LendingTree Credit Card Stress Index: These Metros Are Most, Least Distressed

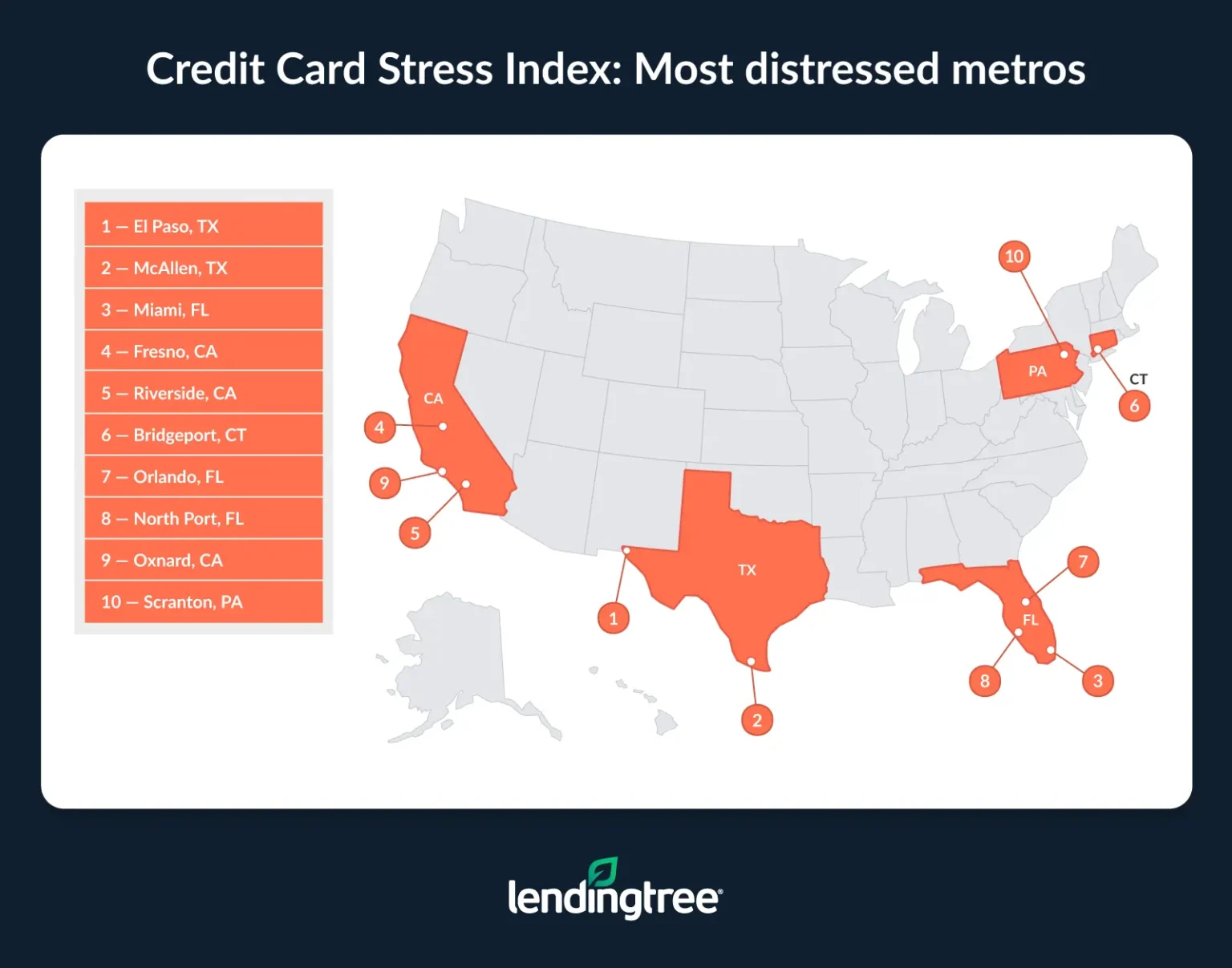

Credit card debt stress is everywhere, but a LendingTree analysis shows Sun Belt metros feel the heat more than anywhere else.

