1 in 3 Buy Now, Pay Later (BNPL) Users Paid Late in Past Year

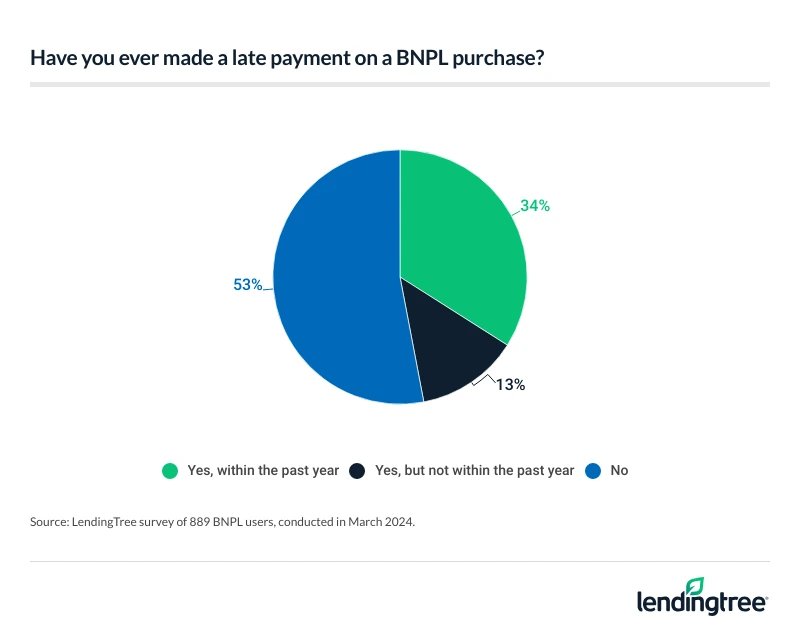

A third of buy now, pay later (BNPL) users say they’ve paid late on one of those loans in the past year, according to a new LendingTree report.

That grows to nearly half of BNPL users when you ask if they’ve ever paid late on a BNPL loan — and that figure is climbing.

That’s just some of the troubling data from our latest report on these popular loans. Here’s more of what we found.

Key findings

- One-third of buy now, pay later (BNPL) users say they’ve paid late in the past year. 34% say so, while another 13% say they’ve paid late but not in the past year. That means nearly half of BNPL users (47%) have paid late on one of these loans at some point, up from 40% in 2023.

- More than 4 in 10 Americans have used a BNPL service — with 20% of them having done so six or more times. 43% of Americans have used a BNPL service. Two-thirds of BNPL users have done so at least twice. The financing option is most popular with Gen Zers (58%), parents with young children (57%), millennials (55%) and men (50%).

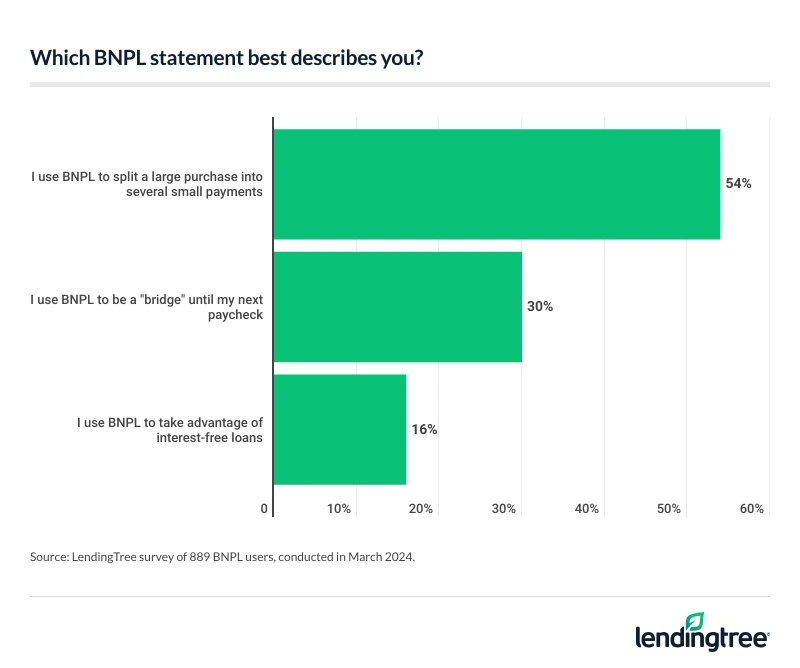

- A higher rate of BNPL users utilize the loans as a “bridge” between paychecks. 30% of BNPL loan users say they do so, a bump from 27% in 2023.

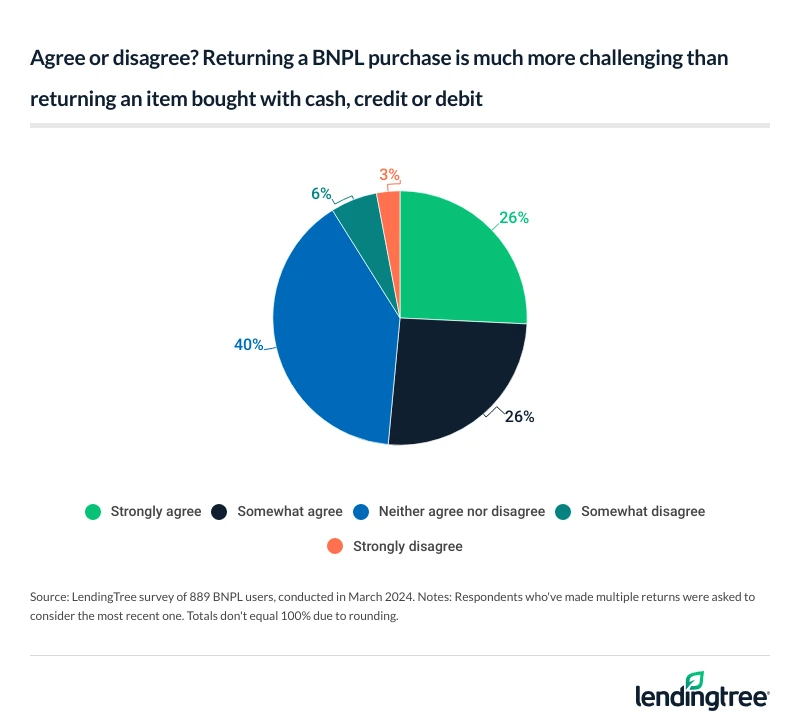

- Most BNPL users say BNPL returns are more challenging than those for other types of purchases. 51% of BNPL users agree that returning a BNPL purchase is much more challenging than returning an item bought with cash, credit or debit. In all, 43% of BNPL users say they’ve returned an item they purchased with BNPL.

- Regret is common for BNPL users. 43% have regretted financing a purchase with BNPL, and a third of those with regret leveraged BNPL for a purchase of $500 or more. That makes sense when you consider that 54% of BNPL users have financed a purchase with BNPL knowing they couldn’t afford it at the time.

One-third of BNPL users say they’ve paid late in past year

Job No. 1 for anyone with any type of loan is to pay bills on time. With life as expensive as it is in 2024, that’s often easier said than done, but it should always be the goal. To miss payments can mean wrecking your credit, which can cost you untold dollars during your life.

Unfortunately, our latest report shows that a third (34%) of buy now, pay later users have missed a payment in the past year.

The two groups struggling the most with late payments recently are parents of young children (50% say they’ve paid late in the past year) and, surprisingly, those making $100,000 or more a year in household income. Nearly half of the highest earners (49%) say they’ve paid late on a BNPL loan in the past year, nearly 18 percentage points higher than any other income group.

Men are much more likely than women to say they’ve paid late in the past year (41% versus 26%). Younger Americans are at least twice as likely to say they’ve done so, led by 45% of Gen Z BNPL users ages 18 to 27 and 44% of millennials ages 28 to 43, compared with 20% of Gen Xers ages 44 to 59 and 7% of baby boomers ages 60 to 78.

More than 4 in 10 Americans have used BNPL service, led by younger generations, parents, men

Those late payment percentages would be troubling even if BNPL was just a niche financial tool as it was a few years back. However, those days are long gone. Now, BNPL is firmly entrenched in the mainstream, used by every demographic to at least some degree.

Our survey finds that 43% of Americans have used a BNPL service. The most likely to have used one: Gen Zers (58%), parents with young children (57%), millennials (55%) and men (50%).

The biggest holdouts from the BNPL phenomenon? Baby boomers. Just 24% of boomers say they’ve used a BNPL service.

Those who’ve used one are highly likely to do so again. Two-thirds of BNPL users (67%) say they’ve used BNPL services at least twice. That includes 20% who’ve used them six or more times and 8% who’ve done so more than 10 times.

That amount of repeat users likely bodes very well for the future of the BNPL business.

Growing number of BNPL users utilizing these loans as bridge between paychecks

Is the growth of the BNPL business good for consumers? Not necessarily.

Our survey shows that more and more BNPL users are getting the loans to help them get by, acting as a bridge from one paycheck to the next. Three in 10 users say they do just this.

That rate is up slightly (from 27% last year to 30% today). Given the toll inflation has taken on so many American families in recent years, perhaps that growth shouldn’t be surprising. However, it’s still bothersome.

More than 4 in 10 parents with young children (43%) say they use BNPL to make ends meet between paychecks — the highest percentage of any demographic.

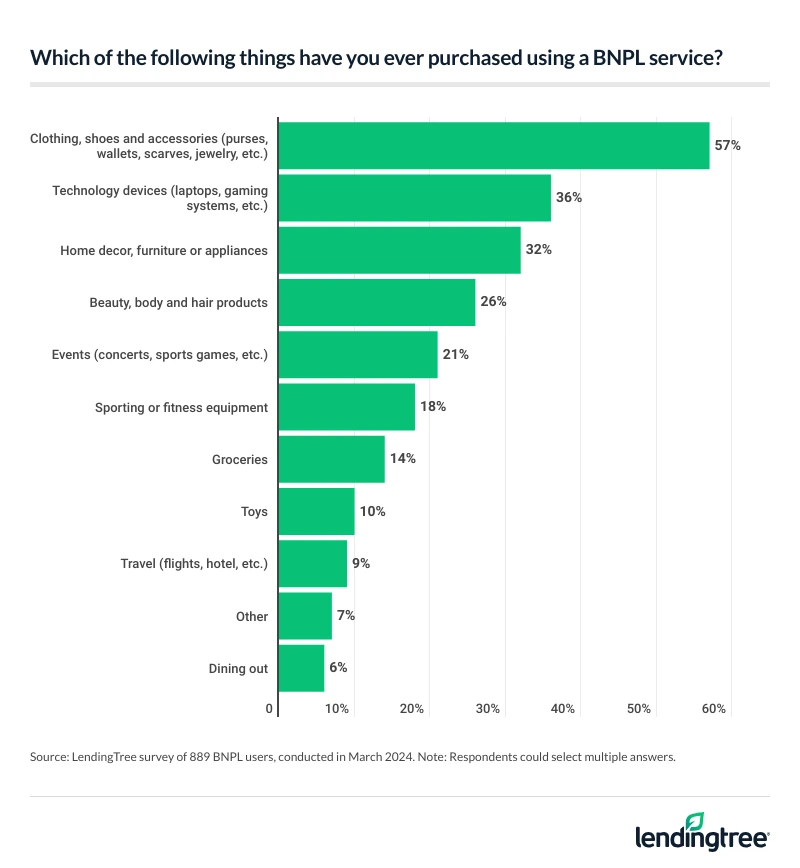

When they do use BNPL, people are buying all sorts of things. Clothing, shoes and accessories are the most common, by far, but plenty of people use the loans to buy technology, home decor, beauty products, concert tickets, fitness equipment and even groceries.

Clothing is the most common, regardless of age, income level, gender or parental status.

