Mother’s Day Spending Has Dropped 14%, With Many Scaling Back Due to Tariffs

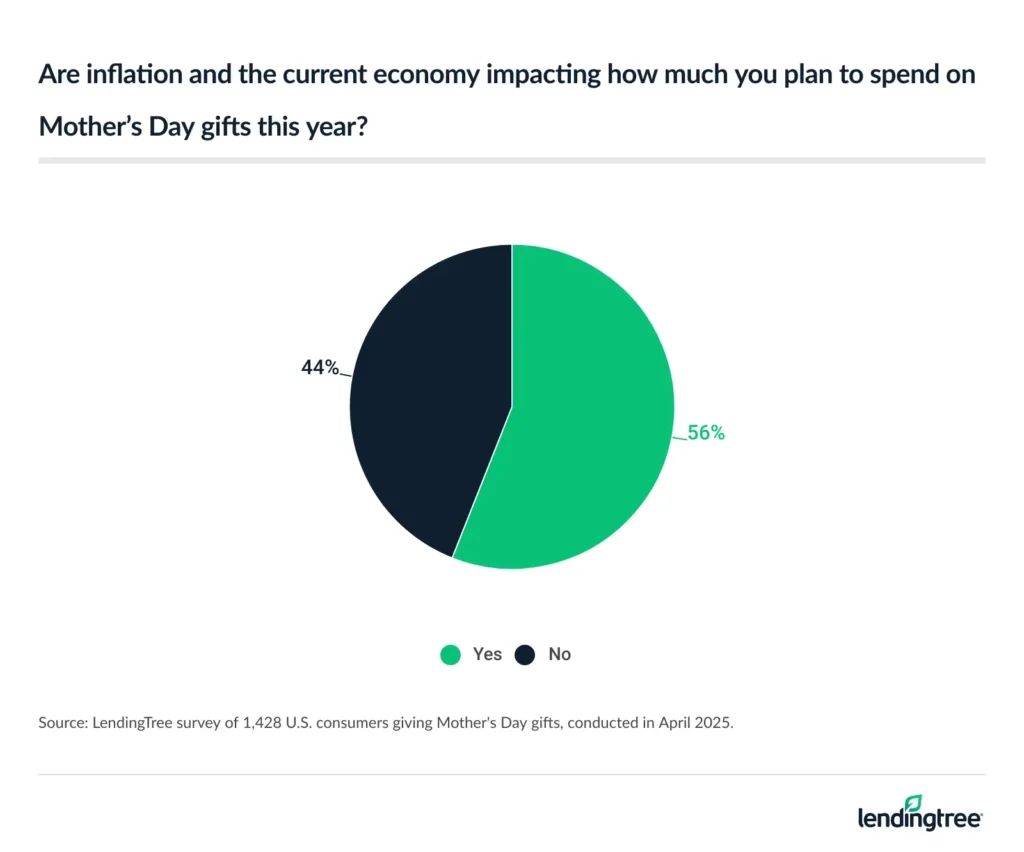

Mother’s Day is an opportunity to celebrate some of the pivotal figures in our lives, but moms may be subject to some tough love this year. According to a LendingTree survey of 2,000 U.S. consumers, those giving Mother’s Day gifts will spend 14% less this year — and 56% of gift givers say inflation and the current economy impact how much they plan to spend.

Here’s what we found.

Key findings

- Mother’s Day spending is declining. 71% of Americans will give gifts this year, mostly to their moms (42%), spouses/partners (17%) and mothers-in-law (12%). On average, gifters will spend $148. That’s down 14% from $172 in 2023 and 34% from $225 in 2022.

- The economy impacts mothers. 56% of gift givers say inflation and the current economy impact how much they plan to spend, and 38% will spend less because of tariffs. Still, though, 50% may spend more than they can afford.

- Flowers and cards top wish lists. The top items moms hope for are flowers or plants and cards or letters. Fortunately, these are also the top items givers plan to buy.