We looked at several key indicators, including balances, utilization rates and late payments, to create the Credit Card Stress Index, a measure of how much residents in a metro struggle with their credit cards. No area is immune to credit card stress, but cardholders in West Texas’ El Paso appear to be the most stressed.

Here’s what we found.

- El Paso, Texas, is the credit card stress capital of the U.S. Among the 100 largest, the West Texas metro has the highest credit card debt-to-income ratio at 9.9%, with a median credit card balance of $4,365. El Paso surpasses the average in each metric in our index — and not in a good way.

- Sun Belt metros dominate the list of high-stress locations. The five metros with the highest credit card stress scores are in the Sun Belt. Along with El Paso, the list includes McAllen, Texas; Miami; Fresno, Calif.; and Riverside, Calif. At least half of these metros’ residents maintain balances on three or more credit cards.

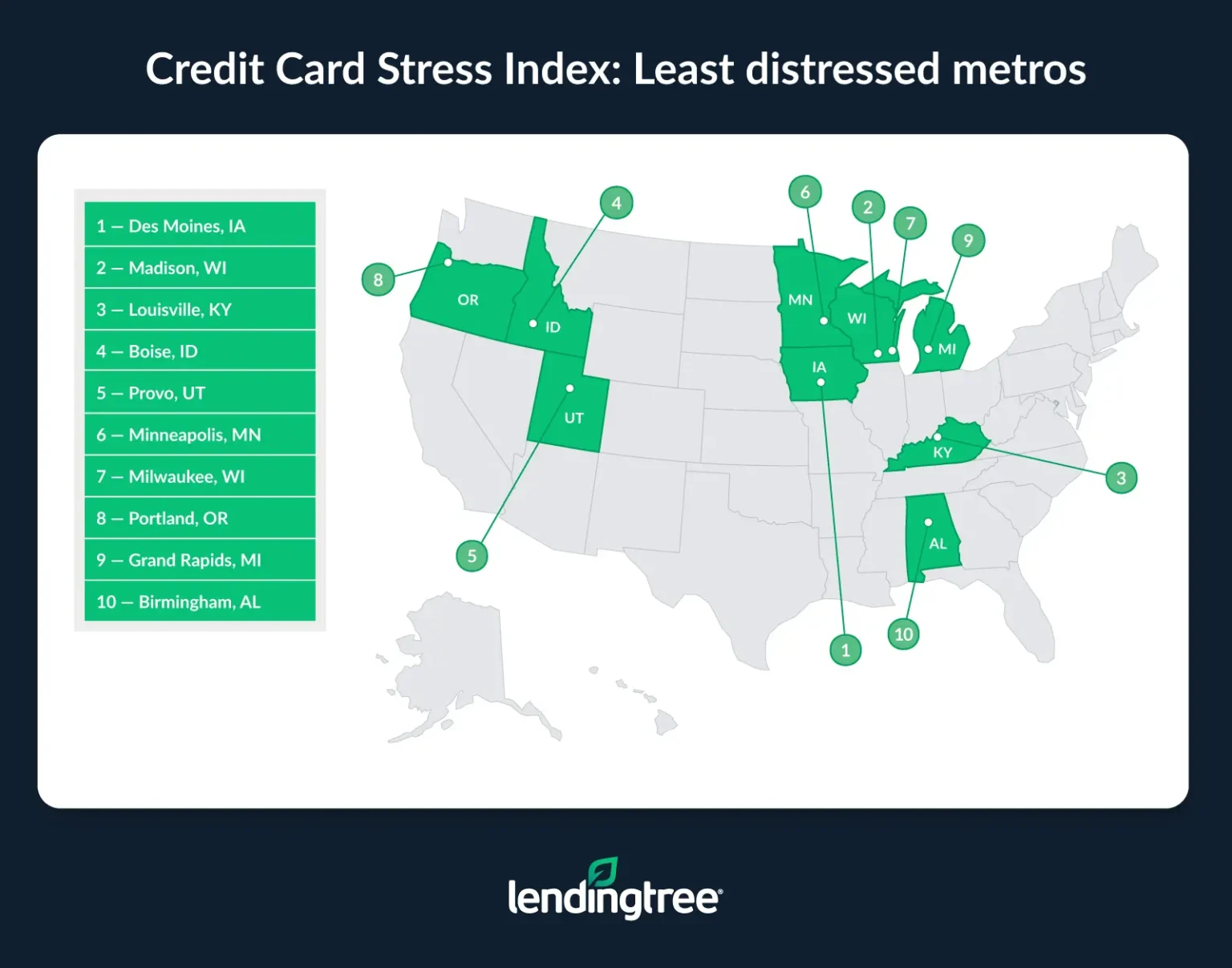

- Des Moines, Iowa, and Madison, Wis., have the lowest credit card stress scores. Des Moines has the second-lowest utilization rate, at 23.9%. Meanwhile, Madison has the second-lowest delinquency rate, with only 1.2% of residents late on credit card payments.

- Looking solely at the 10 biggest metros, Philadelphia has the least credit card stress, while Miami has the most. The home of the Super Bowl champs ranks just 56th among the 100 biggest metros for credit card stress. Washington, D.C., and Chicago have the next lowest. Dallas and Houston follow Miami at the top of the list.

We created a Credit Card Stress Index for the 100 largest metros, focusing on consumers with active credit cards on their credit reports in the first quarter of 2025. The index includes five metrics:

- Median credit card balance

- Average credit card utilization, calculated by dividing the credit balance by the credit limit for each consumer. (In short, how much consumers owe compared to their available credit, displayed as a percentage.)

- Percentage of consumers in each metro with three or more credit cards with a balance

- Percentage of consumers with at least one credit card payment 30, 60 or 90 days late

- Credit card balance-to-income ratio, or the median balance divided by the median earnings for full-time, year-round workers 16 and older

We used the median balance instead of the average because it more accurately reflects typical consumers. This minimizes the influence of a small number of individuals with very high credit card debt.

These metrics were normalized using a 0-to-100 scale, where higher scores indicate more credit stress.

El Paso, other Sun Belt metros dominate most-stressed list

Credit card stress is a big problem in the U.S. Sun Belt, home of eight of the 10 metros with the highest credit card stress scores. In the Northeast, only Bridgeport, Conn. (sixth-highest score), and Scranton, Pa. (10th-highest), broke into the top 10 most stressed.

Though we included several distinct metrics in our analysis, one most closely mirrored our overall rankings: balance-to-income ratio. That’s how big your credit card balance is compared to how much money you make.

The metros with the five highest stress scores — El Paso and McAllen, Texas; Miami; and Fresno and Riverside, Calif. — are all among the eight with the highest balance-to-income ratios. Every other category had at least one significant outlier, such as Miami having only the 27th-highest utilization or McAllen’s balance only ranking 51st ($3,529, compared with a 100-metro average of $3,848).

Still, even among the most-stressed areas, El Paso stands head and shoulders above. El Paso has the nation’s:

- Highest balance-to-income ratio (9.9%, compared with a 100-metro average of 6.3%)

- Third-highest utilization (40.3%, compared with a 100-metro average of 32.3%)

- Third-highest percentage of cardholders who’ve paid late (5.3%, compared with a 100-metro average of 2.5%)

Its lowest ranking in any category: 11th, both for overall balance ($4,365) and the percentage of cardholders with three or more cards with a balance (56.2%, compared with a 100-metro average of 52.7%).

El Paso’s numbers top the average for every metric included, helping make it the most stressed. In fact, the 10.9-point spread between El Paso and McAllen, the second-most stressed area, is greater than the 10.3-point spread between McAllen and Orlando, the seventh-most stressed area.

Midwestern metros top list of least-stressed areas

Midwestern states dominate the list of least-stressed metros. Just one Sun Belt metro — Birmingham, Ala., at 10th — ranked among the 10 with the lowest Credit Card Stress Index scores. Cardholders in Des Moines, Iowa, and Madison, Wis., fared the best in our analysis.

Neither metro had the best ranking for any individual metric analyzed, but both had strong across-the-board showings. For example, Des Moines has the second-lowest utilization rate among the 100 metros reviewed (23.9%, compared with the 100-metro average of 32.3%), and Madison has the second-lowest delinquency rate (1.2%, compared with the 100-metro average of 2.5%). However, both ranked among the 20 best scores in each metric, and no others can match that.

The five metros with the lowest stress scores are among the least likely to have three or more cards with a balance. Louisville and Provo, Utah, have the second- and third-lowest rates in this metric, respectively, and none of the other three rates worse than 13th-lowest.

Miami, Philadelphia most, least stressed giant metros

When drilling down to just the nation’s 10 biggest metros, the situation looks worse. The average stress score across the 100 biggest metros is 39.2, but the average among the 10 biggest is 47.3.

Miami has the highest stress score among the 10 biggest metros and ranks third-worst overall — behind only El Paso and McAllen — when considering the top 100. Conversely, Philadelphia has the lowest stress score among the 10 best metros and ranks 56th overall.

Dallas, Houston and Atlanta follow Miami with the highest stress scores among the biggest metros. D.C. and Chicago are close behind Philadelphia for the lowest stress scores.

Full rankings: Credit Card Stress Index: High to low

| Rank | Metro | Median CC balance | CC utilization | % with 3 or more cards with balance | % with at least 1 late payment | CC balance-to-income ratio | Score |

|---|---|---|---|---|---|---|---|

| 1 | El Paso, TX | $4,365 | 40.3% | 56.2% | 5.3% | 9.9% | 80.0 |

| 2 | McAllen, TX | $3,529 | 46.2% | 56.3% | 3.8% | 8.4% | 69.1 |

| 3 | Miami, FL | $4,892 | 34.7% | 58.9% | 2.2% | 9.6% | 68.7 |

| 4 | Fresno, CA | $4,394 | 39.2% | 54.5% | 4.1% | 8.3% | 66.9 |

| 5 | Riverside, CA | $4,388 | 36.7% | 57.7% | 3.2% | 7.8% | 63.7 |

| 6 | Bridgeport, CT | $5,613 | 38.7% | 55.8% | 1.8% | 6.8% | 61.8 |

| 7 | Orlando, FL | $4,246 | 35.5% | 55.7% | 2.8% | 8.2% | 58.8 |

| 8 | North Port, FL | $4,899 | 28.3% | 57.3% | 2.0% | 8.9% | 57.8 |

| 9 | Oxnard, CA | $4,857 | 31.2% | 56.9% | 2.5% | 7.3% | 56.3 |

| 10 | Scranton, PA | $3,241 | 40.7% | 55.7% | 4.3% | 6.1% | 56.1 |

| 11 | Kiryas Joel, NY | $4,509 | 32.8% | 57.2% | 3.1% | 6.3% | 55.0 |

| 12 | New Orleans, LA | $3,293 | 35.2% | 52.1% | 6.1% | 6.1% | 53.9 |

| 13 | San Antonio, TX | $3,877 | 38.6% | 52.9% | 3.2% | 7.2% | 53.7 |

| 14 | Stockton, CA | $4,084 | 34.5% | 53.8% | 3.6% | 6.8% | 52.9 |

| 15 | Dallas, TX | $4,361 | 34.7% | 54.2% | 2.7% | 7.1% | 52.7 |

| 16 | Charleston, SC | $4,174 | 35.8% | 51.3% | 3.5% | 7.2% | 52.1 |

| 17 | Worcester, MA | $4,343 | 32.9% | 56.7% | 3.0% | 6.0% | 52.0 |

| 18 | Houston, TX | $4,052 | 35.9% | 54.6% | 2.7% | 6.7% | 51.0 |

| 19 | Lakeland, FL | $3,137 | 37.5% | 52.2% | 4.4% | 6.8% | 50.5 |

| 20 | Deltona, FL | $3,799 | 32.2% | 56.4% | 2.3% | 7.6% | 50.0 |

| 21 | Atlanta, GA | $4,292 | 35.9% | 53.3% | 2.1% | 7.1% | 49.7 |

| 21 | Palm Bay, FL | $4,227 | 28.7% | 57.4% | 1.9% | 7.7% | 49.7 |

| 23 | Tampa, FL | $4,043 | 33.4% | 54.9% | 2.2% | 7.3% | 49.2 |

| 23 | Colorado Springs, CO | $3,992 | 32.1% | 51.3% | 4.3% | 6.7% | 49.2 |

| 25 | Austin, TX | $4,622 | 30.7% | 54.7% | 2.2% | 6.8% | 48.5 |

| 26 | Bakersfield, CA | $3,185 | 37.7% | 51.8% | 4.3% | 6.1% | 47.8 |

| 27 | New York, NY | $4,255 | 33.7% | 56.1% | 2.3% | 5.7% | 47.5 |

| 28 | Providence, RI | $4,130 | 32.4% | 54.9% | 2.6% | 6.3% | 47.2 |

| 29 | Los Angeles, CA | $4,046 | 32.8% | 55.2% | 2.3% | 6.5% | 46.8 |

| 30 | Jacksonville, FL | $4,070 | 33.5% | 52.6% | 2.3% | 7.3% | 46.7 |

| 31 | Albuquerque, NM | $3,752 | 35.2% | 52.0% | 2.9% | 6.8% | 46.2 |

| 32 | Cape Coral, FL | $4,031 | 28.4% | 56.0% | 1.7% | 7.9% | 46.1 |

| 33 | Las Vegas, NV | $3,364 | 35.4% | 53.6% | 3.2% | 6.4% | 45.9 |

| 33 | New Haven, CT | $3,671 | 33.5% | 56.3% | 3.2% | 5.2% | 45.9 |

| 35 | Oklahoma City, OK | $3,395 | 35.0% | 51.0% | 3.4% | 6.4% | 43.0 |

| 35 | Honolulu, HI | $3,998 | 31.1% | 54.5% | 2.1% | 6.4% | 43.0 |

| 37 | San Francisco, CA | $4,741 | 34.3% | 54.0% | 1.5% | 5.0% | 42.8 |

| 38 | Virginia Beach, VA | $3,429 | 38.1% | 50.0% | 3.2% | 5.9% | 42.2 |

| 39 | Memphis, TN | $2,903 | 36.5% | 49.4% | 4.8% | 5.6% | 42.1 |

| 40 | Hartford, CT | $4,205 | 29.9% | 55.0% | 2.2% | 5.7% | 42.0 |

| 41 | Chattanooga, TN | $3,249 | 29.5% | 52.5% | 4.3% | 6.1% | 41.9 |

| 42 | Phoenix, AZ | $3,780 | 33.6% | 51.7% | 2.3% | 6.5% | 41.1 |

| 43 | Allentown, PA | $3,589 | 31.7% | 51.4% | 3.5% | 5.9% | 40.6 |

| 44 | Dayton, OH | $2,935 | 34.5% | 52.3% | 4.2% | 5.0% | 40.0 |

| 45 | San Diego, CA | $4,290 | 30.8% | 52.3% | 1.8% | 6.2% | 39.7 |

| 46 | Chicago, IL | $3,858 | 30.4% | 54.2% | 2.3% | 5.7% | 39.5 |

| 46 | Detroit, MI | $3,456 | 32.4% | 52.3% | 3.3% | 5.5% | 39.5 |

| 48 | Buffalo, NY | $3,731 | 31.1% | 53.8% | 2.0% | 6.2% | 39.2 |

| 49 | Washington, DC | $4,366 | 31.2% | 53.6% | 1.9% | 5.1% | 39.1 |

| 49 | Baltimore, MD | $4,189 | 32.2% | 52.9% | 1.7% | 5.7% | 39.1 |

| 51 | Baton Rouge, LA | $2,870 | 36.1% | 46.0% | 5.8% | 5.0% | 38.9 |

| 52 | Albany, NY | $3,848 | 33.3% | 51.0% | 2.7% | 5.5% | 38.7 |

| 53 | Boston, MA | $4,258 | 32.0% | 52.9% | 1.9% | 5.1% | 38.2 |

| 54 | Denver, CO | $4,200 | 31.1% | 50.5% | 2.2% | 5.8% | 37.3 |

| 54 | Tucson, AZ | $3,798 | 32.2% | 49.2% | 1.9% | 7.2% | 37.3 |

| 56 | Philadelphia, PA | $3,634 | 31.8% | 52.9% | 2.6% | 5.2% | 37.2 |

| 56 | Charlotte, NC | $3,423 | 32.8% | 51.5% | 2.7% | 5.8% | 37.2 |

| 58 | Winston-Salem, NC | $3,194 | 31.9% | 51.3% | 2.6% | 6.2% | 35.5 |

| 59 | Syracuse, NY | $3,228 | 30.5% | 51.6% | 3.4% | 5.3% | 35.2 |

| 60 | Greensboro, NC | $2,995 | 36.4% | 48.7% | 2.8% | 6.0% | 34.9 |

| 61 | Rochester, NY | $3,615 | 30.4% | 50.0% | 2.7% | 5.9% | 34.6 |

| 62 | Wichita, KS | $3,176 | 31.4% | 48.5% | 3.4% | 6.1% | 34.1 |

| 63 | Sacramento, CA | $3,827 | 29.0% | 52.8% | 1.9% | 5.5% | 34.0 |

| 64 | Harrisburg, PA | $2,976 | 33.9% | 50.5% | 3.4% | 4.9% | 33.8 |

| 65 | Pittsburgh, PA | $3,334 | 29.5% | 53.1% | 2.5% | 5.4% | 33.7 |

| 66 | Raleigh, NC | $3,909 | 29.8% | 50.6% | 2.1% | 5.6% | 33.3 |

| 67 | Nashville, TN | $3,488 | 27.3% | 49.1% | 3.4% | 5.9% | 32.6 |

| 67 | Richmond, VA | $3,347 | 32.6% | 51.4% | 2.0% | 5.5% | 32.6 |

| 69 | Cleveland, OH | $3,144 | 29.7% | 52.3% | 2.6% | 5.3% | 31.7 |

| 70 | Columbia, SC | $2,850 | 35.4% | 48.7% | 2.9% | 5.4% | 31.5 |

| 71 | Augusta, GA | $2,728 | 37.9% | 49.2% | 2.5% | 5.2% | 31.4 |

| 72 | St. Louis, MO | $3,371 | 28.6% | 50.6% | 2.8% | 5.5% | 31.3 |

| 73 | Toledo, OH | $2,603 | 34.4% | 49.5% | 3.7% | 4.7% | 31.1 |

| 74 | Tulsa, OK | $3,373 | 33.3% | 46.8% | 2.1% | 6.4% | 30.5 |

| 75 | Knoxville, TN | $2,806 | 27.1% | 50.2% | 3.8% | 5.3% | 29.2 |

| 76 | Greenville, SC | $2,932 | 32.0% | 48.7% | 2.8% | 5.5% | 29.0 |

| 77 | Durham, NC | $4,123 | 23.6% | 49.8% | 1.5% | 6.5% | 28.7 |

| 78 | Salt Lake City, UT | $3,421 | 30.4% | 48.7% | 2.2% | 5.6% | 28.6 |

| 79 | Indianapolis, IN | $3,139 | 31.8% | 49.0% | 2.4% | 5.3% | 28.3 |

| 80 | Jackson, MS | $2,466 | 37.7% | 44.8% | 3.8% | 5.0% | 28.2 |

| 81 | Cincinnati, OH | $3,374 | 28.9% | 48.9% | 2.5% | 5.5% | 28.1 |

| 82 | Kansas City, MO | $3,420 | 28.4% | 48.3% | 2.5% | 5.6% | 27.5 |

| 83 | Akron, OH | $3,261 | 27.5% | 51.5% | 1.8% | 5.6% | 27.2 |

| 84 | Little Rock, AR | $2,566 | 36.5% | 45.7% | 3.4% | 4.9% | 27.0 |

| 85 | Columbus, OH | $3,228 | 29.0% | 48.8% | 2.5% | 5.2% | 26.2 |

| 86 | Omaha, NE | $3,324 | 27.6% | 48.1% | 2.7% | 5.4% | 26.0 |

| 87 | San Jose, CA | $4,026 | 24.4% | 54.9% | 1.1% | 3.8% | 25.2 |

| 88 | Spokane, WA | $3,213 | 36.0% | 44.6% | 1.7% | 5.5% | 24.4 |

| 89 | Seattle, WA | $3,959 | 26.9% | 49.4% | 1.4% | 4.8% | 24.0 |

| 90 | Ogden, UT | $3,260 | 32.0% | 44.1% | 2.6% | 5.3% | 23.4 |

| 91 | Birmingham, AL | $2,670 | 33.8% | 45.5% | 3.1% | 4.7% | 23.2 |

| 92 | Grand Rapids, MI | $2,654 | 31.1% | 45.5% | 3.6% | 4.5% | 22.0 |

| 93 | Portland, OR | $3,800 | 27.2% | 46.1% | 1.6% | 5.4% | 21.6 |

| 94 | Milwaukee, WI | $2,923 | 27.7% | 48.0% | 2.6% | 4.7% | 20.8 |

| 95 | Minneapolis, MN | $3,463 | 25.4% | 49.8% | 1.5% | 4.8% | 20.5 |

| 96 | Provo, UT | $3,309 | 27.9% | 44.5% | 2.4% | 5.4% | 20.1 |

| 97 | Boise, ID | $3,060 | 26.3% | 45.3% | 2.0% | 5.4% | 16.6 |

| 98 | Louisville, KY | $2,548 | 30.6% | 44.2% | 2.4% | 4.5% | 14.4 |

| 99 | Madison, WI | $3,049 | 24.7% | 46.3% | 1.2% | 4.6% | 10.7 |

| 100 | Des Moines, IA | $2,942 | 23.9% | 45.0% | 1.5% | 4.7% | 9.1 |

Tips for managing credit card stress

How do you begin to dig out from under this crushing credit card stress? Try to gain some control. It can be easier said than done, but small steps can make a major difference.

The best thing you can do to relieve credit card stress is to pay down your balance. Of course, if it were easy, we’d all do it and have $0 balances, right? The same goes for increasing your income. Way easier said than done.

With that in mind, here are some steps to better manage your credit card stress.

- Lower your interest rate. This would be about as impactful as it gets. Interest can be a killer when it comes to credit cards, and moving your rate down just a few percentage points can make a major difference. Don’t be afraid to call your credit card issuer and ask it to lower your interest rate. It works way more often than you’d imagine. For an even bigger impact, consider a 0% balance transfer credit card. These cards can allow you to go a year or longer without accruing a cent of interest on the transferred balance. That can reduce the interest you pay and the time it takes to pay off the balance.

- Set up autopay and pay at least the minimum (but ideally more). Let technology help. Setting up automatic payments on your credit card account can help ensure you never miss a payment — the most important thing you can do for your credit score. A single payment made 30 days or more late can knock 50 or more points off your credit score, and a lower credit score means higher interest rates when you get a new card.

- Get more available credit, but don’t spend it. You want me to reduce my credit card stress by getting more available credit? Whaaa? Admittedly, this one requires discipline — and may not be realistic for some. It works because the unused available credit improves your credit utilization (how much debt you have versus available credit), and utilization is one of the most important factors in credit-scoring formulas. Say you have a $2,000 balance and $5,000 in available credit. Your utilization is 40%, which is high enough to hurt your credit score. However, if you bump your available credit to $8,000 and keep your balance the same, your utilization falls to 25%. That’ll improve your credit score and set you up to receive better terms the next time you look for a card. Just make sure you don’t spend that new credit. Otherwise, you’ll have defeated the purpose.

- Ask for help. This can sometimes be the hardest, but it may also be the most important. Help is available when you’re struggling, but you have to ask for it. Consider reaching out to your card issuer and telling your story. It may be willing to help with a temporarily lowered APR, waived fees or other tweaks. A nonprofit credit counselor can be a great tool, too. They can help you with everything from budgeting to negotiating with creditors. But be wary of places that offer help that seems too good to be true. It probably is.

Methodology

LendingTree researchers analyzed about 230,000 anonymized credit reports from LendingTree users with active credit cards between Jan. 1 and March 31, 2025. To create a Credit Card Stress Index for the 100 largest metros, analysts included five metrics:

- Median credit card balance

- Average credit card utilization

- Percentage of consumers in each metro with three or more credit cards with a balance

- Percentage of consumers with at least one credit card payment 30, 60 or 90 days late

- Credit card balance to income ratio (median credit card balances divided by median earnings for full-time, year-round workers)

These metrics were normalized on a 0-to-100 scale and equally weighted to generate a credit stress score, where higher scores signify greater credit stress.

Analysts used the U.S. Census Bureau 2023 American Community Survey with five-year estimates for median annual earnings of full-time, year-round workers in the 100 largest metros.

Recommended Articles