From Swipe to Split: More Americans Ditch Store Cards for BNPL

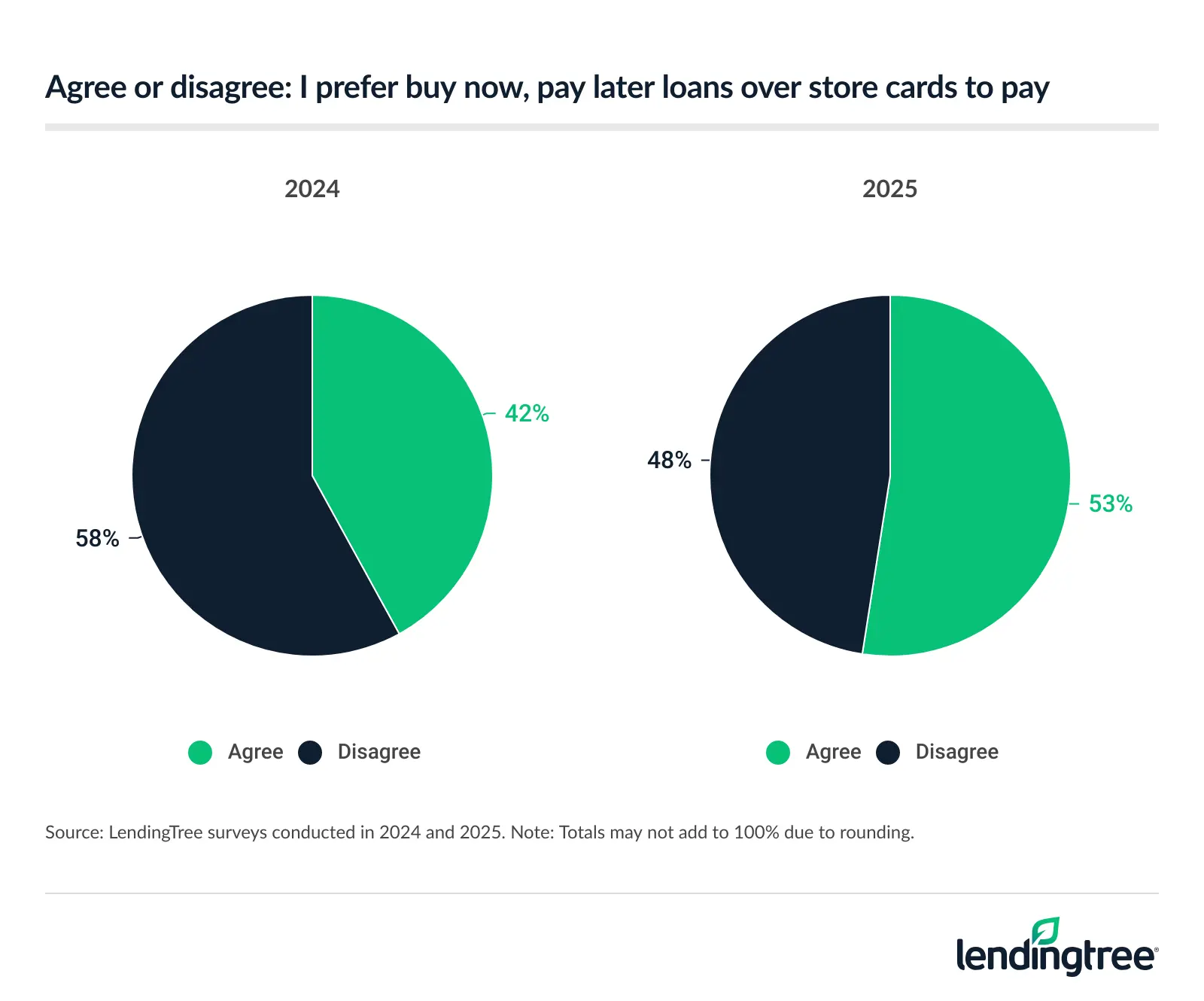

Americans now prefer buy now, pay later (BNPL) loans as a payment option over store credit cards, a major reversal from a year ago.

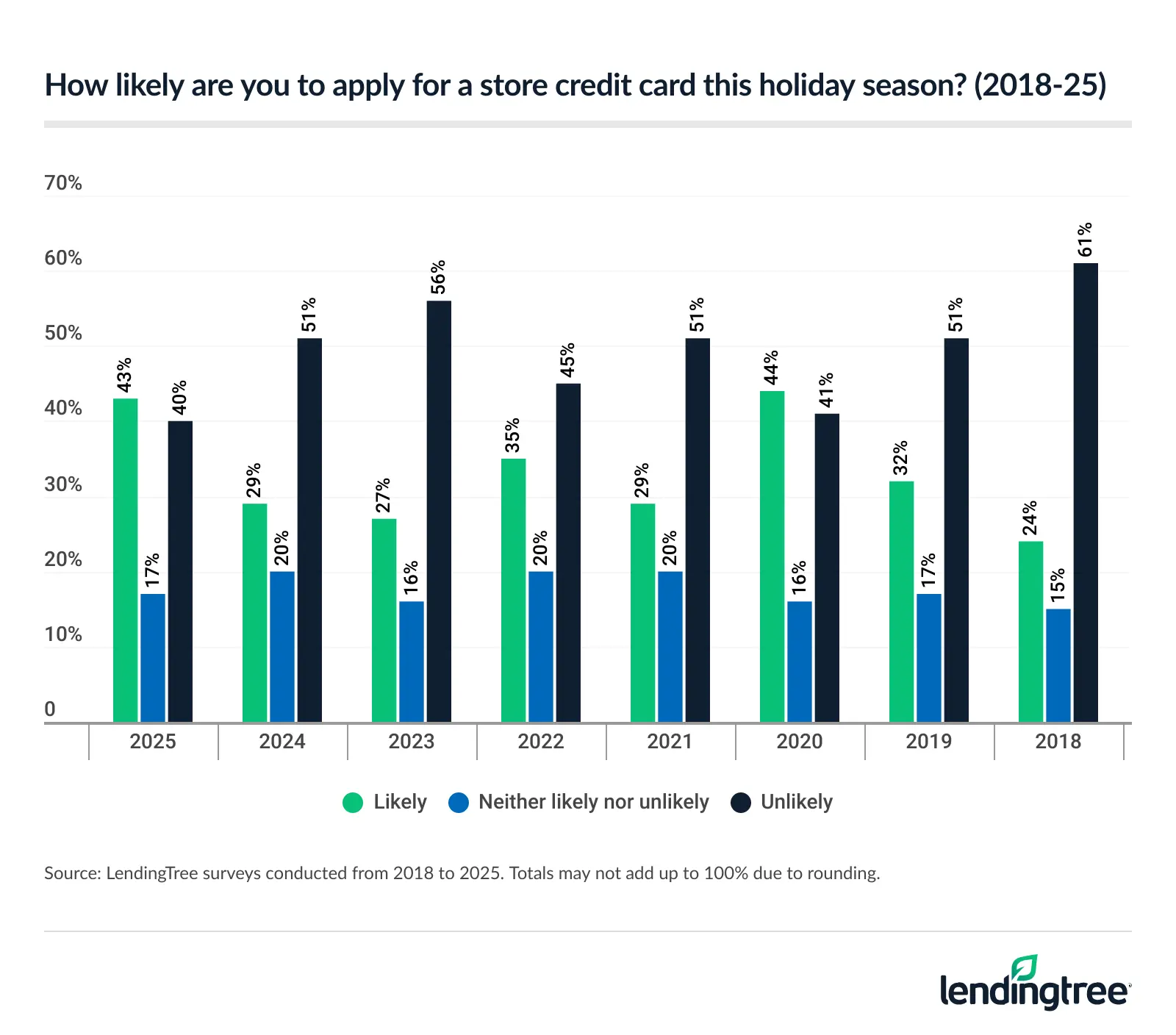

However, that doesn’t mean shoppers are completely abandoning store cards. Far from it, in fact. Interest in these cards hit a five-year high this year, even with the average APR above 30%.

Scroll to see more from our 2025 Store Credit Card Report.

Key findings

- Most Americans prefer buy now, pay later loans over store cards, a major switch from a year ago. 53% prefer BNPL over store credit cards as a payment option. Last year, the first in which we asked this question, just 42% said so. Nearly 3 in 4 parents of young kids prefer BNPL, as do 70% of millennials, 64% of Gen Zers and 60% of men.

- Interest in store credit cards hits a five-year high. 43% of Americans are at least somewhat likely to apply for a store credit card during the 2025 holidays, including 18% who are highly likely to do so. That 43% figure is up 14 points from last year and is the highest percentage since 44% in 2020.

- The average store card APR has dipped over the past year but remains above 30%. The average interest rate on a new store credit card is 30.58%. That’s down from 30.78% a year ago, but it’s still the second-highest since we began tracking in 2018.

