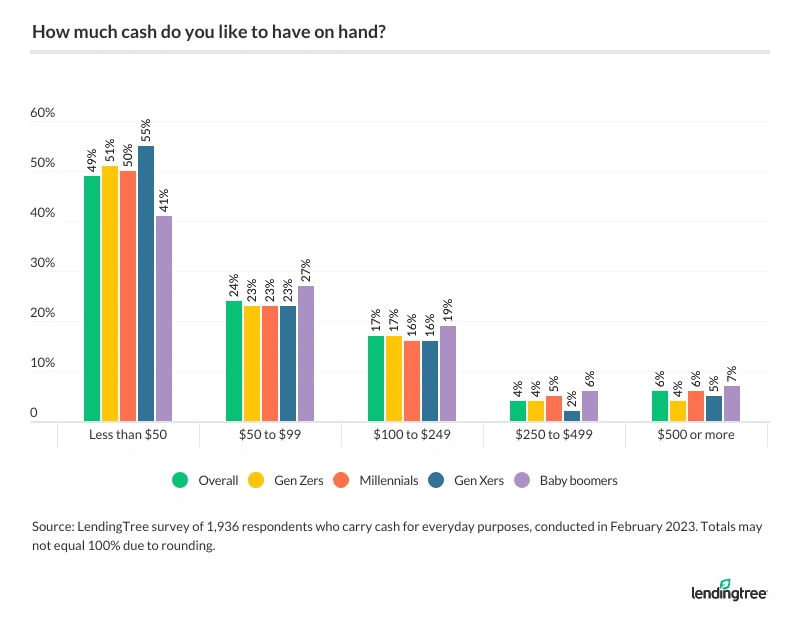

- Cold, hard cash still reigns supreme for some. 13% of baby boomers like to keep $250 or more in their wallets. Meanwhile, Gen Xers are most likely to have less than $100 on hand.

Younger consumers are more financially optimistic

The young (and, quite possibly, naive) are the most optimistic about their 2023 financial outlooks. In fact, 66% of Gen Zers (ages 18 to 26) say they feel 2023 will be better for them financially than 2022 was — making them the most optimistic demographic. Following that, 54% of millennials (ages 27 to 42) say similarly.

Meanwhile, older consumers aren’t feeling so confident. Nearly 4 in 10 (38%) baby boomers (ages 59 to 77) and 35% of Gen Xers (ages 43 to 58) say they feel less financially optimistic about 2023. They’re also the most likely groups to say they’re not sure which year will be better, at 28% for Gen Xers and 27% for baby boomers.

According to LendingTree chief consumer finance analyst Matt Schulz, there are a few reasons for younger consumers’ optimism.

“There’s something to be said for the optimism of youth,” he says. “I think it’s great that such a huge portion of Gen Z is so optimistic, but it doesn’t surprise me that they’re far more so than boomers and Xers. Gen Z is still so young — even the oldest among them are just getting started in their careers. That’s a scary time, but it’s also one of great possibility, excitement and opportunity for change. The fact that the unemployment rate is at or near historic lows could be helping their optimism as well.”

Those aren’t the only demographic groups with different outlooks for 2023. Some other notable findings include:

- Men (52%) are more financially optimistic than women (43%).

- 59% of six-figure earners say they’re more optimistic for 2023, while just 38% of consumers making less than $35,000 annually say similarly — a difference of more than 20 percentage points.

- Consumers with children older than 18 (37%) are more likely to feel less optimistic than those with children younger than 18 and those with no children (at 27% for both).

Financial optimism changes the way consumers plan to spend. Generally, those who feel more confident plan to use their credit card more in 2023 than those who feel less confident — at 38% versus 26%. (More on preferred payment methods later.)

Household finances cause the most stress

Regardless of demographic, Americans agree: Household expenses cause the most stress. Overall, 29% say household expenses — including mortgage or rent and utilities — cause the most financial headaches. Gen Xers are the most likely age group to stress over household expenses at 36%.

Schulz attributes high inflation to high stress over household finances.

“When the basic expenses of life get more and more expensive, it’s incredibly stressful,” he says. “After all, you can’t just cancel a utility bill or mortgage payment like you can a Netflix subscription. When those things get pricier, it requires tough choices and sacrifice.”

The second most stress-inducing financial factor varies by generation. For Gen Zers and millennials, income is the second-leading cause of financial stress (at 21% for both). Gen Xers are also concerned about income — 16% of this age group cite it as their top financial stressor, making it the second-leading cause of financial stress among this generation. Meanwhile, baby boomers are particularly concerned about their medical bills (15%).

Baby boomers are the least-stressed generation. Among this age group, 28% say they’re not stressed about their financial situation — double the overall average of 14%.

Among other demographics:

- 20% of consumers with no children and 18% with children younger than 18 are most stressed about income, compared with just 11% of those with adult children.

- Women worry more about household expenses than men (32% versus 26%).

- Consumers earning less than $35,000 are the most likely to worry about income (25%).

- 24% of six-figure earners don’t have any financial stressors — lower than baby boomers but highest among income groups.

BNPL loans, credit cards and more: Payment preferences by generation

Payment preferences vary by generation, and younger consumers are quick to adapt to newer methods like buy now, pay later (BNPL). In fact, 45% of Gen Zers with a credit card say they generally prefer using a BNPL loan instead of a credit card — the most of any generation.

Meanwhile, 69% of baby boomers with a credit card say they seldom use a BNPL loan instead of their card — making them the least likely to convert to BNPL.

