Inflation Puts a Damper on Mother’s Day Spending, But Most Moms Prefer Budget-Friendly Gifts Anyway

As Mother’s Day approaches, many may scramble to find the perfect gift for the special women in their lives. However, according to the latest LendingTree survey of 2,000 Americans, 57% of consumers planning to give a Mother’s Day gift this year say that inflation impacted their spending.

Here’s what else we found.

Key findings

- Inflation has forced many Americans to cut back on spending, and Mother’s Day is no exception. 57% of consumers planning to give a Mother’s Day gift this year say that inflation impacted their spending. Parents with children younger than 18 are feeling it the most, at 65%.

- Americans purchasing gifts expect to spend an average of $172 on moms this year — a 24% drop from $225 last year. Men ($227) plan to spend more, on average, than women ($112) to celebrate moms, with married men with kids younger than 18 planning to spend heavily at $322.

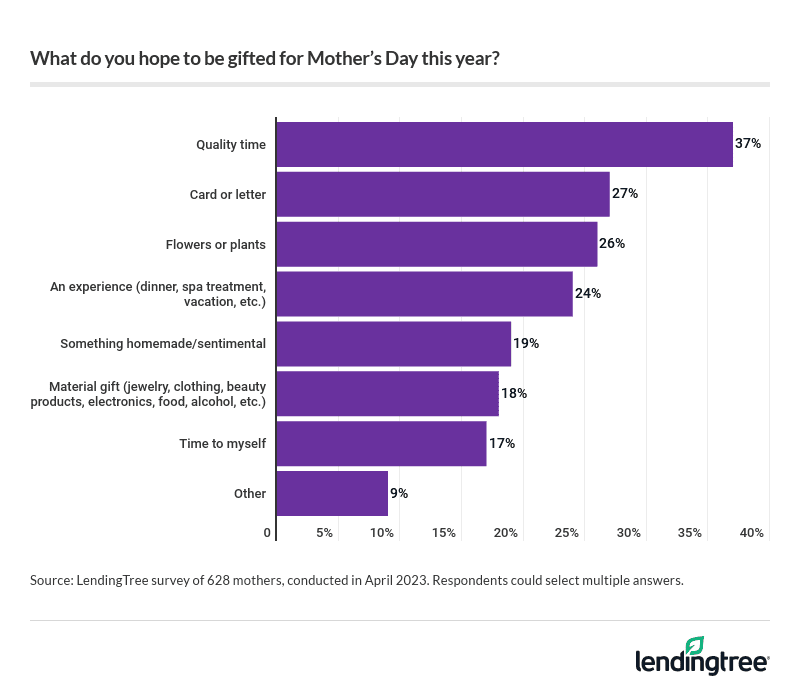

- Although more than a quarter of Americans (26%) planning to give a Mother’s Day gift will spend more than they can afford, you don’t have to break the bank to satisfy Mom. The top Mother’s Day gifts moms hope to receive are quality time (37%), a card or letter (27%) and flowers or plants (26%).

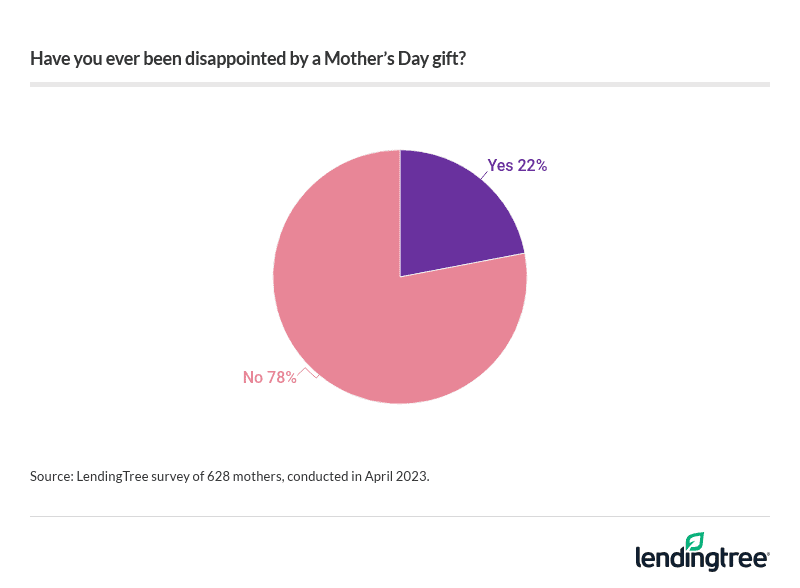

- Moms know that spending less doesn’t mean they’re loved any less — and their spending expectations are low. This year’s spending average ($172) is far more than mothers expect their loved ones to spend ($59). 78% of mothers say they’ve never been disappointed by a Mother’s Day gift.

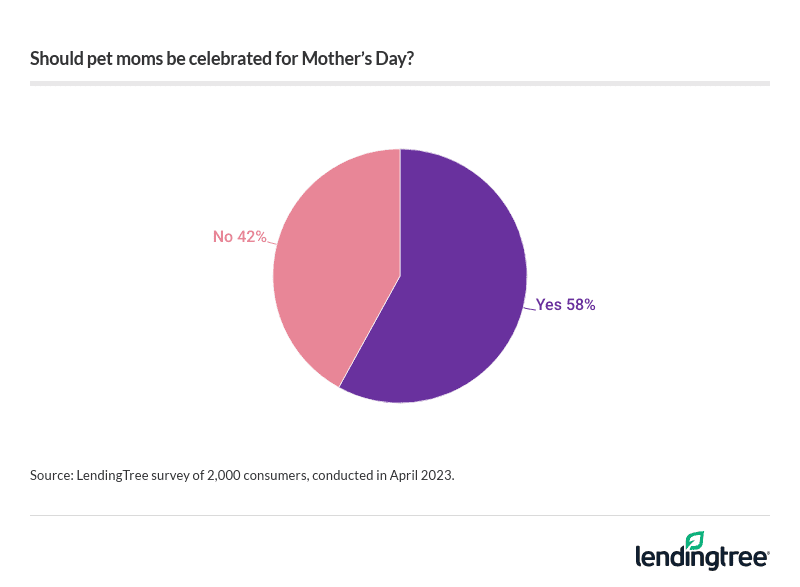

- Many Americans believe mothers of all types should be celebrated as 58% say pet moms deserve praise on Mother’s Day. Gen Zers are most in favor of honoring pet moms for Mother’s Day (67%), while baby boomers are on the other end at 42%.

Consumers cutting back on Mother’s Day spending

While Mother’s Day is arguably an important time to recognize maternal figures, this year’s celebrations are threatened by rising costs. In fact, 57% of consumers planning to give a Mother’s Day gift this year say inflation will impact their spending.

According to LendingTree chief consumer finance analyst Matt Schulz, this is indicative of a larger trend.

“Rampant inflation, rising interest rates and general economic uncertainty have shrunk millions of Americans’ financial margin for error in a big way,” he says. “Tight budgets have gotten tighter. Paycheck-to-paycheck living has gotten tougher. When that happens, sacrifices have to be made, and some of the first expenses that get cut are holiday gifts.”

By demographic, parents with children younger than 18 are feeling inflation’s impact the most, at 65%. That’s followed by consumers with a household income of $35,000 to $49,999 at 63%.

Meanwhile, each generation feels the impact of inflation on Mother’s Day budgets differently. Millennials (ages 18 to 26) are most impacted, with 62% saying inflation will play a role in their planned Mother’s Day spending. That’s followed by:

- Gen Zers (ages 18 to 26) (56%)

- Gen Xers (ages 43 to 58) (52%)

- Baby boomers (ages 59 to 77) (46%)

Americans plan to spend an average of $172 on Mother’s Day gifts

How much do people plan to spend? On average, Americans planning to give gifts this year expect to shell out $172 on their mothers and mother figures — a 24% drop from $225 last year.

While Schulz expected a spending drop, he’s surprised by the significance of this year’s.

“When you factor in inflation, the value of that drop gets even bigger,” he says. “If you have the same Mother’s Day gift budget this year as last year, the sad truth is that you’ll be getting your mom a little bit less. Dropping a budget by nearly 25% is a big change. Hopefully this is a sign that more people are leaning into less expensive, more thoughtful and more creative gifts for mom instead, but I’m not sure that’s the case.”

Men could be feeling significant pressure to spend — on average, they expect to shell out $227. (That ramps up for dads: Married dads with kids younger than 18 plan to spend an average of $322.) Comparatively, women plan to spend $112.

Meanwhile, six-figure earners plan to spend $280 on average — the most of any income group. That’s followed by those earning between $75,000 and $99,999 at $224. Those with children younger than 18 also plan to spend significant amounts of cash, at an average of $225.

By age group, millennials plan to shell out the most, spending an average of $202. That compares with:

- Gen Zers: $193

- Gen Xers: $133

- Baby boomers: $107

When it comes to what they’re spending their cash on, 52% of Americans plan to give flowers — the most common Mother’s Day gift. Following that, 46% plan to give cards or letters and 42% plan to give material gifts like jewelry, clothing and beauty products.

