Potential Thanksgiving Hosts Gobble Up Higher Costs, Spending 13% More This Year

Pass the rolls … and maybe your paycheck, too. According to a LendingTree survey, potential Thanksgiving hosts expect to spend an average of $487 on food, drinks and decor — up 13% from when we conducted this survey last year.

Here’s a closer look at how inflation is affecting plans, how stressful the financial strain is and what hosts expect from their guests.

- The cost of gratitude keeps rising. Nearly 6 in 10 (59%) Americans might host Thanksgiving this year. Potential hosts expect to spend an average of $487 on food, drinks and decor, up 13% from last year. Given the costs, 19% may reconsider hosting next year.

- Inflation forces some hosts to rethink their plans. Among those who plan to celebrate Thanksgiving, 60% say inflation is affecting their plans, with 28% couponing more, 18% scaling back guest lists and 10% choosing not to host. To cover expenses, 42% of potential hosts expect to use credit cards, and 22% plan to use buy now, pay later (BNPL) loans, up from 13% in 2024.

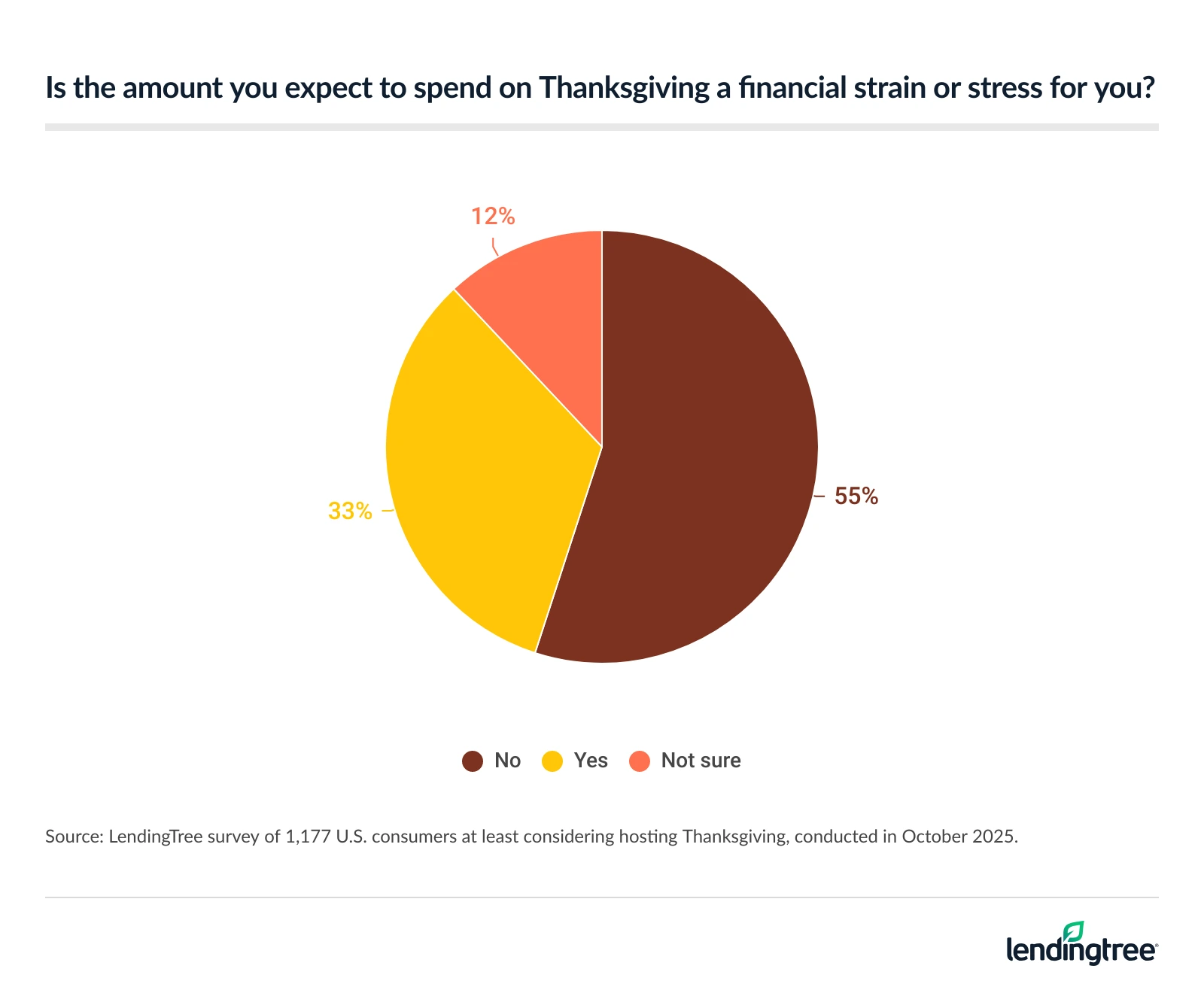

- For some, the stress is starting to outweigh the joy. Even though 81% of potential hosts have a budget for their gathering, 1 in 3 (33%) still say the cost is a financial strain. In fact, 18% of potential hosts regret hosting Thanksgiving, up from 14% last year.

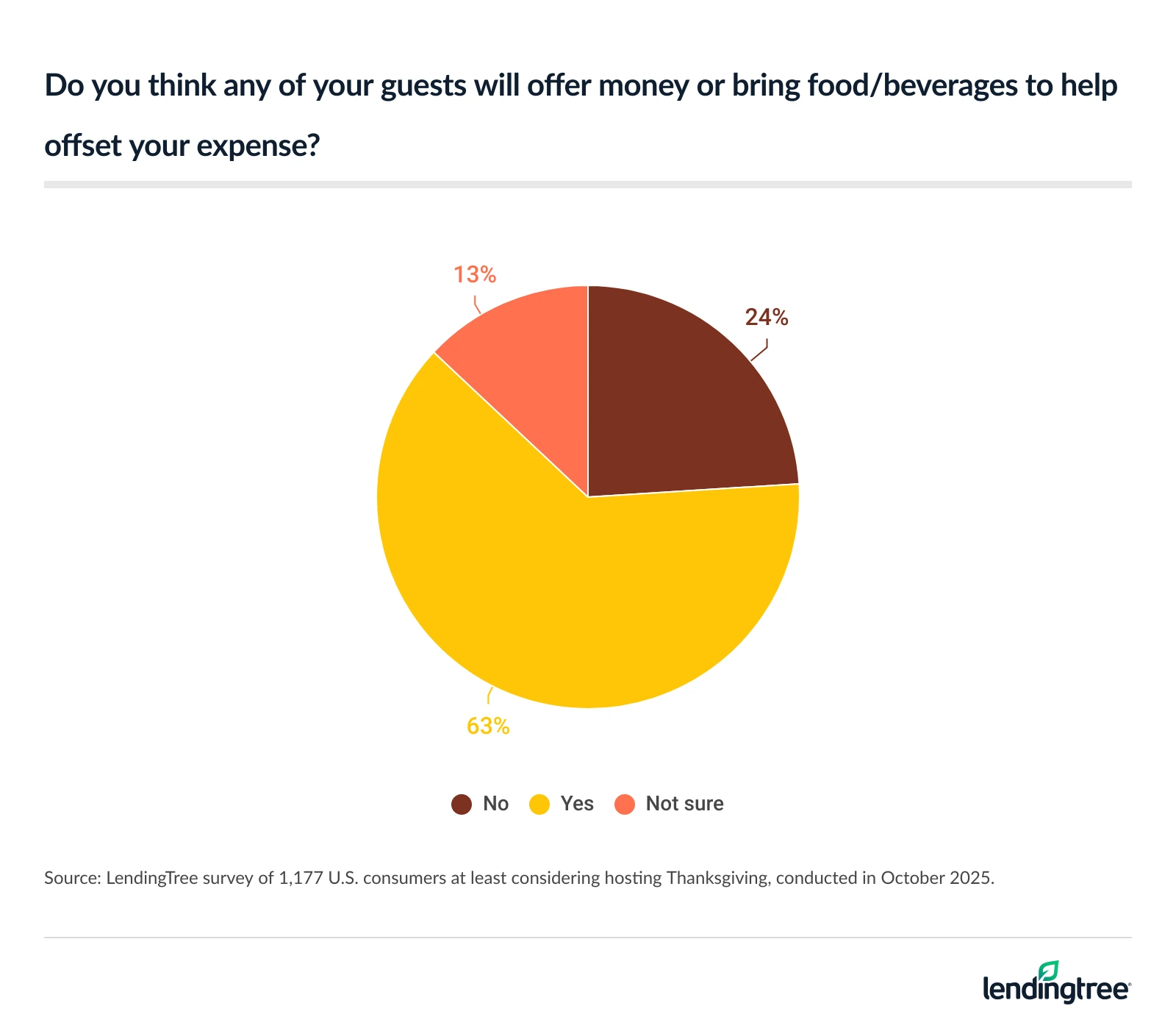

- Hosting isn’t cheap, and many consumers hope their guests will chip in. Nearly 2 in 3 (63%) potential hosts expect guests to contribute money or bring an item to help offset costs, and 1 in 10 admit they wouldn’t invite empty-handed guests back next year. Thankfully, 64% of attendees plan to contribute to the meal, bringing everything from homemade sides (47%) and desserts (42%) to booze (22%).

Thanksgiving gobbling up your cash

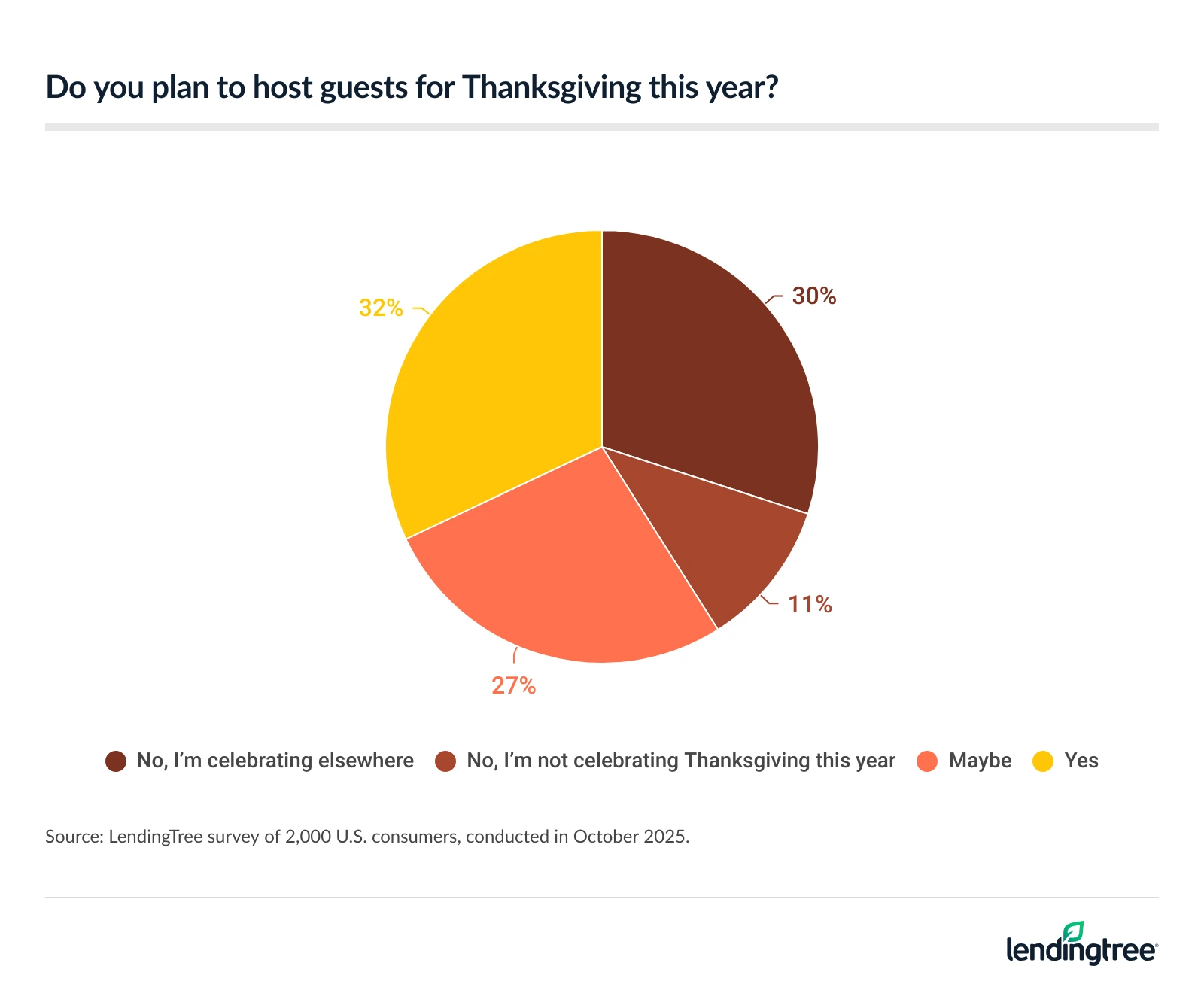

This Thanksgiving, 59% of Americans say they might host for the holiday. That figure is highest among six-figure earners (73%), those with children younger than 18 (72%) and millennials ages 29 to 44 (70%).

As far as who they’re hosting, 88% of potential hosts say they’ll have family over, followed by friends (51%). Meanwhile, they’re less likely to host neighbors (18%), distant relatives (16%) and colleagues (14%).

Potential hosts expect to spend an average of $487 on food, drinks and decor this year. That’s a 13% increase from the $431 they planned to spend last year. Six-figure-earning hosts plan to spend the most, at an average of $633. That’s followed by millennials ($594) and those with children younger than 18 ($590).

With the costs of hosting a holiday continuing to rise, 19% say they may reconsider doing so next year.

Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” says that considering life in general keeps getting more expensive, it should be no surprise that people expect to spend more this year.

“With the rising cost of groceries and other items, the unfortunate truth is that last year’s Thanksgiving budget won’t cut it for most folks this year,” he says. “Rising prices, a difficult job market and an uncertain economy are combining to force people to make some tough choices and sacrifices when it comes to their money. The fact that people are planning to spend a little more on Thanksgiving may signal that holiday gatherings are not something that most people are willing to sacrifice.”

For those who aren’t hosting, most plan to spend the holiday at someone’s house. Among attendees, 45% plan to celebrate at a family member’s house (excluding parents). Meanwhile, 20% plan to celebrate at their parents’ place and 13% plan to go to a friend’s house.

Inflation changing how Americans celebrate

Inflation has been affecting Americans’ habits for some time. As one example, a LendingTree study on grocery shopping habits in February 2025 found that 88% have changed theirs.

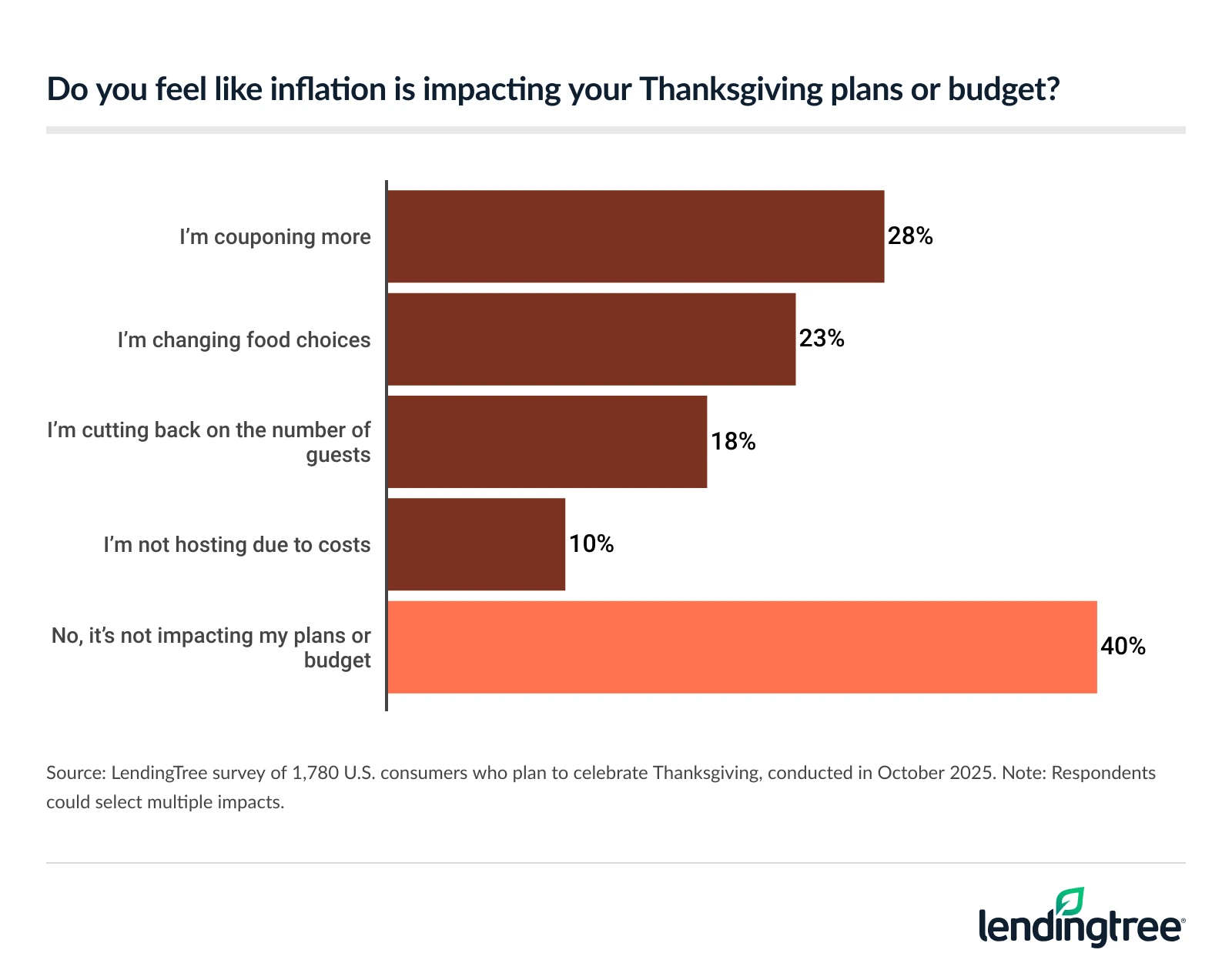

Thanksgiving is no different. Among those who plan to celebrate the holiday, 60% say inflation is affecting their plans, with 28% couponing more — the most common response. Following, 23% are changing food choices, 18% are scaling back guest lists and 10% are choosing not to host.

To foot the bill, 42% of potential hosts expect to use credit cards. Notably, 22% plan to use buy now, pay later (BNPL) loans. That’s up from 13% in 2024.

Schulz says both options can be helpful. “The power of the credit card is in its flexibility,” he says. “You can use as much or as little of that line of credit as you need and pay it off in your own time. Of course, with interest rates as high as they are today, there’s real danger with credit cards, too, so it’s important to tread lightly.”

With BNPL, Schulz believes predictability is a huge plus. “You know how much you owe and how long it’ll take to pay off, and then once it’s paid off, you can wash your hands of that loan,” he says. “If you can pay the loan in a timely manner, it will likely be interest-free, the biggest plus of all. However, BNPL loans lack the flexibility that credit cards offer. There’s likely no wiggle room on what you have to pay each time, and you may get hit with a fee if you’re late.”

Thankfully, most don’t expect to stay in debt. Just under half (49%) expect to pay off Thanksgiving costs on their credit card in one billing cycle, while 35% expect it’ll take up to three months.

Meanwhile, 31% don’t plan to use credit cards or borrow money to help cover the cost of hosting.

Hosts stuffed with financial strain

Some potential hosts are struggling to find a reason to be thankful this holiday season. Even though 81% of potential hosts have a budget, 33% still say the cost is a financial strain. Hosts with children younger than 18 (42%) and millennials (39%) are the most likely to feel the strain.

For hosts feeling the pinch, Schulz says creating a Thanksgiving fund can be a great idea. “It may be a little late for this in 2025, but taking the time to put a few dollars from every paycheck into it over the course of a year can help ease the burden you feel,” he says. “Using a credit card wisely can help, too. A 1% or 2% cash back reward may not sound like much, but every little bit helps when you’re trying to extend a budget.”

Of those who may host, 18% say they regret signing up for it. That’s a 4 percentage point increase from last year. The sentiment is especially felt among those with children younger than 18 (27%), six-figure earners (27%) and millennials (23%).

Guests shouldn’t come empty-handed

Given the high cost of hosting, many hope their guests will chip in. In fact, a whopping 63% of potential hosts expect guests to contribute money or bring an item to help offset costs.

Not helping has consequences, as 10% of potential hosts admit they wouldn’t invite empty-handed guests back next year. But most guests get the memo: Among attendees, 64% plan to contribute to the meal. Homemade sides (47%) are the most popular option, followed by desserts (42%) and booze (22%). Guests also plan to bring:

- Store-bought food (16%)

- A host/hostess gift (10%)

- Flowers (10%)

- Turkey (8%)

- Nonalcoholic beverages (8%)

- Leftover containers/storage bags (8%)

- Games (5%)

- Music/entertainment (5%)

- Dinnerware/utensils (4%)

- Decorations/centerpieces (3%)

- Children’s items (3%)

Regardless of whether you’re a host or a guest, Schulz says communication is key. “There may not be a way to avoid all awkwardness altogether, but you still have to have these conversations,” he says. “If you’re in a financial rough patch, tell someone. It may not be easy. But if you’re open about what you’re going through and make it clear that you need help as a host or would still like to help as a guest, it can make things easier for everyone.”

Top expert tips on keeping your wallet thankful this Thanksgiving

If you’re planning to host this year, you’re probably focused on putting gravy on the table while keeping money in the bank. There are plenty of creative alternatives to keep the Thanksgiving spirit alive. We recommend the following:

- Rely on community. “Perhaps the most important is the most obvious: Get people to pitch in,” Schulz says. “It isn’t always easy to ask for help, but it can make a massive difference. Plus, people often are more than willing to help.”

- Reuse items from previous years. “You don’t need new things every year, and chances are you still have some things left over from last year that are in perfectly good condition,” he says. Not only is this a sustainable approach to hosting, but it can also lead to some major savings.

- Look for deals at dollar stores and on clearance racks. “You’re not throwing a state dinner at the White House,” Schulz says. “No one’s going to judge you if some of the things you use come from dollar stores or similar shops. Focus your spending on what matters, and bargain shop for the rest.”

- Get creative with decor. “If you’re crafty or have kids who love doing art projects, take the time to make something fun for the event,” he says. “Sure, it may not look as perfect as that store-bought decoration, but it can be much more fun and save you real money.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from Oct. 2 to 6, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennials: 29 to 44

- Generation X: 45 to 60

- Baby boomers: 61 to 79