According to Schulz, it’s hard to blame younger Americans for looking into credit card alternatives like BNPL.

“BNPL isn’t perfect, but people like it in part because it’s finite,” he says. “Once you’ve paid it off, you’re done with it. You don’t have to manage that credit going forward. People also like the predictability and clarity of BNPL loan payments. That can make them easier to budget for than credit card payments.”

Still, he says, BNPL comes with risks. Because BNPL loans can be much easier to get than other types of loans, it can be easy to overspend or mismanage payments. In addition, returns can be trickier with BNPL than with credit cards, and BNPL doesn’t come with some of the other consumer protections consumers have come to expect from credit cards.

On the other hand, millennials are the most likely to prefer debit cards. Among millennials with a credit card, 66% say they prefer debit over credit. That’s closely followed by Gen Zers (61%) and Gen Xers (59%) with credit cards.

That’s just those with credit cards, though. Overall, 35% of Gen Zers and 34% of Gen Xers say they have a credit card but prefer other payment methods (like cash or debit) for everyday purchases. Meanwhile, 31% of millennials say they use the same credit card for everyday purchases — the most of any generation — followed by baby boomers (30%).

In addition, 23% of baby boomers say they use multiple credit cards for everyday purposes. On the other hand, 26% of millennials say they don’t own a credit card — the most of any age group.

When it comes to paying the bills, paying with a debit card is the most popular option for all bill types outside mortgage (direct debit tops the list here). Still, different generations have different preferences — specifically:

- Baby boomers (33%) and Gen Xers (31%) prefer to pay their mortgage bills through direct debit.

- Gen Zers (30%) are the most likely group to say they prefer paying for streaming services with a credit card.

- Although they’re not the most cash-friendly group, Gen Zers are also the most likely group to pay for transportation costs — like gas and parking fees — and food with cash, at 27% and 28%, respectively.

Majority of consumers would use credit cards as an emergency fund

Regardless of what they prefer to use, the majority (65%) of Americans say they’d go into debt for an emergency. Millennials are particularly likely to say they have or would use credit cards as an emergency fund at 74%. That’s followed by 73% of Gen Zers, 65% of Gen Xers and 49% of baby boomers.

Although those figures can be scary, Schulz says it’s understandable.

“The truth is that millions of Americans’ financial margin for error is tiny, leaving them little room to save money and forcing them to rely on credit cards when emergencies strike,” he says. “Unfortunately, it creates a cycle of debt that’s often nearly impossible to break.”

While 28% of consumers say they’d only use their credit card if they could afford a purchase, that figure’s highest generationally among baby boomers (42%) and lowest among millennials and Gen Zers (both 21%). Meanwhile, 9% of baby boomers and Gen Xers avoid using their credit cards when possible — the most likely groups to say so.

Cash is king for some consumers

Most consumers (93%) say they carry cash — but its importance varies. By generation, 13% of baby boomers who carry cash like to keep $250 or more in their wallets, making them the most likely group to carry large sums.

On the flip side, Gen Xers who carry cash (78%) are the most likely to have less than $100 on hand, and that’s followed by Gen Zers (74%). Breaking that down even further:

- 34% of cash-carrying Gen Zers say they like to have between $20 and $49 on hand.

- 23% of cash-carrying millennials and Gen Xers only like to have less than $20 on hand.

Still, money is money. And while cash isn’t particularly preferred by many age groups, finding an extra grand would be useful. When asked what they’d do if they found an extra $1,000 on the ground and didn’t have to return it, the majority of consumers say they would save the extra money they found and use it for a rainy day. By generation:

- 26% of millennials would spend that extra money on rent or their mortgage. That’s followed by 20% of Gen Xers, 18% of Gen Zers and 9% of baby boomers.

- 16% of Gen Xers would use the extra cash to pay down their credit card debt, followed by 15% of millennials, 14% of baby boomers and 10% of Gen Zers.

Taking advantage of credit card perks: Expert advice

Given how often most of us use our credit cards, Schulz believes taking advantage of the many perks issuers offer is essential. Particularly, he recommends:

- If you don’t carry a balance and you’re not using a rewards credit card, you’re leaving money on the table. “With inflation and rising interest rates, that’s the last thing that any of us should do,” Schulz says. “Look at your budget to see what you spend money on most each month and find a card that rewards you most for those things. You should also think about what type of rewards you want. For example, would you rather get cash back, or do you prefer points and miles? Figuring these things out can help guide you to the right card, and the right card can make a real difference in your budget.”

- If you have a rewards card and haven’t shopped around for a new one in a while, you could be leaving money on the table as well. “The pandemic changed many things for Americans, including what many of us spend money on,” he says. “That means that your old 2018 credit card may no longer reflect what you spend money on. Card rewards have evolved in recent years, with many cards now offering extra rewards for things like streaming services, ride-share and entertainment, along with the old standards such as groceries, gas, dining and travel.”

- If you have debt, break the cycle. “The best way to do it is to try to build up emergency savings while paying down your credit card debt,” he says. “That way, once your card balance is $0 and your car gets a flat tire or you have to take your dog to an emergency visit at the vet, that cost won’t have to go right back on your credit card. It’s not easy to save while paying down your card debt. It can require discipline, prioritization and sacrifice, and sometimes it isn’t possible even if you do all those things. However, it’s a worthy goal.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,088 U.S. consumers ages 18 to 77 from Feb. 21-24, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Recommended Articles