26% will spend more than they can afford

Despite consumers spending less on average to celebrate Mother’s Day this year, budgets are certainly tighter. In fact, more than a quarter of Americans (26%) planning to give a Mother’s Day gift will spend more than they can afford. This is especially true among those making $100,000 or more (34%), millennials (34%) and men (32%).

That may be because they feel like they have to overspend. Overall, 28% of consumers say they’ve felt pressured to overspend for Mother’s Day — with the top influences including society, moms and spouses. Parents with children younger than 18 (40%), millennials (39%) and men (33%) are particularly likely to feel the pressure.

Generally speaking, though, you don’t have to break the bank to satisfy Mom. Among moms, 37% hope to receive quality time — making it their top want. That’s followed by a card or letter (27%) and flowers or plants (26%).

Meanwhile, the top gifts moms with children younger than 18 want are quality time (37%), flowers (29%) and an experience like dinner or a spa treatment (28%).

For some, a break may be the best Mother’s Day gift. Overall, 17% of mothers want time to themselves on Mother’s Day — and this is especially true for mothers with children younger than 18 (23%).

On average, moms expect their loved ones to spend $59

While consumers expect to shell out for Mother’s Day, moms’ expectations are comparatively low. Mothers expect their loved ones to spend just $59 — and regardless of how much is spent, 78% of mothers say they’ve never been disappointed by a Mother’s Day gift.

While it’s a noble impulse to want to shower those who mother with gifts, Schulz says it’s important to understand that the maternal figures in your life almost certainly don’t want you to go into debt to give them a Mother’s Day gift.

“Before you drop a ton of money on flowers, chocolates, massages and another robe or pair of slippers, know there’s plenty you can give to your mom that costs little to nothing,” he says. “Something as simple as a heartfelt phone call, a longer-than-usual in-person visit, a homemade gift or a creative presentation of old family photos can be a wonderful gift without breaking the bank.”

Some moms certainly wouldn’t want their loved ones to overspend — and 32% of consumers say they’ve been scolded for doing so. That’s particularly true of parents with children younger than 18 (43%), millennials (40%), six-figure earners (39%) and men (36%).

Should pet moms get Mother’s Day gifts? Majority of consumers say yes

Many Americans believe mothers of all types should be celebrated as 58% say pet moms deserve praise on Mother’s Day. Gen Zers are most in favor of honoring pet moms for Mother’s Day, with 67% supporting it. That’s followed by millennials (63%), consumers with no children (62%) and consumers who’ve never been married (61%).

Meanwhile, baby boomers (42%) and consumers with adult children (47%) are the least likely to support celebrating pet moms for Mother’s Day.

While celebrating pet moms may be unconventional, Schulz says there’s certainly no harm in it.

“Pets are so important to people, so it doesn’t surprise me a bit that people think pet moms should be celebrated on Mother’s Day,” he says. “The truth is that everyone has their favorite things to spend money on, and that’s fine. What matters most to one person may seem silly to someone else, but it doesn’t mean that it isn’t still worthwhile for the person who loves it.”

Celebrating Mother’s Day without breaking the bank: Top expert tips

At the end of the day, the most important takeaway is this: You don’t have to overspend to celebrate the maternal figures in your life. If you’re not sure how a low-cost Mother’s Day may work for you, Schulz offers the following advice:

- Your time can be more valuable than your money. “Flowers, cards, chocolates and fancy dinners are amazing, but chances are that your mom wants more time with you,” he says. “Call your mom. FaceTime or Zoom with her. Or if possible, go to see her in person. Depending on your circumstances, that may not be a particularly cheap option, but as far as bang for your buck goes, it can be amazing. That quality time you spend together can be priceless.”

- Give her a break. “Moms carry so much of the workload in so many families,” he says. “If you can’t afford to shower your mom with gifts this year, celebrate her by taking a bunch of those tasks off her to-do list for a while. Whatever your mom’s least favorite chore is, do it for a week or two. Run a bunch of errands for her. There are likely countless different options to help lighten your mom’s load for a little while, and doing some of those things can be an inexpensive way to show your mom some love.”

- Budget for those expensive Mother’s Day gifts. “If you’re going to go all-out on Mother’s Day, be thoughtful and planful about it,” he says. “Take the time to think about what you want to get her and how much you can afford to spend on it. That way, you’re likely more able to avoid impulse purchases that can wreck your budget. And don’t forget to shop around. It’s some of the oldest shopping advice, but it’s so, so important. It can save you a lot of money, even on Mother’s Day.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,000 U.S. consumers ages 18 to 77 from April 3 to 5, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles