67% Have Bought From Social Media — and Nearly Half Say It Shapes What’s ‘Necessary’

Two addictions many young Americans seem to relate to are social media and shopping — and often, one fuels the other.

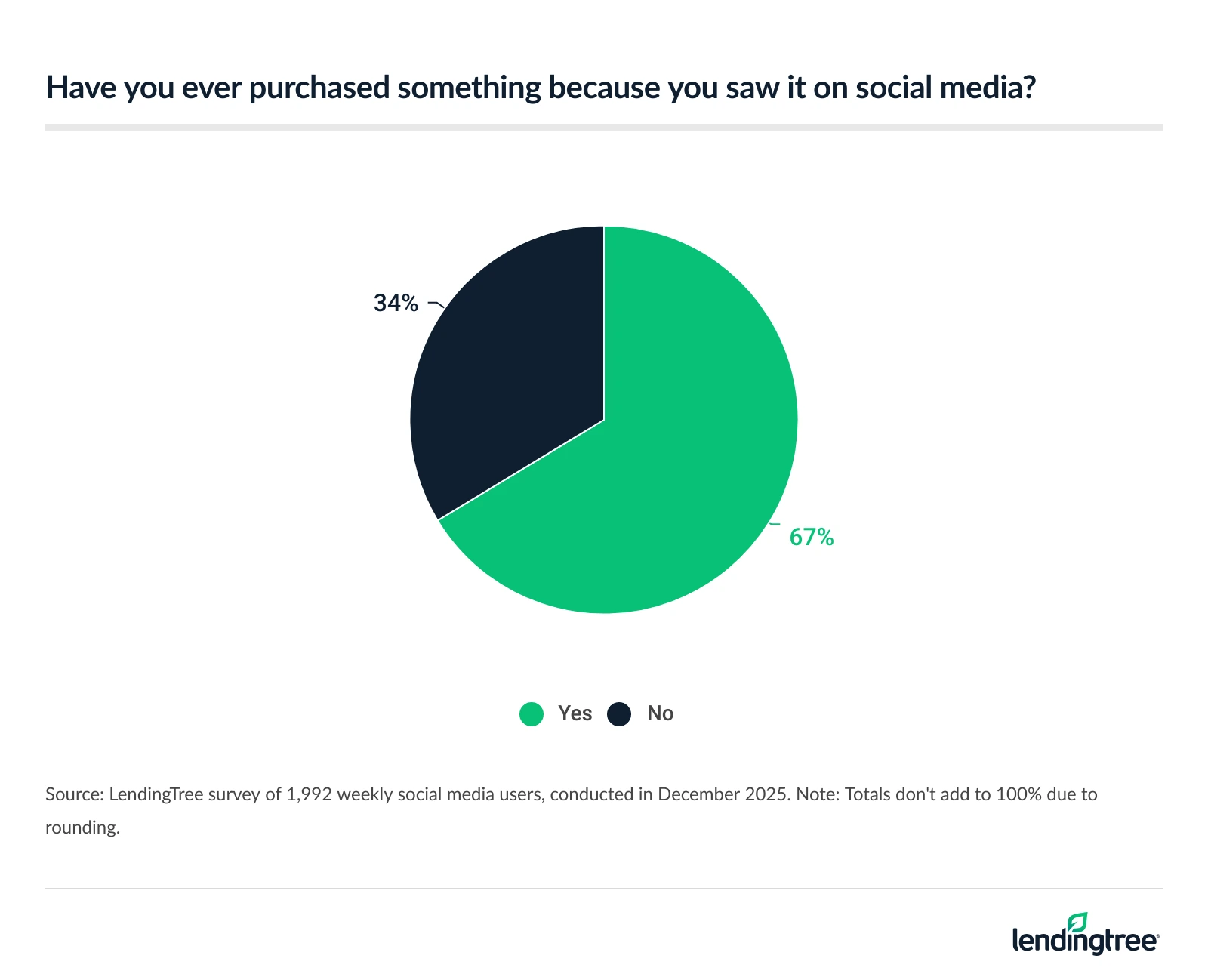

According to a LendingTree survey of 2,050 U.S. consumers, 67% of weekly social media users have purchased a product after seeing it on social media. However, 57% of those buyers say they sometimes regret their purchases.

Here’s a closer look.

- For many Americans, social media has become a hot storefront. 67% of weekly social media users have purchased a product after seeing it on a social platform. Among those shoppers, nearly 6 in 10 say an influencer prompted their purchase. Clothing (26%), beauty (18%) and tech (15%) are the most common impulse-buy categories.

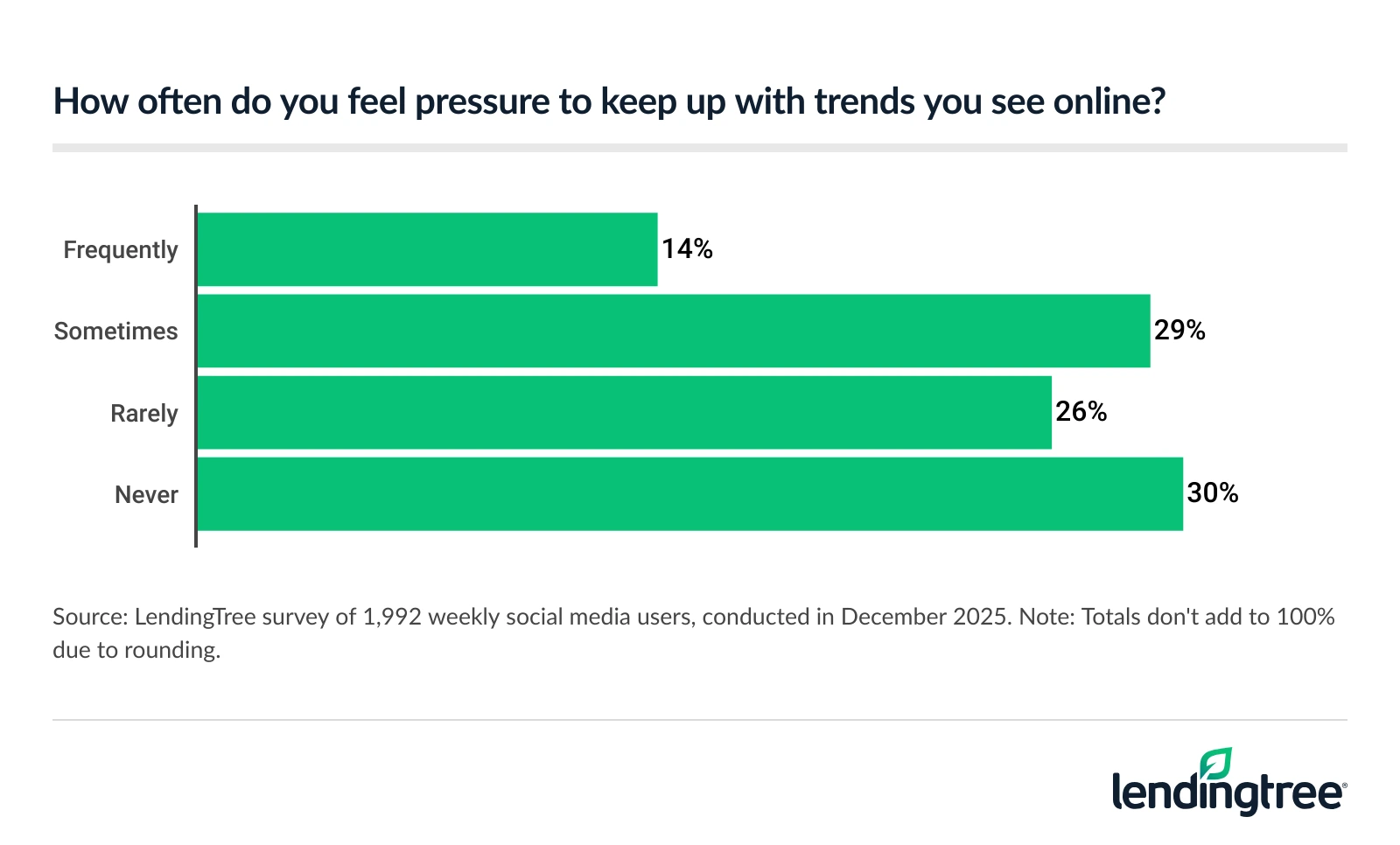

- Social media is forcing Americans to keep up. 43% of users say they’ve at least sometimes felt pressure to keep up with trends they see online, and nearly half (49%) say it sometimes influences what they consider “necessary” to buy. Additionally, 48% report that social media increases their desire to buy new or trending products, while 78% believe it’s fueling consumerism.

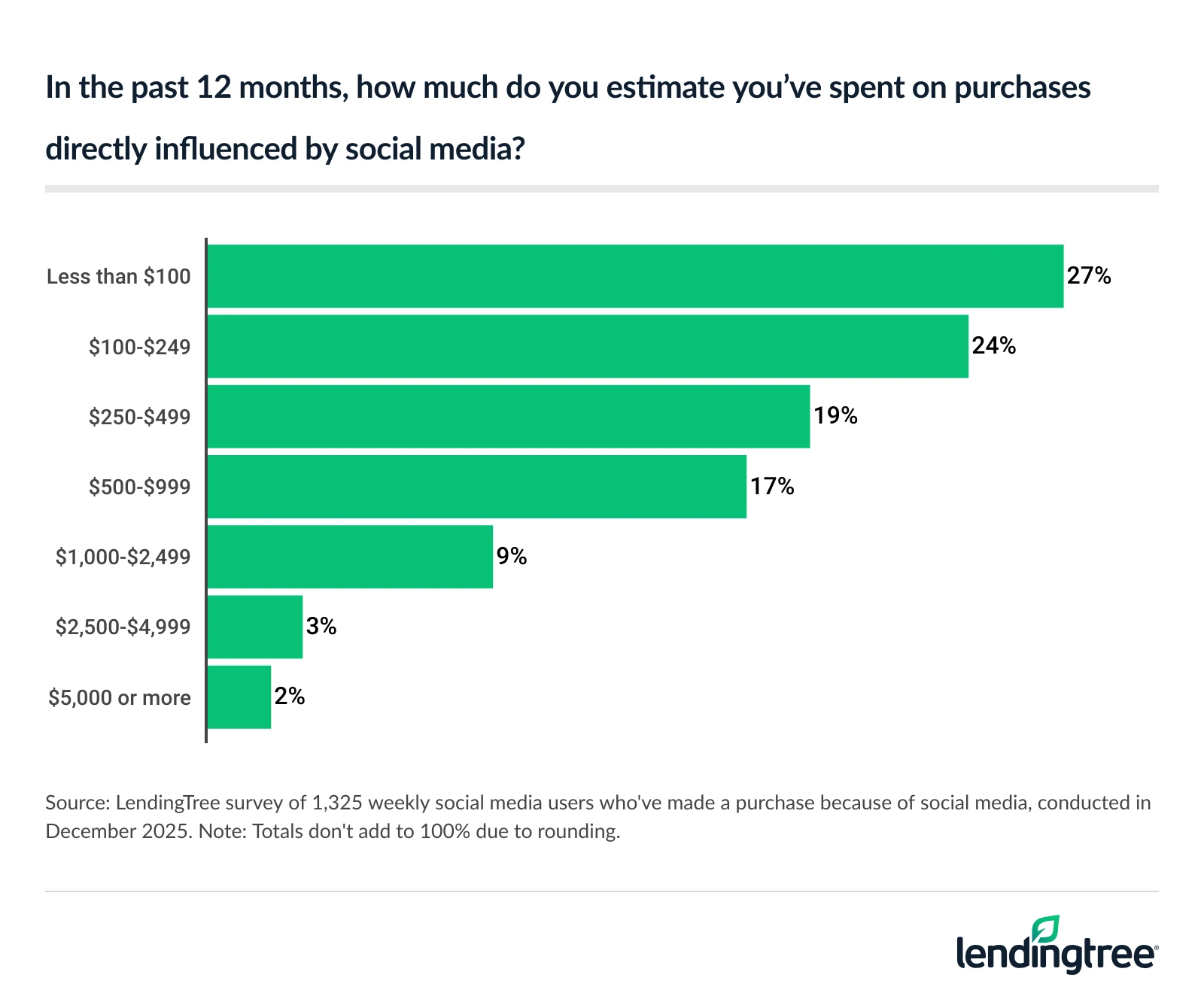

- What starts as a scroll can quickly become a costly habit. In the past year, 30% of social media shoppers say they’ve spent $500 or more on social-influenced purchases, led generationally by millennials. Meanwhile, 29% of users say they’ve cut back on social media to save money — including half of Gen Zers.

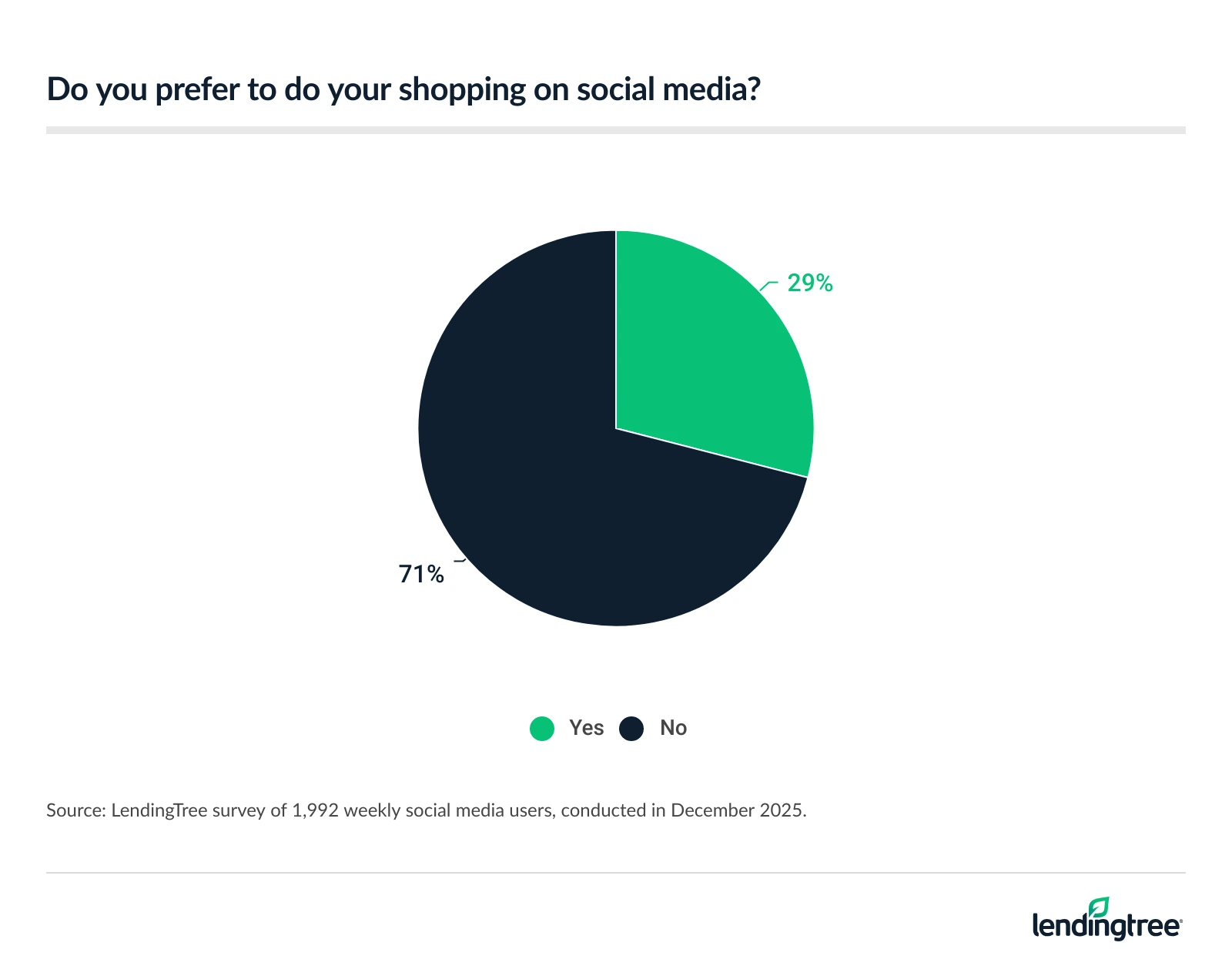

- The allure of social shopping is strong, but the regret may be stronger. Nearly 3 in 10 users (29%) prefer to do their shopping on social media, and 27% have used buy now, pay later to do so. Still, 57% of social media shoppers say they sometimes regret their purchases.

Social media fuels purchases

Among weekly social media users, 67% have purchased a product after seeing it on a social platform. That figure jumps to more than 80% among those with children under 18 (87%), Gen Zers ages 18 to 28 (85%) and millennials ages 29 to 44 (81%).

Among those shoppers, 58% say an influencer prompted their purchase. Additionally, 68% report making impulse buys at least sometimes because of social media. Clothing (26%), beauty (18%) and tech (15%) top the list of impulse-buy categories, followed by:

- Food and beverages (8%)

- Home goods (6%)

- Digital goods (6%)

- Children’s products (5%)

- Fitness or health products (5%)

- Travel or experiences (3%)

- Pet goods (3%)

- Financial products (2%)

Facebook remains the most widely used platform among Americans, with 79% reporting weekly use. YouTube follows closely at 76%, while Instagram comes in at 55%. Other platforms include:

- TikTok (46%)

- X (formerly Twitter) (33%)

- Snapchat (30%)

- Reddit (23%)

- Pinterest (23%)

- LinkedIn (19%)

- Discord (12%)

Users feel pressured to keep up with trends

Social media isn’t just influencing what users buy — it’s also pressuring them to keep up. In fact, 43% of users say they’ve felt pressure to follow trends they see online at least sometimes. Gen Zers (67%) are the most likely to report this feeling, followed closely by parents with children under 18 (65%).

Nearly half (49%) of social media users say it shapes their sense of what’s “necessary” to buy, at least sometimes. Unsurprisingly, 48% report that social media increases their desire to purchase new or trending products, and 78% believe it’s fueling consumerism in U.S. culture.

It’s not all negative, though. Social media can also help users make more informed purchases: 67% say they sometimes use social platforms to research products before buying.

Scrolling is expensive

Social media-influenced shopping can add up quickly. In the past year, 30% of social media shoppers say they’ve spent $500 or more on purchases driven by social media. Higher earners are the most likely to spend at that level, with nearly half (48%) of six-figure earners reporting $500 or more in social-influenced spending.

Most users don’t shell out that much, however: 51% say they’ve spent $249 or less.

Meanwhile, 29% of social media users say they’ve cut back on social media to save money — including half of Gen Zers.

More than half of social media shoppers regret purchase

Social media has become a preferred shopping channel for many users, with 29% saying they prefer to do their shopping on social platforms. That preference is strongest among parents with children under 18 (49%), millennials (45%) and six-figure earners (45%).

More than a quarter (27%) of users say they’ve used buy now, pay later to purchase something on social media. Even so, regret is common: 57% of social media shoppers say they at least sometimes regret their purchases.

Social media and mindful shopping: Top tips

Being online often feeds the desire for instant gratification, but shopping isn’t always the healthiest quick fix. To help rein in social media-driven spending, consider the following tips:

- Turn your credit card into a friction point. Social media platforms are designed to make spending feel effortless — especially when your card details are saved in digital wallets and checkout pages. To slow impulse buys, remove your card information from these services. Manually entering your details creates a brief pause that can be enough to rethink a purchase, without requiring you to stop using your card altogether.

- Use credit card alerts and statements as reality checks. When spending is spread across dozens of small social purchases, it’s easy to lose track of how much you’re actually spending. Setting transaction alerts can help you see how influencer-driven buys add up in real time. Reviewing monthly statements by category can also reveal patterns you might otherwise miss.

- Avoid turning social media spending into long-term debt. Using credit cards or buy now, pay later for trend-driven purchases can stretch costs well beyond the moment of excitement. Treat social media purchases as discretionary spending — ideally paid off in full each month. Carrying a balance on short-lived trends risks paying interest on items that may lose value and relevance faster than you can pay them off.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,050 U.S. consumers ages 18 to 79 from Dec. 10-16, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennials: 29 to 44

- Generation X: 45 to 60

- Baby boomers: 61 to 79