Keeping Up With the Joneses: Nearly 40% of Americans Overspend to Impress Others; Most Want to ‘Feel Successful’

At some point or another, most — if not all — of us have felt the pressure to keep up with the Joneses.

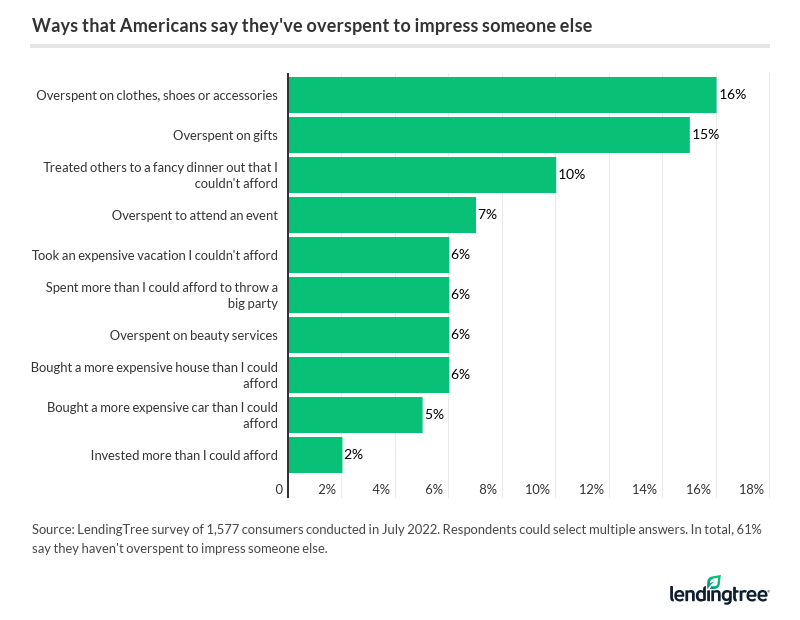

According to a new LendingTree survey of nearly 1,600 U.S. consumers, almost 40% of Americans have overspent to impress someone else, especially on clothes, shoes or accessories. Feeling the need to overspend can be frustrating, which is especially true when the stakes are high. In fact, more than a quarter of those who overspent to impress others are currently struggling to get out of debt because of those purchases.

Often, the key to breaking bad habits is awareness. We’ll look at how Americans are overspending to keep up.

Key findings

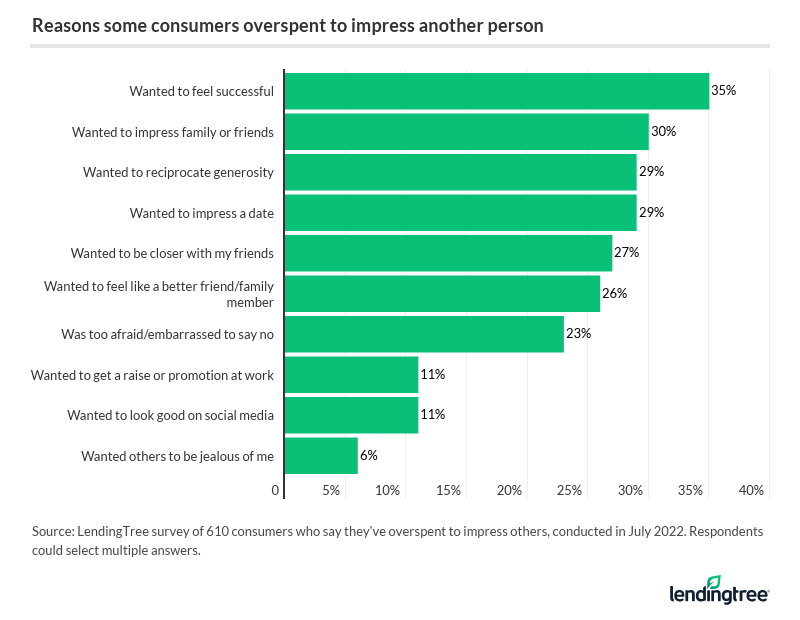

- Nearly 40% of Americans have overspent to impress someone else, especially on clothes, shoes or accessories (16%) and gifts (15%). Their main reasons for doing so are to feel “successful,” impress family or friends, reciprocate generosity or impress a date.

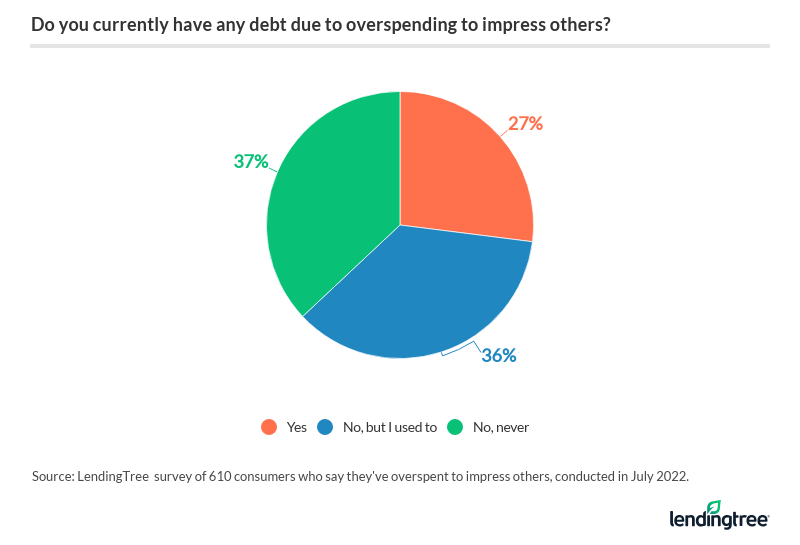

- 27% of those who overspent to impress others are currently in debt. An additional 36% previously had related debt. By generation, Gen Xers are most likely to currently be in debt for this reason (34% of whom overspent).

- The vast majority who overspent to impress others wish they hadn’t. 77% say they regret overspending. To make matters worse, more than a third aren’t in contact with at least one person they previously tried to impress.

- Americans’ desire to keep up with friends and family turns into financial pressure. Nearly 30% of Americans feel financially pressured to keep up with others, mainly their family (17%) and friends (13%). Gen Zers feel the most pressure (51%). By income, higher income earners feel more pressured than those who make less.

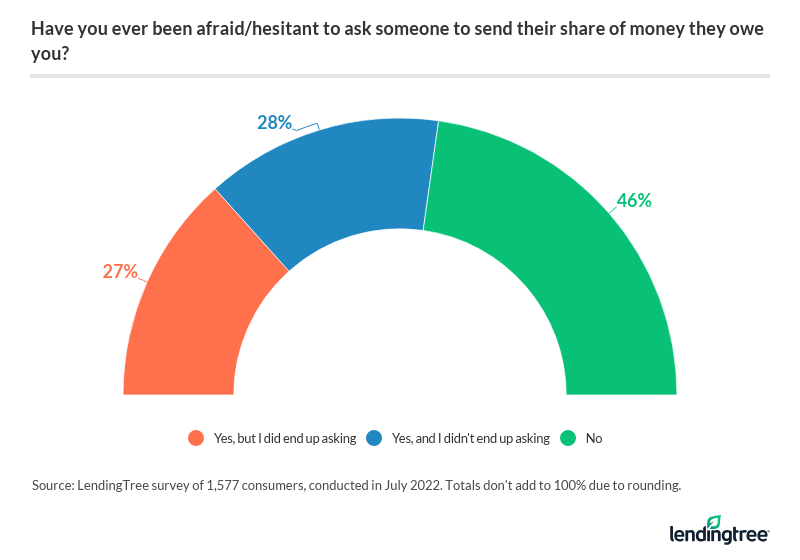

- Another key form of overspending to impress is not asking to be paid back for money you’re owed. 55% of Americans say they’ve hesitated to ask someone to send their share of money owed, including 28% who didn’t ask to be paid back. By gender, women (32%) were more likely not to request money owed than men (23%).

Nearly 40% of Americans overspend to impress someone

A solid portion of Americans (39%) say they’ve spent more money than they could afford to impress another person. This is especially common among the younger generations — Gen Zers ages 18 to 25 (52%) and millennials ages 26 to 41 (46%). Only 34% of Gen Xers ages 42 to 56 and 25% of baby boomers ages 57 to 76 say the same.

“It’s certainly a cliché, but as you age, you’re often less concerned about what other people think of you,” LendingTree chief consumer finance analyst Matt Schulz says. “You get more comfortable with who you are and spend less time worrying about other people’s perception of you.”

Despite the wide variations by age, there’s no gender divide — 38% of men have overspent to impress, versus 39% of women.

Why are people willing to overspend to impress others? The most common reasons are to feel “successful,” impress family or friends, reciprocate generosity or impress a date.

“There’s no question that the things we can buy can make us feel better about ourselves,” Schulz says. “That tailored suit, that shiny new car, those designer heels, those first-class tickets — they can bring an adrenaline rush that’s palpable and exhilarating. The problem is that those feelings usually fade fairly quickly, and people are often left with depreciating assets and debt in their wake.”

That said, Schulz says it’s OK to overspend a little on things that genuinely make you feel better about yourself or help you accomplish something you’re working toward.

“It’s just important not to overdo it so much that all the positivity is drowned in a sea of debt,” he says.

Here’s a look at why people tend to overspend to impress someone.

Where a gender divide arises is the more precise motivation behind overspending to impress. For example, 41% of men say they did so to impress a date, versus 17% of women. Additionally, women are twice as likely as men to say they overspent because they were afraid or embarrassed to say no (31% versus 15%).

Different income levels also have varying motivations. High income earners making $100,000 or more annually are especially likely to admit to overspending to feel successful. In fact, 52% within that bracket have spent more than they could afford to impress others, versus 32% who make $35,000 or less a year. Nearly 1 in 5 high income earners who overspent say they did so in hopes of getting a promotion or raise at work, versus 6% of the lowest earners.

Regarding generational divides, Gen Zers and millennials’ main reason for overspending is to feel successful, while Gen Xers want to feel like a better friend or family member and baby boomers want to reciprocate generosity.

Overspending leads to debt, regret

Understandably, overspending can lead to regret. Most consumers (77%) who overspent to impress others wish they hadn’t. This was more common among Gen Zers (85%) and millennials (82%) than Gen Xers (74%) and baby boomers (60%).

The survey findings reveal two potential reasons for this regret: debt and estrangement.

First looking at bad feelings surrounding debt, 63% of those who overspent went into debt as a result. That breaks down to 27% who currently have debt associated with overspending and 36% who previously had debt.

The other main reason people regret overspending is that 38% of those who did so aren’t in contact with at least one person they were trying to impress.

“People could certainly regret the overspending when their efforts to impress aren’t successful,” Schulz says. “If you take on a little bit of debt to show off in pursuit of a promotion, a partner or something else positive and it works, that’s an amazing feeling. But when you go out of your way and maybe even take a little risk to try to accomplish something or impress someone and it flops, it’s tough. It can lead to sadness, anger and regret.”

The pressure to keep up with others is real

We talked about consumers who spent more money than they could afford to impress dates or colleagues, but the desire to keep up with the Joneses often hits much closer to home — friends and family, to be specific.

More than a quarter (28%) of Americans say they feel financially pressured to keep up with someone else. Among that group, 17% feel pressured to keep up with family members and 13% feel that same pressure with friends.

While family members and friends are the primary people with which Americans want to keep up, this varies by generation. Once again, this drive to compete is more common with Gen Zers and millennials and less with Gen Xers and baby boomers.

“Younger people are more likely to be discovering their own identity than older folks,” Schulz says. “So many people in their 20s and 30s put so much pressure on themselves by comparing all aspects of themselves to those around them or those they see in social media and it can lead to really bad decisions.”

The pressure to keep up with the Joneses appears to decrease over time. For example, 45% of baby boomers say they feel less financially pressured as they age. That said, 45% of Gen Zers say they feel more pressured as they age.

To be clear, Schulz doesn’t believe this is just a Gen Z or millennial problem.

“Everyone wants to impress from time to time,” Schulz says. “However, many older Americans benefit from the experiences that they’ve had and the myriad mistakes they made in their 20s and 30s, so they may not be as likely to have those same issues going forward.”

More than half of consumers have worried about asking to be paid back money they’re owed

An accidental way to overspend to impress others is not to ask to be paid back for money owed. More than half (55%) of Americans say they’ve hesitated to ask someone to send their share of money owed, including 28% who didn’t ask to be paid back.

There aren’t surprising age and gender gaps around asking to be repaid. Our survey found that women (32%) are less likely to request money owed than men (23%).

A lack of confidence in youth also seems to impact asking to be paid back, as Gen Zers are least likely to ask to be paid back (37% didn’t ask).

“So many Americans are terrified of confrontation and avoid it at all costs, even if it ends up costing them money,” Schulz says. “It’s a shame because often you don’t have to do anything more than ask nicely and politely to get your way. It’s usually worth the risk and feeling of awkwardness that comes along with the ask.”

This hesitation can cost consumers. In fact, 30% of those who didn’t ask to be paid back say they’re owed $100 or more. Among Gen Xers, 43% say they’re owed $100 or more, compared with 39% of baby boomers, 27% of millennials and 11% of Gen Zers.

How to cope with the pressure to keep up with others

The pressure to keep up with the Joneses is fairly universal and isn’t likely to end anytime soon. When spending pressures to keep up with friends, family or colleagues arise, these are some ways you can cope that Schulz recommends.

- Create a budget: A well-planned budget allows you to prioritize spending that matters to you, so you may feel less pressure to overspend. It also lets you shuffle money around when you go off the rails.

- Refinance and consolidate your debt: Refinancing and consolidating debt can help you dig out of a hole. If you have strong credit, a 0% balance transfer credit card can save you a lot of money in interest. If that’s not an option, a low-interest personal loan can also save you money. “Both can help you consolidate multiple bills into one, streamlining your financial situation and knocking a few items off your to-do list,” Schulz says.

- Wait on purchases: When you have the temptation to buy a flashy new designer item, a gift or any other kind of purchase, it’s a good idea to walk away temporarily. If you want to make the purchase, there’s no reason it can’t wait a few days or weeks. Chances are, you’ll forget all about it and can save your money.

- Lean into your support system: If spending pressure has led to debt, remember that you don’t have to tackle it entirely on your own. “Anyone who has wrestled with debt knows how important it is to have folks rooting for you and supporting you emotionally along the way,” Schulz says. “Paying down debt is a really, really hard thing. The last thing you need is to have friends and family pressuring you to spend or making you feel small for working on your debt.”

- Ask yourself “why”: Before making any unnecessary purchase, ask yourself why you’re making it. Is it because you need something, or that’ll bring value? Or is it because you think buying the item would make you appear more successful, more generous or better in some sort of way? Make sure you’re spending your hard-earned money for the right reasons.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,577 U.S. consumers ages 18 to 76 from July 26-29, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

Get debt consolidation loan offers from up to 5 lenders in minutes