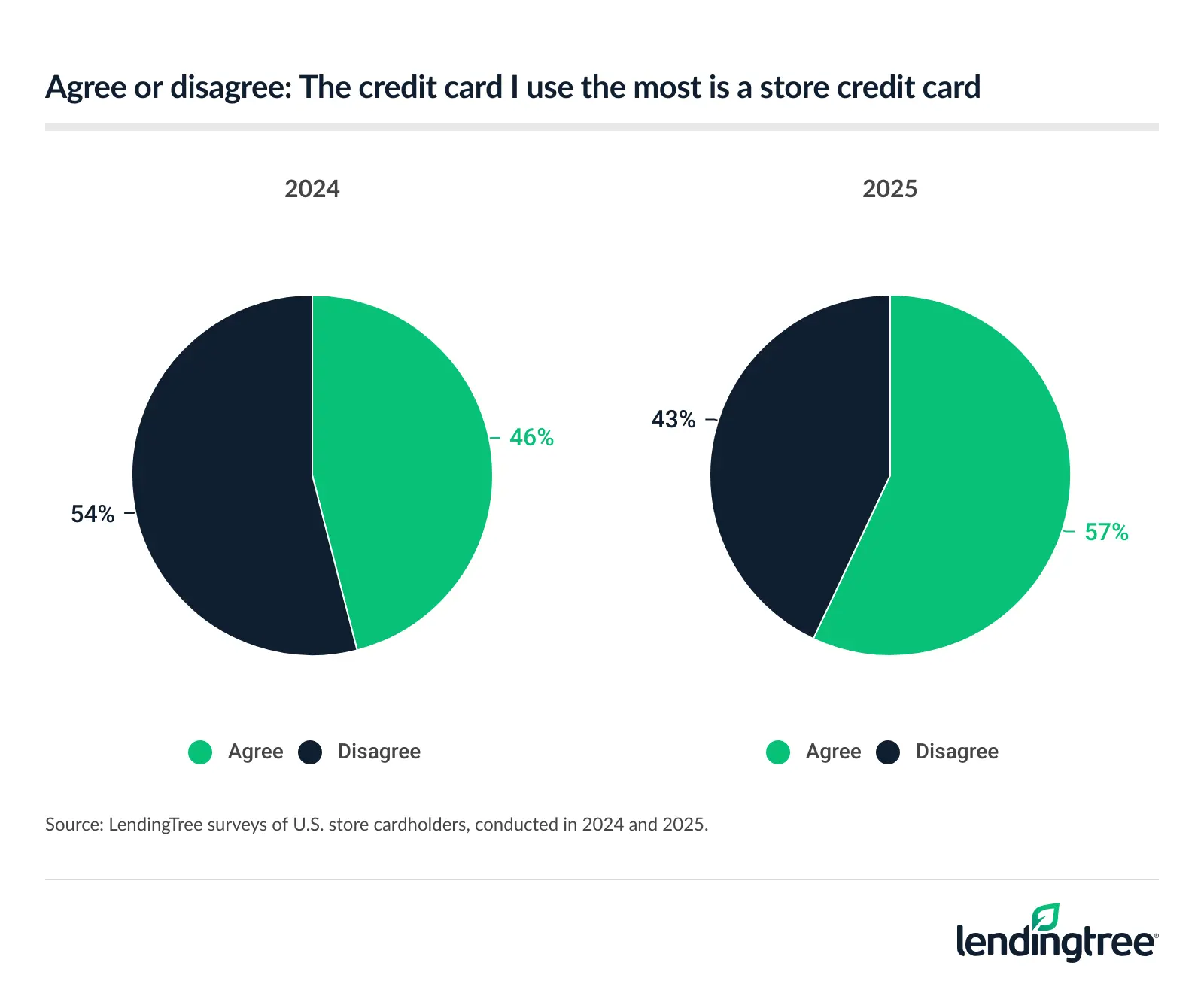

- Most store cardholders say their most used credit card is a store card. 57% say so, up from 46% a year ago. Among those with store cards, nearly 8 in 10 millennials and parents of young kids say it’s their primary card.

In reversal, most Americans prefer BNPL loans over store cards

Buy now, pay later (BNPL) loans have grown from a somewhat mysterious new phenomenon into an enormously popular financial tool in just a few years. If there were any lingering doubts about the appeal of BNPL, our survey should end them.

More than half of Americans (53%) prefer BNPL to store credit cards as a payment option. A year ago, when we first asked this question, just 42% said so.

Nearly 3 in 4 parents of young kids (73%) prefer BNPL, while 70% of millennials ages 29 to 44, 64% of Gen Zers ages 18 to 28 and 60% of men say the same. While younger generations are more likely to prefer BNPL to store cards, nearly half of Gen Xers ages 45 to 60 (47%) do, too. Even 26% of baby boomers ages 61 to 78 prefer them.

Interest in store credit cards hits 5-year high

Though more people prefer BNPL, store credit cards remain popular for many Americans.

More than 4 in 10 Americans (43%) say they’re at least somewhat likely to apply for a store credit card during the 2025 holiday shopping season. That’s up 14 points from last year and is the second-highest since we started tracking in 2018. Only 2020’s 44% was higher. That 43% this year includes 18% who are highly likely to do so.

Seven in 10 parents of young kids are likely to apply, including 34% who are highly likely to do so. Men are nearly twice as likely as women to say they’re likely to apply (56% versus 29%). Millennials are more likely than any other age group, with two-thirds (66%) saying they’re at least somewhat likely to apply. Compare that to just 13% of boomers.

Perhaps surprisingly, the higher your income, the more likely you are to say you expect to apply for a store credit card. More than half (56%) of those earning $100,000 or more a year say they’re at least somewhat likely to apply, while just 32% of those making less than $30,000 a year say the same.

Average store card APR has dipped but is still above 30%

This increased demand for store credit cards comes at a time when the typical interest rate on a new store card is above 30%.

Our review of terms and conditions for more than 100 cards revealed an average APR for a new store credit card of 30.58%, with an average range of 29.39% to 31.76%. That 30.58% figure is down from 30.78% a year ago — the highest since we began tracking in 2018 — but it’s still the second-highest on record. It’s also more than six percentage points above the average for all new credit card offers, which is 24.19%.

Average APR for new store card offers vs. average APR for all new credit card offers (2018 to 2025)

| Year | Avg. APR, all new credit card offers | Avg. APR, new store credit card offers |

|---|---|---|

| 2018 | 20.62% | 24.97% |

| 2019 | 20.59% | 25.41% |

| 2020 | 19.29% | 24.24% |

| 2021 | 19.47% | 24.27% |

| 2022 | 22.21% | 26.60% |

| 2023 | 24.46% | 29.31% |

| 2024 | 24.61% | 30.78% |

| 2025 | 24.19% | 30.58% |

While store credit card interest rates are sky-high, our survey hints that they’re not a deal-breaker for many potential applicants. Just 58% of those who’ve had store cards say they considered the card’s interest rate before applying.

Most store cardholders say the card they use most is a store card

Nearly 6 in 10 Americans (59%) have a store credit card today, while another 23% have had one in the past. Among those who currently have a store card, more are using it as their primary credit card. More than half (57%) of store cardholders say so. That’s up from 46% just a year ago.

Among store cardholders, nearly 8 in 10 millennials (79%) and 77% of parents of young kids say they use a store card most often. Men are far more likely than women to say so (69% versus 43%).

Most important thing to know about store credit cards

Most of us have faced this dilemma at the checkout counter: To apply for the store credit card or not to apply. That’s the question.

The answer is simple. If you’ll carry a balance on that store credit card, don’t apply.

The APRs are so high, even by credit card standards, that any rewards you earn from using the card will likely be outweighed by the interest you’d pay on that balance.

Put simply, it doesn’t make much sense to pay 30% interest to save 15% on a purchase.

On the other hand, if you never carry a balance, a store credit card can be a great financial tool, even better than a BNPL loan. Here’s why:

- Rewards and discounts. Over the years, stores have done a better job at offering perks that matter to their credit cardholders. You may get early access to sales, VIP treatment in stores, extra cash back, invitations to exclusive events and more. You’re not going to get that, typically, with BNPL.

- Easier returns. BNPL loans are notoriously challenging when it comes to making returns. That’s not the case with a store credit card.

- Helping you build credit. Plans are in the works to have BNPL loans help people build credit, but the truth is that it’ll be a long time before those plans are fully implemented with all BNPL lenders and credit bureaus. Meanwhile, store credit cards have long been seen as a decent starting point for those looking to establish or rebuild credit.

Of course, BNPL loans have their strong points as well. People love them because they typically are:

- Pretty easy to get

- Interest-free when handled wisely

- Offered with predictable payments

- Short-term and finite

As with most financial tools, there’s no universal answer for whether BNPL or store cards are best for everyone. It’s about figuring out which one best aligns with your needs, goals and spending habits. Understanding that will lead to the right decision for you.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 78 from Oct. 2 to 6, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 78

LendingTree also reviewed 103 credit card offers — including cobranded and noncobranded cards — from 70 of the nation’s biggest retailers, including brick-and-mortar and online-only stores. We reviewed basic terms and conditions, including APRs, online through issuers’ publicly available websites. Credit card offer data is accurate as of Oct. 21, 2025.