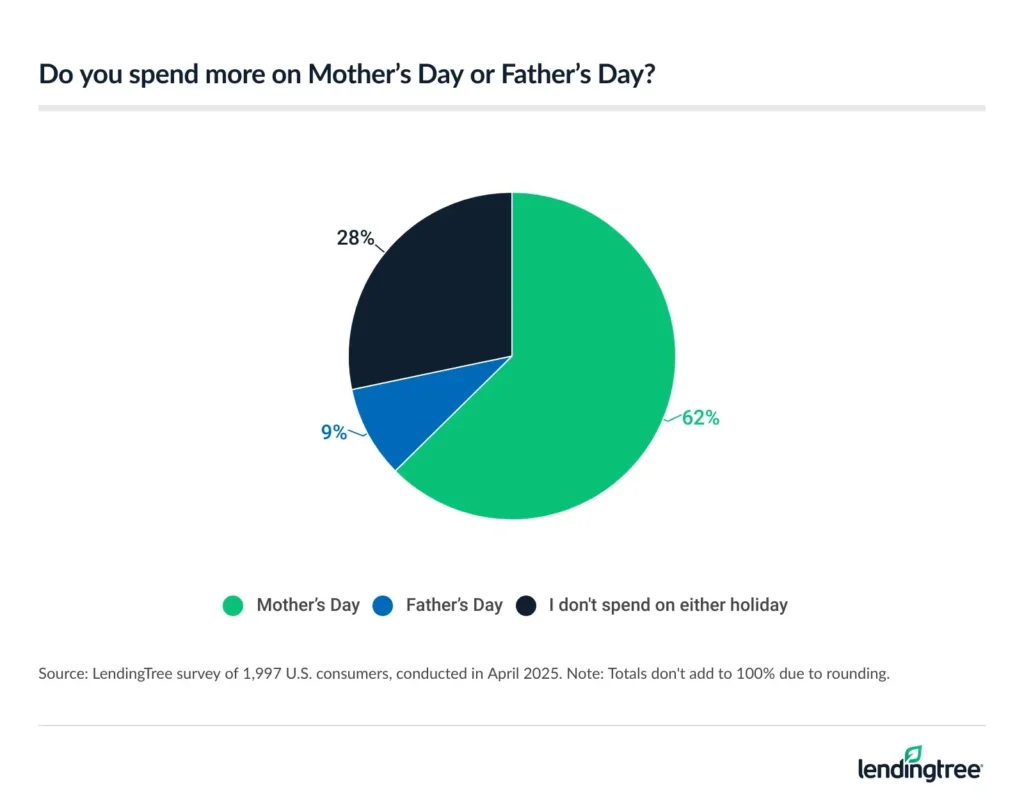

- Moms feel the love more than dads. 62% of Americans spend more on Mother’s Day than Father’s Day, with just 9% spending more on Father’s Day. Additionally, 60% say pet moms should be celebrated for Mother’s Day.

Mother’s Day spending is down 14%

This year, 71% of Americans will give gifts to the mother figures in their lives. Specifically, 42% will give gifts to their moms, 17% will give gifts to their spouses/partners and 12% will give gifts to their mothers-in-law.

Budget cuts are hitting home, though. For Mother’s Day, gifters will spend $148 on average. That’s down 14% from $172 in 2023 and 34% from $225 in 2022.

Those with children younger than 18 ($216) and six-figure earners ($209) are the only groups that plan to spend over $200 on average.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — believes lower spending is a sign that people are struggling.

“Hardly anyone wants to get their mom less of a Mother’s Day gift than they have in the past, but in a time of rising prices and great financial uncertainty, difficult decisions need to be made,” he says. “Unfortunately, this survey hints at the fact that for many families, one of those sacrifices involves spending less on Mom this Mother’s Day.”

It’s not just about gifts, though, as 84% will spend quality time with someone this Mother’s Day. Overall, 40% will spend time with their mothers, 33% will spend time with their spouses/partners and 22% will spend time with their daughters.

Inflation and tariffs are to blame for lower spending

Moms are feeling the financial squeeze this year. The majority (56%) of gift givers say inflation and the current economy impact how much they plan to spend, and those with children younger than 18 (67%), Gen Zers ages 18 to 28 (62%) and millennials ages 29 to 44 (62%) feel this financial pressure the most.

Additionally, 38% will spend less because of tariffs — though some may be trying to get their gifts before prices rise, as 14% are spending more because of tariffs

LendingTree tariffs imports and exports study

Still, though, half (50%) of gift givers may spend more than they can afford — a figure that concerns Schulz.

“It may seem noble and sweet to overspend on Mom, but the last thing most moms would want is for you to go into debt getting them a Mother’s Day gift,” he says. “She’d likely rather have you put that money in an emergency fund or use it to pay down your other debts.“

Moms want flowers and cards for Mother’s Day

Most moms are hoping to get classic Mother’s Day gifts. Across all moms, 35% want flowers or plants for Mother’s Day — making it the top gift. That’s followed by cards or letters (28%) and gift cards or cash (23%).

Gift givers are on the same page. Flowers or plants are the top gifts that gifters are getting for their moms, at 44%. That’s followed by:

- A card or letter (38%)

- A material gift like jewelry or clothing (33%)

- A gift card/cash (32%)

- An experience like dinner or a spa trip (23%)

- Something homemade/sentimental (15%)

- Time alone (10%)

- A charitable donation in her name (6%)

Consumers prioritize Mother’s Day over Father’s Day

Mother’s Day may be a big household event, but dads may not be feeling as much love. In fact, 62% of Americans spend more on Mother’s Day than Father’s Day. Just 9% spend more on Father’s Day.

Going further, 41% of those who prioritize Mom spend significantly more on Mother’s Day and 35% spend somewhat more.

Animal moms are feeling the love also, with 60% saying pet moms should be celebrated for Mother’s Day.

That said, Schulz says those planning to shell out on Father’s Day should think ahead.

“If you’re planning to go big on Father’s Day, start planning now and putting a little money aside to ease the financial blow,” he says. “You’ve also got plenty of time to shop around for the best deal on a great gift for your dad and make sure you’re not gifting yourself into debt.”

Celebrating Mom amid financial uncertainty: Top expert tips

Times may be tough (and getting tougher), but if you prioritize celebrating your mom, Schulz offers a few tips for this Mother’s Day:

- Leverage credit card rewards. “The right credit card, used wisely, can extend your gift-giving budget significantly,” he says. “Whether you’re looking to gift your hard-working mom a free night at a swanky hotel or just earn a little bit of cash back to help you afford a better gift for her, credit card rewards can make a difference.”

- Give the gift of your time. “We all love fancy gifts, but any parent worth their salt will tell you that what they want from their kids is time,” he says. “It’s a priceless gift. Maybe that’s an in-person visit. Maybe that’s a phone call or a Zoom. However it looks, your mom will love that you spent the time with her.”

- Get creative. A heartfelt, handmade gift can mean far more than something expensive. Whether it’s a photo, handwritten letter or something else, the effort you put in shows love in a way no price tag can match.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from April 2 to 3, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles