2024 Streaming Services Report

Streaming services have become a fixture in entertainment. But as prices rise and some crack down on password sharing, many Americans think these services are losing their allure.

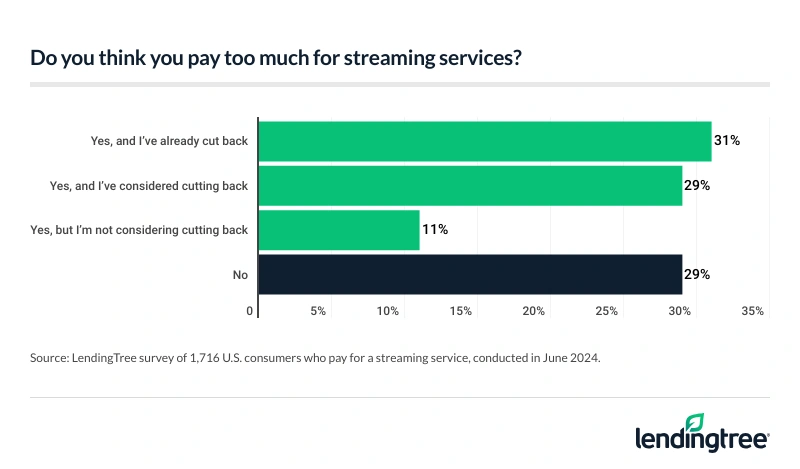

According to the latest LendingTree survey of 2,000 U.S. consumers, 72% of subscribers think they pay too much for streaming services.

After reviewing our findings, stick around for tips on utilizing your credit card to help budget for streaming services.

- Nearly 3 in 4 streaming service subscribers think they pay too much, but negotiating could help. 72% of subscribers think they pay too much; as a result, 31% have already cut back and 29% have considered it. On the bright side, a little over a third (34%) of subscribers have tried negotiating the price of a service, with 68% of them seeing success.

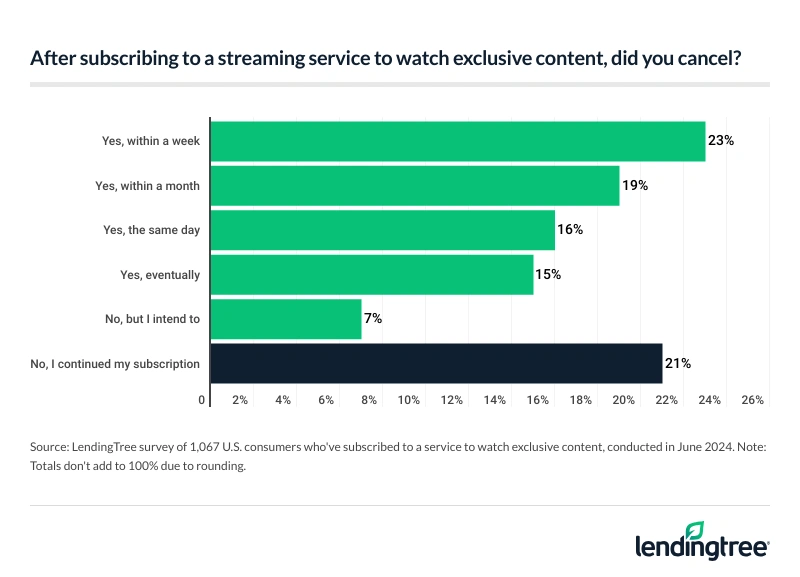

- More than half of Americans have subscribed to watch one program. 53% of consumers have signed up for a new service in the past year to watch one piece of content. After watching the most recent event, 72% then canceled their subscription. 57% canceled within a month. Sign-ups are expected for future events, with 30% planning to purchase a streaming service for this year’s Olympics.

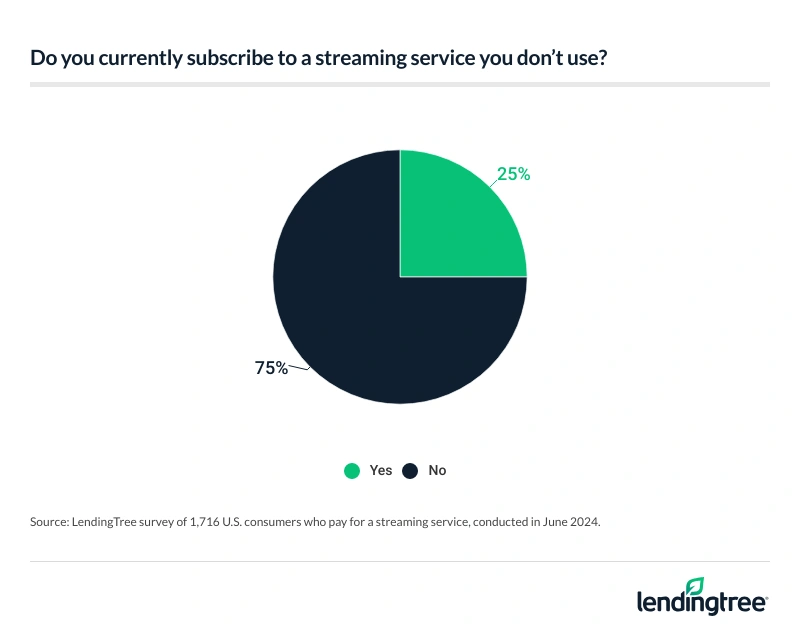

- Subscribers turn to apps to keep track of their streaming subscriptions. Of those who pay for a streaming service, a quarter (25%) subscribe to one they no longer use. More than a third (36%) utilize apps or services to manage their subscriptions, with 22% canceling a streamer as a result.

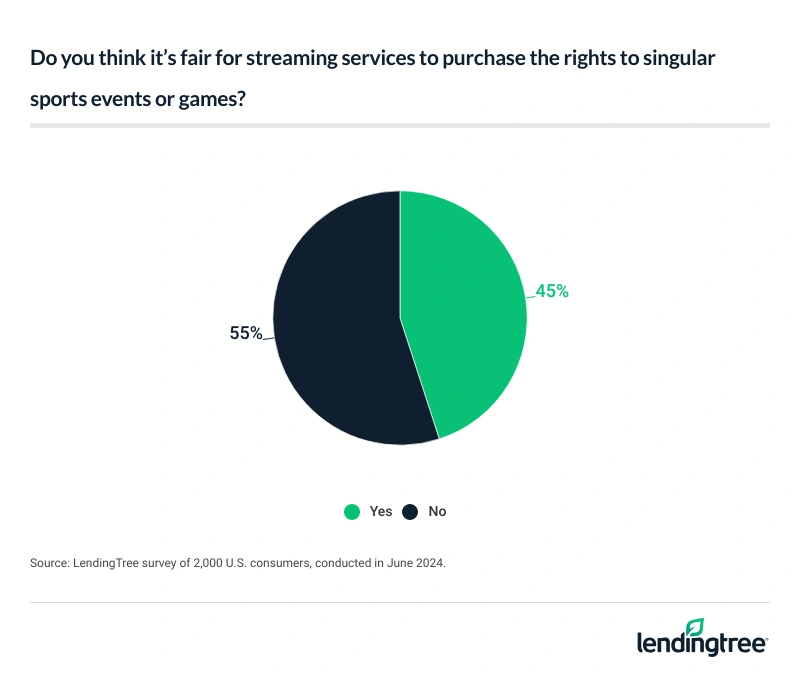

- Many Americans aren’t happy with sports moving to streaming platforms. Across all Americans, 55% don’t think it’s fair that streaming platforms can purchase the rights to a singular sports event or game. However, 41% say they’d be more likely to watch their favorite sport if more games were available to stream. Additionally, 75% of subscribers say streaming services have replaced their need for cable.

- While some streamers have cracked down on moochers, not everyone has stopped. A third (33%) of Americans use someone else’s streaming account. Of this group, 59% have done so without permission. Still, an overwhelming 86% of moochers think it’s fair to do so, believing streaming services already make enough money or they don’t use someone else’s account frequently enough to do harm.

Prime investments: Negotiating could help lower streaming service costs

Across all Americans, 86% pay for at least one streaming service. Netflix (47%) is the most popular choice, with Amazon Prime Video (41%) and Hulu (33%) following. Other popular streaming services include:

- Peacock (24%)

- Disney Plus (23%)

- Paramount Plus (21%)

- Spotify (18%)

- Max (18%)

- YouTube Premium or TV (18%)

- Apple TV+ (12%)

- ESPN+ (11%)

- Apple Music (10%)

- SiriusXM (8%)

- Discovery Plus (7%)

- Sling TV (5%)

- FuboTV (4%)

Costs range widely depending on the type of service. For example, Netflix plans range from $6.99 (standard with ads) to $22.99 (premium) a month. Meanwhile, FuboTV plans range from $32.99 (Latino package) to $99.99 (premier package) a month, with add-ons galore that could push costs far higher.

With that in mind, 72% of subscribers think they pay too much — and 31% have started cutting back, while 29% have considered it. Gen Zers ages 18 to 27 (81%) are the most likely to say they pay too much, followed by millennials ages 28 to 43 (74%).

Prices aren’t always set in stone, though. Across all subscribers, 34% have tried negotiating the price of a service, a figure that rises to 55% across Gen Zers. And negotiators have success, too. Of those who’ve tried to negotiate the price of a service, 68% have done so successfully.

How much is too much? Among subscribers, 62% say the maximum they would spend on a streaming service is $20 a month.

Americans are binging and bolting

Services are successfully reeling in Americans for exclusive content — at least temporarily. Across all Americans, 53% have signed up for a new service in the past year to watch one piece of content, whether a show, movie, sporting event or something else. This is especially true for Gen Zers (75%), parents with children younger than 18 (71%) and millennials (66%).

Still, most binge and bolt. After watching the content for which they signed up, 72% then canceled their subscription. Some stay on, though: Just 66% of Gen Xers ages 44 to 59 and 68% of baby boomers ages 60 to 78 canceled their subscriptions after watching.

Of those who signed up to watch one piece of content, 16% canceled the same day they watched, while 23% did so within a week and 19% within a month.

With the Olympics approaching, 30% of Americans plan to purchase a streaming service to watch. Gen Zers (48%), those with children younger than 18 (47%) and millennials (41%) are the most likely to subscribe for the Olympics. Meanwhile, men (36%) are more likely than women (24%) to do so.

Subscribers use apps to keep track of streaming services

With so many streaming services, it can be hard to keep track of payments — and which you don’t need. Of those who pay for a streaming service, 25% say they’re subscribed to one they no longer use. That jumps to 42% among Gen Zers.

This comes as 76% of subscribers pay for more than one streaming service, and a third (33%) have more streaming subscriptions today than a year ago. Those with children younger than 18 (87%), Gen Zers (82%) and millennials (82%) are the most likely to have more than one streaming service.

These groups are also the most likely to have more streaming services than a year ago, at 47% among those with children younger than 18, 44% among Gen Zers and 42% among millennials.

To help juggle their subscriptions, 36% utilize apps or services designed to keep track of their subscription services. Of all subscribers, 22% have used an app and canceled a service as a result. Gen Z subscribers (56%) are significantly more likely to use these apps, with 34% using one and canceling a service because of it.

If subscribers had to give up every service except one, Netflix is king, with 28% reporting they’d keep it. That’s followed by Amazon Prime (18%) and Hulu (10%).

Americans unhappy sports events may be exclusive to streaming

The war for streaming rights includes sports — and Americans aren’t happy over this corporate battle. Across all consumers, 55% don’t think it’s fair that streaming platforms can purchase the rights to a singular sports event or game. That rises to 65% among baby boomers.

Still, Americans wouldn’t be opposed to seeing their sport on streaming services. In fact, 41% say they’d be more likely to watch their favorite sport if more games were available to stream, while 38% are indifferent.

Meanwhile, 75% of subscribers say streaming services have replaced any need for cable, where many traditionally would watch sports.

Amid password crackdowns, sharing accounts still common

Netflix cracked down on password sharing last year (and other streaming services have indicated they’ll do the same). Still, 33% of Americans use someone else’s streaming account — a figure that rises to a whopping 61% among Gen Zers.

Of these password sharers, 59% have used someone else’s account without permission. That being said, 61% would purchase their own subscription if they no longer had access to the account they borrow, while just 34% would stop using the platform.

Regardless, 86% of moochers think it’s fair to use someone else’s account, with 59% saying the companies already make enough money and 28% believing they don’t use someone else’s account frequently enough to do harm. Among streaming service subscribers, 39% say their perception has changed toward companies that crack down on shared logins.

Meanwhile, 29% are the password sharers themselves, saying someone outside their household uses one of their streaming services.

Cutting costs on streaming services: Top expert tips

As costs continue to rise and companies crack down on passwords, streaming services are taking up larger chunks of consumers’ budgets. To help navigate these costs, we recommend the following:

- Look into rewards credit cards. Some credit cards offer more than $100 a year on streaming service spending, which can help stretch your budget.

- Explore bundled options. Some companies offer bundled services with multiple streaming platforms. For example, the Disney Bundle includes Hulu, Disney Plus and ESPN+. While savings may be small, it beats buying each platform separately.

- If you’re looking forward to a particular show, see what’s coming on your platform. You don’t always need to sign up for a new service to watch what you want. Streaming rights change hands constantly, so a movie or show you may be eager to watch could show up on your platform sooner than you think.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 78 from June 4 to 6, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78