For most groups, groceries are well down the list of most common uses for BNPL loans. However, nearly 1 in 5 millennials (19%) say they’ve bought groceries with BNPL, the highest percentage of any group.

Most BNPL users say BNPL returns challenging

As BNPL has moved into the mainstream, one of the chief criticisms is that it can be more difficult to return items bought with BNPL than with other methods. Our survey showed that most BNPL users agree.

More than half of BNPL users (51%) agree that returning a BNPL purchase is much more challenging than returning an item bought with cash, credit or debit. Just 9% disagree, while 40% neither agree nor disagree.

Those making $100,000 a year or more (68%), parents of young children (66%), Gen Zers (65%) and men (63%) are the most likely to say the returns were more challenging. Meanwhile, women are among the most likely demographics to say they disagree — 11% say so, while 37% agree and 52% have no opinion.

What makes these returns so challenging? For one, the refund will likely go from the merchant to the BNPL provider rather than you. That’s an extra step in the process, one that could dramatically lengthen the time it takes you to get your money back.

Also, you may have to continue making your scheduled payments for the BNPL loan before getting a refund. That could mean, for example, making another payment or two even after receiving a broken piece of merchandise. That’s not something you have to face when you return something bought with a credit card.

Regret common for BNPL users

Given all the above, it shouldn’t be surprising that many BNPL users regret using these services. Our survey finds that 43% of BNPL users say they’ve regretted a BNPL purchase.

The most likely group to regret a BNPL purchase? Gen Zers. More than 6 in 10 Gen Z BNPL users (62%) say so. That’s more than double the percentage of Gen Xers (26%) and baby boomers (21%) who say so.

The data also reveals a gender gap, with 51% of male BNPL users expressing regret over a purchase, versus just 33% of women. We also see that the likelihood of regret rises with income. More than half (51%) of those earning $100,000 or more a year say they’ve regretted a BNPL purchase, while just 38% of those earning less than $30,000 say the same.

Best practices for handling BNPL

Despite all the gloom and doom in this report, it’s unambiguously true that BNPL can be an awesome financial tool. However, it’s also true that it can be a headache — and even dangerous — if not used wisely.

Perhaps the biggest danger is taking on too much too quickly. More so than with many other financial tools, getting quite a few BNPL loans in a short window can be pretty easy. That can make for a challenging situation if you’re on a tight budget. After all, these BNPL loans typically aren’t like credit cards, which let you stretch out payments for a long time as long as you pay a little bit monthly. These are installment loans — like a car loan, mortgage or student loan, albeit usually in smaller amounts than those types of loans — in which a set amount has to be paid each month or you’re hit with fees (or worse).

Here are a few tips for managing BNPL loans.

- Limit how many you’ll take on at once. Even small loans can be challenging to manage if there are too many. Ideally, you’d only have one of these loans active at any point, though individuals’ comfort levels will vary. The 24-hour rule — if you’re considering something, wait 24 hours to buy it so you can see if you want or need it — can be helpful.

- Adjust your budget accordingly when you take out new BNPL loans. If the new loan is a spur-of-the-moment buy, it can be OK. Make sure you have room in your budget so other priorities don’t pay the price for your splurge. Maybe that means dining out a time or two less this month, or maybe the sacrifice has to be a little more significant. Either way is OK. What isn’t OK is ignoring the purchase and pretending it never happened.

- For gifts and other things that might get returned, consider using a credit card instead. We’ve all had people return gifts we’ve bought them, and we’ve all returned gifts ourselves. It happens. Buying the gift with a credit card can make the return process easier so the person can get what they want with minimal hassle.

- Look at the lender’s late payment policy before getting the loan. Most people don’t get loans thinking they’re going to pay late. But as this report makes clear, delinquencies happen — a lot. Different BNPL lenders may have different policies for late payments, including if they charge fees, if they report the late payment to credit bureaus and if the late payment disqualifies you from borrowing from them in the future.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,049 U.S. consumers ages 18 to 78 from March 15 to 18, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Get personal loan offers from up to 5 lenders in minutes