48% of Americans Plan Spring Travel, but Some Bring Home Debt as a Souvenir

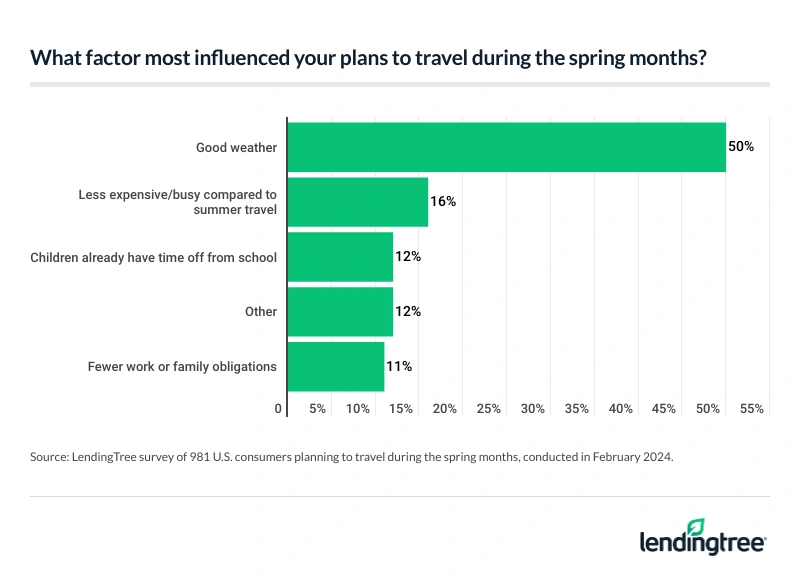

For many Americans, spring break means making a break for it — often toward somewhere primed for fun in the sun. That’s according to the 50% of spring break travelers who, in the latest LendingTree survey asking more than 2,000 Americans about their March-through-June travel plans, cited weather as the main influence. But at what cost?

Although the majority of spring travelers have a budget in mind for their trip, more than half say they’ll use a credit card to pay for it, and 4 in 10 will pull from their savings. From potential debt to doubt in the face of recent airline incidents, read on for respondents’ take on all things springtime travel.

- Spring travel fever is high, with many drifting to sun and sand. Nearly half (48%) of Americans are planning on traveling during the spring months (March through June), heading to the beach or ocean (47%), visiting with friends and family (42%) and going to the mountains (25%).

- Vacations can be costly even when budgets are set, and some travelers expect to come home with debt — and possibly regret. With 65% of spring travelers having a specific budget in mind, 71% plan to spend under $3,000. When asked how they plan to pay for their travel costs, 51% said they’ll use a credit card and 40% will pull from savings. 19% of travelers think they’ll go into debt for their trip. Overall, roughly 1 in 5 (21%) Americans have gone into debt because of vacation costs, and 62% of them regret doing so.

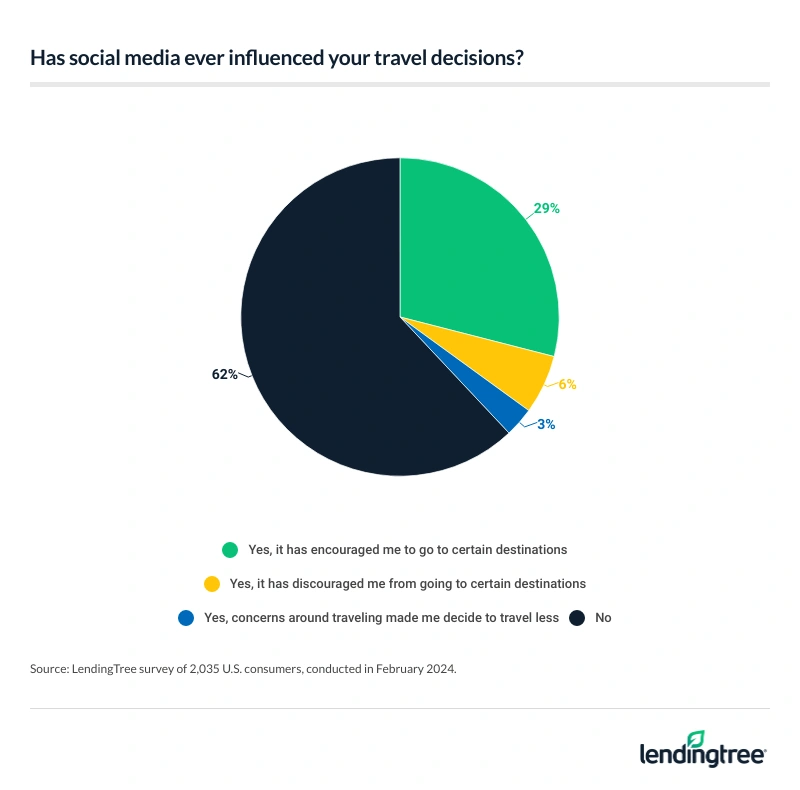

- Social media has influenced travel for many — and younger generations won’t travel without it. 29% of Americans say they’ve been encouraged to visit specific destinations thanks to social media, led generationally by half of Gen Zers and 39% of millennials. However, some are traveling solely for the ‘Gram, as 28% of Gen Zers and 21% of millennials wouldn’t go on a trip if they couldn’t post about it on social media.

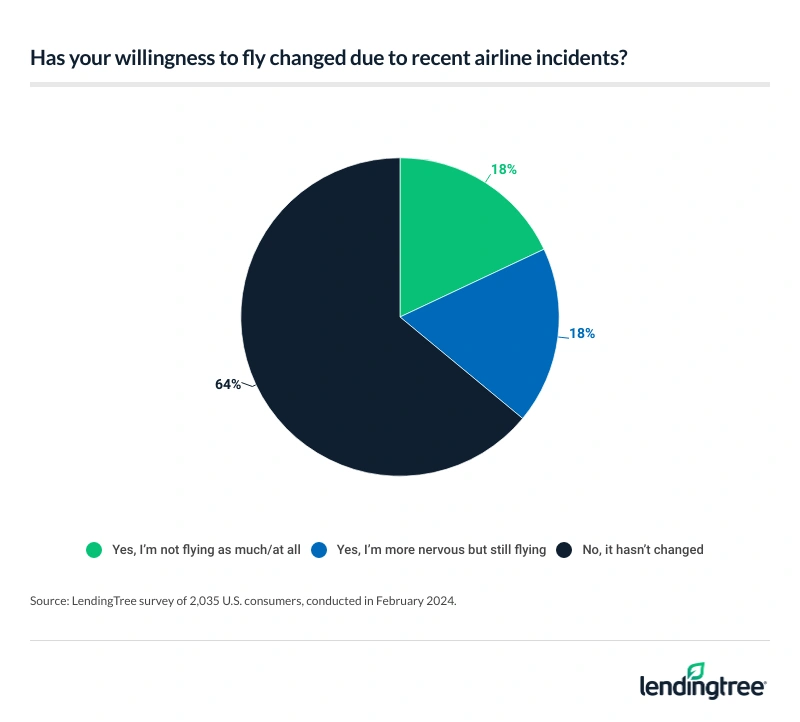

- Aviation safety has been in question, and some are staying grounded this spring. 36% of Americans say recent airline incidents have affected their willingness to travel in some way, with Gen Zers and parents of young children most apprehensive at 44%. Older generations feel the most comfortable with flying, as 70% of Gen Xers and 68% of baby boomers say their willingness to fly hasn’t changed.

Travelers spring for sun and sand

Nearly half of Americans, or 48%, say they plan to travel sometime between March and June this year.

Higher earners are more likely to say yes to a trip: While only 29% of those with an annual household income of less than $30,000 plan to travel, 67% of those who earn $100,000 or more do. And younger demographics are leading the way in getting out there this spring: 56% of Gen Zers ages 18 to 27 say they’ve got travel plans — the most of any generation.

Of those with travel plans, almost half — 47% — say the beach or ocean figured prominently in choosing a spring break destination. Other popular destination features included mountains (25%), theme parks (19%) and special events (19%). The opportunity to connect with family and friends was important, too, at 42%.

Half of springtime travelers say good weather motivates them to sojourn during these specific months. Schools’ built-in breaks act as an incentive for the parents of children under 18 — according to just under a quarter of traveling respondents from that demographic.

The majority of travelers, 60%, will stay at a hotel, motel or bed-and-breakfast while they’re away, though staying with friends and family (41%) or at a short-term vacation rental (25%) is also popular. Gen Z travelers in particular are likely to opt for a short-term rental (like Airbnb or Vrbo): 36% say they’ll stay in one, compared to only 12% of baby boomer (ages 60 to 78) travelers.

28% of spring travelers are going abroad — but they may not research exchange rates

While the majority of spring travelers — 72% — will keep their adventures closer to home, almost a third say they’ll travel internationally. That includes 13% who say they’ll go to an international destination only and 15% who will travel both domestically and abroad.

Men are slightly more likely than women to figure international destinations into their travel itineraries: 33% of male travelers plan to sojourn abroad, while only 23% of female travelers do.

However, more than a third of those planning international travel — 37% — say they haven’t researched the exchange rate of U.S. dollars to their destination’s currency. (That figure includes 15% of internationally traveling respondents who say U.S. dollars are accepted where they’re going.)

On the other hand, 34% say they researched the exchange rate of the U.S. dollar at their destination — and what they found influenced them to book their travel plans.

LendingTree chief consumer finance analyst Matt Schulz says it’s always good to research exchange rates ahead of time. “What you don’t know can cost you a lot of money,” he warns.

Exchange rates can vary significantly depending on where you get foreign currency — you’re likely to do better ordering currency from your bank than from an airport kiosk, for example. And making international purchases without a general exchange rate in mind can lead to overspending before you realize it.

“International travel is expensive enough,” Schulz says. “The last thing you need is to get a bad exchange rate to make everything cost more.” One tip: Credit card issuers generally offer favorable exchange rates for cardholders, so consider relying on plastic while abroad. (Just be sure your card of choice doesn’t charge a foreign transaction fee.)

Although most travelers budget for trips, some will go into debt while away

Most travelers — 65% — are heading into their spring trips with a specific budget.

Of the age groups we studied, younger demographics are more budget-conscious about their getaways: 74% of Gen Z respondents and 73% of millennials (ages 28 to 43) say they have a specific budget in mind, compared with 67% of Gen X (ages 44 to 59) travelers and 44% of baby boomers.

A travel budget can be good not only for your money but also for your mental health, Schulz says. Drafting one “can make it much easier for you to indulge your passion without the guilt of wondering if you’re setting yourself back financially.”

But how much are travelers planning to spend? The majority, or 71%, have budgeted under $3,000 for their springtime sojourns, but 21% plan to spend between $3,000 and $4,999 — and 8% will spend $5,000 or more.

To pay the price, 51% of travelers will reach for their credit cards — though 38% say they’ll pay the card off immediately. (So long as you don’t carry a revolving balance, using credit cards can be a great way to stack up miles or cash back vouchers that can incrementally lower your overall travel spending — as the 4% of respondents who say they will use reward points know.) Four in 10 (40%) respondents say they’ll reach into savings to pay for their trip, while 1% plan to take out a personal loan.

While the overwhelming majority, or 82%, of travelers don’t think they’ll go into debt to take their trip, 19% do. Those with children younger than 18 are far more likely (31%) than those with adult children (10%) or without children (12%) to think they’ll go into debt — perhaps owing to the increasing cost of child-rearing in the U.S.

As for a travel budget, Schulz recommends opting for flexibility — seeing your budget as a roadmap rather than a hard-and-fast rule. “That way, if you spend a little more than you expected, it isn’t a vacation-wrecker,” he says. “It just means you’ll need to do a little bit of adjustment going forward.”

And as far as going into debt for vacation, Schulz says it isn’t always the worst possible decision — so long as it’s done reasonably and responsibly.

“It’s all about making sure that debt gives you a return on investment, and I think vacations can do that,” he explains. “The return isn’t financial, but it comes in the form of memories that will last a lifetime.”

“The big caveat to this is that you can’t do it too often or to too big of a degree,” Schulz adds. “It’s one thing to take a couple of months to pay off your trip to Hawaii or Paris. It’s something else entirely to take a year or more to pay it off.”

About 1 in 5 Americans have gone into debt to travel

Most travelers don’t plan on going into debt to enjoy their upcoming spring travels — but about 1 in 5 Americans, or 21%, admit they’ve gone into debt to travel in the past. And of that pool, 62% say they regretted doing so.

But the experience of overspending on travel may have been instructive for some respondents: 71% say they’ve turned down an opportunity to travel because the trip’s costs superseded their budget. (The other 29%, however, say they’ve never said no to a costly trip.)

Almost a third of Americans are traveling to a specific location for the ‘Gram

These days, posting about one’s travels is almost tantamount to the traveling itself — as evidenced by the 29% of respondents who say social media encouraged them to choose specific travel destinations. (This tendency was most common among Gen Z respondents, of whom 50% say they’d planned travel based on social media-based recommendations.)

Smaller proportions of respondents indicate that social media discouraged them from certain destinations (6%) — or led them to travel less (3%).

In all, 38% of Americans say social media has influenced their travel decisions in some way.

And while most Americans — 81% — would travel regardless of whether they were allowed to share pictographic proof, 19% say they’d skip the trip entirely if they couldn’t post about it on social media. (The figure increases to 28% among Gen Z respondents.)

Have recent airline incidents impacted willingness to travel? 36% say yes

While experts contend (and statistics maintain) that flying remains the safest way to travel long distances, a spate of recent high-profile incidents in American airspaces — including the harrowing tale of Alaska Airlines 1282, a January 2024 flight in which a door plug flew off a brand-new plane less than 10 minutes after takeoff — has made some travelers understandably hesitant.

While 64% of Americans say their attitude toward flying hasn’t changed in the wake of these incidents, 18% say they’re still flying but are more nervous about it — and another 18% say they’re not flying as much as they used to (or at all).

While Schulz says it’s understandable when high-profile incidents provoke nervousness in passengers, he reminds that “flying is still extremely safe, by and large. When something goes wrong, it makes headlines, as it should, but it’s easy to lose sight of the fact that countless other flights went off without a hitch that same day,” he concludes.

Of course, if you’re not comfortable flying, there are other ways to get away — and opting for a road trip might shave dollars off a more expensive international venture.

Wait and see, or plan? 4 travel tips

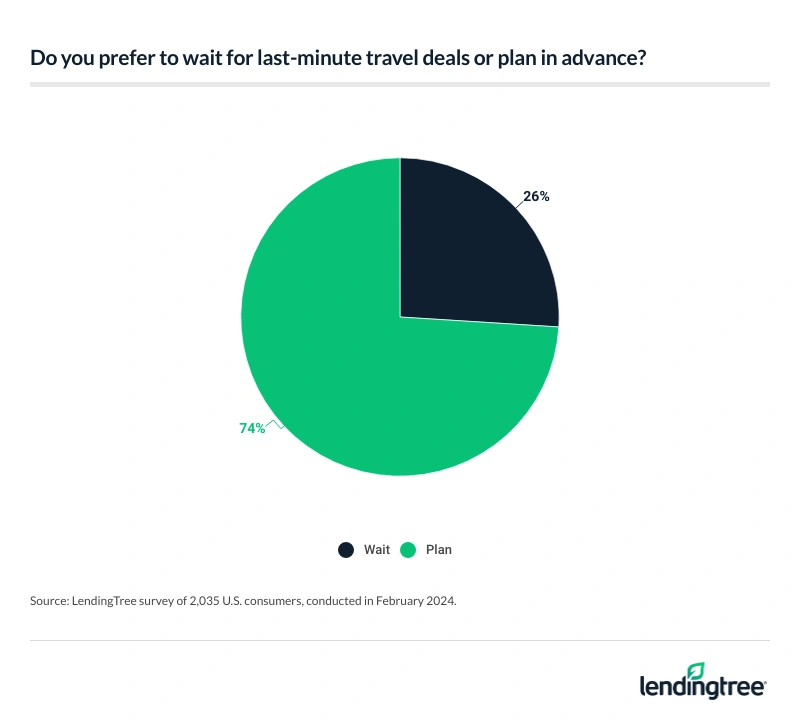

Though one might think the early bird always gets the worm on travel deals, good things come to those who wait in some cases. While it’s not a guarantee, hotel rooms and airfare can drop — sometimes precipitously — when you book at the last minute as companies scramble to fill empty beds and seats.

While 74% of Americans say they prefer to plan, 26% risk it to wait and see if an unbeatable bargain comes up. (While the overall trend toward planning held for all age groups, Gen Z respondents and millennials were substantially more likely to hold out for a last-minute travel deal than older demographics.)

For those who plan, the most common time frame in which to do so is about three to four months before departure. In fact, 39% of respondents say that’s when they book their vacations, while 31% do so one to two months before travel and 30% book their plans five months or more ahead of time.

While there’s no right answer, there are steps you can take to make the most of your trip, whichever approach you take. For example:

- If you’re planning, don’t plan too far ahead. Especially for domestic travel, there’s such a thing as being too on top of it. According to a 2023 study by CheapAir.com, the statistically “best” day to buy a domestic airline ticket was 42 days before departure — a little over a month. For international travel, it depends on the destination.

- Consider your life circumstances. If you’re a parent, for example, chances are you’ll have to plan to make a vacation realistically work — and simply to feel like a vacation. “As a parent of a high schooler, a husband and someone with a demanding job,” says Schulz, “I feel like I do enough scrambling and putting out fires daily. When it comes to vacations, I prefer to work it out ahead of time and have things mostly lined up well in advance.”

- For last-minute deals, use technology to your advantage. For example, apps like HotelTonight can help you see which inns offer last-minute deals and steals, and Hopper allows you to quickly and easily compare airfare depending on dates.

- As a last-minute traveler, know your rights. Since making plans on the fly can be a dynamic and fast-paced experience, knowing that, for instance, even nonrefundable airfare is refundable for the first 24 hours after booking, can make a big difference.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,035 U.S. consumers ages 18 to 78 from Feb. 1 to 5, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78